Global Cloud Gaming Market By Device Type (Smartphones, Tablets, Gaming Consoles, PCs and Laptops, Smart TVs, and Head Mounted Displays), By Streaming Type ( Video Streaming and File Streaming), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Feb. 2024

- Report ID: 32243

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

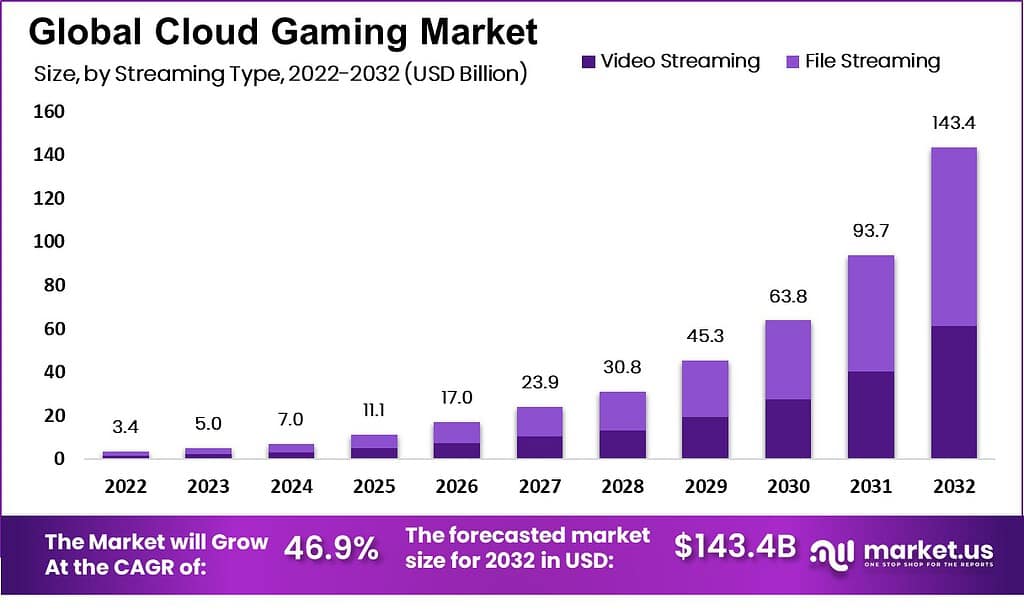

The Global Cloud Gaming Market size is expected to be worth around USD 143.4 Billion by 2032 from USD 5.0 Billion in 2023, growing at a CAGR of 46.9% during the forecast period from 2023 to 2032.

Cloud gaming is a game that uses cloud-based technology. It allows users to control and interact with a variety of games via web servers. The cloud then broadcasts the entire game to any device that has the cloud attached. Cloud gaming technology is different from traditional gaming, which runs on the device’s disk space. Instead, it works by incorporating cloud technology. This means that less storage is required on the device. Also known as gaming-as a-service cloud gaming is also called gaming-as-a-service.

Cloud gaming is the future of the gaming industry. Cloud gaming is a key component of delivering smooth gaming experiences to customers’ entire devices without the need for additional hardware configuration. Market growth will be driven by the growing demand for an immersive, low-latency gaming experience. Gamers can play games via an external cloud server without downloading the entire game. These games can be played on any device, which reduces storage space requirements and hardware setup costs.

In 2024, the global cloud gaming market is expected to witness significant user engagement, with total users worldwide reaching approximately 29.8 million. This growth underscores the increasing acceptance and popularity of cloud gaming across diverse regions and gamer demographics.

The distribution of cloud gaming users by region highlights the predominance of North America in the market, with an impressive 17.3 million users, accounting for over half of the global user base. Europe follows with 8 million users, showcasing the region’s strong adoption rates and infrastructure readiness for cloud gaming services.

The Asia Pacific region, with 3.6 million users, indicates a growing market with vast potential for expansion, given its large population and increasing internet penetration rates. The rest of the world collectively contributes to 0.9 million users, reflecting emerging markets and areas with growing interest in cloud gaming.

