Global Chloroplatinic Acid Market By Purity (99%, 99.9%, Others), By Form (Liquid, Solid), By Application (Catalysis, Electroplating, Printing, Ceramics, Photographic, Others), By End Use (Chemical Industry, Pharmaceutical Industry, Automotive Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135044

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

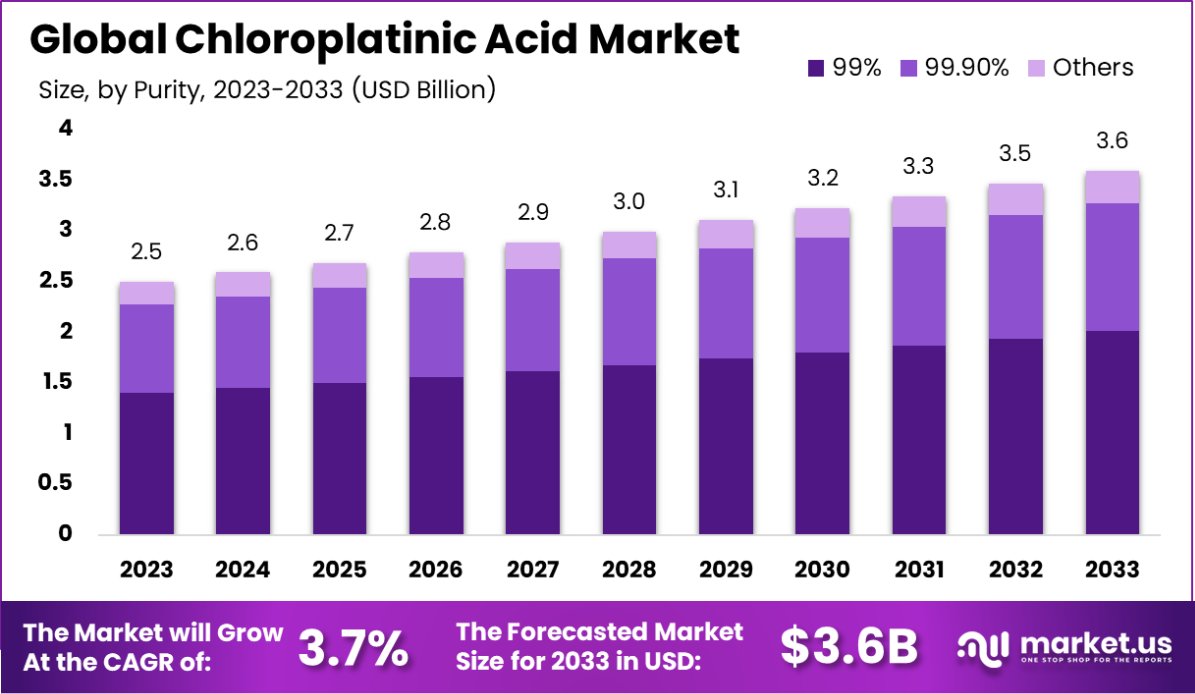

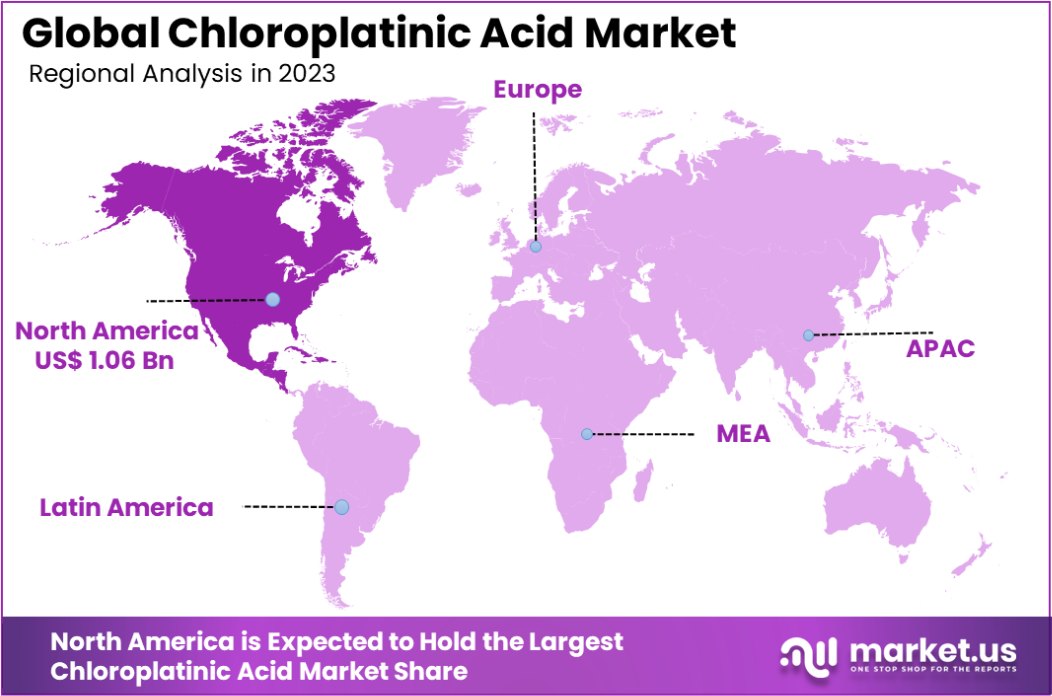

The Global Chloroplatinic Acid Market is expected to be worth around USD 3.6 Billion by 2033, up from USD 2.5 Billion in 2023, and grow at a CAGR of 3.7% from 2024 to 2033. North America holds 42.4% of the chloroplatinic acid market, USD 1.06 billion.

Chloroplatinic acid, also known as hexachloroplatinic acid, is a complex of platinum, with the chemical formula H2PtCl6. It is a reddish-brown compound and plays a crucial role in various chemical reactions, primarily used as a catalyst and in the preparation of platinum group metal and its derivatives.

The market for chloroplatinic acid is driven by its extensive use in the automotive industry, especially in catalytic converters, and its applications in chemical synthesis and pharmaceuticals. The demand for chloroplatinic acid is primarily fueled by the increasing requirements for catalysts that facilitate emissions reduction and organic synthesis processes.

The growth of the chloroplatinic acid market can be attributed to advancements in automotive catalyst technologies and stringent environmental regulations demanding lower vehicle emissions.

Increased demand for high-performance catalysts in the pharmaceutical and fine chemical industries, where chloroplatinic acid is integral in synthesis processes, significantly impacts market dynamics.

