Global Bleeding Control Kit Market By Product Type (Tourniquet, Medical Gloves, Trauma Shears, Compressed Gauze and Others), By End-user (Hospitals & Clinics, Industries & Corporate Offices, Sports Academies, Aviation and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170959

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

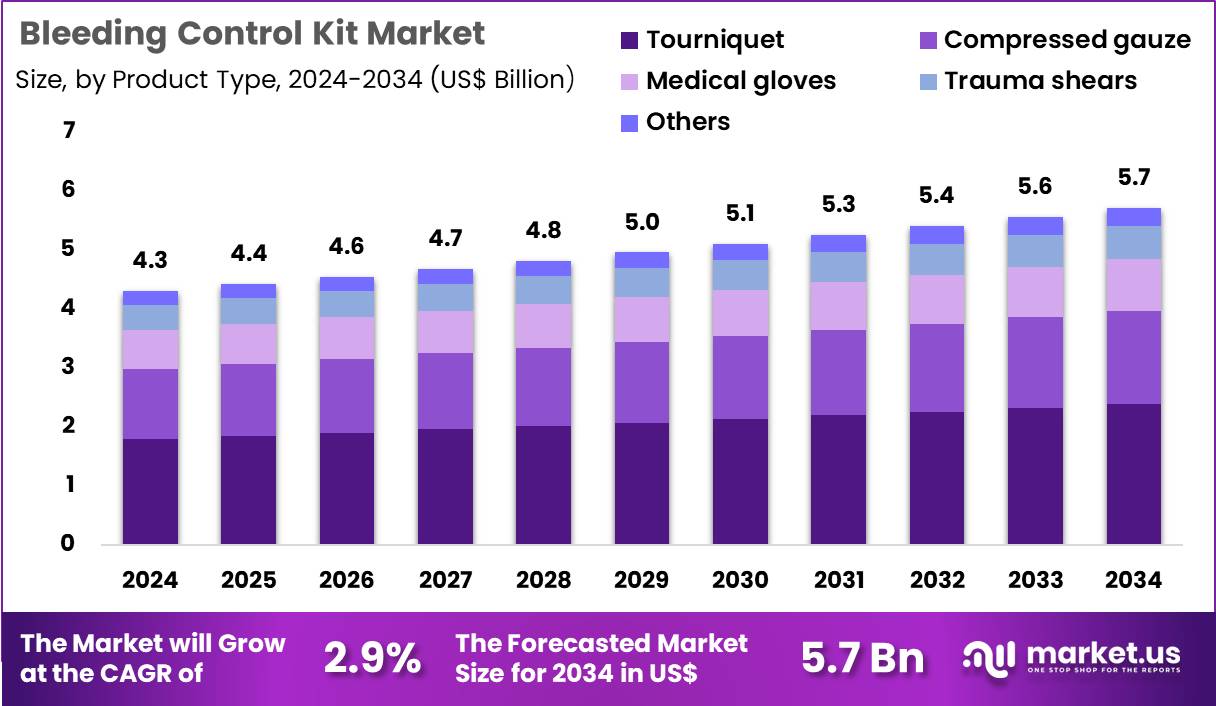

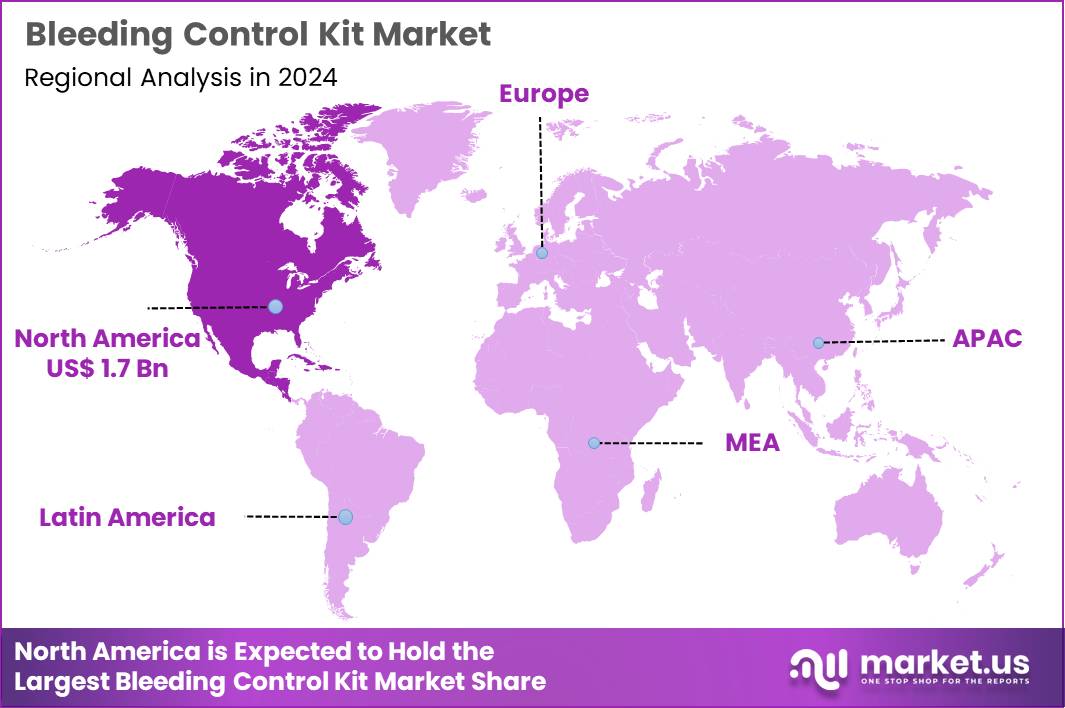

The Global Bleeding Control Kit Market size is expected to be worth around US$ 5.7 Billion by 2034 from US$ 4.3 Billion in 2024, growing at a CAGR of 2.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.2% share with a revenue of US$ 1.7 Billion.

Increasing public awareness of preventable trauma deaths propels the Bleeding Control Kit market, as communities and organizations equip laypersons with tools to intervene effectively during the critical minutes before professional help arrives. Manufacturers design compact kits containing tourniquets, hemostatic gauze, pressure bandages, and chest seals that enable rapid hemorrhage control in extremity, junctional, and torso wounds.

These kits serve active shooter response in public venues, industrial accident management on construction sites, natural disaster first-aid stations for crush injuries, and sports venue medical cabinets for penetrating trauma from equipment failures. Government initiatives create opportunities for widespread deployment that standardize bystander training and kit placement.

