Global Biotechnology Instruments Market By Product (Analytical Instruments, Cell Culture Instruments, Cell Separation Instruments, Immunoassay Instruments, Clinical Chemistry Analyzers and others), By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Academic & Research Institutes), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124486

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

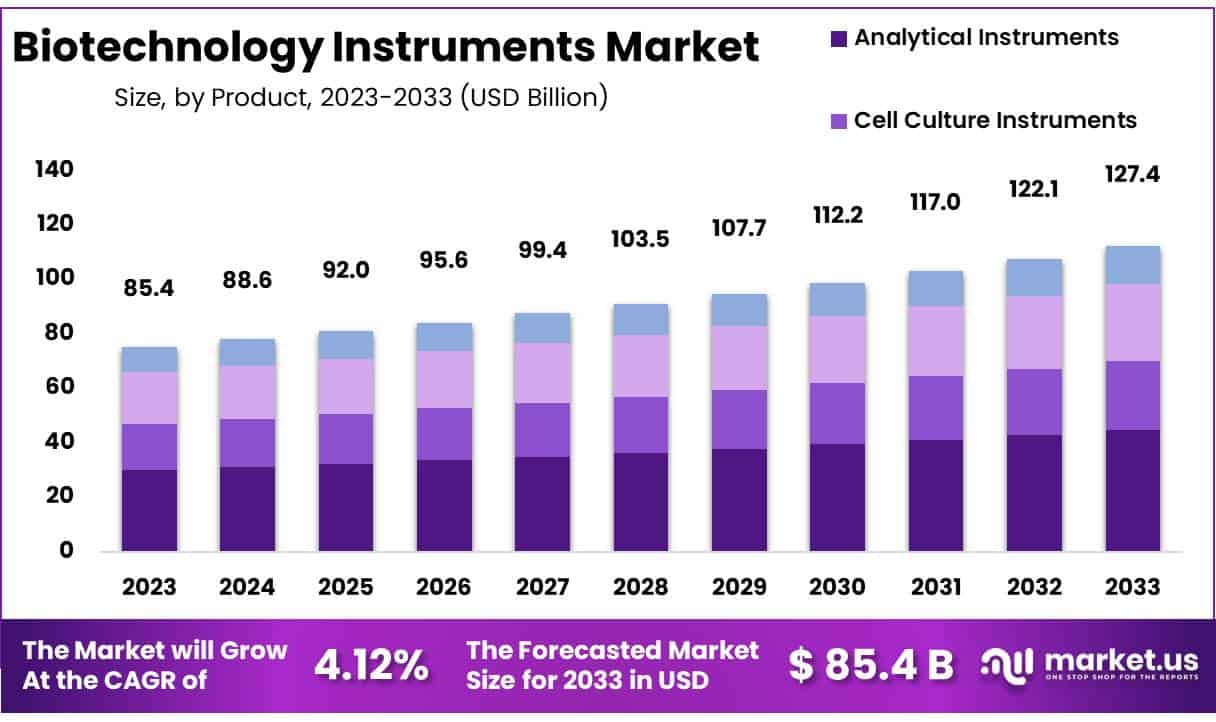

The Global Biotechnology Instruments Market size is expected to be worth around USD 127.4 Billion by 2033 from USD 85.4 Billion in 2023, growing at a CAGR of 4.12% during the forecast period from 2024 to 2033.

The biotechnology instruments market is driven by rapid advancements in biotechnology, including genomics and proteomics, and the growing demand for personalized medicine, which necessitates sophisticated diagnostic and therapeutic tools. Increasing research funding and the rise in chronic diseases further fuel market growth, while the expansion of biotechnology and pharmaceutical industries accelerates the need for innovative instruments.

The market for biotechnology instruments experiences major thrives owing to rapid advancements by biotechnology instruments companies in screening, NMR, MS Chromatography and various other products. The market is further boosted by the growth of gene and cell therapies and their scaling ultimatum. FDA approvals are increasing leading to a healthy outlook for gene therapies in the near future. In addition, the number of clinical trials is anticipated to rise to the advancements in recombinant DNA Products.

