Global Refurbished Audio Devices Market Size, Share, Statistics Analysis Report By Product Type (Loudspeakers, Microphones, Amplifiers, Turntables, Other Audio Equipment (Audio Interfaces, Mixing Consoles, etc.)), By Technology (Wired, Wireless), By End User (Individual Consumers, Corporate Sector, Educational Institutions, Government Organizations, Music Professionals, Entertainment Industry), By Distribution Channel (Online Retailers and E-commerce Platforms, Physical Stores, Authorized Refurbishment Centers, Direct Sales), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141868

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- China Market Size

- Analysts’ Viewpoint

- Product Type Analysis

- Technology Analysis

- End User Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

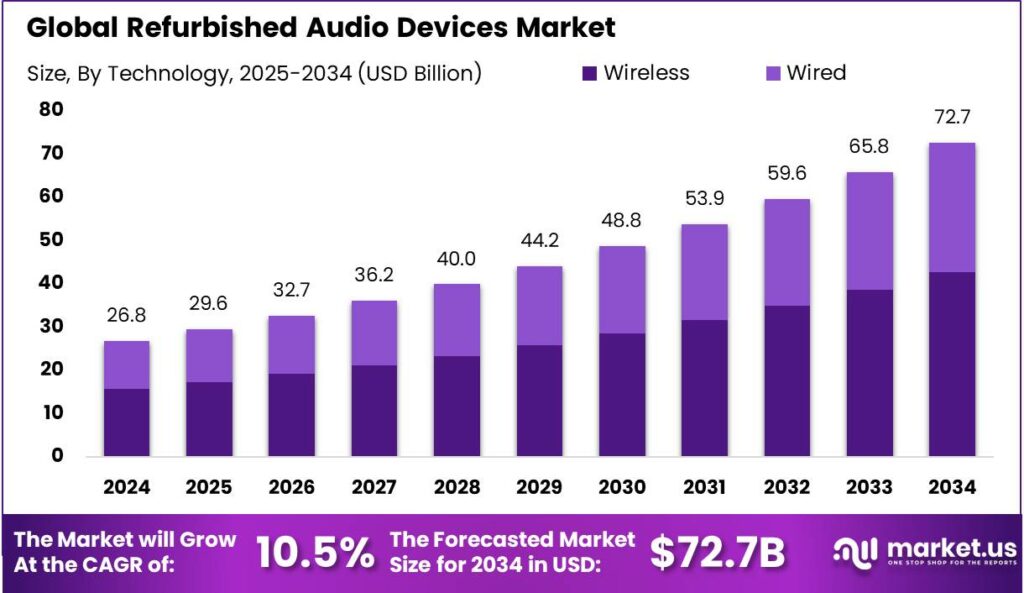

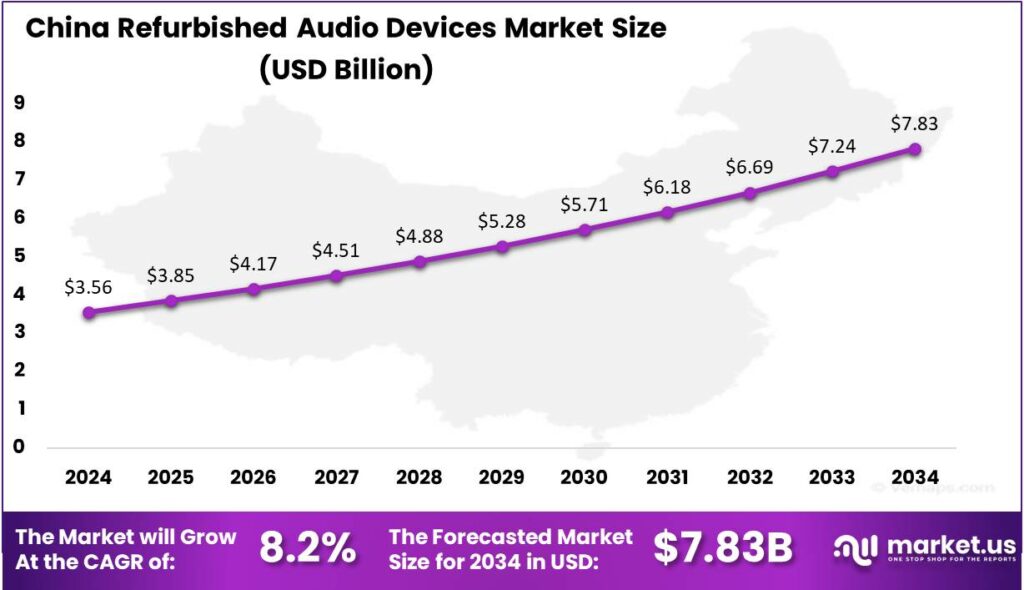

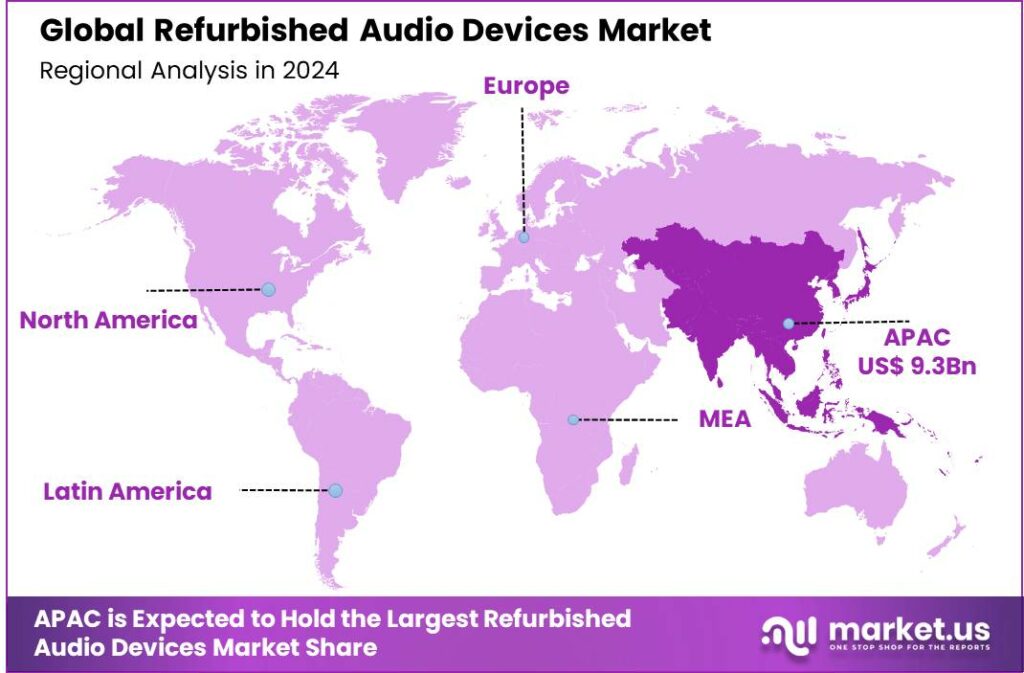

The Refurbished Audio Devices Market size is expected to be worth around USD 72.7 Bn By 2034, from USD 26.8 Bn in 2024, growing at a CAGR of 10.50% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific dominated the refurbished audio devices market with over 35% share, generating USD 9.3 bn in revenue. China’s market was valued at USD 3.56 bn, growing at a CAGR of 8.2%.

Refurbished audio devices are pre-owned electronic products, such as headphones, speakers, and audio interfaces, that have been restored to full functionality. These items may have been returned by customers or displayed as models in stores, and then repaired, tested, and certified to be in good working condition by manufacturers or authorized centers before being resold.

