Global Carbolic Oil Market Size, Share, And Industry Analysis Report By Product (Analysis Level, Industrial Grade), By Application (Pyridine Bases, Extraction Of Phenol, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170247

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

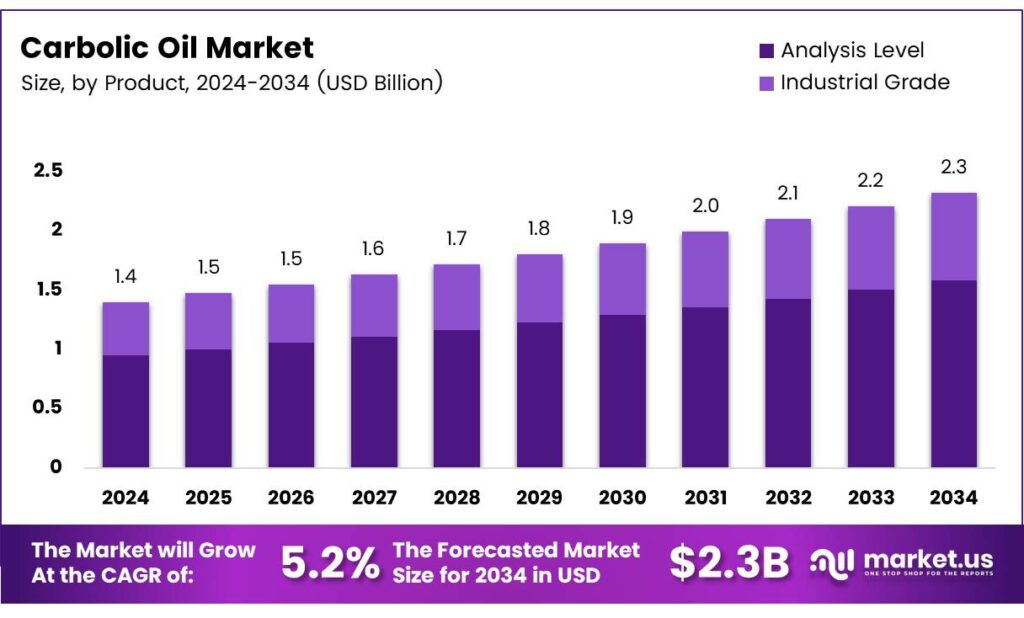

The Global Carbolic Oil Market size is expected to be worth around USD 2.3 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Carbolic oil, commonly known as crude phenol oil, is a phenolic mixture obtained from coal tar distillation or biomass-based thermal conversion. It functions as a feedstock for phenol derivatives rather than a finished chemical. Therefore, the Carbolic Oil Market operates as an intermediate-driven market closely linked to industrial chemical consumption cycles.

The Carbolic Oil Market represents steady, utility-focused demand instead of speculative growth. It serves disinfectants, resins, intermediates, and specialty chemical synthesis. As industries prioritize cost efficiency, carbolic oil remains relevant where high-purity phenol is economically restrictive, thereby supporting recurring transactional demand in regional chemical hubs.

- The same studies report phenol production from palm kernel shell peaked at 500 °C, while other phenolic compounds showed maximum yields at 400 °C. Including phenol, H-type phenolic compounds dominated outputs from both feedstocks, while C-type phenolics appeared prominently in lignin bio-oil, indicating a broader application scope.

India maintains a concentrated phenol base. According to the Indian Chemical Council and Department of Chemicals and Petrochemicals, the Indian synthetic phenol industry has approximately 60,000 TPA installed capacity across two operational units, largely dependent on the cumene oxidation process for downstream carbolic oil-linked supply.

Regulatory oversight remains critical due to handling risks. As noted by the U.S. CDC and Indian safety datasheets, phenol appears colorless when pure but turns pink or red otherwise, is combustible, and has a flash point of 175 °F. Vapors are heavier than air, necessitating controlled storage and compliance-driven investments.

Key Takeaways

- The Global Carbolic Oil Market is projected to grow from USD 1.4 billion in 2024 to USD 2.3 billion by 2034, registering a 5.2% CAGR during 2025–2034.

- Analysis Level dominates the market with a share of 59.1%, driven by its consistent performance in regulated industrial processes.

