Busbars Market Report By Conductor type (Copper, Aluminium), By Power range type (Low, Medium, High), By Insulation Material (Epoxy Powder Coating, Polyvinyl Fluoride Film, Polyester, Heat-Resistant fibre), By End User (Commercial, Residential, Industrial, Power Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 76851

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

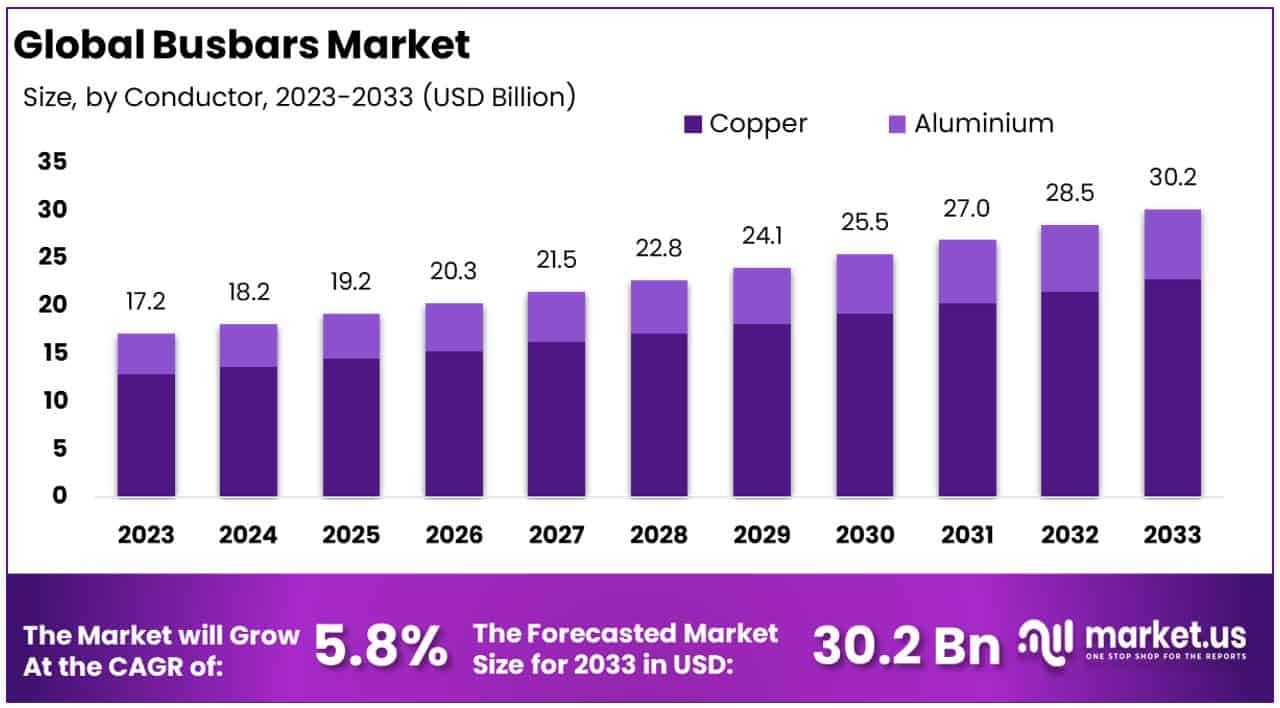

The Global Busbars Market size is expected to be worth around USD 30.2 Billion by 2033, from USD 17.2 Billion in 2023, growing at a CAGR of 5.80% during the forecast period from 2024 to 2033.

The busbars market refers to the industry centered around the production and distribution of busbars, which are conductive strips or bars made primarily from copper or aluminum. These components are crucial in the electrical power distribution sector, serving to connect and manage the flow of electricity in a range of settings, from switchboards and distribution boards to battery banks and electrical substations.

With their efficiency in reducing power loss and optimizing electrical conductivity, busbars play a vital role in enhancing the reliability and performance of electrical systems. Market demand is driven by developments in the energy sector, including renewable energy projects and upgrades to electrical infrastructure.

In the context of the evolving energy landscape, the busbars market stands as a critical component of the global electrical infrastructure. According to the U.S. Energy Information Administration (EIA), the anticipated expansion in global electric-power generating capacity by 50% to 100% by 2050, coupled with a 30% to 76% increase in electricity generation.

