Colorectal Cancer Molecular Diagnostics Market By Product Type (Reagents & Kits, Instruments, and Services), By Technology (PCR-based, Transcription Mediated Amplification-based, Sequencing-based, Mass Spectrometry-based, Isothermal Nucleic Acid Amplification, and Chips & Microarrays-based), By End-user (Hospitals, Diagnostic Laboratories, and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163044

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

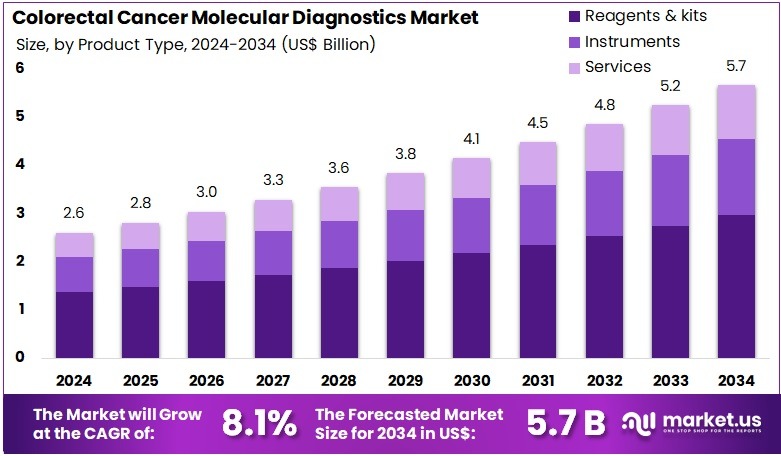

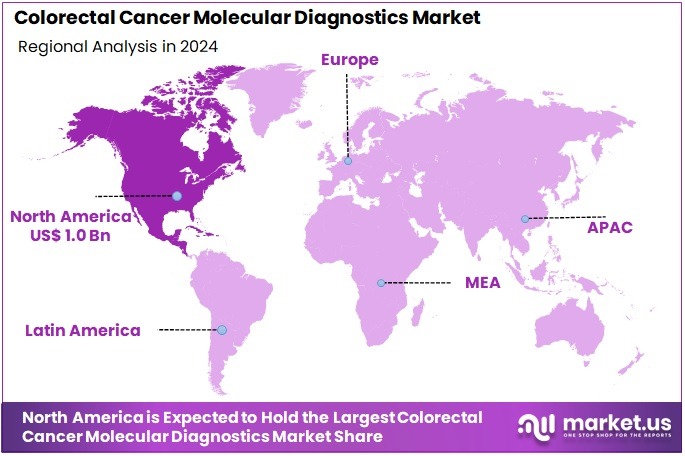

The Colorectal Cancer Molecular Diagnostics Market size is expected to be worth around US$ 5.7 billion by 2034 from US$ 2.6 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.7% share and holds US$ 1.0 Billion market value for the year.

Increasing emphasis on early cancer detection drives the Colorectal Cancer Molecular Diagnostics Market, as healthcare providers prioritize non-invasive screening for improved patient outcomes. Clinicians utilize stool-based DNA tests to identify genetic mutations associated with colorectal cancer, enabling early intervention in asymptomatic populations. These diagnostics support personalized treatment by detecting KRAS and BRAF mutations, guiding targeted therapy selection.

Research institutions apply molecular assays to study tumor biomarkers, advancing precision oncology. In November 2024, Thermo Fisher Scientific, through Life Technologies, partnered with Mainz Biomed N.V. to co-develop a next-generation CRC screening product, enhancing innovation in molecular diagnostics. This collaboration strengthens market growth by expanding access to cutting-edge, non-invasive testing solutions.

Growing adoption of accessible screening methods fuels the Colorectal Cancer Molecular Diagnostics Market, as public health initiatives target at-risk populations. Laboratories employ multitarget DNA assays for population-wide screening, detecting precancerous polyps in average-risk adults. These tests aid post-treatment monitoring by identifying residual disease through circulating tumor DNA analysis.

