Digestive Health Market By Product Type (Non-Alcoholic Beverages, Dairy Products, Bakery & Cereals, Supplements), By Ingredient Type (Probiotics, Prebiotics, Digestive Enzymes), By Form Type (Capsules, Tablets, Chewable, Drops), By Distribution Channel Type (Drug Stores & Retail Pharmacies, Online Providers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast; 2023-2032

- Published date: Sep 2024

- Report ID: 95658

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global digestive health market size is expected to be worth around USD 104 billion by 2032 from USD 48.4 billion in 2022, growing at a CAGR of 8.2% during the forecast period from 2023 to 2032.

Good digestive health means helping the food break down and absorb its nutrients from this food to maintain a healthy gut and lower gastrointestinal tract disorders. Hence, microbiome and gut health has been in demand for several years, but the global pandemic has increased the share of the digestive health market at a very high rate.

As awareness in the world is rising, the overall demand for digestive health products in the market is increasing. Also, increasing awareness by key market players worldwide boosts the demand for digestive health solutions.

Key Takeaways

- The global digestive health market is projected to be valued at USD 104.4 billion by 2032.

- The market is expected to grow at a CAGR of 8.2% from 2023 to 2032.

- Digestive health market size was USD 48.4 billion in 2022.

- By product, the dairy products segment contributed to a revenue share of 55% in 2022.

- The probiotics ingredient segment dominated with 82% market share in 2022.

- Digestive enzymes ingredient segment is forecasted to grow at a CAGR of 6.8% from 2023 to 2032.

- The digestive health capsule form segment held a revenue share of 39% in 2022.

- In 2022, North America led the market with the highest revenue share of 34.0%.

- Europe’s revenue share in the market was 27.3% in 2022.

- The dairy products segment is expected to grow significantly over the next few years.

- The global digestive health market, by form, primarily witnessed dominance by capsules in 2022.

- Distribution via drug & retail pharmacy shops held a significant market share.

- Over 40% of the population suffers from gastrointestinal disorders.

- The European Commission and EPA established a new regulation in 2022 to enhance the consumption of natural-derived materials.

Product Type Analysis

Based on product types, the global digestive health market is segmented into non-alcoholic beverages, dairy products, bakery & cereals, supplements, and other product types.

Among these products, the dairy products segment is dominating the market share and will increase significantly in the next few years. Due to the increased demand for supplements & nutritional food, non-alcoholic beverages, dairy products, supplements, bakeries, and cereals are growing in the market.

Also, increasing demand for dairy products such as milk, cheese, and yogurt will expand over the next few years, with increased health concerns in the forecast period.

Dairy products share about 55% of the market in terms of the total market demand for healthy habits and increased consumer awareness.

Ingredient Type Analysis

Based on ingredient types, the global digestive health market is segmented into probiotics, prebiotics, and digestive enzymes. Among these ingredients, In-depth analysis in 2022, the probiotics segment had the largest market share at 82.5%.

Demand for the probiotics segment type generated the most revenue in 2022, with 6.7% CAGR helping to increase awareness for intestinal disorders, digestive health, and gut health. Individuals with chronic diseases spend money on high-end probiotic products, which help to strengthen the growth of the global digestive health market.

Robust growth is due to increased immune system awareness, which is the benefit of probiotics to boost immunity. Prebiotics has a market share of 12%, and digestive enzymes have a share of 6%, respectively. Digestive food enzymes have two types based on animal and plant.

Digestive enzymes have an expected growth of 6.8% CAGR. The digestive enzymes segment type dominates the market with a high CAGR because the enzyme segment allows more food to eat to gain benefits.