The breakdown of cloud gaming users by platform reveals that mobile cloud gaming users constitute a significant portion of the market, with 12.2 million users, or 41% of the total. This statistic emphasizes the importance of mobile devices in the cloud gaming ecosystem, attributed to their widespread availability, convenience, and the increasing capability of mobile networks such as 5G to support high-quality gaming experiences.

In terms of user types, the market is almost evenly split between casual cloud gamers and core/enthusiast cloud gamers, with 14.2 million and 15.6 million users, respectively. This balance highlights the broad appeal of cloud gaming, catering to both casual players looking for accessible, on-the-go gaming options and dedicated enthusiasts seeking high-quality, immersive gaming experiences without the need for expensive hardware.

Key Takeaways

- Cloud gaming is an emerging industry projected to reach USD 143.4 billion by 2032 and experience compound annual growth rate of 46.9% from 2023-2032.

- Smartphone gaming dominates its respective device segment due to its lower costs and enhanced performance, especially with 5G networks and unlimited data plans making mobile gaming more accessible than ever.

- File streaming dominates the streaming type segment of the Cloud Gaming Market as it provides game developers with cost savings while simultaneously cutting production costs, leading to rapid compound annual growth rates.

- Asia Pacific holds the largest market share for cloud gaming services globally, thanks to large gaming populations such as China, India, and Japan. Cloud gaming services continue to see widespread adoption across these regions.

- NVIDIA, Amazon Inc., Apple Inc., Google Inc., Intel Corporation, IBM Corporation, Microsoft Corporation and Sony Interactive Entertainment are some of the key players in the Cloud Gaming Market.

- Cloud gaming growth can be attributed to various factors, including increasing consumer demand for immersive, low-latency gaming experiences; rising mobile gaming popularity; and rapid adoption of advanced 5G features to enable cloud gaming without latency.

- The market faces some hurdles such as unstable internet connections and latency issues, but these should be reduced thanks to investments by telecom companies in high-speed connectivity, as well as key industry players investing in data servers.

Driving Factors

The market for cloud gaming is anticipated to grow as a result of an increase in internet users and the popularity of mobile gaming.

Smartphone use is accelerating globally at an incredible rate in today’s technology-driven world. As a result, technology is altering how people socialize and communicate as a whole. Smartphone users get access to a wide range of online services and content through a number of apps. The popularity of video games has been rising over time. And the trend has only gotten stronger as individuals look for new ways to socialize and pass the time during the pandemic. The industry of gaming has expanded to surpass that of movies and sports put together.

Cloud gaming is a new style of online gaming in which game data is rendered on the cloud side rather than the system of the end-user and transmitted via a high-speed network. One of the industries in the multimedia entertainment sector with the quickest growth is video gaming. The widespread use of smart mobile devices and mobile gaming is driving up market demand.

Restraining Factors

Unstable Internet Connection and Latency Issues Can Hinder the Market Growth of Cloud Gaming Market.

Streaming games to a cloud platform needs a low latency network that has high bitrates as well as sufficient bandwidth. In some countries, however, it may not be possible to establish a connection to the internet that provides the desired performance. If the network and bandwidth levels are not up to standard, latency and responsiveness may be a problem. The limiting factor could be eliminated as more telecom companies offer high-speed connectivity, as well as other key organizations, such as Google LLC and Microsoft Corporation, invest in data servers.

We have already mentioned that bandwidth can be a problem when gaming via the Cloud. It has been attempted to counter this issue with compression. Compression of the gameplay can also reduce its quality. It doesn’t appear as detailed on a high-end PC.

Growth Opportunities

Advanced 5G Features will be Key to Unlocking Cloud Gaming Without Latency.

The distance between an end user and a server location can affect network latency. This can be solved by placing distributed servers closer to users. Servers can be moved within a service provider network to provide maximum traffic control. The experience will be enhanced by implementing 5G SA and network slicer in mobile networks. Advanced features such as (L4S 3) will enhance the management of data flow and offer an optimal user experience.

Game providers are upgrading their cloud gaming subscriptions to expand their gaming portfolios and make games more accessible across multiple platforms. Cloud gaming requires a subscription, a smartphone or TV, and an internet connection. Cloud gaming is a lucrative market, and many companies have the ability to provide connectivity to end users to support cloud gaming.

