Global Fruit and Vegetable Juice Market By Product Type(Fruit & Vegetable Blend, Fruit Juices, Vegetable Juices), By Type(Regular Juice, Low-Sugar, Fortified), By Distribution Channel(Convenience Stores, Supermarkets/Hypermarkets, Online, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 48934

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

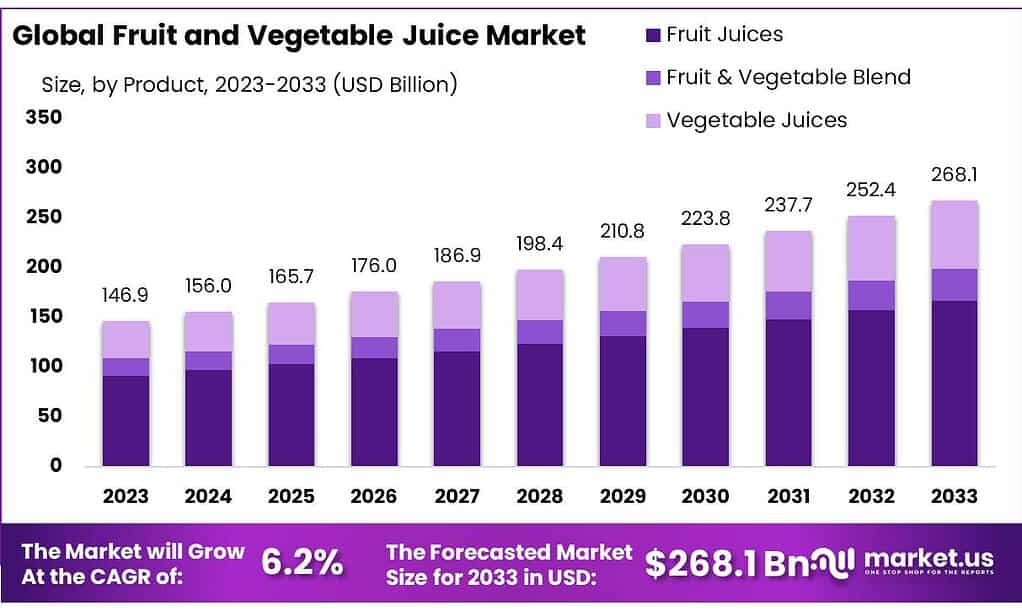

The Fruit and Vegetable Juice Market size is expected to be worth around USD 268.1 billion by 2033, from USD 146.9 Bn in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

The Fruit and Vegetable Juice Market refers to the global industry involved in the production, distribution, and consumption of liquid extracts derived from fruits and vegetables.

These juices are extracted through various methods, including pressing, squeezing, or mechanically processing fresh fruits and vegetables, resulting in beverages that retain the natural flavors, colors, and nutritional components of the raw produce.

Key Takeaways

- Market Growth: The Fruit and Vegetable Juice Market is set to reach USD 268.1 billion by 2033, growing at a CAGR of 6.2% from its 2023 value of USD 146.9 billion.

- Fruit Juice Dominance: In 2023, Fruit Juices claimed a notable 62.3% market share, emphasizing natural sweetness and nutrition, with Orange and Apple Juice leading the way.

- Juice Diversity: Vegetable Juices, including carrot and tomato, and Blended Juices, combining fruits and vegetables, offer diverse nutrient profiles and flavors.

