Global Beverage Coolers Market By Type (Freestanding Beverage Coolers, Built-in Beverage Coolers, Countertop Beverage Coolers, Outdoor Beverage Coolers), By Capacity (Less than 100 cans and bottles. 100 to 200 cans and bottles, 200 to 300 cans and bottles, Above 300 cans and bottles), By End-User (Households, Supermarkets and Hypermarkets, HoReCa, Convenience Stores), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 60275

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

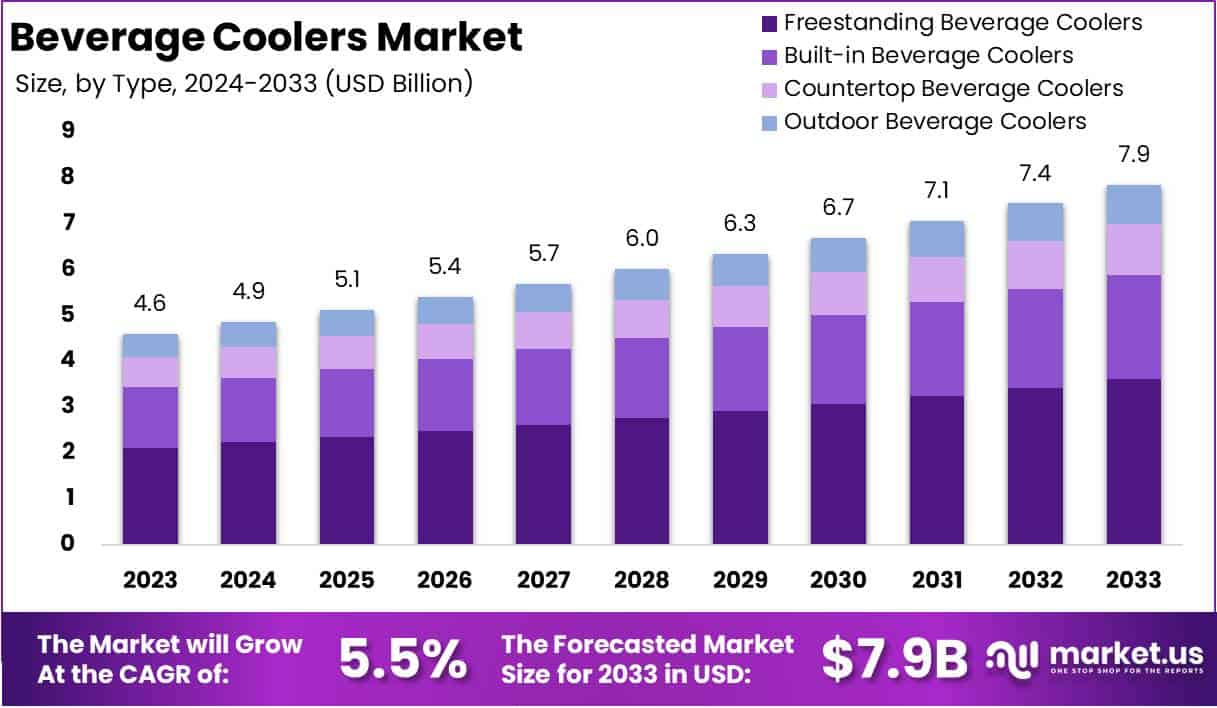

The Global Beverage Coolers Market size is expected to be worth around USD 7.9 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

Beverage Coolers are refrigeration units designed to store and chill beverages at ideal temperatures, often featuring adjustable temperature controls and flexible shelving to accommodate various bottle and can sizes. These coolers are widely used in residential settings, restaurants, bars, hotels, and retail stores, providing a dedicated solution for maintaining optimal temperatures for drinks, enhancing both convenience and beverage quality.

The Beverage Coolers Market encompasses the production, sales, and distribution of these cooling appliances, catering to a broad range of consumer and commercial applications. This market has seen significant growth driven by evolving consumer preferences for convenient, chilled beverages and rising disposable incomes, especially in urban regions.

Technological advancements such as energy-efficient designs, digital temperature controls, and eco-friendly cooling systems have also bolstered market demand, aligning with the growing consumer focus on sustainability.

Growth in the beverage coolers market is propelled by increasing consumption of cold beverages, particularly as lifestyles shift towards convenience and on-the-go options. The rising number of hospitality venues, coupled with an expanding retail sector, has intensified demand for reliable cooling solutions.

Demand is further amplified by the premiumization trend, where consumers show a preference for high-quality, specialized products for wine and craft beer storage, driving higher-end cooler purchases.