Trending Factors

In today’s digital world, smartphones are everywhere. With the popularization of smartphones, game developers are creating a mobile gaming environment. Network providers are investing in mobile gaming to provide a better gaming experience. Users can also improve their gaming experience by using high-end smartphones and cloud technologies.

Mobile gaming can offer a low latency with a high-quality gaming experience. Out of 106 service providers, all have launched mobile cloud gaming services. The survey found that there are approximately 2.4 billion mobile gamers worldwide. The market is expected to grow due to cloud-based mobile gaming.

Cloud gaming will be a success worldwide if 5G is released and unlimited data plans become available. This is because most gamers prefer to play games on their smartphones. This success is also dependent on the growth of services and investments made in 5G infrastructure. Cloud gaming platforms like Google Stadia or PlayStation already exist on the market.

They mainly target PC and console players. Cloud gaming services are expected to increase as 5G services launch in multiple countries. They will take advantage of the mobile commonness, ultrafast 5G connections, and provide high-quality gaming for smartphone users. Cloud gaming services will be pushed by key companies in the gaming industry and mobile network operators to increase the use of cloud gaming.

Cloud-based games saw a surge in demand during the lockdown because they don’t require any additional hardware and can be used on any device. People around the world turned to cloud-based games and digital entertainment platforms during the lockdown to pass their time.

According to a survey, gaming apps have seen their average time spent rise by 21%. Many players saw the outbreaks as an opportunity to increase their customer base and create cloud gaming platforms. For instance, in May 2021, ATechnos introduced GoGames. It is a premium gaming platform that offers a range of services. It will offer users a variety of games, including action and virtual reality games.

Device Type Analysis

Low Cost and High Performance Helps Smartphones to Lead in the Device Type Segment in Cloud Gaming Market.

The highest-earning device category in this market is smartphones. This is due to its cost-effectiveness and steady rise in mobile gaming in the past five years. It is also preferred because it is very expensive to upgrade consoles and PCs in order to maintain game performance.

The numerous technological advances in cloud gaming, such as AR, VR, and 5G, are responsible for the rise in demand for mobile games. Cloud gaming has seen a surge in popularity due to the launch of 5G networks and the availability of unlimited data plans. Most gamers prefer to play games on mobile devices rather than on their PCs or tablets.

Gaming consoles are becoming more popular due to the growing popularity of cloud gaming. Consoles are becoming increasingly popular because only a small percentage of people have the means to afford them.

They also offer the convenience of using controllers instead of spending the time or effort needed to build or buy a computer. These factors are expected to grow the gaming consoles’ share in the device segment in the global cloud gaming market.

HMD technology is expected to become the next big thing in cloud gaming, particularly in horror games. It enhances scares and opens up new perspectives on how people experience horrifying scenes. The implementation of 3D technology in gaming is a new development.

It makes it difficult for people to distinguish a game from its real-life counterparts. These major advancements have allowed gaming to reach a new level. The seamless transition between cut scenes and gameplay gives gamers a unique perspective of VR gaming. This is expected to increase the HMD’s growth at the highest rate of CAGR over the forecast period.

Streaming Type Analysis

File Streaming Dominates in the Streaming Type Segment of the Cloud Gaming Market.

File streaming is more affordable for game developers; it will see the fastest CAGR. File streaming reduces costs for media production and can be used to send patches to players. Cloud streaming is a trend that many gaming companies are now adopting. This trend will likely continue for the next few years. Private clouds are used by businesses to host their games. This allows them to enjoy greater security and exclusivity.

Video streaming is increasing in popularity because it eliminates the need to purchase additional hardware. Video streaming services allow users to play and access games on any device and at any time via the internet. Vendors are focusing more on creating platforms that offer a better gaming experience to drive the global cloud gaming market. Many key players like Shadow, GeForce Now, and LiquidSky support video streaming games and are expected to boost video streaming in the streaming-type segment.

