Global Centralized Heating Systems Market Size, Share, And Industry Analysis Report By Product Type (Conventional Boilers, System Boilers, Condensing Boilers, Combination Boilers), By Source (Gas Heating, Oil Heating, Electric Heating, Renewable Heating, Environmental Heating, Infrared Heating), By End-Use (Residential, Commercial Offices, Manufacturing Plants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176300

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

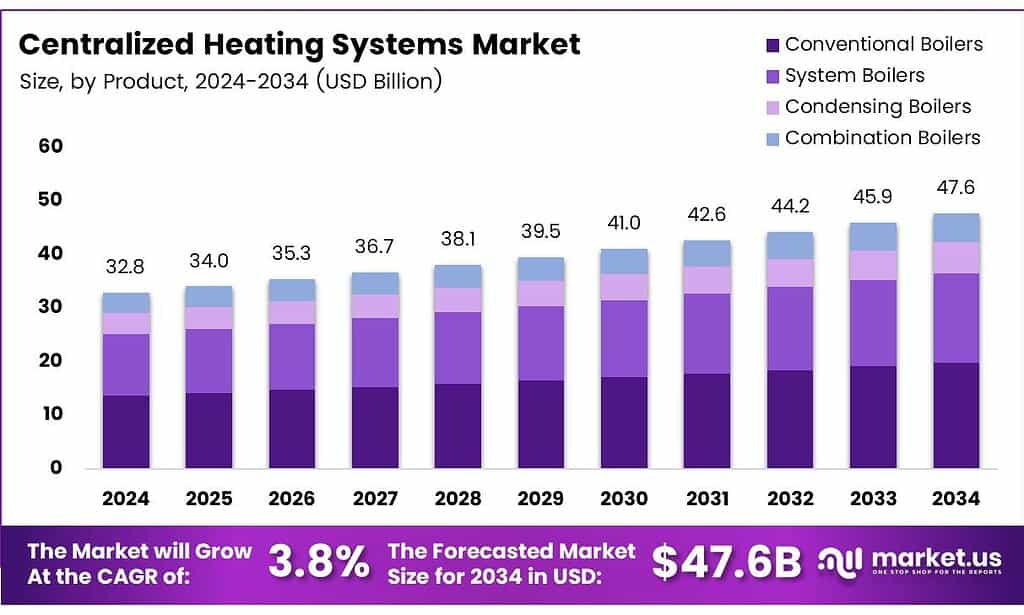

The Global Centralized Heating Systems Market size is expected to be worth around USD 47.6 billion by 2034, from USD 32.8 billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Centralized Heating Systems Market represents a coordinated approach to heating where heat is generated in a central source and distributed across residential, commercial, or industrial buildings. It improves energy efficiency, reduces operating costs, and supports urban sustainability goals, especially as cities focus on decarbonizing heating infrastructure and upgrading legacy thermal networks.

The market continues to grow as governments invest in cleaner heating technologies, expand district heating grids, and promote low-temperature systems for improved efficiency. Rising consumer interest in cost-effective heating and the push toward energy-efficient buildings further reinforce adoption, especially across colder regions seeking long-term operational savings.

- Central heating radiators in 800mm format offer multiple height options of 300, 400, 500, and 600 mm, with lengths between 400–3000 mm, and panel configurations including 11K, 22K, and 33K, supporting both indirect and closed heating systems using convection-based air heating. These product attributes indicate strong design flexibility within centralized heating applications.

The average annual system efficiency for converting solar radiation into useful hot water ranges between 30% and 40%, with coverage potential up to 80% even in challenging climates. Likewise, according to condensing furnace engineering principles, cooling exhaust gases below 140°F enables vapor condensation, unlocking higher furnace efficiency and reinforcing the market’s shift toward advanced heat-recovery technologies.

Centralized heating technology benefits from modernization trends, including hybrid systems, heat pumps, solar-assisted heating, and smart energy management. These innovations expand opportunities for utilities and infrastructure developers, particularly in markets shifting from outdated boilers to environmentally compliant heating networks aligned with new efficiency regulations and emissions standards.