The market for these devices is driven by cost-conscious consumers who seek quality audio products at reduced prices. It is growing rapidly, fueled by rising consumer awareness of sustainability, which encourages the purchase of refurbished products to reduce electronic waste. Additionally, the availability of high-quality, cost-effective refurbished products that match the performance of new ones appeals to budget-conscious consumers.

One of the primary objectives of the refurbished audio devices market is to provide consumers with access to affordable, high-quality audio technology. By offering products that have been restored to their original condition, retailers aim to demystify the notion that only new products can guarantee quality and reliability.

Key drivers of the refurbished electronics market include environmental sustainability, the availability of high-end features at lower prices, and the rising consumer trust in the quality of refurbished products. The demand is further bolstered by extensive online retail platforms that offer a wide variety of refurbished products, making it easy for consumers to purchase these items from the comfort of their homes.

Additionally, improvements in refurbishment processes and the expansion of warranties and guarantees by sellers have built greater trust in refurbished products. These factors, combined with the rising demand for advanced audio technology at reduced prices, are propelling the growth of the refurbished audio devices market.

Key Takeaways

- The Global Refurbished Audio Devices Market size is expected to reach USD 72.7 Billion by 2034, growing from USD 26.8 Billion in 2024, at a compound annual growth rate (CAGR) of 10.50% during the forecast period from 2025 to 2034.

