Global Canned Pineapple Market Size, Share, And Business Benefits By Product (Whole Pineapple, Slices, Chunks, Crushed Pineapple, Pineapple Juice, Others), By Application (Beverages and Drinks, Bakery and Snacks, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158913

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

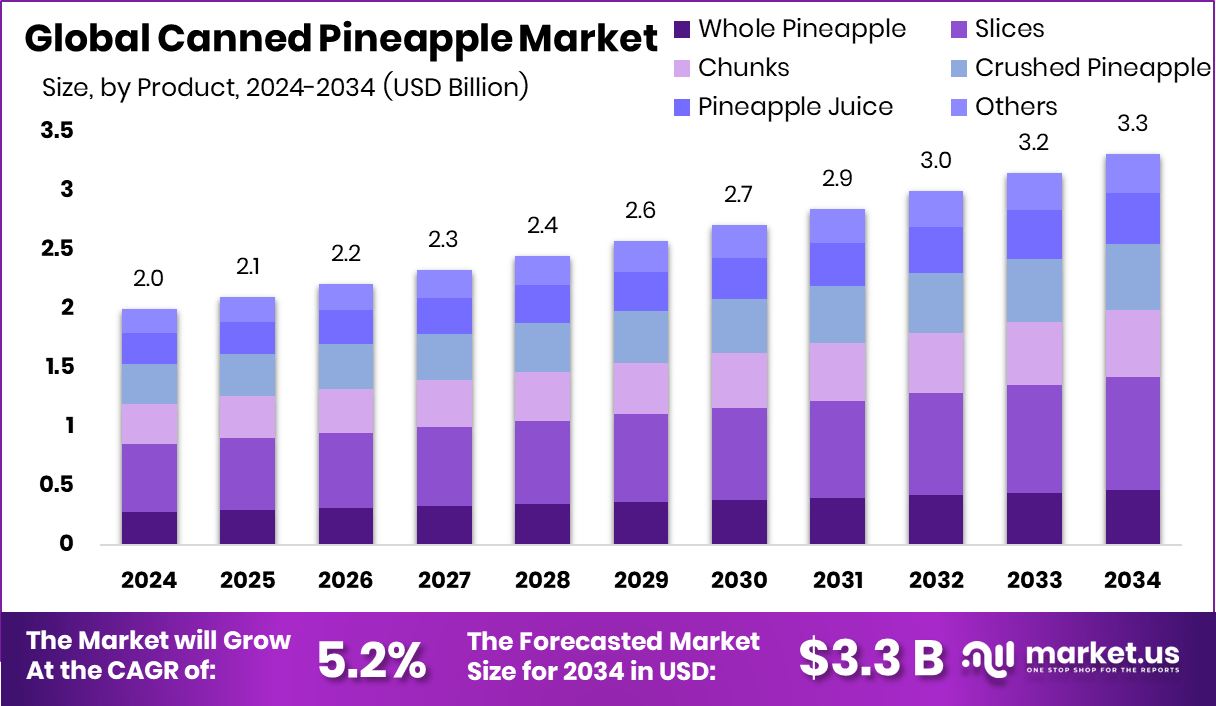

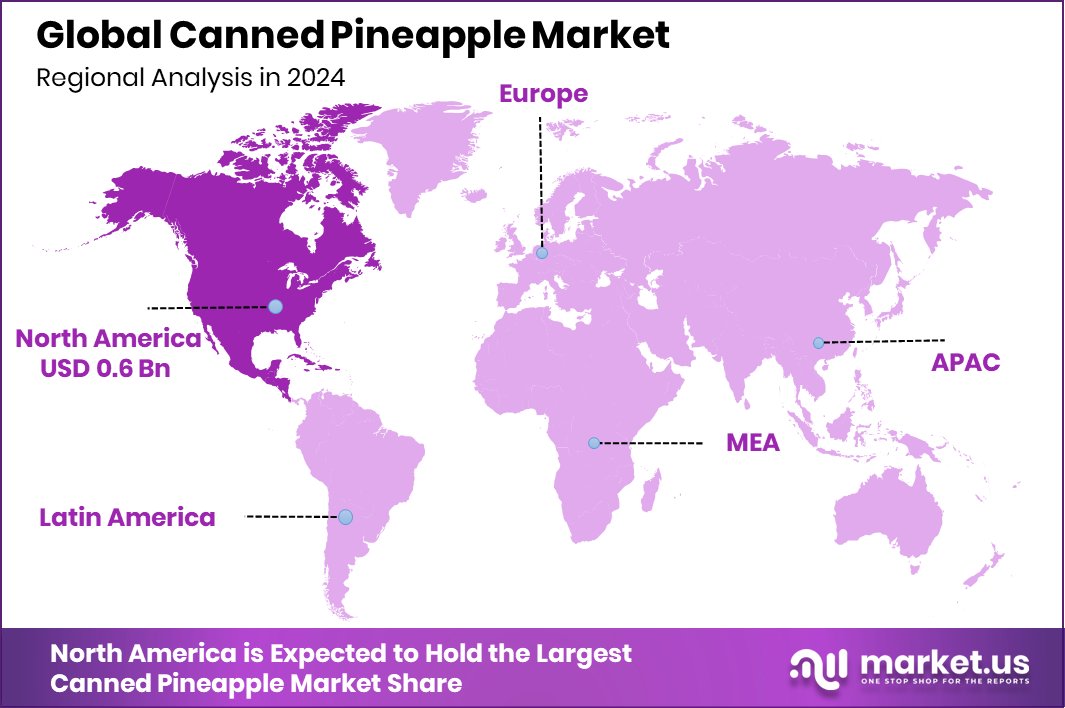

The Global Canned Pineapple Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. North America accounted for 32.40% of the market, with canned pineapple sales totaling USD 0.6 Bn.

Canned pineapple is a preserved fruit product made by slicing, crushing, or chunking fresh pineapples and packing them in juice or syrup before sealing in airtight cans. This process allows the fruit to maintain its flavor, nutrients, and texture for a longer shelf life, making it convenient for year-round consumption. It is widely used in households, restaurants, bakeries, and the beverage industry for its sweet taste and versatility.

The canned pineapple market refers to the global trade and consumption of these preserved fruit products. The market is shaped by rising consumer demand for ready-to-eat foods, changing lifestyles, and the expansion of processed food distribution channels. Growth is also driven by increasing awareness of pineapple’s health benefits, as it is rich in vitamin C, antioxidants, and digestive enzymes.

One major growth factor is convenience. With urban populations leading busier lives, demand for quick and nutritious food options is growing. Canned pineapple provides an easy solution without compromising taste or health, pushing demand upward in both domestic and export markets.

Opportunities are emerging in new product formats and healthier packaging. For example, reducing added sugar content and offering fruit packed in natural juice appeals to health-conscious buyers. Meanwhile, shifts in funding patterns highlight both challenges and openings—while a canned fruit and vegetable company in business for 139 years recently filed for bankruptcy, a canned seafood startup raised $4M in seed funding, showing investor appetite for innovation in preserved foods. Additionally, small initiatives like Pitt receiving $60,000 in PA Hunger-Free Campus grant funding point to growing institutional support for affordable and accessible food solutions, indirectly benefiting the canned pineapple segment.

Key Takeaways

- The Global Canned Pineapple Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- By Product, slices dominated the canned pineapple market in 2024, holding a strong 28.9% global share.

