Global Carnauba Wax Market Size, Share, And Industry Analysis Report By Product (Type 1, Type 3, Type 4), By Application (Cosmetics, Food, Automotive, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172554

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

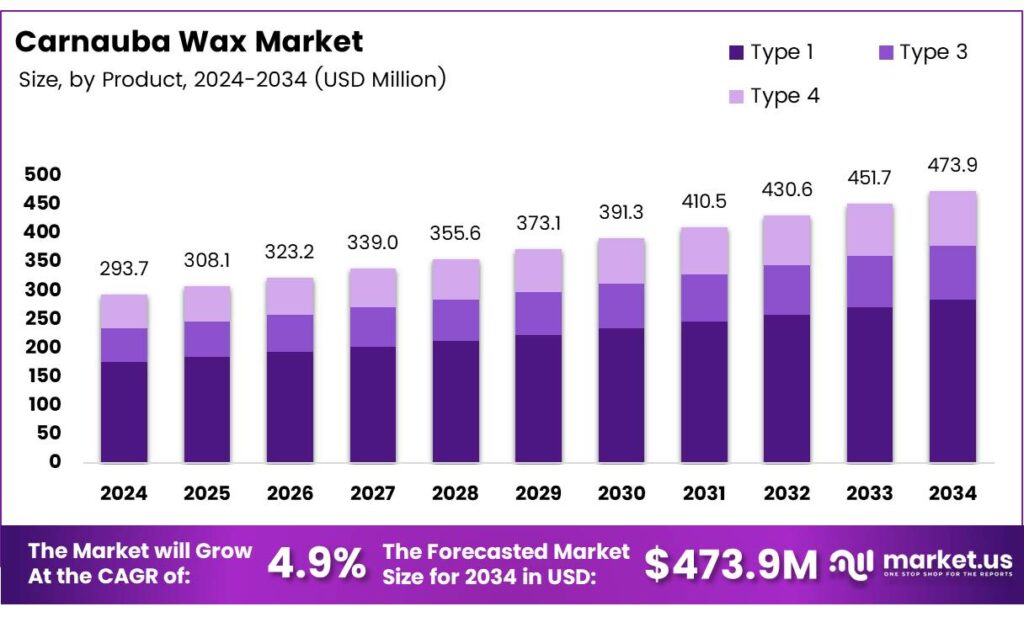

The Global Carnauba Wax Market size is expected to be worth around USD 473.9 million by 2034, from USD 293.7 million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Carnauba Wax Market represents the global supply and demand ecosystem for a natural vegetable wax extracted from Copernicia prunifera palm leaves, mainly sourced from Brazil. Broadly, this market supports food glazing, cosmetics, pharmaceuticals, polishes, coatings, and sustainable packaging, driven by its natural origin, hardness, and premium functional properties.

Carnauba wax itself is valued for enabling performance where durability and natural compliance intersect. Therefore, manufacturers prefer it in formulations requiring gloss, heat resistance, and low solubility. Moreover, its plant-based profile aligns with clean-label and bio-based material strategies across food, personal care, and industrial applications.

- Scientifically, carnauba wax derives its performance from esters, which account for more than 80% of its composition, dominated by aliphatic esters and diesters of cinnamic acid. These esters include monocarboxylic acids and monohydric alcohols with chain lengths of C26 and C32, providing notable hardness and thermal stability.

About 90% of these esters consist of ω-hydroxy acids (C26) and mono alcohols (C32), while only 10% are mono-carboxylic acids (C28) and α,ω-diols (C30). Additionally, early chemical assessments isolated cinnamic acid with a 5% yield, showing para-hydroxy cinnamic acid accounts for nearly 75% of aromatic acids, alongside triterpenes like metildamar-25-ene-3β,20-diol.

Carnauba wax’s physical behavior further supports its premium positioning across end-use industries. Its melting temperature ranges from 79.2°C to 84.2°C, depending on the palm subspecies. Consequently, this high melting point and rigidity distinguish carnauba wax within natural wax, food glaze, cosmetic, and sustainable coating value chains.

Key Takeaways

- The Global Carnauba Wax Market is projected to grow from USD 293.7 million in 2024 to USD 473.9 million by 2034, registering a 4.9% CAGR during 2025–2034.

- Type 1 leads the market with a dominant share of 44.8% in 2024, driven by wide industrial acceptance.