- The Food and Drug Administration projected more than 210 applications for cell and gene therapy clinical trials by 2029 annually.

Key Takeaways

- Market Size: Biotechnology Instruments Market size is expected to be worth around USD 127.4 Billion by 2033 from USD 85.4 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.12% during the forecast period from 2024 to 2033.

- Product Analysis: In 2023, the analytical instruments segment took the lead in the global market, securing 33% of the total revenue share.

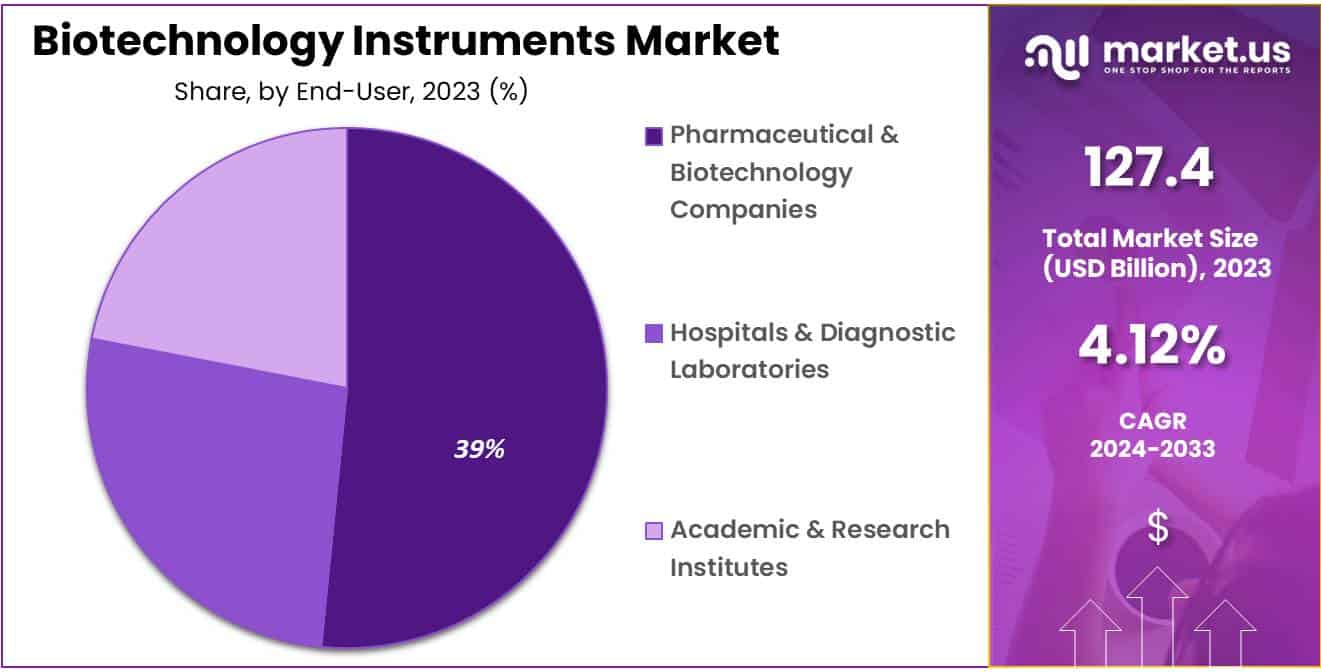

- End-Use Analysis: Among end-use segments, pharmaceutical & biotechnology companies emerged as the dominant sector, capturing 39% of the total revenue.

