Chiplets Market Size, Share Analysis Report By Type (CPU Chiplets, GPU Chiplets, Memory Chiplets, Networking Chiplets, Sensor Chiplets), By Application (Consumer Electronics, Data Centers, Automotive, Industrial, Healthcare, Other Applications), By End-User (Telecommunications, IT and Telecommunication Services, Automotive, Healthcare and Life Sciences, Consumer Electronics, Other End-Users) and by Region- Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2025

- Report ID: 83992

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

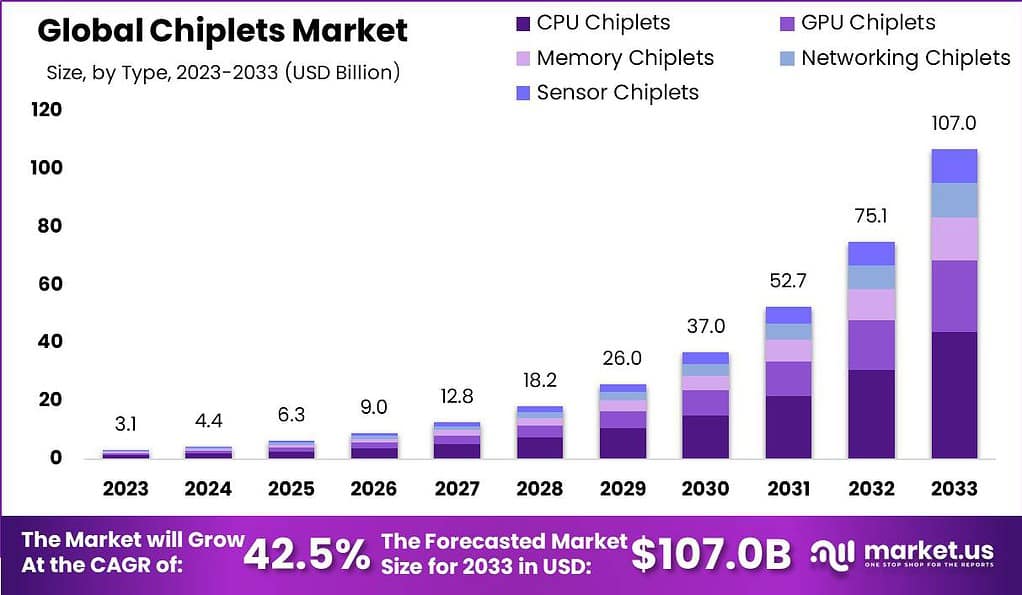

The Global Chiplets Market size is expected to be worth around USD 107.0 Billion by 2033, from USD 4.4 Billion in 2024, growing at a CAGR of 42.5% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region led the global chiplets market with over a 40% share, generating around USD 1.2 billion in revenue.

Chiplets are small, specialized semiconductor components designed to perform specific functions. Unlike traditional monolithic chips, which integrate all functionalities into a single die, chiplets allow for the assembly of multiple smaller dies within a single package. This modular approach enables manufacturers to combine different chiplets – such as CPUs, GPUs, memory, and I/O interfaces – tailored to specific performance and cost requirements.

The global chiplets market is experiencing significant growth, driven by the increasing demand for high-performance computing and the limitations of traditional chip scaling. Several factors are propelling the adoption of chiplet technology. The modular nature of chiplets allows for rapid innovation and customization, catering to specific market needs while reducing development timelines and costs.

The demand for chiplets is particularly strong in sectors such as AI, high-performance computing, data centers, and advanced consumer electronics. These industries require flexible, cost-effective chip designs that can deliver enhanced performance and power efficiency. The ability to mix and match chiplets to create tailored solutions is a significant advantage in meeting these demands.

The Global AI Chip Market is projected to reach a staggering USD 341 billion by 2033, growing from USD 23.0 billion in 2023 at a robust CAGR of 31.2% during the forecast period from 2024 to 2033, according to experts at Market.us. This growth trajectory aligns with the escalating global investment in chiplet technology, which in 2023 alone reached approximately $3.2 billion – a significant 35% increase from the previous year.

Technologies such as Universal Chiplet Interconnect Express (UCIe) are facilitating the increasing adoption of chiplets by providing standardized die-to-die interconnects. UCIe enables the construction of large System-on-Chip (SoC) packages that exceed maximum reticle size, allowing for the integration of components from different silicon vendors within the same package. This standardization is crucial for the scalability and interoperability of chiplet-based systems.