This shows the pivotal role of efficient power distribution systems. This expansion is directly linked to the rising demand for busbars, given their efficiency in minimizing power loss and enhancing electrical conductivity.

The busbars market is poised for substantial growth, fueled by the urgent need for modernizing electrical systems and integrating renewable energy sources. With the total primary energy consumption in the United States reaching 100.41 quadrillion British thermal units (Btu) in 2022, the distribution across various sectors—electric power (37.75 quadrillion Btu), transportation (27.47), industrial (23.18), residential (7.11), and commercial (4.90)—highlights the extensive energy distribution networks that busbars support.

This data not only reflects the current state of energy consumption but also signals the growing pressures on electrical infrastructures to adapt to increasing demands and the shift towards greener sources. As industries, residential areas, and commercial entities increasingly rely on electricity, the efficiency and reliability of busbars become more critical.

Therefore, stakeholders in the electrical, construction, and renewable energy sectors are advised to monitor developments within the busbars market closely. The market’s trajectory suggests a strategic opportunity for businesses to invest in upgrading and expanding their electrical infrastructure, aligning with global trends towards energy efficiency and sustainability.

Key Takeaways

Driving Factors

Increasing Demand for Renewable Energy Sources Drives Market Growth

The busbars market is experiencing significant growth, driven largely by the increasing demand for renewable energy sources like solar and wind power. As global efforts to shift towards more sustainable energy solutions intensify, the role of busbars in these systems becomes increasingly critical. Solar farms and wind turbines, for instance, depend on busbars for the efficient collection and distribution of electricity to grid systems or storage solutions.

The integration of renewable energy sources into the power grid requires reliable and efficient power distribution methods, where busbars stand out for their ability to minimize power loss and optimize electrical conductivity. This surge in renewable energy adoption, therefore, not only highlights the indispensable role of busbars in modern electrical infrastructure but also signals a robust trajectory for market growth in the coming decades.

Expansion of Data Centers and Telecommunication Infrastructure Fuels Busbars Market

The proliferation of data centers and the expansion of telecommunication infrastructure are key factors propelling the busbars market forward. In an era dominated by digital transformation, data centers and telecommunication facilities are critical to ensuring uninterrupted service and operational efficiency. These facilities require sophisticated power distribution systems capable of handling high current loads with minimal power loss, making busbars an ideal solution.

The demand is further amplified by major tech giants like Google, Amazon, and Microsoft, who are significantly investing in data center expansions globally. This expansion is not isolated; it reflects a broader trend of digitalization affecting various sectors, necessitating reliable and efficient power distribution solutions. Consequently, the busbars market is set to benefit substantially from this digital infrastructure boom, with an increased demand for busbars to support the high power needs and continuous operation of data centers and telecommunication networks.

Electrification of Transportation Electrifies Busbars Market Growth

The shift towards electric vehicles (EVs) and the burgeoning development of EV charging infrastructure are opening new avenues for the busbars market. EVs represent a pivotal move away from fossil fuels, with charging stations being an integral part of this transition. These stations, along with the broader power distribution systems for EVs, rely on busbars for the efficient transfer of electricity from the grid to vehicles.

The adoption of electric vehicles is on a steady climb, driven by global environmental concerns and supported by government policies promoting clean energy. As the number of EVs increases, so does the need for extensive charging infrastructure, which in turn boosts the demand for busbars. This segment’s growth is expected to accelerate, further propelled by technological advancements in EVs and the expansion of public and private charging networks. The electrification of transportation is not just a shift in vehicle preference but a transformative movement with wide-reaching implications for the busbars market, signaling a significant growth vector.

Restraining Factors

Limited Flexibility Restrains Market Growth

Busbars, known for their role in efficient power distribution within various electrical systems, face a significant growth limitation due to their limited flexibility. Once installed, busbars present challenges in terms of adaptability to future modifications or expansions of the electrical infrastructure. Any necessary changes often entail comprehensive rework or even complete replacement of the existing busbar setup.

This limitation not only increases the costs associated with modifications but also leads to potential operational disruptions. In an era where technological advancements and system upgrades are frequent, this rigidity can deter sectors seeking scalable and flexible power distribution solutions. The need for adaptability in electrical systems, especially in rapidly evolving industries, positions this characteristic of busbars as a notable restraint on market growth, affecting decisions in system design and infrastructure investment.