Key Takeaways

- The Global Centralized Heating Systems Market is projected to reach USD 47.6 billion by 2034, growing from USD 32.8 billion in 2024 at a 3.8% CAGR.

- Conventional Boilers dominate the product type segment with a 34.7% market share in 2025.

- Gas Heating leads the source segment with a strong 49.1% share.

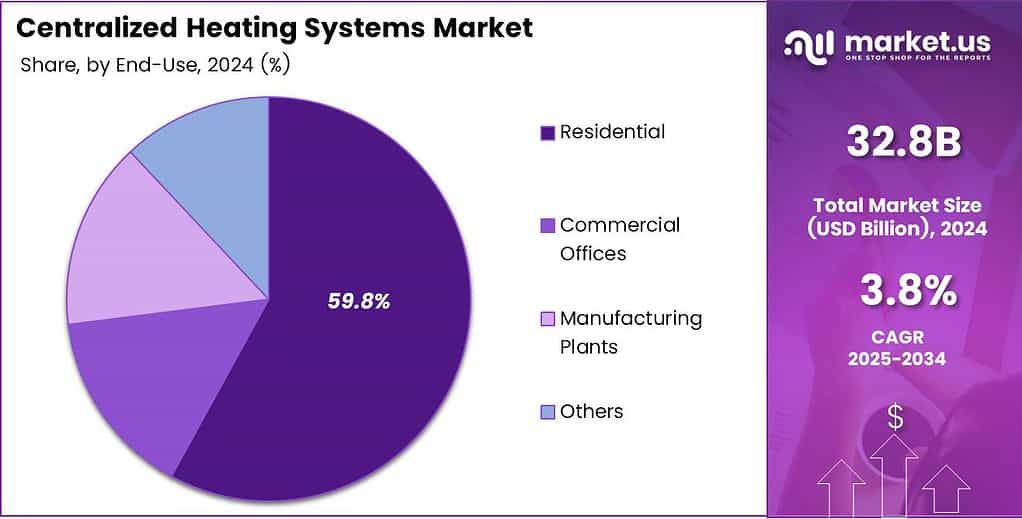

- The Residential end-use segment accounts for the highest contribution at 59.8%.

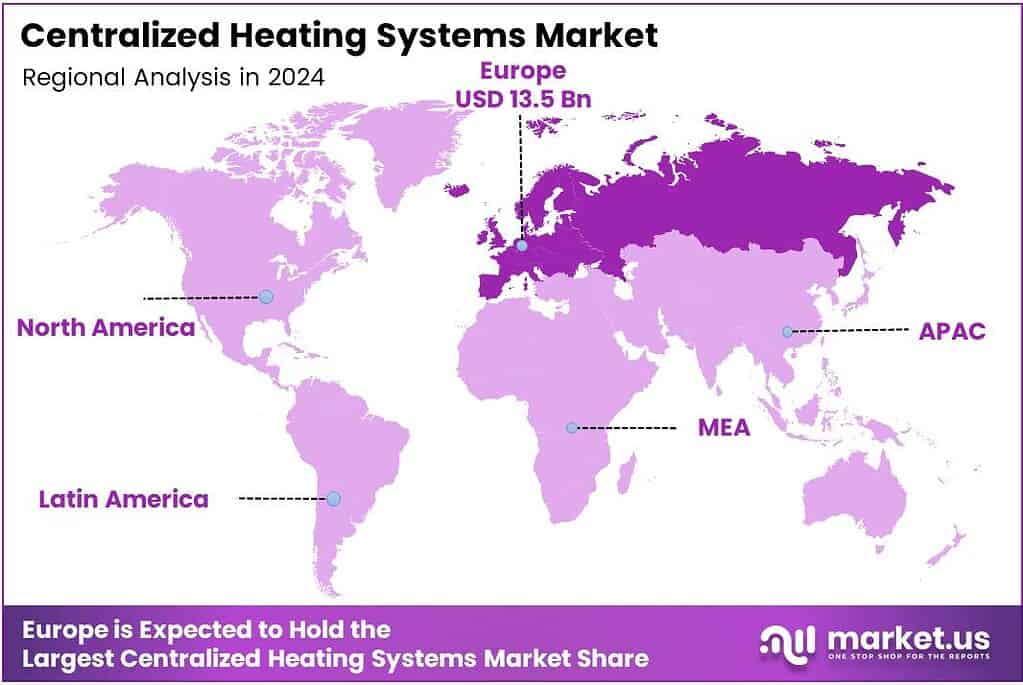

- Europe remains the leading regional market with a 41.4% share valued at USD 13.5 billion.

