Global Graphics Processing Unit (GPU) Market Size, Share, Statistics Analysis Report By Type (Discrete GPU, Integrated GPU, Hybrid GPU), By Application (Mobile Devices, PCs and Workstations, Servers/Data Centers, Automotive/Self-driving Vehicles, Gaming Consoles, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141992

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

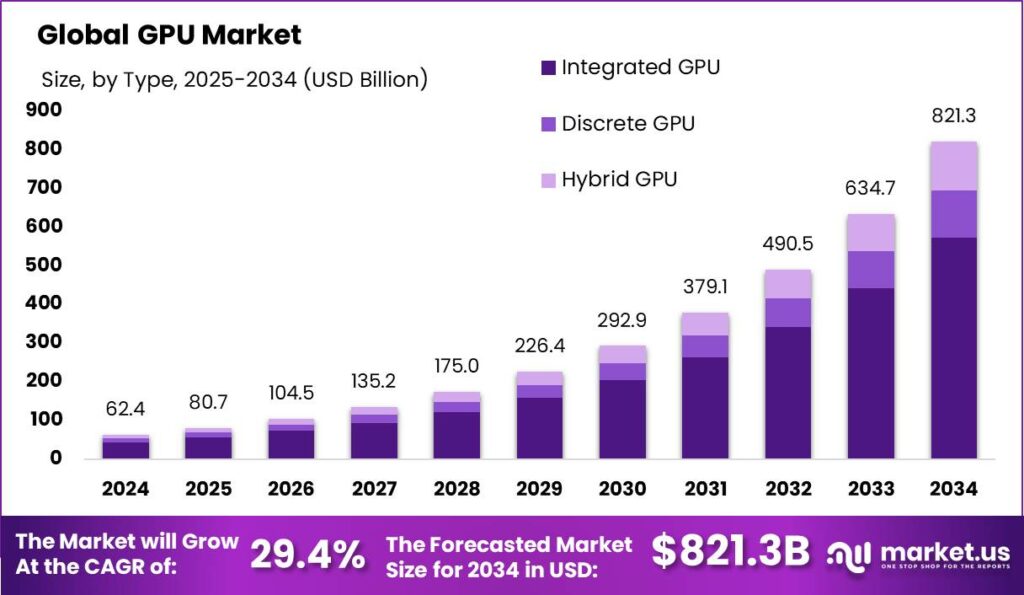

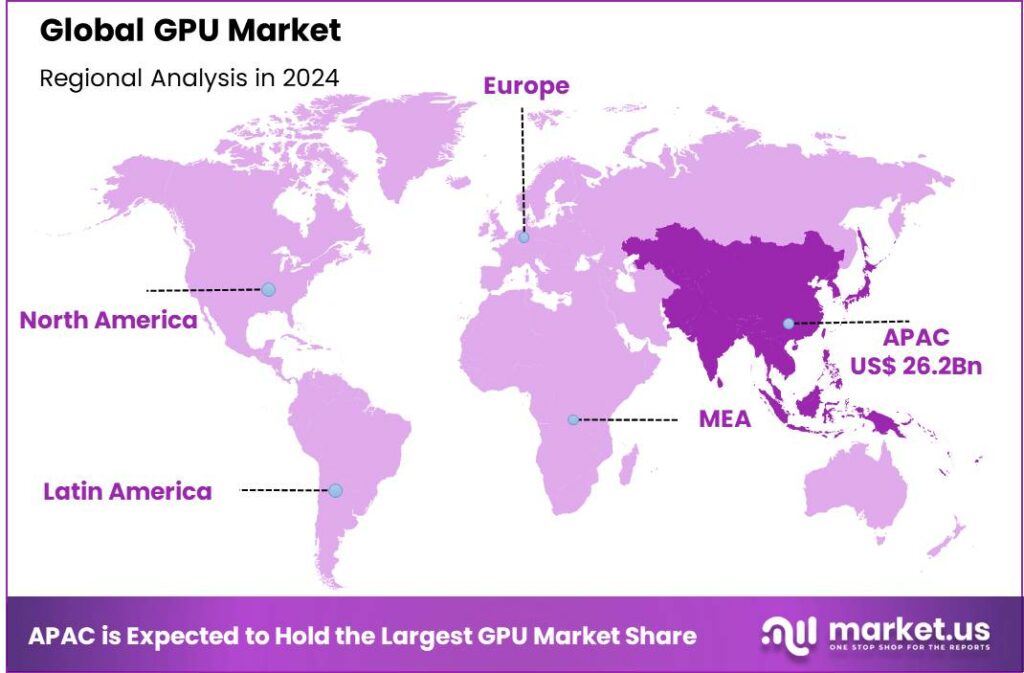

The Global Graphics Processing Unit (GPU) Market size is expected to be worth around USD 821.3 Billion By 2034, from USD 62.4 Billion in 2024, growing at a CAGR of 29.40% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant position in the global GPU market, capturing more than 42.1% of the market share, with revenue amounting to USD 26.2 billion.

A Graphics Processing Unit (GPU) is a specialized electronic circuit designed to rapidly manipulate and alter memory to accelerate the creation of images in a frame buffer intended for output to a display device. GPUs are used in embedded systems, mobile phones, personal computers, workstations, and game consoles.

The GPU market is characterized by its dynamic growth and expansive application across various sectors, including gaming, automotive, healthcare, and more recently, artificial intelligence (AI) and deep learning. This market is driven by the increasing demand for enhanced graphics in video games, a surge in mobile computing, and the growing need for high-performance computing solutions.

The primary drivers of the GPU market include the increasing demand for high-performance computing, the rise of cloud gaming and virtualization, and significant advancements in AI and machine learning applications. These technologies rely heavily on the parallel processing capabilities of GPUs, which are far superior to traditional CPUs for tasks requiring intense computational power.