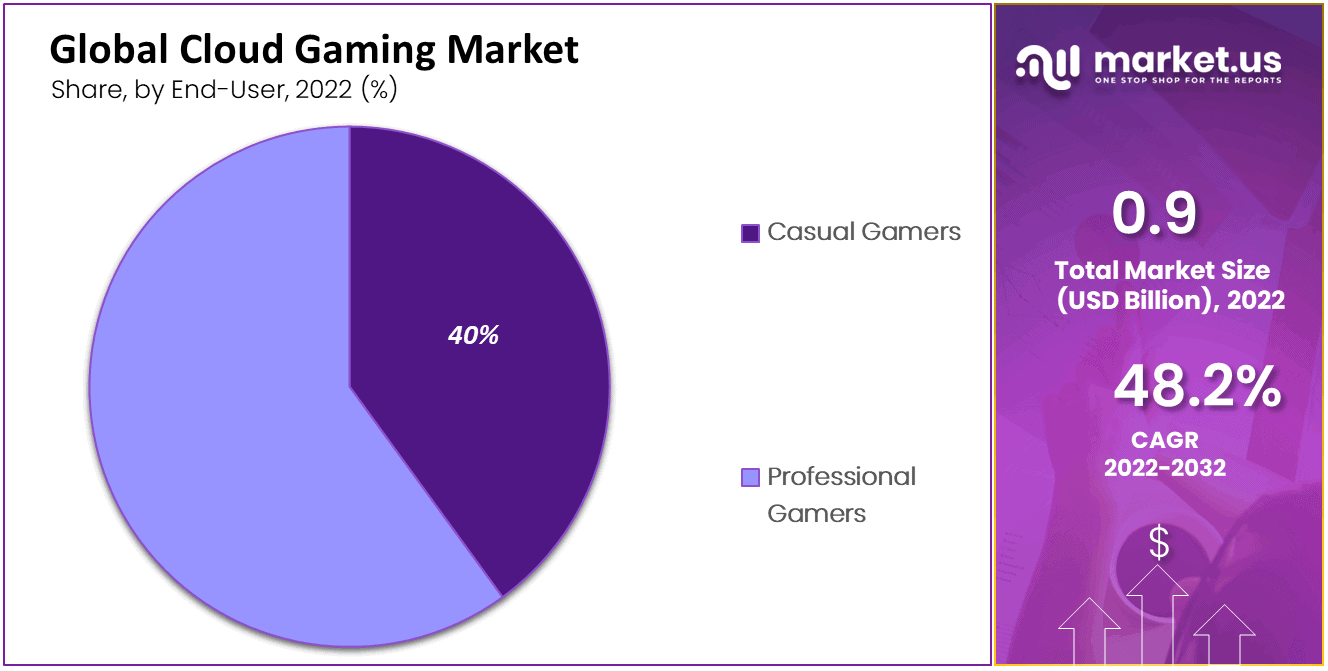

End-User Analysis

Casual Gamers Lead the Segment with the Highest CAGR.

More than half of the market share is held by casual gamers. They are predicted to increase the segment at a CAGR exceeding 40.0%. Hyper-casual is one of the most popular gaming categories currently. They have the largest viewership and could be monetized to earn revenue. Voodoo’s hyper-casual games have been downloaded more than 2 billion times. Casual gamers are people who play video games for entertainment, fun, with friends, or just to have fun.

People who fall under this category have greater access to video games thanks to the availability of smart TVs, smartphones, and laptops. Casual gamers will not be able to afford gaming-specific hardware like gaming laptops, which are more expensive than those used for non-gaming purposes.

The hardware requirements for memory and technology are increasing as video games become more advanced. Cloud gaming eliminates this requirement and allows casual gamers to play the games they choose without limitations.

The Professional gamers segment will grow rapidly due to increased investments in innovative and creative gaming solutions. Market participants are investing heavily in rich media content to offer high-quality streaming games on smart TVs, laptops, computers, smartphones, and other devices. As a result, hardcore gamers will increase their use of cloud-based gaming solutions, and this is expected to drive market growth in the near future. They have the ability to play expensive games, such as consoles or gaming PCs. This allows them to have access to a wider variety of games.

