Global DevOps Market By Component (Solution and Services), By Deployment Mode (Cloud and On-Premise), By Enterprise Size (Large Enterprises and SME’s), By End-User (IT & Telecom, BFSI, Retail, Manufacturing, Healthcare, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 67475

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- By Enterprise Size Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Key Market Segments

- Geopolitical and Recession Impact Analysis

- Regional Analysis

- Market Share and Key Player Analysis

- Recent Development

- Report Scope

Report Overview

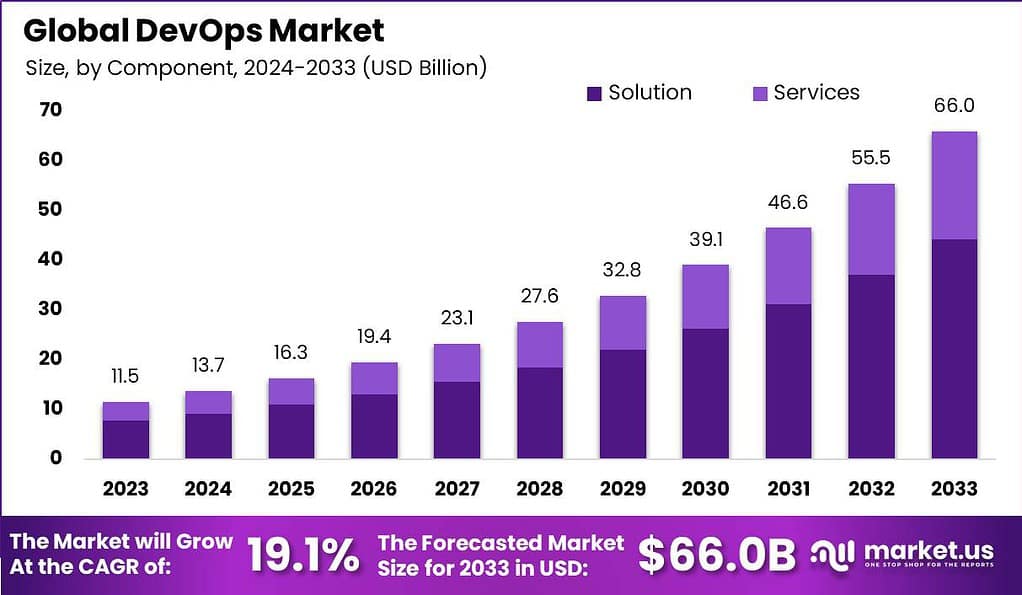

The Global Development and Operations (DevOps) Market size is expected to be worth around USD 66.0 Billion by 2033, from USD 11.5 Billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

Development and Operations (DevOps) is a set of practices and methodologies that combines software development (Dev) and IT operations (Ops) to enable organizations to deliver software applications and services more rapidly, reliably, and efficiently. DevOps emphasizes collaboration, automation, and continuous integration and delivery (CI/CD) to streamline the software development lifecycle and enhance overall business outcomes.

The Global DevOps Market is experiencing robust growth, driven by the increasing demand for rapid software delivery and enhanced operational efficiency across businesses. DevOps, a compound of development and operations, represents a set of tools and practices that bring software development and IT operations teams together to improve the software development lifecycle’s speed and quality.

This approach supports continuous integration and continuous delivery practices, enabling organizations to release new features and fixes more quickly and with fewer errors. The adoption of cloud technologies, automation tools, and agile methodologies further fuels this market’s expansion. Additionally, the need for better collaboration and communication between development and operations teams in the face of complex IT environments and the shift towards digital transformation strategies across industries are significant contributors to the market’s growth.

As businesses strive to stay competitive by enhancing their software delivery processes, the DevOps market is poised for further expansion, offering solutions that cater to these evolving requirements. According to a survey conducted by Atlassian Corporation, 99% of respondents said that DevOps had a positive impact on their organization.

AWS will likely maintain its dominant position in 2023, backed by its $6 billion investment. Its broad and deeply integrated DevOps tools give AWS significant competitive advantages. However, aggressive investments from Microsoft and Google mean their share gains may outpace AWS. Microsoft’s $12 billion allocation should cement Azure DevOps as the number two player, exceeding 25% share.