As reported by electroiq, the chiplet technology landscape is rapidly evolving, driven by landmark investments that signal long-term strategic shifts. Intel has committed US$7 billion toward expanding its advanced packaging facilities in Arizona, a move that strengthens its capability in modular chip design.

Meanwhile, AMD’s acquisition of Xilinx for US$35 billion showcases its intent to leverage chiplets for scalable, high-performance computing. Nvidia’s ambitious US$40 billion acquisition of ARM further underscores the central role chiplet integration plays in next-gen architectures.

North America currently leads the global chipset market, holding about 29.8% share, while Europe – particularly Germany, the UK, and France – is emerging as a strong contender with a projected 20.9% share in 2023, reflecting growing interest in advanced semiconductor ecosystems across the region.

Key Takeaways

- The Chiplets Market is expected to grow at a remarkable CAGR of 42.5% over the next decade, reaching a substantial valuation of USD 107.0 billion by 2033. This growth trend is projected to continue in 2024, with an estimated value of USD 4.4 billion.

- In 2023, CPU Chiplets held a dominant market position, capturing over 41% of the market share. Their efficiency and ability to enhance processing capabilities while maintaining energy efficiency contribute to their preeminence.

- The Consumer Electronics segment dominated the market in 2023, with over a 26% share. This is due to the rapid advancement of technology in devices like smartphones, laptops, and wearables, where chiplets offer flexibility and scalability.

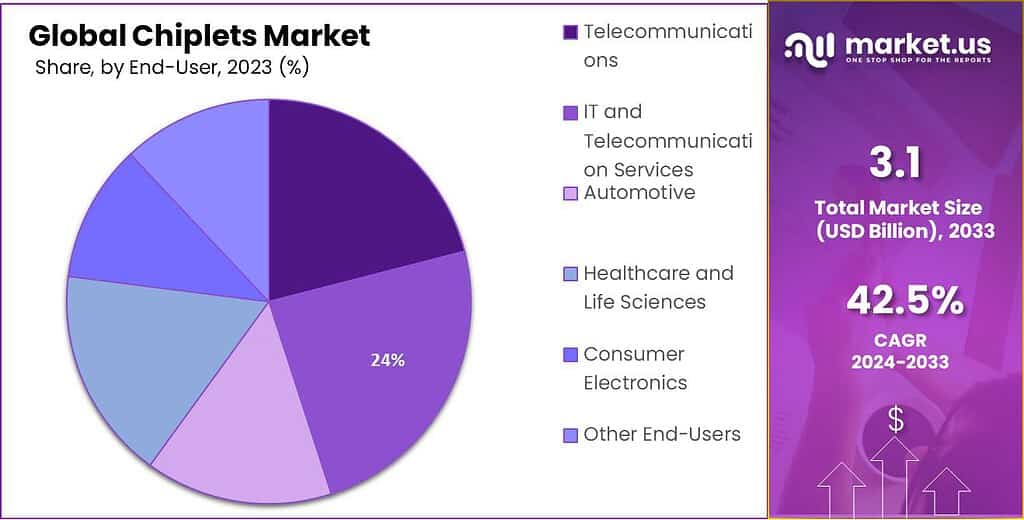

- In 2023, the IT and Telecommunication Services segment held a dominant position, with more than a 24% share. This is driven by the demand for high-performance computing solutions in data centers and the need for efficient network infrastructure.

- In 2023, APAC emerged as a dominant force, capturing over 40% of the market share. APAC’s leading position is attributed to its advanced semiconductor manufacturing capabilities and rapid technological advancements.

- The North American region maintains a substantial stake in the Chiplets market, capturing approximately 29.8% of the global market share.

- The European market holds a significant position, accounting for roughly 20.9% of the chiplets market share. Notable contributions stem from Germany, the UK, and France.

- Asia-Pacific Dominating the global landscape, the Asia-Pacific region secures a dominant market share of 40.5%, with pivotal contributions from China, South Korea, and Taiwan.

- Latin America Despite being a relatively smaller market, Latin America holds a market share of 5.7%, showcasing gradual growth within the chiplets sector.