Opportunities in the chloroplatinic acid market are expanding with the rise of eco-friendly technologies and the increasing adoption of photochemical reactions in organic synthesis, positioning chloroplatinic acid as a key component in sustainable industrial practices.

The global market for chloroplatinic acid is currently experiencing a phase of incremental growth, primarily driven by its critical applications in chemical analysis and advanced material production.

Historically, chloroplatinic acid has been instrumental in the quantitative analysis of potassium, where it facilitates the precipitation of potassium as potassium hexachloroplatinate from alcohol solutions.

Recent advancements in material science have further expanded the utility of chloroplatinic acid, particularly in the synthesis of platinum nanoparticles (PtNP) combined with reduced graphene oxide (RGO). These PtNP-RGO composites have demonstrated significant potential as supercapacitor electrodes.

Notably, these electrodes exhibit a specific capacitance of 154 F g^-1 at a low current density, with a markedly high capacity retention rate of 72.3% at elevated current densities. This performance is a substantial improvement over traditional RGO electrodes, highlighting the superior electrochemical properties imparted by chloroplatinic acid-derived materials.

Platinum, the fundamental component of chloroplatinic acid, remains a scarce resource with concentrated deposits primarily in South Africa, accounting for approximately 80% of global production.

The metal’s characteristics, such as high malleability, ductility, and exceptional corrosion resistance, coupled with its rarity, underpin its high value and extensive use across various industries, including automotive, jewelry, and electronics.

Key Takeaways

- The Global Chloroplatinic Acid Market is expected to be worth around USD 3.6 Billion by 2033, up from USD 2.5 Billion in 2023, and grow at a CAGR of 3.7% from 2024 to 2033.

