Catheter Related Bloodstream Infection Market By Drug Class (Cloxacillin, Echinocandin, Ceftazidime, Cefazoline, Daptomycin, and Others), By Route of Administration (Oral and Injectable), By Indication (Bacterial Infections, Fungal Infection, and Viral & Parasitic Infections), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133598

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

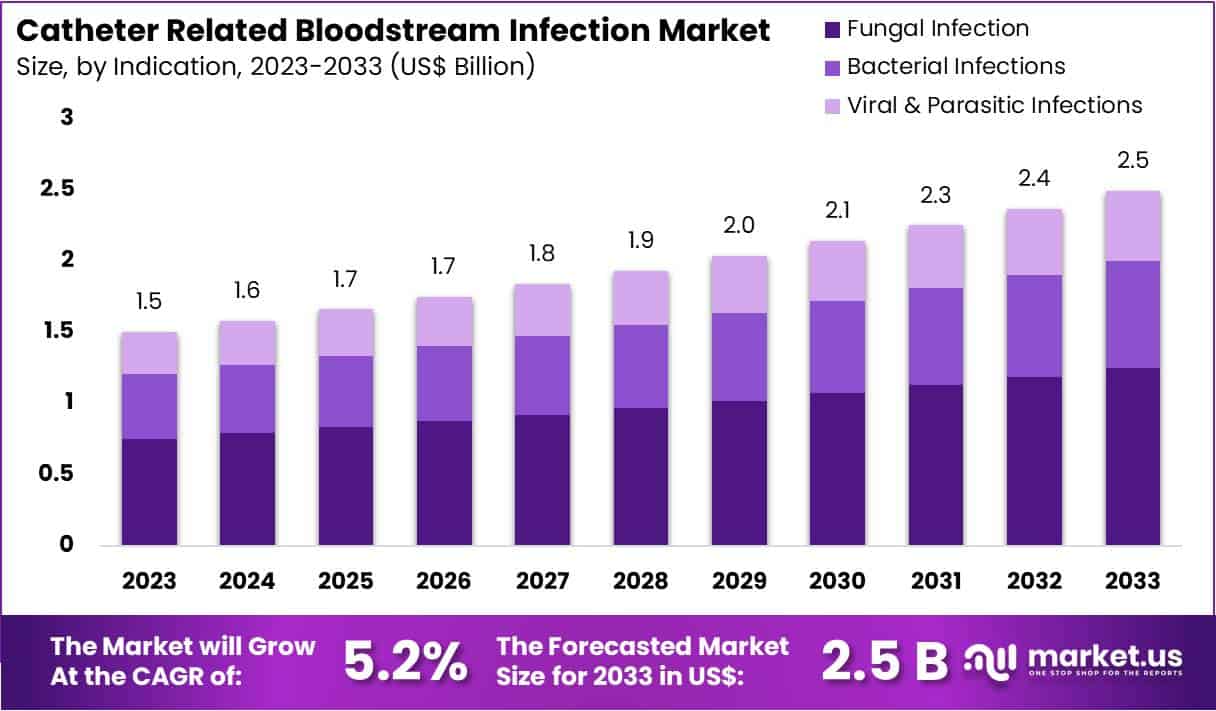

The Catheter Related Bloodstream Infection Market size is expected to be worth around US$ 2.5 billion by 2033 from US$ 1.5 billion in 2023, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

Increasing incidence of catheter-related bloodstream infections (CRBSIs) is driving the growth of the market, as these infections remain a significant concern in healthcare settings, particularly among patients with long-term catheterization. CRBSIs are often associated with patients receiving hemodialysis, those in intensive care, and individuals undergoing long-term treatments requiring central venous catheters (CVCs).

In December 2022, CorMedix released findings from an extensive study that combined clinical and claims data from kidney failure patients on hemodialysis with CVCs, aiming to develop therapeutic solutions for preventing and treating CRBSIs. This study underscored the urgency of addressing CRBSIs, which can lead to severe complications and are costly to treat.