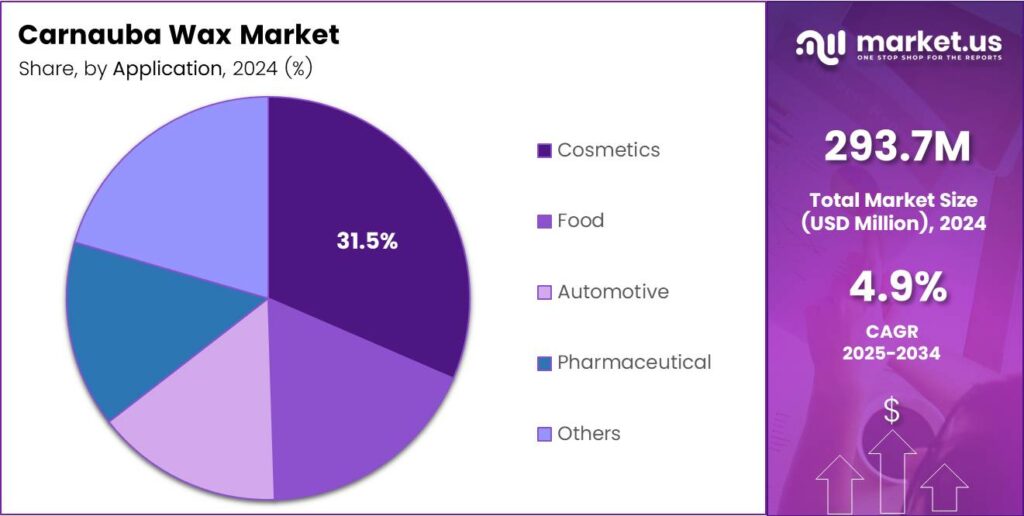

- The Cosmetics segment holds the largest share at 31.5% in 2024, supported by demand for natural gloss and texture enhancers.

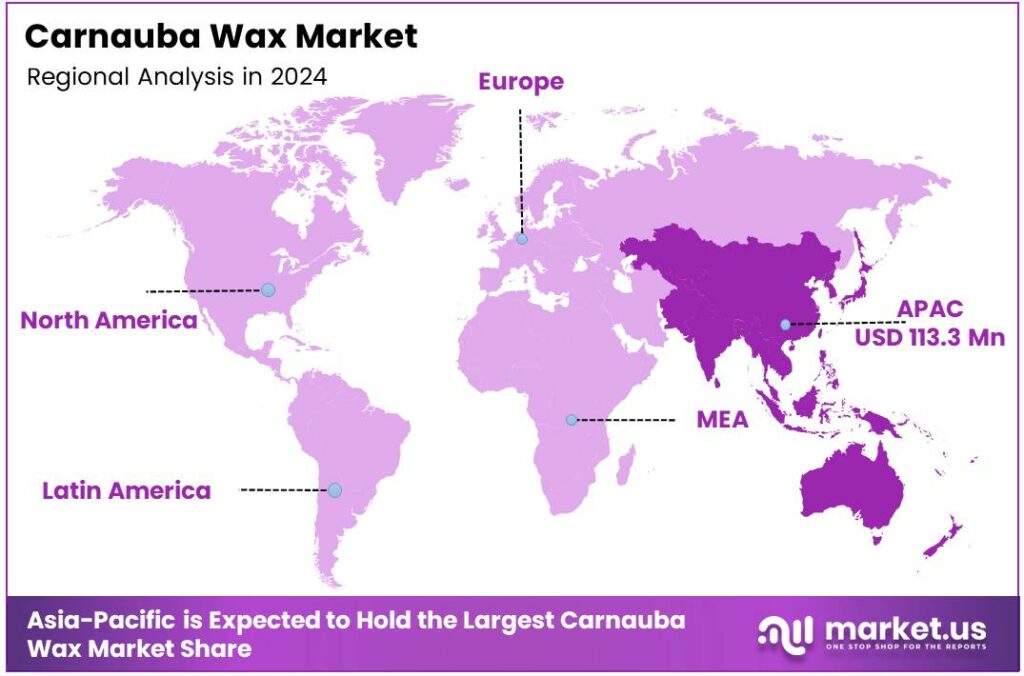

- Asia Pacific dominates the global market with a share of 38.6%, accounting for approximately USD 113.3 million in 2024.

By Product Analysis

Type 1 dominates with 44.8% due to its wide industrial acceptance and balanced performance profile.

In 2024, Type 1 held a dominant market position in the By Product Analysis segment of the Carnauba Wax Market, with a 44.8% share. This dominance is driven by its stable hardness, high melting point, and consistent gloss properties. As a result, manufacturers prefer it for reliable, large-scale processing.

Type 3 follows as a specialized product grade, mainly adopted where moderate hardness and flexibility are required. Compared to Type 1, it supports niche formulations. Consequently, it is used selectively, especially when end-users need controlled performance rather than maximum durability.