By Product Type Analysis

Conventional Boilers dominate with 34.7% due to established use and compatibility with legacy heating networks.

In 2025, Conventional Boilers held a dominant market position in the ‘By Product Type’ Analysis segment of the Centralized Heating Systems Market, with a 34.7% share. Their strong presence continues as consumers favor familiar technologies, easy installation, and stable performance across varied building structures, supporting both cost efficiency and system longevity.

System Boilers follow gradually, benefiting from integrated components that reduce on-site installation time. These boilers serve medium to large homes effectively and offer better hot-water delivery compared to traditional systems. Their low-maintenance design, combined with improved operational reliability, supports steady adoption across regions, upgrading mid-sized residential heating frameworks.

Condensing Boilers gain traction as energy-efficient systems that maximize heat recovery. These units appeal to end-users seeking reduced emissions and lower fuel consumption. Their superior thermal efficiency, driven by modern heat exchangers, encourages wider deployment, especially in areas implementing stricter emission rules and incentivizing high-efficiency heating technologies.

Combination Boilers continue expanding as compact, all-in-one solutions suitable for small homes and apartments. They eliminate the need for separate water tanks, offering on-demand heating with space savings. This convenience supports rapid urban adoption where real estate constraints make traditional multi-unit heating setups less feasible for households.

By Source Analysis

Gas Heating dominates with 49.1% due to cost efficiency and strong infrastructure support.

In 2025, Gas Heating held a dominant market position in the ‘By Source’ Analysis segment of the Centralized Heating Systems Market, with a 49.1% share. Its widespread utility connections, lower fuel prices, and consistent output make it the preferred source across dense urban regions relying on established heating grids.

Oil Heating remains relevant in regions lacking gas pipelines. It supports legacy heating setups and offers high heating intensity. While gradually declining, oil-based systems persist in colder rural locations. Adoption is stable where fuel storage is feasible, and users prioritize reliability over modern alternatives.

Electric Heating gradually rises with advancements in high-efficiency electric boilers and heat pumps. Electrification initiatives in urban areas encourage users to shift away from fossil systems. Lower maintenance needs and compatibility with renewable-powered grids support this segment’s growing presence in sustainable heating transitions.

Renewable Heating grows steadily as governments promote biomass, biogas, and solar-assisted heating. This shift reflects consumer interest in carbon-neutral solutions. Improved technology integration and incentives accelerate adoption among eco-conscious residential and commercial users seeking long-term savings and reduced emissions.

Environmental Heating expands through the use of geothermal and ambient air sources. These low-emission systems deliver consistent performance across seasons. Their appeal strengthens as heat pump technology matures, offering operational efficiency and reduced lifetime energy costs in modern district heating setups.

By End-Use Analysis

The residential segment dominates with 59.8%, driven by widespread household adoption and consistent heating needs.

In 2025, Residential held a dominant market position in the ‘By End-Use’ Analysis segment of the Centralized Heating Systems Market, with a 59.8% share. Rising urbanization, multi-dwelling housing projects, and stable annual heating demand strongly support this segment, ensuring dependable market contribution across both developed and emerging regions.

Commercial Offices adopt centralized heating steadily as companies prioritize employee comfort and energy-managed workspaces. Upgraded building codes and green-building certifications encourage the installation of efficient heating systems. Modern office complexes prefer centralized solutions for enhanced operational savings and uniform climate control across large indoor environments.

Manufacturing Plants utilize centralized heating for process stability, indoor climate management, and equipment protection. Facilities requiring consistent temperatures benefit from integrated systems capable of delivering reliable, high-capacity heat. Adoption continues where operational efficiency and worker safety align with controlled industrial heating conditions.