According to Jon Peddie Research, the global GPU market experienced a 1% year-over-year growth, driven by a 2% increase in laptop GPU shipments, while desktop graphics card sales declined by 3%. The market is expected to face ongoing challenges, with a projected 1% annual decline from 2024 to 2028. By 2030, only 15% of systems are forecasted to include a discrete GPU, reflecting a shift toward integrated graphics and cloud-based solutions.

Based on data from electroiq, The single-server GPU market is expected to see steady expansion, with revenue projected to reach $2.74 billion by 2028. The demand is driven by cloud computing, AI training workloads, and data center expansions that require high-performance GPU solutions. Companies investing in scalable AI infrastructure are likely to fuel this segment’s growth.

The quad-server GPU market is set to grow significantly, with revenues estimated to hit $20.41 billion by 2028. This growth is attributed to the increasing need for multi-GPU setups in enterprise applications, including AI model training, large-scale simulations, and deep learning tasks. The rise of AI-driven industries is expected to accelerate demand for these powerful configurations.

NVIDIA remains the undisputed leader in the graphics add-in-board (AIB) market, holding an impressive 80% market share. The company’s high-performance GPUs, particularly in gaming and AI applications, maintain their stronghold, outpacing competitors in innovation and performance.

Key Takeaways

- The Global GPU Market size is expected to be worth around USD 821.3 Billion by 2034, up from USD 62.4 Billion in 2024, growing at a CAGR of 29.40% during the forecast period from 2025 to 2034.

- In 2024, the Integrated GPU segment held a dominant market position, capturing more than 69.7% of the global GPU market.