Automated platforms streamline sample processing, supporting high-throughput screening in clinical settings. In October 2024, Exact Sciences Corporation received FDA approval for Cologuard Plus, a multitarget stool-based DNA test for adults aged 45 and older, reinforcing leadership in early detection. This regulatory milestone drives market expansion by broadening non-invasive options for routine colorectal cancer screening.

Rising integration of blood-based diagnostics propels the Colorectal Cancer Molecular Diagnostics Market, as innovative technologies enhance testing convenience. Oncologists use liquid biopsy assays to monitor treatment response in metastatic colorectal cancer patients, optimizing therapeutic adjustments. These diagnostics support clinical trials by profiling tumor genomics, accelerating drug development. Trends toward RNA-based biomarkers improve early-stage detection, complementing traditional DNA assays.

In July 2024, Guardant Health secured FDA approval for its Shield blood-based CRC screening test for adults aged 45 and older, with Medicare coverage enhancing accessibility. This approval, alongside May 2024’s FDA approval of Geneoscopy’s ColoSense RNA-based test, positions the market for sustained growth through advanced, patient-friendly diagnostic solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.6 billion, with a CAGR of 8.1%, and is expected to reach US$ 5.7 billion by the year 2034.

- The product type segment is divided into reagents & kits, instruments, and services, with reagents & kits taking the lead in 2024 with a market share of 52.4%.

- Considering technology, the market is divided into PCR-based, transcription mediated amplification-based, sequencing-based, mass spectrometry-based, isothermal nucleic acid amplification, and chips & microarrays-based. Among these, PCR-based held a significant share of 45.7%.

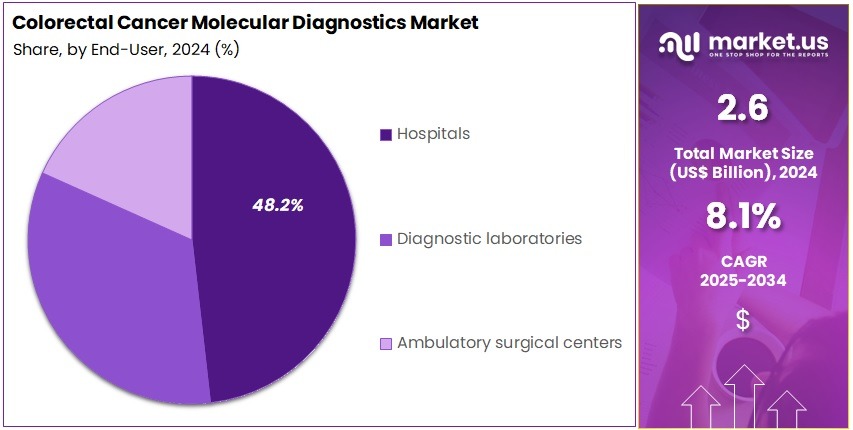

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic laboratories, and ambulatory surgical centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 48.2% in the market.

- North America led the market by securing a market share of 38.7% in 2024.

Product Type Analysis

Reagents and kits account for 52.4% of the Colorectal Cancer Molecular Diagnostics market and are expected to remain dominant due to their indispensable role in performing molecular assays and genetic analyses. These products enable precise detection of cancer biomarkers such as KRAS, NRAS, and BRAF mutations, which are essential for diagnosis and targeted therapy selection.

Hospitals and diagnostic laboratories increasingly rely on pre-packaged reagent kits for their ease of use, reproducibility, and compatibility with automated platforms. The growing incidence of colorectal cancer globally is projected to drive demand for these kits across screening and monitoring applications. Continuous advancements in multiplex assay reagents enhance test accuracy and reduce turnaround time.

Manufacturers are investing in developing reagents with higher sensitivity for detecting low-frequency mutations. Increased focus on personalized medicine and companion diagnostics also boosts reagent adoption. The scalability of reagent-based testing systems allows laboratories to manage high sample volumes efficiently.

Government initiatives promoting early cancer detection and genetic testing expand accessibility. As molecular diagnostics continue to integrate into routine clinical workflows, reagents and kits remain critical components supporting reliable and high-throughput analysis in oncology diagnostics.