In March 2024, the New Jersey Office of Homeland Security and Preparedness launched distribution of bleeding control kits to religious institutions statewide, delivering approximately 7,100 units to 6,400 houses of worship over 12 months to prepare for potential active-shooter incidents. This program directly empowers faith communities with lifesaving resources and accelerates market adoption in non-traditional healthcare settings.

Growing integration of bleeding control training programs accelerates the Bleeding Control Kit market, as schools, workplaces, and transportation hubs mandate “Stop the Bleed” certification alongside kit installation. Suppliers bundle kits with instructional cards, gloves, and shears to facilitate immediate use by trained civilians under extreme stress. Applications encompass school lockdown drills for penetrating injuries, corporate office active-threat preparedness, mass transit station trauma response for stabbing incidents, and recreational facility coverage for severe lacerations from machinery.

Mandatory training opens avenues for subscription-based replenishment services that ensure kit readiness and compliance auditing. Emergency management agencies increasingly procure kits in bulk for public access stations similar to AED placements. This educational synergy drives sustained demand and positions kits as standard safety infrastructure.

Rising innovation in hemostatic agent formulations invigorates the Bleeding Control Kit market, as developers introduce next-generation gauze impregnated with chitosan, kaolin, or factor concentrators that achieve hemostasis in coagulopathic patients. Companies package advanced agents in vacuum-sealed, intuitive applicators that function effectively through clothing and in low-light conditions.