- Chloroplatinic acid with 99.9% purity constitutes 56.3% of the market, indicating high demand for premium quality.

- Liquid form dominates the chloroplatinic acid market, capturing 69.1% due to its extensive application range.

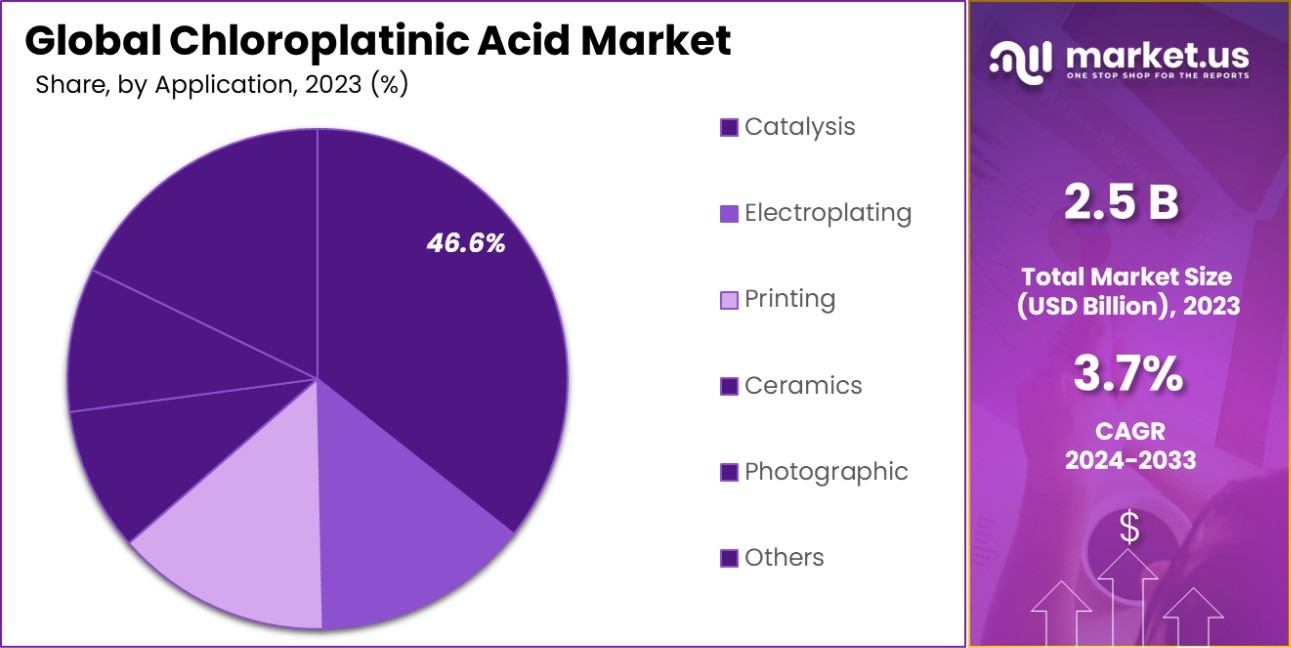

- In the catalysis sector, chloroplatinic acid accounts for 46.6% of its applications, underscoring its critical role.

- The chemical industry remains the largest end user of chloroplatinic acid, making up 44.6% of the market.

- In North America, the chloroplatinic acid market holds a 42.4% share, valued at USD 1.06 billion.

By Purity Analysis

Chloroplatinic acid with 99.9% purity accounts for 56.3% of the market, indicating high demand for premium quality.

In 2023, 99.9% held a dominant market position in the By Purity segment of the Chloroplatinic Acid Market, with a 56.3% share. This high level of purity is critically important for applications requiring stringent quality standards, such as pharmaceuticals and precision electronics, where impurities can significantly impact product performance and safety.

The demand for 99.9% pure chloroplatinic acid underscores the industry’s push towards higher-quality, more reliable chemical products, reflecting a broader trend of quality over cost among end users.