Technology Analysis

PCR-based technology holds 45.7% of the technology segment and is anticipated to dominate the market owing to its precision, speed, and affordability in detecting genetic mutations associated with colorectal cancer. Polymerase Chain Reaction enables amplification of specific DNA sequences, allowing early and accurate identification of oncogenic alterations such as APC, TP53, and KRAS mutations.

Hospitals and laboratories prefer PCR-based assays for their high sensitivity, cost-effectiveness, and compatibility with a wide range of clinical specimens. Real-time PCR and digital PCR advancements are enhancing quantification accuracy and limit of detection, supporting the identification of minimal residual disease. The technology’s adaptability for multiplex testing improves efficiency in comprehensive cancer panels. Growing adoption of liquid biopsy-based PCR methods for non-invasive cancer screening is anticipated to strengthen market growth.

Increasing clinical validation of PCR-based diagnostic kits further boosts trust and utilization. Regulatory approvals for new PCR-based molecular diagnostic systems expand product availability globally. PCR’s integration with automated sample preparation and data analysis platforms simplifies laboratory operations. As precision oncology gains traction, PCR-based methods are likely to remain the cornerstone technology for colorectal cancer diagnostics, offering a balance of reliability, speed, and cost efficiency.

End-User Analysis

Hospitals represent 48.2% of the end-user segment and are expected to lead the market due to their comprehensive diagnostic infrastructure and access to advanced molecular testing technologies. Hospitals play a crucial role in early detection, screening, and treatment planning for colorectal cancer patients.

The increasing availability of in-house molecular laboratories allows hospitals to perform rapid genetic and biomarker testing, improving clinical decision-making. Rising cancer prevalence and expanding patient screening programs are projected to drive testing volumes in hospital settings. Hospitals benefit from integrated testing workflows that combine molecular diagnostics with histopathology and imaging for precise diagnosis.

Collaborations with diagnostic companies and research institutions enable hospitals to adopt innovative molecular testing solutions. The implementation of government-supported cancer awareness and screening programs strengthens demand for diagnostic services. Hospitals also participate in clinical trials assessing novel targeted therapies, which require molecular testing for patient selection and monitoring.

Investments in automation and digital pathology enhance testing accuracy and efficiency. The expansion of specialized oncology departments with dedicated molecular labs supports continued growth. As healthcare systems emphasize personalized treatment approaches, hospitals are likely to remain at the forefront of colorectal cancer molecular diagnostics adoption.

Key Market Segments

By Product Type

- Reagents & Kits

- Instruments

- Services

By Technology

- PCR-based

- Transcription Mediated Amplification-based

- Sequencing-based

- Mass Spectrometry-based

- Isothermal Nucleic Acid Amplification

- Chips & Microarrays-based

By End-user

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgical Centers

Drivers

Increasing Incidence of Colorectal Cancer is Driving the Market

The persistent upward trend in colorectal cancer cases has significantly propelled the colorectal cancer molecular diagnostics market, as molecular profiling becomes essential for precise risk stratification and therapeutic selection in affected patients. This malignancy, originating from adenomatous polyps, demands advanced assays like KRAS and BRAF mutations to guide targeted therapies and improve survival outcomes.

The driver is amplified by demographic shifts, including aging populations and lifestyle factors, necessitating widespread adoption of next-generation sequencing for comprehensive genomic characterization. Healthcare systems are integrating these diagnostics into routine workflows, from screening to metastatic management, to address the growing caseload. The emphasis on personalized medicine further elevates its role, enabling identification of microsatellite instability for immunotherapy eligibility.

Public health campaigns underscore its prognostic value, influencing policy-driven expansions in testing infrastructure. The American Cancer Society estimated 152,810 new cases of colorectal cancer in the United States for 2024, with 106,590 colon and 46,220 rectal cases, reflecting the escalating clinical imperative for molecular insights. This projection highlights the diagnostic urgency, as early molecular detection averts advanced-stage presentations.