Safety Concerns Limit Busbars Market Expansion

The inherent safety concerns associated with busbars also play a crucial role in limiting their market expansion. While designed for safe operation, busbars require meticulous installation and maintenance to prevent potential hazards such as electrical short circuits or arcing. These risks are exacerbated by factors like improper insulation, overloading, or exposure to adverse environmental conditions. The need for strict safety protocols and regular maintenance to mitigate these risks introduces additional operational costs.

Furthermore, the possibility of safety incidents can lead to regulatory scrutiny and the need for compliance with stringent safety standards, further complicating the deployment of busbars. This aspect not only impacts the operational expenses but also influences the perception and acceptance of busbars in sensitive applications, where safety is paramount. Consequently, safety concerns, coupled with the associated costs and regulatory challenges, significantly hinder the busbars market’s ability to expand without addressing these critical issues.

Conductor Type Analysis

In the Busbars Market, the conductor type segment is crucial, with copper and aluminum being the primary materials used. Copper dominates this segment significantly, accounting for 75.6% of the market share. This predominance is attributed to copper’s superior electrical conductivity, reliability, and efficiency in power distribution systems.

Copper busbars are extensively utilized in settings where maximum conductivity and minimal power loss are critical, such as in industrial manufacturing, renewable energy systems, and high-demand electrical networks. The material’s durability and resistance to corrosion further enhance its appeal, ensuring longevity and reducing maintenance needs.

Aluminum, while holding a smaller market share compared to copper, plays a vital role in applications where weight and cost considerations are paramount. Aluminum busbars are lighter and less expensive than their copper counterparts, making them suitable for projects with strict budget constraints or where weight plays a critical role, such as in certain aerospace and automotive applications. Despite its lower conductivity relative to copper, aluminum’s advantages in specific contexts cannot be overlooked, contributing to the overall growth of the busbars market.

The dominance of copper in the conductor type segment underscores the industry’s prioritization of efficiency and performance. However, the significance of aluminum in offering cost-effective and lightweight solutions illustrates the market’s diverse needs. As technology advances and new applications emerge, both copper and aluminum busbars will continue to play essential roles, albeit in different capacities and market niches.

Power Range Type Analysis

In power range types within the Busbars Market, the segmentation into low, medium, and high power ranges serves diverse application needs. The high power range segment, capturing 62.4% of the market, stands out as the dominant sub-segment.

This dominance is largely due to the critical role high power busbars play in heavy industrial settings, large-scale data centers, and major renewable energy installations. High power busbars are designed to handle substantial electrical loads efficiently, making them indispensable in environments where power distribution requirements are extensive and uninterrupted operation is critical.

Low and medium power busbars, while constituting a smaller portion of the market, address the needs of a wide array of applications in residential, commercial, and light industrial settings. Low power busbars are often found in smaller electrical systems where the power demand is limited, offering a cost-effective solution for efficient energy distribution. Medium power busbars fill the gap between low and high power applications, catering to medium-sized enterprises and facilities that require a balance between performance and affordability.

The preeminence of the high power range in the busbars market underscores the growing demand for robust power distribution solutions in sectors with high energy consumption. As industries continue to evolve and expand, the requirement for high-capacity power distribution systems becomes increasingly critical. This trend is complemented by the ongoing development in the low and medium power segments, which are essential for ensuring the versatility and accessibility of busbars across a broad spectrum of applications. Together, these segments illustrate the busbars market’s capacity to meet varying power distribution needs, contributing to its sustained growth and diversification.

Insulation Material Analysis

In the insulation material segment of the busbars market, various materials such as epoxy powder coating, polyvinyl fluoride film, polyester, and heat-resistant fibre are utilized to enhance the safety, durability, and efficiency of busbars. Among these, polyester insulation emerges as the dominant sub-segment, capturing 43.9% of the market. Polyester’s prominence is attributed to its excellent electrical insulation properties, durability against mechanical stress, and resistance to a wide range of chemicals and temperatures. These characteristics make polyester-insulated busbars a preferred choice in a variety of settings, including industrial, commercial, and power utility applications, where reliability and safety are paramount.

Epoxy powder coating and polyvinyl fluoride films are also significant, offering unique benefits such as superior protection against corrosion and environmental factors, making them suitable for harsh operating conditions. Heat-resistant fibre insulation, while less common, plays a crucial role in applications requiring extreme temperature resilience.

