Global Biologics CDMO Market Analysis By Product Type (Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Cell and Gene Therapies, Blood and Blood Components, Others), By Application (Therapeutic Applications, Diagnostic Applications, Others), By End-User (Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Academic and Research Institutions, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146443

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

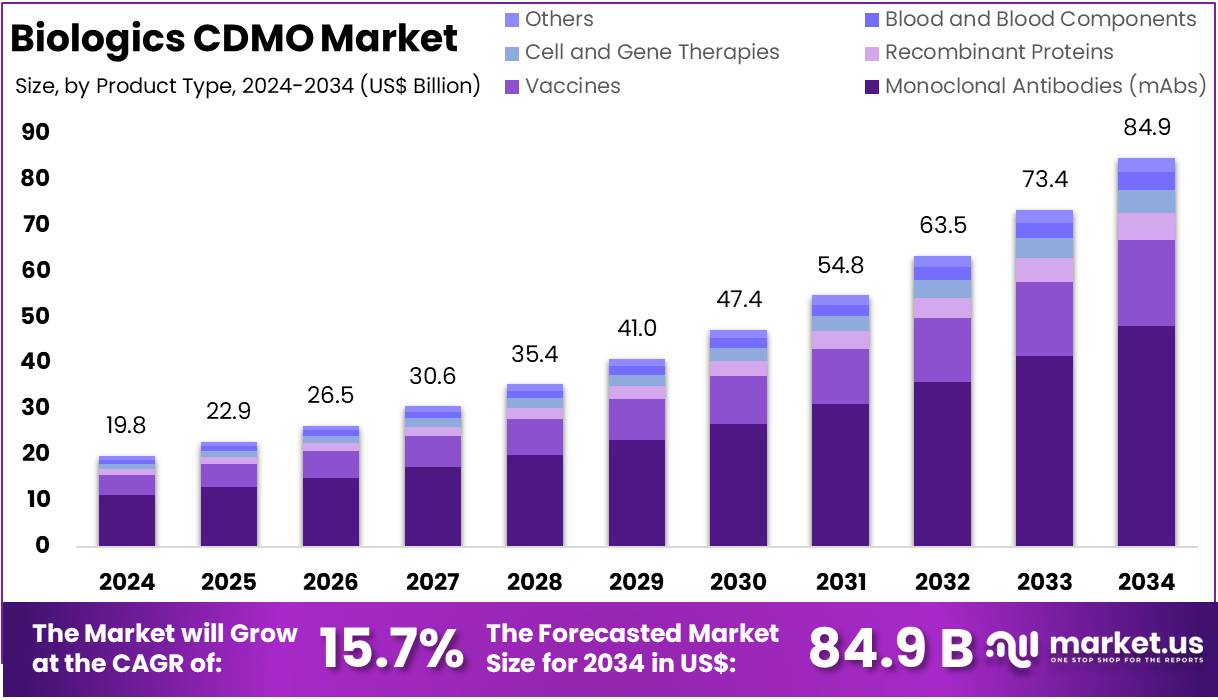

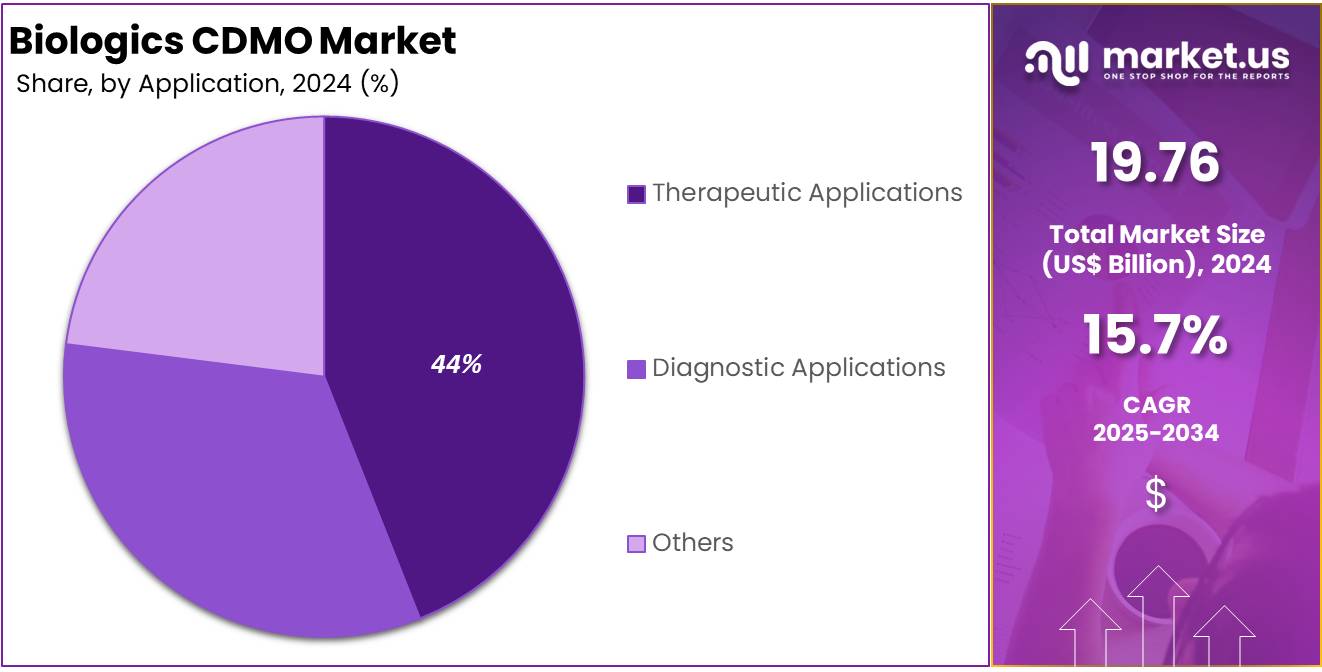

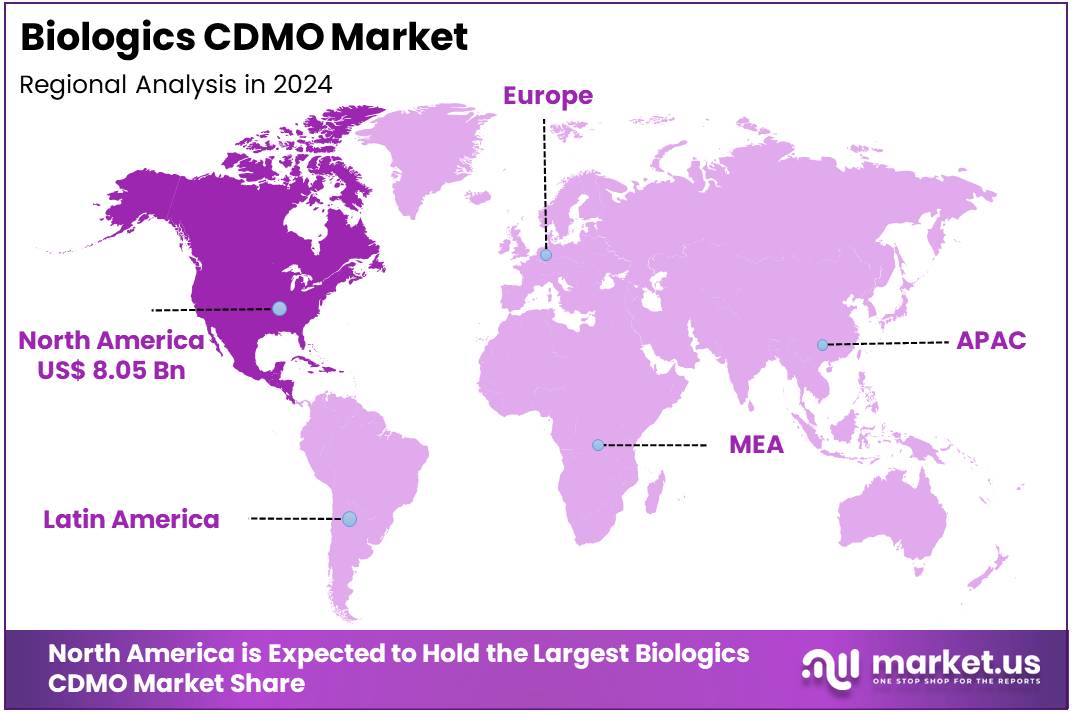

The Global Biologics CDMO Market Size is expected to be worth around US$ 84.9 Billion by 2034, from US$ 19.8 Billion in 2024, growing at a CAGR of 15.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.9% share and holds US$ 8.08 billion market value for the year.

