Global Cancer Immunotherapy Market By Product Type (Monoclonal Antibodies, Immunomodulators, and Oncolytic Viral Therapies & Cancer Vaccines), By Application (Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Prostate Cancer, Head and Neck Cancer, Ovarian Cancer, Pancreatic Cancer, and Others), By End-User (Hospitals & Clinics, Cancer Research Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 67380

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

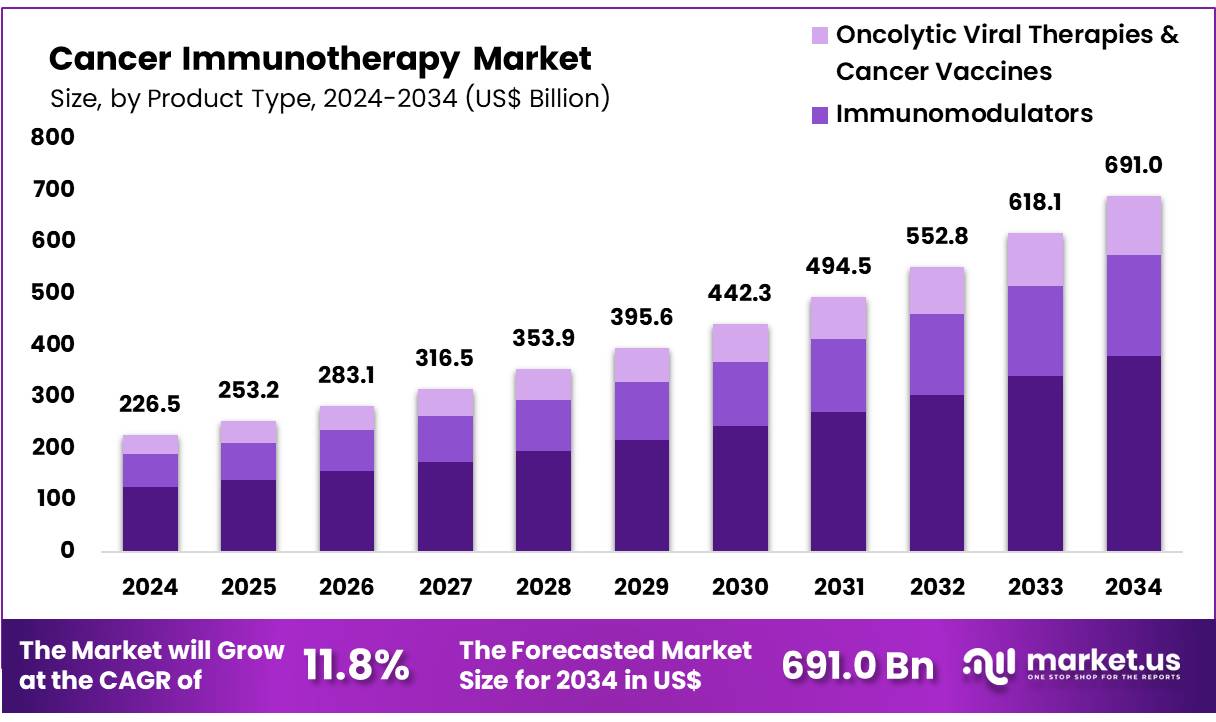

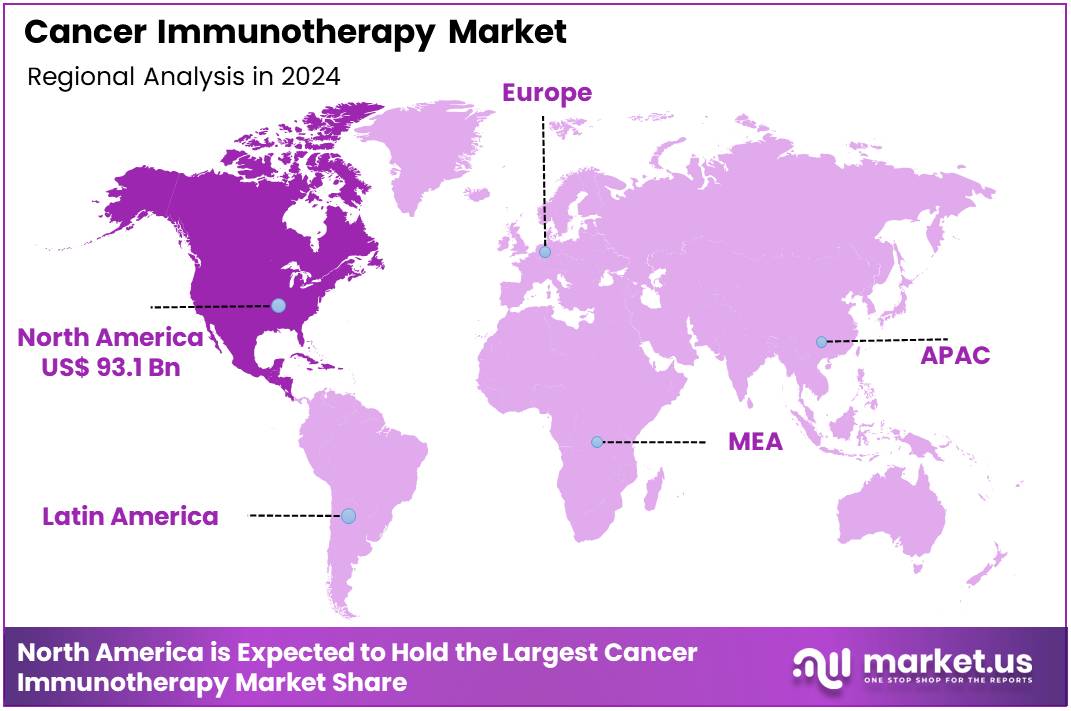

Global Cancer Immunotherapy Market size is expected to be worth around US$ 691.0 Billion by 2034 from US$ 226.5 Billion in 2024, growing at a CAGR of 11.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 93.1 Billion.

Rising prevalence of cancer and the growing demand for more effective, targeted therapies are driving the expansion of the cancer immunotherapy market. Immunotherapy has revolutionized cancer treatment by harnessing the body’s immune system to target and destroy cancer cells, offering an alternative to traditional treatments like chemotherapy and radiation. The market sees increased adoption of therapies such as immune checkpoint inhibitors, monoclonal antibodies, cancer vaccines, and adoptive cell therapies.