Innovations in multiplex panels streamline variant calling, accommodating diverse tumor heterogeneity. Economically, its implementation reduces overtreatment costs, justifying investments in laboratory automation. International collaborations standardize reporting, promoting equitable access in resource-limited settings. This epidemiological surge not only intensifies assay volumes but also reinforces its integration within oncology care pathways. Overall, it fosters advancements toward multimodal platforms, aligning diagnostics with evolving therapeutic landscapes.

Restraints

High Costs and Limited Reimbursement for Molecular Assays is Restraining the Market

The substantial financial burden of advanced molecular assays and inconsistent reimbursement policies continue to hinder the accessibility of colorectal cancer molecular diagnostics, particularly in community-based settings. These comprehensive genomic tests, requiring sophisticated instrumentation and bioinformatics pipelines, often exceed budgetary thresholds for routine implementation. This restraint perpetuates disparities, as payers impose stringent criteria for coverage, delaying adoption and favoring less precise alternatives.

Jurisdictional variations in funding models exacerbate inequities, with some systems mandating prior authorizations that prolong patient pathways. Developers face escalating validation expenses, constraining portfolio expansions to high-volume indications. The resultant underutilization inflates indirect costs through suboptimal treatment selections.

The European Union’s In Vitro Diagnostic Regulation, effective in 2022, imposed additional requirements for clinical evidence and post-market surveillance, leading to a 15% increase in compliance costs for manufacturers of molecular diagnostics. Such regulatory intensifications reflect broader fiscal pressures, as cost containment limits innovation diffusion.

Clinician hesitancy stems from unrecouped outlays, prioritizing established markers over emerging panels. Advocacy for value-based pricing advances incrementally, impeded by outcome data deficiencies. These economic barriers not only stifle scalability but also compromise the market’s potential for equitable precision oncology.

Opportunities

Advancements in Liquid Biopsy Technologies is Creating Growth Opportunities

The evolution of liquid biopsy platforms has unlocked expansive prospects for the colorectal cancer molecular diagnostics market, offering non-invasive alternatives for ctDNA analysis to monitor minimal residual disease and therapeutic responses. These circulating biomarkers enable serial sampling without procedural risks, facilitating dynamic assessments in metastatic settings.

Opportunities proliferate in companion diagnostic developments, where liquid biopsies stratify patients for EGFR inhibitors based on RAS status. Pharmaceutical alliances subsidize validations for multi-analyte panels, bridging gaps in real-time resistance profiling. This minimally invasive paradigm addresses biopsy inaccessibility, positioning it as a prophylactic against disease progression.

Fiscal incentives for biomarker-driven trials catalyze procurements, diversifying toward integrated sequencing workflows. The National Cancer Institute supported studies in 2022 demonstrating that organoid models quantitatively monitor NK cell-mediated cytotoxicity against breast cancer cells, validating liquid biopsy efficacy for preclinical immunotherapy assessments in colorectal contexts. This framework exemplifies transferable models, with extensions projecting amplified reagent demands in surveillance applications.

Innovations in enrichment techniques, such as digital droplet PCR, mitigate low ctDNA yields, broadening clinical utility. As tele-oncology matures, remote sample processing unlocks longitudinal data revenues. These liquid biopsy expansions not only variegate diagnostic modalities but also entrench the market within adaptive cancer management architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the colorectal cancer molecular diagnostics market, leading them to delay next-generation sequencing expansions while prioritizing core biomarker kit production amid constrained oncology funding. U.S.-China export controls and Mediterranean shipping disruptions are restricting supplies of genomic probes from European suppliers, prolonging accuracy validation timelines and raising certification costs for international screening consortia. To mitigate these issues, some developers are partnering with California-based probe manufacturers, implementing compliance protocols that expedite FDA approvals and secure precision oncology grants.

Escalating colorectal screening mandates are directing NCI allocations into ctDNA-based panels, fostering adoptions in gastroenterology practices. U.S. tariffs of 25% on imported medical devices and components are elevating costs for Asian-sourced reagents and arrays, squeezing budgets for ambulatory labs and occasionally disrupting global mutation detection harmonizations. In response, developers are leveraging IRA innovation credits to build Oregon synthesis facilities, advancing methylation-specific assays and enhancing expertise in liquid biopsy workflows.

