Global Software-as-a-Service (SaaS) Subscription Market Size, Share, Statistics Analysis Report By Solution (Software, Services), By Application (Customer Relationship Management (CRM), Enterprise Resource planning (ERP), Human Capital Management, Content, Collaboration & Communication, BI & Analytics, Others), By Deployment (Public, Private, Hybrid), By Enterprise Size (Large Enterprises, SMEs), By Industry (BFSI, Retail And Consumer Goods, Healthcare, Education, Manufacturing, Travel & Hospitality, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 141946

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Growth and Size

- Analysts’ Viewpoint

- Solution Analysis

- Application Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

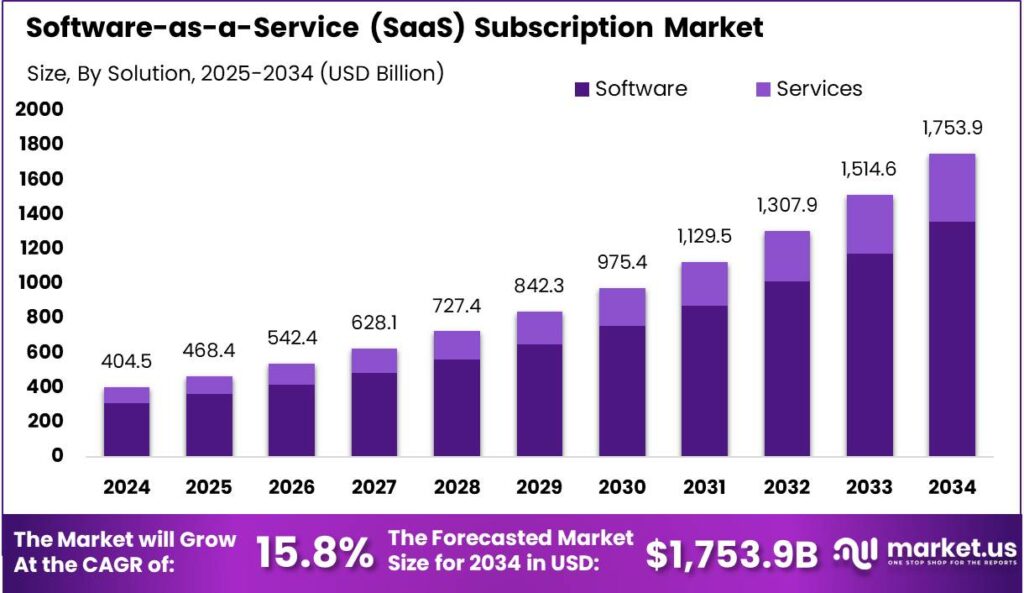

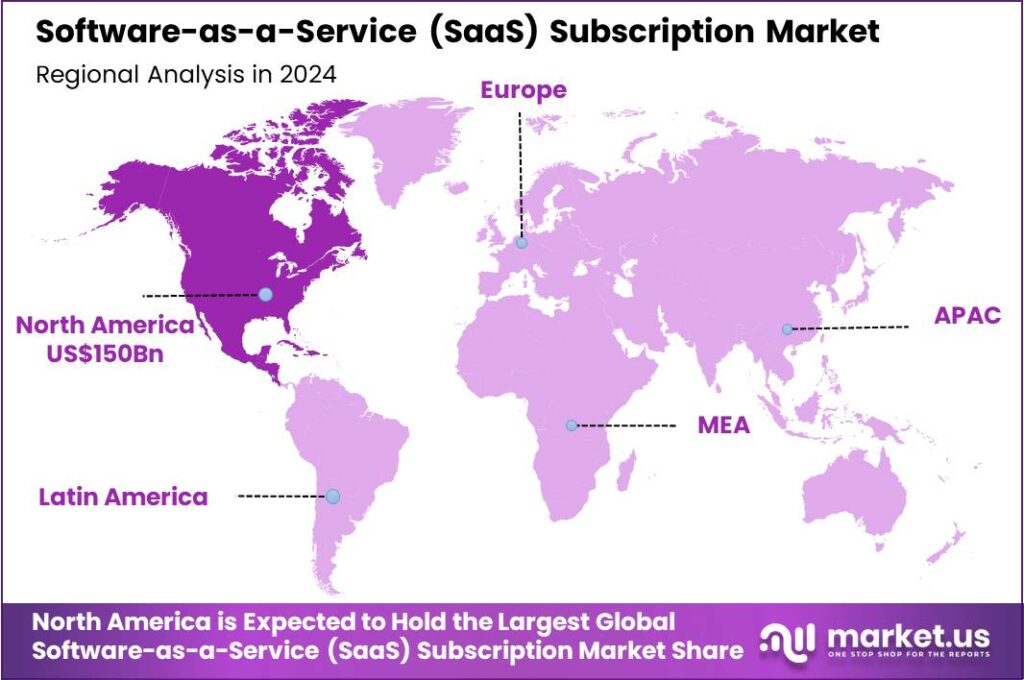

The Software-as-a-Service Subscription Market size is expected to be worth around USD 1,753.9 Bn By 2034, from USD 404.5 Bn in 2024, growing at a CAGR of 15.80% during the forecast period from 2025 to 2034. In 2024, North America led the SaaS Subscription Market, holding over 37.2% share, with revenue around USD 150 bn.

Software-as-a-Service, commonly known as SaaS, operates under a subscription-based licensing model where software is accessed online through servers hosted by the SaaS provider, rather than being installed and managed on local servers. This model allows users to access software via a web browser from anywhere, provided they have an internet connection.

The SaaS subscription market has seen exponential growth due to its cost-effectiveness and flexibility. Businesses of all sizes are able to use sophisticated software applications without the high costs of licensing, infrastructure, and maintenance associated with traditional software models.

The primary driving factors for the SaaS subscription market include the increasing adoption of mobile and cloud technologies, the need for businesses to reduce their operational costs, and the growing demand for scalable software solutions. As more businesses transition to remote work settings, the need for efficient, cloud-based collaboration tools has surged, further propelling the market growth.