As the prevalence of patients requiring CVCs grows, the demand for effective solutions to prevent infections increases. The market also benefits from rising awareness of healthcare-associated infections and the need for advanced technologies to prevent and manage these complications. Opportunities are expanding for novel medical devices and antimicrobial coatings, which could significantly reduce the risk of infections.

Recent trends indicate increased focus on preventive therapies, including antiseptic locks and catheter modifications, which help mitigate the risks associated with catheter use. Additionally, growing investments in research and development for infection control solutions present further prospects for market growth.

Key Takeaways

- In 2023, the market for catheter related bloodstream infection generated a revenue of US$ 1.5 billion, with a CAGR of 5.2%, and is expected to reach US$ 2.5 billion by the year 2033.

- The drug class segment is divided into cloxacillin, echinocandin, ceftazidime, cefazoline, daptomycin, and others, with echinocandin taking the lead in 2023 with a market share of 45.5%.

- Considering route of administration, the market is divided into oral and injectable. Among these, oral held a significant share of 55.8%.

- Furthermore, concerning the indication segment, the market is segregated into bacterial infections, fungal infection, and viral & parasitic infections. The fungal infection sector stands out as the dominant player, holding the largest revenue share of 50.1% in the catheter related bloodstream infection market.

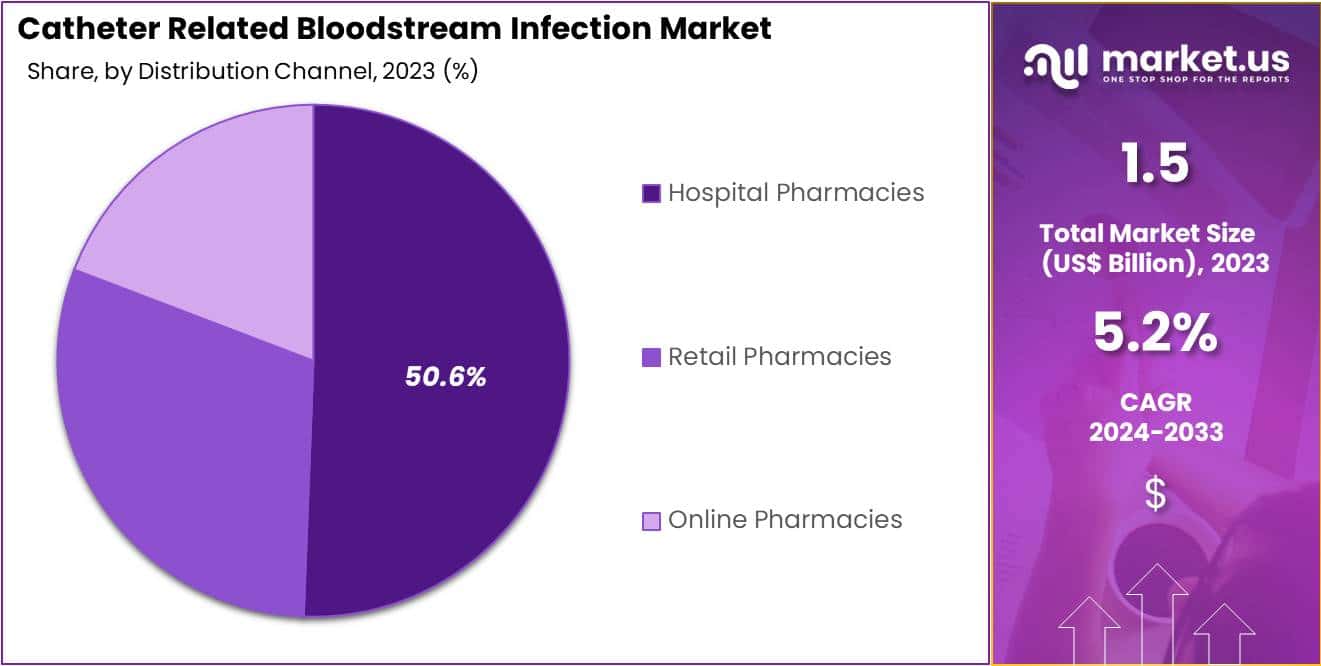

- The distribution channel segment is segregated into hospital pharmacies, retail pharmacies, and online pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 50.6%.

