Global Computer on Module Market Size, Share Analysis Report By Architecture Type (ARM (Advanced RISC Machines) Architecture, x86 Architecture, Power Architecture, Others), By Standard (COM Express, SMARC (Smart Mobile Architecture), Qseven, ETX (Embedded Technology Extended), Others), By Application (Industrial Automation, Medical, Transportation, Gaming, Communication, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150756

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

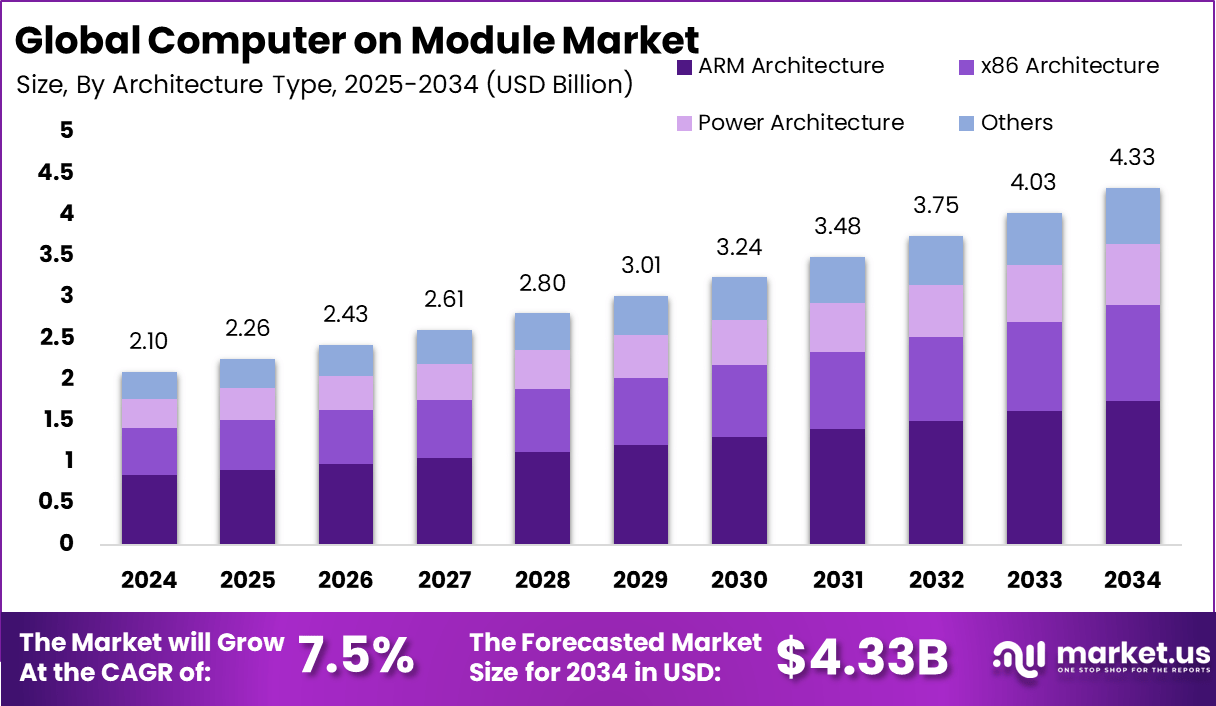

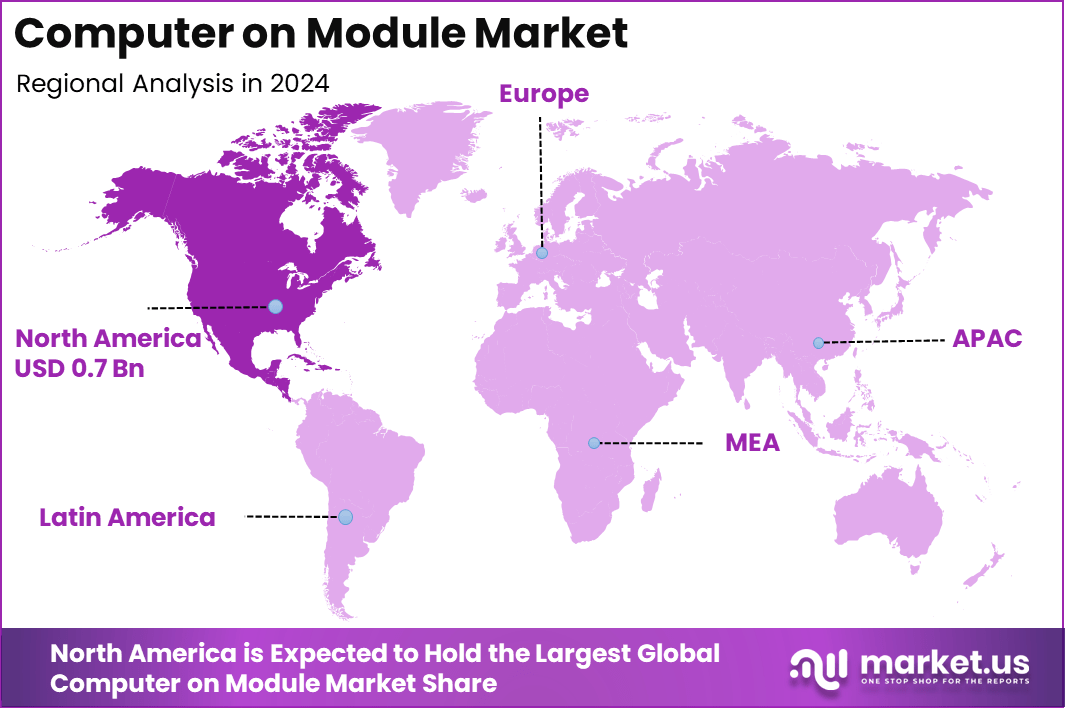

The Global Computer on Module Market size is expected to be worth around USD 4.33 Billion By 2034, from USD 2.10 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.2% share, holding USD 0.7 Billion revenue.

The Computer on Module (CoM) market is characterized by compact, scalable embedded computing solutions that integrate processing units, memory, and essential I/O interfaces on a single board. These modules are engineered to simplify system design, enabling developers to focus on custom carrier boards while off‑loading the complexity of core computing components.

The primary driving factors behind market expansion include the proliferation of industrial automation, and the rise of IoT and edge computing applications. CoMs are finding increased utility in robotics, UAVs, transportation systems, and healthcare automation, where compact form factors and real‑time processing capabilities are essential.

In terms of demand analysis, manufacturing and transportation industries have emerged as key adopters, with Asia‑Pacific leading market share due to investments in automation and robotics. North America also maintains significant foothold, particularly within industrial and transportation sectors.

The increasing adoption of specific technologies such as ARM architecture, COM Express and Qseven form factors, AI-enabled edge computing, and 5G connectivity has been observed. These technologies deliver enhanced performance, low power functionality, and flexible integration that align effectively with modular embedded systems.

Key reasons for adopting CoMs include accelerated development timelines, reduced engineering overhead, simplified upgrades, and scalability. The division between processing and carrier board design enables easier CPU transitions and cost-effective adaptation without redesigning core hardware.

Key Takeaways

- The Global Computer on Module Market was valued at USD 2.10 Billion in 2024 and is projected to reach USD 4.33 Billion by 2034, expanding at a CAGR of 7.5% during the forecast period.

- North America led the market with over 36.2% share, contributing approximately USD 0.7 Billion in 2024, driven by rising adoption in industrial and embedded computing applications.