- In 2024, the Loudspeakers segment held a dominant position in the market, capturing more than 34.6% of the share.

- In 2024, the Wireless segment held a dominant position, accounting for more than 58.7% of the market share.

- In 2024, the Individual Consumers segment led the market, holding more than 28.8% of the share.

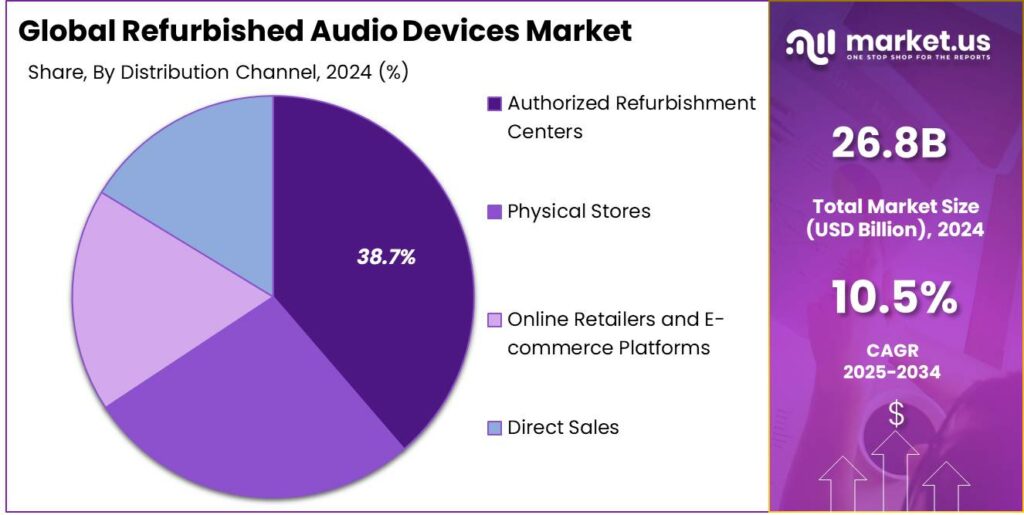

- In 2024, the Authorized Refurbishment Centers segment was the largest, commanding more than 38.7% of the market share.

- In 2024, Asia-Pacific was the dominant region in the refurbished audio devices market, holding more than 35% of the global market share.

- The market for refurbished audio devices in China was valued at USD 3.56 billion in 2024, experiencing a CAGR of 8.2%.

China Market Size

In 2024, the market for refurbished audio devices in China was valued at USD 3.56 billion. This sector is experiencing a compound annual growth rate (CAGR) of 8.2%.

The growth of the refurbished audio device market in China is driven by heightened consumer awareness of electronic waste and the rising cost of new technology. Refurbished devices, sold at a fraction of the price of new models, provide high-quality, affordable options. This trend is further supported by the increasing availability of certified refurbished products, ensuring reliability and functionality.

The market’s growth is supported by improved refurbishment processes and strict quality checks, which help build trust in refurbished products. As technology evolves, the appeal of purchasing updated models at lower prices encourages more consumers to consider these alternatives, driving continued market expansion.

In 2024, Asia-Pacific held a dominant market position in the refurbished audio devices market, capturing more than a 35% share. The region generated revenue of approximately USD 9.3 billion, driven by a combination of economic, technological, and consumer behavior factors.

Asia-Pacific leads the refurbished audio devices market due to high adoption rates in countries like China, India, and South Korea. These nations are major consumers and producers of electronics, fostering a culture of rapid tech adoption and recycling. The region also benefits from strong distribution networks, supported by e-commerce platforms and specialized retail chains.

The diverse economic landscape of Asia-Pacific further drives the growth of the refurbished market. In emerging economies, cost sensitivity among consumers boosts demand for affordable, high-quality refurbished audio devices, making advanced technology accessible to a wider population and supporting market expansion.

Environmental concerns also play a crucial role in this region. With increased awareness of sustainability issues, consumers are more inclined to opt for refurbished devices as a way to reduce e-waste and minimize their environmental footprint. Governments and NGOs in Asia-Pacific are actively promoting the recycling and refurbishing of electronics, further supporting the market growth.

Analysts’ Viewpoint

The demand for refurbished audio devices is increasing globally, with a notable uptick in both developed and emerging markets. The key demographic includes tech-savvy consumers looking for high-quality products at lower prices and environmentally conscious buyers aiming to reduce their ecological impact. The market is also seeing growth due to the expansion of certified refurbishment programs that assure product quality and reliability.