These treatments have shown significant promise in various cancers, including melanoma, lung cancer, and lymphoma. Advances in biomarker identification and genetic profiling allow for more precise and personalized immunotherapy options, increasing their effectiveness. As more patients seek treatments that offer better survival rates and fewer side effects, the demand for immunotherapy continues to rise.

In October 2023, the U.S. Food and Drug Administration (FDA) granted approval for MEKTOVI (binimetinib) in combination with BRAFTOVI (encorafenib) to treat adult patients with metastatic non-small cell lung cancer (NSCLC) who possess a BRAF V600E mutation, identified through an FDA-approved test. This approval highlights the ongoing trend toward precision therapies that target specific genetic mutations, enabling more tailored and effective treatments.

The continued development of combination therapies, which pair immunotherapies with other treatment modalities such as chemotherapy and targeted therapies, presents new opportunities for enhancing patient outcomes. Additionally, expanding research into new immune targets and cancer types fuels the growth of the immunotherapy pipeline, creating promising opportunities for market expansion. As immunotherapy continues to show transformative results, it is poised to become a cornerstone of cancer treatment.

Key Takeaways

- In 2024, the market for cancer immunotherapy generated a revenue of US$ 226.5 billion, with a CAGR of 11.8%, and is expected to reach US$ 691.0 billion by the year 2034.

