Global Biologic Excipient Market By Type (Buffering Agents, Surfactants and Solubilizers, Lyoprotectants, Tonicity-Adjusting Agents, pH-Adjusting Components, Amino Acid Stabilizers, Chelators and Antioxidants and Others), By Source Type (Polymers and Polysaccharides, Natural Sugars and Disaccharides, Inorganic Salts and Others), By Route of Administration (Parenteral, Oral, Topical and Others), By End-User (Biopharmaceutical Manufacturers, CROs & CDMOs, Academic and Research Organizations and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173331

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

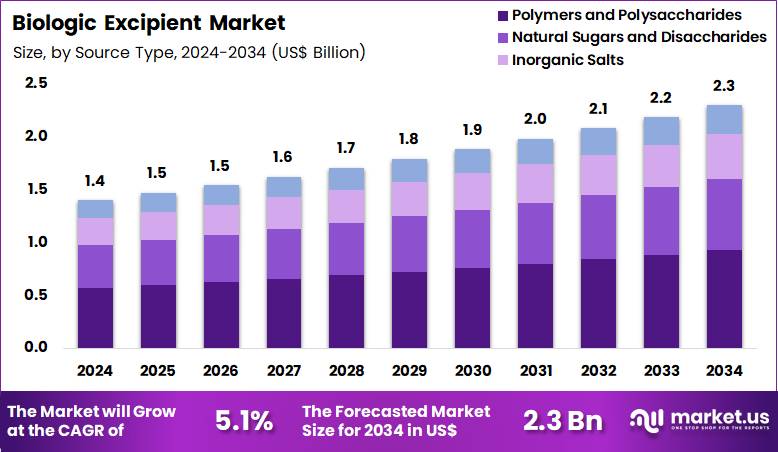

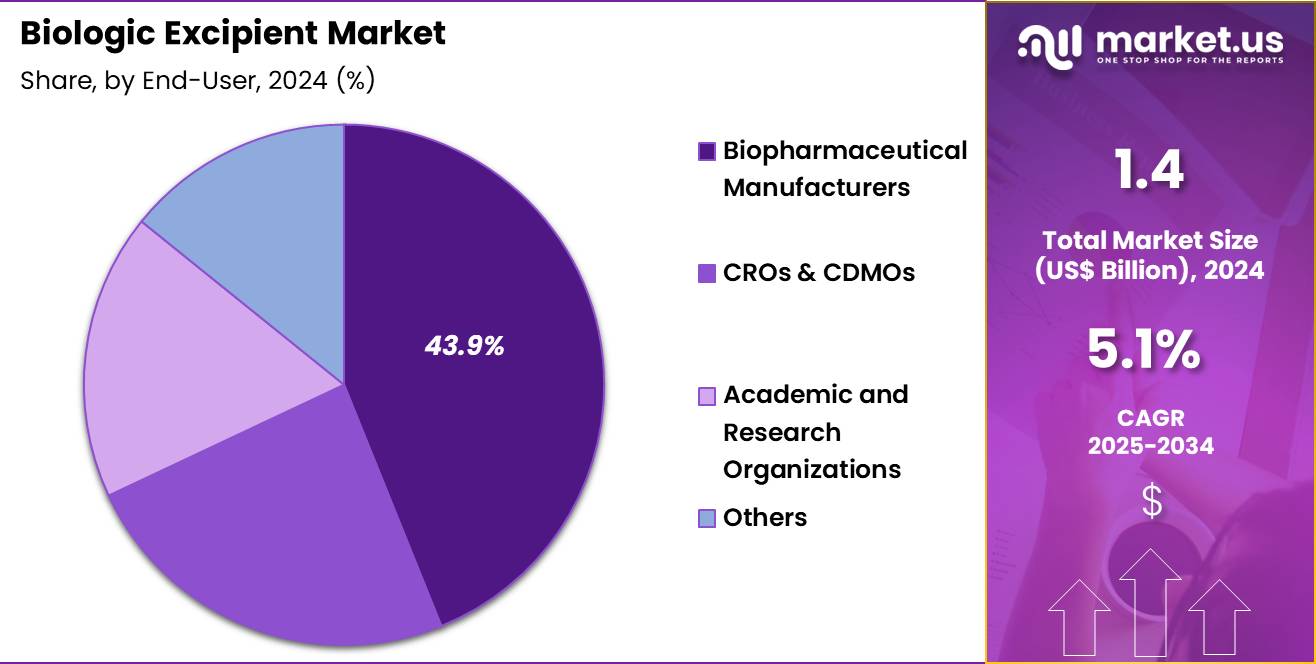

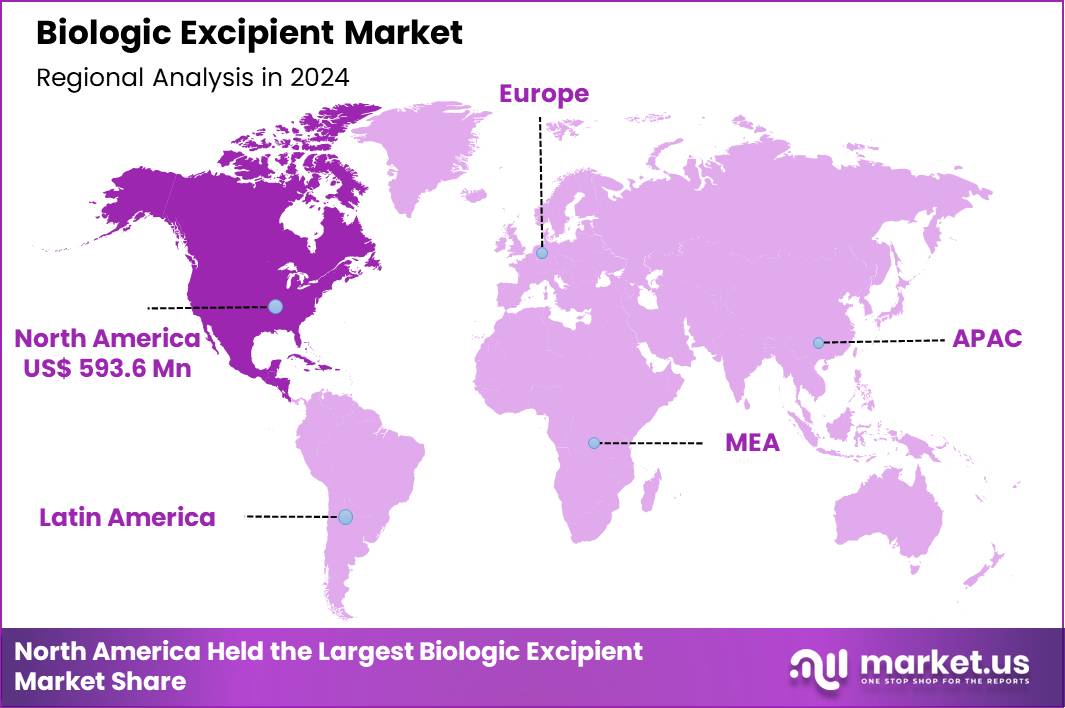

The Global Biologic Excipient Market size is expected to be worth around US$ 2.3 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 593.6 Billion.

Growing complexity in biopharmaceutical formulations drives demand for specialized biologic excipients that ensure stability, solubility, and effective delivery of sensitive large-molecule therapeutics. Manufacturers increasingly incorporate surfactants such as polysorbates to prevent protein aggregation during manufacturing and storage of monoclonal antibodies. These excipients support cryoprotection in lyophilized vaccines, maintaining potency through freeze-drying and reconstitution processes.

Formulators utilize sugars like sucrose and trehalose as stabilizers to preserve structural integrity in recombinant proteins and gene therapy vectors. These components facilitate high-concentration formulations for subcutaneous administration, reducing injection volume in patient self-care settings.

In April 2024, Roquette made a strategic investment in Danish startup Biograil through its venture arm, Roquette Ventures. The investment aims to support the development of innovative drug delivery technologies with a focus on health and sustainability. Alongside funding, Roquette is providing technical expertise in pharmaceutical excipients to help advance Biograil’s platform technologies for next-generation drug delivery systems.

Manufacturers capitalize on opportunities to develop multifunctional excipients that combine stabilization with viscosity reduction, enabling high-concentration monoclonal antibody products for convenient dosing. Developers engineer novel polymers for controlled release in implantable biologics, extending therapeutic duration in chronic disease management. These innovations broaden applications in cell and gene therapies, where excipients protect viral vectors from degradation during processing and transport.