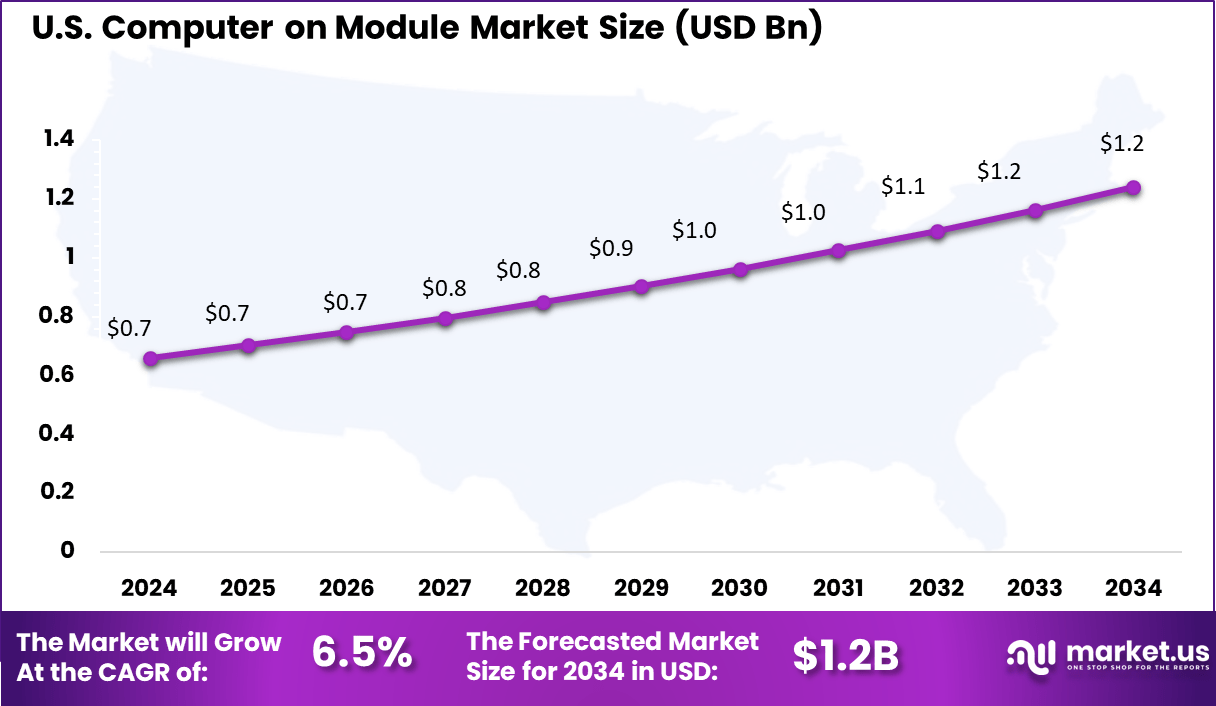

- The U.S. market alone accounted for USD 0.669 Billion in 2024 and is expected to grow at a CAGR of 6.5%, supported by demand from automation, medical, and defense sectors.

- ARM (Advanced RISC Machines) Architecture dominated the architecture type segment with a 40.2% share, owing to its power efficiency, scalability, and strong adoption in edge and IoT devices.

