Global CBRN Defense Market Size, Share, Statistics Analysis Report By Type (Chemical, Biological, Radiological, Nuclear, Explosive), By Equipment (Protective Wearables, Respiratory Systems, Detection & Monitoring Systems, Decontamination Systems, Simulators, Information Management Software), By End-User (Defense & Government, Civil & Commercial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142469

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

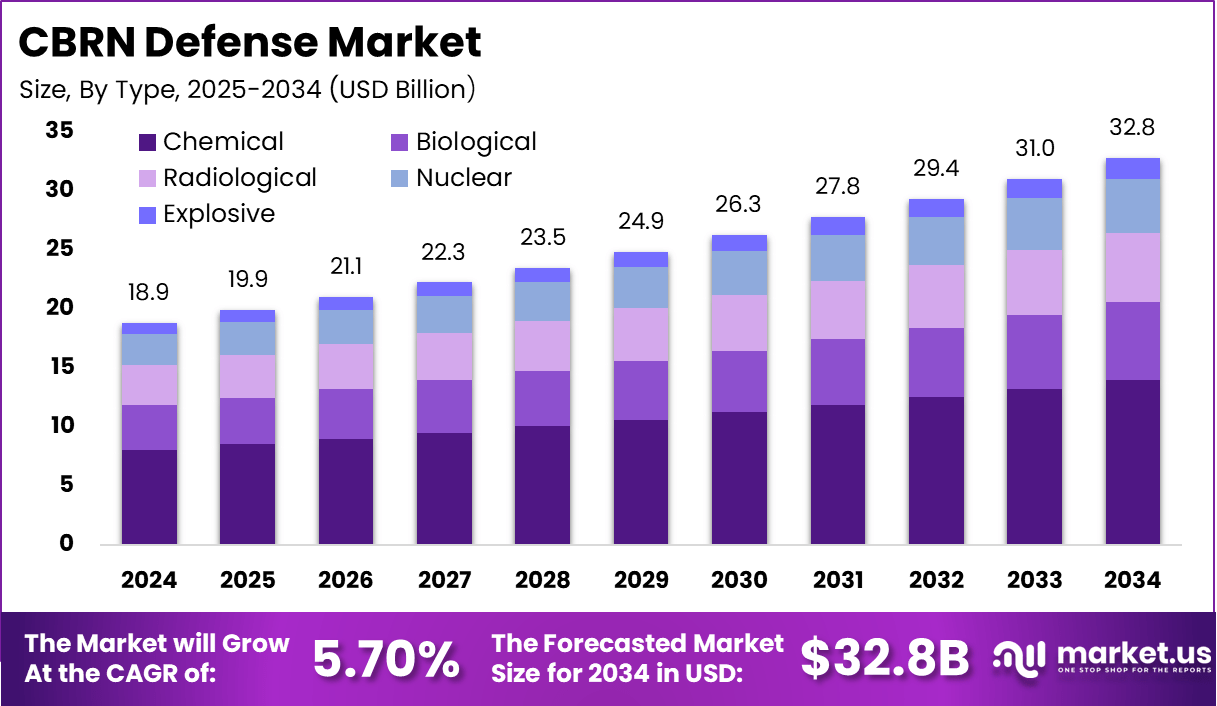

The Global CBRN Defense Market is expected to be worth around USD 32.8 Billion by 2034, up from USD 18.85 Billion in 2024. It is expected to grow at a CAGR of 5.70% from 2025 to 2034.