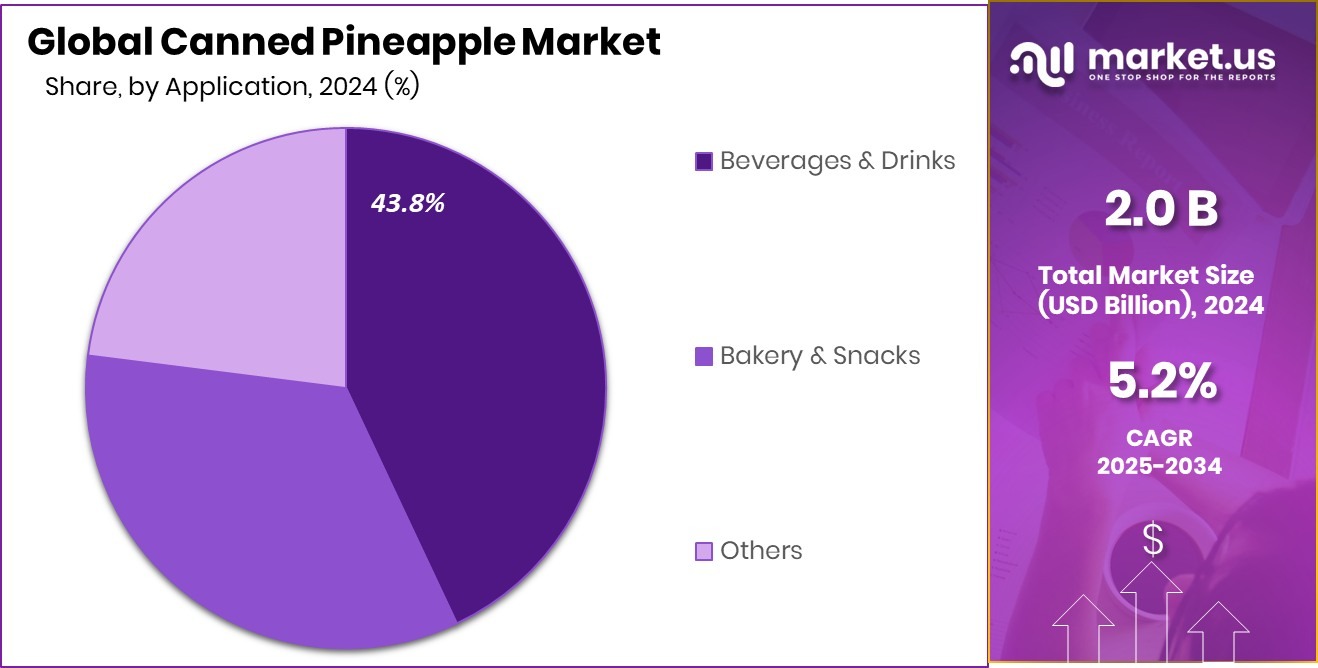

- By application, beverages and drinks accounted for the largest demand in 2024, capturing 43.8% of the market share.

- By distribution channel, hypermarkets and supermarkets led sales in 2024, representing 48.4% of overall market revenue.

- The canned pineapple market in North America reached USD 0.6 Bn, capturing 32.40% share.

By Product Analysis

As a byproduct, canned pineapple slices dominate the market with a 28.9% share.

In 2024, Slices held a dominant market position in the By Product segment of the Canned Pineapple Market, with a 28.9% share. The preference for sliced canned pineapple is largely driven by its versatility and convenience for both household and commercial use. Consumers favor slices for direct consumption, desserts, baking, and culinary preparations, as they require minimal effort compared to whole or crushed forms.

The steady availability of high-quality slices in juice or syrup further enhances their appeal, ensuring consistent taste and texture. This format also benefits retailers and foodservice providers due to easy portioning and attractive presentation. Overall, the Slices segment continues to outperform others, reflecting strong consumer preference and consistent market demand.

By Application Analysis

By application, the beverages and drinks segment leads the canned pineapple market at 43.8%.

In 2024, Beverages and Drinks held a dominant market position in the By Application segment of the Canned Pineapple Market, with a 43.8% share. The strong demand is driven by the increasing use of canned pineapple in juices, smoothies, cocktails, and ready-to-drink beverages, where its natural sweetness and tropical flavor enhance taste and nutritional value.

Beverage manufacturers favor canned pineapple for its consistency, year-round availability, and ease of processing, which allows for efficient production of flavored drinks. Consumers are increasingly seeking refreshing, healthy, and convenient drink options, further boosting this segment. The popularity of pineapple-based beverages in cafes, restaurants, and retail outlets has solidified its position as the leading application within the canned pineapple market.