The preference for polyester in the insulation material segment is indicative of the market’s direction towards materials that offer a balanced combination of performance, safety, and cost-effectiveness. However, the roles of other insulation materials highlight the market’s diversity, catering to specific needs that vary by application, environmental conditions, and regulatory requirements. This segmentation ensures that the busbars market can address the broad spectrum of demands across different sectors, contributing to its overall growth and adaptability.

End User Analysis

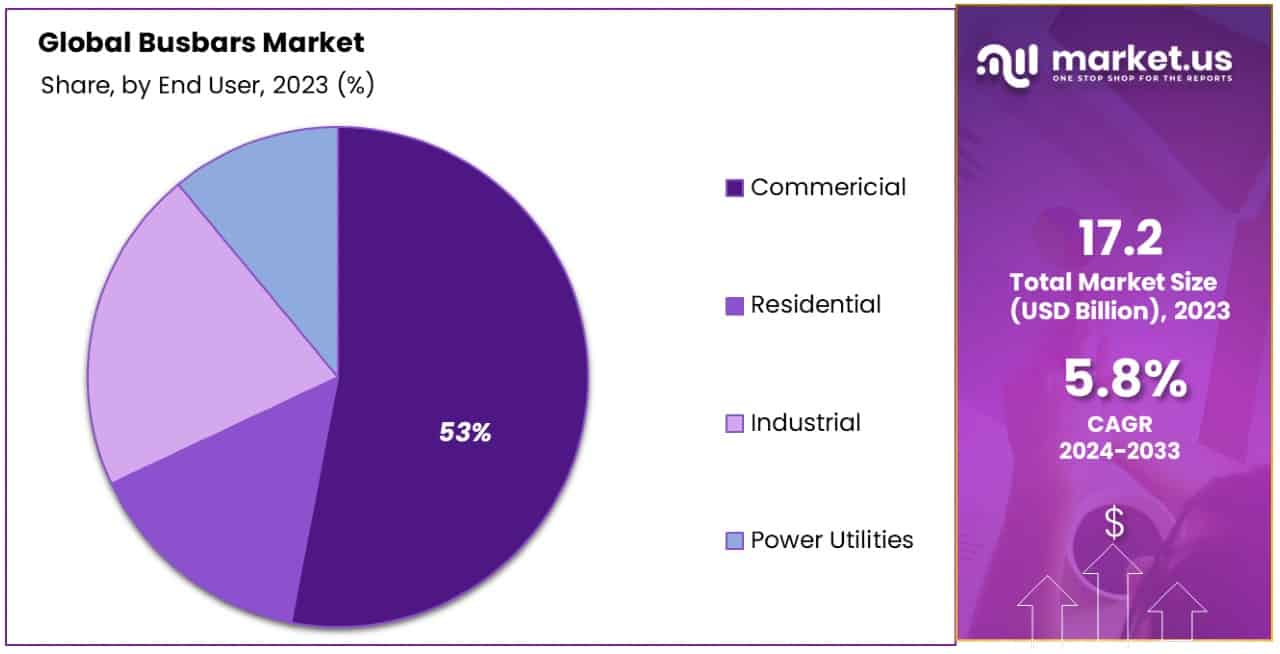

The busbars market serves a wide range of end users, including commercial, residential, industrial, and power utilities sectors. Among these, the commercial sector stands out as the dominant segment, accounting for 53% of the market. This significant share is driven by the expanding demand for efficient and reliable power distribution systems in commercial buildings, shopping centers, office complexes, and hospitality venues. The growth in this segment is fueled by the global surge in commercial construction activities, alongside the increasing emphasis on energy efficiency and sustainability in commercial infrastructure.

Residential, industrial, and power utilities segments, though comprising smaller portions of the market, are pivotal to the busbars market’s diversity and growth. Residential applications focus on safe and efficient power distribution in homes and living complexes, while industrial applications highlight the need for robust busbars capable of handling high power loads in manufacturing and processing plants. Power utilities rely on busbars for the effective distribution of electricity across grid networks, ensuring reliability and stability in power supply.