Others include institutional buildings, educational facilities, hospitals, and public infrastructure. These spaces rely heavily on consistent and cost-effective heating. Seasonal demand, combined with government investments in public infrastructure, sustains the need for centralized heating frameworks tailored to high-occupancy environments with round-the-clock thermal requirements.

Key Market Segments

By Source

- Gas Heating

- Oil Heating

- Electric Heating

- Renewable Heating

- Environmental Heating

- Infrared Heating

- Others

By End-Use

- Residential

- Commercial Offices

- Manufacturing Plants

- Others

Emerging Trends

Growing Shift Toward Low-Carbon and Smart Heating Technologies Shapes Market Trends

One of the most notable trends in the centralized heating systems market is the rapid shift toward low-carbon heating solutions. Countries committed to carbon-neutral goals are adopting cleaner heat sources like geothermal, biomass, and heat pumps integrated into district networks. This trend is strongly supported by government incentives and climate policies.

- Another key trend is the rise of digitalization in heating systems. Smart meters, automated controls, and real-time monitoring tools improve system efficiency and reduce heat loss. A practical signal of momentum is coming from Denmark. More than 615 MW of electrified district-heating solutions were installed, described as a record year for these installations.

Hybrid heating systems are also gaining popularity. These systems combine multiple heat sources—renewables, waste heat, and conventional boilers—to maintain reliability while reducing emissions. Cities with older heating infrastructure are adopting hybrid models to transition gradually toward fully renewable heating.

Drivers

Growing Need for Efficient Urban Heating Solutions Drives Market Growth

The centralized heating systems market is gaining strong momentum as more cities look for reliable and energy-efficient heating solutions. Urban areas continue expanding, and residential and commercial buildings need stable heating, which encourages governments to promote district-level heating networks. This shift helps reduce power wastage and ensures a consistent heat supply across multiple buildings.

- The rising cost of electricity and fuel is pushing consumers and industries to adopt centralized heating. These systems use energy more efficiently, lowering overall heating expenses. EU gross production of derived heat was 568 TWh (down 3.7% year over year), and the largest share came from renewables at 34.4%, followed by natural gas at 32.5% and solid fossil fuels at 17.4%.

Environmental awareness is another key driver as centralized heating systems support cleaner technologies such as biomass, geothermal, and waste-heat recovery. Governments encourage these solutions through subsidies and policy support to reduce carbon emissions. As climate regulations become stricter, more regions invest in modern heat networks.

Restraints

High Installation and Infrastructure Costs Restrict Market Expansion

The centralized heating systems market faces restraints mainly due to the high cost of installation. Developing an entire network of pipelines, heat production units, and distribution systems requires major upfront investment. Many small cities and developing regions cannot afford these expenses, limiting market penetration in cost-sensitive areas.

- A long construction time is required to set up district heating networks. These projects often take years to complete, making it difficult for regions with fast-changing infrastructure needs. The European Commission approved a Spanish state-aid scheme worth €3.1 billion to support electricity generation from highly efficient CHP plants, covering new or substantially refurbished projects under the EU’s energy-efficiency rules.

Competition from decentralized heating solutions—such as electric heaters and heat pumps—also acts as a restraint. Many consumers prefer these cheaper, individually controlled systems. In warmer climates, centralized heating demand remains low, reducing its commercial viability. These factors together limit overall market growth, especially in developing countries and regions with mild winters.

Growth Factors

Rising Adoption of Renewable Energy-Based Heat Networks Creates Strong Market Opportunities

The shift toward renewable heating presents major growth opportunities for the centralized heating systems market. Countries are increasingly investing in biomass, geothermal, and solar-thermal systems to reduce carbon emissions. Centralized heating networks can integrate these renewable sources easily, making them a preferred choice for sustainable urban planning.

There is also growing demand for waste-heat utilization from industrial plants, data centers, and power stations. Instead of releasing excess heat into the environment, this energy can be captured and distributed through district heating systems. This approach lowers operational costs and supports circular energy models.

Upgrading old infrastructure in developed regions is another significant opportunity. Many European cities are replacing decades-old heating networks with modern, digitalized, and more efficient systems. Governments are offering funding to speed up modernization and reduce heat loss.