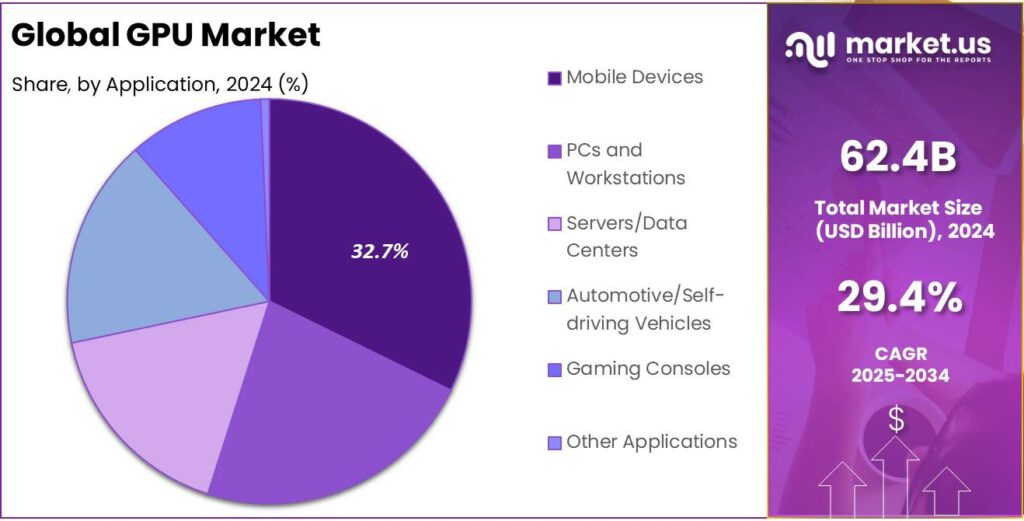

- The Mobile Devices segment also held a dominant position in 2024 within the GPU market, capturing more than 32.7% of the market share.

- In 2024, Asia-Pacific held a dominant position in the global GPU market, capturing more than 42.1% of the market share, with revenue amounting to USD 26.2 billion.

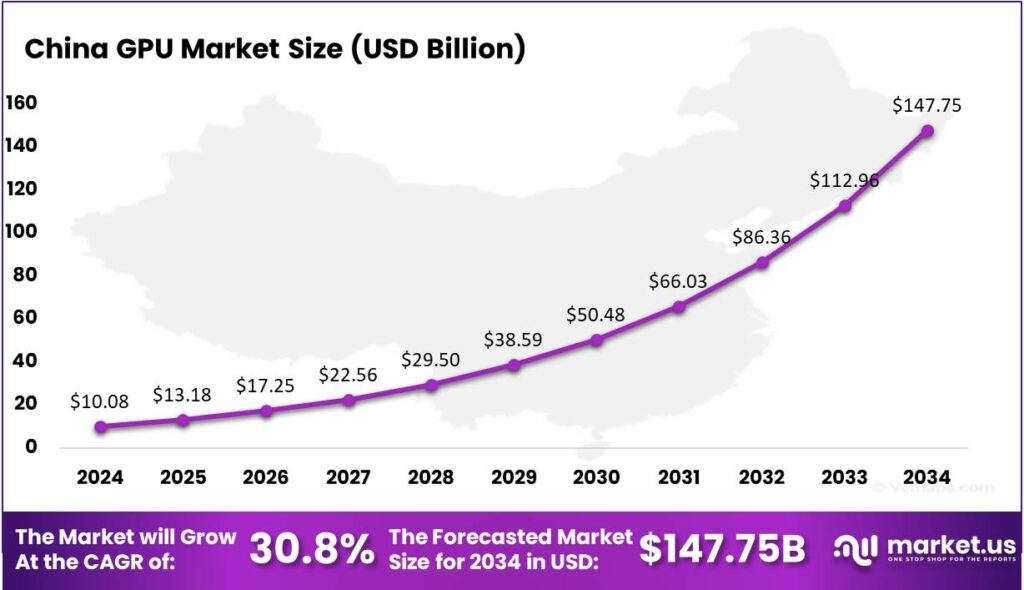

- The GPU market in China was valued at USD 10.08 billion in 2024, with a projected CAGR of 30.8%.

China GPU Market

The GPU market in China was valued at USD 10.08 billion in the year 2024. It is projected to grow at a compound annual growth rate (CAGR) of 30.8%. This significant growth rate underscores the expanding demand for graphic processing units within this region, driven by several key factors.

The rapid growth of the GPU market in China is driven by the rising demand for graphic-intensive applications like video gaming, virtual reality, and augmented reality, as well as the need for advanced data centers. Additionally, the automotive industry’s shift toward autonomous vehicles, which depend on GPUs for vision processing and decision-making, further fuels market expansion.

Government initiatives promoting AI and ML advancements, along with the presence of key industry players, are driving demand for high-performance GPUs in China. These efforts foster technological innovation and the development of products tailored to the Chinese market, ensuring sustained growth in the GPU market and highlighting its vital role in modern technological infrastructure.

In 2024, Asia-Pacific held a dominant market position in the global GPU market, capturing more than a 42.1% share, with revenue amounting to USD 26.2 billion. This commanding lead is attributed to several strategic factors that uniquely position the region at the forefront of the GPU industry.

The prominence of Asia-Pacific in the GPU market can primarily be credited to the robust manufacturing capabilities and extensive technological advancements within the region. Countries like China, South Korea, and Taiwan are pivotal, hosting major semiconductor manufacturing facilities that not only cater to local demand but also supply to global markets.