Opportunities in this market are abundant, with manufacturers increasingly adopting Internet of Things (IoT)-enabled features, allowing remote control and monitoring of cooler temperatures. The trend toward smart home integration provides potential for beverage coolers to become part of larger smart appliance ecosystems, enhancing consumer appeal.

Additionally, growth in the hospitality sector in emerging markets offers considerable potential for market expansion, as these regions continue to see increased investment in tourism and retail infrastructure.

According to CLASP, the beverage coolers market has seen substantial demand, with refrigeration alone accounting for 67 terawatt hours (TWh) of electricity consumption in the sector, with commercial refrigeration contributing a notable 24%. A 2023 stock analysis reveals 3.21 million commercial beverage coolers, reflecting strong market saturation, particularly in India, where leading brands collectively command 70% of the visi cooler market.

A detailed study across nine cities covering 77 cooler models found that 75% are single-door, floor-standing units with swing doors, with most offering five shelves. Leading manufacturer M1 has sold 320,000 units domestically in five years and exports around 20% to Africa. Their units, designed to last 7-9 years, predominantly utilize R134a refrigerant, with 42% operating continuously.

According to Financier Worldwide, Carlsberg’s recent acquisition of Britvic for $4.2 billion marks a pivotal shift in the beverage coolers market. Following two prior bids at 1200 pence and 1250 pence per share that Britvic deemed undervalued, Carlsberg succeeded with an enhanced offer of 1315 pence per share, including a 25-pence special dividend.

This acquisition is anticipated to yield $128 million in cost and efficiency savings over five years, as Carlsberg leverages synergies across procurement, production, and distribution networks.

Key Takeaways

- The global beverage coolers market, valued at USD 4.6 billion in 2023, is projected to reach USD 7.9 billion by 2033, driven by a CAGR of 5.5%, underscoring robust demand for both consumer and commercial cooling solutions.

- Freestanding beverage coolers lead with a 46% market share, favored for their versatility and appeal across residential and commercial use cases.

- The 100-200 cans/bottles capacity range dominates at 32%, meeting the balanced needs of both moderate residential and light commercial users.

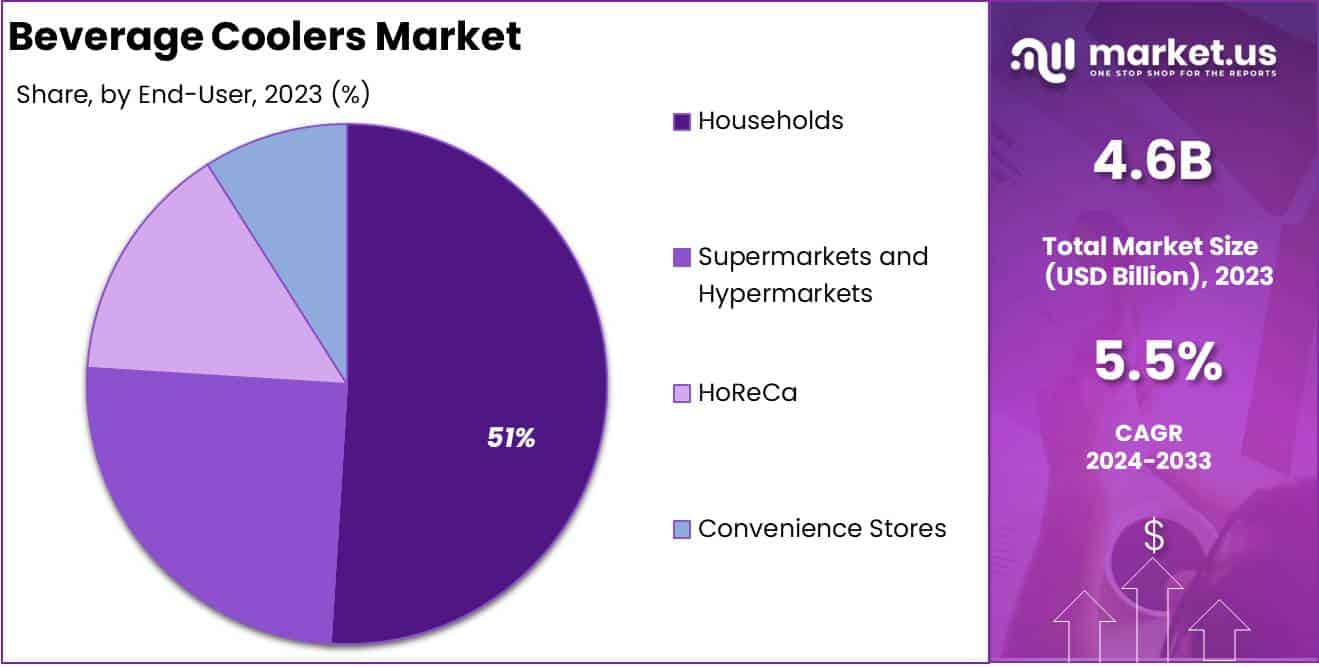

- Households are the largest end-user segment, capturing 51% of the market as consumers increasingly seek dedicated beverage storage solutions.