Most professional and competitive gamers engage in MOBA and FPS games. Cloud gaming vendors must recognize this requirement and act accordingly. Cloud gaming also allows professional gamers to play multiplayer with their friends on different devices and locations. This can be a great option for those who wish to play with more friends or take part in online tournaments. This will increase cloud gaming’s popularity among professional gamers and thus increase revenue growth for this segment.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Device Type

- Smartphones

- Tablets

- Gaming Consoles

- PCs and Laptops

- Smart TVs

- Head-Mounted Displays

Streaming Type

- Video Streaming

- File Streaming

End-User

- Casual Gamers

- Professional Gamers

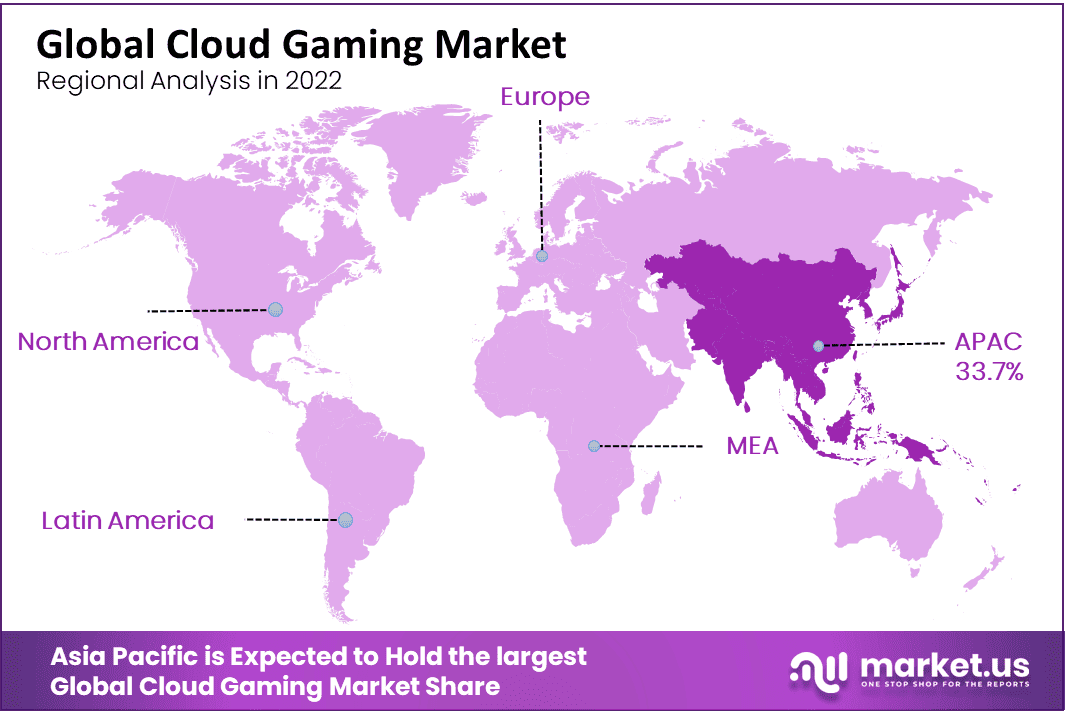

Regional Analysis

Asia Pacific Dominates the Market with Major Share in Global Cloud Gaming Market.

Asia Pacific had the largest revenue share at almost 33.7%. It is expected to continue growing steadily over the forecast period. The demographics of the region and the large gaming population are two major factors that contributed to market growth. China and India are two of the most populous countries in the world that have large gaming communities.

Cloud gaming services have also increased in Japan. Cloud gaming platforms allow users to stream video games instead of downloading them onto their smartphones. This is a market that is seeing new platform launches. Tencent began testing its cloud gaming service, “Start.” Tencent has begun testing the cloud gaming service “Start” in several markets, including China. The company will only allow a small number of users to sign up. The company is attempting to outdo its competition in the next major gaming industry trend.

North America will be a major market for cloud gaming. Cloud technology is accepted quickly in this region, with rising demand for cloud gaming and the widespread availability of efficient internet infrastructure. This will help increase North America’s market expansion. The European gaming industry is also expanding, which will, in turn, increase cloud gaming revenues.