Furthermore, the increasing penetration of digital services and consumer electronics in Asia-Pacific countries drives demand for GPUs. The region experiences high adoption rates of smartphones, gaming consoles, and personal computers, all of which require advanced graphics processing units for optimal performance.

Asia-Pacific’s focus on emerging technologies like AI, machine learning, and data centers is driving the demand for high-capacity GPUs. These technologies require substantial computational power, which GPUs are well-suited for. As AI and ML continue to grow in industries such as automotive, healthcare, and finance, the demand for advanced GPUs will rise, ensuring ongoing growth in the region’s GPU market and solidifying Asia-Pacific’s leadership in the global market.

Analysts’ Viewpoint

The GPU market presents substantial investment opportunities, particularly in sectors integrating AI technologies and IoT applications. Investors are particularly keen on companies developing AI-driven GPUs and those expanding their capabilities into new, untapped markets such as smart cities and advanced healthcare systems, where image processing and quick data analysis are crucial.

Organizations leveraging GPUs can achieve significant performance enhancements in areas such as data analysis, scientific research, and complex simulations. GPUs reduce the time required for processing large datasets, enabling faster decision-making and improved operational efficiency. This capability is particularly beneficial in sectors like healthcare, financial services, and logistics where time and accuracy are critical.

The GPU market has seen continuous technological innovations, including the development of hybrid GPUs that offer flexibility by combining the features of both integrated and dedicated GPUs. These advancements not only enhance performance but also improve energy efficiency and heat management, which are crucial for mobile devices and compact systems.

Regulatory factors affecting the GPU market include standards and guidelines related to power consumption, electronic waste, and environmental impact. Manufacturers are increasingly focused on producing energy-efficient GPUs that comply with international regulatory standards, which is also aligned with global sustainability goals.

Type Analysis

In 2024, the Integrated GPU segment held a dominant market position, capturing more than a 69.7% share of the global GPU market. Integrated GPUs are built into the same chip as the CPU, offering efficient power consumption and space utilization, making them ideal for mobile devices and entry-level laptops.

The growth of the Integrated GPU segment is driven by the demand for compact, energy-efficient computing devices. As consumers increasingly prefer laptops, tablets, and ultraportable devices, manufacturers must balance performance with portability. Integrated GPUs are ideal for this, fueling the segment’s expansion.

The evolving user interface technologies, which incorporate advanced visual and touch components, increasingly rely on GPUs that are power-efficient and space-saving. Integrated GPUs meet these needs effectively, making them a preferred choice for manufacturers aiming to innovate in device functionality while optimizing power efficiency and maintaining a compact form factor.

The rise of entry-level gaming and the popularity of streaming services requiring decent graphics have boosted the market for Integrated GPUs. These GPUs offer enough performance for casual gaming and video streaming, making them ideal for consumers who don’t need the power of discrete GPUs. This broad usability ensures Integrated GPUs maintain a strong position in the market.

Application Analysis

In 2024, the Mobile Devices segment held a dominant market position within the GPU market, capturing more than a 32.7% share. This segment’s leadership is primarily driven by the escalating demand for advanced smartphones and tablets equipped with powerful graphical capabilities.

The growth of the Mobile Devices segment is driven by rising consumer demand for mobile gaming and multimedia consumption. As mobile devices become the primary entertainment and connectivity tool, manufacturers are focusing on enhancing their graphical processing power to provide a seamless, immersive experience.

Another contributing factor to the dominance of the Mobile Devices segment is the ongoing advancements in mobile technology that require high-performance GPUs. These advancements include improvements in screen resolutions, faster internet connectivity, and the integration of AI functionalities, which all demand substantial graphical processing capabilities to function efficiently.

The economic scalability of mass-producing GPUs for mobile devices has been key to the segment’s success. Economies of scale enable cost-effective production while meeting the high demands of the global mobile market. This drives growth and profitability, making it a focal point for leading GPU manufacturers targeting the expanding mobile devices market.

Key Market Segments

By Type

- Discrete GPU

- Integrated GPU

- Hybrid GPU

By Application

- Mobile Devices

- PCs and Workstations

- Servers/Data Centers

- Automotive/Self-driving Vehicles

- Gaming Consoles

- Other Applications

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Escalating Demand for Artificial Intelligence and Machine Learning Applications

The GPU market is rapidly expanding due to the rising demand for AI and ML applications. Originally built for graphics rendering, GPUs have evolved to handle parallel processing, making them crucial for AI and ML tasks.

