Global Bisphenol S Market Size, Share, And Business Benefits By Product Type (Liquid, Powder), By Sales Channel (Direct Sales, Indirect Sales), By End Use (Thermal Papers, Fine Chemicals, Epoxy Resins, Phenolic Resins, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165473

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

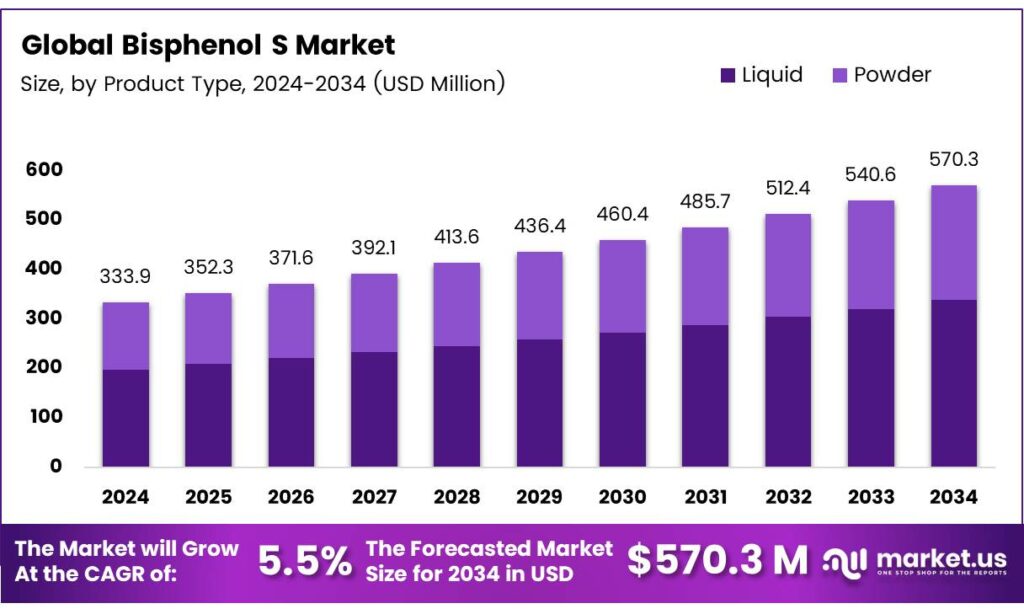

The Global Bisphenol S Market size is expected to be worth around USD 570.3 Million by 2034, from USD 333.9 Million in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Bisphenol S (BPS) is a key component in the production of polyethersulfone (PES) plastic, a material used to manufacture hard plastic products and synthetic fibers found in clothing and various textiles. It is also added to certain fabrics to help colors last longer. Beyond plastics and textiles, BPS has become a common substitute for bisphenol A (BPA) in thermal paper receipts and appears in protective coatings inside some food cans.

Chemically, 4,4′-sulfonyldiphenol, another name for BPS, is a sulfone compound derived from diphenyl sulfone, where both para-position hydrogens are replaced by hydroxy groups. It is classified as both a sulfone and a bisphenol and is known to function biologically as a metabolite and an endocrine disruptor due to its structural similarity to other hormone-interfering chemicals.

- BPS has the molecular formula (HOC₆H₄)₂SO₂ and a molar mass of 250.27 g/mol. Under normal conditions, it appears as a white, colorless solid with a density of 1.3663 g/cm³ and melts at 240–250 °C. It dissolves freely in aliphatic hydrocarbons and is soluble in solvents such as ethanol, isopropyl alcohol, acetonitrile, and acetone, while exhibiting only slight solubility in aromatic hydrocarbons.

Although BPS is widely used as a replacement for BPA in consumer products, research on its behavior and health effects lags behind the extensive studies conducted on BPA. Existing evidence shows that BPS is now widespread in the environment and has been detected globally, though its levels are generally lower than BPA in media such as water, sediments, sludge, indoor dust, air, and consumer goods, as well as in human urine.