This expanding potential drives massive collaboration, investment, and acquisition in Europe’s gaming sector. Microsoft Corporation acquired ZeniMax Media, a publisher and game developer, from the European Commission.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

NVIDIA is the market leader in cloud gaming. NVIDIA develops GPUs that solve complex problems in computer science. It is a specialist in markets that use GPU-based visual computing or accelerated computing platforms. These platforms combine processors, software systems, and services. The company’s continued growth in 3D graphics and the size of the gaming market have prompted it to develop Virtual Reality (VR) and Artificial Intelligence. NVIDIA Corporation, Microsoft Corporation, Apple Inc., and Intel Corporation are some of the key players in the global cloud gaming market.

Top Market Leaders

- Amazon Inc.

- Apple Inc.

- Electronic Arts, Inc.

- Google Inc.

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Ubitus Inc.

- Tencent Holdings Ltd.

- Other Key Players

Recent Developments

Microsoft Corporation:

- January 2023: Acquired Activision Blizzard for $68.7 billion, expanding its cloud gaming library with popular titles like Call of Duty.

- June 2023: Launched Xbox Cloud Gaming on Meta Quest headsets, bringing its streaming service to VR platforms.

- September 2023: Signed a 10-year deal with NVIDIA to bring Xbox PC games to GeForce NOW, addressing concerns about the Activision acquisition and expanding its cloud gaming reach.

NVIDIA Corporation:

- September 2023: Signed a 10-year deal with Microsoft to bring Call of Duty and other Xbox titles to GeForce NOW, solidifying its position as a major cloud gaming platform.

- October 2023: Launched GeForce NOW RTX 4080 tier, offering high-performance cloud gaming with the latest NVIDIA GPUs.

- November 2023: Partnered with Ubisoft to bring Ubisoft+ subscription service to GeForce NOW, expanding its game library further.

Report Scope

Report Features Description Market Value (2023) US$ 5.0 Bn Forecast Revenue (2032) US$ 143.4 Bn CAGR (2023-2032) 46.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type – Smartphones, Tablets, Gaming Consoles, PCs and Laptops, Smart TVs, and Head Mounted Displays; By Streaming Type – Video Streaming and File Streaming; By End-User – Casual Gamers and Professional Gamers. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amazon Inc., Apple Inc., Electronic Arts Inc., Google Inc., Intel Corporation, IBM Corporation, Microsoft Corporation, NVIDIA Corporation, Sony Interactive Entertainment, Ubitus Inc., Tencent Holdings Ltd., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cloud gaming?Cloud gaming, also known as gaming on demand, is a type of online gaming that allows direct and on-demand streaming of games onto a variety of devices. Instead of using a local device such as a console or PC, users can play games using remote hardware, with the game video and audio streamed directly to their device.

How does cloud gaming work?Cloud gaming works by running games on powerful remote servers and streaming the gameplay to the user's device over the internet. The user's commands are sent to the server, which processes the input and updates the game state accordingly. The video and audio output are then streamed back to the user's device, creating the illusion of a local gaming experience.

How Big is Cloud Gaming Market?The Global Cloud Gaming Market size is expected to be worth around USD 143.4 Billion by 2032 from USD 3.4 Billion in 2022, growing at a CAGR of 46.9% during the forecast period from 2023 to 2032.

What are the advantages of cloud gaming?Some advantages of cloud gaming include the ability to play high-quality games on low-end devices, eliminating the need for expensive hardware upgrades, and providing the flexibility to play games on multiple devices without the need for installation or downloads. Cloud gaming also allows for instant access to a wide range of games without the need for physical copies or large downloads.

Who are the key players in the cloud gaming market?Some of the key players in the cloud gaming market include major technology companies such as Amazon Inc., Apple Inc., Electronic Arts Inc., Google Inc., Intel Corporation, IBM Corporation, Microsoft Corporation, NVIDIA Corporation, Sony Interactive Entertainment, Ubitus Inc., Tencent Holdings Ltd., and Other Key Players.

What is the future of the cloud gaming market?The future of the cloud gaming market is expected to be promising, with increasing adoption of 5G technology, advancements in streaming technology, and improvements in infrastructure. As more players enter the market and competition intensifies, the industry is likely to see further innovation and improvements in the overall gaming experience.

-

-

- Amazon Inc.

- Apple Inc.

- Electronic Arts, Inc.

- Google Inc.

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Ubitus Inc.

- Tencent Holdings Ltd.

- Other Key Players