Opportunities expand in oral delivery platforms for biologics, utilizing permeation enhancers and pH-responsive materials to overcome gastrointestinal barriers. Companies advance plant-based and sustainable excipients to meet biocompatibility requirements in regenerative medicine products. Firms pursue collaborations with device manufacturers to integrate excipients into prefilled syringes, optimizing stability for autoinjector-based therapies.

Industry leaders refine high-purity, low-endotoxin excipients to meet stringent regulatory standards in injectable biologics, enhancing safety profiles in oncology and immunology applications. Developers prioritize viscosity-modifying agents that minimize injection pain in subcutaneous monoclonal antibody treatments. Market participants advance clean-label solutions that eliminate controversial additives, supporting patient acceptance in long-term biologic regimens.

Innovators incorporate AI-driven formulation modeling to predict excipient interactions, accelerating development for next-generation bispecific antibodies. Companies emphasize bioresorbable excipients for sustained-release implants in endocrine disorders. Ongoing advancements focus on sustainable sourcing and green chemistry approaches, aligning excipient innovation with environmental goals in biopharmaceutical manufacturing.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 5.1%, and is expected to reach US$ 2.3 Billion by the year 2034.

- The type segment is divided into buffering agents, surfactants and solubilizers, lyoprotectants, tonicity-adjusting agents, pH-adjusting components, amino acid stabilizers, chelators and antioxidants and others, with buffering agents taking the lead in 2024 with a market share of 36.2%.

- Considering source type, the market is divided into polymers and polysaccharides, natural sugars and disaccharides, inorganic salts and others. Among these, polymers and polysaccharides held a significant share of 40.4%.

- Furthermore, concerning the route of administration segment, the market is segregated into parenteral, oral, topical and others. The parenteral sector stands out as the dominant player, holding the largest revenue share of 45.7% in the market.

- The end-user segment is segregated into biopharmaceutical manufacturers, CROs & CDMOs, academic and research organizations and others, with the biopharmaceutical manufacturers segment leading the market, holding a revenue share of 43.9%.

- North America led the market by securing a market share of 42.4% in 2024.

Type Analysis

Buffering agents accounted for 36.2% of the biologic excipient market, reflecting their essential role in maintaining formulation stability of complex biologics. Biopharmaceutical developers rely on buffering systems to control pH throughout manufacturing, storage, and administration. Sensitive protein structures require tight pH control to prevent aggregation and degradation. Rising development of monoclonal antibodies and recombinant proteins increases reliance on robust buffering solutions.

Regulatory expectations emphasize formulation consistency, strengthening adoption. Advances in buffer optimization improve shelf life and product robustness. High compatibility with injectable biologics supports widespread use. Manufacturers prioritize buffers that perform across temperature and stress conditions. Process intensification strategies increase demand for reliable excipients. This segment is projected to grow steadily due to formulation criticality and expanding biologics pipelines.

Source Type Analysis

Polymers and polysaccharides represented 40.4% of the biologic excipient market, driven by their multifunctional stabilization properties. These materials provide viscosity control, protection against mechanical stress, and enhanced solubility. Biologics increasingly require excipients that support complex molecular structures. Natural and semi-synthetic polymers demonstrate strong biocompatibility, which supports regulatory acceptance.

Expanding use of sustained and controlled release formulations increases demand. Polysaccharides offer effective cryoprotection during freeze drying processes. Formulators favor these materials due to their versatility across dosage forms. Improvements in purification and sourcing enhance quality consistency. Growing focus on long term storage stability reinforces adoption. This segment is anticipated to maintain leadership due to functional breadth and formulation reliability.

Route of Administration Analysis

Parenteral routes accounted for 45.7% of the biologic excipient market, reflecting dominance of injectable biologic therapies. Most monoclonal antibodies, vaccines, and cell based products require parenteral delivery for bioavailability. Injectable formulations demand high purity excipients to ensure safety and efficacy. Stringent regulatory standards elevate excipient quality requirements.