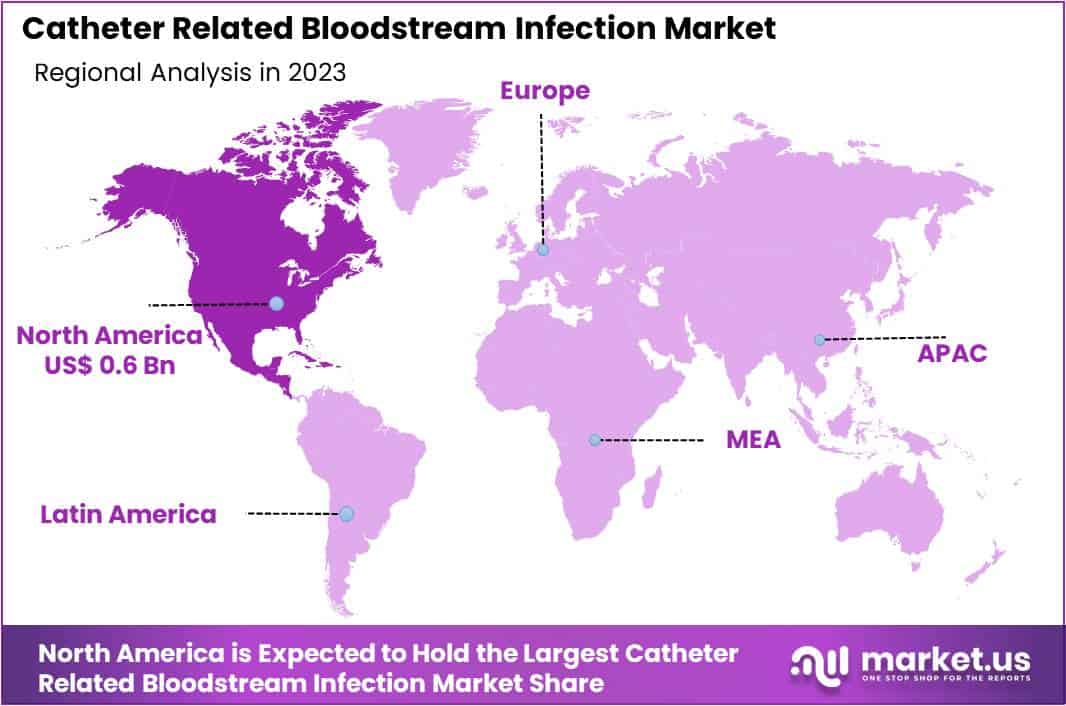

- North America led the market by securing a market share of 37.5% in 2023.

Drug Class Analysis

The echinocandin segment led in 2023, claiming a market share of 45.5% owing to its increasing effectiveness against fungal infections, which are common complications in catheter-related infections. Echinocandins are known for their broad-spectrum activity against Candida and other fungal pathogens, making them a preferred choice in treating such infections.

The rise in hospital-acquired infections and the increasing number of immunocompromised patients, such as those undergoing chemotherapy or organ transplantation, are anticipated to drive the demand for echinocandins. Additionally, the growing preference for these drugs over traditional antifungal treatments due to their favorable safety profile and efficacy is likely to boost market growth.

As more healthcare professionals turn to echinocandins as a first-line treatment for catheter-related fungal infections, the segment is projected to see continuous growth in both hospital settings and clinical practice.