Turning to the form in which chloroplatinic acid is utilized, the liquid state led with a 69.1% market share. Its liquid form’s predominance is attributed to its ease of handling and integration into various industrial processes compared to solid forms. This convenience significantly enhances its application scope across multiple sectors, including catalysis and material science.

Regarding applications, catalysis emerged as the leading segment, consuming 46.6% of the market. Chloroplatinic acid’s role in catalysis is vital due to its ability to accelerate chemical reactions, which is essential in the manufacture of numerous chemical products.

Lastly, the chemical industry, as the primary end-user, accounted for 44.6% of chloroplatinic acid usage. This sector relies heavily on the acid for producing high-purity platinum catalysts and other specialty chemicals, driving consistent demand within this market segment.

By Form Analysis

The liquid form of chloroplatinic acid dominates the market, representing 69.1% of total sales, reflecting widespread industrial preference.

In 2023, Liquid held a dominant market position in the By Form segment of the Chloroplatinic Acid Market, with a 69.1% share. This preference for liquid chloroplatinic acid over its solid counterpart can be attributed to its versatility and ease of use in various industrial processes.

Liquid form facilitates more precise dosing and integration into chemical reactions, making it highly favored in sectors such as pharmaceuticals and electronics manufacturing, where accuracy is paramount.

The solid form, while less prevalent, still plays a critical role in certain applications where storage stability and long shelf life are necessary. However, the convenience and efficiency of using liquid chloroplatinic acid continue to drive its higher adoption rate across most industrial applications.

The market’s inclination towards liquid form is further reinforced by its significant application in catalysis processes, where liquid chloroplatinic acid is utilized to enhance reaction efficiencies. It holds a pivotal position in producing catalysts that are crucial for organic synthesis and petrochemical refining.

Moreover, the chemical industry, as the largest end user, predominantly utilizes liquid chloroplatinic acid to streamline production processes and improve product quality. The ongoing demand within this sector underscores the sustained market preference for the liquid form, reflecting its integral role in modern industrial applications.

By Application Analysis

In applications, 46.6% of chloroplatinic acid is used in catalysis, showcasing its pivotal role in chemical reactions.

In 2023, Catalysis held a dominant market position in the By Application segment of the Chloroplatinic Acid Market, with a 46.6% share. This significant proportion underscores the crucial role of chloroplatinic acid as a catalyst in a variety of chemical reactions, particularly in the synthesis of fine chemicals and pharmaceuticals.

Its ability to accelerate reaction rates while ensuring product purity makes it indispensable in high-stakes industries where quality cannot be compromised.

Other applications such as electroplating, printing, ceramics, and photographic processes also utilize chloroplatinic acid but to a lesser extent. In electroplating, it serves to improve the adherence and quality of plating on metal surfaces, whereas, in printing and photographic applications, it is used for its chemical properties that enhance the quality and durability of images and prints.

Despite the diversity of its applications, the demand for catalysis remains dominant due to the ongoing need for efficient and sustainable chemical processes in industrial production. This demand is further supported by the rise in stringent environmental regulations, which push industries toward greener and more efficient catalytic processes.

The sustained high usage of chloroplatinic acid in catalysis is a reflection of the expanding scope of its applications and the innovation within chemical industries, emphasizing its foundational role in modern industrial practices.

By End Use Analysis

The chemical industry is the largest end-user of chloroplatinic acid, consuming 44.6%, highlighting its essential utility in manufacturing.

In 2023, the Chemical Industry held a dominant market position in the By End Use segment of the Chloroplatinic Acid Market, with a 44.6% share. This leading status reflects the extensive use of chloroplatinic acid in manufacturing high-purity platinum catalysts and other specialty chemicals essential for various chemical processes.

The chemical sector’s reliance on this substance is driven by its efficacy in enhancing product yields and the efficiency of chemical reactions, critical factors in maintaining competitive industrial operations.

The Pharmaceutical and Automotive industries also incorporate chloroplatinic acid but to a lesser degree. In the pharmaceutical sector, it plays a pivotal role in research and development activities, particularly in the synthesis of active pharmaceutical ingredients (APIs) where precision and reaction control are paramount.