Growth in chronic disease biologics expands injectable treatment volumes. Hospital and specialty care settings favor parenteral administration for controlled dosing. Advances in self injection devices further increase demand. Cold chain distribution emphasizes excipient stability performance. Development of high concentration formulations strengthens excipient usage intensity. This segment is likely to expand due to sustained injectable biologics growth.

End-User Analysis

Biopharmaceutical manufacturers held 43.9% of the biologic excipient market, reflecting their central role in drug development and production. These companies manage extensive biologics pipelines that require tailored excipient solutions. Internal formulation expertise drives early excipient selection and validation. Manufacturers prioritize excipients that support scalability and regulatory compliance.

Rising biologics approvals increase procurement volumes. Strategic partnerships with excipient suppliers accelerate innovation adoption. Process optimization efforts emphasize excipient performance under manufacturing stress. Capital investment supports adoption of premium quality materials. Integration of formulation and manufacturing workflows strengthens demand. Consequently, this end user segment is expected to remain dominant due to sustained biologics innovation and production scale.

Key Market Segments

By Type

- Buffering Agents

- Surfactants and Solubilizers

- Lyoprotectants

- Tonicity-Adjusting Agents

- pH-Adjusting Components

- Amino Acid Stabilizers

- Chelators and Antioxidants

- Others

By Source Type

- Polymers and Polysaccharides

- Natural Sugars and Disaccharides

- Inorganic Salts

- Others

By Route of Administration

- Parenteral

- Oral

- Topical

- Others

By End-User

- Biopharmaceutical Manufacturers

- CROs & CDMOs

- Academic and Research Organizations

- Others

Drivers

Increasing approvals of biologic therapies is driving the market

The biologic excipient market is significantly driven by the increasing approvals of biologic therapies, which require specialized excipients to ensure stability, solubility, and bioavailability during formulation and storage. Pharmaceutical companies rely on excipients to protect sensitive biologic molecules from degradation, facilitating the development of complex therapies like monoclonal antibodies. Regulatory agencies prioritize excipients that meet stringent quality standards, supporting the surge in biologic submissions and approvals.

Healthcare systems benefit from these therapies for treating chronic diseases, amplifying the need for advanced excipient technologies. Academic research contributes to excipient innovations that address formulation challenges in biologics. Global demand for personalized medicine further propels excipient use in tailored biologic products.

Economic incentives from biologic market expansion encourage investment in excipient R&D. Patient outcomes improve with excipients enabling longer shelf life and better administration routes. Pharmaceutical partnerships focus on excipient optimization to expedite biologic commercialization. The U.S. Food and Drug Administration approved 37 novel drugs in 2022, 55 in 2023, and 50 in 2024, with a significant portion being biologics reliant on specialized excipients.

Restraints

High regulatory hurdles for excipient qualification in biologics are restraining the market

The biologic excipient market is restrained by high regulatory hurdles for excipient qualification in biologics, which demand extensive data on compatibility, safety, and impact on product quality. Manufacturers must conduct rigorous risk assessments to demonstrate excipient suitability, prolonging development timelines. Regulatory agencies require detailed documentation for any excipient changes, increasing administrative burdens.

Pharmaceutical firms face delays in biologic approvals due to excipient-related validation requirements. Clinical trials incorporate additional testing to verify excipient performance, elevating costs. Global inconsistencies in excipient standards complicate international supply chains. Academic studies highlight challenges in qualifying novel excipients for sensitive biologic formulations.

Patient access to new biologics is limited by these stringent processes. Economic pressures from compliance investments deter smaller players from market entry. These factors collectively slow innovation and market expansion in excipient applications for biologics.

Opportunities

Growth in biosimilar development is creating growth opportunities

The biologic excipient market offers substantial growth opportunities through the expansion in biosimilar development, where excipients play a key role in achieving comparability and stability similar to reference products. Developers can innovate excipients to support biosimilar formulations that meet regulatory requirements for equivalence.

Regulatory pathways for biosimilars encourage the use of advanced excipients to enhance product performance. Healthcare providers gain affordable alternatives with excipients enabling improved shelf life and administration. Pharmaceutical collaborations focus on excipient technologies to accelerate biosimilar market entry. Clinical applications broaden with biosimilars addressing high-cost biologics in oncology and rheumatology.