- The product type segment is divided into monoclonal antibodies, immunomodulators, and oncolytic viral therapies & cancer vaccines, with monoclonal antibodies taking the lead in 2024 with a market share of 55.0%.

- Considering application, the market is divided into lung cancer, breast cancer, colorectal cancer, melanoma, prostate cancer, head and neck cancer, ovarian cancer, pancreatic cancer, and others. Among these, lung cancer held a significant share of 34.5%.

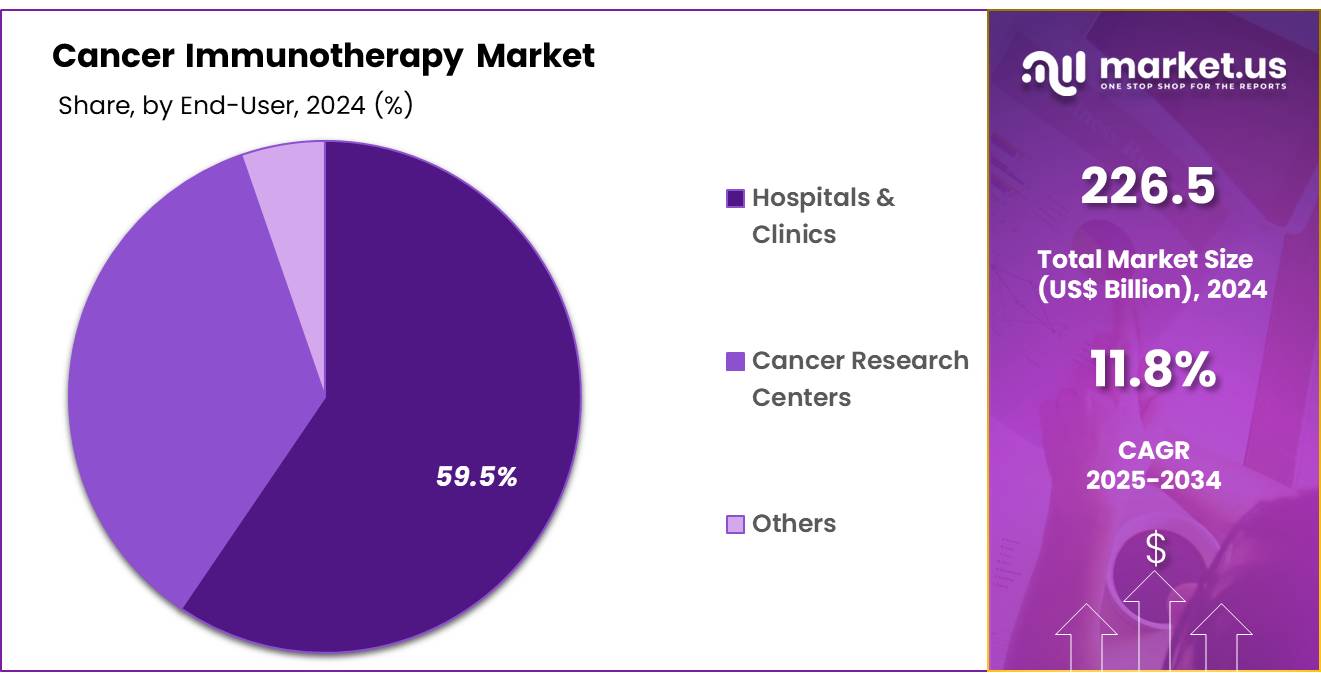

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, cancer research centers, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 59.5% in the cancer immunotherapy market.

- North America led the market by securing a market share of 41.1% in 2024.

Product Type Analysis

Monoclonal antibodies are expected to dominate the cancer immunotherapy market, holding 55.0% of the market share. This class of therapeutics has shown significant promise in treating various cancers, including lung cancer, breast cancer, and lymphoma, by specifically targeting cancer cells without harming healthy cells. Monoclonal antibodies work by either marking cancer cells for destruction by the immune system or by blocking the cancer cell’s ability to grow and divide.