Route of Administration Analysis

The oral held a significant share of 55.8% due to the increasing demand for patient convenience and outpatient management. Oral formulations of antibiotics and antifungal agents are expected to see greater adoption as they offer easier administration compared to injectable alternatives. The rising preference for non-invasive treatments, particularly for patients with mild to moderate infections, is likely to drive this segment’s growth.

Moreover, advancements in oral drug formulations, which improve bioavailability and absorption, are anticipated to expand the use of oral drugs for treating catheter-related bloodstream infections. Additionally, the growing trend toward at-home healthcare and outpatient treatment is expected to further propel the demand for oral medications, making them a more attractive option for both patients and healthcare providers.

Indication Analysis

The fungal infection segment had a tremendous growth rate, with a revenue share of 50.1% owing to the increasing prevalence of fungal pathogens, especially among patients with long-term catheter use. The rise in immunocompromised populations, such as those with cancer, HIV/AIDS, or diabetes, is expected to contribute significantly to the growing number of fungal infections.

Fungal infections, particularly caused by Candida species, are projected to increase due to the widespread use of intravenous catheters and indwelling medical devices. Additionally, the limited treatment options for resistant fungal strains and the growing focus on targeted antifungal therapies are likely to further drive market growth.

Healthcare providers are expected to continue prioritizing fungal infection management, including catheter-related infections, as part of broader infection control strategies, fueling demand for specialized treatments and antifungal agents.

Distribution Channel Analysis

The hospital pharmacies segment grew at a substantial rate, generating a revenue portion of 50.6% due to hospitals’ central role in treating such infections. Hospital pharmacies are expected to continue as the primary distribution channel for medications used in treating bloodstream infections, especially those that require specialized care or intravenous administration.

The growing number of catheter-related infections, coupled with the increasing complexity of patient care, is likely to elevate the demand for medications available through hospital pharmacies. Additionally, the ability of hospital pharmacies to provide medications that require specialized handling, such as injectables or antifungal treatments, is expected to support their dominance in the market.

As hospitals focus on improving infection prevention and treatment protocols, the reliance on hospital pharmacies for these critical medications is projected to increase, further driving segment growth.

Key Market Segments

By Drug Class

- Cloxacillin

- Echinocandin

- Ceftazidime

- Cefazoline

- Daptomycin

- Others

By Route of Administration

- Oral

- Injectable

By Indication

- Bacterial Infections

- Fungal Infection

- Viral and Parasitic Infections

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Innovative Treatments Driving the Market

The rise in availability of innovative treatments is driving the growth of the catheter-related bloodstream infection (CRBSI) market. New antibiotics and lock solutions, such as Citius Pharmaceuticals’ Mino-Lok, which completed a key clinical milestone in August 2023, are expected to play a major role. The company achieved the necessary 92 events for the trial, bringing them closer to determining the treatment’s efficacy.

These innovations, particularly those focused on preserving catheters in high-risk patients, are likely to reduce infection rates and improve patient outcomes. Additionally, new medical devices designed for better catheter management are anticipated to become integral to infection prevention strategies. As healthcare providers adopt these advanced solutions, the market is expected to grow as a result of more effective and convenient infection management.

With continuous advancements in treatment protocols, the demand for these solutions is projected to increase, especially as they reduce complications and improve the quality of care.

Restraints

High Costs Restraining the Market

High costs related to infection prevention and treatment protocols are anticipated to restrain the growth of the catheter-related bloodstream infection market. The substantial financial investment required for advanced medical devices, ongoing monitoring, and specialized treatments is expected to strain healthcare budgets.

These rising expenses are likely to hamper the widespread adoption of necessary infection control measures, especially in low-resource settings. Long-term treatments for infections, such as antibiotics and extended hospital stays, also contribute to the financial burden. Hospitals, particularly those in economically constrained regions, may find it difficult to implement optimal prevention strategies, which could impede the market’s growth.

