Global Clear Aligners Market By Age (Adults and Teens) By Material Type (Polyurethane, Plastic Polyethylene Terephthalate Glycol and Others) By End-Use (Hospitals, Stand Alone, Practices, Group Practices and Others) By Dentist Type (General Dentists, Orthodontists) Duration Outlook (Revenue, USD Million, 2018 - 2030), Comprehensive malfunction (treatment > 12 month/ > 40 sets of Aligner), Medium treatments (treatment > 6-12 month/ 20-40 sets of Aligner), Small little beauty Alignments (treatment

- Published date: Nov 2023

- Report ID: 64714

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

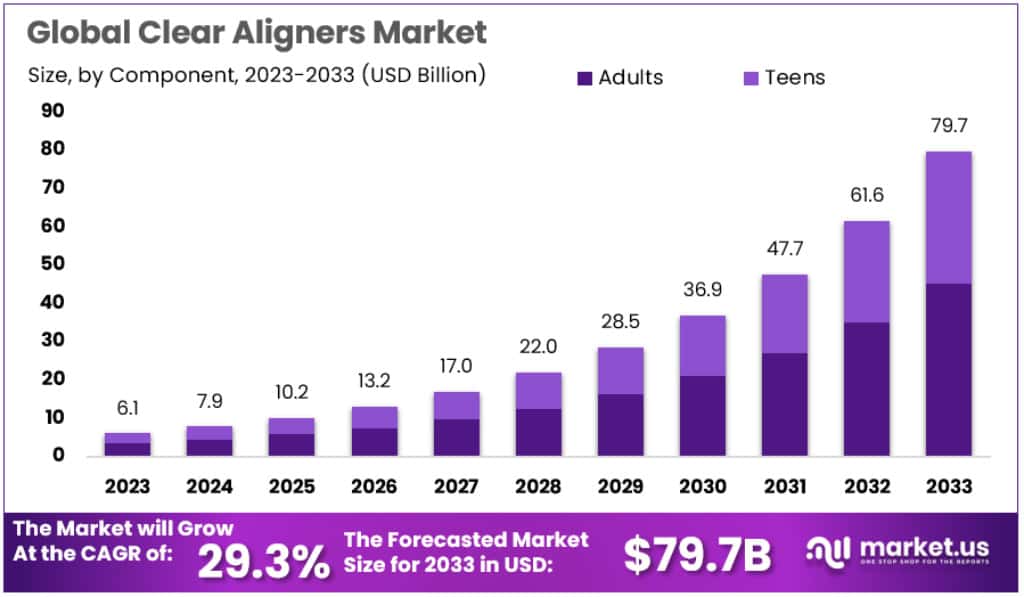

The Global Clear Aligners Market size is expected to be worth around USD 79.7 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 29.3% during the forecast period from 2023 to 2033.

Clear aligners are a custom-made set of orthodontic systems that fit tightly to the teeth. Clear aligners are discreet alternatives to braces and can be removed. They can be removed easily and are convenient for patients.

Market forces include the growing number of patients with malocclusions and technological advancements in dental treatment. Clear aligners that are custom-made are also in high demand.

Key Takeaways

- The Clear Aligners Market is projected to expand from USD 6.1 Billion in 2023 to around USD 79.7 Billion by 2033.

- A compound annual growth rate (CAGR) of 29.3% is anticipated during the forecast period of 2023-2033.

- In 2023, the adult demographic commands a dominant share of 56.9% in the market.

- Standalone practices hold a 54.8% share of the market in 2023.

- Orthodontists possess the largest market share among dentist types with 66.9% in 2023.

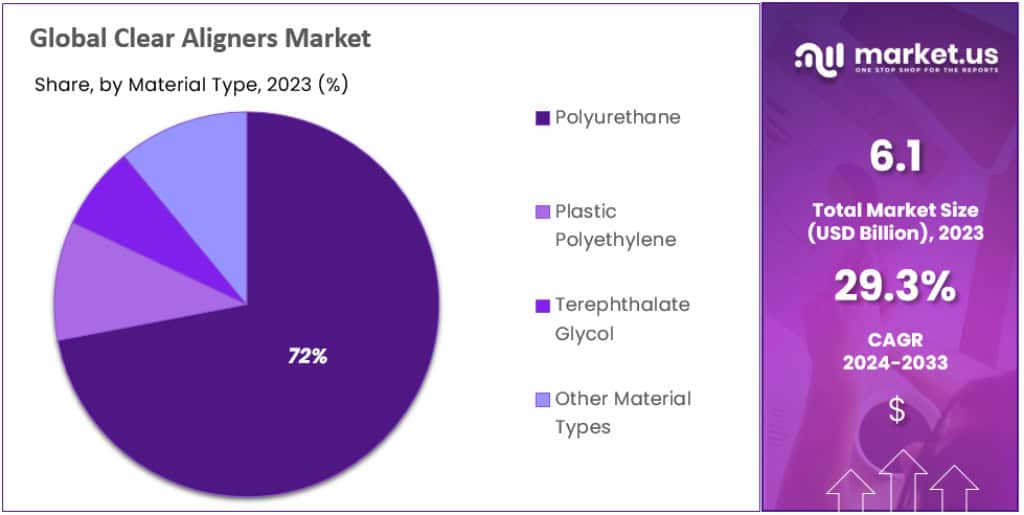

- Polyurethane is the leading material type, holding a 72% market share in 2023.