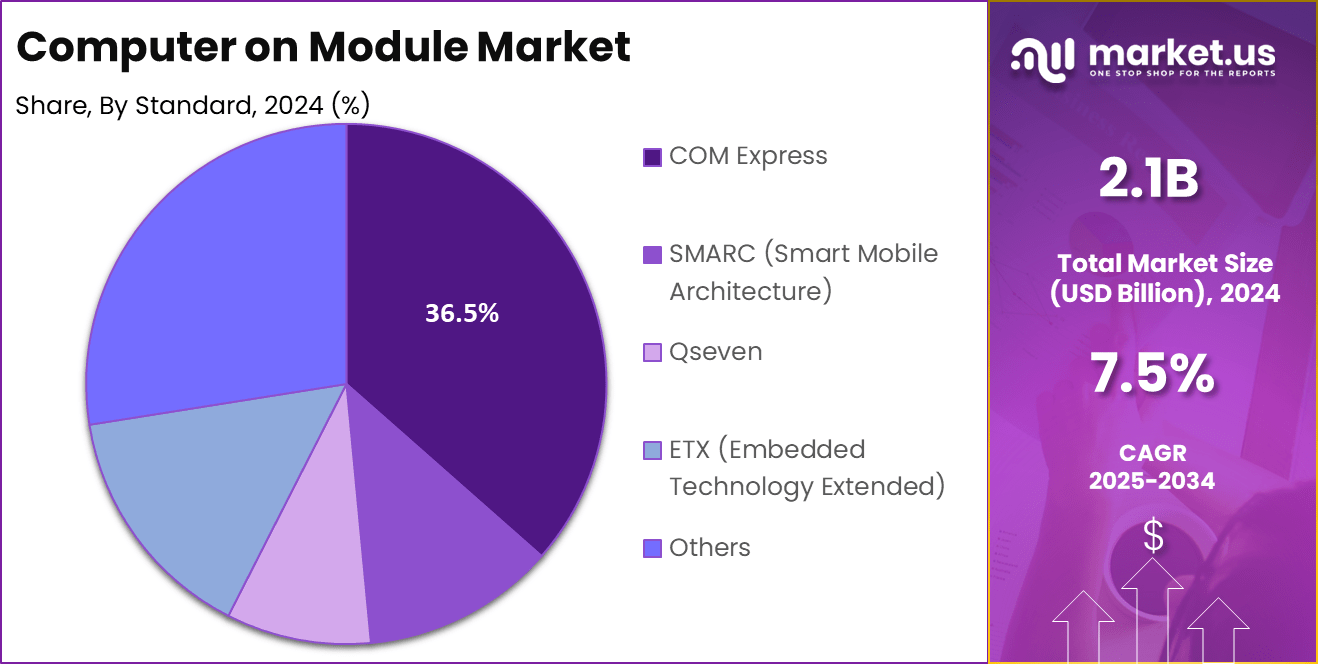

- COM Express led the standard segment, capturing 36.5% market share, favored for its flexibility, interoperability, and suitability across a wide range of embedded computing environments.

- Industrial Automation emerged as the top application area, holding 30.5% share, as industries increasingly deploy CoMs in robotics, control systems, and smart factory solutions.

Role of AI

The integration of artificial intelligence within Computer-on-Module (CoM) platforms has redefined the landscape of embedded computing, enabling high-value applications to be executed directly at the edge. CoMs, compact computing units combining processor, memory, power management, and I/O interfaces, are now routinely paired with AI accelerators – such as GPUs, NPUs, TPUs, and FPGAs – to optimize inference-speed performance in environments with strict space, power, or latency constraints.

AI-enabled CoMs now support real-time image processing, predictive maintenance, intelligent surveillance, autonomous systems, and more – facilitating on-device inference and freeing reliance from cloud infrastructure . This capability is especially critical in mission‑critical environments (e.g., aerospace, medical systems), where latency and reliability are non‑negotiable.

The augmented CoM hardware includes higher memory configurations and neural accelerators tailored for deep-learning workloads, enabling heterogeneous computing architectures to be deployed in compact form‑factors

US Market Expansion

The US Computer on Module Market is valued at approximately USD 0.7 Billion in 2024 and is predicted to increase from USD 0.9 Billion in 2029 to approximately USD 1.2 Billion by 2034, projected at a CAGR of 6.5% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36.2 % share, corresponding to approximately USD 0.7 billion in revenue. This leadership can be attributed to the region’s advanced industrial automation landscape, extensive deployment of AI-enabled edge computing platforms, and strong demand from sectors such as aerospace, healthcare, and defense.

The presence of leading semiconductor manufacturers and embedded module developers within the United States and Canada has fostered innovation in PC-on-Module designs, ensuring North America remains the most mature market. Edge-AI adoption across smart factories and autonomous systems has further bolstered demand for compact, compute-intensive modules that offer low-latency data processing with enhanced security.

By Architecture Type Analysis

In 2024, ARM (Advanced RISC Machines) Architecture segment held a dominant market position, capturing more than a 40.2% share in the global Computer on Module (CoM) market. This leadership can be attributed to the architecture’s high scalability, energy efficiency, and wide adoption across embedded systems.

ARM-based modules are preferred in applications where low power consumption, compact design, and real-time performance are critical – such as industrial automation, IoT devices, automotive control units, and medical instruments. The architecture’s support for a broad range of operating systems, including Android, Linux, and Windows Embedded, further strengthens its compatibility and developer ecosystem, making it a first choice for OEMs and system integrators.

The rising demand for edge computing and smart devices has reinforced the dominance of ARM architecture in the CoM market. As industries increasingly shift toward decentralized data processing, ARM’s ability to deliver high performance per watt becomes a key differentiator.

Moreover, advancements in ARM Cortex and Neoverse cores have enabled better AI processing, security, and real-time capabilities at the module level. These developments are pushing manufacturers to adopt ARM-based solutions to stay competitive, thereby sustaining its leading position in the architecture type segment.

By Standard Analysis

In 2024, COM Express segment held a dominant market position, capturing more than a 36.5% share in the global Computer on Module (CoM) market. This dominance is primarily driven by the standard’s versatility, scalability, and long-standing industry adoption.

COM Express supports a wide range of high-performance processors, high-speed interfaces like PCIe, SATA, and USB 3.0, and is suitable for complex computing applications. It is widely used in industrial automation, transportation, medical imaging, and defense systems, where robust performance and flexibility are essential.