One of the main objectives for SaaS providers is to deliver continuous improvements and updates to their software without disrupting the user experience. Providers aim to offer a platform that is not only reliable and secure but also adaptable to the changing needs of businesses. Ensuring high uptime standards and providing robust security measures are crucial to maintaining customer trust and satisfaction.

Based on data from Blogging Lift, The Software as a Service (SaaS) industry continues to expand rapidly, reaching a valuation of over $170 billion as of 2025. The United States leads the global market, with over eight times more SaaS companies compared to any other country. The industry is set to more than double in value by 2025, signaling strong growth and increasing adoption worldwide.

India’s SaaS market has experienced remarkable expansion, growing by approximately 75% in just two years. In 2020, 41.12% of startups were already operating within the SaaS sector, reflecting its strong presence in the startup ecosystem. Meanwhile, China’s SaaS cloud industry has witnessed consistent year-over-year growth over the past decade, positioning it as an emerging leader in the space.

Globally, there are approximately 30,000 SaaS companies, with about 60% based in the United States. SaaS platforms in the U.S. alone process 54 billion customer interactions annually, underscoring their critical role in business operations. The global SaaS market is projected to reach $242.8 billion by 2025, further solidifying its position as a dominant force in the tech industry.

The demand for SaaS solutions is increasingly influenced by the need for businesses to enhance operational efficiency and reduce costs. SaaS applications support a wide range of business functions including file sharing, project management, and real-time communication and collaboration, which are essential in today’s fast-paced business environments.

Key Takeaways

- The Global Software-as-a-Service (SaaS) Subscription Market size is expected to reach USD 1,753.9 Billion by 2034, growing from USD 404.5 Billion in 2024, at a CAGR of 15.80% during the forecast period from 2025 to 2034.

- In 2024, the Software segment held a dominant market position within the SaaS Subscription Market, capturing more than a 77.6% share.

- The Customer Relationship Management (CRM) segment also held a dominant market position in 2024, accounting for over 36.3% of the market share.

- The Private segment of the SaaS Subscription Market dominated in 2024, holding more than a 44.2% share.