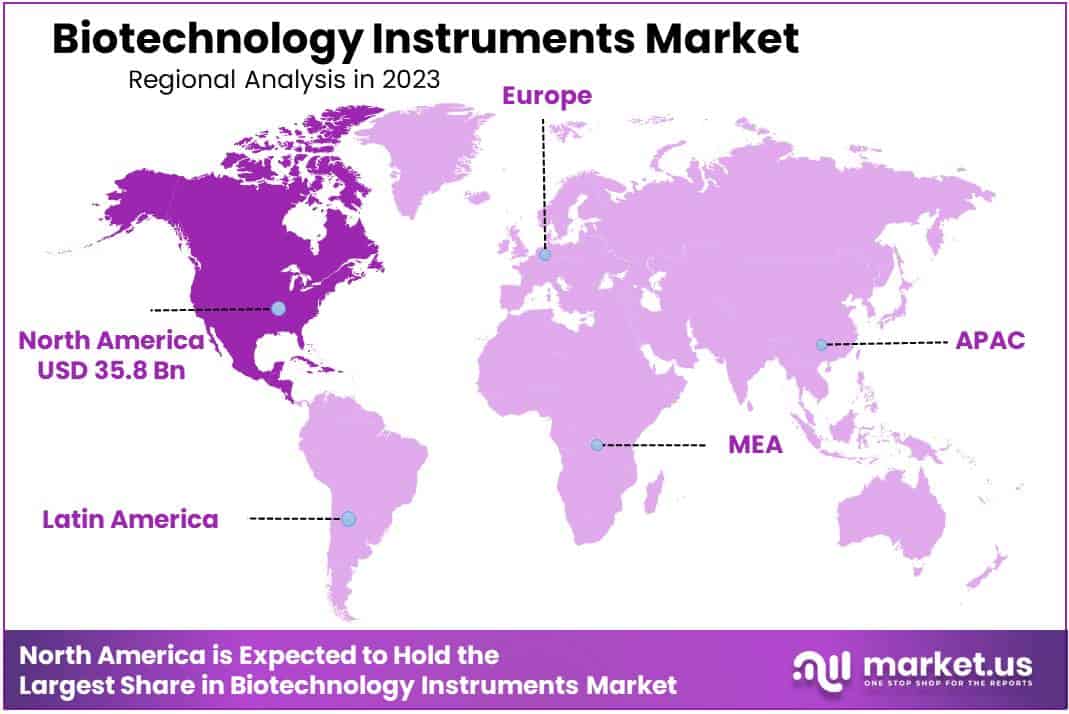

- Regional Analysis: A dominant market revenue share of 42% is withheld by North America, commanding the global biotechnology instruments market in the year 2023.

- Market Drivers: Increased R&D investments, rising prevalence of chronic diseases, and government initiatives in biotechnology fuel market expansion.

- Challenges: High costs of instruments and stringent regulatory requirements pose significant challenges to market growth.

- Future Trends: Integration of AI and automation in biotechnology instruments is expected to enhance efficiency and accuracy in research and clinical applications.

By Product Analysis

Based on Product the market is fragmented into Analytical Instruments, Cell Culture Instruments, Cell Separation Instruments, Immunoassay Instruments, Clinical Chemistry Analyzers, and others. Amongst these, Analytical Instruments dominated the global biotechnology instruments market capturing a praiseworthy market share of 33% in 2023.

Due to their critical role in advancing research and development across various applications. These instruments, which included technologies such as mass spectrometers, chromatographs, and spectrophotometers, were pivotal in providing accurate and detailed analysis of biological samples. These products facilitated the separation, identification, and quantification of complex biomolecules, thus supporting a wide range of scientific investigations from genomics and proteomics to drug discovery and clinical diagnostics.

The prominence of analytical instruments was largely driven by their ability to deliver high precision and reliability in data, which was essential for researchers aiming to understand intricate biological processes and disease mechanisms.

By End-user Analysis

Based on end use, the market fractionates into Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, and Academic & Research Institutes. An indispensable role is performed by the pharmaceutical & biotechnology companies segment apprehending a large market revenue share of 39% in the year 2023.

Driven by extensive reliance of pharmaceutical & biotechnology companies on advanced analytical and diagnostic tools to support drug development, research, and quality control processes. These companies invest heavily in biotechnology instruments to facilitate critical stages of drug discovery, including target identification, compound screening, and clinical trials.