Google stands to benefit the most from any cloud provider diversification among developers. Its $11 billion investment signals intent to seriously challenge for leadership. Expanding Anthos and multicloud capabilities while filling DevOps product gaps could see Google surpass 15% share. Success here is critical to durability of its overall cloud business.

Key Takeaways

- The DevOps market is projected to reach a value of USD 66.0 billion by 2033, with a notable CAGR of 19.1% during the forecast period from 2024 to 2033.

- Cloud-based deployment mode holds a significant share, with 65.2% of the market in 2023, owing to benefits such as flexibility, scalability, and cost-effectiveness, aligning perfectly with DevOps principles.

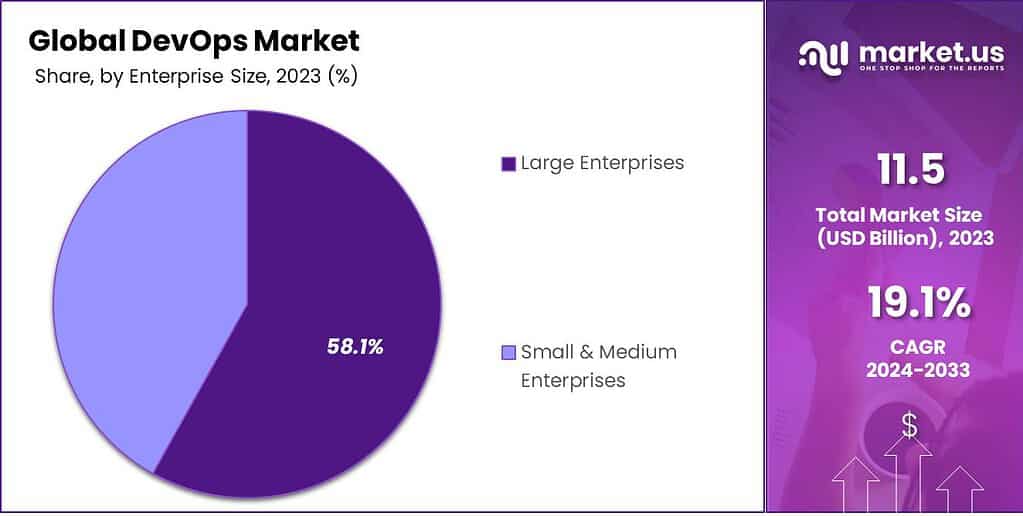

- Large enterprises, constituting 58.1% of the market in 2023, are major adopters of DevOps solutions due to their extensive operational scales and the need for sophisticated tools to manage complex IT environments.

- Microsoft’s $12 billion allocation should cement Azure DevOps as the number two player, exceeding 25% share.