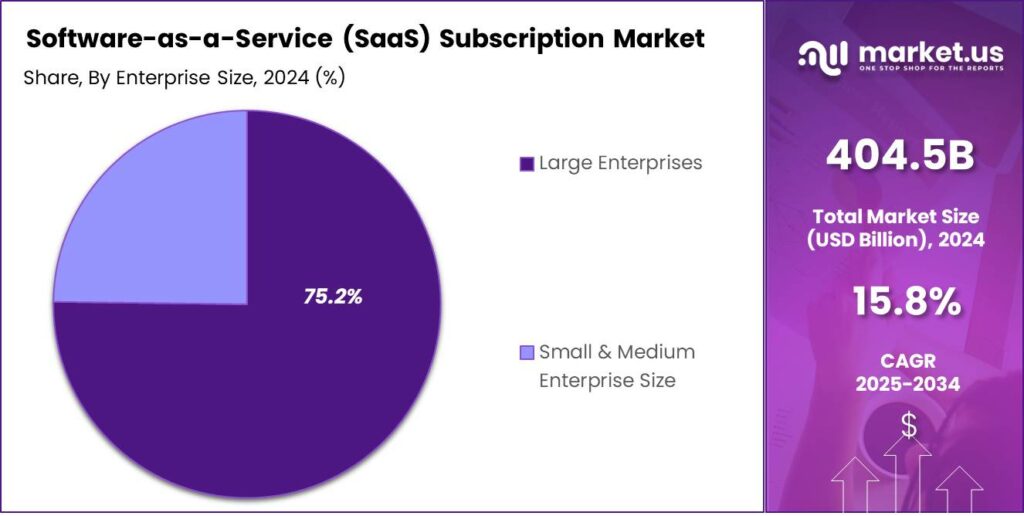

- In 2024, the Large Enterprises segment captured more than 75.2% of the SaaS Subscription Market.

- The BFSI (Banking, Financial Services, and Insurance) sector represented a significant portion of the SaaS Subscription Market in 2024, with a share exceeding 30.5%.

- North America dominated the Software-as-a-Service (SaaS) Subscription Market in 2024, holding more than a 37.2% share, with revenue reaching approximately USD 150 billion.

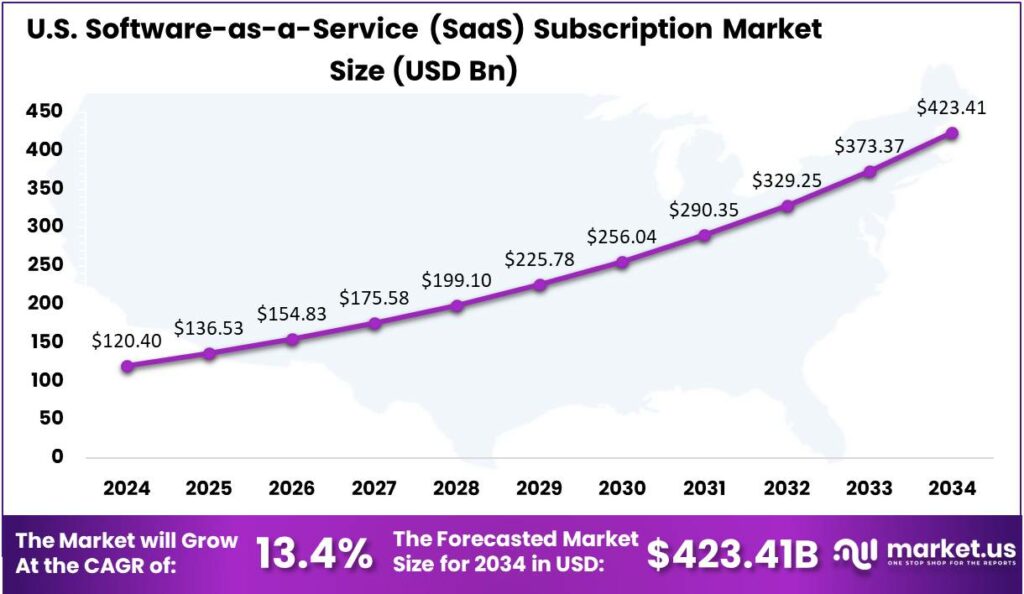

- The U.S. SaaS Subscription Market alone reached a valuation of USD 120.4 billion in 2024 and is projected to grow at a CAGR of 13.4%.