Instruments such as mass spectrometers, chromatographs, and high-throughput screening systems are integral to these processes, enabling detailed molecular analysis and ensuring the accuracy and efficacy of therapeutic products. Additionally, biotechnology firms leverage these instruments for genomics and proteomics research, which are essential for understanding disease mechanisms and developing personalized medicine.

Key Segments Analysis

By Product

- Analytical Instruments

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

- Sequencing

- Microarray

- Others

- Cell Culture Instruments

- Culture Systems

- Incubators

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

- Cell Separation Instruments

- Centrifuge

- Filtration Systems

- Magnetic-activated Cell Separator Systems

- Immunoassay Instruments

- Clinical Chemistry Analyzers

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

Market Dynamics

Growing Target Diseases

The burgeoning prevalence of chronic diseases is significantly driving the growth of the biotechnology instruments market, as the increasing incidence of these conditions escalates the demand for advanced diagnostic and therapeutic technologies. Chronic diseases, such as cardiovascular disorders, diabetes, and cancer, are rising globally, necessitating more sophisticated instruments for early detection, monitoring, and treatment.

In 2021, the World Health Organization (WHO) highlighted that cardiovascular diseases alone contribute to a substantial proportion of non-communicable disease (NCD) deaths, i.e. 17.9 million people annually, underlining the urgent need for improved healthcare solutions. As these conditions lead to a greater number of medical procedures and require ongoing management, there is a concurrent surge in the demand for high-precision biotechnology instruments used in diagnostics, personalized medicine, and therapeutic interventions.

These instruments enable healthcare providers to conduct detailed molecular analyses, monitor disease progression, and tailor treatments to individual patient profiles, thereby improving outcomes and efficiency.

Market Restraints

Recall of products by regulatory authorities

The biotechnology instruments market faces significant constraints due to the growing frequency of product recalls mandated by regulatory authorities such as the U.S. Food and Drug Administration (FDA). These recalls occur when products fail to meet safety, efficacy, or quality standards, leading to delays in market introduction and additional scrutiny for manufacturers. Such regulatory actions not only hinder the timely launch of new technologies but also impose substantial financial burdens on companies.

The costs associated with addressing recall issues, ranging from redesign and revalidation to conducting additional clinical trials escalate the overall expense of product development. This financial strain can be particularly challenging for new entrants attempting to break into the market, as the increased costs and regulatory hurdles may deter innovation and limit market competition.

- In November 2018, the Class I flow cytometer manufactured by Beckman Coulter (manufacturer of the diagnostic system) was recalled by the Food & Drug Administration

Market Opportunities

Advancements in Technology

The market for biotechnology instruments is witnessing tremendous growth by advancements in techniques in the areas of sequencing technologies, NMR, and chromatography methods. Investments are made in research and development for products and services related to life sciences, which is gradually propelling the demand for biotechnology instruments.

The market is on the rise due to the acquisitions in the life-sciences and biopharma industries bolstering its strong presence in the marketplace. Improvements are made in infrastructure as compared to the previous time when only a few market players had the infrastructure to manage the complete value chain of biological production. Increased approvals by regulatory authorities such as the Food and Drug Administration (US) further drive the market of biotechnology instruments to a large extent.

- For instance, in January 2022, the Tebentafusp-tebn monoclonal antibody was approved by the Food and Drug Administration, which aids in the treatment of metastatic uveal melanoma.

Impact of macroeconomic factors / Geopolitical factors

Despite the continued inflation, the biotechnology instruments market has experienced growth. This can be attributed to the steady demand for biotechnology instruments and services. Additionally, the investment in R&D assists in the growth of the market. Such investments hinge on healthcare expenditure and public spending on healthcare. Healthcare expenditure constitutes up to 11% of global GDP, which the World Health Organisation estimated to be about US$ 9 trillion in 2022.

Alternatively, according to an article by the American Medical Association, there was a 2.7% increase in health spending in the US in 2021. Moreover, the biotechnology instruments market is also influenced by taxation policies by regional governments and the national GDP.