- Middle East and Africa Representing an emerging market, the Middle East and Africa region holds a market share of 3.1% in the chiplets industry.

Chiplets Market in APAC

In 2023, the Asia-Pacific (APAC) region established a significant foothold in the global chiplets market, securing a dominant position with over a 40% share. The region’s revenue from chiplets was estimated at approximately USD 1.2 billion. This substantial market share underscores the pivotal role APAC plays in the semiconductor and microelectronics industries, driven by advanced manufacturing capabilities and extensive investments in research and development.

The region’s strategic focus on enhancing semiconductor technologies, coupled with strong government support and collaborations between tech giants, continues to fuel growth and innovation within the chiplets market. This dominance not only highlights APAC’s integral contribution to the global market but also its potential to lead future advancements in chiplet technology.

The Asia-Pacific (APAC) region’s dominant position in the chiplets market in 2023 can be attributed to several critical factors:

- Advanced Semiconductor Manufacturing Capabilities: APAC is home to some of the world’s leading semiconductor manufacturing hubs, particularly in countries like Taiwan, South Korea, and China. These regions offer advanced technological infrastructure and substantial investment in semiconductor production, contributing significantly to the chiplets market growth.

- High Demand for High-Performance Computing: There is a growing requirement for high-performance computing across various industries such as AI, data centers, and consumer electronics within APAC. Chiplets are favored in these applications due to their ability to enhance computational power and efficiency, which is crucial for managing complex algorithms and large data volumes.

- Cost Effectiveness: The chiplets approach is economically beneficial, particularly in a region where cost management is crucial. By enabling the integration of different components fabricated separately, chiplets help in reducing the overall manufacturing costs, which is a strong advantage in price-sensitive markets.

- Supply Chain Flexibility: APAC benefits from a modular chiplet design that allows greater supply chain flexibility. Companies in the region can source various components from diverse suppliers, which minimizes dependency on any single source and enhances supply chain resilience.

- Rapid Technological Advancements: The region is at the forefront of technological innovations, which drives the adoption of advanced technologies including those used in chiplet designs. This rapid pace of technological development supports the complex needs of modern electronics and computing requirements, further bolstering the APAC’s dominance in the chiplets market.

The Chiplets Market exhibits robust growth across various regions, each demonstrating unique market dynamics and opportunities influenced by regional technological advancements and industrial demands.

North America stands as a leader in the Chiplets Market, holding a 52.5% share. This region benefits from the presence of major semiconductor companies and a strong ecosystem supporting technological innovation. The adoption of chiplets in North America is primarily driven by the need for high-performance computing solutions in sectors such as cloud computing and advanced electronics.

In Europe, the market share is slightly lower at 50.3%. The region’s focus on automotive and industrial applications significantly contributes to the growth of the chiplets market. Europe’s commitment to reducing electronic waste and improving energy efficiency also propels advancements in chiplet technologies, making it a key player in sustainable electronic design.

Latin America shows a competitive edge with a 48.6% market share. The region is increasingly investing in telecommunications infrastructure, which necessitates advanced semiconductor solutions, including chiplets. This demand is expected to rise as Latin America continues to enhance its connectivity and digital transformation initiatives.

Asia-Pacific leads with the highest regional market share at 54.6%, attributed to its vast manufacturing base and the rapid expansion of consumer electronics and automotive sectors. Countries like China, South Korea, and Taiwan are pivotal in the chiplets market, driving innovation through substantial investments in semiconductor research and development.

Lastly, the Middle East & Africa holds a 39.8% share, showing considerable growth potential. This region is in the early stages of adopting chiplet technology, primarily focused on developing its technological infrastructure and digital services. As these markets mature, the adoption of advanced semiconductor technologies like chiplets is expected to accelerate, supporting regional development initiatives.

Type Analysis

In 2023, the CPU chiplets segment held a dominant market position, capturing more than a 41% share of the global chiplets market. This leading status can be attributed primarily to the critical role that CPU chiplets play in the modern computing ecosystem.

CPU chiplets serve as the central processing unit within a chip, handling a broad array of tasks from basic to complex computational processes, making them indispensable in both consumer and enterprise computing devices.

The architecture of CPU chiplets allows for a modular approach to building processors, where different components can be developed and scaled independently. This modularity significantly enhances the flexibility and scalability of CPU designs, enabling manufacturers to more effectively meet specific market demands.