U.S. Market Growth and Size

In 2024, the U.S. Software-as-a-Service (SaaS) Subscription Market reached a valuation of USD 120.4 billion. It is projected to grow at a compound annual growth rate (CAGR) of 13.4% during the forecast period. This robust growth trajectory underscores the increasing reliance on cloud-based solutions across various sectors.

The rapid growth of the SaaS market is driven by the shift towards digital transformation, with organizations adopting cloud-based solutions for efficiency and cost reduction. SaaS offers scalability, enabling businesses to adapt to changing demands. As flexibility and remote work become priorities, demand for SaaS solutions is set to rise.

Ongoing advancements in AI and machine learning are enhancing SaaS products with personalized and predictive features, boosting their appeal. These technologies help businesses improve customer engagement and efficiency. As a result, the U.S. SaaS market is set for continued growth, offering opportunities for both established and new players.

In 2024, North America held a dominant position in the Software-as-a-Service (SaaS) Subscription Market, capturing more than a 37.2% share with revenue reaching approximately USD 150 billion. This leadership can be attributed to several strategic advantages inherent to the region.

North America’s concentration of leading tech firms, especially in the U.S., has positioned the region as a leader in the SaaS market. These firms drive advancements in cloud computing and SaaS technologies, adopting them faster than other regions due to strong infrastructure and a business environment supportive of digital transformation.

Also, North America’s strong entrepreneurial ecosystem fosters innovation and competition in the SaaS market, with new startups continually emerging. Businesses in the region are eager to invest in new technologies, enhancing efficiency and competitive advantage, which creates a thriving environment for SaaS products.

Advanced digital connectivity and widespread remote work models have fueled SaaS market growth, as businesses seek scalable, flexible solutions for distributed teams. The demand is further driven by a focus on customer-centric and data-driven operations, supported by SaaS platforms’ advanced analytics and integration. These factors solidify North America’s leadership in the global SaaS subscription market.

Analysts’ Viewpoint

The ongoing expansion of the SaaS market provides numerous investment opportunities, especially in sectors that are still in the early stages of digital transformation. Investors are particularly interested in SaaS solutions that offer innovative uses of artificial intelligence and machine learning, as these technologies can significantly enhance the capabilities of traditional SaaS platforms.

Technological innovation is a cornerstone of the SaaS subscription market. Recent advancements include the integration of artificial intelligence (AI) and machine learning (ML) to enhance the capabilities of SaaS products, such as improving personalized user experiences, optimizing operations, and delivering better data-driven insights.

Artificial intelligence significantly impacts the SaaS subscription market by enabling more advanced, predictive analytics and smarter, automated features that streamline user tasks and business processes. AI technologies help SaaS providers offer more efficient, personalized, and adaptive services, thereby influencing market trends and competition dynamics.

Solution Analysis

In 2024, the Software segment held a dominant market position within the Software-as-a-Service (SaaS) Subscription Market, capturing more than a 77.6% share. The substantial market share of SaaS is driven by its core value of delivering software solutions over the internet, eliminating the need for physical installations and on-site management.

The dominance of the Software segment is reinforced by the ongoing evolution of SaaS products, incorporating AI, machine learning, and big data analytics. These advancements improve functionality and efficiency, making SaaS solutions more appealing to enterprises seeking a competitive edge through technology.

Moreover, the increasing focus on customer-centric business models has propelled the demand for SaaS software solutions. These solutions enable businesses to deliver superior customer experiences through personalized interactions and services, facilitated by the SaaS model’s ability to seamlessly update and innovate.

The global shift to remote work has strengthened the Software segment’s dominance in the SaaS market. With teams dispersed across locations, the demand for reliable, secure, and accessible software has grown, and SaaS solutions meet these needs, ensuring business continuity and boosting productivity. This trend solidifies the Software segment’s leading position in the SaaS market.