The modular approach of COM Express also allows developers to reduce time-to-market by simplifying system upgrades and maintenance. The popularity of COM Express is further supported by its broad acceptance among system integrators and OEMs seeking long product lifecycles and standardized connectivity. Its ability to support both x86 and ARM architectures also makes it adaptable across different hardware ecosystems.

Additionally, the ongoing transition toward Industry 4.0 and smart infrastructure is creating strong demand for high-bandwidth, high-reliability modules – areas where COM Express excels. The growing integration of AI, machine vision, and real-time data processing in embedded platforms continues to reinforce its leadership in the standard type segment of the CoM market.

By Application Analysis

In 2024, the Industrial Automation segment held a dominant market position, capturing more than a 30.5% share in the global Computer on Module (CoM) market. This leadership has been supported by the rapid digitization of manufacturing systems, where CoMs are essential in enabling real-time control, predictive maintenance, and machine-to-machine communication.

Industries are increasingly deploying smart machinery and robotics that require compact, modular computing platforms with high reliability and performance – characteristics that CoMs based on industrial-grade standards provide. The ability to operate in harsh environments and support long product lifecycles makes them especially valuable in factory settings and automated production lines.

The strong growth of Industry 4.0 and demand for intelligent edge computing have further strengthened the role of CoMs in industrial automation. As manufacturers prioritize cost-efficiency, flexibility, and faster deployment of smart equipment, CoMs offer an ideal solution with their plug-and-play integration and scalability.

Additionally, the need for advanced HMI (Human Machine Interface) systems, real-time data analytics, and industrial safety protocols has increased the reliance on robust computing modules. The continuous investments in digital transformation and smart factory initiatives across developed and emerging economies are expected to sustain the dominance of this segment over the forecast period.

Key Market Segments

By Architecture Type

- ARM (Advanced RISC Machines) Architecture

- x86 Architecture

- Power Architecture

- Others

By Standard

- COM Express

- SMARC (Smart Mobile Architecture)

- Qseven

- ETX (Embedded Technology Extended)

- Others

By Application

- Industrial Automation

- Medical

- Transportation

- Gaming

- Communication

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Rise of Micro-SOMs and Edge AI Integration

The latest trend in the Computer on Module market is the shift toward ultra-compact micro System on Modules (micro-SOMs). These modules, some as small as 25×25 mm, are engineered to deliver full computing functionality while minimizing space and energy usage.

Their design makes them ideal for wearables, compact robotics, and sensor-heavy industrial applications where performance must be delivered without compromising size or thermal efficiency. Simultaneously, there is a growing integration of AI and ML processing capabilities directly on CoMs.

Modules are increasingly being embedded with AI accelerators and neural processing units, enabling real-time analytics at the edge. This development is transforming sectors like surveillance, predictive maintenance, and autonomous vehicles, where decisions must be made instantly and securely without relying on cloud connectivity.

Driver

Industrial Automation and IoT Expansion

The Computer on Module market is being driven by the rapid growth in industrial automation. As industries embrace robotics and automated production systems, the demand for compact, reliable embedded computing platforms has surged. CoMs offer the processing power and modularity necessary to manage sensors, real-time controls, and HMIs, making them a core component in smart factories.

In addition, the widespread adoption of IoT and edge computing is pushing demand for scalable and energy-efficient computing. CoMs, especially those based on ARM and x86 architectures, support IoT applications by offering flexible connectivity, robust performance, and support for long product life cycles. These characteristics make CoMs well-suited for remote and edge deployments in energy, agriculture, and infrastructure.

Restraint

Complexity and Component Shortages

Despite their advantages, CoMs face challenges related to design complexity and integration. Combining advanced CPUs, memory, security modules, and I/O interfaces into a small form factor requires high-end expertise and testing. This complexity can extend development timelines and increase costs, particularly for small and mid-sized companies.

Moreover, supply chain instability, particularly from the global semiconductor shortage, continues to impact availability of essential components used in CoM production. Delays in sourcing high-performance CPUs or specialized connectors have disrupted manufacturing timelines and increased unit costs, limiting the ability of manufacturers to meet demand efficiently.

Opportunity

Industry 4.0 and Medical Device Innovation

Significant opportunities are emerging from Asia-Pacific and Europe, where national policies support Industry 4.0 initiatives. Countries such as India and Germany are investing heavily in smart manufacturing, which requires compact and scalable embedded systems. CoMs, being modular and upgrade-friendly, are increasingly chosen for such applications, reducing product development time and enhancing customization.