These enhanced kits address military-derived junctional wounds in civilian mass casualty events, anticoagulant-related bleeding in elderly fall victims, pediatric trauma from playground accidents, and obstetric hemorrhage in remote birthing centers. Material advancements create opportunities for hybrid kits that combine mechanical compression with biologic clotting acceleration.

First responder organizations actively field-test these products to refine tactical emergency casualty care protocols. This technological evolution establishes bleeding control kits as indispensable components of modern trauma systems worldwide.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.3 billion, with a CAGR of 2.9%, and is expected to reach US$ 5.7 billion by the year 2034.

- The product type segment is divided into tourniquet, medical gloves, trauma shears, compressed gauze and others, with tourniquet taking the lead in 2024 with a market share of 41.8%.

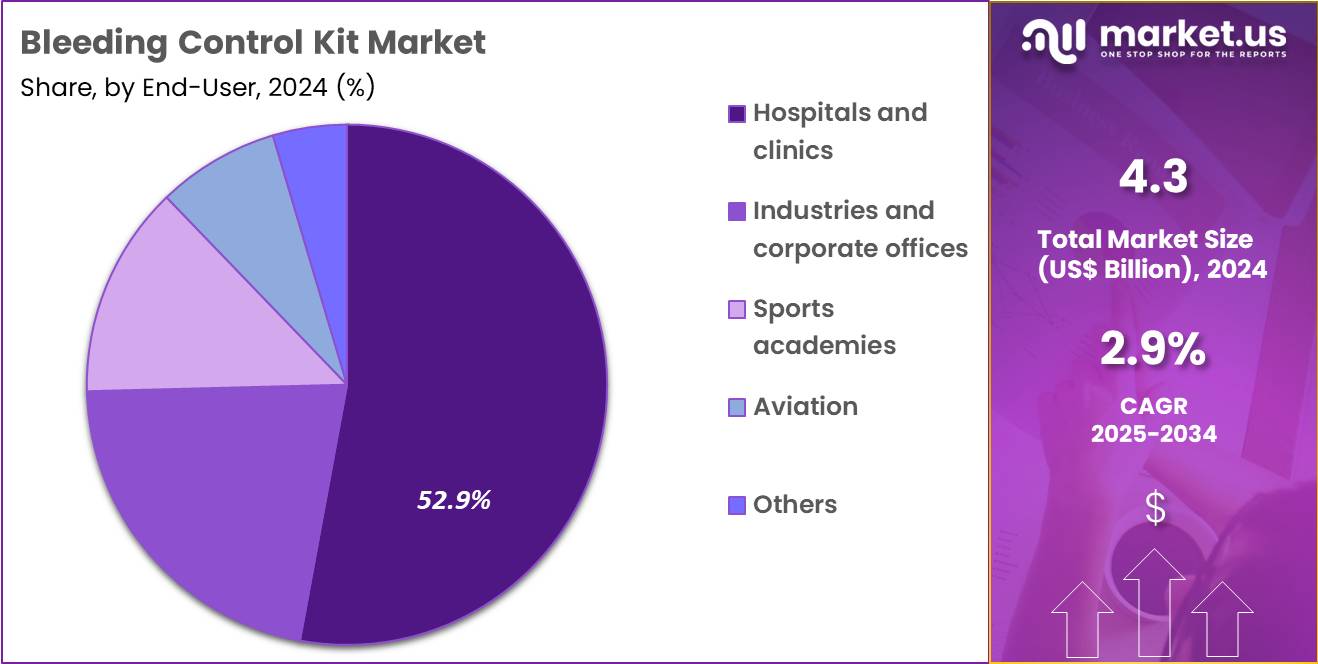

- Considering end-user, the market is divided into hospitals & clinics, industries & corporate offices, sports academies, aviation and others. Among these, hospitals & clinics held a significant share of 52.9%.

- North America led the market by securing a market share of 40.2% in 2024.