The refurbished audio device market presents numerous investment opportunities. Investors can capitalize on the expanding consumer base that is increasingly receptive to refurbished products. Retail chains and online platforms offering certified refurbished products are particularly attractive investment avenues, as they reassure customers about the quality and durability of their purchases.

Technological advancements play a crucial role in the refurbishment process of audio devices. Improved diagnostic tools and more efficient repair techniques enhance the quality and reliability of refurbished products. Innovations in testing software and hardware refurbishment techniques continue to elevate the standard of products returned to the market, essentially indistinguishable from their newer counterparts.

Product Type Analysis

In 2024, the Loudspeakers segment held a dominant position in the refurbished audio devices market, capturing more than a 34.6% share. This significant market share is primarily due to the widespread use of loudspeakers in various settings, including home entertainment systems, professional audio setups, and portable audio devices.

Loudspeakers, being central to most audio experiences, tend to wear out or go out of fashion, leading consumers to opt for refurbished models that offer comparable performance at a reduced cost. This trend is bolstered by the growing consumer inclination towards eco-friendly and cost-effective alternatives to new products.

The Loudspeakers segment thrives due to technological advancements that improve the lifespan and performance of refurbished units. Manufacturers and refurbishers can restore devices to like-new condition, incorporating the latest audio technologies to meet or surpass original specs, which boosts consumer trust and satisfaction.

Another factor driving the dominance of the Loudspeakers segment is the aggressive marketing and promotional strategies used by sellers. These strategies emphasize the quality, durability, and value of refurbished loudspeakers, often supported by warranties and guarantees to alleviate consumer concerns about product reliability.

Technology Analysis

In 2024, the wireless segment held a dominant position in the refurbished audio devices market, capturing more than a 58.7% share. This segment’s leadership can be attributed to the increasing consumer preference for convenience and advanced technology.

The rise of wireless technology in audio devices is closely tied to improvements in battery life and the proliferation of wireless charging solutions, which enhance the user experience. Consumers are increasingly drawn to the seamless integration of wireless audio devices with various multimedia platforms, whether for home entertainment, fitness, or mobile use.

The growing trend of minimalism and clean aesthetics has boosted the popularity of wireless audio devices. The wire-free design offers a cleaner setup, aligning with modern consumer preferences, and influencing both manufacturer priorities and consumer purchasing choices, strengthening the wireless segment in the refurbished market.

The commitment of major tech companies to phasing out headphone jacks in smartphones and other devices has significantly driven the adoption of wireless audio solutions. This shift has created a robust market for refurbished wireless audio devices, as consumers look for affordable alternatives to complement their wireless-enabled gadgets.

End User Analysis

In 2024, the Individual Consumers segment held a dominant market position in the refurbished audio devices market, capturing more than a 28.8% share. This segment’s leading status can be attributed to several key drivers that reflect the changing dynamics of consumer behavior and economic factors.

The affordability of refurbished audio devices is a key factor in their popularity. As new audio technology becomes more expensive, refurbished models offer a budget-friendly alternative, allowing consumers to access high-end technology at a fraction of the cost without sacrificing quality.

Advancements in refurbishing techniques and strict quality assurance processes have significantly improved the quality and availability of refurbished audio devices. These improvements have reduced skepticism around refurbished electronics, with certified products, often backed by warranties, offering consumers greater security and purchases.

Furthermore, the shift towards more sustainable consumer practices has also played a crucial role in the growth of this segment. Environmental awareness has led more individuals to consider the impact of their buying choices, resulting in increased preference for refurbished products, which contribute to reducing electronic waste and conserving resources.

Distribution Channel Analysis

In 2024, the Authorized Refurbishment Centers segment held a dominant position in the refurbished audio devices market, capturing more than a 38.7% share. This segment’s leading status is driven by key factors that set it apart from other distribution channels like online retailers, e-commerce platforms, and physical stores.

Authorized Refurbishment Centers provide a level of trust and assurance that is critical in the refurbished market. Consumers often express concerns regarding the quality and authenticity of refurbished products. These centers address such concerns by offering certified refurbishments that are often backed by warranties similar to those of new products.

Additionally, Authorized Refurbishment Centers, often endorsed or operated by OEMs, ensure strict quality control standards that may not be guaranteed in other channels. OEM endorsement enhances consumer trust and provides access to proprietary tools and genuine parts, contributing to the high quality of refurbished products.