Global adoption of biosimilars drives demand for cost-effective excipient solutions. Academic research explores excipient roles in biosimilar immunogenicity reduction. Patient care benefits from increased access to therapies facilitated by optimized excipients. The U.S. Food and Drug Administration approved a record 18 biosimilars in 2024, creating avenues for excipient utilization in these products.

Impact of Macroeconomic / Geopolitical Factors

Economic expansions across major economies stimulate robust investments in biopharmaceutical research, heightening the need for high-quality biologic excipients in drug formulations. Firms leverage favorable interest rates to scale operations, capturing opportunities in aging populations that demand more biologic therapies. Nevertheless, surging commodity prices from global inflation force suppliers to contend with elevated manufacturing overheads, which curtails expansion in cost-conscious regions.

Geopolitical frictions, notably in Asia-Pacific trade routes, impede ingredient sourcing and escalate transportation delays for international stakeholders. Organizations respond by establishing redundant logistics networks, which bolsters operational flexibility and uncovers novel supplier ecosystems. Present US tariffs, levying 20-25% on biologic excipients imported from dominant producers such as China and India, amplify input costs and complicate pricing strategies for dependent companies.

Local enterprises capitalize on this shift by ramping up domestic output, which spurs technological upgrades and fortifies national supply security. Forward-thinking collaborations in sustainable excipient development ultimately propel the industry toward enduring prosperity and innovation-driven gains.

Latest Trends

Advancement in machine learning for excipient selection is a recent trend

In 2025, the biologic excipient market has demonstrated a prominent trend toward the advancement in machine learning for excipient selection, enabling predictive modeling to optimize formulations for stability and efficacy. Developers integrate machine learning algorithms to analyze vast datasets on excipient interactions with biologic molecules. Healthcare formulations benefit from faster identification of suitable excipients, reducing trial-and-error in development.

Regulatory discussions address validation of machine learning tools for excipient recommendations in biologics. Clinical efficiency improves with excipients selected for minimal degradation and enhanced solubility. Academic publications highlight machine learning’s role in broadening excipient options for high-concentration biologics. Global research networks refine algorithms for diverse biologic classes.

Patient therapies gain from accelerated formulation processes leading to quicker market availability. Ethical protocols ensure machine learning applications prioritize safety in excipient choices. A 2025 study from the National Institutes of Health detailed the expansion of predictive tools like ExPreSo to include a wider spectrum of excipients for biologic formulations.

Regional Analysis

North America is leading the Biologic Excipient Market

In 2024, North America secured a 42.4% share of the global biologic excipient market, propelled by the rapid expansion of biopharmaceutical pipelines requiring advanced stabilizing agents to maintain the integrity of complex protein-based therapeutics during formulation and storage. Contract development organizations ramped up procurement of high-purity polysorbates and amino acid-based excipients to support monoclonal antibody and fusion protein production, driven by stringent stability requirements for long shelf-life products.

Regulatory emphasis on immunogenicity mitigation prompted manufacturers to adopt novel surfactants and cryoprotectants that minimize aggregate formation in high-concentration solutions. Rising approvals for cell and gene therapies intensified demand for specialized excipients such as cyclodextrins and trehalose, ensuring viability of viral vectors and cellular components through freeze-thaw cycles.

Bioprocess engineers integrated lipid nanoparticles and PEGylated derivatives into mRNA platforms, aligning with accelerated development timelines for emerging vaccines and oncology treatments. Collaborative initiatives between academia and industry refined buffer systems with enhanced buffering capacity, addressing pH shifts in multi-dose vials.

Supply chain diversification guaranteed consistent availability of GMP-grade materials, supporting scale-up in regional manufacturing hubs. The U.S. Food and Drug Administration approved 16 biologic products in 2024, reflecting the growing reliance on sophisticated excipients to achieve therapeutic efficacy and safety.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate substantial advancement in biologic excipient utilization across Asia Pacific throughout the forecast period, as nations strengthen domestic biomanufacturing to meet escalating demands for accessible protein therapeutics. Formulators incorporate polysorbate alternatives to enhance stability in humid environments, optimizing monoclonal antibody shelf life for regional distribution. Governments subsidize research into amino acid stabilizers, enabling local producers to support biosimilar development amid patent expirations on originator biologics.