Furthermore, this segment benefits from substantial investments in research and development by major semiconductor companies, aiming to optimize performance and efficiency, which in turn drives market adoption and growth.

Moreover, the surge in demand for high-performance computing, driven by advancements in AI, machine learning, and large-scale data analytics, has propelled the growth of the CPU chiplets segment. As these technologies continue to evolve, the need for more powerful and efficient CPUs becomes paramount, further solidifying the dominant position of CPU chiplets in the market.

Application Analysis

In 2023, the Consumer Electronics segment held a dominant market position, capturing more than a 26% share of the global chiplets market. This leadership is primarily due to the integral role chiplets play in enhancing the performance and efficiency of consumer electronics such as smartphones, tablets, laptops, and gaming consoles. These devices benefit significantly from the advanced modular chip architecture that chiplets offer, allowing for the integration of high-performance components without the cost and complexity associated with traditional monolithic chip designs.

The consumer electronics market demands continuous innovation and miniaturization of devices while maintaining high performance and low energy consumption. Chiplets meet these needs by enabling manufacturers to assemble chips using specialized components that are tailored for specific functions within electronic devices. This approach not only boosts the device’s overall performance but also reduces the time and expense related to the development of complex chips.

Additionally, the trend towards smart home devices and wearable technology, which require compact yet powerful computing capabilities, further drives the demand for chiplets in consumer electronics. As the Internet of Things (IoT) continues to expand, and as devices become increasingly interconnected, the versatility and efficiency of chiplets make them even more crucial to the consumer electronics industry, reinforcing their leading position in the market.

End-User Analysis

In 2023, the IT and Telecommunication Services segment held a dominant market position within the chiplets market, capturing more than a 24% share. This leading status is primarily driven by the segment’s critical role in underpinning the backbone of the modern digital economy.

As businesses and services continue to digitize, the demand for robust and efficient computing infrastructure escalates, making the deployment of chiplets an attractive proposition. Chiplets enhance computational capabilities and flexibility, enabling the development of customized processors that meet the specific requirements of diverse IT and telecommunication services.

The rapid expansion of cloud computing and data centers is another pivotal factor boosting the demand for chiplets in this sector. These technologies require high-performance, energy-efficient computing solutions that can handle vast amounts of data and high-speed processing.

Chiplets offer a solution by allowing the integration of heterogeneous technologies into a single package, thereby improving performance and reducing power consumption. This is particularly advantageous for telecommunication providers who are investing heavily in upgrading their infrastructure to support increased traffic and the rollout of 5G networks.

Moreover, the integration of AI and machine learning into various applications across the IT spectrum has propelled the need for more specialized and powerful computing solutions. Chiplets, with their ability to combine different functionalities and optimization features in a compact form, are ideally suited to meet these demands. Their modularity allows for the rapid deployment of tailored solutions that can adapt to the evolving needs of IT and telecommunications services, further solidifying this segment’s lead in the chiplets market

Key Market Segments

Type

- CPU Chiplets

- GPU Chiplets

- Memory Chiplets

- Networking Chiplets

- Sensor Chiplets

Application

- Consumer Electronics

- Data Centers

- Automotive

- Industrial

- Healthcare

- Other Applications

End-User

- Telecommunications

- IT and Telecommunication Services

- Automotive

- Healthcare and Life Sciences

- Consumer Electronics

- Other End-Users

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Demand for High-Performance Computing Solutions

The Chiplets market is witnessing substantial growth due to the increasing demand for high-performance computing solutions. As technology advances, there is a growing need for more powerful and efficient computing systems to support complex applications like artificial intelligence (AI), big data analytics, and high-speed networking.

Chiplets, which are smaller semiconductor components that can be integrated into a larger system, provide a flexible and scalable solution to meet these demands. They allow system designers to mix and match different chip functionalities to create customized and optimized computing solutions. Chiplets enable the development of highly specialized and targeted systems that deliver exceptional performance for specific applications, driving the demand in the market.

Restraint

Technical Complexities in Integration and Interoperability and Heat Management Issues

However, the Chiplets market faces certain restraints that need to be addressed. One significant restraint is the technical complexities involved in integrating and ensuring interoperability between chiplets. Since chiplets come from different manufacturers and may have different designs and specifications, integrating them into a cohesive system can be challenging. Ensuring compatibility and seamless communication between chiplets require careful planning and development of standardized interfaces and protocols.