Latest Trends

FDA Approval of Shield Blood Test is a Recent Trend

The regulatory endorsement of blood-based screening modalities has epitomized a landmark progression in colorectal cancer molecular diagnostics during 2024, prioritizing non-invasive ctDNA detection for population-level surveillance. Guardant Health’s Shield test, leveraging methylation and mutation profiling, identifies advanced neoplasms with 83% sensitivity for colorectal cancer and 13% for adenomas. This innovation embodies a shift toward accessible platforms, accommodating average-risk adults without stool collection burdens.

Oversight validations affirm its analytical robustness, expediting endorsements for guideline integrations amid screening adherence challenges. This endorsement resonates with preventive imperatives, tethering outputs to follow-up algorithms for endoscopic triage. The platform addresses compliance gaps, prioritizing configurations resilient to demographic variabilities.

The Food and Drug Administration approved Guardant Health’s Shield blood test for screening of colorectal cancer in average-risk adults aged 45 and older on July 29, 2024, marking a milestone in liquid biopsy applications. Such advancements underscore scalability, as implementations affirm concordance with FIT benchmarks. Observers anticipate payer assimilations, elevating its stature in national programs.

Longitudinal benchmarks confirm discordance minimizations, refining cost-effectiveness appraisals. The trajectory envisions multiplex enhancements, prognosticating adenoma-to-carcinoma transitions. This serological inflection not only augments screening equity but also synchronizes with ambulatory health visions.

Regional Analysis

North America is leading the Colorectal Cancer Molecular Diagnostics Market

In 2024, North America secured a 38.7% share of the global colorectal cancer molecular diagnostics market, driven by expanded Medicare coverage for non-invasive assays like stool DNA tests, which boosted screening uptake for early-stage detection among adults aged 45-75, aligning with updated USPSTF guidelines. Oncologists adopted NGS-based panels to identify PIK3CA and TP53 mutations, enabling tailored checkpoint inhibitor therapies for metastatic patients, reducing futile treatments by up to 25% in tertiary centers.

The FDA’s streamlined clearances for blood-based ctDNA assays supported recurrence monitoring in stage III survivors, facilitating real-time adjustments in chemotherapy regimens. Collaborative research networks refined epigenetic marker panels for adenoma detection, correlating with federal grants to address disparities in African American and Hispanic communities.

Demographic trends, including a 15% rise in young-onset cases, amplified demand for liquid biopsies in community oncology practices. These advancements underscored the region’s commitment to precision-driven colorectal diagnostics. The National Cancer Institute reported 153,020 new colorectal cancer diagnoses in the United States for 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Governments across Asia Pacific project the colorectal cancer molecular diagnostics sector to flourish during the forecast period, as national health initiatives target rising incidences through accessible biomarker screening in urbanizing regions. Authorities in Japan and Thailand deploy subsidized methylation assays, equipping rural clinics to detect early polyps in dietary high-risk populations.

Diagnostic firms collaborate with academic labs to validate KRAS-targeted NGS kits, anticipating precise therapy selection for metastatic cases in densely populated cities. Regulatory bodies in Malaysia and the Philippines fund portable ctDNA platforms, enabling community centers to monitor recurrence without urban referrals.

National programs estimate integrating diagnostic outputs into digital registries, streamlining referrals for EGFR therapies in familial cancer clusters. Regional researchers advance stool-based PCR assays, syncing with cancer surveillance networks to track MSI-high prevalence in coastal communities. These efforts forge a robust framework for equitable oncology diagnostics. The World Health Organization’s 2022 GLOBOCAN data estimated 607,339 new colorectal cancer cases in Eastern Asia, reflecting sustained regional burden into 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the colorectal molecular testing sector propel growth by advancing next-generation sequencing kits that profile KRAS and BRAF mutations, enabling oncologists to tailor therapies for improved patient responses. They secure co-development alliances with biotech innovators to refine liquid biopsy techniques, accelerating non-invasive screening and reducing dependency on invasive procedures. Enterprises allocate substantial resources to AI-enhanced bioinformatics platforms, automating variant interpretation to cut turnaround times in overburdened labs.