The dominance of the commercial sector in the end user segment underlines the critical role of busbars in supporting the infrastructural development and energy needs of commercial spaces. The comprehensive demand across all segments demonstrates the busbars market’s capacity to cater to a broad spectrum of energy distribution requirements, driving its growth in various sectors. This versatility ensures the continued expansion of the market, as it adapts to evolving trends and demands in power distribution across different end-user industries.

Key Market Segments

By Conductor type

- Copper

- Aluminium

By Power range type

- Low

- Medium

- High

By Insulation Material

- Epoxy Powder Coating

- Polyvinyl Fluoride Film

- Polyester

- Heat-Resistant fibre

By End User

- Commercial

- Residential

- Industrial

- Power Utilities

Growth Opportunities

Development of Smart Cities and Intelligent Buildings Offers Growth Opportunity

The advent of smart cities and the evolution of intelligent buildings are opening significant avenues for growth in the busbars market. This trend stems from the need for efficient, intelligent power distribution systems crucial for the operation of such advanced infrastructures. Busbars stand out as key components in ensuring reliable and optimized energy transmission within these environments.

Their integration into building automation systems allows for real-time monitoring and control of energy usage, leading to enhanced energy management and substantial cost reductions. The role of busbars in smart cities extends beyond energy efficiency to include the facilitation of renewable energy integration and the support of sustainable urban development goals. As cities worldwide embrace smart technologies to improve infrastructure, the demand for busbars is expected to rise, driven by their ability to contribute to the efficiency and sustainability of urban energy systems.

Adoption of Energy Storage Solutions Offers Growth Opportunity

The busbars market is poised to benefit significantly from the increasing adoption of energy storage solutions, such as batteries and supercapacitors. These technologies are crucial for the stabilization of the power grid, especially with the integration of intermittent renewable energy sources. Busbars provide a vital link by enabling efficient and reliable power distribution between storage devices and the broader power system.

Their role in facilitating the bidirectional flow of electricity is essential for the seamless integration of storage solutions, enhancing energy management and ensuring the reliability of power supply. As the world moves towards greater reliance on renewable energy and seeks to enhance grid stability, the demand for busbars in energy storage applications is set to increase. This trend underscores the importance of busbars in the evolving energy landscape, where they serve as a critical component in enabling the effective use and management of energy storage technologies.

Trending Factors

Sustainability and Energy Efficiency Are Trending Factors

The movement towards sustainability and energy efficiency is a significant trend affecting the Busbars Market. As industries worldwide aim to lower their energy use and decrease their environmental impact, the efficiency of busbars becomes a key factor. Their ability to conduct electricity with minimal resistance and power loss makes them an attractive choice for energy-conscious projects.

This growing emphasis on sustainability is not just a regulatory or environmental consideration; it’s also about cost savings and operational efficiency. Busbars contribute to the development of greener, more efficient power distribution systems, driving their demand in a market increasingly focused on reducing carbon footprints and enhancing energy efficiency.

Miniaturization and Compact Design Are Trending Factors

The trend towards miniaturization and compact design in power distribution components is reshaping the Busbars Market. As electronic devices and industrial equipment demand more space-efficient solutions, busbars are evolving. Manufacturers are innovating to produce smaller, lighter busbars that fit into increasingly tight spaces without compromising on power transmission efficiency.

This trend reflects the broader industry shift towards more integrated and compact systems, where every component must be optimized for space and performance. By adapting to the miniaturization trend, busbar solutions are becoming more versatile, catering to a wide range of applications from consumer electronics to large-scale industrial machinery, thus broadening their market appeal and potential for growth.