The medical sector also presents major growth potential. Portable diagnostic systems, wearable monitors, and next-gen imaging devices benefit from CoMs due to their compact size, flexibility, and support for real-time data processing. Medical device manufacturers favor CoMs to meet strict compliance standards while accelerating time-to-market for critical innovations.

Challenge

Cybersecurity and Cost Pressures

The widespread deployment of CoMs across sensitive systems – industrial control, transportation, and healthcare – has raised serious cybersecurity concerns. Embedded devices are often targeted by attackers due to outdated firmware or unsecured communication protocols. To address this, manufacturers must integrate secure boot processes, hardware root-of-trust, and encrypted storage into their modules from the design stage.

Another challenge lies in the high cost of advanced modules, which can be a barrier for startups and low-volume OEMs. While CoMs save development costs in the long term, their upfront pricing – especially for AI or high-performance variants – can deter entry into budget-sensitive markets. This challenge underscores the need for scalable pricing models or open-source ecosystem support to promote broader adoption.

Key Player Analysis

The global Computer‑on‑Module (CoM) market is characterized by a diverse landscape of established multinational players and emerging specialist vendors.

AAEON has introduced several advanced COM Express and Jetson‑based modules in 2025. Notably, the COM‑MTHC6 compact COM Express Type 6 brings Intel Core Ultra performance up to 45 W, AI SDK support, and eight‑lane PCIe connectivity. In parallel, AAEON showcased Jetson‑based AI developer kits, such as the NV8600‑Nano (Orin Nano) and panel PC solutions (NIKY‑2155‑NX) at GTC and Embedded World.

Advantech completed its acquisition of AURES Technologies (POS and kiosk provider) in late 2024, integrating retail IoT capabilities into its product ecosystem. At COMPUTEX 2025, the firm promoted its SKYRack, modular AI edge servers, and versatile SMARC/COM modules including the new ROM‑6881 module featuring Rockchip RK3588/K chipsets.

At Embedded World and MWC 2025, Axiomtek highlighted high‑performance network and industrial cybersecurity platforms, including fanless DIN‑rail IoT gateways. Meanwhile, the launch of the eBOX630B embedded computer leverages 15th‑gen Intel Core Ultra CPUs, DDR5 memory support, and enhanced performance for edge computing.

Top Key Players Covered

- AAEON Technology Inc.

- Advantech Co. Ltd.

- Axiomtek Co. Ltd.

- congatec AG

- Digi International Inc.

- iWave Systems Technologies Pvt. Ltd.

- Kontron S&T AG (S&T AG)

- PHYTEC Embedded Pvt. Ltd.

- TechNexion, Toradex Systems (India) Pvt. Ltd.

- Variscite

- Others

Recent Developments

- May 2025, AAEON introduced the COM‑MTHC6, a COM Express Type 6 compact module through its news release last month. It features up to 45 W Intel Core Ultra processors, AI SDK support, and connectivity for eight PCIe devices

- January 2025, Introduced SOM modules powered by AMD Ryzen™ Embedded 8000 series, targeting edge AI and rugged applications. These SOMs support IPC-A-610G class 3 and MIL-STD-810G testing.

Report Scope

Report Features Description Market Value (2024) USD 2.10 Bn Forecast Revenue (2034) USD 4.33 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Architecture Type (ARM (Advanced RISC Machines) Architecture, x86 Architecture, Power Architecture, Others), By Standard (COM Express, SMARC (Smart Mobile Architecture), Qseven, ETX (Embedded Technology Extended), Others), By Application (Industrial Automation, Medical, Transportation, Gaming, Communication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AAEON Technology Inc., Advantech Co. Ltd., Axiomtek Co. Ltd., congatec AG, Digi International Inc., iWave Systems Technologies Pvt. Ltd., Kontron S&T AG (S&T AG), PHYTEC Embedded Pvt. Ltd., TechNexion, Toradex Systems (India) Pvt. Ltd., Variscite, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AAEON Technology Inc.

- Advantech Co. Ltd.

- Axiomtek Co. Ltd.

- congatec AG

- Digi International Inc.

- iWave Systems Technologies Pvt. Ltd.

- Kontron S&T AG (S&T AG)

- PHYTEC Embedded Pvt. Ltd.

- TechNexion, Toradex Systems (India) Pvt. Ltd.

- Variscite

- Others