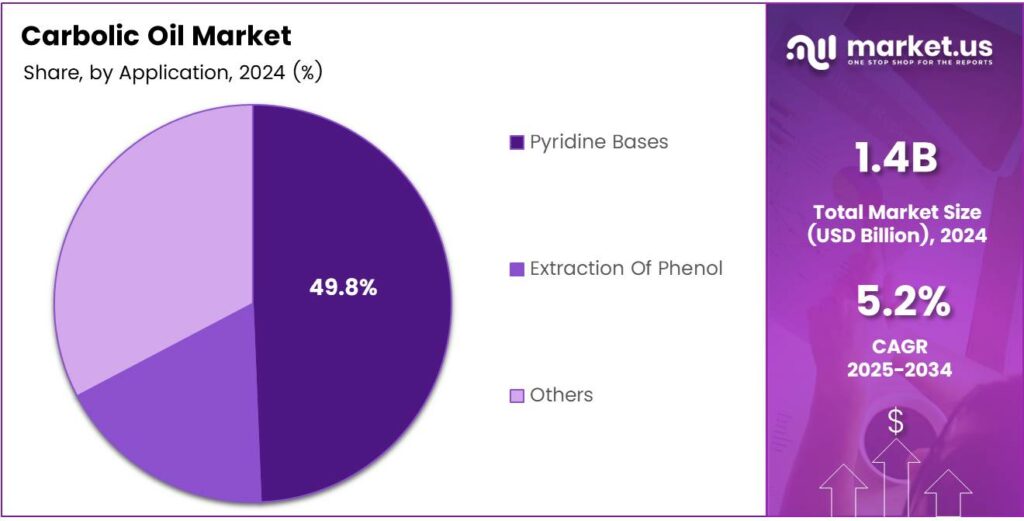

- Pyridine Bases lead consumption with a market share of 49.8%, supported by strong demand from agrochemical and pharmaceutical synthesis.

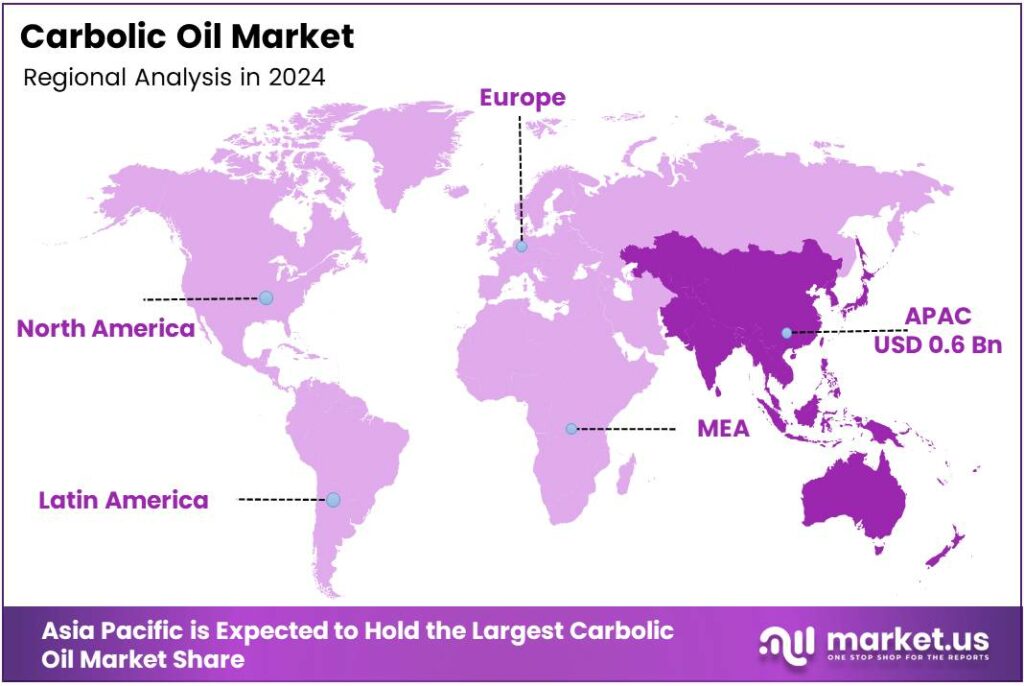

- Asia Pacific is the largest regional market, accounting for 45.9% of global demand and valued at USD 0.6 billion in 2024.

By Product Analysis

Analysis Level dominates with 59.1% due to its consistent use across standardized industrial processes.