Regional Analysis

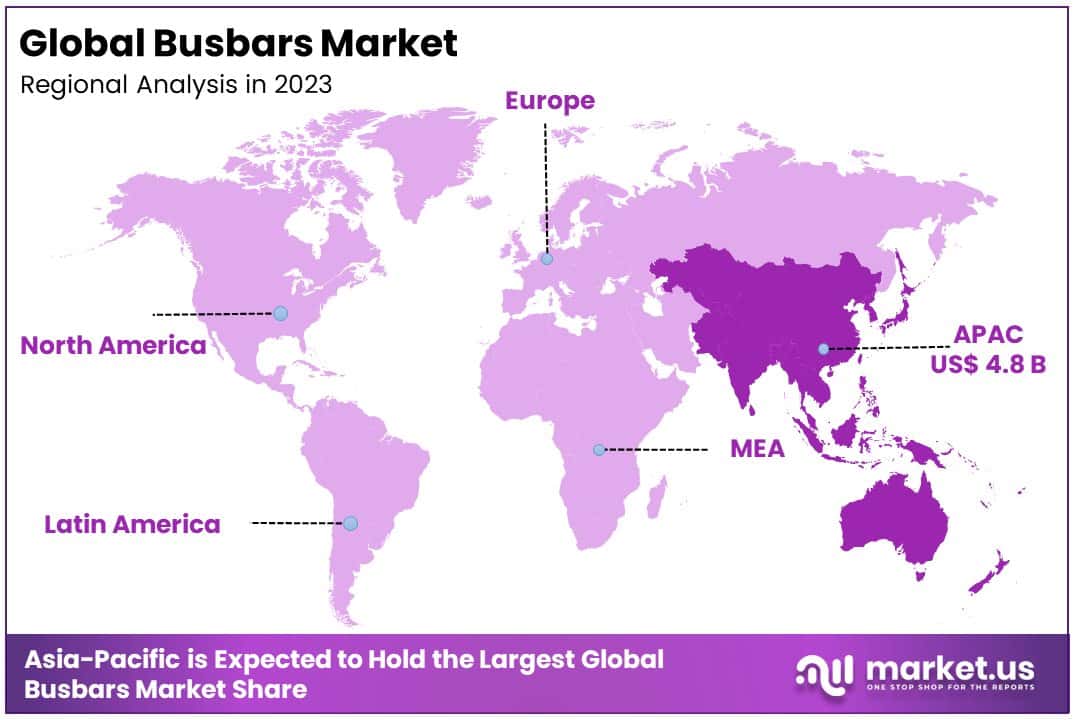

APAC Dominates with 28.4% Market Share

The Asia Pacific (APAC) region leads the Busbars Market with a commanding 28.4% share. This dominance is fueled by rapid industrialization, significant investments in renewable energy, and extensive infrastructure development projects. Countries like China, India, and Japan are at the forefront, driving demand for busbars through their commitment to energy efficiency and sustainability. The region’s focus on modernizing power distribution systems to support growing urban and industrial needs further amplifies this demand.

APAC’s high market share is also a reflection of its vibrant manufacturing sector, which requires efficient and reliable power distribution solutions. The push towards electrification of transportation and the adoption of smart city technologies contribute to the region’s leading position. This dynamic market environment, coupled with supportive government policies and initiatives aimed at boosting renewable energy, sets a solid foundation for the continued dominance of APAC in the busbars market.

APAC’s influence on the global busbars market is expected to grow even further. The region’s ongoing investments in infrastructure and renewable energy, coupled with its commitment to sustainability, position it as a critical driver of market trends and innovations. The demand for busbars in APAC is likely to see sustained growth, fueled by the continued expansion of industrial activities and the electrification of various sectors. This trend underscores the region’s pivotal role in shaping the future landscape of the busbars market.

Regional Market Shares

- North America: North America holds a significant portion with 24% of the market, with advancements in energy infrastructure and a rising focus on renewable energy sources contributing to its market share. The region’s emphasis on modernizing electrical grids and increasing investments in green technologies are pivotal to its market dynamics.

- Europe: Europe commands a 22.3% market share, which is bolstered by stringent regulations on energy efficiency and a strong push towards decarbonization. The region’s commitment to sustainability and the integration of renewable energy sources into the power grid drive the demand for busbars.

- Middle East & Africa: The Middle East & Africa region, holding a 12.5% share of the busbars market, is increasingly focusing on diversifying energy sources and enhancing power distribution infrastructure. Investments in renewable energy projects and infrastructure development are key drivers.

- Latin America: Latin America, with a 9.6% share of the busbars market, is experiencing growth driven by the expansion of its energy infrastructure and a heightened emphasis on renewable energy. The region’s efforts to improve electricity access and reliability are important factors influencing its market dynamics.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Busbars Market, key players like Schneider Electric SE, Siemens AG, ABB Ltd, and Eaton Corporation Plc stand out for their impactful market presence and strategic positioning. These companies have solidified their influence through continuous innovation, expansive product portfolios, and strategic global networks, addressing diverse energy distribution needs across industries. Schneider Electric SE and Siemens AG, for instance, are renowned for their pioneering technologies and solutions that enhance energy efficiency and reliability. ABB Ltd and Eaton Corporation Plc excel in integrating digital technologies with power distribution solutions, propelling the market towards smart and sustainable energy management.