Application Analysis

In 2024, the Customer Relationship Management (CRM) segment held a dominant market position within the Software-as-a-Service (SaaS) subscription market, capturing more than a 36.3% share. This leadership can be attributed to the increasing demand for streamlined customer interactions and data management across various industries.

Businesses are leveraging CRM systems to enhance customer satisfaction by integrating data analytics and personalized customer service solutions. The integration of AI and machine learning has further propelled the adoption of CRM systems, making them more efficient in predicting customer behavior and managing large volumes of customer data effectively.

The dominance of the CRM segment is driven by its scalability and accessibility, appealing to businesses of all sizes. CRM platforms have become more user-friendly and customizable, enabling organizations to tailor solutions to their needs without hefty upfront IT infrastructure investments.

As data privacy regulations like GDPR and CCPA become stricter, companies are increasingly adopting robust CRM systems to ensure compliance. These systems enable secure customer data management and operational transparency, helping businesses meet legal requirements while fostering customer trust.

Deployment Analysis

In 2024, the Private segment of the Software-as-a-Service (SaaS) Subscription Market held a dominant market position, capturing more than a 44.2% share. This leadership is largely due to the enhanced security and control that private deployments provide, which is crucial for organizations handling sensitive data and needing to comply with strict data protection regulations.

Moreover, the private SaaS model allows organizations to customize applications to fit their specific needs without the constraints typically associated with public or hybrid models. The ability to tailor services and maintain a close alignment with core business processes encourages many large enterprises to invest in private SaaS solutions, thereby driving segment growth.

As technology evolves, private SaaS providers are offering more flexible and scalable solutions, addressing the traditional scalability limitations. These advancements make private deployments as agile as public offerings, broadening their appeal and ensuring the continued dominance of the private SaaS segment.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the Software-as-a-Service (SaaS) Subscription market, capturing more than a 75.2% share. This substantial market share can be attributed to several factors that are intrinsic to large organizations.

Furthermore, large enterprises typically have more complex operational needs and a higher demand for automation and integration capabilities that SaaS products offer. This drives the adoption of multiple SaaS applications across various departments, further entrenching their dominance in the market.

Moreover, the shift towards remote working models, accelerated by recent global events, has necessitated the need for accessible and secure remote technologies. Large enterprises have led this shift, leveraging SaaS solutions to ensure business continuity, enhance collaboration, and maintain operational efficiency across geographically dispersed teams.

The preference for SaaS solutions in large enterprises is driven by long-term cost savings. While initial investments may be significant, the overall cost of ownership is often lower than maintaining on-premise systems. The economic benefits, along with the flexibility, scalability, and enhanced security of SaaS, reinforce the continued leadership of the Large Enterprises segment in the SaaS market.

Industry Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Software-as-a-Service (SaaS) Subscription market, capturing more than a 30.5% share. This prominence is largely driven by the digital transformation initiatives that have become critical in the BFSI sector.

Financial institutions are increasingly relying on SaaS solutions to meet the growing demands for robust cybersecurity measures, regulatory compliance, and innovative customer service solutions. These platforms enable BFSI companies to deploy advanced technologies such as artificial intelligence for fraud detection and blockchain for secure transactions rapidly and efficiently.

The adoption of SaaS in the BFSI sector is driven by the need for agility and flexibility in financial operations. As customer demands for personalized, instant services grow, banks and insurance companies are using SaaS to deliver these solutions quickly and cost-effectively, enhancing customer engagement and improving operational efficiency.

The scalability offered by SaaS platforms also plays a crucial role in their widespread adoption within the BFSI sector. As financial institutions face variable workloads and fluctuating demands based on economic conditions and market dynamics, SaaS solutions provide the ability to scale services up or down as needed, ensuring cost-effectiveness and resource optimization.

Key Market Segments

By Solution

- Software

- Services

By Application

- Customer Relationship Management (CRM)

- Enterprise Resource planning (ERP)

- Human Capital Management

- Content, Collaboration & Communication

- BI & Analytics

- Others

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By Industry

- BFSI

- Retail And Consumer Goods

- Healthcare

- Education

- Manufacturing

- Travel & Hospitality

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Embracing multi-cloud and hybrid cloud strategies

The increasing adoption of multi-cloud and hybrid cloud strategies is a significant driver for the growth of Software-as-a-Service (SaaS) subscriptions. Organizations are increasingly seeking flexibility and resilience in their IT infrastructures.