Latest Trends

Significant traction has been achieved by 3D cell culture models and organ-on-a-chip platforms due to their advanced capabilities compared to traditional 2D cell culture systems. These innovative technologies enable researchers to more accurately replicate the complexity of natural tissue microenvironments and examine organ-level functions, disease mechanisms, and drug responses in vitro.

Additionally, the integration of cloud-based platforms, bioinformatics tools, and data repositories within the life sciences sector has greatly enhanced collaboration, data sharing, and the incorporation of multi-omics datasets, allowing for a comprehensive analysis. The field of life sciences has been further transformed by the advent of CRISPR-Cas9 gene editing technology, which enables precise genome editing and manipulation.

Furthermore, recent advancements in CRISPR-powered technologies have broadened their applications, significantly impacting drug discovery, therapeutic development, and functional genomics.

Regional Analysis

A dominant market revenue share of 42% is withheld by North America, commanding the global biotechnology instruments market in the year 2023. The dominance of the region is highly accredited to the quick-witted acquisition of proteomics, diagnostic screening, oncology and genomics.

To diagnose and treat clinical disorders regions like the United States and Canada are highly adopting biopharmaceuticals, novel technologies, and genomic medicines is signifying the market growth of the region. The regional market is further subjected to extension due to well-regulated ecosystems for approval and usage of genomic and tissue diagnostic tests over the projection period.

- For instance, in August 2021, Agilent Technologies launched COVID-19 Severity Test Screening using Agilent Cary 630 FTIR Spectrometer

Asia-Pacific is projected to witness the fastest market growth during the projected period, owing to the scaling efforts and investments by major industry players. This allows the region to grab untapped avenues in the global market.

- In January 2022, Atara Bio-Therapeutics T-Cell Operations and manufacturing facility was acquired by FUJIFILM Corporation for USD 100 million. This assisted FUJIFILM Corporation in producing commercial and clinical treatments including T-cell and CAR-T cell immunotherapies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The biotechnology instruments market is consolidated in nature with a strong presence of established players. Further, the lucrative nature of the industry attracts new players, but the high barriers to entry abate the businesses from entering. Key players compete to either increase or maintain their market share, which keeps the market in a constant state of flux. Businesses seek to cement their positions through strategies like alliances, acquisitions, agreements and product launches.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Abbott

- Waters Corp.

- Shimadzu Corp.

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- BIOMÉRIEUX S.A.

- Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

- Eppendorf SE

Recent Developments

- In October 2023: Revvity, Inc. and Element Biosciences, Inc., creator of the AVITI System, a cutting-edge genomic sequencing platform, partnered to present workflow solutions simplifying the genomic analysis of samples. This collaboration aims to enhance the accessibility of high-quality sequencing, providing a comprehensive solution for improved efficiency.

- In May 2023: Opentrons introduced the Opentrons Flex robot, a cost-effective and user-friendly liquid-handling lab robot, aiming to democratize advanced lab automation for labs of all sizes. The product is designed to enhance the lab’s efficiency and flexibility. This helped the company to expand its product offerings.

- In February 2023: A fledging life-science firm Avida Biomed has been acquired by Agilent Technologies, Inc. Avida Biomed creates high-performance target enrichment workflows with distinctive features for clinical researchers using next-generation sequencing methods to study cancer.

Report Scope

Report Features Description Market Value (2023) USD 85.4 billion Forecast Revenue (2033) USD 127.4 billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Analytical Instruments, Cell Culture Instruments, Cell Separation Instruments, Immunoassay Instruments, Clinical Chemistry Analyzers and others), By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Abbott, Waters Corp., Shimadzu Corp., Agilent Technologies, Inc., Bruker Corp., PerkinElmer, Inc., Zeiss Group, Bio-Rad Laboratories, Inc., Illumina, Inc., BIOMÉRIEUX S.A., F. Hoffmann-La Roche AG, Sartorius AG, Avantor, Inc., Eppendorf SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biotechnology Instruments MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Biotechnology Instruments MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Abbott

- Waters Corp.

- Shimadzu Corp.

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- BIOMÉRIEUX S.A.

- Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

- Eppendorf SE