The growth of this segment is anticipated to be driven by the increasing number of monoclonal antibody drugs approved by regulatory agencies and the expanding use of combination therapies. The ability to personalize cancer treatments and minimize side effects compared to traditional chemotherapy has led to greater acceptance of monoclonal antibodies in clinical practice.

Additionally, advancements in biotechnology and the growing pipeline of monoclonal antibody therapies for various cancers are expected to continue driving the growth of this segment. As more monoclonal antibody therapies enter the market, particularly those targeting immune checkpoints and other innovative cancer-related pathways, the segment is projected to maintain its dominance in the cancer immunotherapy landscape.

Application Analysis

Lung cancer is expected to remain the largest application segment in the cancer immunotherapy market, comprising 34.5% of the market share. Lung cancer, particularly non-small cell lung cancer (NSCLC), is one of the most common and deadly cancers worldwide, leading to an urgent demand for more effective treatment options. Immunotherapy has revolutionized the treatment of lung cancer, particularly with the introduction of immune checkpoint inhibitors such as pembrolizumab and nivolumab, which have shown significant success in extending survival rates and improving patient outcomes.

The rising prevalence of lung cancer, particularly due to smoking and environmental factors, is likely to drive the continued growth of this segment. Furthermore, the shift toward combination therapies involving immunotherapy and other treatment modalities is expected to enhance the effectiveness of treatment regimens, boosting the adoption of immunotherapy for lung cancer. As more patients and healthcare providers turn to immunotherapy options for lung cancer, this segment is projected to remain at the forefront of the cancer immunotherapy market.

End-User Analysis

Hospitals and clinics are projected to be the largest end-users in the cancer immunotherapy market, holding 59.5% of the market share. These healthcare facilities are the primary setting for the administration of cancer immunotherapies, which are increasingly integrated into treatment regimens for a variety of cancers. Hospitals and clinics are expected to continue their dominance in the cancer immunotherapy market due to their ability to provide the infrastructure, specialized medical staff, and resources required to administer and monitor complex immunotherapies.

The growing availability of immunotherapies in these settings, combined with the rising number of cancer patients seeking treatment, is expected to drive the demand for cancer immunotherapy in hospitals and clinics. Additionally, the increasing focus on providing personalized, precision treatments that involve immunotherapy is anticipated to boost the adoption of these therapies in hospital settings. As healthcare systems worldwide prioritize cancer care and the integration of advanced therapies, hospitals and clinics will remain a central player in the delivery of cancer immunotherapy.

Key Market Segments

By Product Type

- Monoclonal Antibodies

- Immunomodulators

- Oncolytic Viral Therapies & Cancer Vaccines

By Application

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Melanoma

- Prostate Cancer

- Head and Neck Cancer

- Ovarian Cancer

- Pancreatic Cancer

- Others

By End-User

- Hospitals & Clinics

- Cancer Research Centers

- Others

Drivers

Rising Global Cancer Incidence and Unmet Medical Needs is Driving the Market

The increasing global incidence of various cancer types, coupled with the persistent challenge of providing effective and durable treatments for many advanced cancers, serves as a primary driver for the cancer immunotherapy market. Traditional treatments like chemotherapy and radiation therapy often come with severe side effects and limited efficacy in many aggressive or metastatic cancers, leaving a significant unmet medical need.

Immunotherapy offers a paradigm shift by harnessing the patient’s own immune system to specifically target and eliminate cancer cells, often leading to more durable responses and fewer systemic side effects in responsive patients. According to the World Health Organization (WHO) and the International Agency for Research on Cancer (IARC), there were an estimated 20 million new cases of cancer globally in 2022, and 9.7 million deaths from cancer.

The IARC further projects that the global cancer burden will increase dramatically, by about 77% to 35 million new cases by 2050, underscoring the urgent demand for innovative and more effective therapeutic modalities like these immune-boosting treatments. This growing disease burden and the search for better patient outcomes continuously fuel research, development, and commercialization within this specialized oncology sector.

