Global Cardiovascular Drugs Market By Drug Type (Asnticoagulants, Antihypertensive, Antihyperlipidemic, Antiplatelet Drugs, and Others), By Disease Indication (Hypertension, Coronary Artery Disease, Hyperlipidaemia, Arrhythmia, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 127533

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Drug Type Analysis

- By Disease Indication Analysis

- By Route of Administration Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

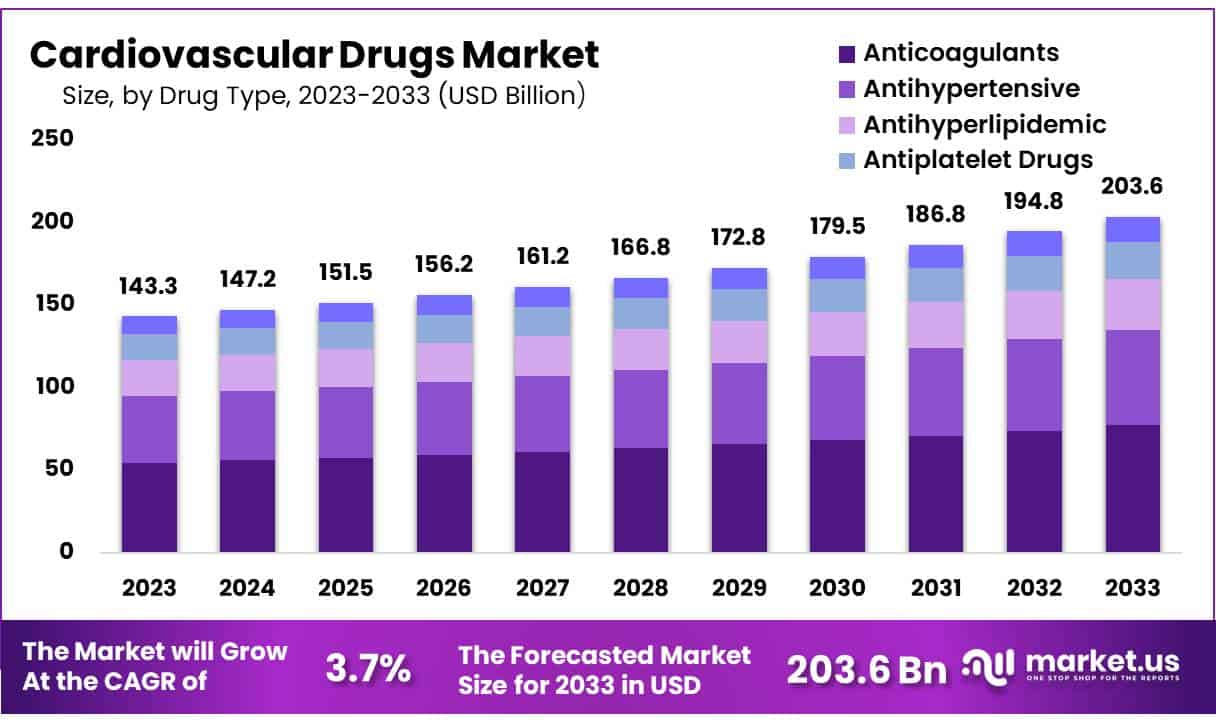

Global Cardiovascular Drugs Market size is expected to be worth around USD 203.6 billion by 2033 from USD 143.3 billion in 2023, growing at a CAGR of 3.7% during the forecast period 2024 to 2033.

Global changes in dietary habits and sedentary lifestyles have contributed to the increased prevalence of cardiovascular diseases. As a result, pharmaceutical companies specializing in cardiovascular drugs are prioritizing the development of more effective and safer medications to address these conditions. This trend is expected to boost market growth in the cardiovascular drugs sector. The aging global population, improved knowledge about heart diseases, and increased research and development efforts for innovative therapeutics are driving progress in the cardiovascular drugs market.

Additionally, awareness campaigns focused on preventing and treating cardiovascular conditions are anticipated to contribute to market growth. Nevertheless, strict regulatory requirements for drug approval and market entry pose challenges to future growth. The substantial increase in the number of patients affected by cardiovascular diseases is a global health issue. Healthcare professionals prescribe various types of cardiovascular drugs to manage conditions related to the heart and blood vessels.

According to the latest data published by the Centers for Disease Control and Prevention, the most common type of heart ailment is coronary heart disease. In 2022, it killed around 371,506 people. Consequently, the demand for effective treatments to combat cardiovascular ailments is likely to propel the cardiovascular drugs market in the coming years.

Key Takeaways

- Market Size: Cardiovascular Drugs Market size is expected to be worth around USD 203.6 billion by 2033 from USD 143.3 billion in 2023.

- Market Growth: The market growing at a CAGR of 3.7% during the forecast period 2024 to 2033.