By Distribution Channel Analysis

By distribution channel, hypermarkets and supermarkets capture 48.4% of canned pineapple sales.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Canned Pineapple Market, with a 48.4% share. The prominence of these channels is driven by their wide product availability, competitive pricing, and convenience for shoppers seeking quality canned pineapple.

Hypermarkets and supermarkets offer organized shelving, attractive packaging, and promotional deals, making it easier for consumers to select and purchase products in bulk or for regular use. The growing trend of one-stop shopping and increased footfall in modern retail outlets further support sales through these channels. This distribution dominance ensures that canned pineapple reaches a broad customer base efficiently, reinforcing its accessibility and sustaining market growth.

Key Market Segments

By Product

- Whole Pineapple

- Slices

- Chunks

- Crushed Pineapple

- Pineapple Juice

- Others

By Application

- Beverages and Drinks

- Bakery and Snacks

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Health Consciousness Drives Canned Pineapple Demand

In 2024, the surge in health awareness significantly boosted the demand for canned pineapple. As consumers increasingly prioritize nutrition, the fruit’s rich vitamin C content, antioxidants, and digestive enzymes have become appealing attributes. Canned pineapple offers a convenient way to incorporate these health benefits into daily diets, especially for those seeking quick, nutritious options. This trend aligns with the broader shift towards functional foods that support immunity, digestion, and overall wellness. The convenience of canned pineapple, combined with its health benefits, positions it as a preferred choice for health-conscious consumers, thereby driving its market growth.

The food and beverage sector experienced notable investment activities in 2024. For instance, Zepto, an Indian grocery startup, secured $665 million in a recent funding round, escalating its valuation to $3.6 billion. Similarly, Gladful, a clean-label food brand emphasizing children’s nutrition, raised Rs 8 crore in a fresh funding round. These investments highlight the growing investor confidence in the food and beverage industry, particularly in startups that focus on health-conscious and convenient food options, aligning with the rising demand for nutritious products like canned pineapple.

Restraining Factors

High Sugar Content Limits Canned Pineapple Demand

One of the main restraining factors for the canned pineapple market is the high sugar content found in many canned varieties. Pineapple is often packed in syrup to enhance sweetness, which increases calorie levels and may discourage health-conscious consumers. Rising concerns about obesity, diabetes, and other sugar-related health issues make some buyers prefer fresh fruit or products with no added sugar.

Additionally, processed canned products sometimes face criticism for losing certain nutrients during preservation, which can further reduce consumer appeal. While canned pineapple is convenient, the perception of high sugar content acts as a barrier for wider adoption, particularly among parents, fitness enthusiasts, and individuals seeking low-calorie diets. This factor slightly slows overall market growth despite the fruit’s popularity.

Growth Opportunity

Rising Demand for Ready-to-Eat Pineapple Products

A significant growth opportunity in the canned pineapple market lies in the rising demand for ready-to-eat fruit products. Modern consumers are increasingly looking for convenient, nutritious options that save preparation time while maintaining taste and health benefits. Canned pineapple, available in slices, chunks, or crushed forms, fits perfectly into this trend, making it ideal for quick meals, desserts, snacks, and beverages.

Manufacturers can capitalize on this by offering innovative packaging, natural juice options, or no-added-sugar variants to attract health-conscious buyers. The growth of urban lifestyles, busy work schedules, and increasing snacking habits provides a fertile market for ready-to-eat canned pineapple products. By targeting convenience-oriented consumers, the market can expand steadily in both domestic and international segments.

Latest Trends

Exotic Fruit Blends Gain Popularity in 2024

In 2024, the canned pineapple market witnessed a notable trend toward exotic fruit blends. Consumers are increasingly seeking unique and diverse flavors, prompting manufacturers to combine pineapples with other tropical fruits like mangoes, lychees, and guavas. These blends offer a novel taste experience and cater to adventurous palates.