Biotech enterprises customize cyclodextrin derivatives, tailoring them to protect fragile viral vectors in gene therapy programs targeting inherited disorders. Regional consortia validate trehalose-based formulations through stability studies, facilitating compliance with international pharmacopeial standards. Pharmaceutical manufacturers adopt PEGylated excipients for extended-release injectables, addressing chronic disease management in aging populations.

Policy incentives promote technology localization, empowering smaller firms to integrate advanced buffering agents into vaccine production. The World Health Organization reports that the Western Pacific Region accounted for 27% of global new cancer cases in 2022, underscoring the urgent need for robust excipient systems in oncology biologics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Biologic Excipient market drive growth by developing high-purity stabilizers, buffers, and delivery aids that protect protein structure and extend shelf life across complex biologic formulations. Companies expand demand through close collaboration with biologics and biosimilar developers to customize excipients that improve solubility, stability, and manufacturability.

Commercial strategies emphasize regulatory-grade documentation, traceability, and consistent supply to meet stringent quality expectations in late-stage and commercial production. Innovation efforts focus on novel polymers, sugars, and surfactants that support higher concentrations and next-generation injectable and lyophilized products.

Market expansion targets regions scaling biologics manufacturing capacity and tightening compliance standards for injectable drugs. MilliporeSigma operates as a leading participant with a broad excipient portfolio, deep formulation science expertise, and global manufacturing and distribution infrastructure that supports reliable biologic drug development and commercialization.

Top Key Players

- FMC Corporation

- Wacker Chemie AG

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Archer-Daniels-Midland Co. (ADM)

- Roquette Freres S.A.

- The Dow Chemical Company

- Colorcon Inc.

- Signet Chemical Co. Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd

- DFE Pharma GmbH & Co. KG

- JRS Pharma GmbH & Co. KG

- Croda International Plc

- BASF SE

- Anhui Fanrong Biotechnology Co., Ltd.

- MEGGLE Excipients GmbH

Recent Developments

- In early 2025, Merck expanded its pharmaceutical materials portfolio by launching a new range of high-purity surfactants and stabilizers developed for advanced antibody-drug conjugates. These excipients are engineered to improve formulation stability by reducing protein aggregation and preserving the functional integrity of complex biologic therapies, supporting the growing demand for reliable components in next-generation biologics manufacturing.

- In March 2024, Roquette completed an agreement to acquire IFF’s Pharma Solutions business for US$2.85 billion. The transaction significantly strengthened Roquette’s position in the pharmaceutical excipients market by adding a broad portfolio of oral drug excipients and integrating multiple manufacturing sites that had previously operated under different owners. This acquisition expanded Roquette’s global production capabilities and reinforced its role as a key supplier to the pharmaceutical industry.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 2.3 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Buffering Agents, Surfactants and Solubilizers, Lyoprotectants, Tonicity-Adjusting Agents, pH-Adjusting Components, Amino Acid Stabilizers, Chelators and Antioxidants and Others), By Source Type (Polymers and Polysaccharides, Natural Sugars and Disaccharides, Inorganic Salts and Others), By Route of Administration (Parenteral, Oral, Topical and Others), By End-User (Biopharmaceutical Manufacturers, CROs & CDMOs, Academic and Research Organizations and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FMC Corporation, Wacker Chemie AG, Evonik Industries AG, Ashland Global Holdings Inc., Archer-Daniels-Midland Co., Roquette Freres S.A., The Dow Chemical Company, Colorcon Inc., Signet Chemical Co. Pvt. Ltd., Sun Pharmaceutical Industries Ltd, DFE Pharma GmbH & Co. KG, JRS Pharma GmbH & Co. KG, Croda International Plc, BASF SE, Anhui Fanrong Biotechnology Co., Ltd., MEGGLE Excipients GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- FMC Corporation

- Wacker Chemie AG

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Archer-Daniels-Midland Co. (ADM)

- Roquette Freres S.A.

- The Dow Chemical Company

- Colorcon Inc.

- Signet Chemical Co. Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd

- DFE Pharma GmbH & Co. KG

- JRS Pharma GmbH & Co. KG

- Croda International Plc

- BASF SE

- Anhui Fanrong Biotechnology Co., Ltd.

- MEGGLE Excipients GmbH