Emerging alongside these giants are specialized entities like Starline Holdings, LLC, and Methode Electronics, Ltd, who contribute to the market with niche innovations and customized solutions, enriching the sector’s diversity. Companies such as Mersen and Chint Electric focus on the reliability and safety aspects of busbars, catering to specific industry requirements and setting safety benchmarks.

Furthermore, Rittal GmbH and Co., Cubic-Modulsystem A/S, and Pentair are instrumental in developing compact and flexible busbar systems, addressing the market’s demand for space-efficient and adaptable power distribution options. Sedotec Gmbh and Co, KG, and Godrej and Boyce Mfg. Co. Ltd add regional expertise and tailored solutions to the mix, enhancing the market’s geographic reach and application-specific offerings.

Collectively, these companies drive the Busbars Market forward through innovation, strategic market expansion, and a keen focus on sustainability and efficiency. Their combined efforts not only cater to the current demands but also shape the future trajectory of the busbars industry, ensuring it remains dynamic and responsive to evolving global energy needs.

Market Key Players

- Schneider Electric SE

- Cubic-Modulsystem A/S

- Starline Holdings, LLC

- Siemens AG

- Eaton Corporation Plc

- ABB ltd

- Sedotec Gmbh and Co, KG

- Methode Electronics, ltd

- Mersen

- Chint Electric

- Rittal Gmbh and Co.

- Pentair

- Godrej and Boyce Mfg. Co.ltd

Recent Developments

- On October 2023, Freudenberg Sealing Technologies introduced a groundbreaking rectangular busbar overmold designed to provide impermeable sealing for electric vehicles’ power electronics.

- On September 2022, Aptiv signed a definitive agreement to acquire an 85% equity stake in Intercable Automotive Solutions, a subsidiary of Intercable S.r.l., for €595 million. This strategic move broadens Aptiv’s portfolio of high-voltage system solutions, enhancing its position as a global leader in vehicle architecture systems.

- On January 2022, Mersen, a global expert in electrical specialties and advanced materials, signed a partnership agreement with Automotive Cells Company (ACC) to provide smart laminated busbars for their new generation of batteries. These busbars play a crucial role in connecting Li-ion cells while communicating with the Battery Management System.

Report Scope

Report Features Description Market Value (2023) USD 17.2 Billion Forecast Revenue (2033) USD 30.2 Billion CAGR (2024-2033) 5.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Conductor type (Copper, Aluminium), By Power range type (Low, Medium, High), By Insulation Material (Epoxy Powder Coating, Polyvinyl Fluoride Film, Polyester, Heat-Resistant fibre), By End User (Commercial, Residential, Industrial, Power Utilities) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schneider Electric SE, Cubic-Modulsystem A/S, Starline Holdings, LLC, Siemens AG, Eaton Corporation Plc, ABB ltd, Sedotec Gmbh and Co, KG, Methode Electronics, ltd, Mersen, Chint Electric, Rittal Gmbh and Co., Pentair, Godrej and Boyce Mfg. Co.ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Global Busbars Market by 2033?The Global Busbars Market is expected to reach approximately USD 30.2 Billion by 2033. The Busbars Market is anticipated to grow at a CAGR of 5.80% during the forecast period from 2024 to 2033.

What are the key drivers of market demand for busbars?Market demand for busbars is driven by developments in the energy sector, including renewable energy projects, upgrades to electrical infrastructure, and the increasing demand for efficient power distribution systems.

Which regions dominate the busbars market, and why?Asia Pacific dominates the busbars market with a 28.4% market share due to rapid industrialization, significant investments in renewable energy, and extensive infrastructure development projects.

What are the dominant conductor types in the busbars market, and why?Copper dominates the conductor type segment with a 75.6% market share due to its superior electrical conductivity and reliability, especially in critical applications like industrial manufacturing and renewable energy systems.

-

-

- ABB Ltd.

- Schneider Electric

- Siemens AG

- Eaton Corporation plc.

- Legrand S.A.

- C&S Electric Company

- Eaton Corporation plc.

- Mersen S.A.

- Schneider Electric SE

- CHINT Electric Co. Ltd.

- Rittal GMBH & CO. KG, among others.