Key Takeaways

- The Global Bisphenol S Market is expected to grow from USD 333.9 million in 2024 to USD 570.3 million by 2034 at a 5.5% CAGR.

- Liquid form dominated by Product Type in 2024 with 59.3% share, ideal for polymer production blending.

- Direct Sales led by Sales Channel in 2024 with 69.2% share, enabling cost control and faster delivery.

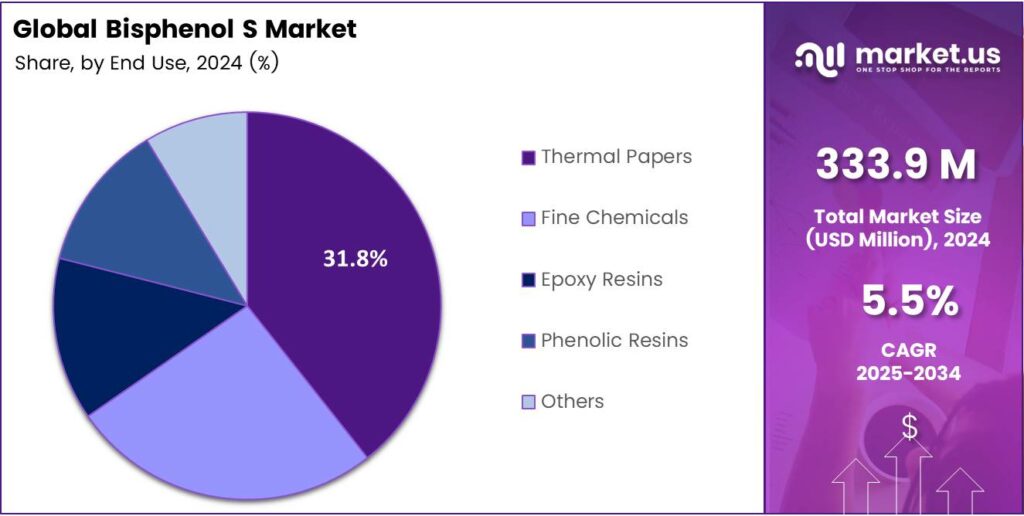

- Thermal Papers held the top By End Use position in 2024 with 31.8% share, driven by heat sensitivity in POS and e-commerce.

- Asia Pacific commanded 45.9% market share in 2024, valued at USD 153.2 million, fueled by manufacturing and safer alternatives.

By Product Type Analysis

Liquid dominates with 59.3% due to its superior solubility and ease of integration in industrial processes.

In 2024, Liquid held a dominant market position in the By Product Type Analysis segment of the Bisphenol S Market, with a 59.3% share. This form excels in applications requiring seamless blending, such as polymer production.

Its high demand stems from efficient handling and reduced processing time. Liquid BPS offers better compatibility with solvents, boosting adoption in manufacturing. Transitioning smoothly, industries prefer it for consistent quality output.

Conversely, Powder serves niche roles despite lower dominance. It provides stability in dry formulations and suits specific chemical reactions. However, handling challenges limits its widespread use. Still, powder form finds traction in specialized coatings and adhesives. Gradually, innovations may enhance its market presence, yet liquid continues to lead.

By Sales Channel Analysis

Direct Sales dominates with 69.2% due to its streamlined supply chain and direct manufacturer-consumer relationships.

In 2024, Direct Sales held a dominant market position in the By Sales Channel Analysis segment of Bisphenol S Market, with a 69.2% share. This channel ensures cost control and customized solutions for bulk buyers. It fosters trust through direct negotiations. Furthermore, direct sales minimize intermediaries, speeding delivery. Progressing forward, this approach supports large-scale industrial needs effectively.

Meanwhile, Indirect Sales caters to smaller buyers via distributors. It offers wider accessibility but involves higher costs. Nevertheless, indirect channels expand reach in remote areas. Over time, they complement direct sales by handling retail demands. Ultimately, direct remains preferred for efficiency.