Restraints

High Cost and Limited Patient Response Rates are Restraining the Market

A significant restraint on the cancer immunotherapy market stems from the exceptionally high cost associated with these advanced therapies and the fact that they do not work for all patients. Treatments such as checkpoint inhibitors or CAR T-cell therapies involve complex manufacturing processes, extensive research and development, and highly specialized administration, leading to substantial price tags that can strain healthcare budgets and raise concerns about patient access.

For instance, a single course of CAR T-cell therapy can cost hundreds of thousands of U.S. dollars, which, while covered by some payers, remains a significant financial hurdle for healthcare systems globally. Furthermore, while highly effective for some, many patients do not respond to these therapies, or they develop resistance over time, leading to continued unmet needs and a demand for more predictive biomarkers to identify optimal responders.

The National Cancer Institute (NCI), in discussions regarding cancer treatment advancements in 2024, consistently highlights the ongoing challenge of patient selection and optimizing response rates for these powerful yet expensive therapies. This combination of high economic burden and variable patient outcomes necessitates ongoing research to improve efficacy and make these life-saving treatments more accessible and cost-effective.

Opportunities

Expansion into New Cancer Indications and Combination Therapies Creates Growth Opportunities

The continuous expansion of cancer immunotherapies into new cancer indications and the exploration of novel combination therapies present significant growth opportunities in the market. Initially approved for specific cancers, these immune-based treatments are increasingly being investigated and approved for a broader spectrum of solid and hematological malignancies, reaching a larger patient population.

Additionally, combining different immunotherapy agents with each other, or with conventional treatments like chemotherapy or radiation, often demonstrates synergistic effects, leading to improved anti-tumor responses and better patient outcomes. For example, in May 2025, the U.S. Food and Drug Administration (FDA) approved the combination of nivolumab (Opdivo) and ipilimumab (Yervoy) for the initial treatment of some people with advanced colorectal cancer, specifically for those whose tumors are classified as MSI-H or dMMR, after updated findings from a large clinical trial.

This approval reflects a growing trend towards combination regimens leveraging multiple mechanisms to overcome tumor resistance. Ongoing clinical trials are evaluating hundreds of new combinations and indications, consistently broadening the therapeutic landscape and creating new avenues for market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the cancer immunotherapy market, primarily through their impact on global healthcare spending, government funding for biomedical research, and the overall economic capacity of nations. During periods of robust global economic growth, countries often have greater financial resources to invest in advanced medical technologies and therapies, which can lead to increased adoption and reimbursement for expensive cancer treatments.

Conversely, economic downturns, high inflation rates, or fiscal austerity measures can lead to tightened healthcare budgets, potentially delaying product launches, restricting patient access, or reducing investment in crucial research and development for new immune-based therapies. The International Monetary Fund (IMF) indicated in its April 2025 “World Economic Outlook” that global economic growth is projected to remain stable, but risks from geopolitical fragmentation and higher-for-longer interest rates persist, which could impact pharmaceutical innovation and market access.

Geopolitical factors, such as international trade policies affecting the import and export of complex biologics and raw materials, intellectual property protections for patented drugs, and the stability of global supply chains for specialized manufacturing components, also play a crucial role. Political instability or trade disputes can disrupt supply chains, increase manufacturing costs, and create uncertainty for global distribution, affecting the timely availability and pricing of these life-saving drugs.

However, the immense clinical benefit and transformative potential of cancer immunotherapies for patients facing dire prognoses ensures continued governmental and private sector focus on facilitating access and supporting innovation, allowing the market to adapt and grow even amidst broader economic and political shifts.

Current US tariff policies can indirectly impact the cancer immunotherapy market by influencing the cost of manufacturing ingredients, specialized equipment used in drug production, and the overall supply chain dynamics for complex biologics. While many key immunotherapy drugs are patented and manufactured by large pharmaceutical companies with global footprints, their production relies on a vast network of international suppliers for raw materials, cell culture components, and specialized machinery.