The widespread adoption of AI across sectors like healthcare, finance, automotive, and entertainment has increased the need for GPUs to manage complex computations. In healthcare, for example, GPUs support advanced imaging and predictive analytics, improving diagnostic accuracy and patient outcomes.

The growth of big data analytics has further fueled the demand for GPUs. As organizations rely more on data-driven insights for strategic decisions, the need for powerful computing to process large datasets has increased. GPUs, with their parallel processing capabilities, are ideal for accelerating data processing and enabling real-time analytics.

Restraint

High Costs and Supply Chain Disruptions

Despite the promising growth trajectory, the GPU market faces significant restraints, notably high costs and supply chain disruptions.Advanced GPUs are often expensive due to their complex architecture and manufacturing processes. This high cost can be a barrier for small businesses and startups looking to invest in AI technology.

Supply chain disruptions have also posed challenges to the GPU market. The global chip shortage, exacerbated by the COVID-19 pandemic, led to significant delays in production and increased costs for GPUs. Factors like increased demand for consumer electronics, manufacturing disruptions from lockdowns, and geopolitical tensions have strained supply chains.

Opportunity

Expansion into Emerging Technologies

The GPU market is presented with significant opportunities through expansion into emerging technologies such as high-performance computing, big data analytics, and the Internet of Things (IoT). High-performance computing (HPC) leverages GPUs to solve complex computational problems across various fields, including scientific research, financial modeling, and climate simulations.

The parallel processing capabilities of GPUs make them well-suited for these tasks, offering faster processing times and enhanced computational efficiency.The growth of IoT devices has caused a surge in data generation, with GPUs playing a crucial role in processing this data.

They support applications like smart cities, industrial automation, and connected healthcare systems. By efficiently managing and analyzing data from IoT devices, GPUs help create intelligent systems that improve operational efficiency and user experiences.

Challenge

Competition and Technological Advancements

The GPU market faces challenges from increasing competition and rapid technological advancements. Companies like AMD are investing heavily in AI and GPU technologies to capture a larger market share. This intensifying competition requires continuous innovation and strategic positioning by GPU manufacturers to maintain their market presence.

For instance, In January 2024, Advanced Micro Devices (AMD) introduced the Radeon RX 7600 XT 16GB and Radeon RX 7600 XT 8GB, targeting mid-range and budget-conscious gamers. The company claims these GPUs deliver up to 1.9x faster performance in gaming and ray tracing compared to the GeForce RTX 2060, offering enhanced graphics at 1440p resolution.

Technological advancements pose both opportunities and challenges. The rapid evolution of AI and ML technologies requires constant development of more powerful and efficient GPUs, which demands substantial investment in research and development. This creates a challenge for companies to stay competitive.

Additionally, the rise of alternative computing paradigms, like quantum computing, could challenge the traditional GPU market by offering superior performance for specific applications, potentially reducing demand for conventional GPUs.

Emerging Trends

A notable trend is the integration of advanced tensor cores, enhancing capabilities in artificial intelligence (AI) and machine learning by accelerating complex computations. This evolution positions GPUs as pivotal in AI systems, moving beyond traditional roles to become central processing hubs.

Another significant development is the adoption of chiplet-based architectures. For instance, AMD’s RDNA 3 architecture employs modular chiplets instead of a single monolithic die, optimizing performance and manufacturing efficiency. This approach allows different components to be fabricated using process nodes best suited to their functions, enhancing overall efficiency.

Memory advancements like High Bandwidth Memory (HBM) and GDDR7 SDRAM are boosting GPU performance with higher data transfer rates and better energy efficiency. Additionally, cloud-based GPUs offer scalable, cost-effective solutions for businesses, enabling quick deployment and workload acceleration without heavy infrastructure investments.

Business Benefits

The integration of advanced GPU technology offers numerous advantages to businesses across various sectors. One primary benefit is the acceleration of data-intensive tasks. GPUs, with their parallel processing capabilities, significantly enhance the speed of operations such as financial modeling, data analysis, and machine learning, leading to faster insights and decision-making processes.