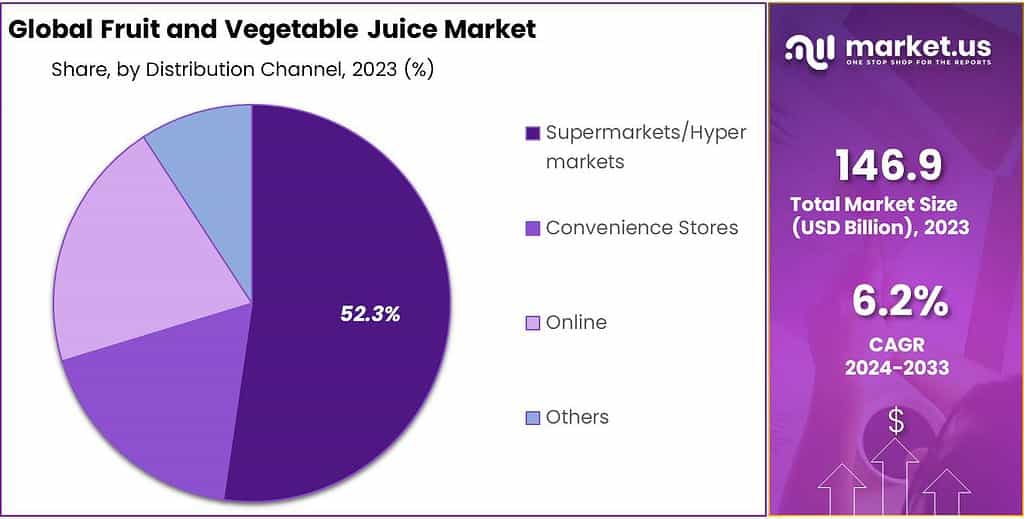

- Retail Prowess: Supermarkets/Hypermarkets dominated distribution channels with over 52.3% market share in 2023, providing a wide selection and convenient shopping.

- Consumer Preferences: Regular Juice led with 53% market share, while Low-Sugar Juices attracted health-conscious consumers. Fortified Juices with added nutrients exhibited steady growth.

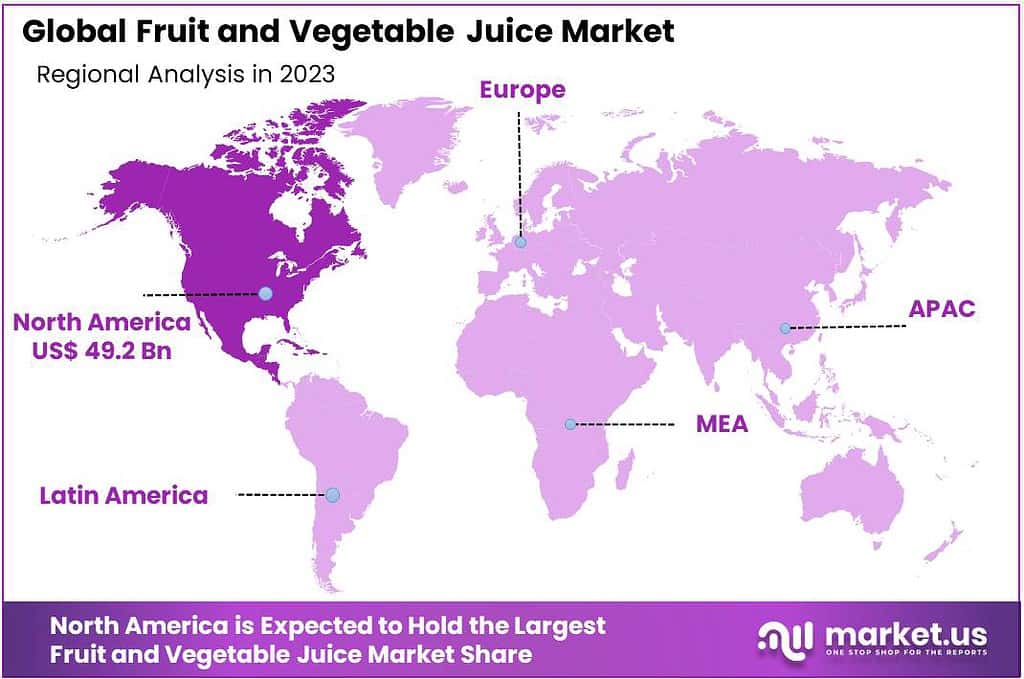

- Regional Dynamics: North America held a dominant 33.5% revenue share in 2023, with Asia Pacific emerging as the fastest-growing region, driven by a large consumer base and increasing disposable income.

Product Type Analysis

In 2023, the Fruit Juice segment maintained a prominent market position, securing over 62.3% share in the Fruit and Vegetable Juice Market. Fruit juices, revered for their natural sweetness and nutritional content, enjoyed widespread consumer preference due to their refreshing taste and health benefits.

Fruit Juices, such as Orange Juice or Apple Juice can be extracted by pressing or squeezing, while Grape Juice and Mixed Fruit Juice are commonly enjoyed beverages made by extracting fruits through various methods like pressing or squeezing. They can be classified based on which fruits were used as the source for their production – Orange, Apple, or Grape-based beverages are popularly popular options that offer natural sweetness with vitamin richness; making for refreshing yet nutritious beverages to quench thirst!