By distributing workloads across multiple cloud providers, such as AWS, Google Cloud, and Microsoft Azure, businesses can avoid vendor lock-in and optimize performance. This approach allows for the selection of best-of-breed solutions tailored to specific needs, enhancing operational efficiency.

Additionally, hybrid cloud strategies enable the integration of on-premises systems with public cloud services, facilitating a seamless and scalable environment. SaaS providers are responding by ensuring their applications are compatible across diverse platforms, thereby meeting the evolving demands of enterprises.

Restraint

Integration Challenges with Existing Systems

Integrating SaaS applications with existing on-premises systems poses a notable challenge for organizations. Compatibility issues, data migration difficulties, and potential disruptions to established workflows can hinder the seamless adoption of SaaS solutions.

Businesses may face obstacles in achieving interoperability between new SaaS applications and legacy systems, leading to increased costs and extended implementation timelines.The increasing frequency of cyberattacks and data breaches has heightened apprehension among businesses regarding the safety of sensitive information stored in the cloud. These integration complexities can act as a deterrent for organizations considering the transition to SaaS models.

Opportunity

Growing integration of AI and Machine Learning (ML).

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into SaaS offerings presents a significant growth opportunity. By embedding AI capabilities, SaaS providers can offer advanced features such as predictive analytics, automated customer support, and personalized user experiences.

Additionally, the integration of AI into SaaS platforms enables providers to offer personalized experiences and predictive analytics, further enhancing customer satisfaction. This data-driven approach allows businesses to anticipate market trends, optimize resource allocation, and improve customer retention.

As AI continues to evolve, its ability to automate complex tasks and deliver actionable insights will empower SaaS providers to unlock new business models and create more targeted, scalable solutions for diverse industries.

Challenge

Ensuring Regulatory Compliance Across Jurisdictions

Ensuring regulatory compliance across different jurisdictions poses a significant challenge for SaaS providers. As data protection laws and industry-specific regulations vary globally, SaaS companies must navigate a complex landscape to ensure their services comply with all applicable legal requirements.

Moreover, non-compliance can also lead to increased scrutiny from regulatory bodies, potential lawsuits, and a loss of customer trust, which can have long-lasting financial and operational consequences. To mitigate these risks, businesses must invest in regular training for employees, adopt compliance automation tools, and establish clear communication channels for reporting potential issues.

Emerging Trends

One notable trend is the integration of Artificial Intelligence and Machine Learning into SaaS platforms. By embedding AI and ML, SaaS providers enhance functionalities such as data analytics, customer service automation, and personalized user experiences. This allows businesses to derive more value from their data and improve operational efficiency.

Another significant development is the rise of vertical SaaS solutions. Unlike horizontal SaaS that serves a broad range of industries, vertical SaaS tailors its offerings to meet the specific needs of particular sectors, such as healthcare, finance, or retail. This specialization enables providers to address unique industry challenges more effectively, offering customized features and compliance measures.

The adoption of low-code and no-code platforms within SaaS is also gaining momentum. These platforms empower users with minimal programming knowledge to develop and customize applications, fostering innovation and reducing the time-to-market for new solutions.

Business Benefits

- Cost Savings: SaaS operates on a subscription model, reducing the need for large upfront investments in hardware and software. This approach can lead to significant cost reductions compared to traditional on-premises solutions.

- Scalability: SaaS solutions are designed to scale with your business needs. Whether you’re expanding or downsizing, you can adjust your SaaS subscriptions accordingly, ensuring you only pay for what you use.

- Automatic Updates: With SaaS, providers handle all software updates and maintenance. This ensures that your business always has access to the latest features and security enhancements without the need for manual interventions.

- Accessibility: SaaS applications are accessible from any device with an internet connection, facilitating remote work and collaboration across different locations. This flexibility supports modern work environments and enhances productivity.