Another restraint in the Chiplets market is the issue of heat management. When multiple chiplets are integrated into a single system, heat dissipation becomes a critical concern. As each chiplet generates heat, managing and dissipating it to maintain optimal operating temperatures can be a technical challenge. Effective heat management techniques such as advanced cooling solutions and thermal design considerations need to be implemented to address this issue.

Opportunities

Expansion in AI, IoT Applications and Rapid Expansion of 5G Infrastructure

The Chiplets market offers significant opportunities for growth. One such opportunity lies in the expansion of AI and IoT applications. AI and IoT technologies are rapidly evolving, and chiplets provide a way to enhance the performance and efficiency of these applications. The modularity and flexibility of chiplets enable the integration of specialized AI accelerators or IoT functionalities, allowing for more powerful and efficient processing. This opens up new avenues for applications such as autonomous vehicles, smart homes, and industrial automation.

Additionally, the rapid expansion of 5G infrastructure presents another opportunity for chiplets. With the increased connectivity and data processing requirements of 5G networks, chiplets can be utilized to develop specialized components for base stations, edge computing, and other 5G-related applications. Chiplets can enable the development of high-speed and low-latency systems that can handle the massive amounts of data generated by 5G networks, driving the demand for chiplets in this market segment.

Challenge

Maintaining Consistent Quality and Reliability Across Different Chiplet Designs and Intellectual Property (IP) Protection and Licensing

A challenge in the Chiplets market is maintaining consistent quality and reliability across different chiplet designs. As chiplets come from various manufacturers, ensuring uniform quality standards and reliability across different chiplet designs can be a challenge. Standardization of interfaces and protocols, rigorous testing procedures, and effective quality control measures need to be in place to address this challenge and ensure consistent performance and reliability of chiplet-based systems.

Another challenge in the Chiplets market is related to intellectual property (IP) protection and licensing. Different chiplet designs may involve proprietary technologies and IP, which need to be protected and properly licensed to ensure fair and lawful usage. Addressing IP concerns, establishing licensing agreements, and fostering collaboration among manufacturers and IP holders is crucial to navigate this challenge and foster innovation in the Chiplets market.

In summary, the Chiplets market is driven by the increasing demand for high-performance computing solutions, offering opportunities for expansion in AI, IoT applications, and the rapid growth of 5G infrastructure. However, technical complexities in integration and interoperability, heat management issues, maintaining consistent quality and reliability, and addressing IP protection and licensing challenges are important factors that need to be addressed to ensure the continued growth and success of the market.

Top Use Cases for Chiplets

- High-Performance Computing (HPC): Chiplets are extensively used in HPC environments to enhance computational power and efficiency. By integrating multiple chiplets, systems can achieve superior performance, making them ideal for complex simulations, scientific research, and data analysis tasks.

- Data Centers: The modular nature of chiplets allows for scalable and efficient designs in data centers. They help improve processing capabilities while reducing power consumption and heat generation, which is crucial for large-scale data storage and processing facilities.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML applications benefit significantly from chiplet technology. Chiplets enable the integration of specialized processors for AI tasks, enhancing performance and reducing latency in neural network computations and real-time data processing.

- Consumer Electronics: Chiplets are used in a variety of consumer electronics, including smartphones and laptops, to provide high performance in a compact form factor. This modular approach allows manufacturers to upgrade and customize devices more efficiently.

- Automotive Industry: In the automotive sector, chiplets are used to support advanced driver-assistance systems (ADAS) and autonomous driving technologies. They enable high-speed processing of data from various sensors, improving vehicle safety and performance.

Growth Factors

- Increased Demand for High-Performance Computing: The growing need for powerful computing solutions in various industries drives the adoption of chiplets, which offer enhanced performance and efficiency.

- Advancements in AI and ML: The rapid development of AI and ML technologies requires more powerful and specialized processors, which chiplets can provide, thus fueling market growth.

- Expansion of Data Centers: The global expansion of data centers, driven by the increasing demand for data storage and processing, boosts the chiplet market as these facilities seek efficient and scalable solutions.