- North America leads with a 32% market share, driven by high consumer demand for premium, energy-efficient coolers.

By Type Analysis

Freestanding Beverage Coolers Dominating Segment in Beverage Coolers Market with 46% Market Share

In 2023, Freestanding Beverage Coolers held a dominant position in the Beverage Coolers Market, capturing over 46% of the market share. This segment’s popularity stems from its flexibility in placement and ease of installation, appealing to both residential and commercial users.

Freestanding units offer varied capacity options, making them suitable for both small households and large-scale commercial environments. As consumer demand for convenience and customizable storage solutions grows, freestanding coolers are expected to maintain a strong foothold in the market.

Built-in Beverage Coolers accounted for approximately 29% of the market share in 2023, driven by a rising preference for seamless integration in modern kitchen and hospitality designs. Their popularity is especially high in premium and urban households, where consumers seek space-efficient, visually cohesive appliances.

Built-in coolers also appeal to the commercial sector, particularly in high-end bars and restaurants that prioritize aesthetics alongside functionality. The Countertop Beverage Coolers segment held around 14% of the market in 2023, gaining traction among consumers with limited space and a preference for compact, accessible storage solutions.

Ideal for small apartments, offices, and compact kitchens, countertop coolers offer convenience without occupying significant floor space. This segment is expected to grow steadily, fueled by increasing demand in urban and workspace environments.

Outdoor Beverage Coolers captured an estimated 11% market share in 2023, reflecting their appeal in outdoor entertainment spaces, such as patios, backyards, and hospitality venues.

With features like weather-resistant materials and enhanced cooling systems, outdoor coolers cater to consumers looking to enhance their outdoor living spaces. Demand for these units is anticipated to grow, especially in regions with a high interest in outdoor entertaining and leisure activities.

By Capacity Analysis

100 to 200 Cans/Bottles Dominating Segment in Beverage Coolers Market with 32% Market Share

In 2023, beverage coolers with a capacity of 100 to 200 cans/bottles held a dominant position in the Beverage Coolers Market, capturing over 32% of the market share. This capacity range strikes a balance between sufficient storage space and compact design, making it an attractive choice for households, offices, and small retail environments.

Its versatility and ability to meet the needs of both moderate residential users and light commercial use drive its widespread adoption, and it is expected to maintain its strong market presence as a preferred capacity option.

Beverage coolers with a capacity of less than 100 cans/bottles accounted for around 25% of the market share in 2023. These units cater to consumers with limited space or lower beverage storage needs, such as individuals, small households, or workplaces with minimal demand.

Compact and highly portable, this segment is gaining traction among urban consumers and those prioritizing space-saving solutions, fueling its gradual growth in the market.

The 200 to 300 cans/bottles segment held approximately 22% of the market share in 2023, reflecting growing interest from larger households, commercial establishments, and hospitality venues that require ample storage capacity.

These coolers are favored for their ability to store a substantial number of beverages while fitting into a standard retail or residential setup, supporting their steady growth in the market.

Beverage coolers with a capacity above 300 cans/bottles captured an estimated 21% market share in 2023, appealing to specialized commercial users and venues that handle high beverage volumes, such as event spaces, hotels, and restaurants.

Although a niche segment, its demand is consistent, especially in regions where large-scale gatherings and hospitality services are prevalent. The robust capacity and durability of these coolers cater to the needs of high-volume users, making it a stable yet specialized market segment.

By End-User Analysis

Households: Dominating Segment in Beverage Coolers Market with 51% Share

In 2023, households held a dominant market position in the beverage coolers market, capturing more than a 51% share. This substantial demand stems from a combination of rising consumer preferences for at-home beverage storage solutions, driven by increasing awareness around energy-efficient, space-saving appliances that offer temperature control.

The growing trend of home entertaining and the rise of health-conscious, wellness-oriented consumers are also supporting household market growth, as consumers seek to keep both non-alcoholic and alcoholic beverages readily available in convenient, specialized cooling units.