- Quick Implementation: Deploying SaaS solutions is typically faster than traditional software installations. This rapid implementation allows businesses to start using the software promptly, reducing downtime and accelerating return on investment.

Key Player Analysis

Adobe Inc. has solidified its position as a top player in the SaaS market through its diverse suite of creative software products, such as Adobe Creative Cloud. Adobe’s software tools, which include Photoshop, Illustrator, and Premiere Pro, are essential for professionals in industries ranging from design to marketing.

Microsoft, with its Microsoft 365 suite, is a dominant player in the SaaS market. Microsoft’s cloud-based productivity tools, such as Word, Excel, and PowerPoint, are crucial to daily operations for businesses of all sizes. Microsoft Azure, its cloud platform, further strengthens its SaaS offerings, enabling businesses to build, manage, and deploy applications.

Alibaba Cloud International, part of Alibaba Group, has become a prominent player in the global SaaS market. Known for its reliable cloud infrastructure, Alibaba Cloud provides businesses with scalable SaaS solutions that support everything from data storage to artificial intelligence. Alibaba Cloud’s focus on emerging Asian markets and cost-effective pricing make it a strong competitor to AWS and Azure, offering customizable solutions.

Top Key Players in the Market

- Adobe Inc.

- Microsoft

- Alibaba Cloud International

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

- Others

Top Opportunities Awaiting for Players

- Artificial Intelligence Integration: AI continues to redefine SaaS by enhancing user experiences through personalized services and automated operations. The adoption of AI-driven tools is enabling SaaS companies to offer predictive insights and streamline processes, which not only boosts operational efficiency but also enhances customer satisfaction.

- Niche and Vertical SaaS Expansion: There’s a shifting focus towards specialized SaaS solutions tailored to specific industries or business functions. This trend towards micro-SaaS and vertical SaaS platforms allows companies to meet unique market demands with more precise and effective solutions, which are particularly advantageous in sectors like healthcare, finance, and retail.

- Advanced Subscription Models: Innovative subscription pricing models are becoming prevalent, including usage-based pricing and flexible service tiers. These models are designed to improve customer retention and adapt to varying usage patterns, offering businesses a way to align pricing more closely with customer value.

- Enhanced Customer Experience Optimization: SaaS providers are increasingly focusing on optimizing the customer experience through personalization, improved user interfaces, and mobile-first development. By enhancing customer engagement and convenience, companies can foster greater user loyalty and satisfaction.

- Robust Security Measures: As cybersecurity threats evolve, there is a significant opportunity for SaaS providers to lead with advanced security measures. Implementing stringent security protocols and compliance management systems not only protects sensitive data but also builds trust with users, making security a competitive advantage.

Recent Developments

- In October 2024, Salesforce has introduced Government Cloud Premium, a tailored SaaS and PaaS solution for U.S. national security and intelligence agencies. This offering provides a dedicated environment for app development with no-code, low-code, and pro-code options, supports workflow automation, and features an API-first architecture for seamless integration with government systems.

- In September 2024, Palo Alto Networks has acquired IBM’s QRadar SaaS assets, strengthening their strategic alliance and enabling more organizations to leverage advanced next-gen security operations and AI-driven solutions.

Report Scope

Report Features Description Market Value (2024) USD 404.5 Bn Forecast Revenue (2034) USD 1,753.9 Bn CAGR (2025-2034) 15.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Software, Services), By Application (Customer Relationship Management (CRM), Enterprise Resource planning (ERP), Human Capital Management, Content, Collaboration & Communication, BI & Analytics, Others), By Deployment (Public, Private, Hybrid), By Enterprise Size (Large Enterprises, SMEs), By Industry (BFSI, Retail And Consumer Goods, Healthcare, Education, Manufacturing, Travel & Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Microsoft, Alibaba Cloud International, IBM Corporation, Google LLC, Salesforce, Inc., Oracle, SAP SE, Rackspace Technology, Inc., VMware Inc., IONOS Cloud Inc., Cisco Systems, Inc., Atlassian, ServiceNow, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Software-as-a-Service Subscription MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Software-as-a-Service Subscription MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Microsoft

- Alibaba Cloud International

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

- Others