- Drug Type Analysis: The anticoagulants segment led in 2023, claiming a market share of 38.0%.

- Disease Indication Analysis: The hypertension segment held a significant share of 39.5%.

- Route of Administration Analysis: The oral segment had a tremendous growth rate, with a revenue share of 57.7%.

- Distribution Channel Analysis: The retail pharmacies segment grew at a substantial rate, generating a revenue portion of 40.3%.

- Regional Analysis: North America dominated the market with the highest revenue share of 32.5%.

By Drug Type Analysis

The anticoagulants segment led in 2023, claiming a market share of 38.0% owing to the increasing prevalence of cardiovascular disorders, especially among the geriatric population. As awareness about these conditions grows, more individuals are being treated and diagnosed with anticoagulants to manage and prevent blood clots associated with cardiovascular issues.

Ongoing advancements in medication formulations further drive the demand for anticoagulants. The expansion of this market segment underscores its critical role in current cardiovascular care. Factors such as initiatives to reduce thromboembolic complications and broader applications of anticoagulants in different medical conditions contribute to its growth.

By Disease Indication Analysis

The hypertension segment held a significant share of 39.5% due to factors like high work pressure among young individuals and age-related disorders in the geriatric population. Sedentary lifestyles, excessive salt intake, and poor dietary habits contribute to the prevalence of hypertension. Additionally, heavy alcohol consumption is a common risk factor for this cardiovascular disorder. Overall, hypertension significantly influences the cardiovascular drugs market.

By Route of Administration Analysis

The oral segment had a tremendous growth rate, with a revenue share of 57.7% owing to patient preference for convenient and non-invasive treatment options. Oral drugs, such as tablets and capsules, are easy to administer and require minimal medical supervision, contributing to their popularity.

The segment’s growth is also fueled by the availability of a wide range of oral medications for various cardiovascular conditions, including hypertension and heart failure. Additionally, the advancements in oral drug formulations, such as extended-release and combination therapies, improve treatment outcomes and enhance patient compliance.

By Distribution Channel Analysis

The retail pharmacies segment grew at a substantial rate, generating a revenue portion of 40.3% due to their extensive convenience and accessibility for purchasing medications. Factors such as an aging population in need of ongoing management, heightened awareness of cardiovascular health, expanded services such as health screenings, and the integration of e-commerce for procuring online medication all contribute to this growth.

Additionally, evolving healthcare initiatives and policies promoting preventive care encourage individuals to seek advice and cardiovascular medications from retail pharmacies, further establishing them as a rapidly expanding distribution channel.

Key Market Segments

By Drug Type

- Anticoagulants

- Antihypertensive

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Disease Indication

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Route of Administration

- Oral

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Growing Prevalence of Chronic Diseases

Due to the increasing adoption of unhealthy habits associated with the modern lifestyle. Habits such as smoking, excessive drinking of alcohol, and regular consumption of highly processed food lead to chronic health problems such as overweight, obesity, artery blockages, high blood pressure, and hypertension. These problems are known to be the direct contributors to cardiovascular disorders. These problems are especially prevalent among people from Developed and developing economies, where there is an abundance of processed foods and sugar-based foods.

Consequently, this is anticipated to increase the rate of occurrence of chronic diseases, thereby driving the market during the forecast period. As per the latest data published by the Centers for Disease Control and Prevention, in 2022, around 1 in every 5 deaths caused by cardiovascular diseases (CVDs) was in people less than 65 years old.

Restraints

Lack of Skilled Professionals

The lack of skilled professionals in the cardiovascular drugs market hinders research and development, leading to a shortage of innovative treatments. Insufficient expertise in clinical trials slows down the approval process for new drugs, limiting market growth. The scarcity of skilled cardiologists and researchers constrains the development of personalized medicine approaches, reducing treatment effectiveness.

Additionally, the lack of professionals with expertise in pharmacovigilance and regulatory affairs delays market entry for new cardiovascular drugs. Furthermore, inadequate training and education in pharmacotherapy lead to suboptimal drug utilization, impacting patient outcomes.

Opportunities

Rising Prevalence of Hypertension

The rising prevalence of hypertension creates a significant opportunity for the cardiovascular drugs market, as it increases the demand for effective treatments. Hypertension is a major risk factor for cardiovascular diseases, driving the need for antihypertensive medications. The growing patient pool fuels the market growth, with more individuals requiring lifelong medication.

This trend also encourages innovation, as pharmaceutical companies develop new drugs and combination therapies to address resistant hypertension. Moreover, the rising prevalence of hypertension in emerging markets expands the geographic scope of cardiovascular drugs. These factors are likely to create profitable projections for the market in the years to come.