The U.S. Census Bureau’s “U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES, DECEMBER AND ANNUAL 2024” report indicates that US imports of pharmaceutical preparations in 2024 totaled US$247.2 billion, highlighting the significant reliance on global sourcing for these critical medical products. Any new tariffs imposed on these specific raw materials or manufacturing components could incrementally increase the production costs for pharmaceutical companies operating in or importing into the US. This might translate to higher drug prices for patients and payers, or potentially constrain research and development budgets if companies absorb increased costs, thereby affecting patient access to innovative therapies.

Conversely, if tariffs encourage the domestic production of essential drug components or specialized manufacturing technologies within the US, it could foster a more secure and resilient supply chain for cancer immunotherapies. This strategic shift towards localized production aims to reduce dependence on potentially volatile international sources and enhance national medical self-sufficiency, ensuring a more predictable supply of these crucial treatments despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Shift Towards Personalized Immunotherapy and AI-Driven Biomarker Discovery is a Recent Trend

A prominent recent trend in the cancer immunotherapy market is the accelerating shift towards highly personalized treatment approaches, driven by the integration of artificial intelligence (AI) and advanced biomarker discovery. Researchers are increasingly leveraging genomic, proteomic, and clinical data to identify specific biomarkers that can predict a patient’s likelihood of responding to a particular immunotherapy, thus enabling more tailored and effective treatment strategies.

AI algorithms play a crucial role in analyzing vast datasets to identify these complex patterns and novel therapeutic targets, including neoantigens unique to an individual’s tumor. The Cancer Research Institute (CRI) highlighted in their “2025 Cancer Immunotherapy Insights + Impact Report” that in 2024, the FDA granted 17 new immunotherapy approvals, signaling a diversification of mechanisms and modalities, including first approvals for personalized therapies like the first FDA-approved Tumor-Infiltrating Lymphocyte (TIL) therapy (lifileucel) for advanced melanoma. This report underscores that the future of these treatments will be defined by “integrated strategies that align immune biology, tumor microenvironment, and patient-specific context.

Furthermore, an NCI “Cancer Currents Blog” article from February 2025 discussed an AI-based tool, SCORPIO, which showed promising accuracy in predicting whether immune checkpoint inhibitors would benefit cancer patients, utilizing routine blood tests and medical records. This powerful combination of personalized medicine principles and AI-driven insights is revolutionizing how these treatments are developed and administered, moving towards more precise and effective patient care.

Regional Analysis

North America is leading the Cancer Immunotherapy Market

North America dominated the market with the highest revenue share of 41.1% owing to the persistent and rising burden of cancer, continued advancements in immune-oncology research, and a supportive regulatory environment that has facilitated the approval of groundbreaking therapies. In the United States, the Centers for Disease Control and Prevention (CDC) reported 1,851,238 new cancer cases in 2022, underscoring a significant patient population in need of advanced treatments.

Similarly, Canada projected 247,100 new cancer diagnoses for 2024, as per the Canadian Cancer Statistics Dashboard. This high incidence drives demand for innovative solutions. The U.S. Food and Drug Administration (FDA) has played a crucial role by granting approvals for various immunotherapy drugs and new indications.

For instance, in 2023, the FDA’s Office of Oncologic Diseases (OOD) approved several novel oncology drugs, including those that leverage immunotherapy mechanisms, with notable approvals such as Talvey (talquetamab-tgvs) and Elrexfio (elranatamab-bcmm) for relapsed/refractory multiple myeloma. Leading pharmaceutical companies in the region reported strong sales for their flagship immunotherapy drugs; Merck’s Keytruda, a prominent checkpoint inhibitor, recorded worldwide sales of US$29.48 billion in 2024, an 18% increase from US$25.01 billion in 2023.