Product Type Analysis

Tourniquet, holding 41.8%, is expected to dominate because it remains the most critical component in controlling severe external bleeding during emergencies. Growing awareness of hemorrhage-related mortality strengthens demand for effective tourniquet solutions in both clinical and pre-hospital settings.

Modern designs featuring rapid-application mechanisms improve ease of use for trained personnel and bystanders. Increasing trauma incidents from road accidents and workplace injuries support the expansion of tourniquet adoption across public and private sectors. Military-inspired best practices influence civilian emergency preparedness programs, leading to broader integration in first-aid systems.

Public safety authorities promote tourniquet accessibility as part of national bleeding control initiatives. These factors keep tourniquets anticipated to remain the dominant product type within bleeding control kits.

End-User Analysis

Hospitals and clinics, holding 52.9%, are projected to dominate because they manage the highest volume of trauma cases requiring immediate bleeding management. Emergency departments and surgical units depend on comprehensive bleeding control kits to stabilize patients rapidly. Rising surgical procedure rates and increasing accident-related admissions drive continuous demand for reliable hemorrhage control tools.

Hospitals adopt standardized bleeding protocols that incorporate tourniquets, pressure dressings, and gauze to improve patient outcomes. Government healthcare policies emphasize facility readiness for mass casualty events, strengthening kit procurement. Continuous clinical training ensures high usage competence within medical teams. These factors keep hospitals and clinics expected to remain the leading end-user segment in this market.

Key Market Segments

By Product Type

- Tourniquet

- Medical Gloves

- Trauma Shears

- Compressed Gauze

- Others

By End-user

- Hospitals & Clinics

- Industries & Corporate Offices

- Sports Academies

- Aviation

- Others

Drivers

Increasing unintentional injury deaths is driving the market

Unintentional injuries remain a leading cause of mortality in the United States, compelling healthcare systems and emergency responders to prioritize accessible bleeding control measures. The Centers for Disease Control and Prevention reported 222,698 deaths from unintentional injuries in 2023, ranking third among all causes of death. This statistic highlights the persistent threat of trauma-related hemorrhage, which accounts for a significant portion of preventable fatalities in the initial hours post-injury.

Public health initiatives have responded by emphasizing bystander intervention tools, elevating the demand for standardized kits in community settings. Legislative mandates for emergency preparedness in schools and public venues further amplify procurement needs for these essential supplies. The integration of bleeding control into first aid curricula underscores the market’s alignment with broader injury prevention strategies.

As urban environments expand, the potential for mass casualty events necessitates scalable distribution networks for rapid deployment. Collaborative efforts between federal agencies and local authorities ensure kits meet rigorous performance criteria for real-world efficacy. Economic analyses reveal that early hemorrhage control can reduce long-term healthcare expenditures associated with trauma care. Consequently, this driver fosters a robust ecosystem for innovation in kit design and accessibility.

Restraints

Insufficient public training and awareness is restraining the market

Despite available resources, widespread gaps in bystander proficiency limit the effective utilization of bleeding control kits during critical incidents. Many individuals lack hands-on experience with tourniquet application or wound packing, leading to hesitation in high-stress scenarios. This knowledge deficit perpetuates reliance on professional responders, delaying life-saving interventions in the golden hour.

Resource constraints in rural areas exacerbate disparities, where training programs reach only a fraction of at-risk populations. Variability in kit familiarity across demographics complicates standardization efforts for universal adoption. Ethical concerns over misuse, such as improper tourniquet placement causing secondary injuries, temper enthusiasm for broad dissemination.

Funding shortfalls for community education initiatives hinder sustained outreach, particularly in underserved communities. Integration challenges with existing emergency protocols create silos, reducing cohesive response capabilities. Longitudinal evaluations indicate that without reinforcement, initial training retention wanes over time. Collectively, these barriers constrain market penetration, underscoring the need for targeted awareness campaigns.

