Global Consumer Foam Market By Type (Flexible Foam, Rigid Foam), By End-use (Bedding and Furniture, Automotive, Footwear, Consumer Electronics and Appliances, Sports and Recreational Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135390

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

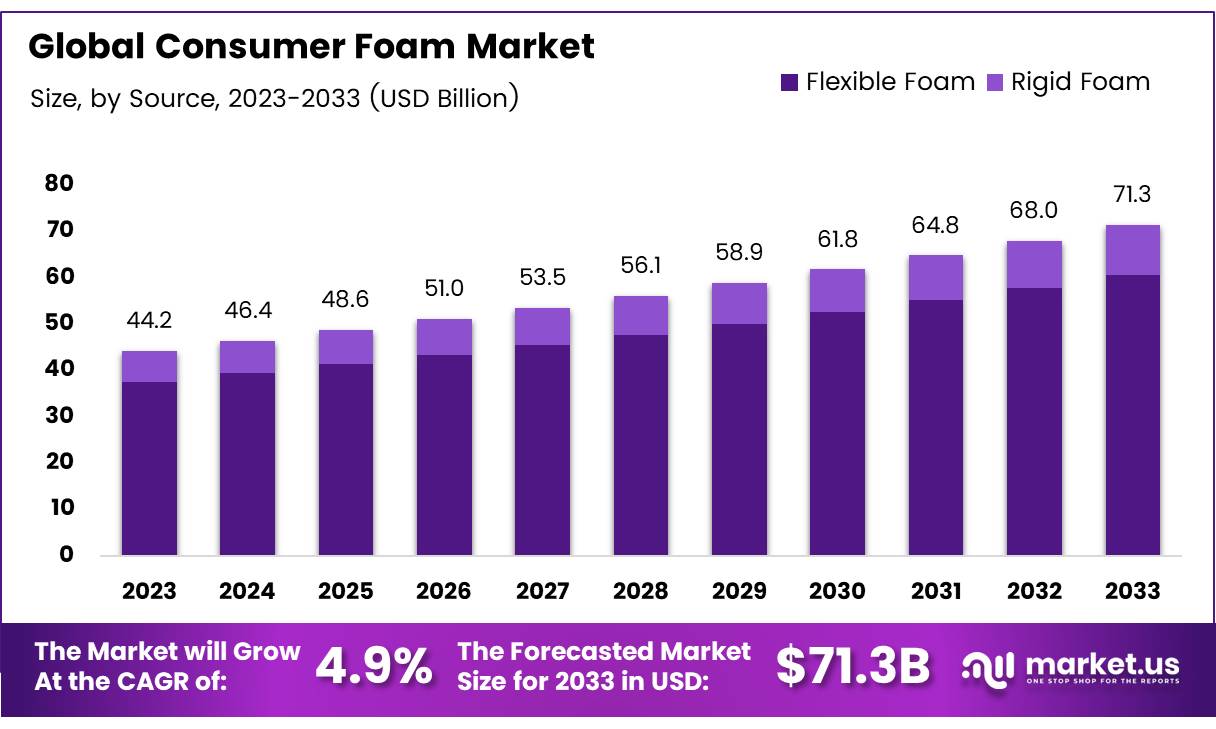

The Global Consumer Foam Market size is expected to be worth around USD 71.3 Billion by 2033, from USD 44.2 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Consumer foam refers to foam products designed primarily for use in everyday consumer goods such as furniture, bedding, automotive seats, packaging, and more. These foams are typically made from polyurethane foam, memory foam, and other synthetic or natural materials. The properties of consumer foam—such as comfort, resilience, and durability make it an integral part of various industries.

Over time, the demand for specialized foams, such as those with memory or high resilience properties, has risen. Additionally, the growing trend towards sustainability has led to the development of biodegradable foams, which cater to environmentally conscious consumers and businesses seeking to reduce their environmental impact. Consumer foam is thus central to sectors that prioritize comfort and functionality, while also increasingly being scrutinized for its environmental footprint.

The consumer foam market refers to the global sector involved in the production, distribution, and consumption of foam materials used in a wide array of consumer-facing industries. This market includes the production of foams used in products like mattresses, cushions, upholstery, and automotive interiors.