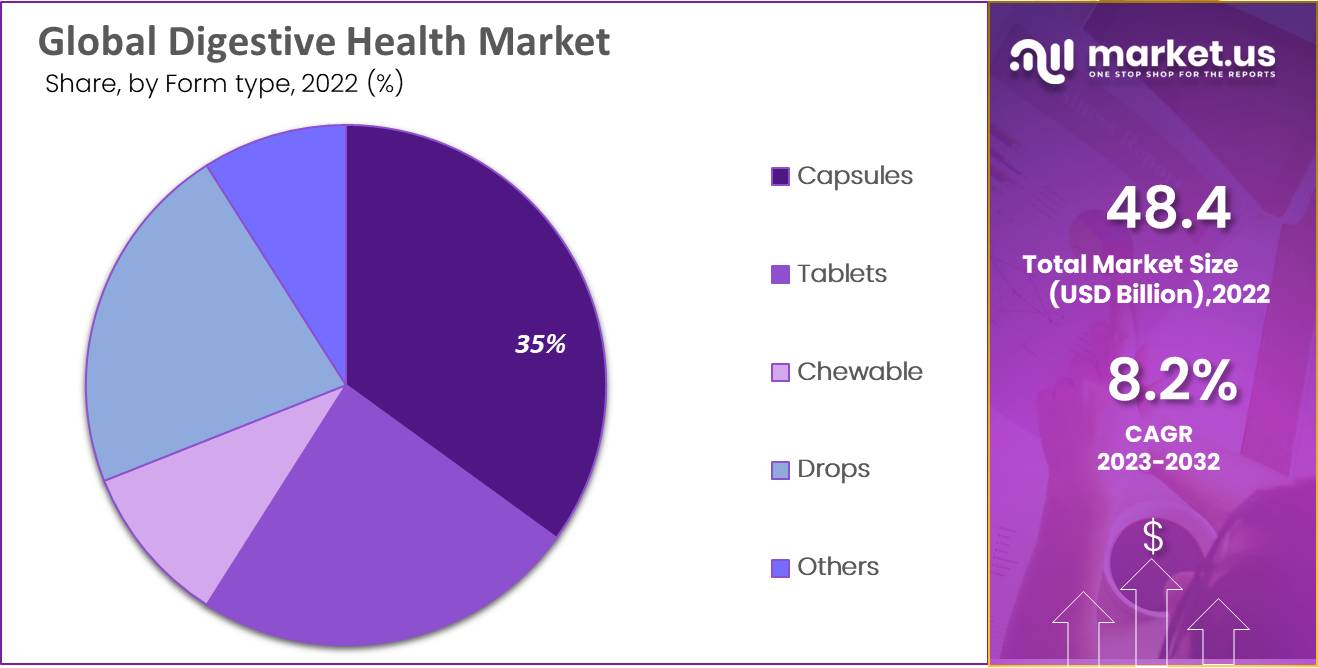

Form Type Analysis

Based on form types, the global digestive health market is segmented into tablets, capsules, chewables, drops, and others. These are some forms to administrate dosage for digestive health.

Among these forms, the digestive health capsule dominated the market and is expected to reach the highest CAGR during the forecast period. Moreover, the capsule segment is easier to use than other digestive health products. Regarding revenue share, capsules comprise about 39% of the total digestive health market share.

A hectic life can lead to unhealthy food habits. People tend to eat fast food, which has fewer nutrients and so less intake of nutrients in their diet; hence, to fulfill fiber requirements, consumers prefer capsules.

Distribution Channel Type Analysis

The market has been segmented based on distribution channels into online providers, modern trade, and drug and retail pharmacy stores.

Among these distribution channels, drug and retail pharmacy stores dominated the market even though there is expected growth in online providers and high digitalization of smart devices with increased accessibility.

Drug stores and retail pharmacies can be directly used with the help of prescriptions and OTC.

Key Market Segments

By Product Type

- Non-Alcoholic Beverages

- Dairy Products

- Bakery and Cereals

- Supplements

- Others

By Ingredient Type

- Probiotics

- Prebiotics

- Digestive Enzymes

- Microbial-Based

By Form Type

- Capsules

- Tablets

- Chewable

- drops

- Others

By Distribution Channel Type

- Drug Stores and Retail Pharmacies

- Online Providers

- Others

Drivers

Increased Awareness of Probiotic’s Health Benefits

Demand for nutritious food is increasing; moreover, a boost in digestive disorders is helping to raise awareness of probiotics’ benefits. Increasing awareness of the gut health of geriatric people is growing in public. In the modern world, changing active lifestyles and busy schedules give people unhealthy eating habits.

There was an increase in diseases like bacterial overgrowth, malabsorption, bacterial overgrowth, and other conditions. Due to these, increasing demand for health products and supplements is popularized in the modern world to obtain a healthy mind and body.

Increasing customers’ awareness and education level toward health and diet consciousness help improve the overall demand for digestive health products. The knowledge of digestive problems awareness is growing among people helping to expand market share and investment of key market players in R&D initiatives helping to provide new lucrative ideas to invest in the market to increase overall growth.

In Western countries, Gut health has increased popularity among consumers with a holistic approach to healthy living. The US has continued to increase demand for digestive health products because of the prevalence of obesity, diseases related to poor habits with high consumption of processed food, and sometimes ready-to-eat foods.