Bristol Myers Squibb’s Opdivo, another key immunotherapy, also saw its worldwide revenues increase by 8% in 2023 compared to 2022, with its U.S. revenues specifically growing 12% to US$1.4 billion. Roche’s Pharmaceuticals Division reported an 8% increase in sales in 2024, with newer medicines like Phesgo (for breast cancer) contributing significantly, reflecting the overall robust performance of cancer treatments, including immunotherapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing cancer incidence across the region, coupled with rising healthcare investments, improving access to advanced treatments, and a growing awareness of novel therapeutic approaches. In China, approximately 4,824,700 new cancer cases were estimated for 2022 by the National Cancer Center of China, indicating a significant and growing patient pool that will necessitate advanced treatment options.

The World Health Organization (WHO) also reported an estimated 2.37 million new cancer cases in the South-East Asia Region in 2022, highlighting the immense disease burden. Governments in the region are increasingly prioritizing cancer control and treatment, with initiatives supporting the adoption of innovative therapies. For example, India launched NexCAR19, its first indigenously developed CAR-T cell therapy for blood cancers, in April 2024, marking a significant step towards self-reliance in advanced oncology care and potentially improving access to such therapies for a broader population.

While specific regional sales figures for immunotherapy drugs are often consolidated in global reports, companies like Merck and Bristol Myers Squibb continue to expand their presence in Asian markets. Roche’s Pharmaceuticals Division reported a 19% sales growth in its “International” segment (which includes Asia-Pacific) in the first nine months of 2024, underscoring the rising demand for their advanced medicines in the region. This combination of high cancer prevalence, supportive government initiatives, and expanding market access is projected to drive robust growth for these therapies across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cancer immunotherapy market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting cancer treatment. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for cancer treatment solutions.

Bristol Myers Squibb is a prominent player in the cancer immunotherapy market. Headquartered in New York, the company specializes in developing and delivering innovative therapies for various types of cancer. Bristol Myers Squibb’s portfolio includes immune checkpoint inhibitors like Opdivo and combination therapies targeting specific cancer pathways.

The company emphasizes research and development to discover new treatment options and improve patient outcomes. Through strategic acquisitions and collaborations, Bristol Myers Squibb continues to expand its capabilities and maintain a leadership position in the oncology market. The company’s commitment to innovation and patient care drives its growth in the competitive cancer immunotherapy landscape.

Top Key Players

- Simcere Zaiming

- Pfizer Inc

- Novartis AG

- Lilly

- Johnson & Johnson Services

- Reddy’s Laboratories

- AstraZeneca

- AbbVie

Recent Developments

- In January 2025, AbbVie and Simcere Zaiming announced a partnership to develop a novel trispecific antibody candidate aimed at treating multiple myeloma. This collaboration focuses on advancing treatment options for the disease, offering potential for improved patient outcomes.

- In November 2024, Dr. Reddy’s Laboratories introduced Zytrovi, an immunotherapy drug designed for the treatment of metastatic nasopharyngeal carcinoma (NPC). This new therapy provides an innovative treatment option for patients with this aggressive form of cancer.

Report Scope

Report Features Description Market Value (2024) US$ 226.5 Billion Forecast Revenue (2034) US$ 691.0 Billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies, Immunomodulators, and Oncolytic Viral Therapies & Cancer Vaccines), By Application (Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Prostate Cancer, Head and Neck Cancer, Ovarian Cancer, Pancreatic Cancer, and Others), By End-User (Hospitals & Clinics, Cancer Research Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Simcere Zaiming, Pfizer Inc, Novartis AG, Lilly, Johnson & Johnson Services, Dr. Reddy’s Laboratories, AstraZeneca, AbbVie. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cancer Immunotherapy MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cancer Immunotherapy MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Simcere Zaiming

- Pfizer Inc

- Novartis AG

- Lilly

- Johnson & Johnson Services

- Reddy's Laboratories

- AstraZeneca

- AbbVie