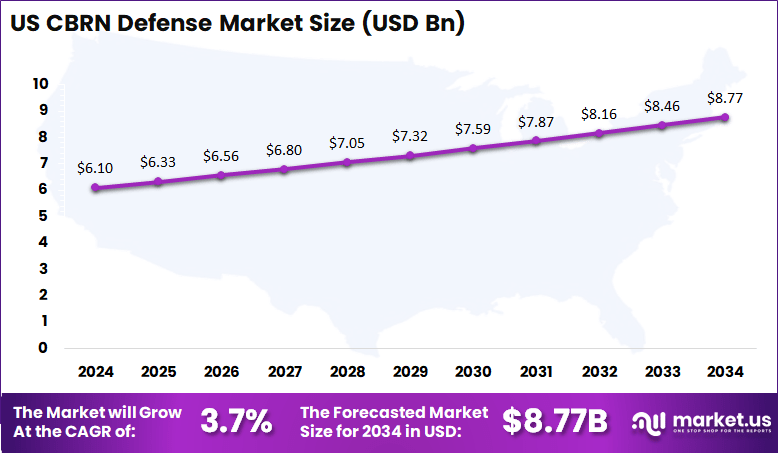

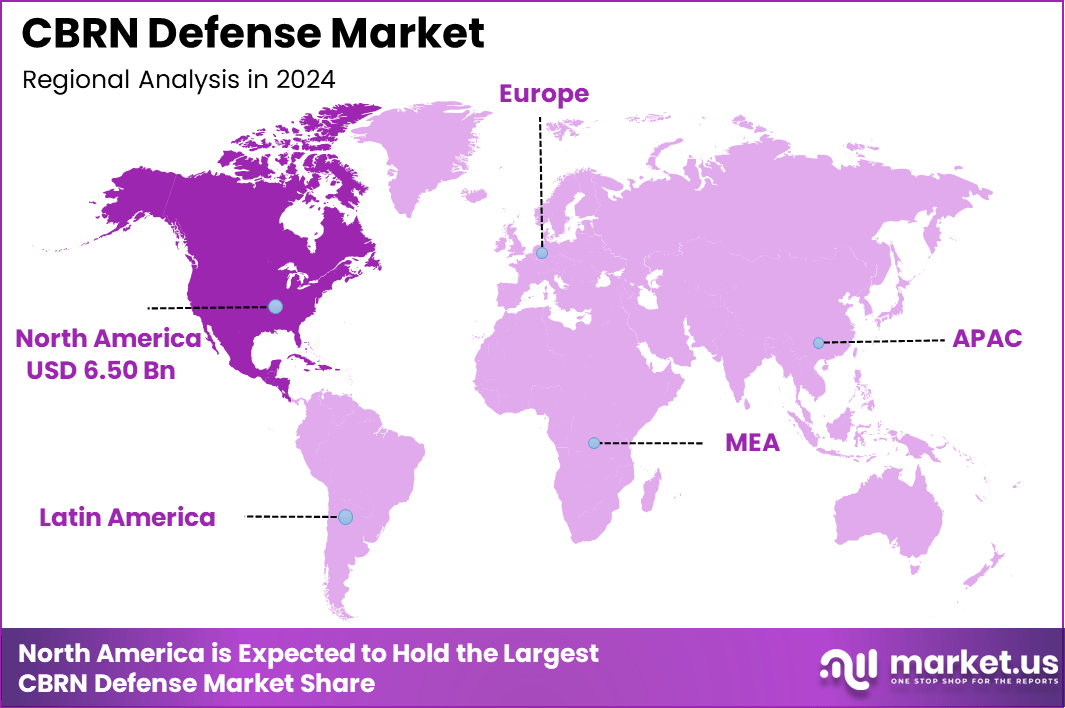

In 2024, North America held a dominant market position, capturing over a 34.5% share and earning USD 6.50 Billion in revenue. Further, the United States dominates the market by USD 6.1 Billion, steadily holding a strong position with a CAGR of 3.7%.

The Chemical, Biological, Radiological, and Nuclear (CBRN) defense market is dedicated to developing and supplying equipment and strategies to protect against CBRN threats. This sector encompasses protective wearables, detection and monitoring systems, decontamination units, and training simulators, all aimed at safeguarding military personnel, emergency responders, and civilians from hazardous agents.