It is influenced by consumer preferences for comfort, the growth of the housing market, the rise of e-commerce in home goods, and innovations in foam technology, such as more sustainable or high-performance materials.

As sustainability becomes a priority, there is an observable shift toward eco-friendly alternatives like biodegradable foams and those with a lower carbon footprint. The global consumer foam market is supported by advancements in manufacturing processes and the ongoing development of materials that meet both performance and environmental standards.

The consumer foam market is poised for significant growth, driven by increasing consumer demand for comfort-oriented products across a range of applications, such as bedding, home furnishings, and automotive interiors.

Consumer behavior is also being shaped by a greater focus on health and wellness, particularly in products like memory foam mattresses, which are seen as offering enhanced comfort and support. This growth is further augmented by the rising trend of online shopping, which is expanding access to foam-based products and encouraging innovation in delivery and packaging.

Government investment and regulations play a crucial role in shaping the future of the consumer foam market. As the global push toward sustainability intensifies, many governments are enforcing stricter regulations to reduce the environmental impact of foam production and disposal. This has spurred investment in alternative foam materials, such as biodegradable polyurethane foams, which offer a significantly lower environmental footprint.

Manufacturers are also increasingly focused on creating recyclable and renewable foam materials to meet these new regulations and consumer demands. As governments around the world continue to implement policies that encourage sustainability, the market for eco-friendly foam products is likely to expand further, creating opportunities for companies that are quick to innovate and adapt.

In line with the growing demand for eco-friendly materials, biodegradable polyurethane foam has emerged as a key innovation.

According to Bergad, these foams can reduce the carbon footprint by up to 40% compared to traditional foams, positioning them as a more sustainable alternative. As the production of flexible polyurethane foam continues to grow, especially in Europe, manufacturers are expanding their capacity to meet the rising demand.

For instance, according to Europur, the 172 factories in Europe that produce flexible polyurethane slabstock foam contribute to a total production of around 1.35 million tonnes annually. Moreover, the shift towards sustainability in the foam sector is evident in the efforts to reduce the environmental impact of foam products, encouraging both regulatory bodies and manufacturers to explore greener alternatives.

The total production of polyurethane flexible foam across the EMEA region, which reached over 1.98 million tonnes in 2023 (as reported by Utech), underscores the robustness of the market, despite increasing regulatory pressure. These figures indicate that the market is expanding, with an ever-growing demand for both conventional and eco-friendly foam solutions.

Key Takeaways

- The global consumer foam market is projected to reach USD 71.3 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

- Flexible foam dominated the market in 2023, driven by its versatility, comfort, and cost-effectiveness across multiple applications.