The Biologics Contract Development and Manufacturing Organization (CDMO) sector is witnessing robust growth, driven by a surge in demand for biologic therapies. Biologic medicines such as vaccines, monoclonal antibodies, and growth factors are increasingly used to treat chronic diseases like cancer, diabetes, and autoimmune conditions. According to the World Health Organization (WHO), these therapies offer high efficacy and safety. However, their cost often limits global access. The emergence of biosimilars is addressing this issue by offering more affordable options, particularly in low- and middle-income countries.

The development of biosimilars is significantly boosting the biologics CDMO market. These alternatives to original biologics are subject to stringent analytical and clinical evaluations to confirm therapeutic equivalence. A study by the WHO emphasizes biosimilars as safe, effective, and essential for broadening global access to biologic treatments. As pharmaceutical companies expand their biosimilar pipelines, the demand for CDMO services continues to grow. This trend is opening new opportunities for biologics CDMOs to support drug development and scale-up manufacturing.

Technological advancements are also playing a crucial role in the expansion of CDMO capabilities. Innovations in cell culture, purification, and analytical methods have made biologic production more efficient and scalable. For example, modern biomanufacturing platforms allow for better batch consistency and lower production costs. These technologies are essential for meeting the growing global demand for biologic therapies. CDMOs are rapidly adopting such technologies to enhance their service offerings and address complex production needs.

Regulatory support further strengthens the growth trajectory of biologics CDMOs. According to the U.S. Food and Drug Administration (FDA), detailed guidelines on chemistry, manufacturing, and control (CMC) have streamlined the biologics development process. These frameworks improve quality assurance and facilitate faster approval timelines. For instance, the FDA and WHO continue to align standards to ensure safety, efficacy, and consistency across biologic products, which helps CDMOs maintain compliance while accelerating development timelines for clients.

The strategic role of CDMOs became especially clear during the COVID-19 pandemic. Vaccine production scaled up from 1.5 billion doses annually to over 11 billion doses by the end of 2021. CDMOs supported this dramatic expansion by participating in the manufacturing of vaccines from Pfizer-BioNTech, Moderna, AstraZeneca, and Johnson & Johnson. This highlighted their ability to adapt quickly to global health demands. Furthermore, a study by the FDA revealed that between 2013 and 2017, 62% of drug shortages in the U.S. were due to quality issues—an area where CDMOs offer critical expertise.

The biologics manufacturing landscape is globally distributed. According to recent data, 39% of biologics manufacturing sites supplying the U.S. market are located domestically. In contrast, 12% are in India, 11% in China, 4% in Germany, and 4% in South Korea. Interestingly, a small number of sites in India and China account for a substantial portion of the output. CDMOs continue to be essential to the pharmaceutical supply chain, especially in times of crisis, due to their scalability, flexibility, and commitment to regulatory compliance.

Key Takeaways

- The global biologics CDMO market is projected to reach approximately US$ 84.9 billion by 2034, rising from US$ 19.8 billion in 2024.

- This growth reflects a strong CAGR of 15.7% between 2025 and 2034, indicating increasing demand for contract development and manufacturing services in biologics.

- In 2024, monoclonal antibodies (mAbs) dominated the product type segment, accounting for over 56.7% of the total market share.

- Therapeutic applications led the application segment in 2024, representing more than 80.4% of the market due to widespread use in disease treatment.

- The opioids segment captured over 50.7% of the biologics CDMO drug class segment in 2024, showing its significant role in pharmaceutical production outsourcing.

- North America emerged as the leading regional market in 2024, holding more than a 40.9% share and generating US$ 8.08 billion in value.

Product Type Analysis

In 2024, Monoclonal Antibodies (mAbs) held a dominant market position in the product type segment of the Biologics CDMO market, capturing more than a 56.7% share. This dominance is due to their high use in treating cancer and autoimmune diseases. mAbs are preferred for their precision and low side effects. Their demand continues to rise with advancements in personalized medicine. The increasing number of biologics approvals is also boosting the need for mAb manufacturing services.