Several factors are propelling the growth of the CBRN defense market. Increasing geopolitical tensions and the persistent threat of terrorism have heightened the need for advanced defense mechanisms. Governments worldwide are investing in CBRN defense systems to ensure national security and public safety.

Additionally, international regulations and agreements, such as the “National Strategy for Chemical, Biological, Radiological, Nuclear, and Explosives (CBRN) Standards” by the US Department of Homeland Security, promote collaboration to enhance research and development in this field.

Key Takeaways

- Market Growth: The CBRN defense market is projected to grow from USD 18.85 billion in 2024 to USD 32.8 billion by 2034, at a CAGR of 5.70%.

- Segment Dominance by Type: The chemical defense segment holds the largest share, accounting for 42.7% of the market.

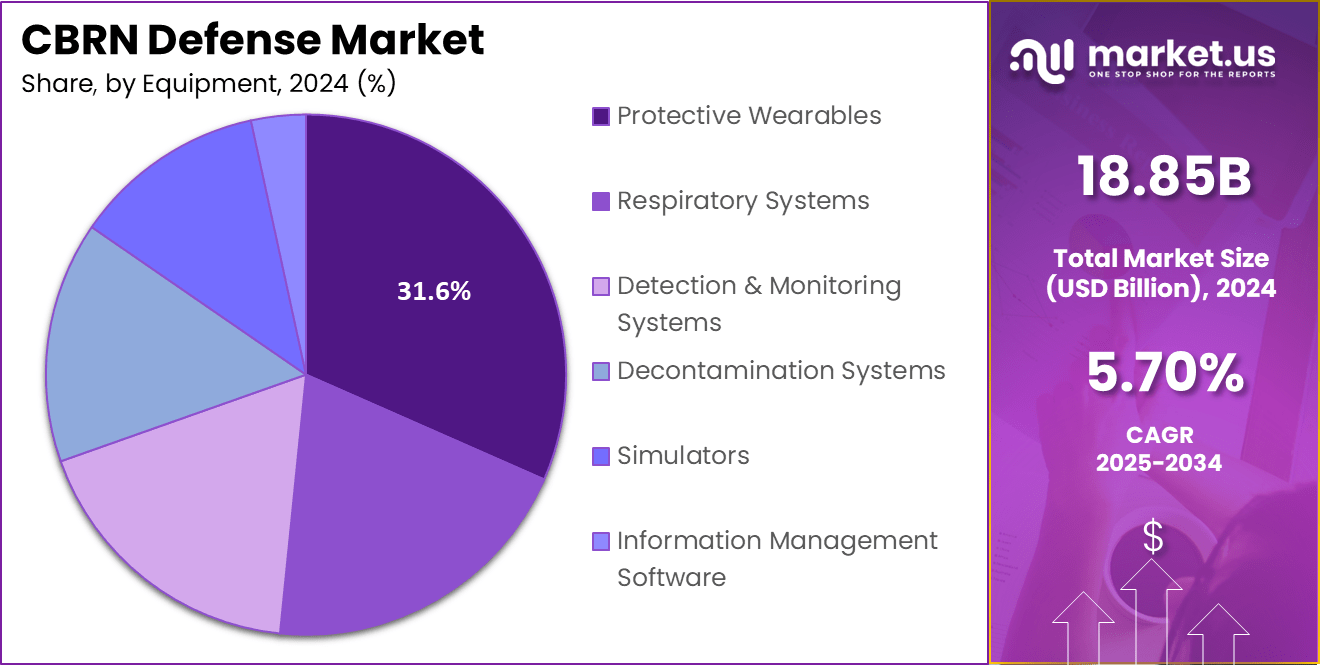

- Leading Equipment Segment: Protective wearables dominate the market with a 31.6% share, highlighting the demand for safety gear.

- End-User Demand: The defense & government sector remains the primary consumer, representing 61.0% of the total market demand.

- Regional Insights: North America leads the market with a 34.5% share. The US market is valued at USD 6.1 billion in 2024, with a CAGR of 3.7%.