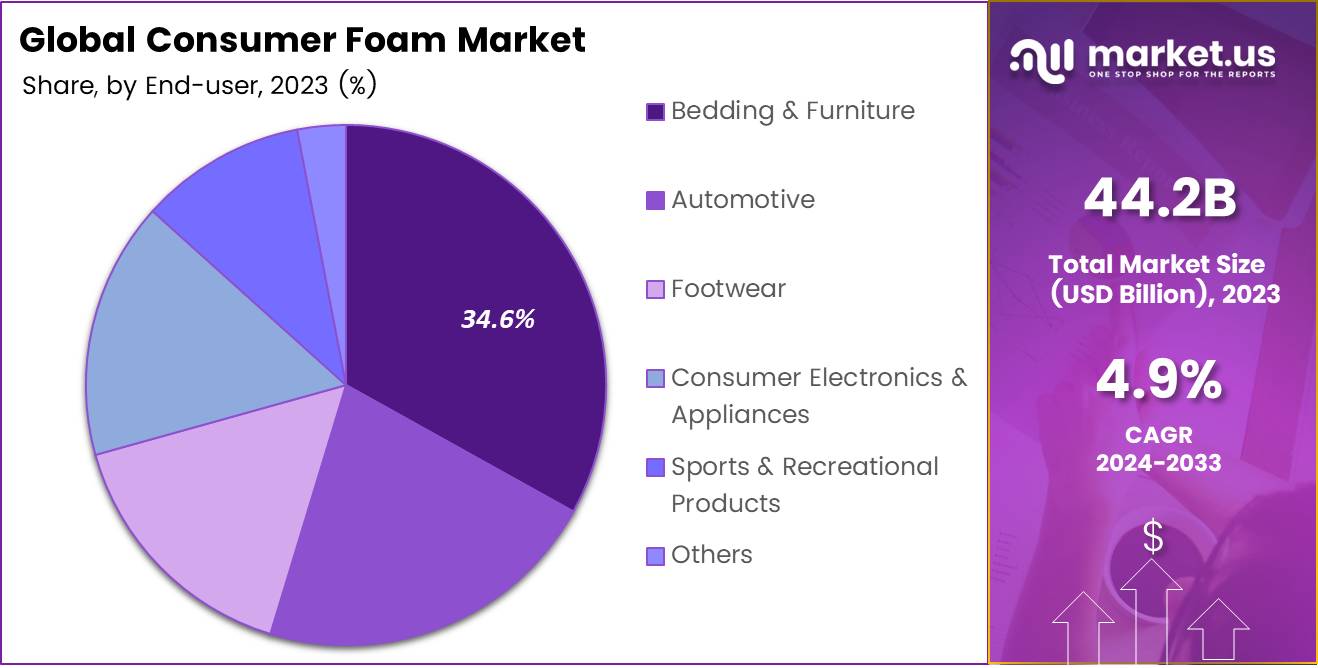

- Bedding & Furniture accounted for 34.6% of the consumer foam market share in 2023, fueled by ongoing demand for comfort and support.

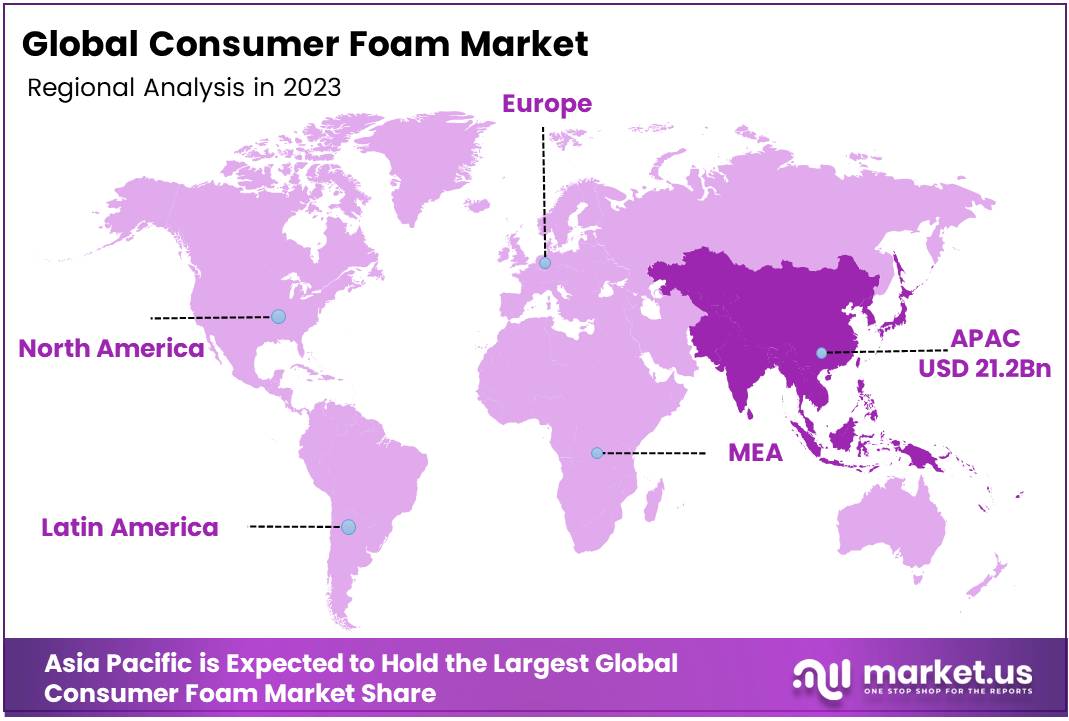

- Asia Pacific held the largest market share in 2023, contributing 48.2% of the total market value, or approximately USD 21.2 billion.