By End Use Analysis

Thermal Papers dominate with 31.8% due to their critical role in receipt printing and labeling applications.

In 2024, Thermal Papers held a dominant market position in the By End Use Analysis segment of the Bisphenol S Market, with a 31.8% share. BPS enhances heat sensitivity in thermal coatings, vital for POS systems. Its usage surges in retail and logistics. Moreover, thermal papers benefit from BPS’s stability. Shifting focus, demand grows with e-commerce expansion.

Similarly, Fine Chemicals utilizes BPS in synthesis processes. It acts as an intermediate for pharmaceuticals and dyes. Though secondary, this segment values purity. Increasingly, fine chemicals drive innovation in specialty products. Hence, BPS supports advanced chemical engineering.

Epoxy Resins incorporate BPS for enhanced durability. These resins apply in coatings and electronics. Growing infrastructure boosts this end use. Consequently, epoxy formulations rely on BPS for performance. Finally, Phenolic Resins employ BPS in high-temperature applications. It improves resin strength in automobiles.

Key Market Segments

By Product Type

- Liquid

- Powder

By Sales Channel

- Direct Sales

- Indirect Sales

By End Use

- Thermal Papers

- Fine Chemicals

- Epoxy Resins

- Phenolic Resins

- Others

Emerging Trends

Scrutiny of BPA-free BPS in receipts and everyday papers

Bisphenol S has quietly become the workhorse behind many BPA-free labels, especially on receipts and other coated papers. An ECHA survey estimated that about 61% of all thermal paper in Europe contained BPS as the main replacement for BPA. Regulators and toxicologists are now treating this as a classic case of regrettable substitution.

- The European Food Safety Authority has modelled typical daily dermal exposure from handling BPS-based receipts at about 0.059 µg per kg of body weight, which may sound tiny but is continuous for cashiers and other workers. At the same time, biomonitoring studies and animal work point toward endocrine-disrupting and reproductive effects similar to BPA.

A shift away from single-substance bans (only BPA) toward group-based measures that also capture BPS and other bisphenols, and a push for non-bisphenol developers like vitamin-C-based papers or fully digital receipts. For producers of BPS, the short-term story is high use in thermal papers and some polymers; the longer-term story is mounting pressure to redesign formulations so that BPA-free genuinely means lower hormonal risk, not just a different bisphenol in the coating.

Drivers

BPA phase-outs are pushing short-term demand for BPS

The main force that pushed Bisphenol S into the spotlight was not its performance alone, but the global retreat from BPA. In the EU, BPA has been restricted in thermal paper, with a full ban on BPA-containing thermal receipts entering into force, forcing paper makers to switch developers in only a few years. Many printers, paper mills, and brand owners chose BPS because its chemistry is close to BPA, so existing curing and printing lines needed minimal tweaking.

- Human biomonitoring underscores how strong that adoption wave has been. In the US National Health and Nutrition Examination Survey (NHANES), BPS was detected in 89.4% of urine samples from the general population, based on 1,808 adults and 868 children, alongside similarly high detection rates for BPA. This tells us BPS has spread well beyond niche industrial applications into everyday exposure, including from receipts, food-contact coatings, and textiles.

Industry has leaned on BPS because it offers heat stability and compatibility with high-performance materials like polyethersulfone and certain epoxy systems used in cans, filters, and electronics. When retailers and FMCG brands committed publicly to BPA-free packaging, resin producers and converters needed a drop-in building block that preserved product performance and avoided immediate supply chain disruption.

Restraints

Health concerns and group restrictions are closing in on BPS

Toxicologists have highlighted that BPS shows estrogen-like activity and reproductive toxicity in several experimental systems, leading European and national regulators to treat it much more cautiously. The European Chemicals Agency added 4,4′-sulphonyldiphenol (Bisphenol S) to the REACH Candidate List as a substance of very high concern for reproductive toxicity and endocrine-disrupting properties in humans and the environment.