- Medium treatments, taking 6 to 12 months, dominate the market with a 48.3% share in 2023.

- Offline distribution channels have a substantial market share of over 73% in 2023.

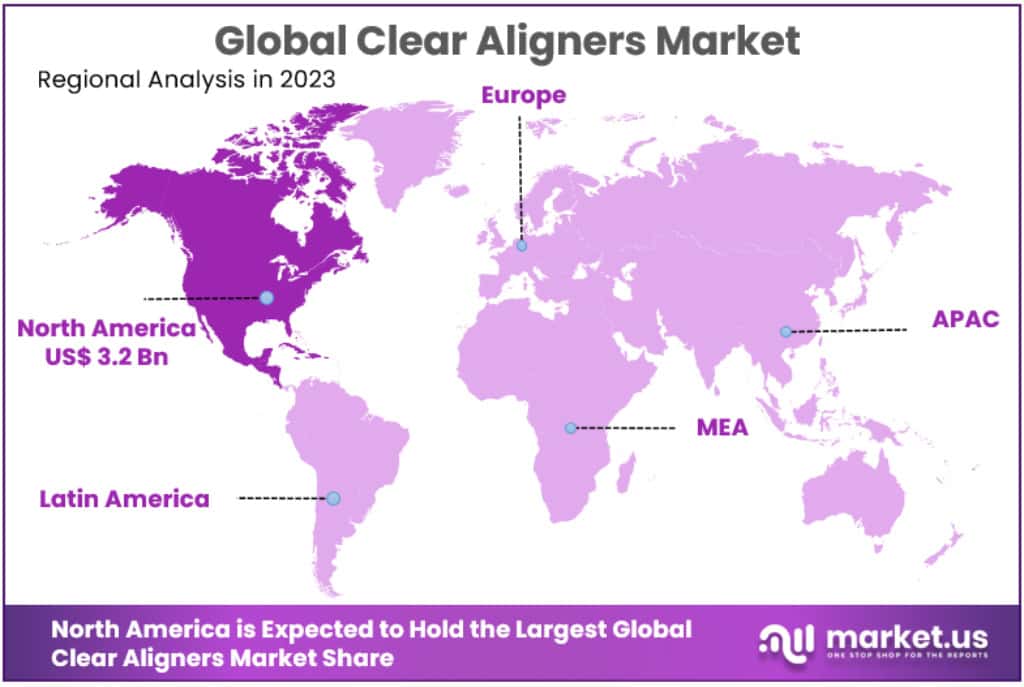

- North America leads the market with a 52.37% share, valuing USD 3.2 billion in 2023.

- The APAC region is anticipated to have the highest CAGR of 33.6% during the forecast period.

By Age

In 2023, Adults held a dominant market position, capturing more than a 56.9% share in the clear aligners market. This predominance is reflective of the growing consciousness among adults regarding dental aesthetics and the advantages of clear aligners in terms of comfort and discretion. The adult segment benefits from higher disposable incomes and willingness to invest in cosmetic dental treatments. Moreover, technological advancements have expanded treatment effectiveness for a broader range of dental issues, further driving adult adoption rates.

Conversely, the teen segment, while smaller in comparison, exhibits a promising growth trajectory. Clear aligners are becoming increasingly popular among teenagers due to their near-invisibility, which addresses the social self-consciousness associated with traditional braces. Additionally, the rising involvement of parents in seeking advanced dental solutions for their children bolsters this segment’s expansion. However, the growth within the teen demographic may be tempered by the higher vigilance required to ensure consistent use, which is a pivotal factor in the effectiveness of the treatment.

By End-Use

In 2023, Standalone Practices held a dominant market position in the clear aligners market, capturing more than a 54.8% share. This segment’s success stems from the personalized service and dedicated attention they offer to individual patients, qualities highly valued in orthodontic care. Standalone practices are often preferred for their specialized focus on dental and orthodontic services, allowing for a tailored patient experience.

Hospitals are another key segment, taking a sizable market share due to their comprehensive care facilities and the trust associated with established healthcare institutions. They serve as a full-service option for patients, although higher costs can influence patient preferences towards more cost-effective solutions.