Type Analysis

Flexible Foam Dominates Consumer Foam Market in 2023 with Strong Demand for Comfort and Versatility

In 2023, Flexible Foam held a dominant market position in the By Type Analysis segment of the Consumer Foam Market. This dominance can be attributed to the material’s versatility, superior comfort, and cost-effectiveness across a range of applications, including furniture, mattresses, automotive, and packaging.

Flexible foam accounted for a significant share, driven by increasing consumer demand for lightweight, durable, and supportive products. Additionally, advancements in manufacturing technologies and the growing trend toward sustainable materials have further bolstered the segment’s growth.

Rigid Foam, while holding a smaller market share compared to Flexible Foam, has shown steady growth. This type of foam is primarily used in insulation applications across industries like construction and appliances. Rigid foam’s excellent thermal resistance properties, coupled with its lightweight nature, make it an ideal choice for energy-efficient solutions.

The demand for eco-friendly, high-performance insulation materials has contributed to its rising adoption in various building and industrial projects. Despite its smaller market presence, Rigid Foam’s consistent growth trajectory highlights its essential role in the consumer and industrial sectors.

Together, these foam types are poised to shape the market’s future, with Flexible Foam continuing to lead, while Rigid Foam is expected to see incremental gains due to ongoing technological and sustainability trends.

End-use Analysis

Bedding & Furniture Dominated the Consumer Foam Market in 2023 with a 34.6% Share

In 2023, Bedding & Furniture held a dominant market position in the By End-use Analysis segment of the Consumer Foam Market, with a 34.6% share. This growth can be attributed to the continued demand for comfort and support in residential and commercial applications.

Foam materials, particularly memory foam and polyurethane, are widely used in mattresses, pillows, cushions, and upholstery, offering key benefits such as durability, comfort, and thermal insulation. The increasing consumer preference for ergonomic and high-quality sleep solutions has fueled this segment’s expansion.

The Automotive segment followed, contributing significantly to market growth, driven by the rising demand for lightweight, durable, and comfortable materials in vehicle interiors. Automotive foams are used in seats, headrests, and soundproofing materials, ensuring a blend of comfort, safety, and performance.

Footwear and Consumer Electronics & Appliances also contributed notable shares, with foams used in cushioning for shoes, headphones, and appliance insulation. The Sports & Recreational Products segment, while smaller, showed steady growth due to rising interest in fitness and outdoor activities. Other categories, encompassing diverse applications like packaging and medical devices, also added to the overall market size, though they represented a smaller portion compared to the primary sectors.

Key Market Segments

By Type

- Flexible Foam

- Rigid Foam

By End-use

- Bedding & Furniture

- Automotive

- Footwear

- Consumer Electronics & Appliances

- Sports & Recreational Products

- Others

Drivers

Rising Demand for Comfort and Convenience Boosts Consumer Foam Market

The consumer foam market is experiencing significant growth, driven primarily by an increasing demand for comfort and convenience in products like mattresses, cushions, and furniture. This trend is amplified by rising disposable incomes, enabling consumers to invest in premium foam-based products, such as memory foam mattresses and ergonomic seating solutions.

Concurrently, the expansion of the furniture industry, fueled by a growing global population and rapid urbanization, further escalates the demand for consumer foam. Additionally, technological advancements in foam production, including the development of memory foam, gel-infused options, and environmentally friendly alternatives, are enhancing product performance, durability, and sustainability.

These innovations not only meet consumer expectations but also comply with increasing regulatory standards on environmental impact, making advanced foams more appealing in both residential and commercial markets.

Restraints

Competition from Alternative Materials and Regulatory Challenges

The consumer foam market faces notable restraints, particularly from the growing competition posed by alternative materials like memory gels, latex, and other cushioning technologies.

These alternatives often offer similar or superior benefits, such as enhanced comfort, durability, and eco-friendliness, making them attractive to consumers and manufacturers alike. This shift towards newer materials can potentially limit the growth of traditional foam products.