Vegetable Juices, these beverages made primarily from vegetables are known for their high nutrient content of vitamins, minerals, and antioxidants – thus providing numerous health benefits when taken regularly as part of an attempt to increase vegetable consumption. Common variants include carrot juice, beetroot juice, tomato juice, or mixed vegetable drinks.

Vegetable juices have long been associated with improving overall health; people seeking to increase vegetable consumption often consume these beverages to increase vegetable consumption. Blended Juices, Or Mixed Juices: Blends are combinations of fruits and/or vegetables designed to offer a diverse nutrient profile and unique flavor combinations, for instance, apple, carrot, and ginger combined create an appealing, nutritious juice blend that brings together their benefits into one tasty beverage.

Freshly Pressed or Cold-Pressed Juices are made by pressing fruits or vegetables without heat extraction methods to preserve more nutrients and flavors than conventional methods of juicing. Cold-pressed juices often boast higher nutritional values due to reduced exposure to heat and air during their extraction. Each type of juice offers its distinctive taste, nutritional profile, and health benefits – providing choices tailored specifically to consumer preferences and dietary requirements.

By Type

In 2023, Grid and Regular Juice held a dominant market position, capturing more than a 53% share. Regular Juice, known for its authentic fruit and vegetable flavors, led the market with widespread consumer appeal. These juices retained their natural sweetness without additional sugar, aligning with the preference for classic, full-flavored options.

Low-sugar juices carved a niche, appealing to health-conscious consumers. With reduced sugar content, they met the demand for beverages that balance taste and nutritional considerations. This segment gained traction as more consumers sought healthier alternatives without compromising on flavor.

Fortified Juices, enriched with added nutrients, experienced steady growth. Positioned as functional beverages, they attracted consumers looking for additional health benefits. Fortified juices offered vitamins, minerals, or other supplements, aligning with the growing interest in beverages that contribute to overall well-being.

As consumer preferences diversified, the Fruit and Vegetable Juice Market adapted to provide a spectrum of choices, balancing traditional favorites with options tailored to specific dietary needs and health-conscious trends.

Distribution Channel Analysis

In 2023, the Fruit and Vegetable Juice Market witnessed a significant stronghold by Supermarkets/ Hypermarkets, capturing a dominant share of more than 52.3%. These expansive retail spaces offered a vast selection of juice varieties, drawing customers with their convenient shopping experience and large product offerings.

Shoppers especially enjoyed visiting these outlets due to the easy one-stop shopping experience and access to various brands and flavors under one roof. Convenience Stores also emerged as key contributors to the market, though with a lesser share. These outlets played an invaluable role in meeting immediate consumer needs by providing quick access to fruit and vegetable juices for individuals on the go or making spontaneous purchases.

The Online distribution channel showed promising growth, leveraging the increasing trend of digital shopping. Online platforms provided a convenient avenue for consumers to explore a vast range of juice options, facilitating easy comparison and purchase from the comfort of their homes. This rise in e-commerce allowed for greater accessibility and choice, contributing steadily to the market landscape.

Other distribution channels, encompassing specialty stores or local markets, though holding a smaller market share, offered unique juice selections tailored to specific consumer preferences or regional demands. These channels served niche markets, appealing to consumers seeking particular varieties or artisanal options not readily available in mainstream retail spaces.

Key Market Segmentation

By Product Type

- Fruit & Vegetable Blend

- Fruit Juices

- Vegetable Juices

By Type

- Regular Juice

- Low-Sugar

- Fortified

By Distribution Channel

- Convenience Stores

- Supermarkets/Hypermarkets

- Online

- Other Distribution Channels

Drivers

Fruit and Vegetable Juice Market growth is driven by several key drivers. A major one is changing consumer preferences towards healthier beverage options; as more individuals prioritize wellness, demand for natural and nutritious beverages like fruit and vegetable juice continues to surge – fuelling its expansion as consumers seek vitamin-rich natural alternatives to carbonated and sugary drinks.

Innovation within the industry is also a driving force, with companies regularly creating innovative juice blends, flavors, and packaging formats to entice consumers. Combinations that suit various lifestyles attract wider consumer bases while stimulating market expansion.

Convenience plays an integral role in driving market demand for fruit and vegetable juice products. Their accessibility through various distribution channels such as supermarkets, convenience stores, and online platforms increases consumer awareness while their varied options fuel consumer interest – ultimately fuelling market expansion.

Effective marketing and promotional activities have an immense effect on consumer behavior. Advertisement campaigns highlighting the health benefits, nutritional values, and flavor profiles of fruit and vegetable juices play a vital role in shaping consumer preferences and creating awareness of these products as well as raising interest and demand in the market.