Group Practices have carved out their market space by combining resources and expertise, which can lead to enhanced service provision and efficiency. They strike a balance between personalized care and resource-rich services, appealing to a broad patient base.

The ‘Others’ category, including dental chains and non-traditional dental service organizations, is gradually expanding. These providers leverage marketing and economies of scale to cater to price-sensitive customers, while also investing in technology to improve patient outcomes.

By Dentist Type

In 2023, Orthodontists held a dominant market position, capturing more than a 66.9% share of the clear aligners market. Their expertise in aligning and straightening teeth positions them as the preferred choice for patients seeking clear aligner treatments. The trust in their specialized skills drives demand, as they are perceived to deliver optimal results in teeth correction.

General Dentists also play a vital role in the clear aligners market, catering to a broad patient base. They offer the convenience of providing clear aligner services alongside routine dental care, which can be a compelling factor for patients looking for a one-stop dental care solution. Although they hold a smaller share of the market compared to orthodontists, general dentists are expanding their offerings in orthodontic care, thereby growing their market presence.

By Material Type

Polyurethane secured a dominant market position in the clear aligners sector, capturing more than a 72% share in 2023. Its prevalence in the market can be attributed to its superior properties, such as flexibility and durability, which are essential for the efficacy and comfort of clear aligners. The material’s strength ensures a longer lifespan of the aligner, making it a cost-effective option for consumers.

Plastic polyethylene terephthalate glycol (PETG), another key material, is also favored for its clarity and ease of molding, which are vital for the aesthetic aspect of aligners. While PETG holds a smaller segment of the market relative to polyurethane, it is gaining traction due to its recyclability and lower production costs, catering to a market segment that is cost-sensitive and environmentally conscious.

The ‘Others’ category encompasses a variety of emerging materials, including biodegradable and innovative polymer blends, which are starting to make inroads into the market. These materials are tapping into the growing demand for sustainable and allergen-free options within the orthodontic space.

By Duration Outlook

In 2023, Medium Treatments held a dominant market position in the clear aligners sector, capturing more than a 48.3% share. This segment addresses a wide range of dental malocclusions requiring 6 to 12 months of treatment, making it a versatile and appealing option for patients with moderate alignment issues. The balance between duration and effectiveness makes this option attractive, as it fits within the lifestyle needs of many individuals seeking noticeable yet not overly prolonged treatment.

Comprehensive malfunction treatments, which extend beyond 12 months, cater to patients with more complex dental issues. While this segment is smaller due to the longer commitment and higher cost, it remains critical for those needing significant dental corrections. The assurance of a thorough and complete alignment process justifies the extended duration for those with severe malocclusions.

On the shorter end, Small little beauty Alignments, suitable for minor adjustments, are gaining popularity. These treatments, often lasting less than 6 months, are ideal for patients desiring quick enhancements to their smiles. The convenience and shorter time frame resonate with those looking for rapid results and fewer dental visits.

Each duration category within the clear aligners market caters to specific patient needs, ranging from extensive corrective treatments to minor aesthetic improvements. The market reflects a broad spectrum of consumer preferences, with medium treatments leading due to their moderate treatment time and broad applicability.

By Distribution Channel

In 2023, Offline distribution channels held a dominant market position in the clear aligners market, capturing more than a 73% share. This channel’s strength lies in the direct patient-practitioner interactions, which are crucial for personalized treatment planning and follow-up. The hands-on approach offered by dental clinics and orthodontic offices ensures that patients receive custom-fitted aligners and professional monitoring throughout their treatment, factors that are highly valued for medical devices requiring precise fitting.

Online channels, while holding a smaller portion of the market, are rapidly growing. They appeal to the modern consumer’s preference for convenience and often competitive pricing. The online model allows for remote consultation and easy direct-to-consumer delivery, making it an increasingly popular choice for those with minor alignment issues and busy lifestyles.

Key Market Segments

Age

- Adults

- Teens

Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

End-Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

Dentist Type

- General Dentists

- Orthodontists

Duration Outlook (Revenue, USD Million, 2018 – 2030)

- Comprehensive malfunction (treatment > 12 month/ > 40 sets of Aligner)

- Medium treatments (treatment > 6-12 month/ 20-40 sets of Aligner)

- Small little beauty Alignments (treatment <4-6 month/ <20 sets Aligner)

Distribution Channel

- Online

- Offline

Regional Analysis

North America leads the Clear Aligners Market, holding a 52.37% share with a market value of USD 3.2 billion in 2023. This is due to increased R&D investment, the present global players in local markets, & their efforts to obtain new patents. The American Dental Association reports that 80% of Americans value oral health & consider it a key part of overall health. Braces are used by nearly four million Americans, with 30% of them being adults.