In 2024, Analysis Level held a dominant market position in the By Product analysis segment of the Carbolic Oil Market, with a 59.1% share. This dominance is supported by its suitability for controlled chemical processing, testing environments, and regulated applications. Moreover, stable composition improves reliability, therefore supporting steady demand across laboratories and process-driven industries.

In contrast, Industrial Grade carbolic oil serves broader commercial operations where purity tolerance is flexible. It is commonly used in bulk phenol recovery, intermediate chemical production, and downstream synthesis. Although it holds a smaller share, growing industrial output and capacity expansions are gradually improving its relevance within cost-sensitive manufacturing environments.

By Application Analysis

Pyridine Bases dominate with 49.8% driven by its critical role in chemical synthesis pathways.

In 2024, Pyridine Bases held a dominant market position in the By Application analysis segment of the Carbolic Oil Market, with a 49.8% share. This leadership is driven by strong demand from agrochemicals and pharmaceuticals. Carbolic oil remains essential for producing pyridine intermediates, therefore maintaining consistent industrial consumption.

The Extraction of Phenol application continues to play a supporting role, as carbolic oil acts as a valuable feedstock for phenolic compound recovery. Increasing emphasis on resource efficiency encourages refiners to maximize phenol yield. Consequently, extraction processes remain relevant in integrated chemical and coke-oven operations.

The Others segment includes niche applications such as disinfectants, preservatives, and specialty formulations. Although smaller in scale, this segment benefits from diversified end uses. Gradual expansion of specialty chemical manufacturing, therefore, sustains steady, application-specific demand without disrupting overall market structure.

Key Market Segments

By Product

- Analysis Level

- Industrial Grade

By Application

- Pyridine Bases

- Extraction Of Phenol

- Others

Emerging Trends

Shift Toward Cleaner Processing Technologies Shapes Market Trends

A key trend in the carbolic oil market is the adoption of cleaner and safer processing technologies. Producers are focusing on closed-loop systems to reduce worker exposure and environmental release of phenolic vapors. This improves safety while meeting regulatory requirements.

- The American Chemistry Council reports that U.S. chemical production related to construction materials grew by around 4%, reflecting ongoing demand for phenolic inputs. Carbolic oil continues to serve as a low-cost phenol source for downstream processing in several regions.

Another trend is better integration with downstream chemical units. Instead of selling raw carbolic oil, many producers are converting it into phenol, cresols, and resins within the same facility. This increases value addition and reduces dependence on volatile raw material pricing.

Drivers

Rising Demand for Phenol-Based Chemicals Drives Market Growth

The carbolic oil market is mainly driven by its strong link with phenol and phenolic derivatives. Carbolic oil is a key raw material for producing phenol, which is widely used in resins, plastics, laminates, and insulation materials. As the construction, automotive, and electrical industries grow, the need for phenol-based products also increases, supporting steady demand for carbolic oil.

- The U.S. Infrastructure Investment and Jobs Act commits USD 1.2 trillion toward transport, housing, and energy upgrades, all of which consume phenol-based materials. This long-term investment pipeline keeps carbolic oil relevant despite gradual shifts in feedstock preferences.

Another important driver is the expansion of steel, aluminum, and metallurgical industries. Carbolic oil is used in carbon products, refractories, and binders required in metal processing. Many developing economies continue to invest in infrastructure and industrial capacity, which indirectly boosts the consumption of crude oil.

Restraints

Environmental and Health Regulations Limit Market Expansion

One of the major restraints in the carbolic oil market is strict environmental regulation. Carbolic oil contains toxic and hazardous components that can harm human health if not handled properly. Governments across many regions enforce tight controls on storage, transport, and disposal, which increases compliance costs for manufacturers.

- Exposure to phenolic compounds can cause skin, eye, and respiratory problems. Companies must invest in protective equipment, training, and safety systems, raising operational expenses and limiting small-scale participation. According to the International Energy Agency, global bioenergy supply reached about 55 EJ.

Environmental pressure to reduce coal-based products also affects the market. Since carbolic oil is derived from coal tar, it faces competition from cleaner and bio-based alternatives. Sustainability policies encourage industries to shift away from coal-derived chemicals, slowing long-term demand growth.

Growth Factors

Growth in Specialty Chemicals Creates New Market Opportunities

The carbolic oil market has strong growth opportunities in specialty and value-added chemicals. By improving refining and separation processes, manufacturers can extract higher-purity phenols and cresols, which are used in pharmaceuticals, agrochemicals, and high-performance resins.