Restraints

Regulatory Restrictions and Expensive R & D

There are strict rules and regulations restrictions for the digestive health market to manufacture products. R&D is costly to develop new probiotics. Also, strict regulations for supplement and vitamin manufacturers are restraining the launching of new products.

The Dietary Supplement Health and Education Act was introduced in 1994, under which manufacturing firms need to distribute safe products, and claims made by firms must be accurate as per announced.

Opportunity

Increase in Geriatric Population and Consumer Awareness

Due to the increase of geriatric people, digestive health problems have increased. Also, people’s attention to digestive health is growing due to increased stomach-related issues.

More than 40% of people worldwide have a gastrointestinal disease affecting health care and quality of life. Hence, the increase in healthy and safe product demands will increase. Lipase, lactase, and amylases are food enzymes found in digestive health products that help maintain the acid intensity of the stomach with better digestion.

Hence, increasing demand for main products is experienced with supplements and food additives. In annual reports in 2022, food, beverages, and supplements were consumed by nearly up to 31%, while functional foods were up to 29%.

Challenges

Strict Regulations About Supplements and Vitamins are Stopping The Growth

A few challenges are stopping the growth of the global digestive health market. Many have strict regulations about supplements and vitamins in the Dietary Supplement Health and education act introduced in 1994.

So, this act validates any claims and presentations about distributors or manufacturers. Before selling or producing supplements, manufacturers have to register with FDA under the Bioterrorism Act.

Hence, creating a delay in product launch. In the previous few years, the tax increased by 6 to 10 %, which also restrained the growth of the digestive health market.