Restraints

Fruit and Vegetable Juice Market. Several factors are limiting its growth; among the primary concerns lies in its high sugar content – while natural, this has caused health-conscious customers to reduce their intake or search for lower-sugar alternatives, thus impacting demand. Price fluctuations of raw materials, particularly fruits and vegetables, present another formidable obstacle. Variations due to weather conditions, crop yield, or global supply chain disruptions can increase production costs significantly – leading to higher retail prices that impact consumer affordability and market demand.

The market also faces stiff competition from an array of alternative beverages, including flavored waters and functional drinks that offer consumers alternatives beyond fruit and vegetable juices. Such extensive competition can distort consumer preferences and limit market growth potential. Furthermore, fresh juice’s perishability presents significant challenges to its shelf life and distribution networks.

Ensuring freshness without compromising nutritional value or resorting to extensive processing is another difficult hurdle that lies in its path for industry players. Attaining strict regulations regarding labeling, quality standards and food safety presents manufacturers with additional challenges. Adherence to these standards while still fulfilling consumer satisfaction can be both time-consuming and financially burdensome, impacting both consumer choices and industry dynamics within the Fruit & Vegetable Juice Market.

Opportunities

Fruit and Vegetable Juice Market presents several opportunities for growth and innovation. Chief among them is consumer’s growing focus on health and wellness, creating a prime opportunity. As more individuals turn towards natural, nutrient-rich juices due to perceived health benefits, this presents an opening to expand market presence.

Innovation within product offerings represents another exciting opportunity. By creating new flavors, blends or functional formulations designed to address specific health needs or align with differing consumer preferences, companies can attract a wider range of customer segments while expanding market reach.

As consumer preferences shift towards healthier and more eco-friendly juice options, manufacturers offering organic or clean-label alternatives have an opportunity to capitalize on this burgeoning market segment. Convenience and portability in juice products present an opportunity for market expansion. Ready-to-drink formats and innovative packaging designs tailored towards busy lifestyles resonate well with consumers looking for convenience, expanding market potential.

Digital platforms and e-commerce offer another promising avenue. Establishing an impressive online presence and using effective digital marketing strategies to reach a wider consumer base – particularly tech-savvy customers that appreciate convenience – is a highly desirable goal that could drive innovation, expand market reach, meet evolving consumer needs in the Fruit and Vegetable Juice Market.

Challenges

Sustaining growth within the Fruit and Vegetable Juice Market requires successfully navigating its many challenges. Fluctuations in raw material costs and supply chain disruptions often present manufacturers with serious difficulties. Furthermore, seasonal variations and weather-induced volatility in prices for produce could significantly alter production costs as well as overall market stability.

Consumer education remains another challenge of fruit and vegetable juice products, despite their health advantages. Although their consumption offers numerous health advantages, concerns persist about the sugar content and additives present. Therefore, providing consumers with accurate information about nutritional values and authenticity remains key in helping dispel misconceptions.

Market competition also poses a unique set of difficulties. Given the variety of juice products on offer, standing out and maintaining consumer loyalty requires ongoing innovation, strong branding, and differentiation strategies to succeed in today’s crowded marketplace. Regulated food and beverage industries present unique challenges. Meeting regulatory standards regarding labeling, quality control, and health claims requires constant vigilance requiring significant resources and expertise.

Sustainable packaging poses unique challenges. Addressing issues related to wasteful packaging practices and environmental footprint requires innovative yet eco-friendly packaging solutions that cater to consumer preference for eco-friendly products. Conquering these challenges requires industry adaptability, innovation, and an unwavering commitment to meet evolving consumer expectations while adhering to quality standards and sustainable practices in the Fruit and Vegetable Juice Market.

Regional Analysis

North America held the highest revenue share at over 33.5% in 2023. High product demand for fruit juices has been a hallmark of the region. According to Food Navigator-USA’s 2021 article, sales of shelf-stable juices that are shelf-stable were up 20% and sales of fruit and vegetable juice made from natural products rose by 4.9%. The region’s fruit juice market will grow in the future due to the increasing consumption of juices as a staple breakfast item. Major players in the U.S. market are now introducing products that cater to health-conscious consumers.