Moreover, the expertise at Authorized Refurbishment Centers is crucial. These centers employ skilled technicians trained by OEMs, ensuring that all products meet original factory specifications. Their expertise guarantees the functionality and aesthetic condition of refurbished devices, offering a significant advantage over lesser-equipped service providers.

Key Market Segments

By Product Type

- Loudspeakers

- Microphones

- Amplifiers

- Turntables

- Other Audio Equipment (Audio Interfaces, Mixing Consoles, etc.)

By Technology

- Wired

- Wireless

By End User

- Individual Consumers

- Corporate Sector

- Educational Institutions

- Government Organizations

- Music Professionals

- Entertainment Industry

By Distribution Channel

- Online Retailers and E-commerce Platforms

- Physical Stores

- Authorized Refurbishment Centers

- Direct Sales

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Consumer Demand for Cost-Effective and Sustainable Options

The refurbished audio devices market is primarily driven by consumers seeking affordable and environmentally friendly alternatives to new products. Refurbished devices offer significant cost savings, making high-quality audio equipment accessible to a broader audience. This affordability appeals to budget-conscious consumers who desire premium features without the premium price tag.

Additionally, growing environmental awareness has led consumers to consider the ecological benefits of purchasing refurbished items, as this practice reduces electronic waste and promotes sustainability. By extending the lifecycle of audio devices, refurbishment aligns with the principles of the circular economy, further attracting environmentally conscious buyers.

Restraint

Challenges in Sourcing High-Quality Used Devices

Another restraint is the difficulty refurbishers face in sourcing high-quality used audio devices suitable for refurbishment. The availability of such devices is often limited, and competition with original equipment manufacturers (OEMs) running their own buyback programs intensifies the challenge.

In addition to establishing reliable sourcing channels and partnerships, refurbishment businesses may also face constraints related to regulatory requirements and environmental standards. Compliance with local and international regulations on e-waste disposal, data security, and product safety can increase operational complexities and costs. These constraints may reduce device availability for refurbishment and require extra resources for compliance, further affecting profitability.

Opportunity

Expansion of E-Commerce Platforms and Environmental Sustainability as opportunity

The growth of e-commerce platforms specializing in refurbished electronics presents a significant opportunity for the refurbished audio devices market. Online marketplaces have made it easier for consumers to access a wide range of refurbished products, complete with detailed descriptions, certifications, and warranties.

Additionally, the growing awareness of environmental sustainability has played a significant role in driving the demand for refurbished audio devices. As consumers become more eco-conscious, the appeal of reducing electronic waste and contributing to a circular economy has further fueled interest in purchasing refurbished products. This eco-friendly trend, alongside the convenience and affordability of online platforms, has created a strong market for refurbished audio devices.

Challenge

Competition from Low-Cost New Devices

A notable challenge for the refurbished audio devices market is the competition from low-cost new devices, particularly those manufactured in regions with lower production costs. These new products often come with the latest features and warranties, making them attractive to consumers who might otherwise consider refurbished options.

To address this challenge, refurbishers must emphasize the value proposition of refurbished devices, such as superior quality checks, extended warranties, and the environmental benefits of reducing electronic waste. Differentiating refurbished products through certifications and highlighting their sustainability aspects can help mitigate the impact of competition from inexpensive new devices.

Emerging Trends

One significant trend is the growing consumer focus on sustainability. As awareness of environmental issues grows, consumers are seeking eco-friendly alternatives to new electronic devices. Refurbished electronics have emerged as a sustainable choice, as they promote resource conservation by extending the lifespan of electronic products.

Another emerging trend is the rapid adoption of e-commerce platforms that offer refurbished products. These platforms provide convenience, transparency, and a wide range of options, enhancing consumer trust and expanding market reach.

The integration of advanced digital technologies, such as AI and machine learning, has led to improved sound customization and room correction in audio devices. Wireless and streaming technologies are becoming more prevalent, offering high-resolution audio without the need for complex wiring.

The resurgence of retro technology has also impacted the refurbished audio devices market. Retro tech from the early 2000s, like Razr phones and iPods, is making a comeback among Gen Z and millennials, driven by nostalgia, a desire for tangible ownership, and the appeal of Y2K aesthetics.

Business Benefits

Investing in refurbished audio devices presents several advantages for businesses. Foremost is the potential for significant cost savings. Refurbished desktops and laptops offer consumers a ‘new’ machine at a relatively cheap price since they are sold at a lower price than new ones.