Vaccines followed mAbs in market share. Their demand surged with global immunization efforts and pandemic response strategies. CDMOs play a vital role in vaccine production, including mRNA and viral vector platforms. Recombinant proteins also showed strong growth. These are widely used in chronic disease treatments like diabetes and hormone deficiencies. Innovation in protein expression systems is further supporting this segment. Both vaccines and recombinant proteins continue to benefit from strong research pipelines and global health priorities.

Cell and gene therapies are emerging as high-growth segments. Although their market share is still smaller, demand is rising quickly. These therapies require advanced manufacturing capabilities and regulatory support. Blood and blood components, while essential, represent a smaller segment. They face supply chain and storage challenges. The Others category includes biosimilars, peptides, and oligonucleotides. These are gaining attention due to innovation and cost-effectiveness. Each of these segments reflects the growing complexity and diversification in biologics manufacturing.

Application Analysis

In 2024, Therapeutic Applications held a dominant market position in the application segment of the Biologics CDMO market, capturing more than an 80.4% share. This strong presence was driven by the increasing demand for biologic drugs targeting chronic and infectious diseases. Therapeutic biologics such as monoclonal antibodies and gene therapies are widely used in treating cancer, autoimmune disorders, and rare genetic conditions. Their proven clinical benefits and targeted action have made them the preferred choice for advanced treatment solutions.

The large market share of therapeutic applications is also supported by ongoing research and innovation in biologic drug development. Pharmaceutical pipelines are increasingly focused on high-efficacy therapies with fewer side effects. Regulatory agencies are encouraging this shift through accelerated approval pathways for novel treatments. As a result, more drug manufacturers are outsourcing production to CDMOs for cost-efficiency and technical expertise in handling complex biologic formulations.

In comparison, Diagnostic Applications and Other Applications held a smaller market share. Diagnostic biologics are used for disease detection and biomarker identification but are produced in lower volumes. Although their contribution remains limited, the segment is expected to grow. The rise of personalized medicine and companion diagnostics is creating new opportunities. CDMOs are gradually expanding their capabilities to meet the evolving needs of the diagnostic biologics segment.

End-User Analysis

In 2024, the Opioids segment held a dominant market position in the Drug Class Segment of the Biologics CDMO, capturing more than a 50.7% share. This was mainly due to the increasing outsourcing needs of major pharmaceutical companies. These firms are focusing on reducing internal manufacturing costs. They are also shifting toward external partnerships to streamline biologics production. The need for large-scale production and regulatory compliance has further pushed pharmaceutical companies to rely on CDMOs for operational efficiency.

Biotechnology companies formed the second-largest end-user group in this market. Many of these companies lack the infrastructure needed for commercial manufacturing. Hence, they turn to CDMOs for support in clinical and early-stage biologics production. Emerging biotech firms, especially start-ups, depend on CDMOs for advanced capabilities and cost control. This partnership enables faster product development and regulatory filing. The flexibility offered by CDMOs is crucial for biotech firms managing limited resources and fluctuating demand.

Other contributors to the Biologics CDMO market include CROs, academic institutions, and public research bodies. Contract Research Organizations often use CDMOs to meet the biologics requirements of their clinical trials. Academic and research institutions also collaborate with CDMOs for small-scale, pilot production. These collaborations support innovation in biologic therapies. In some cases, government agencies and nonprofit groups engage CDMOs for public health programs and vaccine development. These diverse end-users highlight the broad utility of CDMO services in biologics manufacturing.

Key Market Segments

By Product Type

- Monoclonal Antibodies (mAbs)

- Vaccines

- Recombinant Proteins

- Cell and Gene Therapies

- Blood and Blood Components

- Others

By Application

- Therapeutic Applications

- Diagnostic Applications

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutions

- Others

Drivers

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is significantly influencing the demand for biologic therapies. Noncommunicable diseases (NCDs) such as cancer, diabetes, and autoimmune disorders now account for around 74% of all global deaths. These conditions require long-term, targeted treatments, making biologics—including monoclonal antibodies and biosimilars—critical to patient care. As treatment protocols evolve, the role of biologics in managing NCDs continues to grow. This shift is creating strong pressure on healthcare systems to ensure access to advanced biologic solutions.