Opportunities

Expansion of state-mandated public access kits is creating growth opportunities

State-level requirements for installing bleeding control kits in high-traffic venues open avenues for widespread deployment and enhanced emergency readiness. For instance, in March 2024, the New Jersey Office of Homeland Security and Preparedness distributed approximately 7,100 kits to 6,400 houses of worship as part of a phased initiative to bolster active shooter response capabilities. This model promotes equity by equipping non-medical sites with validated tools, bridging gaps in professional response times. Partnerships with faith-based organizations facilitate community-led maintenance and restocking protocols.

Scalable procurement frameworks enable bulk acquisitions, optimizing costs for recurring distributions. Educational components bundled with kits amplify skill-building, fostering a culture of preparedness among volunteers. Alignment with national campaigns like Stop the Bleed ensures interoperability with federal guidelines.

Opportunities extend to corporate and recreational facilities seeking compliance certifications. Data-driven placements target vulnerability hotspots, maximizing impact per unit. In summary, these mandates catalyze a decentralized network, driving sustained demand and infrastructural integration.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic momentum strengthens the bleeding control kit market as rising healthcare budgets and growing focus on trauma readiness drive hospitals, first responders, and public venues to stock modern kits with tourniquets, hemostatic dressings, and pressure bandages. Leading suppliers quickly introduce compact, intuitive designs, seizing strong demand from workplace safety programs, military needs, and community stop-the-bleed training efforts.

At the same time, ongoing inflation and uneven growth push up costs for gauze, polymers, and active ingredients, forcing many buyers to stretch existing inventories and postpone large-scale purchases. Geopolitical friction, especially U.S.-China trade barriers and regional instability, repeatedly interrupts supplies of critical medical-grade materials, creating delivery bottlenecks and price swings for global manufacturers.

Current U.S. tariffs add significant duties on imported trauma supplies and components, lifting landed costs for U.S. customers and pressuring profitability across the distribution chain. These measures also invite overseas counter-duties that slow American exports and complicate joint product development. Still, the challenges spark fresh capital into U.S.-based production, regional partnerships, and next-generation material research, delivering a tougher, more independent industry ready for steady expansion and greater lifesaving impact ahead.

Latest Trends

Passage of the Improving Police Critical Aid for Responding to Emergencies Act is a recent trend

In July 2025, the U.S. Senate approved the Improving Police Critical Aid for Responding to Emergencies (CARE) Act, expanding federal funding for bleeding control kits through the Byrne Justice Assistance Grant program. This bipartisan legislation mandates inclusion of Committee on Tactical Combat Casualty Care-recommended tourniquets and instructional materials in funded kits.

Administered by the Department of Justice, the initiative targets state, tribal, and local governments to equip law enforcement with standardized trauma response tools. It directs collaboration with stakeholders, including the American College of Surgeons Committee on Trauma, to establish uniform kit standards and best practices. The trend reflects a policy shift toward integrating hemorrhage control into routine policing, addressing gaps in officer preparedness for violent encounters.

Early implementations emphasize training integration to ensure proficient deployment under duress. This development complements prior state laws, creating a cohesive national framework for public safety enhancements. Monitoring provisions track efficacy, informing iterative improvements in kit composition. The Act’s passage signals regulatory momentum toward proactive injury mitigation. Overall, this 2025 advancement positions bleeding control as a cornerstone of community resilience strategies.

Regional Analysis

North America is leading the Bleeding Control Kit Market

In 2024, North America commanded a 40.2% share of the global bleeding control kit market, catalyzed by amplified trauma preparedness initiatives and regulatory endorsements for widespread deployment. Emergency response agencies, including the Federal Emergency Management Agency, integrate tourniquets and hemostatic dressings into standard protocols, addressing hemorrhage as the primary preventable cause of death in civilian and military casualties.

Educational mandates in schools and workplaces, spurred by advocacy from the American Red Cross, equip communities with compact kits for immediate intervention during mass casualty events. Innovations in biodegradable agents and pressure applicators, validated through Department of Defense trials, enhance portability and efficacy in austere environments.