Analyst’s Review

The demand for CBRN defense solutions is on the rise, driven by the need to protect against potential CBRN incidents. This includes equipping military forces and first responders with the necessary tools and training to handle such threats effectively. The increasing frequency of natural disasters and industrial accidents also underscores the importance of robust CBRN defense mechanisms.

Opportunities within the CBRN defense market are expanding, particularly with the integration of advanced technologies. The development of unmanned systems, such as drones equipped with CBRN detection sensors, offers the potential for safer and more efficient threat assessment and response. Collaborations between defense contractors, research institutions, and government agencies are fostering innovation, leading to more effective CBRN defense solutions.

Technological advancements are significantly enhancing CBRN defense capabilities. The incorporation of artificial intelligence and machine learning into detection systems allows for rapid analysis and identification of threats.

Portable and mobile detection units enable swift deployment in various environments, improving response times. Moreover, the development of advanced protective materials has led to more comfortable and effective protective wearables, ensuring better compliance and safety for users.

Key Statistics

Usage and Users

- Military: Over 1 million personnel worldwide involved in CBRN defense.

- Law enforcement: Thousands of units globally equipped with CBRN gear.

- Emergency response units: Over 100,000 responders in the U.S. alone.

- Governmental agencies: Hundreds of agencies worldwide involved in CBRN defense.

- Commercial enterprises: Thousands of companies providing CBRN services.

- Healthcare sectors: Millions of healthcare workers globally who may require CBRN training.

Applications

- Protection: Over 500,000 protective suits distributed annually.

- Detection: More than 10,000 detection systems sold worldwide each year.

- Decontamination: Hundreds of decontamination units deployed globally.

- Simulation & training: Over 50,000 personnel trained annually in CBRN simulations.

Quantity

- Protective Suits: Over 1 million suits distributed annually worldwide.

- Detection Systems: More than 5,000 systems sold globally each year.

- Decontamination Units: Approximately 500 units deployed annually.

Regional Analysis

United States Market Size

In North America, the United States dominates the market size by USD 6.1 billion, holding a strong position steadily with a CAGR of 3.7%. The region’s leadership in the CBRN defense market is driven by significant government investments, ongoing military modernization programs, and a heightened focus on national security.

The increasing risk of chemical, biological, radiological, and nuclear threats has led to rising demand for advanced protective equipment, detection systems, and decontamination solutions. The defense and government sectors remain the largest consumers, as they prioritize preparedness and response mechanisms. Technological advancements, including AI-powered detection and rapid-response systems, continue to enhance efficiency and effectiveness in handling CBRN incidents.

Protective wearables are one of the most demanded equipment categories, ensuring safety for military personnel, first responders, and healthcare professionals dealing with hazardous environments. The market also benefits from regulatory support and government-led initiatives aimed at strengthening defense infrastructure.

With ongoing research and development in autonomous detection systems, portable monitoring units, and next-generation protective materials, the CBRN defense industry is poised for steady expansion. As threats evolve, the focus on preparedness, innovation, and strategic partnerships will continue to drive market growth in North America and beyond.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 34.5% share, generating approximately USD 6.50 billion in revenue. The region’s leadership in the CBRN defense market can be attributed to several factors, including the advanced technological capabilities of defense systems, robust government investments, and a growing emphasis on national security in response to increasing global threats.

The United States, in particular, plays a pivotal role in shaping market trends due to its substantial defense budget, active military presence, and commitment to maintaining cutting-edge CBRN defense technologies. Furthermore, North America’s favorable regulatory environment and strong partnerships between government agencies and defense contractors continue to support the market’s growth.

Europe follows closely in the CBRN defense market, with countries like the United Kingdom, France, and Germany prioritizing the development of advanced protective wearables and detection systems. As concerns over terrorism and political instability persist, European nations are investing in comprehensive CBRN defense strategies, focusing on both military and civilian applications. The growing emphasis on protecting critical infrastructure and first responders is expected to contribute to continued market expansion in the region.