Meanwhile, the automotive industry utilizes chloroplatinic acid primarily in the production of catalytic converters, which are essential for reducing vehicle emissions, and aligning with global environmental standards.

Despite the varied applications across these sectors, the Chemical Industry’s consumption remains robust, underpinned by ongoing industrial processes that require the unique properties of chloroplatinic acid.

The continued dominance of this segment is indicative of the broader industrial reliance on advanced materials and chemicals that drive innovation and efficiency in production techniques.

Key Market Segments

By Purity

- 99%

- 99.9%

- Others

By Form

- Liquid

- Solid

By Application

- Catalysis

- Electroplating

- Printing

- Ceramics

- Photographic

- Others

By End Use

- Chemical Industry

- Pharmaceutical Industry

- Automotive Industry

- Others

Driving Factors

Increased Use in Cancer Treatments and Medical Research

Chloroplatinic acid is essential in the medical field, particularly in developing cancer treatments. As researchers explore new chemotherapy drugs, the demand for this compound grows because it is a key ingredient in some potent cancer-fighting medications.

Additionally, its use in various medical research projects aimed at understanding and treating other diseases contributes to its increasing market value. This growing application in health-related fields is a significant driver for the chloroplatinic acid market, reflecting its critical role in advancing medical science and patient care.

Rising Demand in Automotive Catalysts

The automotive industry heavily relies on chloroplatinic acid for producing catalytic converters, which are crucial for reducing harmful emissions from vehicles. As environmental regulations worldwide become stricter, automotive manufacturers are pushed to enhance the efficiency of these converters, boosting the demand for chloroplatinic acid.

This trend is particularly noticeable in regions with stringent emission standards, where the push for cleaner vehicles drives consistent demand for high-performance catalysts, directly influencing the market growth of chloroplatinic acid.

Expansion of Electroplating and Chemical Applications

Chloroplatinic acid is a vital component in the electroplating industry, used to coat jewelry, electronics, and other items with a thin layer of platinum for durability and aesthetics. Its use in chemical synthesis, such as producing other platinum compounds, and as a catalyst in important industrial reactions, further broadens its market.

As industries expand and the demand for high-quality finishes and specialized chemical processes increases, the need for chloroplatinic acid is expected to rise, contributing significantly to its market expansion.

Restraining Factors

High Costs and Limited Availability of Raw Materials

Chloroplatinic acid production relies on platinum, one of the most expensive metals, currently priced at around $30,000 per kilogram. The high cost of platinum significantly elevates the production expenses of chloroplatinic acid, making it less accessible for various applications.

Additionally, the limited availability of platinum, often found in only a few regions globally, adds to these challenges. These factors create a substantial barrier to entry and limit market growth, as producers and consumers may seek more affordable alternatives or reduce usage rates due to cost concerns.

Environmental and Health Safety Regulations

Stringent environmental and health safety regulations significantly impact the chloroplatinic acid market. Due to its toxic nature, handling and disposing of chloroplatinic acid require strict compliance with safety protocols, which can be costly and complex. In some regions, the cost of compliance can increase by up to 15-20% of the total production cost.

These regulations, while necessary for safety, act as a restraint on the market by increasing operational costs and slowing down production processes, which may deter new players from entering the market or expanding operations.

Development and Adoption of Substitute Materials

As technology advances, the development of cheaper or more efficient substitute materials poses a significant threat to the chloroplatinic acid market. For instance, alternative catalysts in chemical reactions or automotive applications, which cost about 30-50% less than chloroplatinic acid-based catalysts, are becoming increasingly popular.

These alternatives not only reduce the reliance on expensive platinum-based compounds but also offer similar or enhanced performance. The shift towards these substitutes can lead to a decline in demand for chloroplatinic acid, impacting its overall market growth.

Growth Opportunity

Expanding Markets in Emerging Economies

Emerging economies present a significant growth opportunity for the chloroplatinic acid market. As countries like China and India continue to industrialize, their demand for advanced materials, including those used in automotive catalysts and chemical manufacturing, is expected to rise sharply.

The automotive sector in these regions is projected to grow by 5-7% annually over the next decade. This increase in industrial activity provides a large and growing market for chloroplatinic acid, particularly in applications related to emissions control and electronics manufacturing, driving greater demand and market expansion.