The burden of NCDs is especially high in low- and middle-income countries, where healthcare infrastructure is still developing. As these regions confront increasing patient loads, the need for scalable and efficient biologics manufacturing has become more urgent. Expanding contract development and manufacturing capabilities is vital to meeting this demand. Investment in biologics CDMO services can help bridge the supply gap, improve therapeutic access, and support global health outcomes. This trend positions biologics production as a strategic priority in combating the chronic disease burden worldwide.

Restraints

High Production Costs and Scalability Challenges

The manufacturing of biologics involves highly complex processes that require advanced technologies and specialized facilities. These manufacturing steps must meet stringent regulatory standards to ensure safety, efficacy, and quality. As a result, production costs are significantly higher when compared to traditional pharmaceuticals. Establishing and maintaining compliance with global regulatory frameworks such as the FDA, EMA, and ICH adds further to the financial burden. These factors create major cost barriers, particularly for new entrants or smaller Contract Development and Manufacturing Organizations (CDMOs).

In addition to high costs, scalability poses a significant challenge for biologics CDMOs. Scaling biologics production from laboratory to commercial scale requires sophisticated bioreactor systems, continuous monitoring, and robust process controls. Smaller CDMOs often lack the capital and infrastructure necessary for large-scale production, limiting their market competitiveness. Moreover, any variation in production processes can impact product consistency, making scalability even more difficult. These limitations restrict growth potential and make it harder for emerging CDMOs to compete with larger, well-established players.

Opportunities

Expansion in Emerging Markets

Emerging markets, especially in the Asia-Pacific region, offer substantial growth opportunities for biologics CDMOs. These regions are seeing rising demand for advanced biologic therapies due to increasing disease burden and expanding healthcare infrastructure. Several governments are prioritizing local production of biopharmaceuticals to reduce dependency on imports and enhance supply chain resilience. This shift is creating favorable conditions for CDMOs to invest and establish manufacturing capabilities. Improved regulatory frameworks and supportive policies are also helping attract global biologics developers to collaborate with regional service providers.

In addition, global health initiatives are actively supporting biomanufacturing capacity in low- and middle-income countries. One such effort is the WHO’s Global Training Hub for Biomanufacturing, which focuses on enhancing local expertise and infrastructure. These programs aim to reduce healthcare access gaps by enabling the regional production of essential therapies. As a result, biologics CDMOs have the chance to expand their footprint by partnering with public and private stakeholders. This creates a strategic opportunity to serve both domestic and international demand for affordable biologics in emerging economies.

Trends

Adoption of Advanced Manufacturing Technologies

The biologics manufacturing sector is experiencing a notable transition towards advanced technologies such as continuous manufacturing and single-use systems. These innovations are being increasingly adopted to enhance production efficiency and flexibility. Continuous manufacturing helps in reducing production time while improving product quality. Meanwhile, single-use systems lower the risk of cross-contamination and simplify cleaning procedures. These systems are especially beneficial for multi-product facilities, where changeovers between batches are frequent. The adoption of these technologies also contributes to reducing operational costs and maintaining regulatory compliance.

International health organizations, including the WHO, have recognized the importance of integrating advanced manufacturing systems in biologics production. They emphasize these technologies as key to scaling operations and ensuring uninterrupted supply of high-quality biologics. As global demand for biologic therapies rises, manufacturers are under pressure to optimize capacity and streamline processes. Advanced manufacturing enables better scalability and responsiveness to market needs. Moreover, these systems support sustainable production by reducing material waste and energy use, aligning with broader environmental and regulatory goals in the healthcare sector.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 40.9% share and holds US$ 8.08 billion market value for the year. This dominance is linked to the region’s well-established pharmaceutical and biotechnology sectors. Several leading drug manufacturers and biotech innovators operate in the United States and Canada. These firms often rely on contract manufacturing services for biologics development. The growing trend of outsourcing biologics production is further strengthening North America’s share in the global market.

A key factor supporting regional growth is the availability of advanced manufacturing infrastructure. The U.S. especially benefits from strong regulatory support and faster drug approval timelines. Biologics CDMO providers in the region are expanding their capabilities to meet rising demand. Investments in new production facilities, especially for monoclonal antibodies and cell therapies, are growing. In addition, academic and research collaborations in the life sciences field are contributing to innovation and expanding manufacturing needs.