In the Asia-Pacific (APAC) region, rising security concerns, rapid industrialization, and increased defense spending are propelling the market forward. Countries such as China, India, and Japan are focusing on modernizing their defense capabilities to counter evolving threats. Additionally, the region’s large population and vulnerability to natural disasters make CBRN defense a critical component in emergency preparedness.

Latin America and the Middle East & Africa (MEA) regions are expected to witness moderate growth. In Latin America, countries like Brazil and Mexico are beginning to invest more in CBRN defense technologies, driven by both military and disaster response needs. The Middle East and Africa, while facing ongoing political instability and conflict, are increasingly aware of the necessity of having advanced defense systems in place, leading to steady growth in the market. However, limited budgets and infrastructure challenges may hinder faster adoption in these regions.

By Type

In 2024, the Chemical segment held a dominant market position, capturing more than a 42.7% share of the CBRN defense market. This dominance can be attributed to the growing threat of chemical warfare and industrial accidents, which have heightened global concerns. Chemical agents are among the most accessible and potent weapons, often used in asymmetric warfare and terrorism, leading to an increased need for advanced defense solutions.

As a result, governments and military forces around the world are prioritizing the development and deployment of chemical detection, protection, and decontamination systems. Furthermore, the wide range of chemical agents—such as nerve agents, blister agents, and choking agents—requires sophisticated, versatile defense technologies.

The Chemical segment’s continued market leadership is also driven by the increasing investment in protective wearables, monitoring systems, and decontamination kits specifically designed to counter chemical threats. As nations and defense organizations strengthen their preparedness against chemical attacks, the Chemical segment is expected to remain a key focus within the broader CBRN defense market.

By Equipment

In 2024, the Protective Wearables segment held a dominant market position, capturing more than a 31.6% share of the CBRN defense market. This segment’s leadership can be attributed to the increasing need for personal safety in environments exposed to chemical, biological, radiological, and nuclear hazards.

Protective wearables, such as suits, gloves, boots, and helmets, are essential for ensuring the safety and effectiveness of military personnel, emergency responders, and healthcare workers during hazardous situations.

The growing threat of CBRN attacks, along with the emphasis on preparedness and rapid response, has driven significant demand for advanced protective gear. These wearables are designed with cutting-edge materials that offer high levels of durability, comfort, and protection, enabling users to operate in extreme conditions for extended periods.

Additionally, innovations in lightweight, ergonomic designs and advanced materials have improved wearability and functionality, further increasing their adoption across various sectors. As the need for more comprehensive defense solutions grows, the Protective Wearables segment remains at the forefront of the CBRN defense market.

By End-User

In 2024, the Defense & Government segment held a dominant market position, capturing more than a 61.0% share of the CBRN defense market. This segment’s leadership is primarily due to the significant investments made by governments and military agencies worldwide to enhance national security and protect their forces from CBRN threats.

The defense sector is highly focused on improving readiness for various forms of warfare, including chemical, biological, radiological, and nuclear attacks, which makes CBRN defense a critical component of their defense strategy.

Governments are also prioritizing the protection of civilian populations in case of such attacks, further driving demand for advanced detection systems, protective gear, and decontamination technologies.

Additionally, the defense and government sector benefits from substantial budgets allocated to research, development, and procurement of state-of-the-art CBRN defense solutions, making it the leading end-user segment. As global tensions rise and the threat of CBRN attacks persists, the Defense & Government sector will continue to be the primary driver of market growth in this field.

Key Market Segments

By Type

- Chemical

- Biological

- Radiological

- Nuclear

- Explosive

By Equipment

- Protective Wearables

- Respiratory Systems

- Detection & Monitoring Systems

- Decontamination Systems

- Simulators

- Information Management Software

By End-User

- Defense & Government

- Civil & Commercial

Driving Factor

Increasing Geopolitical Tensions and Security Threats

The escalating geopolitical tensions and the growing threat of terrorism have significantly heightened the demand for Chemical, Biological, Radiological, and Nuclear (CBRN) defense solutions. Nations worldwide are investing heavily in advanced defense systems to safeguard their populations and critical infrastructure from potential CBRN attacks.