Innovation in Platinum Recycling Technologies

With the high cost of platinum, innovations in recycling technologies represent a substantial opportunity for reducing material costs and increasing the supply of chloroplatinic acid. New recycling methods could potentially lower platinum costs by up to 20-30%, making chloroplatinic acid more economically viable and accessible.

By improving the efficiency of platinum recovery from used catalysts and electronic equipment, the industry can decrease dependency on mined platinum, stabilize market prices, and make chloroplatinic acid a more competitive option in various applications.

Advances in Green Chemistry and Sustainable Practices

The growing emphasis on sustainability and green chemistry offers a lucrative avenue for the chloroplatinic acid market. As industries shift towards environmentally friendly practices, the demand for catalysts that can facilitate cleaner production processes is increasing.

Chloroplatinic acid is pivotal in developing green technologies, such as organic synthesis and renewable energy sources. By tapping into this trend, producers of chloroplatinic acid can potentially increase their market share by 10-15% in sectors focused on reducing environmental impact, and aligning market strategies with sustainability goals.

Latest Trends

Integration of Nanotechnology in Platinum-Based Applications

Nanotechnology is revolutionizing the chloroplatinic acid market by enhancing the efficiency and functionality of platinum-based products. This trend involves the development of nano-sized platinum catalysts that increase the reaction rates and reduce material costs in various industrial processes.

For example, by utilizing chloroplatinic acid in nanoscale form, catalysts can be made up to 30% more effective. This advancement not only improves performance but also reduces the amount of platinum needed, potentially lowering production costs and boosting market growth.

Rising Adoption in Renewable Energy Sectors

Chloroplatinic acid is gaining traction in the renewable energy sector, particularly in fuel cell technology, where it serves as a crucial catalyst. As the global push for clean energy intensifies, the demand for fuel cells is expected to grow by approximately 15% annually.

This creates a substantial opportunity for the chloroplatinic acid market, as more fuel cells mean a higher need for efficient, platinum-based catalysts. This trend supports the market’s expansion into new and sustainable energy applications, positioning chloroplatinic acid as a key player in green technology.

Enhancement in Catalytic Converter Technologies

The automotive industry’s ongoing enhancement of catalytic converter technologies is a prominent trend impacting the chloroplatinic acid market. With stricter global emission standards, the demand for more efficient converters is on the rise.

Chloroplatinic acid plays a vital role in these improved converters, which are now designed to reduce emissions by up to 50% more than older models. This push towards more stringent environmental compliance is driving the demand for high-quality catalysts, providing a steady growth avenue for chloroplatinic acid in automotive applications.

Regional Analysis

The North American chloroplatinic acid market holds a 42.4% share, valued at USD 1.06 billion.

The chloroplatinic acid market exhibits varied growth dynamics across global regions, each shaped by distinct industrial, regulatory, and economic factors. Dominating the market, North America accounts for 42.4% of the global share, valued at USD 1.06 billion, driven by advanced manufacturing sectors and stringent environmental regulations that boost demand for catalytic converters and industrial catalysts.

In Europe, the market benefits from robust automotive and pharmaceutical industries. The region’s emphasis on reducing vehicle emissions and investing in cancer research fuels demand for chloroplatinic acid, positioning Europe as a significant player with a stable growth trajectory.

Asia Pacific is witnessing rapid market expansion, spurred by industrialization and urbanization in major economies like China and India. The region’s growing automotive and electronics manufacturing sectors, coupled with increasing investments in medical research, are key drivers for the rising demand for chloroplatinic acid.

The Middle East & Africa, though smaller in market size, is emerging as a potential growth area due to developing petrochemical and refining industries, which utilize catalytic processes. Increased industrial activities in these sectors are likely to expand the market for chloroplatinic acid.

Latin America, with its developing industrial base, shows promising growth opportunities. The region’s focus on improving manufacturing capabilities and environmental standards contributes to the demand for industrial catalysts, including chloroplatinic acid.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global chloroplatinic acid market is characterized by a diverse range of key players, each contributing to the market dynamics with their unique strategic approaches, product offerings, and regional footprints.