Patients who don’t want braces but want to improve the appearance of their smiles have been attracted to clear tray-style aligners. Aligners are becoming more popular due to the many options obtained for aligning teeth and increasing awareness about hygiene.

The APAC region will experience the highest CAGR (33.6%) due to increased demand for clear aligners in China and India over the forecast period. The aesthetic appeal and ease of use of the aligner systems is the reason. Align Technology introduced clear aligners Invisalign Teen, Full, and Teen in India in February 2016. These systems are intended for urban residents of over 75 million. These systems account for a large share of India’s premium dental care product sales.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global market has seen intense competition. The rapid adoption of digital technology such as intraoral scans and digital tooth setups, 3D printers, and CAD/CAM devices is a key factor in ensuring market competitiveness. A significant number of these market players are also looking for partnerships and strategic expansions to expand their geographic presence, increase sales volume in economically-friendly regions, and launch new products.

Align Technology, for example, opened a Polish manufacturing plant in April 2021 to expand its global operations. The company will be able to serve a vast and underserved market for Invisalign throughout Europe, the Middle East, and Africa. Dentsply Sirona purchased Straight Smile LLC (BYTE), a leader in direct-to-consumer and doctor-directed clear aligner markets. This acquisition will allow the company to expand its SureSmile aligner market.

Envista Holdings Corporation announced in April 2021 a partnership with Curaeos Clinics, which will provide the company with the most recent dental technology. Curaeos Clinics operates a large network of dental clinics in the Netherlands, Belgium, and Denmark as well as Germany, Germany, and Italy.

Market Key Players

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

- and Other

Recent Development

- November 2023: SmileDirectClub has forged new partnerships with Walmart and Delta Dental to enhance the accessibility and affordability of clear aligners.

- November 2023: Align Technology has introduced Invisalign Go Express, an expedited treatment option for individuals with mild to moderate teeth crowding.

- November 2023: ClearCorrect now incorporates SmartTrack technology, which utilizes artificial intelligence to develop more accurate and reliable treatment plans.

- November 2023: Candid has teamed up with CareCredit, offering patients financing solutions for their clear aligner treatments.

- November 2023: Byte has unveiled Byte for Teens, a specialized range of clear aligners tailored for the teenage market.

Report Scope

Report Features Description Market Value (2023) USD 79.7 Billion Forecast Revenue (2033) USD 6.1 Billion CAGR (2023-2032) 29.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Age (Adults and Teens) By Material Type (Polyurethane, Plastic Polyethylene Terephthalate Glycol and Others) By End-Use (Hospitals, Stand Alone, Practices, Group Practices and Others) By Dentist Type (General Dentists, Orthodontists) Duration Outlook (Revenue, USD Million, 2018 – 2030), Comprehensive malfunction (treatment > 12 month/ > 40 sets of Aligner), Medium treatments (treatment > 6-12 month/ 20-40 sets of Aligner), Small little beauty Alignments (treatment <4-6 month/ <20 sets Aligner) By Distribution Channel (Online and Offline) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Align Technology, Dentsply Sirona, Institute Straumann, Envista Corporation, 3M ESPE, Argen Corporation, Henry Schein Inc, TP Orthodontics Inc, SmileDirect Club and Angel Aligner Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Clear Aligners market in 2021?A: The Clear Aligners market size is US$ 3,800 million in 2021.

Q: What is the projected CAGR at which the Clear Aligners market is expected to grow at?A: The Clear Aligners market is expected to grow at a CAGR of 29.3% (2023-2033).

Q: List the segments encompassed in this report on the Clear Aligners market?A: Market.US has segmented the Clear Aligners Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Age, the market has been segmented into Adults & Teens; by End-use, the market has been segmented into Hospitals, Standalone Practices, Group Practices, & Other End-uses.

Q: List the key industry players of the Clear Aligners market?A: Align Technology, Dentsply Sirona, Institute Straumann, Envista Corporation, 3M ESPE, Argen Corporation, Henry Schein Inc, TP Orthodontics Inc, SmileDirect Club and Angel Aligner and Other Key Players are the key vendors in the Clear Aligners market.

Q: Which region is more appealing for vendors employed in the Clear Aligners market?A: North America accounted for the highest revenue share of 52.37%. Therefore, the Clear Aligners industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Clear Aligners Market.A: The US, Canada, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, etc., are leading key areas of operation for Clear Aligners Market.

Q: Which segment accounts for the greatest market share in the Clear Aligners industry?A: With respect to the Clear Aligners industry, vendors can expect to leverage greater prospective business opportunities through the standalone practices, as this area of interest accounts for the largest market share.

-

-

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

- Other Key Players