Emerging economies present another major opportunity. Rapid industrialization in Asia and parts of Latin America is increasing demand for construction materials, coatings, and insulation products. These sectors rely heavily on phenolic compounds derived from carbolic oil.

There is also potential in circular economy models. Integrated coal chemical complexes can improve efficiency by converting by-products like carbolic oil into useful intermediates instead of treating them as low-value outputs. This improves overall plant economics.

Regional Analysis

Asia Pacific Dominates the Carbolic Oil Market with a Market Share of 45.9%, Valued at USD 0.6 Billion

Asia Pacific leads the global carbolic oil market due to strong industrial activity across chemicals, agro-processing, and downstream manufacturing sectors. In 2024, the region accounted for 45.9% of total demand, reaching a market value of USD 0.6 billion. Growing phenol consumption, expanding refining capacity, and cost-efficient raw material availability continue to support steady regional growth.

North America represents a mature but stable market for carbolic oil, supported by consistent demand from chemical processing and industrial applications. Regulatory focus on controlled handling and waste treatment shapes production practices in the region. Technological upgrades and process efficiency improvements help maintain steady consumption levels across key end-use sectors.

The European carbolic oil market is influenced by strict environmental regulations and a strong shift toward sustainable chemical processing. Demand remains moderate, supported by specialty chemical manufacturing and recovery-based phenol production. Compliance-driven operational costs slightly limit volume growth, but quality-focused applications sustain regional relevance.

The U.S. carbolic oil market is shaped by advanced chemical manufacturing standards and strict safety regulations. Demand is largely replacement-driven, supported by maintenance of existing industrial systems rather than new capacity additions. Process optimization and compliance investments continue to define market dynamics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NalonChem continues to hold a strategically important position in the global carbolic oil market by focusing on a stable supply for downstream chemical processing. In 2024, the company’s strength lies in operational consistency and long-term industrial relationships. Its approach emphasizes process reliability, which supports steady demand from phenol-derived applications despite market volatility.

Jining Carbon Group plays a critical role in meeting regional demand through integrated carbon and chemical operations. The company benefits from proximity to raw materials and industrial clusters, enabling cost control and volume flexibility. In 2024, its market relevance is supported by rising domestic consumption and gradual expansion into export-oriented supply chains.

Elkem ASA brings strong technical expertise and process discipline to the carbolic oil market, supported by its broader materials and industrial chemistry portfolio. The company’s focus on efficiency, environmental compliance, and controlled by-product recovery enhances product consistency. In 2024, Elkem’s position reflects demand from regulated industries seeking dependable quality standards.

Industrial Química del Nalón remains a well-established player with deep experience in coal tar–derived chemical products, including carbolic oil. Its strength lies in specialization and long-standing production know-how. In 2024, the company continues to benefit from niche industrial demand and its ability to serve applications requiring specific compositional characteristics.

Top Key Players in the Market

- NalonChem

- Jining Carbon Group

- Elkem ASA

- Industrial Química del Nalón

- Chinagtchem

- Rain Industries Limited

- DEZA

- Nippon Steel and Sumikin Chemical

- Koppers

Recent Developments

- In 2024, NalonChem, a Spanish carbochemical company specializing in coal tar distillation, pitch, and naphthalene production, has focused its recent activities on sustainability, innovation, and educational partnerships.

- In 2024, Jining Carbon Group, a Chinese high-tech enterprise specializing in carbon anodes and coal tar processing, showed limited publicly available recent developments specifically tied to carbolic oil or carbon products. Broader searches yielded no substantive announcements from government sites or major outlets.

Report Scope

Report Features Description Market Value (2024) USD 1.4 billion Forecast Revenue (2034) USD 2.3 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Analysis Level, Industrial Grade), By Application (Pyridine Bases, Extraction Of Phenol, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape NalonChem, Jining Carbon Group, Elkem ASA, Industrial Química del Nalón, Chinagtchem, Rain Industries Limited, DEZA, Nippon Steel and Sumikin Chemical, Koppers Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- NalonChem

- Jining Carbon Group

- Elkem ASA

- Industrial Química del Nalón

- Chinagtchem

- Rain Industries Limited

- DEZA

- Nippon Steel and Sumikin Chemical

- Koppers