- Switzerland has already banned BPS in thermal paper above a specified concentration, effectively phasing it out of receipts nationally. The UK’s Health and Safety Executive has gone further by proposing a group restriction that would cap the concentration of several bisphenols, including BPS, in articles and mixtures at 0.02% by weight, with additional limits on release rates over a product’s life.

Across the Atlantic, a new study for the Center for Environmental Health in the US showed that simply holding a BPS-coated receipt for 10 seconds could lead to skin absorption above California’s Proposition 65 safety threshold, prompting violation notices to roughly 50 major retailers. That kind of public pressure, combined with SVHC listing and national bans, is a clear commercial restraint.

Opportunity

Safer, tightly-controlled niches and circular design for BPS-based polymers

Even as broad consumer uses come under pressure, there is still a window of targeted opportunity for Bisphenol S in highly controlled, technical applications, especially where migration into food or direct human contact can be kept near zero and where recycling rules push industry toward durable, trackable materials.

The EU’s new Regulation (EU) 2022/1616 on recycled plastic food-contact materials demands that recycling processes keep contaminants under strict control and demonstrate safety before authorisation. In parallel, the broader Packaging and Packaging Waste Regulation aims to make all EU packaging recyclable and to safely increase the use of recycled plastics.

- The new Bisphenol Regulation (EU) 2024/3190, BPA and other hazardous bisphenols are broadly banned in food-contact materials, but very limited exemptions remain for critical applications like polysulfone filtration membranes and large-volume epoxy linings, provided migration into food is non-detectable and capacity exceeds 1,000 litres.

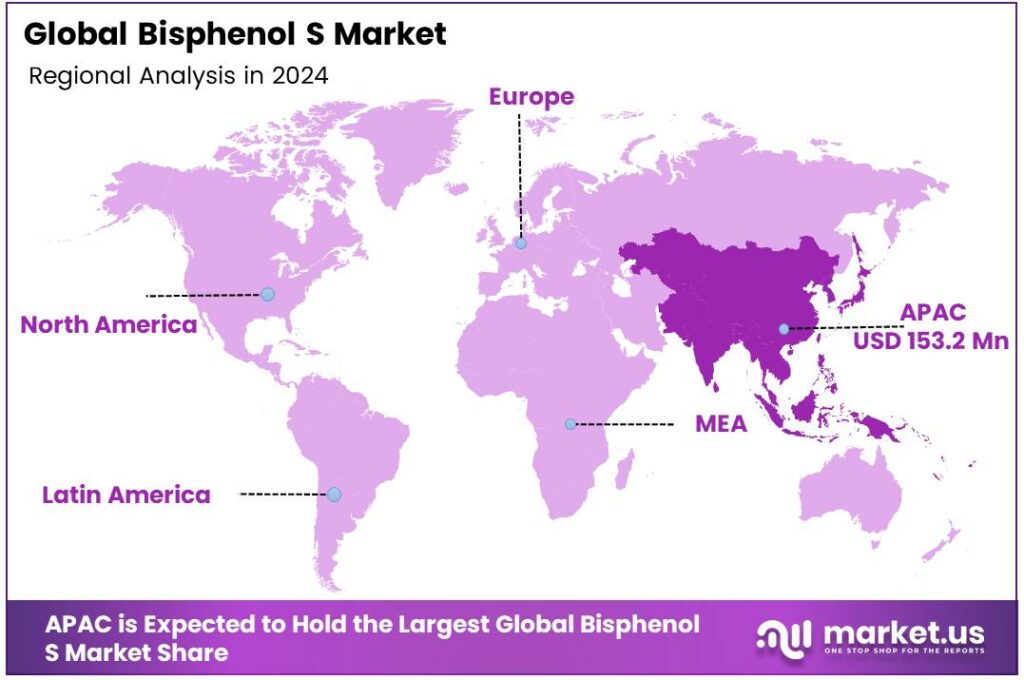

Regional Analysis

Asia-Pacific leads with a 45.9% share and a USD 153.2 Million market value.