Another contributing factor is the rising burden of chronic diseases in North America. This trend is fueling demand for personalized biologic treatments. As a result, companies are turning to CDMOs to accelerate development and reduce costs. Government funding and public-private partnerships are also playing a major role. These initiatives help support early-stage biologic research and commercial production. With these drivers in place, North America is expected to retain its lead in the Biologics CDMO market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The biologics CDMO market is led by major players such as Lonza Group, WuXi AppTec, and Samsung Biologics. Lonza holds a strong market presence through its global biomanufacturing sites and advanced biologics capabilities. It supports both clinical and commercial-scale biologics production. WuXi AppTec provides integrated biologics services, with rapid development timelines and flexible outsourcing models. Samsung Biologics is known for its large-scale capacity and expansion of biologics plants. The company focuses on biosimilars and novel biologics with advanced automation and regulatory compliance systems.

Boehringer Ingelheim is a significant player offering complete CDMO services for biologics, including cell culture and large-scale protein manufacturing. The company uses proprietary platforms to improve production yields. Catalent continues to expand its biologics pipeline through acquisitions and investments in high-capacity production facilities. It offers end-to-end solutions, from early-stage development to fill-finish operations. Both companies focus on monoclonal antibodies, injectable formulations, and gene therapy manufacturing, catering to rising client demands across the biopharmaceutical industry.

Other prominent contributors to this market include Fujifilm Diosynth Biotechnologies, Thermo Fisher Scientific, and AGC Biologics. These companies are expanding biologics capacity through global facilities and strategic partnerships. Their focus remains on recombinant proteins, cell and gene therapies, and vaccines. Continuous investment in biomanufacturing infrastructure and technological advancement supports their growth. As the demand for biologics increases, these players are enhancing quality standards and compliance with global regulatory norms. Their capabilities strengthen the overall supply chain in biologics outsourcing.

Market Key Players

- Lonza Group

- WuXi AppTec

- Samsung Biologics

- Boehringer Ingelheim

- Catalent

- Recipharm

- Fujifilm Diosynth Biotechnologies

- Vetter Pharma

- Rentschler Biopharma

- CordenPharma

- Minakem

- KBI Biopharma

Recent Developments

- In October 2024: Lonza finalized the acquisition of Roche’s biologics manufacturing facility in Vacaville, California, for a total of USD 1.2 billion. Recognized as one of the world’s largest biologics production sites, the facility offers an estimated bioreactor capacity of 330,000 liters. To further enhance its technological capabilities, Lonza announced an additional investment of CHF 500 million for facility upgrades. This strategic acquisition is expected to strengthen Lonza’s commercial-scale manufacturing capacity and align with its long-term growth objectives in next-generation mammalian biologics.

- In October 2024: Samsung Biologics secured a $1.2 billion contract manufacturing agreement with an undisclosed Asia-based pharmaceutical company. This contract, set to run through December 2037, represents the largest single-client deal in the company’s history. Production will take place at Samsung’s biomanufacturing site in Songdo, Incheon, South Korea. With this agreement, Samsung Biologics’ total new contract value for 2024 exceeded $3.3 billion, reflecting the company’s robust growth and expanding global partnerships.

Report Scope

Report Features Description Market Value (2024) US$ 19.8 Billion Forecast Revenue (2034) US$ 84.9 Billion CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Cell and Gene Therapies, Blood and Blood Components, Others), By Application (Therapeutic Applications, Diagnostic Applications, Others), By End-User (Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Academic and Research Institutions, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Lonza Group, WuXi AppTec, Samsung Biologics, Boehringer Ingelheim, Catalent, Recipharm, Fujifilm Diosynth Biotechnologies, Vetter Pharma, Rentschler Biopharma, CordenPharma, Minakem, KBI Biopharma, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lonza Group

- WuXi AppTec

- Samsung Biologics

- Boehringer Ingelheim

- Catalent

- Recipharm

- Fujifilm Diosynth Biotechnologies

- Vetter Pharma

- Rentschler Biopharma

- CordenPharma

- Minakem

- KBI Biopharma