Regional Analysis

Europe Dominates the Centralized Heating Systems Market with a Market Share of 41.4%, Valued at USD 13.5 Billion

Europe leads the global Centralized Heating Systems Market due to its long-established district heating networks, strong regulatory support, and strict energy-efficiency policies. The region’s mature infrastructure and focus on low-carbon heating solutions strengthen its dominance. With a significant 41.4% share valued at USD 13.5 billion, Europe continues investing in modernization and renewable-integrated heating grids to reduce emissions and improve urban energy efficiency.

North America shows steady growth, driven by the rising adoption of energy-efficient heating technologies across residential and commercial sectors. The region benefits from the modernization of aging heating networks, along with government incentives promoting sustainable heating solutions. Increasing awareness of carbon-reduction goals further accelerates system upgrades across the U.S. and Canada.

Asia Pacific is one of the fastest-growing regions, supported by rapid urbanization and the expansion of district heating infrastructure, especially in emerging economies. Governments in the region are encouraging clean-energy heating systems to curb pollution and improve building efficiency. Rising investments in smart and centralized heating technologies are expected to boost long-term market growth.

The Middle East & Africa region is experiencing a gradual adoption of centralized heating systems, primarily in colder high-altitude areas and expanding commercial districts. Growth is supported by infrastructure development and an increasing focus on energy-efficient building solutions. While still emerging, MEA markets are expected to gain momentum as sustainable construction gains wider acceptance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, Siemens AG will remain central to large district-heating upgrades because it connects heat plants, substations, and networks with digital control. Utilities lean on their automation and grid-integration know-how to improve reliability, cut losses, and run mixed heat sources more smoothly across city systems.

Bosch Thermotechnology will benefit from steady demand for modern boiler rooms and hybrid heating solutions used in multi-family and light commercial buildings. The company’s strength is in packaged equipment, service reach, and efficiency-focused replacements that help operators meet tighter energy rules without rebuilding entire systems.

Danfoss A/S – Denmark remains a practical “behind-the-scenes” winner in centralized heating because valves, pumps, controls, and heat exchangers directly affect network performance. District heating operators focus on better balancing, lower return temperatures, and smarter substations—areas where Danfoss components and controls typically play a key role.

ENGIE SA continues to shape the market on the ownership-and-operations side, expanding and optimizing district heating networks where long-term concessions are available. Its growth story is tied to decarbonizing heat with waste heat, biomass, geothermal, and large heat pumps, while improving customer service and network efficiency.

Top Key Players in the Market

- Siemens AG

- Bosch Thermotechnology

- Danfoss A/S – Denmark

- ENGIE SA

- Veolia Environnement S.A.

- Fortum Oyj

- Vattenfall AB

- GEA Group AG

- Honeywell International

- Carrier Global Corporation

Recent Developments

- In 2025, Siemens AG will be actively involved in advancing district heating technologies, which include calculations for emissions from district heating across sites. The company contributed to sustainability stories featuring planned connections to district heating for additional CO2 savings at facilities like Siemens Real Estate in Munich.

- In 2025, Bosch Thermotechnology continues to focus on heat networks and district heating solutions, with recent advancements in large-scale systems. In recent news, the company supplied boilers up to 30 MW for future-proof heat supply to Norway’s third-largest district heating provider. District heating in CO2 calculations and amortization periods for energy supply.

Report Scope

Report Features Description Market Value (2024) USD 32.8 Billion Forecast Revenue (2034) USD 47.6 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Conventional Boilers, System Boilers, Condensing Boilers, Combination Boilers), By Source (Gas Heating, Oil Heating, Electric Heating, Renewable Heating, Environmental Heating, Infrared Heating, Others), By End-Use (Residential, Commercial Offices, Manufacturing Plants, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Siemens AG, Bosch Thermotechnology, Danfoss A/S – Denmark, ENGIE SA, Veolia Environnement S.A., Fortum Oyj, Vattenfall AB, GEA Group AG, Honeywell International, Carrier Global Corporation Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Centralized Heating Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Centralized Heating Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Bosch Thermotechnology

- Danfoss A/S – Denmark

- ENGIE SA

- Veolia Environnement S.A.

- Fortum Oyj

- Vattenfall AB

- GEA Group AG

- Honeywell International

- Carrier Global Corporation