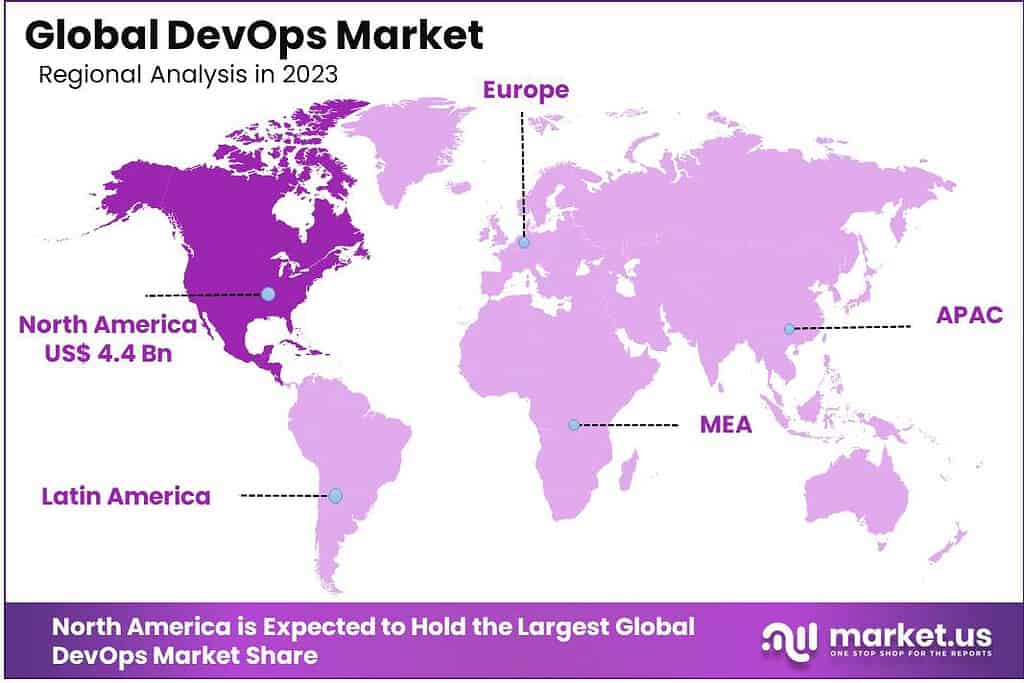

- North America dominated the global DevOps market with a revenue share of 38.5% in 2023, attributed to factors such as robust technological infrastructure and a culture of agility and innovation.

Component Analysis

On the basis of Component, the market for DevOps is further categorized into Solution and Services. Among these Component segments, the Solution segment dominated the market by holding a major revenue share of 67.0% in 2023. The Solution Component segment’s dominance in the market is primarily driven by the increasing need for businesses to enhance operational efficiency and accelerate software delivery cycles.

This segment encompasses a wide range of tools and platforms designed to automate and integrate the processes between software development and IT operations teams. With the rising complexity of IT environments and the continuous push for digital transformation, organizations are seeking comprehensive solutions that can streamline workflows, improve collaboration, and facilitate continuous integration and continuous delivery (CI/CD) practices.

Furthermore, the demand for DevOps solutions is fueled by the growing recognition of their role in supporting agile development methodologies and enabling faster time-to-market for new software products and features.

Deployment Mode Analysis

Based on Deployment Mode, the market is divided into Cloud-Based and On-Premise. From these segments, the Cloud-Based segment dominated the market by obtaining a larger revenue share of 65.2% in 2023.

The dominance of this segment in the market is primarily attributed to the benefits of cloud-based solutions including flexibility, scalability, and cost-effectiveness, which align perfectly with the principles of DevOps practices. Cloud-based platforms facilitate a seamless and efficient environment for development, testing, and deployment processes, enabling organizations to leverage the benefits of DevOps methodologies without the need for substantial upfront investments in physical infrastructure.

Moreover, the cloud infrastructure supports the agile and continuous delivery model of DevOps by allowing teams to rapidly deploy and release resources, thus accelerating the development cycle and enhancing productivity. The ease of integration with various tools and services in the cloud further enhances its appeal, allowing for a more interconnected and automated workflow. Additionally, the global shift towards digital transformation drives businesses to adopt cloud technologies, making cloud-based deployment an attractive option for organizations looking to implement DevOps practices.

By Enterprise Size Analysis

On the basis of Enterprise Size, the market is split into Small & Medium Enterprises and Large Enterprises. Among these Enterprise Size segments, the Large Enterprises segment obtained a larger revenue share of 58.1% in 2023.

The dominance of the Large Enterprise segment in the market is largely attributed to the significant resources and complex operational needs of these organizations, which necessitate sophisticated DevOps solutions. Large enterprises, characterized by their extensive operational scales, diverse product lines, and global market presence, face unique challenges in managing software development and IT operations.

These challenges include the need for rapid innovation, maintaining operational efficiency, and ensuring software quality and compliance across multiple teams and geographies. To address these demands, large enterprises invest heavily in DevOps tools and practices, seeking to enhance collaboration, automate workflows, and streamline the software development lifecycle.

Moreover, large enterprises have adequate financial capacity to invest in comprehensive DevOps solutions, including advanced automation, monitoring, and analytics tools, which are critical for managing complex and distributed IT environments.

Driving Factors

Increasing Demand for Automation and Continuous Delivery

Automation is an important part of the DevOps philosophy, aiming to minimize manual interventions in the software delivery process. The growing need for automation in building, testing, and deploying applications strengthens the expansion of the DevOps Market. Continuous delivery and integration practices enable organizations to release updates more frequently and with fewer errors, which is a critical factor in maintaining operational efficiency and customer satisfaction.