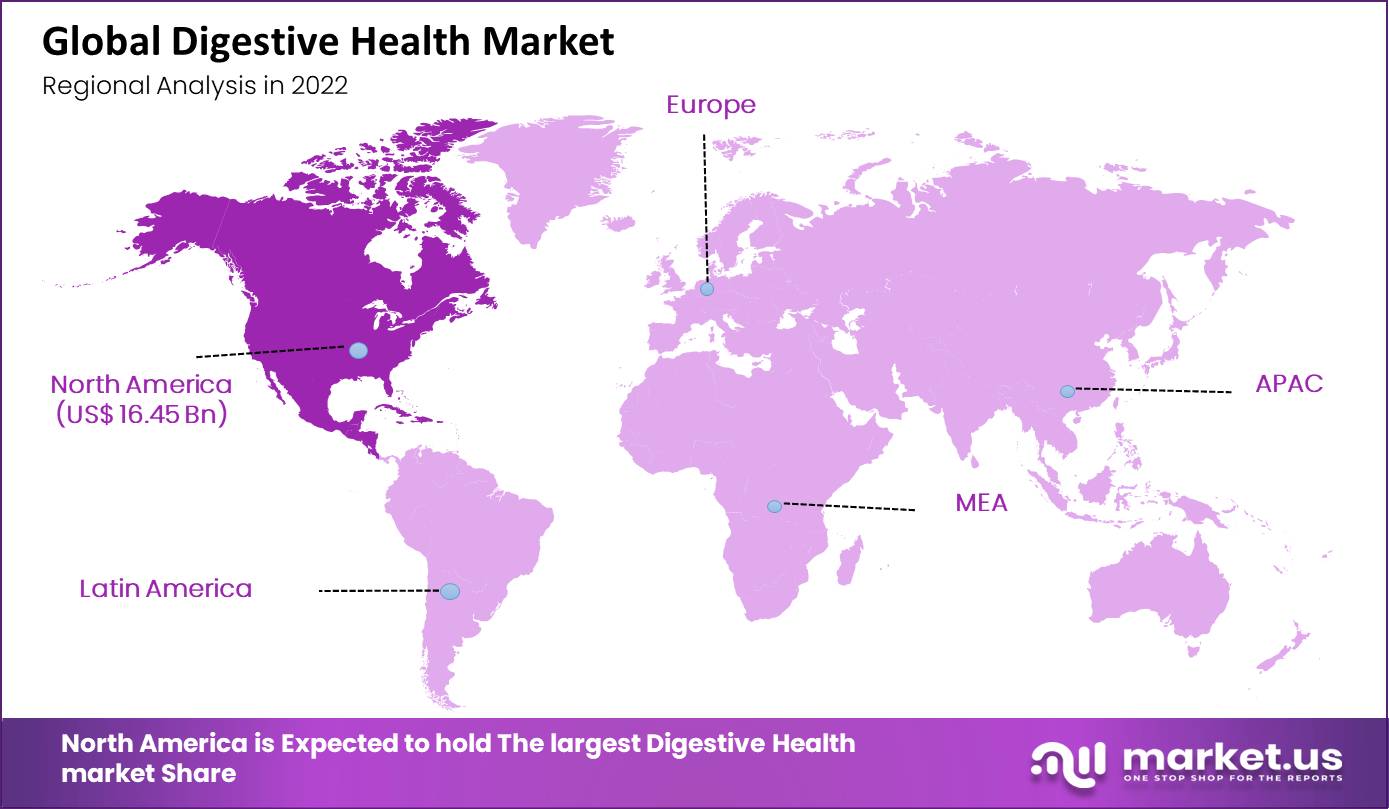

Regional Analysis

With a market share of 34.0%, North America dominated the central regional market of the global digestive health market in 2022. This growth is attributed to increasing government initiatives, developed healthcare infrastructure, rising chronic disease, and the presence of important key players.

In comparison, Asia Pacific expected the best growth rate, with the highest CAGR during the forecast period. Increasing government initiatives will help a healthy lifestyle, scientific advancements, and solve people’s digestive problems.

Different digestive health products in the APAC market are increasing due to large economies such as China, India, and Japan.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Bayer AG, Pfizer Inc., Herbalife Nutrition Ltd., BASF SE, Sanofi, NOW Health Group Inc., Amway Corporation, The Bountiful Company, and GlaxoSmithKline PLC are some of the key market players in the world.

Key players are targeting Southeast Asia for large target consumers in the region. Changing demand for digestive health products helped market players invest in research and development of these products.

Sanofi is targeting to expand its product portfolio by launching Diorabyota to replace its old product. IFF launching a new dairy product enzyme in the US.

Market Key Players

- Bayer AG

- Pfizer Inc.

- Herbalife Nutrition Ltd.

- BASF SE

- Sanofi

- NOW Health Group Inc.

- Amway Corporation

- The Bountiful Company

- GlaxoSmithKline PLC

- Yakult Honsha co. Ltd.

- Alimentary health

- Optibiotix health

- Other Key Players

Recent Market Developments

- In April 2024: Bayer announced its commitment to driving innovation across several core therapeutic areas including digestive health. The company emphasized its efforts to enhance the quality of its pharmaceutical pipeline through strategic collaborations and acquisitions, aiming to introduce new therapeutic options and improve standards of care in these fields.

- In December 2023: Pfizer completed the acquisition of Seagen Inc., a biotechnology company, for a transaction value of approximately $43 billion. This acquisition significantly enhances Pfizer’s oncology portfolio and includes Seagen’s advanced Antibody-Drug Conjugate (ADC) technology, pivotal for developing cancer treatments, which could have implications for advancing treatments in digestive cancers as well.

- In October 2023: Sanofi reported significant growth driven by Dupixent® and ALTUVIIIO®, with a notable emphasis on Digestive Wellness. Dupixent® sales reached €2,847 million, marking a 32.8% increase. The strong performance of their innovative medicines and vaccines was pivotal, offsetting challenges like generic competition in other areas.

- In July 2023: BASF reported financial results indicating robust investment in research and development, despite economic challenges. With cash flows from operating activities reaching €8.1 billion, BASF continues to support sectors including agriculture, which impacts digestive health through enhanced food production practices. The financial stability and ongoing investments underline BASF’s commitment to leading in sustainable and innovative solutions across all its sectors.

Report Scope

Report Features Description Market Value (2022) USD 48.4 billion Forecast Revenue (2032) USD 104 billion CAGR (2023-2032) 8.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Alcoholic Beverages, Dairy Products, Bakery & Cereals, Supplements, and Others), By Ingredient Type (Probiotics, Prebiotics, Digestive Enzymes, and Others), By Form Type (Capsules, Tablets, Chewable, Drops, and Others), By Distribution Channel Type (Drug Stores & Retail Pharmacies, Online Providers, and Others) Regional Analysis North America – US, Canada, Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic; Eastern Europe – Russia, Poland, The Czech Republic, Greece; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates; Competitive Landscape Bayer AG, Pfizer Inc., Herbalife Nutrition Ltd., BASF SE, Sanofi, NOW Health Group Inc., Amway Corporation, The Bountiful Company, GlaxoSmithKline PLC, Alimentary health, Beroni Group, Optibiotix Health, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer AG

- Pfizer Inc.

- Herbalife Nutrition Ltd.

- BASF SE

- Sanofi

- NOW Health Group Inc.

- Amway Corporation

- The Bountiful Company

- GlaxoSmithKline PLC

- Yakult Honsha co. Ltd.

- Alimentary health

- Optibiotix health

- Other Key Players