Tim Hortons launched a line of fruit quenchers in Canada in 2021. It was available in watermelon, strawberry, and peach flavors. These initiatives will provide prominent growth opportunities for manufacturers in the beverage industry over the forecast period. The Asia Pacific is expected to be the fast-rising region market between 2023 to 2032.

These countries have a large consumer base, increasing disposable income, increased awareness, and health consciousness, as well as easy access to international brands. This has led to an increase in the consumption of these products, which is fueling industry growth.

Manufacturers are eager to tap into this segment by launching new products. Jijuan Beverages, a Shanghai-based firm, introduced a new Rainforest Not From-Concentrate (NFC), series of beverages that contains 100% pure juice with no added sugar content or preservatives. These new products are aimed at the largest consumers looking for healthier alternatives to carbonated energy drinks.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UNITED KINGDOM

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape

Local players from every region face fierce competition from major market players like The Coca-Cola Company, Dr. Pepper Snapple Group, Fresh Del Monte Produce Inc., Dr. Pepper Snapple Group Inc., Keurig Dr Pepper Inc., Citrus World Inc., Welch Food Inc., and others. Fruit juice Market fragmentation is caused by the existence of smaller-scale players selling their products at lower prices. Key players have the advantage of being well-established in their industry and having a tight grip on product life cycles.

These larger players can produce large-scale units easily and efficiently, giving them an advantage. Dole Sunshine India’s 100% natural pineapple juice was launched in 2021. The new beverage is made with natural pineapple and is enriched with vitamin A and other types of vitamins. There are no preservatives or added sugars.

Маrkеt Кеу Рlауеrѕ

- PepsiCo Inc.

- The Kraft Heinz Company

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Campbell Soup Company

- Del Monte Foods

- Nestle S.A.

- Welch Foods, Inc.

- Ocean Spray Cranberries, Inc.

- Dr. Pepper Snapple Group

- Reed’s, Inc.

- Fresh Del Monte Produce

- Citrus World Inc.

- Eckes-Granini Group

- Coca-Cola

Recent Developments

In July 2022, Tipco, a Thailand-based juice company, recently introduced an array of vegetable juice and herb-infused drinks in South East Asian and Middle Eastern markets. Herb-infused beverages offered include curcumin and fingerroot flavors.

In May 2022, Bidco recently unveiled their fruit juice called joOz Boost+ (plus), available in orange and lemon-lime flavors, after receiving approval by Kenya Bureau of Standards after conducting chemical and microbiological analyses.

Report Scope

Report Features Description Market Value (2022) USD 146.9 Bn Forecast Revenue (2032) USD 268.1 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Fruit & Vegetable Blend, Fruit Juices, Vegetable Juices), By Type(Regular Juice, Low-Sugar, Fortified), By Distribution Channel(Convenience Stores, Supermarkets/Hypermarkets, Online, Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PepsiCo Inc., The Kraft Heinz Company, Keurig Dr Pepper Inc., The Coca-Cola Company, Campbell Soup Company, Del Monte Foods, Nestle S.A., Welch Foods, Inc., Ocean Spray Cranberries, Inc., Dr. Pepper Snapple Group, Reed’s, Inc., Fresh Del Monte Produce, Citrus World Inc., Eckes-Granini Group, Coca-Cola Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Fruit and Vegetable Juice Market?Fruit and Vegetable Juice Market size is expected to be worth around USD 268.1 billion by 2033, from USD 146.9 Bn in 2023

What is the CAGR for the Fruit and Vegetable Juice Market?The Fruit and Vegetable Juice Market is expected to grow at a CAGR of 6.2% during 2023-2033.Who are the key players in the Fruit and Vegetable Juice Market?PepsiCo Inc., The Kraft Heinz Company, Keurig Dr Pepper Inc., The Coca-Cola Company, Campbell Soup Company, Del Monte Foods, Nestle S.A., Welch Foods, Inc., Ocean Spray Cranberries, Inc., Dr. Pepper Snapple Group, Reed's, Inc., Fresh Del Monte Produce, Citrus World Inc., Eckes-Granini Group, Coca-Cola

Fruit and Vegetable Juice MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Fruit and Vegetable Juice MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- PepsiCo Inc.

- The Kraft Heinz Company

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Campbell Soup Company

- Del Monte Foods

- Nestle S.A.

- Welch Foods, Inc.

- Ocean Spray Cranberries, Inc.

- Dr. Pepper Snapple Group

- Reed's, Inc.

- Fresh Del Monte Produce

- Citrus World Inc.

- Eckes-Granini Group

- Coca-Cola