This demand for automation extends beyond software deployment to encompass various stages of the development lifecycle, including code integration, testing, and infrastructure management. As businesses seek to enhance efficiency and reduce the scope for human error, the adoption of DevOps tools and practices that facilitate automation and continuous delivery continues to rise, driving market growth.

Restraining Factors

Complexity of Implementation

Implementing DevOps practices involves integrating various tools and processes across the software development and deployment lifecycle. The complexity of setting up a seamless DevOps pipeline, which includes continuous integration, continuous delivery, monitoring, and feedback mechanisms, can be troublesome for many organizations. This complexity is intensified in environments with legacy systems or where there are significant technical challenges. Moreover, the challenge of integrating new tools with existing systems without disrupting ongoing operations can deter organizations from adopting DevOps practices.

Additionally, the need to maintain high security and compliance standards adds another layer of complexity to DevOps implementations. This barrier can be particularly noticeable in highly regulated industries, where the pace of adoption may be slower due to the additional requirements for compliance and security assurance.

Growth Opportunity

Emergence of AI and Machine Learning in DevOps

The integration of Artificial Intelligence and Machine Learning into DevOps presents a significant opportunity for the Global DevOps Market. This Integration can help in enhancing operational efficiency and reducing downtime by automating complex and time consuming tasks such as monitoring, analysis, and prediction of system issues.

The predictive capabilities of AI and ML can predict problems before they impact the deployment pipeline, allowing teams to proactively address issues, thereby improving the reliability and stability of software releases. This integration also enables more personalized user experiences by leveraging data analytics.

As organizations increasingly recognize the benefits of AI and ML in improving DevOps processes, the adoption of these technologies is expected to surge, thus driving innovation and growth within the DevOps market. This factor not only creates new opportunities for software development and IT operations but also encourages the development of new tools and platforms that harness the power of AI and ML to streamline DevOps practices. This factor is expected to drive the DevOps Market growth along with creating new opportunities in the market.

Latest Trends

Growing Emphasis on DevSecOps Integration

The integration of security practices into the DevOps pipeline, known as DevSecOps, is a trend gaining momentum in the market. With the increasing prevalence of cyber threats, organizations recognize the importance of incorporating security measures early in the software development lifecycle. DevSecOps promotes the idea that security is a shared responsibility, to be integrated and automated within the DevOps process, rather than being addressed in isolation.

This trend reflects a shift, wherein security considerations become an integral part of the continuous integration and continuous delivery (CI/CD) pipeline. The growing emphasis on DevSecOps is compelling organizations to adopt tools and practices that facilitate this integration, driving the development of new solutions that can seamlessly incorporate security into the DevOps workflow. As businesses continue to prioritize cybersecurity, the DevSecOps trend is expected to shape the evolution of the DevOps Market, emphasizing the need for solutions that can deliver both speed and security.

Key Market Segments

Component

- Solution

- Services

Deployment Mode

- Cloud

- On-Premise

Enterprise Size

- Large Enterprises

- SME’s

End-User

- IT & Telecom

- BFSI

- Retail

- Manufacturing

- Healthcare

- Other End-Users

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis:

The Global DevOps Market is sensitive to geopolitical dynamics, which can influence both the supply chain and the operational framework of organizations worldwide. Geopolitical tensions and trade policies can affect the availability and cost of cloud services and DevOps tools, which are often hosted or developed across different jurisdictions.

For instance, data sovereignty laws and cross-border data transfer restrictions can complicate cloud deployments and collaboration across teams in multinational corporations. Despite these challenges, geopolitical shifts also offer opportunities for innovation in DevOps practices, as organizations seek to navigate these complexities through more resilient and adaptable operational strategies, potentially accelerating the adoption of DevOps methodologies as a means to ensure business continuity.

Recession Impact Analysis:

Economic downturns or recessions present both challenges and opportunities for the Global DevOps Market. During recessions, organizations strive to optimize operational efficiencies and reduce costs, which can increase the appeal of DevOps methodologies known for streamlining software development and operations processes. The focus on automation, continuous integration, and continuous delivery inherent in DevOps practices can help businesses maintain agility and responsiveness to market changes.