Although the benefits of infection prevention and control are clear, the economic burden may delay progress in reducing CRBSI incidence. The high costs associated with managing these infections could make it difficult for healthcare systems to afford widespread implementation of advanced infection control measures.

Opportunities

Increasing Research Activities Creating Opportunities in the Market

Increasing research activities are creating significant opportunities for the growth of the catheter-related bloodstream infection market. Research efforts focused on understanding the incidence, economic impact, and effective prevention strategies for CRBSIs are likely to lead to the development of new treatments and technologies. For example, a study conducted in June 2022 by researchers from Shanghai Jiao Tong University analyzed CRBSI cases across three hospitals, involving over 2,300 beds.

This research, which focused on infection control in intensive care units, is expected to provide valuable insights that could improve hospital protocols and reduce the financial burden of CRBSIs. As the understanding of these infections deepens, more targeted solutions are likely to emerge, creating opportunities for new therapies and devices.

The growing emphasis on improving infection control measures, coupled with increasing investment in clinical trials, is projected to drive innovation in the market. Researchers are expected to play a key role in identifying more effective treatments and preventive methods. This surge in research is creating opportunities for companies to introduce novel products, expand their market share, and ultimately improve patient outcomes while reducing the overall healthcare costs associated with CRBSIs.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the market for catheter-related bloodstream infections. Economic recessions typically lead to budget constraints in healthcare systems, potentially reducing funding for advanced diagnostic and treatment solutions. Conversely, during periods of economic growth, higher healthcare investments and increased patient awareness boost demand for infection prevention and management solutions.

Geopolitical tensions, such as trade barriers or healthcare policy changes, can disrupt the supply of critical medical supplies, exacerbating challenges in managing bloodstream infections. However, government initiatives and healthcare reforms aimed at improving patient outcomes in regions like Asia-Pacific present opportunities for growth.

The rising emphasis on infection prevention, particularly in hospital settings, aligns with the expanding market. Innovations in infection control technologies and growing awareness of the risks associated with central venous catheters further support a positive market outlook.

Trends

Rising Collaborations and Partnerships creating lucrative prospects for the Market

Rising collaborations and partnerships have become a prominent trend in driving growth in the catheter-related bloodstream infection market. Companies in the healthcare sector are increasingly joining forces to develop innovative solutions for infection prevention and treatment. Strategic collaborations enable organizations to pool resources, share expertise, and accelerate the development of advanced technologies.

For instance, in July 2023, Teva Pharmaceuticals and Alvotech strengthened their ongoing partnership by investing US$ 40 million in subordinated convertible bonds. This investment demonstrates a commitment to advancing biosimilar therapies that could significantly benefit patients requiring critical care, including those at risk of infections.

Such collaborations are anticipated to boost market growth by improving access to cutting-edge infection management solutions and enhancing patient care. As these alliances continue to grow, they are expected to positively impact the catheter-related bloodstream infection market.

Regional Analysis

North America is leading the Catheter Related Bloodstream Infection Market

North America dominated the market with the highest revenue share of 37.5% owing to advancements in infection prevention technologies and rising awareness of the significant healthcare burden caused by these infections. CRBSIs are a common complication in patients requiring central venous catheters for treatments such as dialysis or intravenous medication.

In September 2023, a pivotal study conducted by the University of California, the LOCK IT-100 phase 3 trial, highlighted the effectiveness of a taurolidine/heparin combination in reducing CRBSI incidences. The trial, involving 795 patients, demonstrated that the combination therapy significantly lowered infection rates compared to standard heparin treatment alone, offering a promising solution for patients in critical care settings.

The market has also benefited from increased investment in healthcare infrastructure, which includes the adoption of advanced infection prevention protocols and the development of new catheter technologies. With rising healthcare expenditure and the ongoing emphasis on patient safety, North America’s CRBSI market is expected to continue expanding as healthcare providers and patients prioritize reducing infection-related complications.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the catheter-related bloodstream infection market is expected to witness robust growth during the forecast period, driven by improvements in healthcare infrastructure and a growing focus on infection prevention. The region’s healthcare sector is anticipated to undergo significant transformations, particularly in countries like India and China.