This trend is evident in the substantial defense budgets allocated for the procurement of CBRN detection, protection, and decontamination equipment. For instance, reports that North America’s market growth is primarily driven by high military budgets aimed at enhancing CBRN defense capabilities.

Similarly, highlights that increasing terrorism activities and international agreements to counteract weapons of mass destruction are contributing to the market’s expansion. These developments underscore the critical importance of robust CBRN defense mechanisms in today’s volatile global landscape.

Restraining Factor

High Development and Maintenance Costs

A significant challenge hindering the widespread adoption of advanced CBRN defense systems is their substantial development and maintenance costs. Developing state-of-the-art detection and protection equipment requires significant investment in research and development, leading to high initial costs.

Moreover, points out that the continuous maintenance and upgrading of these systems further strain financial resources. This financial burden is particularly challenging for smaller nations and organizations with limited defense budgets, potentially leading to disparities in global CBRN defense capabilities. Addressing this issue necessitates innovative solutions to reduce costs without compromising the effectiveness of defense systems.

Growth Opportunity

Technological Advancements and Integration

The rapid pace of technological innovation presents a significant growth opportunity for the CBRN defense market. Integrating advanced technologies such as artificial intelligence, unmanned systems, and biosensors into CBRN defense equipment can enhance threat detection, response times, and overall effectiveness.

For example, notes that the adoption of unmanned systems, including drones and uncrewed ground vehicles, is increasing in CBRN defense, allowing for safer and more efficient operations. Additionally, highlights that miniaturization of defense systems is a key trend, making equipment more portable and user-friendly. These technological advancements not only improve defense capabilities but also open new avenues for market growth and diversification.

Challenging Factor

Regulatory Compliance and Standardization

Navigating the complex web of international regulations and achieving standardization pose significant challenges in the CBRN defense sector. Different countries have varying standards and protocols for CBRN defense equipment, leading to compatibility issues and operational inefficiencies.

Ensuring that defense systems comply with diverse regulatory requirements necessitates extensive testing, certification processes, and ongoing adjustments, which can delay deployment and increase costs.

Moreover, mentions that stricter regulatory standards and the need for international security cooperation are driving market growth, but they also add layers of complexity for manufacturers and defense agencies. Harmonizing standards and streamlining regulatory processes are essential to mitigate these challenges and enhance global CBRN defense readiness.

Growth Factors

Rising Geopolitical Tensions and Terrorism Threats

The global CBRN defense market is experiencing significant growth, primarily driven by escalating geopolitical tensions and the increasing threat of terrorism. This growth is largely attributed to the rising concerns over the potential use of chemical, biological, radiological, and nuclear weapons by both state and non-state actors.

Governments worldwide are responding by enhancing their defense capabilities, leading to increased investments in advanced detection, protection, and decontamination systems. For instance, the civil and law enforcement segment is anticipated to grow at a CAGR, driven by heightened efforts to counteract terrorist activities involving hazardous materials.

Emerging Trends

Technological Innovations and Integration

The CBRN defense sector is witnessing several emerging trends, notably the integration of advanced technologies to enhance defense capabilities. A key development is the miniaturization of defense systems, making detection and protection equipment more portable and user-friendly. This trend allows for quicker and more efficient responses to CBRN threats, particularly in environments lacking extensive infrastructure.

Another significant trend is the convergence of CBRN defense systems with the Internet of Things (IoT). This integration enables real-time data sharing and coordinated responses to threats. For example, sensors embedded in public infrastructure can detect hazardous materials and immediately alert authorities, triggering automated safety measures. This interconnected approach enhances the efficiency and speed of CBRN defense operations.