Among these, companies like Alfa Aesar, American Elements, and Merck KGaA are noted for their extensive research and development capabilities, which enable them to innovate consistently in the synthesis and application of chloroplatinic acid.

These efforts are crucial as they address the evolving needs of industries such as pharmaceuticals, automotive catalysis, and chemical manufacturing.

Heraeus and Honeywell International Inc. stand out for their operational excellence and strong global distribution networks. These companies leverage their established presence to ensure consistent supply and reliability, factors that are critically important to buyers in sectors where high purity and quality are paramount.

On the other hand, emerging players like Shanghai Xinglu Chemical Technology Co., Ltd. and Kaili Catalyst New Materials are making significant inroads in the Asia Pacific region, capitalizing on local industrial growth and expanding manufacturing sectors.

These companies benefit from proximity to rapidly growing markets for both end-use products and raw materials, allowing them to compete effectively by offering cost-efficient solutions.

EVANS CHEM INDIA PVT LTD. and Triveni Interchem highlight the trend towards regional specialization, focusing on catering to the specific needs of the South Asian market. Their strategies often emphasize compliance with local environmental standards and adapting to the regulatory landscape, which is vital for sustaining growth in these regions.

Overall, the competitive landscape in 2023 reflects a blend of innovation, strategic market placement, and adaptation to regional market conditions, which are essential for driving forward the global chloroplatinic acid market.

Each key player contributes uniquely, either through technological advancement, geographic expansion, or specialization in certain market segments, thereby shaping the industry’s future trajectory.

Top Key Players in the Market

- Alfa Aesar

- American Elements

- Avantor

- Carbosynth

- DO Cheng Chem Material

- ESPI Metals

- EVANS CHEM INDIA PVT LTD.

- Green Chemical Co., Ltd.

- Heraeus

- Honeywell International Inc.

- Kaili Catalyst New Materials

- Merck KGaA

- Parekh Industries

- Ruiyuan Group Limited

- Shaanxi Kaida Chemical Engineering

- Shanghai Xinglu Chemical Technology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals

- Triveni Interchem

- Yogi Dye Chem Industries

Recent Developments

- In 2023, the Avantor Foundation awarded over $1.2 million in grants 2023 to support healthcare and STEM education in underserved communities. Moreover, Avantor employees collectively contributed nearly 10,000 volunteer hours in the same year, emphasizing the company’s commitment to community service.

- In 2023, Heraeus supplied Carboplatin sufficient for approximately 2.3 million chemotherapy cycles, reflecting both the company’s significant production capacity and its contribution to global healthcare.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Billion Forecast Revenue (2033) USD 3.6 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (99%, 99.9%, Others), By Form (Liquid, Solid), By Application (Catalysis, Electroplating, Printing, Ceramics, Photographic, Others), By End Use (Chemical Industry, Pharmaceutical Industry, Automotive Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alfa Aesar, American Elements, Avantor, Carbosynth, DO Cheng Chem Material, ESPI Metals, EVANS CHEM INDIA PVT LTD., Green Chemical Co., Ltd., Heraeus, Honeywell International Inc., Kaili Catalyst New Materials, Merck KGaA, Parekh Industries, Ruiyuan Group Limited, Shaanxi Kaida Chemical Engineering, Shanghai Xinglu Chemical Technology Co., Ltd., Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co., Ltd., Toronto Research Chemicals, Triveni Interchem, Yogi Dye Chem Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chloroplatinic Acid MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Chloroplatinic Acid MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Aesar

- American Elements

- Avantor

- Carbosynth

- DO Cheng Chem Material

- ESPI Metals

- EVANS CHEM INDIA PVT LTD.

- Green Chemical Co., Ltd.

- Heraeus

- Honeywell International Inc.

- Kaili Catalyst New Materials

- Merck KGaA

- Parekh Industries

- Ruiyuan Group Limited

- Shaanxi Kaida Chemical Engineering

- Shanghai Xinglu Chemical Technology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals

- Triveni Interchem

- Yogi Dye Chem Industries