Asia Pacific leads the Bisphenol S (BPS) market with a 45.9% share valued at USD 153.2 million. The region’s strong manufacturing base and broad chemical ecosystem continue to push BPS usage. Rapid adoption of safer bisphenol alternatives further strengthens demand. This foundation keeps Asia Pacific firmly ahead of other global markets.

Stricter regulations targeting BPA across major economies are speeding up the shift toward BPS. Packaging, electronics, and textile processing industries in Southeast Asia are expanding quickly. These sectors rely heavily on stable and safe intermediates like BPS. As compliance requirements tighten, manufacturers are steadily moving to BPS-based systems.

China remains the engine of regional growth with rising output of PES, epoxy systems, and high-performance coatings. These materials depend on BPS for better heat and chemical resistance. Japan and South Korea continue to contribute through advanced R&D and innovation-driven polymer applications. Their long-standing technical ecosystems help support steady high-end BPS demand.

Environmental reforms and stronger product-safety norms are reinforcing BPS adoption across the region. Investments in resin capacity and modern chemical parks continue at a steady pace. Export-oriented specialty chemical clusters add further momentum to growth. These developments ensure the Asia Pacific stays central to global BPS production and applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE leverages its extensive production capacity and robust R&D to maintain a significant position in the Bisphenol S market. The company’s strong global distribution network and focus on high-purity, specialty-grade products cater to diverse industrial demands, particularly in high-performance plastics and epoxy resins. Its commitment to sustainable and safer alternatives aligns with evolving regulatory trends, ensuring its competitive edge and influence over market standards and supply dynamics.

Konishi Chemical distinguishes itself through advanced synthesis technology and a focus on quality and consistency, serving niche applications in the electronics and imaging industries. Its strategic presence in the Asia-Pacific region, a major consumption hub, allows it to effectively respond to regional demand. The company’s specialized approach and reliable supply chain make it a crucial player for specific, high-value market segments.

Solvay S.A. brings its formidable expertise in advanced materials and specialty chemicals to the Bisphenol S landscape. The company’s strength lies in developing innovative applications and solutions, particularly for high-temperature resins and composite materials used in aerospace and automotive sectors. Its global operational scale and commitment to research allow it to drive product development and meet stringent performance requirements.

Top Key Players in the Market

- BASF SE

- Konishi Chemical Ind. Co., Ltd.

- Solvay S.A.

- Nisso Metallochemical Co., Ltd.

- Volant-Chem Corp.

- Nicca Chemical Co., Ltd.

- Chongqing Qiutian Chemical Co., Ltd.

- others

Recent Developments

- In 2025, BASF’s Performance Materials division introduced Ultrason, the first biomass-balanced grade in its Ultrason polyethersulfone (PESU) portfolio. PESU is an aromatic polyethersulfone made from bisphenolic monomers and dihalodiphenylsulfone.

- In 2025, Konishi’s own R&D page lists BS-BXZ as a bisphenol-S–type benzoxazine resin (X = SO₂), alongside BA-BXZ (BPA-based) and BF-BXZ (BPF-based). BS-BXZ is described as a laboratory-stage product with low residual solvent and aniline content, intended for high-performance adhesives and electronic materials.

Report Scope

Report Features Description Market Value (2024) USD 333.9 Million Forecast Revenue (2034) USD 570.3 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Powder), By Sales Channel (Direct Sales, Indirect Sales), By End Use (Thermal Papers, Fine Chemicals, Epoxy Resins, Phenolic Resins, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Konishi Chemical Ind. Co., Ltd., Solvay S.A., Nisso Metallochemical Co., Ltd., Volant-Chem Corp., Nicca Chemical Co., Ltd., Chongqing Qiutian Chemical Co., Ltd., others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Konishi Chemical Ind. Co., Ltd.

- Solvay S.A.

- Nisso Metallochemical Co., Ltd.

- Volant-Chem Corp.

- Nicca Chemical Co., Ltd.

- Chongqing Qiutian Chemical Co., Ltd.

- others