However, recessions can also lead to reduced IT spending, potentially slowing down new investments in DevOps tools and technologies. Nevertheless, the need for efficiency and cost savings during economic downturns often results in an increased adoption of DevOps principles, as organizations seek to leverage the cost savings and efficiency gains these practices offer to navigate challenging economic conditions.

Regional Analysis

North American region dominated the Global DevOps Market with a greater revenue share of 38.5% in 2023. The demand for Development and Operations (DevOps) in North America was valued at US$ 4.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

The dominance of the North America in the market can be attributed to several key factors. Firstly, the presence of a robust technological infrastructure, along with high levels of digital transformation across industries, which facilitates the widespread adoption of DevOps practices.

North America, particularly the United States, has a significant concentration of leading technology companies and startups that are pioneers in implementing and advancing DevOps methodologies. This factor not only contributed to the region’s leadership in the market but also to the advancement of DevOps tools and practices.

Moreover, the region’s corporate culture which focuses agility, innovation, and efficiency, closely aligns with the core principles of DevOps. Additionally, the strong focus on research and development, supported by substantial investments in IT and technology innovation, further solidifies North America’s leading position in the Global DevOps Market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The competitive landscape of the Global DevOps Market is characterized by a mix of established technology companies and innovative startups vying for market share. Major players, such as IBM, Amazon Web Services (AWS), Microsoft, and Google, dominate through comprehensive DevOps solutions that integrate seamlessly with their existing cloud infrastructure and services.

On the other hand, specialized firms offer targeted DevOps tools and services, focusing on niche aspects like automation, continuous integration, and configuration management. This diversification of offerings promotes a competitive market environment for innovation.

The ongoing evolution of DevOps practices, driven by the demand for faster software delivery cycles and enhanced operational efficiency, fosters a market landscape where strategic partnerships and acquisitions are common, enabling companies to broaden their solution portfolios and strengthen their market positions.

Top Market Leaders

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Oracle Corporation

- Broadcom Inc.

- Atlassian Corporation

- Dell Inc.

- Perforce Software, Inc.

- GitLab Inc.

- Docker, Inc.

- Splunk Inc.

- Other Key Players

Recent Development

- In September 2023 – Dell Inc. acquired Moogsoft a company providing intelligent monitoring solutions which support ITOps and DevOps.

- In August 2023 – GitLab Inc. partnered with Google LLC to integrate GitLab’s DevSecOps workflow with Google Cloud.

Report Scope

Report Features Description Market Value (2023) US$ 11.5 Bn Forecast Revenue (2032) US$ 66.0 Bn CAGR (2023-2032) 19.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component- Solution and Services; By Deployment Mode- Cloud and On-Premise; By Enterprise Size- Large Enterprises and SME’s; By End-User- IT & Telecom, BFSI, Retail, Manufacturing, Healthcare, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Oracle Corporation, Broadcom Inc., Atlassian Corporation, Dell Inc., Perforce Software Inc., GitLab Inc., Docker Inc., Splunk Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the DevOps Market?The DevOps Market refers to the industry segment focused on the adoption, implementation, and utilization of DevOps practices, tools, and methodologies within organizations to streamline software development, deployment, and operations processes.

How big is Development and Operations (DevOps) Market?The Global Development and Operations (DevOps) Market size is expected to be worth around USD 66.0 Billion by 2033, from USD 11.5 Billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

Who are the key players in DevOps Market?IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Oracle Corporation, Broadcom Inc., Atlassian Corporation, Dell Inc., Perforce Software Inc., GitLab Inc., Docker Inc., Splunk Inc., Other Key Players are the major companies operating in the DevOps Market.

Which is the fastest growing region in DevOps Market?North American region dominated the Global DevOps Market with a greater revenue share of 38.5% in 2023.

Which component analysis segment accounted for the largest DevOps market share?The Solution segment dominated the market by holding a major revenue share of 67.0% in 2023.

-

-

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Oracle Corporation

- Broadcom Inc.

- Atlassian Corporation

- Dell Inc.

- Perforce Software, Inc.

- GitLab Inc.

- Docker, Inc.

- Splunk Inc.

- Other Key Players