Type 4 represents the most refined option, commonly selected for applications requiring higher purity and a smoother finish. Although it holds a smaller share, it plays an important role in premium formulations. Therefore, its demand remains steady in value-focused product lines.

By Application Analysis

Cosmetics dominate with 31.5% due to rising demand for natural gloss and texture enhancers.

In 2024, Cosmetics held a dominant market position in the By Application Analysis segment of the Carnauba Wax Market, with a 31.5% share. This leadership is supported by its use in lipsticks, mascaras, and creams. Moreover, natural origin improves consumer trust.

Food applications rely on carnauba wax for glazing and surface protection. It is widely used on confectionery and fruits. As a result, it improves shelf appeal while maintaining product safety, supporting consistent demand across food processing industries.

Automotive usage focuses on surface protection and shine in car polishes. Although smaller in share, it adds value through durability and water resistance. Therefore, it remains relevant in premium automotive care products. Pharmaceutical and Others together support functional uses such as tablet coating and industrial finishing. These segments ensure diversification.

Key Market Segments

By Product

- Type 1

- Type 3

- Type 4

By Application

- Cosmetics

- Food

- Automotive

- Pharmaceutical

- Others

Emerging Trends

Focus on Sustainable Sourcing and Premium Applications Shapes Trends

One of the key trends in the carnauba wax market is increased focus on sustainable sourcing. Companies are investing in traceable supply chains and responsible harvesting practices to meet environmental and social standards. The shift toward premium applications.

- High-end cosmetics, specialty food coatings, and luxury car care products increasingly highlight carnauba wax for its superior performance and natural origin. Carnauba (vegetable) wax exports from Ceará grew 67.0% in 2024, reaching 11.9 tonnes, compared with 7.1 tonnes. Export value also increased — from USD 49.4 million to USD 76.9 million in 2024.

Product innovation is also shaping the market. Manufacturers are developing refined and blended carnauba wax grades to meet specific application needs, such as improved dispersion or enhanced gloss. Growing awareness of circular economy principles is encouraging the efficient use of natural resources.

Drivers

Rising Demand for Natural and High-Performance Waxes Drives Market Growth

The carnauba wax market is mainly driven by growing demand for natural and plant-based ingredients across multiple industries. Carnauba wax is valued because it is derived from palm leaves and fits well with clean-label and eco-friendly product trends. Many manufacturers prefer it as a safe alternative to synthetic waxes.

In the food industry, carnauba wax is widely used as a glazing and coating agent for fruits, confectionery, and bakery products. Its ability to improve shine, reduce moisture loss, and extend shelf life supports steady demand. Food processors look for stable, heat-resistant waxes, and carnauba meets these needs well.

The cosmetics and personal care sector is another key driver. Carnauba wax helps improve texture, hardness, and gloss in lipsticks, mascaras, and creams. As demand for premium and natural cosmetics grows, formulators continue to adopt carnauba wax.

Restraints

Dependence on Limited Geographic Supply Restrains Market Expansion

A major restraint for the carnauba wax market is its heavy dependence on a single geographic source. Carnauba wax is mainly harvested from specific regions, making the supply vulnerable to climate conditions and agricultural limitations. Any disruption can affect availability and pricing.

- The harvesting process is seasonal and labor-intensive. This creates supply uncertainty and limits rapid production scaling. The strong performance boosted Ceará’s share of Brazil’s total carnauba wax exports to 71.1%, up from 55.7% and 67.97%. Carnauba wax now accounts for 5.1% of Ceará’s total exports, compared with 2.1% and 2.7%.

Price volatility is another challenge. Limited supply and fluctuating harvest yields often lead to unstable prices. This makes cost planning difficult for end-use industries such as food, cosmetics, and industrial coatings. Regulatory and sustainability concerns around land use and worker welfare add compliance pressure. Companies must invest in ethical sourcing and certification, increasing operational costs.

Growth Factors

Expanding Use in Clean-Label and Bio-Based Products Creates Opportunities

Growth opportunities for the carnauba wax market are closely linked to rising interest in clean-label and bio-based products. Consumers increasingly prefer natural ingredients, encouraging manufacturers to replace synthetic waxes with plant-derived alternatives. In food applications, demand for natural coatings is growing as brands focus on transparency and minimal processing.

The cosmetics industry presents strong opportunities as well. Premium beauty brands are actively reformulating products using natural waxes to meet consumer expectations for sustainable and skin-friendly formulations. Carnauba wax supports both performance and marketing claims.

There is also an opportunity in pharmaceutical and nutraceutical coatings, where stability and controlled release are important. As these industries grow, demand for reliable natural excipients like carnauba wax is expected to increase steadily. Carnauba wax fits well with this shift, offering functional performance without compromising label simplicity.