Business Benefits

Enhanced Preparedness and Market Expansion

Investing in CBRN defense solutions offers substantial business benefits, including improved preparedness against potential threats and access to a growing market. This substantial investment underscores the importance placed on CBRN defense and presents opportunities for businesses to provide innovative solutions.

The increasing frequency of terrorism-related incidents involving hazardous materials has heightened the demand for advanced defense systems. This trend not only drives market growth but also encourages businesses to develop cutting-edge technologies to meet evolving threats. Collaboration between public and private entities further stimulates innovation, leading to the development of novel solutions that enhance public safety and security.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Thales Group, a prominent player in the CBRN defense market, has strategically expanded its capabilities through various collaborations and product developments. In Germany, Thales partnered with Rheinmetall to jointly develop, qualify, and produce 70mm guided and unguided rocket solutions for helicopters. This collaboration aims to enhance the defense capabilities of both companies within the German market.

Bruker Corporation continues to solidify its position in the CBRN defense sector by offering advanced detection and analysis instruments. The company has secured significant contracts, highlighting its expertise in providing reliable solutions for chemical, biological, radiological, and nuclear threats. These contracts underscore Bruker’s commitment to supporting defense and security operations with cutting-edge technology.

Rheinmetall AG has actively pursued strategic acquisitions and partnerships to bolster its defense offerings. In December 2024, Rheinmetall completed the acquisition of Loc Performance Products, LLC, a U.S.-based vehicle specialist. This acquisition strengthens Rheinmetall’s presence in the U.S. market and reinforces its commitment to supporting the U.S. Department of Defense and commercial customers.

Top Key Players in the Market

- Thales Group

- Bruker Corporation

- Rheinmetall AG

- Argon Electronics (UK) Ltd

- Avon Polymer Products Limited

- Battelle

- Leidos Inc.

- Teledyne FLIR LLC

- KNDS – KMW+NEXTER Defense Systems NV

- Karcher Futuretech GmbH

- Chemring Group PLC

- Smiths Group PLC

- QinetiQ Group

- Saab AB

- OSI Systems Inc.

- National Technology and Engineering Solutions of Sandia LLC

- Other Key Players

Recent Developments

- In 2024: Thales Group announced the successful deployment of its advanced CBRN detection systems in military operations across Europe, enhancing real-time threat response capabilities.

- In 2024: Rheinmetall AG unveiled its new mobile decontamination systems designed for rapid deployment in emergency response scenarios, strengthening its position in the CBRN defense sector.

Report Scope

Report Features Description Market Value (2024) USD 18.85 Billion Forecast Revenue (2034) USD 32.8 Billion CAGR (2025-2034) 5.70% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chemical, Biological, Radiological, Nuclear, Explosive), By Equipment (Protective Wearables, Respiratory Systems, Detection & Monitoring Systems, Decontamination Systems, Simulators, Information Management Software), By End-User (Defense & Government, Civil & Commercial) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Thales Group, Bruker Corporation, Rheinmetall AG, Argon Electronics (UK) Ltd, Avon Polymer Products Limited, Battelle, Leidos Inc., Teledyne FLIR LLC, KNDS – KMW+NEXTER Defense Systems NV, Karcher Futuretech GmbH, Chemring Group PLC, Smiths Group PLC, QinetiQ Group, Saab AB, OSI Systems Inc., National Technology and Engineering Solutions of Sandia LLC, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thales Group

- Bruker Corporation

- Rheinmetall AG

- Argon Electronics (UK) Ltd

- Avon Polymer Products Limited

- Battelle

- Leidos Inc.

- Teledyne FLIR LLC

- KNDS - KMW+NEXTER Defense Systems NV

- Karcher Futuretech GmbH

- Chemring Group PLC

- Smiths Group PLC

- QinetiQ Group

- Saab AB

- OSI Systems Inc.

- National Technology and Engineering Solutions of Sandia LLC

- Other Key Players