The appeal lies in the fusion of familiar and unfamiliar flavors, providing a refreshing alternative to traditional fruit options. This trend aligns with the broader movement towards culinary innovation and global flavor exploration. As a result, canned pineapple products featuring exotic fruit combinations are gaining traction in both retail and foodservice sectors, reflecting a shift towards more diverse and exciting offerings in the market.

Regional Analysis

In 2024, North America held 32.40% of the canned pineapple market, valued at USD 0.6 Bn.

In 2024, the global canned pineapple market is witnessing steady growth across all regions, driven by rising demand for convenient fruit products and increasing consumer preference for ready-to-eat tropical fruits.

North America emerges as the dominating region, capturing a significant 32.40% share, valued at USD 0.6 billion, owing to high consumption in both retail and foodservice sectors. The region benefits from well-established distribution networks, modern retail penetration, and growing demand for canned fruit in beverages, desserts, and ready-to-eat meals.

In Europe, demand is steadily increasing due to rising health consciousness and the popularity of tropical fruits in confectionery and food processing industries, supported by countries like Germany, the UK, and France, leading consumption. The Asia Pacific market is expanding rapidly, fueled by increasing urbanization, disposable income growth, and strong adoption in emerging economies such as China, India, and Japan, where processed fruit consumption is rising alongside traditional fresh fruit consumption.

The Middle East & Africa market shows moderate growth, driven by retail expansion and changing dietary habits in the UAE, Saudi Arabia, and South Africa. Latin America benefits from local production and export capabilities, particularly from countries like Costa Rica and Brazil, supporting both domestic consumption and international trade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dole plc, a global leader in the fruit and vegetable industry, continues to dominate the canned pineapple segment. With operations in over 90 countries and a commitment to quality, innovation, and sustainability, Dole ensures a consistent supply of high-grade canned pineapples. Their products, including pineapple chunks and slices in 100% juice, are rich in Vitamin C, non-GMO, and gluten-free, catering to health-conscious consumers. Dole’s extensive distribution network and strong brand presence reinforce its leadership position in the market.

Golden Circle, an Australian subsidiary of Kraft Heinz, has significantly expanded its canned pineapple production. The Northgate cannery now produces over 150,000 tonnes per year of canned pineapple, fruit juices, and cordials. This substantial increase from its initial capacity of 40,000 tonnes underscores the company’s commitment to meeting domestic and international demand. Golden Circle’s focus on local sourcing and sustainable practices further enhances its market appeal.

Pineapple India specializes in manufacturing high-quality canned pineapple products, including whole slices and broken slices packed in natural juice or light sugar syrup. Sourced from the fertile regions of Northeast India, their pineapples are known for their superior taste and quality. The company’s emphasis on quality control and adherence to international standards positions it as a reliable supplier in the global market.

Top Key Players in the Market

- Dole

- Kraft Heinz

- Pineapple India

- V&K Pineapple Canning

- Siam Pineapple

- Winzintl

- Annie’s Farm Company

- Goya Foods

- Tropicana Products

- Del Monte Foods

Recent Developments

- In September 2024, Tropicana introduced the Refreshers line, a collection of juice drinks made with real fruit juice and no artificial sweeteners. This line includes flavors such as Pineapple Mango, aiming to provide consumers with a refreshing and natural beverage option.

- In August 2024, India and Indonesia applied for permission to export de-crowned fresh pineapples to Australia, prompting a biosecurity risk assessment by the Australian Department of Agriculture, Fisheries, and Forestry. If approved, this could open new export avenues for Indian pineapple producers.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Whole Pineapple, Slices, Chunks, Crushed Pineapple, Pineapple Juice, Others), By Application (Beverages and Drinks, Bakery and Snacks, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dole, Kraft Heinz, Pineapple India, V&K Pineapple Canning, Siam Pineapple, Winzintl, Annie’s Farm Company, Goya Foods, Tropicana Products, Del Monte Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Canned Pineapple MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Canned Pineapple MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dole

- Kraft Heinz

- Pineapple India

- V&K Pineapple Canning

- Siam Pineapple

- Winzintl

- Annie’s Farm Company

- Goya Foods

- Tropicana Products

- Del Monte Foods