In the realm of cloud computing, GPUs facilitate improved workflow efficiency. By leveraging cloud-based GPU resources, businesses can achieve faster rendering times and smoother workflows, allowing teams to complete projects more quickly and transition seamlessly between tasks.

Cost-effectiveness is another significant advantage. Utilizing cloud GPUs eliminates the need for substantial upfront investments in hardware, reducing capital expenditures. This approach allows businesses to scale computing resources according to demand, ensuring optimal utilization and cost management.

Key Player Analysis

Intel, traditionally known for its dominance in the CPU market, has made significant strides in the GPU industry. The company entered the discrete GPU market with its Intel Arc series, targeting gaming and high-performance computing. Intel’s strength lies in its extensive research and development capabilities, as well as its vast manufacturing infrastructure.

AMD has emerged as one of the most competitive players in the GPU market, especially with its Radeon series of GPUs. Known for offering high performance at affordable prices, AMD has been able to carve out a strong position in both the gaming and professional markets. The company’s GPUs are praised for their power efficiency and excellent value-for-money, making them a favorite among budget-conscious gamers and content creators.

Nvidia is widely recognized as the undisputed leader in the GPU market, particularly in the realms of gaming, AI, and data centers. The company’s GeForce series of gaming GPUs and the Tesla line for AI and high-performance computing are widely regarded as the best in their respective categories.

Top Key Players in the Market

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- Imagination Technologies Group

- Samsung Electronics Co. Ltd

- Arm Limited

- EVGA Corporation

- SAPPHIRE Technology Limited

- Qualcomm Technologies Inc.

- Other Major Players

Top Opportunities Awaiting for Players

The GPU market is poised for significant growth and transformation, offering numerous opportunities for industry players.

- Expansion into Emerging Markets: There’s a growing demand for GPUs in emerging economies, especially with the rise in digital and technological adoptions such as mobile devices, PCs, and gaming consoles. New entrants and challenger companies can gain a competitive edge by focusing on specialized market segments or regional opportunities in these markets.

- Innovation in AI and Machine Learning: The integration of AI and machine learning technologies presents a huge opportunity for the GPU market. As AI continues to evolve, there is an increased demand for GPUs that can efficiently handle AI tasks such as data analysis, image recognition, and predictive modeling. This is not only limited to tech sectors but spans across various industries including healthcare, automotive and finance.

- Advancements in Gaming and Virtual Reality: The GPU market is crucially supported by the gaming industry, which demands high-performance computing for real-time graphics and video rendering. With advancements in gaming technology, including virtual reality, GPUs designed for intricate visual rendering and real-time ray tracing are increasingly in demand.

- 5G and Telecommunications: GPUs play a pivotal role in the design and operation of 5G infrastructure, which requires high-speed, real-time processing of massive data sets. This role extends into the telecommunications sector, enhancing network optimization and performance.

- Sustainability and Energy Efficiency: As environmental sustainability becomes more crucial, there is an opportunity for GPU manufacturers to innovate products that offer superior performance with better energy efficiency. This not only meets the increasing regulatory demands but also caters to consumer preferences for more sustainable and power-efficient technologies

Recent Developments

- In June 2024, Intel introduced an all-new GPU design, code-named Battlemage, which combines Xe2 GPU cores for graphics and Xe Matrix Extension (XMX) arrays for AI. This design enhances gaming and graphics performance by 1.5 times and offers up to 67 TOPS of AI performance.

- In July 2024, Nvidia revealed the Blackwell GPU architecture, promising up to 30 times greater inference performance and 25 times less energy consumption compared to the Hopper architecture.

Report Scope

Report Features Description Market Value (2024) USD 62.4 Bn Forecast Revenue (2034) USD 821.3 Bn CAGR (2025-2034) 29.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Discrete GPU, Integrated GPU, Hybrid GPU), By Application (Mobile Devices, PCs and Workstations, Servers/Data Centers, Automotive/Self-driving Vehicles, Gaming Consoles, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, Imagination Technologies Group, Samsung Electronics Co. Ltd, Arm Limited, EVGA Corporation, SAPPHIRE Technology Limited, Qualcomm Technologies Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Graphics Processing Unit (GPU) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Graphics Processing Unit (GPU) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- Imagination Technologies Group

- Samsung Electronics Co. Ltd

- Arm Limited

- EVGA Corporation

- SAPPHIRE Technology Limited

- Qualcomm Technologies Inc.

- Other Major Players