According to the India Brand Equity Foundation (IBEF), India’s healthcare sector is projected to grow at a compound annual growth rate (CAGR) of 22%, reaching a value of US$ 372 billion by 2022, up from US$ 110 billion in 2016. This growth in healthcare investment is expected to enhance diagnostic capabilities, leading to an increased demand for advanced infection control technologies. Moreover, as the healthcare sector expands, the prevalence of medical conditions requiring central venous catheters is likely to increase, thereby elevating the risk of CRBSIs.

The growing awareness of the importance of infection prevention, combined with improved access to advanced medical treatments, is projected to drive the adoption of innovative products designed to reduce the incidence of these infections, further contributing to the market’s expansion across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the catheter related bloodstream infection market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the catheter-related bloodstream infection market adopt various strategies to ensure growth, including enhancing product offerings, expanding global presence, and strengthening partnerships with healthcare providers.

Companies focus on developing advanced antimicrobial and coated catheters to reduce infection rates and improve patient outcomes. Strategic acquisitions and collaborations with hospitals and medical institutions help expand market reach. Additionally, players invest in research and development (R&D) to introduce innovative technologies and solutions that address evolving healthcare needs.

These companies also emphasize the importance of educational programs and clinical studies to raise awareness and promote their products. One of the key players in the market is Becton, Dickinson and Company (BD), a leading global medical technology company. BD focuses on providing innovative infection prevention solutions, including advanced catheters designed to minimize the risk of bloodstream infections. The company’s growth strategy involves continuous innovation, expansion into emerging markets, and partnerships with healthcare organizations to improve patient safety and clinical outcomes.

Recent Developments

- On April 4, 2023: Baxter International Inc. launched ZOSYN (piperacillin and tazobactam) Injection in the United States. ZOSYN premix is designed to treat a range of infections caused by susceptible bacteria and is delivered in Baxter’s single-dose Galaxy containers. This launch aligns with Baxter’s commitment to expanding its portfolio of sterile medications and reinforces its efforts to address infections that complicate treatments in critical care settings, potentially benefiting patients requiring regular diagnostic and treatment interventions, such as those in diabetes management.

- On April 24, 2023: Citius Pharmaceuticals, Inc. made significant progress in the clinical trial of its Mino-Lok product, an antibiotic lock solution developed to preserve catheters in patients with catheter-related bloodstream infections (CRBSIs). This breakthrough in critical care therapeutics is expected to lead to further innovations that could improve patient outcomes in critical care environments, underscoring the importance of advancements in medical treatments relevant to the broader healthcare market.

Top Key Players in the Catheter Related Bloodstream Infection Market

- Braun Medical Inc

- Eli Lilly and Company

- GSK plc

- Novartis

- Pfizer Inc.

- Sanofi AG

- SteriMax Inc.

- Teva Pharmaceutical Industries Ltd.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 billion Forecast Revenue (2033) US$ 2.5 billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Cloxacillin, Echinocandin, Ceftazidime, Cefazoline, Daptomycin, and Others), By Route of Administration (Oral and Injectable), By Indication (Bacterial Infections, Fungal Infection, and Viral & Parasitic Infections), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B. Braun Medical Inc, Eli Lilly and Company, GSK plc, Novartis, Pfizer Inc., Sanofi AG, SteriMax Inc., and Teva Pharmaceutical Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Catheter Related Bloodstream Infection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Catheter Related Bloodstream Infection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Braun Medical Inc

- Eli Lilly and Company

- GSK plc

- Novartis

- Pfizer Inc.

- Sanofi AG

- SteriMax Inc.

- Teva Pharmaceutical Industries Ltd.