Executives pursue strategic acquisitions of assay developers, incorporating epigenomic markers to broaden panels for early detection. They deepen market presence in Europe and the Middle East, partnering with regional oncology networks to align with national screening mandates and access public funding. Additionally, they introduce outcome-linked pricing structures with health systems, tying reimbursements to survival metrics to fortify adoption and yield resilient income channels.

Roche Diagnostics, a foundational division of the Roche Group established in 1896 and headquartered in Basel, Switzerland, engineers integrated oncology solutions that span tissue diagnostics, molecular assays, and digital pathology to guide precision cancer care worldwide. The entity deploys its VENTANA MMR IHC Panel for Lynch syndrome screening in colorectal cases, complemented by NGS-based companion diagnostics that identify actionable biomarkers for targeted interventions.

Roche channels extensive R&D into AI collaborations, such as integrations with Owkin for microsatellite instability assessment, to enhance diagnostic accuracy. CEO Thomas Schinecker directs a global network active in over 100 countries, prioritizing interoperability and regulatory leadership. The division engages with clinical consortia to evolve guidelines, fostering equitable access to advanced testing. Roche Diagnostics cements its pivotal authority by synergizing analytical innovation with ecosystem partnerships to optimize colorectal outcomes.

Top Key Players in the Colorectal Cancer Molecular Diagnostics Market

- New Day Diagnostics

- U. Group Holdings

- Guardant Health

- Geneoscopy

- GE HealthCare Technologies

- F-Hoffmann-La Roche

- Exact Sciences Corporation

- DiaCarta

- Danaher Corporation

- Abbott Laboratories

Recent Developments

- In May 2025: Guardant Health introduced its next-generation Shield blood test, designed to detect early signs of colorectal cancer (CRC) directly from a simple blood draw. The test eliminates the need for sedation or dietary preparation, driving adoption in the CRC diagnostics market by improving patient comfort and accessibility to early cancer screening.

- In January 2024: Tempus launched Mx, a plasma-based minimal residual disease (MRD) assay developed for colorectal cancer research. This liquid biopsy test identifies circulating tumor DNA (ctDNA) without the need for baseline tumor tissue, strengthening the CRC diagnostics market by advancing precision monitoring for post-surgical cancer recurrence.

- In November 2023: Guardant Health, in collaboration with Samsung Medical Center in South Korea, introduced the Shield blood-based CRC screening test to expand non-invasive screening options in Asia. This partnership broadened access to advanced diagnostic tools, supporting early CRC detection in a high-risk population.

- In March 2023: BGI Genomics launched COLOTECT™ 1.0 in Slovakia in partnership with Zentya. The product enhances local access to cutting-edge genetic screening technologies, accelerating early diagnosis and treatment pathways for hereditary colorectal cancer.

Report Scope

Report Features Description Market Value (2024) US$ 2.6 billion Forecast Revenue (2034) US$ 5.7 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Kits, Instruments, and Services), By Technology (PCR-based, Transcription Mediated Amplification-based, Sequencing-based, Mass Spectrometry-based, Isothermal Nucleic Acid Amplification, and Chips & Microarrays-based), By End-user (Hospitals, Diagnostic Laboratories, and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape New Day Diagnostics, H.U. Group Holdings, Guardant Health, Geneoscopy, GE HealthCare Technologies, F-Hoffmann-La Roche, Exact Sciences Corporation, DiaCarta, Danaher Corporation, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Colorectal Cancer Molecular Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Colorectal Cancer Molecular Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- New Day Diagnostics

- U. Group Holdings

- Guardant Health

- Geneoscopy

- GE HealthCare Technologies

- F-Hoffmann-La Roche

- Exact Sciences Corporation

- DiaCarta

- Danaher Corporation

- Abbott Laboratories