- Consumer Electronics Boom: The rising demand for advanced consumer electronics, including smartphones, tablets, and wearable devices, propels the chiplet market by necessitating compact and high-performance components.

- Automotive Innovations: The automotive industry’s shift towards electric and autonomous vehicles increases the need for advanced processing capabilities, which chiplets can supply, thereby driving market growth.

Emerging Trends

- Modular Design Approaches: There is a growing trend towards modular chip designs, where different functionalities are split into separate chiplets, allowing for greater flexibility and scalability in product development.

- Integration with Advanced Packaging Technologies: The adoption of advanced packaging technologies, such as 2.5D and 3D integration, is enhancing the performance and efficiency of chiplet-based systems.

- Focus on Power Efficiency: With increasing concerns about energy consumption, there is a strong emphasis on developing chiplets that offer high performance with lower power requirements, particularly for data centers and portable devices.

- Standardization Efforts: The industry is moving towards standardizing chiplet interfaces and designs to ensure compatibility and ease of integration, which will help accelerate the adoption of chiplet technology.

- Collaborations and Partnerships: Key players in the semiconductor industry are forming strategic partnerships to advance chiplet technology, share expertise, and co-develop new solutions, driving innovation and market growth.

Key Players Analysis

The chiplets market is characterized by significant contributions from several key players, each bringing unique strengths and innovations to the industry. Intel Corporation, a pioneer in semiconductor technology, has been at the forefront with its advanced chiplet designs aimed at improving performance and scalability. Similarly, Advanced Micro Devices Inc. (AMD) has leveraged chiplet technology to enhance its processors, offering superior multi-core performance which has gained considerable market traction.

Taiwan Semiconductor Manufacturing Company Limited (TSMC), the world’s largest contract chip manufacturer, plays a crucial role by providing cutting-edge fabrication capabilities for chiplets, which supports various technology companies in bringing their innovative products to market. NVIDIA Corporation, renowned for its graphics processing units (GPUs), has also embraced chiplet technology to push the boundaries of AI and high-performance computing.

Samsung Electronics Co. Ltd., with its extensive expertise in memory and logic chips, is another significant player, integrating chiplets to boost the efficiency and performance of its semiconductor solutions. GLOBALFOUNDRIES, known for its versatile fabrication services, supports the chiplet ecosystem by providing essential manufacturing processes for diverse applications. Xilinx Inc., a leader in programmable logic devices, has utilized chiplets to advance its field-programmable gate arrays (FPGAs), enhancing their flexibility and performance.

Micron Technology Inc. focuses on integrating chiplets with its memory solutions to meet the growing demands for higher data bandwidth and storage efficiency. Broadcom Inc. and Qualcomm Incorporated, prominent names in communication and connectivity technologies, leverage chiplets to enhance their semiconductor offerings, ensuring superior performance and integration.

Toshiba Corporation and ON Semiconductor also contribute significantly to the market, with Toshiba focusing on power and storage solutions and ON Semiconductor offering a range of semiconductor components incorporating chiplet technology. These companies, along with several other key players, continue to drive innovation and development in the chiplets market, making it a dynamic and competitive landscape.

Top Key Players

- Intel Corporation

- Advanced Micro Devices Inc. (AMD)

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- NVIDIA Corporation

- Samsung Electronics Co. Ltd.

- GLOBALFOUNDRIES

- Xilinx Inc.

- Micron Technology Inc.

- Broadcom Inc.

- Qualcomm Incorporated

- Toshiba Corporation

- ON Semiconductor

- Other Key Players

Recent Developments

- April 2024: Toshiba launched a new series of power-efficient chiplets designed for industrial applications. These chiplets are intended to enhance the performance of automation systems and reduce energy consumption

- March 2024: Intel showcased its Optical Compute Interconnect (OCI) chiplet at the Optical Fiber Conference (OFC). This chiplet, designed using Intel’s Silicon Photonics technology, supports a 4 Tbps bidirectional data rate, which is crucial for AI infrastructure scalability. It was demonstrated co-packaged with a next-generation Intel CPU, highlighting its potential in high-bandwidth applications.

- January 2024: Intel opened Fab 9 in New Mexico, a new facility dedicated to advanced semiconductor packaging technologies, including their 3D packaging solution, Foveros. This $3.5 billion investment is part of Intel’s strategy to enhance its manufacturing capabilities and support the growing demand for chiplets.