As per the report published by the World Health Organization in March 2023, around 1.28 billion adults in the age group of 30-79 years all across the world have hypertension. Most of these people, which is roughly two-thirds, live in low- to middle-income economies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the Cardiovascular Drugs market, shaping its growth trajectory and dynamics. Macroeconomic factors such as increasing healthcare spending and growing middle-class populations drive growth in the cardiovascular drugs market. Geopolitical factors such as trade agreements and partnerships facilitate access to new markets and collaborations.

Economic stability and growth in emerging markets expand the patient pool and fuel the demand for cardiovascular drugs. However, economic downturns and trade tensions can lead to reduced healthcare spending and market uncertainty. On the positive side, government initiatives and investments in healthcare infrastructure support market growth.

Latest Trends

Rising Demand for Retail Pharmacies

The rising demand for retail pharmacies is driven by the increased patient preference for convenient and accessible healthcare services. Retail pharmacies offer easy access to medications, counseling, and monitoring, making them an attractive option for patients with cardiovascular conditions. This trend is fueled by the growing number of patients with chronic conditions such as hypertension.

Retail pharmacies are expanding their services to include health clinics, medication therapy management, and cardiovascular health programs. The cardiovascular drugs market is adapting to this trend by partnering with retail pharmacies to improve patient outcomes and increase market research.

Regional Analysis

North America is leading the Cardiovascular Drugs Market

North America dominated the market with the highest revenue share of 32.5%. Sedentary lifestyles, lack of physical activity, poor diets, anxiety, and stress contribute to conditions like diabetes and obesity, which in turn lead to various cardiovascular issues such as coronary artery disease, strokes, and atrial fibrillation. Among the countries in the region, the United States plays a crucial role due to its high prevalence and incidence of cardiovascular diseases.

Notably, coronary artery bypass graft surgery (CABG) is the most common heart surgery in the U.S., with over 300,000 successful procedures performed annually. This underscores the increasing burden of cardiovascular diseases in the country and highlights the need for drug development to address these conditions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising healthcare spending, increasing prevalence of cardiovascular diseases, and growing demand for effective treatment. China, Japan, and India are expected to be key contributors to this growth, with expanding patient pools and improving healthcare infrastructure. The region’s large population, rapid urbanization, and increasing adoption of Western lifestyles contribute to the growing burden of cardiovascular diseases.

Governments in the Asia Pacific are also investing in healthcare infrastructure and initiatives, further driving market growth. According to an article in the American Hearts Association journal, cardiovascular diseases (CVDs) are becoming the primary cause of death in India. Around a quarter of all deaths are caused by CVD.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Cardiovascular Drugs market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. They make heavy investments in research and development to discover new treatments and drugs for unmet medical needs.

Furthermore, they make strategic collaborations and partnerships with other key players, research institutions, or governments to expand product portfolio, improve market research, and enhance technological capabilities.

Top Key Players

- Bristol-Myers Squibb Company

- Bayer AG

- Pfizer Inc.

- Janssen Pharmaceuticals, Inc

- Novartis AG

- Lupin

- Merck & Co.

- AstraZeneca

- GLENMARK PHARMACEUTICALS LTD.

- Sanofi

- Gilead Sciences, Inc.

- Amgen Inc

- Baxter

Recent Developments

- In January 2023, Lupin Pharmaceuticals, one of the prominent players in drug discovery, introduced the generic version of a combination drug in India. This move followed the patent expiration of Novartis’ blockbuster heart medication, Sacubitril and Valsartan. The generic drug is to be marketed under two brands, namely, Arnipin and Valentas, specifically indicated for people with Heart Failure (HF).

- In January 2023, Glenmark Pharmaceuticals, another leading global pharmaceutical company, launched prescription-only tablets containing sacubitril + valsartan in India. These tablets, sold under the brand ‘Sacu V,’ are intended for the treatment of HF.

Report Scope

Report Features Description Market Value (2023) USD 143.3 billion Forecast Revenue (2033) USD 203.6 billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Asnticoagulants, Antihypertensive, Antihyperlipidemic, Antiplatelet Drugs, and Others), By Disease Indication (Hypertension, Coronary Artery Disease, Hyperlipidaemia, Arrhythmia, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Bristol-Myers Squibb Company, Bayer AG, Pfizer Inc., Janssen Pharmaceuticals, Inc, Novartis AG, Lupin, Merck & Co., AstraZeneca , GLENMARK PHARMACEUTICALS LTD., Sanofi , Gilead Sciences, Inc., Amgen Inc, and Baxter. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Drugs MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Drugs MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bristol-Myers Squibb Company

- Bayer AG

- Pfizer Inc.

- Janssen Pharmaceuticals, Inc

- Novartis AG

- Lupin

- Merck & Co.

- AstraZeneca

- GLENMARK PHARMACEUTICALS LTD.

- Sanofi

- Gilead Sciences, Inc.

- Amgen Inc

- Baxter