Additionally, the market is confronted with stricter regulatory compliance requirements, particularly in relation to fire safety standards, chemical usage, and the sustainability of materials.

These regulations often lead to higher production costs for foam manufacturers, especially those producing foam with certain chemicals or flame-retardant properties. Such cost increases could be passed on to consumers, reducing the affordability and appeal of foam products.

Moreover, the growing emphasis on environmental sustainability is pressuring manufacturers to adopt eco-friendly production practices, which can require significant investment in research, development, and supply chain adjustments. These combined challenges may slow the overall growth of the consumer foam market, forcing companies to adapt by either innovating their offerings or facing increased operational costs.

Growth Factors

Growth Opportunities in the Consumer Foam Market

The consumer foam market is poised for substantial growth, driven by several emerging trends and opportunities. One of the most promising areas is the expansion of the health and wellness sector.

Foam products, particularly in medical and therapeutic applications, have seen increasing demand. Foam mattresses designed for pressure ulcers, along with orthopedic supports and cushions, are gaining traction due to their comfort and health benefits.

Furthermore, there is notable growth potential in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and the Middle East. These areas are witnessing rapid urbanization, increasing disposable incomes, and growing demand for quality consumer goods, creating a strong consumer base for foam-based products.

Additionally, the integration of smart technology into foam products presents another growth opportunity. Features such as temperature control, adjustable firmness, and embedded sensors in mattresses and pillows are becoming increasingly popular among consumers seeking personalized comfort and convenience.

These innovations are expected to drive demand for high-tech foam products in both residential and commercial markets, expanding the reach of foam manufacturers. Overall, the consumer foam market stands to benefit from evolving consumer preferences, technological advancements, and global expansion, offering numerous avenues for growth.

Emerging Trends

Key Trends Shaping the Consumer Foam Market

The consumer foam market is experiencing several emerging trends, driven by shifting consumer preferences and technological advancements. One of the most notable trends is the rise of sleep technology.

Consumers are increasingly seeking sleep optimization products, such as memory foam mattresses, that incorporate advanced cushioning materials designed to enhance comfort and improve sleep quality. In parallel, sustainability is becoming a key consideration, with more consumers favoring eco-friendly and renewable materials.

Manufacturers are responding by developing foams made from biodegradable or recyclable materials, addressing environmental concerns while meeting consumer demand for greener products. Another significant trend is the growing popularity of hybrid foam products, such as mattresses and cushions that blend foam with other materials like springs, latex, or gel.

These hybrids offer improved comfort, support, and durability, making them highly appealing to consumers seeking customized sleep solutions.

Lastly, the emergence of smart and adjustable foam mattresses represents a major shift in consumer preferences for high-tech, customizable furniture.

These mattresses, which can be controlled via smartphone apps, provide users with a personalized sleep experience, adding a layer of convenience and luxury. Overall, these trends indicate a market that is increasingly focused on innovation, sustainability, and enhanced comfort, meeting the diverse needs of modern consumers.

Regional Analysis

Asia Pacific Leads Consumer Foam Market with 48.2% Share and USD 21.2 Billion Value Driven by Rising Demand and Industrial Growth

The global consumer foam market is witnessing robust growth across various regions, with Asia Pacific dominating the market. As of 2023, Asia Pacific holds the largest market share, accounting for 48.2% of the total market value, which translates to approximately USD 21.2 billion.

The region’s dominance can be attributed to the rapid industrialization, rising consumer demand, and increasing disposable incomes, particularly in emerging markets like China and India. These factors have led to a surge in the demand for consumer foam in industries such as bedding, automotive, and packaging. The growing focus on product innovation and the increasing use of eco-friendly materials in foam production further fuel the market’s expansion in Asia Pacific.

Regional Mentions:

North America is another significant player in the global consumer foam market, accounting for a substantial market share. The market in this region is driven by high demand from sectors such as furniture, construction, and automotive.

The U.S. represents the largest market in North America, driven by strong consumer spending, technological advancements, and a preference for comfort products. Moreover, the demand for sustainable and high-performance foam solutions is spurring growth in this region, with innovations in bio-based and recycled foam materials gaining traction.