- February 2023: AMD completed its acquisition of Xilinx, expanding its portfolio in adaptive computing. This strategic move aims to leverage Xilinx’s FPGA technology in conjunction with AMD’s high-performance computing capabilities, potentially enhancing chiplet-based designs.

- June 2023: TSMC announced a collaboration with Intel to manufacture chips for Intel’s high-performance computing products. This partnership aims to leverage TSMC’s advanced manufacturing processes to produce cutting-edge chiplet designs.

- August 2023: NVIDIA collaborated with Google Cloud to offer advanced AI infrastructure leveraging NVIDIA’s chiplet technology. This partnership focuses on deploying large generative AI models, enhancing the performance and scalability of AI applications.

- March 2023: Samsung launched a new line of high-performance memory chiplets designed for AI and data center applications. These chiplets are intended to improve the efficiency and speed of data processing tasks.

- May 2023: GLOBALFOUNDRIES announced the expansion of its chiplet manufacturing capabilities with new investments in its Dresden facility. This expansion is aimed at meeting the growing demand for advanced packaging solutions in Europe.

- February 2023: Following its acquisition by AMD, Xilinx launched a new series of adaptive SoCs that utilize chiplet architecture to enhance performance and flexibility in various computing applications.

- November 2023: Micron introduced a new generation of memory chiplets designed for high-performance computing and AI applications. These chiplets offer improved speed and energy efficiency, catering to the needs of modern data centers and AI workloads.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Bn Forecast Revenue (2033) USD 107 Bn CAGR (2024-2033) 42.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (CPU Chiplets, GPU Chiplets, Memory Chiplets, Networking Chiplets, Sensor Chiplets), By Application (Consumer Electronics, Data Centers, Automotive, Industrial, Healthcare, Other Applications), By End-User (Telecommunications, IT and Telecommunication Services, Automotive, Healthcare and Life Sciences, Consumer Electronics, Other End-Users) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Intel Corporation, Advanced Micro Devices Inc. (AMD), Taiwan Semiconductor Manufacturing Company Limited (TSMC), NVIDIA Corporation, Samsung Electronics Co. Ltd., GLOBALFOUNDRIES, Xilinx Inc., Micron Technology Inc., Broadcom Inc., Qualcomm Incorporated, Toshiba Corporation, ON Semiconductor, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are chiplets in the context of the semiconductor industry?Chiplets refer to individual semiconductor components that are designed to perform specific functions and can be integrated into a single package or system.

How big is chiplets market?The net revenue generated by the global chiplets market in 2023 was nearly USD 3.1 Billion. Over the next ten years, the chiplets industry is expected to surge at 42.5% CAGR, concluding at a valuation of USD 107.0 Billion by 2033. It is projected to Reach at a USD 4.4 Billion in 2024.

What are the key driving factors and challenges in chiplets Market?The key driving factors in the chiplets market include the demand for increased flexibility and scalability in semiconductor design, leading to enhanced system performance and reduced production costs. However, challenges such as interconnectivity issues, standardization concerns, and the need for robust testing methodologies pose obstacles to seamless chiplet integration.

Who are the leading players in chiplets Market?Some of leading players in chiplets Market - Intel Corporation, Advanced Micro Devices Inc. (AMD), Taiwan Semiconductor Manufacturing Company Limited (TSMC), NVIDIA Corporation, Samsung Electronics Co. Ltd., GLOBALFOUNDRIES, Xilinx Inc., Micron Technology Inc., Broadcom Inc., Qualcomm Incorporated, Toshiba Corporation, ON Semiconductor, Other Key Players

Which segment is leading the Market in 2023?In 2023, the CPU Chiplets segment held a dominant market position, capturing more than a 41% share.

Which region dominated the Market in 2023?In 2023, the Asia-Pacific (APAC) region emerged as a dominant force in the chiplets market, capturing over 31% of the market share.

-

-

- Intel Corporation

- Advanced Micro Devices Inc. (AMD)

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- NVIDIA Corporation

- Samsung Electronics Co. Ltd.

- GLOBALFOUNDRIES

- Xilinx Inc.

- Micron Technology Inc.

- Broadcom Inc.

- Qualcomm Incorporated

- Toshiba Corporation

- ON Semiconductor

- Other Key Players