Access to high-quality brands is another benefit. Buying used doesn’t mean compromising on quality. It often means you can afford top-tier products that might otherwise be out of reach. Trusted brands design their audio-visual equipment to endure heavy use, ensuring continued performance and reliability.

Sustainability is a further advantage. Choosing refurbished audio gear isn’t just good for your wallet; it’s also beneficial for the environment. The United Nations Environment Programme reports that approximately 50 million tons of e-waste are produced worldwide each year. By opting for refurbished products, consumers can help reduce this e-waste and conserve the resources used in manufacturing new devices.

Key Player Analysis

Bose Corporation is a leader in the audio industry, known for its high-end audio products. In the refurbished market, Bose focuses on delivering premium sound at a more accessible price point. The company ensures that its refurbished devices, such as headphones and speakers, go through rigorous quality checks to meet the same standards as new products.

Sennheiser Electronic SE is another key player offering refurbished audio devices, maintaining its reputation for high-quality sound and durability. The company’s expertise in both consumer and professional audio equipment has helped it create a strong presence in the refurbished market.

Audio-Technica, a well-known name in the audio industry, is recognized for its affordable yet high-performance products. Audio-Technica’s refurbished products undergo rigorous inspection and testing, offering budget-friendly options without compromising sound quality. Their strong reputation ensures reliability in the refurbished audio market.

Top Key Players in the Market

- Bose Corporation

- Sennheiser Electronic SE

- Audio-Technica

- Beyerdynamic

- Turtle Beach

- Sony Corporation

- Apple Inc.

- Sonos Inc.

- Bang & Olufsen

- Klipsch Audio Technologies

- Others

Top Opportunities Awaiting for Players

The refurbished audio devices market is poised for significant growth, driven by several key opportunities that market players can leverage to expand their presence and increase market share.

- Integration with Smart Home Technology: As the demand for seamless integration of audio devices with smart home systems increases, there is a significant opportunity for companies to develop products that can easily connect with other home automation systems. This trend is particularly strong in North America, where there is a high adoption rate of smart home technologies.

- Expansion into Emerging Markets: The Asia-Pacific region is experiencing a surge in demand for audio products, driven by increasing disposable incomes and consumer demand in emerging markets like China and India. Companies can capitalize on this growth by expanding their geographical reach and customizing products to meet local consumer preferences.

- Environmental Sustainability: With growing global awareness about environmental issues, there is a considerable opportunity to market refurbished audio devices as a more sustainable choice. Consumers are increasingly looking for ways to reduce their environmental impact, and refurbished devices, which help reduce electronic waste, are becoming an attractive option.

- Enhanced Online Retail Presence: Online sales channels are crucial, as they offer a broad reach and the convenience of shopping from home. Companies that can strengthen their online retail capabilities are likely to capture a larger share of the market, especially given the popularity of e-commerce platforms for purchasing refurbished electronics.

- Quality and Certification Enhancements: Ensuring high quality and reliability of refurbished products through better certification processes can help alleviate consumer concerns about product quality. Establishing rigorous testing and certification standards can build consumer trust and drive increased adoption of refurbished audio devices.

Recent Developments

- In November 2024, Bose Corporation, known for its premium audio innovations, has acquired McIntosh Group, the parent company behind luxury audio brands like McIntosh and Sonus faber. This acquisition adds world-class amplifiers, speakers, turntables, and more to Bose’s already impressive portfolio.

- In October 2024, Acuity Brands announced the acquisition of QSC, expanding its capabilities in audio, video, and control platforms.

Report Scope

Report Features Description Market Value (2024) USD 26.8 Bn Forecast Revenue (2034) USD 72.7 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Loudspeakers, Microphones, Amplifiers, Turntables, Other Audio Equipment (Audio Interfaces, Mixing Consoles, etc.)), By Technology (Wired, Wireless), By End User (Individual Consumers, Corporate Sector, Educational Institutions, Government Organizations, Music Professionals, Entertainment Industry), By Distribution Channel (Online Retailers and E-commerce Platforms, Physical Stores, Authorized Refurbishment Centers, Direct Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bose Corporation, Sennheiser Electronic SE, Audio-Technica, Beyerdynamic, Turtle Beach, Sony Corporation, Apple Inc., Sonos Inc., Bang & Olufsen, Klipsch Audio Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refurbished Audio Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Refurbished Audio Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bose Corporation

- Sennheiser Electronic SE

- Audio-Technica

- Beyerdynamic

- Turtle Beach

- Sony Corporation

- Apple Inc.

- Sonos Inc.

- Bang & Olufsen

- Klipsch Audio Technologies

- Others