Regional Analysis

Asia Pacific Dominates the Carnauba Wax Market with a Market Share of 38.6%, Valued at USD 113.3 Million

The Asia Pacific region leads the global carnauba wax market due to strong demand from food processing, cosmetics, and pharmaceutical manufacturing hubs across China, India, and Southeast Asia. In 2024, the region accounted for 38.6% of global demand, reaching a market value of USD 113.3 million, supported by rising packaged food consumption and expanding personal care production.

North America represents a mature and stable market for carnauba wax, driven by its widespread use in food glazing agents, pharmaceutical coatings, and specialty industrial polishes. Demand remains steady due to strict quality standards in food and drug applications, where natural waxes are preferred for safety and performance. The region also benefits from sustained consumption of premium cosmetics and nutraceutical products that rely on plant-based ingredients.

Europe shows consistent demand growth for carnauba wax, mainly supported by the cosmetics, organic food, and pharmaceutical sectors. The region’s focus on sustainable sourcing and bio-based raw materials aligns well with carnauba wax’s natural profile. Its use in confectionery coatings, controlled-release medicines, and eco-friendly polishes remains significant.

The U.S. market benefits from high consumption of processed foods, dietary supplements, and pharmaceutical products that use carnauba wax for coating and stabilization purposes. Demand is reinforced by advanced formulation practices in nutraceuticals and personal care products. The preference for non-synthetic, plant-derived ingredients supports steady adoption across applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

FONCEPI Comercial Exportadora Ltda. remained a highly visible origin-linked exporter in 2024, benefiting from Brazil’s position as the natural source of carnauba wax. Its competitiveness is strongest where buyers need steady bulk volumes with consistent filtration and color specs for downstream blending, especially for industrial polishes and ingredient distributors. The key differentiator is reliability in procurement and export execution during seasonal swings.

Carnauba do Brasil Ltda continued to look well placed in 2024 for customers who want traceability and tighter quality control from collection through processing. Companies with cleaner sorting, controlled refining, and repeatable batches tend to win long-term supply agreements in cosmetics and premium care applications where appearance, odor, and stability matter. This positioning also supports private-label and contract supply demand.

Brasil Ceras appears to compete on product range and practical customization in 2024, serving different end-use needs across food-contact coatings, personal care, and industrial formulations. The analyst takeaway is that suppliers able to offer multiple grades—while keeping documentation and batch-to-batch consistency—reduce switching risk for formulators. That makes them attractive partners for mid-sized manufacturers that value flexibility without losing specification discipline.

Pontes Industria de Cera Ltda. in 2024 fits the profile of a processor that can support repeat orders for standard grades while also meeting tighter parameters when required. Operational discipline—moisture control, impurity management, and packaging integrity—directly affects buyer confidence and complaint rates. Players who execute well here tend to strengthen distributor relationships and improve pricing resilience.

Top Key Players in the Market

- FONCEPI Comercial Exportadora Ltda.

- Carnauba do Brasil Ltda

- Brasil Ceras

- Pontes Industria de Cera Ltda.

- Strahl & Pitsch, Inc.

- Kahl GmbH & Co. KG

- Norevo GmbH.

- Koster Keunen Holland

- The International Group, Inc.

- Poth Hille

Recent Developments

- In 2024, FONCEPI Comercial Exportadora Ltda. is a major Brazilian manufacturer of carnauba wax, focusing on production with modern technology and quality control. Products like Carnauba Wax Type 1 are used in food, cosmetics, and industrial applications. Government documents from Ceará state mention the company in export rankings and diagnostics, but these are from earlier.

- In 2025, Carnauba do Brasil Ltda., a company that specializes in carnauba wax extraction, processing, and export. The most recent update identified is a revision to their Quality Policy, emphasizing product safety, environmental respect, and continuous improvement in management systems.

Report Scope

Report Features Description Market Value (2024) USD 293.7 Million Forecast Revenue (2034) USD 473.9 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Type 1, Type 3, Type 4), By Application (Cosmetics, Food, Automotive, Pharmaceutical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape FONCEPI Comercial Exportadora Ltda., Carnauba do Brasil Ltda, Brasil Ceras, Pontes Industria de Cera ltda., Strahl & Pitsch, Inc., Kahl GmbH & Co. KG, Norevo GmbH., Koster Keunen Holland, The International Group, Inc., Poth Hille Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- FONCEPI Comercial Exportadora Ltda.

- Carnauba do Brasil Ltda

- Brasil Ceras

- Pontes Industria de Cera Ltda.

- Strahl & Pitsch, Inc.

- Kahl GmbH & Co. KG

- Norevo GmbH.

- Koster Keunen Holland

- The International Group, Inc.

- Poth Hille