Demographic trends toward active lifestyles elevate recreational injury risks, prompting retailers to stock advanced coagulation promoters in outdoor and fitness sectors. Public health campaigns leverage digital platforms to train laypersons on junctional bleeding techniques, fostering a culture of proactive harm reduction.

Collaborative funding from state health departments accelerates production scaling, ensuring affordability amid supply chain stabilizations. These imperatives collectively reinforce a resilient framework for mitigating exsanguination threats. According to the Centers for Disease Control and Prevention, unintentional injury deaths in the United States totaled 227,039 in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Policymakers anticipate vigorous progression in hemorrhage management solutions across Asia Pacific over the forecast period, as urban densification amplifies accident vulnerabilities. Ministries in South Korea and Australia invest in subsidized stockpiles, outfitting public transit hubs with automated external hemostasis devices to counter road trauma spikes. Local manufacturers engineer culturally adapted pouches featuring herbal-infused gauzes, empowering rural first responders in Indonesia to tackle agricultural mishaps swiftly.

Regional alliances through the Asia-Pacific Economic Cooperation standardize training curricula, enabling paramedics in the Philippines to master vascular occlusion methods via simulation apps. Community health workers distribute miniaturized coagulation sprays to migrant laborers in Malaysia, mitigating construction-site lacerations through on-the-spot application.

Biotech ventures introduce sensor-embedded bandages that alert via mobile alerts, optimizing response times in Thailand’s bustling markets. Export incentives drive innovation in multi-trauma variants, aligning with international standards to bolster disaster relief caches. These endeavors harness collective resolve, fortifying safeguards against escalating hemorrhagic emergencies. The World Health Organization states that violence and injuries account for almost 1 million deaths annually in the Western Pacific Region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key manufacturers in the bleeding-control solutions space drive growth by designing compact, trauma-ready kits that combine tourniquets, hemostatic dressings, pressure bandages, and protective gear to meet the needs of schools, workplaces, public venues, and first responders. They strengthen adoption by partnering with emergency-response agencies, safety-training organizations, and government preparedness programs that mandate rapid-bleed management capabilities in high-risk environments.

Product teams refine materials to improve shelf stability, ease of use, and deployment speed, which increases confidence among untrained civilians and professional responders. Companies expand reach by offering tiered kit configurations and subscription-based replenishment programs that support recurring procurement. They invest in community-education campaigns and digital training modules to promote nationwide readiness and increase kit utilization.

North American Rescue exemplifies this strategic approach through its specialized trauma-care portfolio, strong relationships with military and civilian emergency services, and continuous innovation in life-saving equipment that supports widespread implementation of bleeding-control programs.

Top Key Players

- North American Rescue, LLC

- Combat Medical Systems

- SAM Medical

- Z-Medica (QuikClot)

- H&H Medical Corporation

- Chinook Medical Gear

- TacMed Solutions

- Aero Healthcare

Recent Developments

- In January 2025, Tytek Medical Inc. continued producing a wide range of emergency medical products. The company supplies pre-hospital trauma essentials—including bandages, shears, chest decompression needles, portable suction devices, compressed gauze, and other critical clinical tools—used by first responders and emergency providers.

- In November 2025, Friedrich Bosch Medizintechnik outlined its strategic ambition to expand technologically and geographically, aiming to position itself among the top three suppliers within its target medical device markets worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 4.3 Billion Forecast Revenue (2034) US$ 5.7 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tourniquet, Medical Gloves, Trauma Shears, Compressed Gauze and Others), By End-user (Hospitals & Clinics, Industries & Corporate Offices, Sports Academies, Aviation and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape North American Rescue LLC, Combat Medical Systems, SAM Medical, Z-Medica, H&H Medical Corporation, Chinook Medical Gear, TacMed Solutions, Aero Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bleeding Control Kit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bleeding Control Kit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- North American Rescue, LLC

- Combat Medical Systems

- SAM Medical

- Z-Medica (QuikClot)

- H&H Medical Corporation

- Chinook Medical Gear

- TacMed Solutions

- Aero Healthcare