In Europe, the consumer foam market is experiencing steady growth, primarily fueled by the automotive and furniture industries. Countries such as Germany, France, and the U.K. are the leading markets in the region, with a growing focus on sustainability and regulations promoting eco-friendly foam production. The demand for polyurethane foam in automotive seats and insulation applications is particularly significant in this region.

The Middle East & Africa and Latin America markets are comparatively smaller but are witnessing gradual growth. In the Middle East, growth is driven by increased construction activities and demand for comfort products, while Latin America benefits from rising consumer preferences in industries like bedding and furniture. However, the market potential in these regions remains limited relative to the more dominant regions of Asia Pacific and North America.

Overall, Asia Pacific remains the leading region in the consumer foam market, driven by significant demand, a growing consumer base, and ongoing industrial expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global consumer foam market continues to witness strong competition, with leading players driving innovation and maintaining a significant market share.

The primary companies in this market—BASF SE, Covestro AG, Sekisui Chemical Co. Ltd., The DOW Chemical Company, Rogers Corporation, The Woodbridge Group, Huntsman Corporation, INOAC Corporation, Recticel NV, and Ube Industries, Ltd. are leveraging their extensive technological capabilities and diverse product portfolios to meet the growing demand across various end-use industries, including automotive, furniture, and construction.

BASF SE and Covestro AG remain dominant players due to their robust R&D capabilities and diverse range of high-performance foam solutions.

BASF’s focus on sustainability, with a growing emphasis on bio-based raw materials and environmentally friendly foam products, has positioned the company as a key player in the transition toward greener alternatives.

Similarly, Covestro’s innovations in polyurethanes and polycarbonates cater to the evolving needs for lightweight and durable materials in consumer applications.

Sekisui Chemical and The DOW Chemical Company have also maintained their leadership, driven by their broad product range and technological expertise. Sekisui’s advancements in flexible foam applications have made it a preferred supplier for the automotive industry, while DOW’s investment in high-performance foam technologies has bolstered its position in multiple markets.

Other companies such as Rogers Corporation and The Woodbridge Group are focusing on specialized foam materials for niche applications, allowing them to cater to specific demands such as sound insulation and thermal management in consumer electronics and automotive industries.

Overall, the competitive landscape remains dynamic, with key players continually adapting to market demands for advanced, sustainable, and cost-effective foam solutions.

Top Key Players in the Market

- BASF SE

- Covestro AG

- Sekisui Chemical Co. Ltd.

- The DOW Chemical Company

- Rogers Corporation

- The Woodbridge Group

- Huntsman Corporation

- INOAC Corporation

- Recticel NV

- Ube Industries, Ltd.

Recent Developments

- In April 2022, Cruz Foam raised $2.5 million in its final seed funding round to further advance its biodegradable foam technology, which aims to replace conventional plastic foam in various industries.

- In March 2023, EVOCO Ltd secured CAD $12 million in Series B funding to accelerate the growth of its plant-based materials platform, supporting consumer goods companies in transitioning to sustainably sourced feedstocks.

- In July 2024, a Senate spending bill allocated $70 million to airports to phase out the use of firefighting foam containing “forever chemicals,” addressing growing concerns over environmental and health risks associated with these substances.

- In February 2024, the Edelweiss Private Equity fund led a $25.3 million investment in Rentomojo, a prominent Indian-based rental platform, to expand its consumer offerings and drive growth in the home goods sector.

Report Scope

Report Features Description Market Value (2023) USD 44.2 Billion Forecast Revenue (2033) USD 71.3 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Flexible Foam, Rigid Foam), By End-use(Bedding and Furniture, Automotive, Footwear, Consumer Electronics and Appliances, Sports and Recreational Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Covestro AG, Sekisui Chemical Co. Ltd., The DOW Chemical Company, Rogers Corporation, The Woodbridge Group, Huntsman Corporation, INOAC Corporation, Recticel NV, Ube Industries, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Covestro AG

- Sekisui Chemical Co. Ltd.

- The DOW Chemical Company

- Rogers Corporation

- The Woodbridge Group

- Huntsman Corporation

- INOAC Corporation

- Recticel NV

- Ube Industries, Ltd.