Supermarkets and hypermarkets represent a crucial segment in the beverage coolers market, as they cater to a high volume of consumer traffic and feature extensive storage requirements for a wide variety of beverage types.

This segment is experiencing steady demand due to the large-scale purchasing power of these retailers, which allows them to implement advanced cooler technology to optimize energy use, reduce costs, and maintain product quality across extensive inventory.

Supermarkets and hypermarkets are particularly focused on ensuring customer access to fresh, chilled beverages, which drives their consistent investment in high-capacity coolers.

The HoReCa (Hotels, Restaurants, and Cafés) segment is witnessing a notable uptick in demand for beverage coolers, as businesses in this category rely heavily on efficient, compact cooling solutions to support high service standards and maintain optimal beverage quality.

This segment is driven by the expanding global hospitality industry and increasing consumer spending on dining out.

The HoReCa sector demands innovative cooling solutions that provide energy efficiency, customizable storage, and quick accessibility to meet the dynamic requirements of these establishments.

Convenience stores play a pivotal role in the beverage coolers market as they cater to consumers seeking quick, convenient access to chilled beverages. This segment is particularly driven by the need for compact, reliable cooling solutions that optimize space and provide energy efficiency to manage operational costs.

With the continued growth in urbanization and 24/7 customer demand, convenience stores are investing in beverage coolers that enhance accessibility while reducing energy consumption.

Key Market Segments

By Type

- Freestanding Beverage Coolers

- Built-in Beverage Coolers

- Countertop Beverage Coolers

- Outdoor Beverage Coolers

By Capacity

- Less than 100 cans/bottles

- 100 to 200 cans/bottles

- 200 to 300 cans/bottles

- Above 300 cans/bottles

By End-User

- Households

- Supermarkets/Hypermarkets

- HoReCa

- Convenience Stores

Driver

Growing Demand for On-the-Go Beverages and Home Entertainment

The rising trend of on-the-go lifestyles and the increasing prevalence of home entertainment have substantially driven the demand for beverage coolers. Consumers today prioritize convenience and accessibility, particularly when it comes to maintaining chilled beverages readily available for gatherings, home entertainment, and daily consumption.

With a notable increase in social gatherings and home parties, consumers are increasingly opting for high-quality beverage coolers that allow them to store a range of beverages at optimal temperatures. This shift in consumer behavior has led to a greater demand for specialized coolers, driving growth in the beverage coolers market.

Additionally, the global shift toward urbanization and a rise in disposable incomes have led to greater consumer spending on premium home appliances, including beverage coolers. As more individuals enjoy beverages at home or on the go, the convenience offered by these cooling appliances has become indispensable.

Beverage coolers cater not only to traditional soft drinks but also to craft beers, wines, and artisanal beverages, providing versatile storage solutions for an increasingly diverse range of consumer preferences.

This evolving demand across residential and commercial sectors has created a solid foundation for market growth, making consumer lifestyle changes a primary growth driver in the beverage coolers market.

Restraint

High Energy Consumption and Environmental Concerns

One of the significant restraints in the beverage coolers market is the high energy consumption associated with these appliances, which contributes to elevated electricity costs and environmental concerns.

Beverage coolers, especially older and lower-cost models, often have limited energy efficiency, causing them to consume significant power to maintain low temperatures consistently. With rising awareness of environmental issues and sustainability, consumers and regulatory bodies are increasingly scrutinizing high-energy appliances.

In regions with high energy costs, consumers may be hesitant to purchase or upgrade to newer models, impacting market growth. Additionally, the environmental impact of traditional refrigerants used in some coolers has raised further concerns.

Conventional cooling systems may release refrigerants that contribute to greenhouse gas emissions, adversely affecting the environment. With stricter regulations on energy usage and eco-friendly standards for home appliances in place, manufacturers are under pressure to produce beverage coolers that meet higher energy efficiency standards.

However, achieving these standards may raise production costs, potentially leading to higher prices for consumers and, in turn, slowing the market’s growth. Addressing these concerns is crucial for the beverage coolers market, as companies must innovate to produce energy-efficient, eco-friendly solutions to overcome consumer and regulatory resistance.

Opportunity

Expansion of Smart and Connected Beverage Coolers

The advancement of smart technology offers a promising opportunity for the beverage coolers market, particularly with the integration of Internet of Things (IoT) capabilities in cooling appliances.

Smart beverage coolers allow consumers to monitor and control the temperature remotely via smartphone apps, providing added convenience and functionality that aligns with the growing trend toward smart home ecosystems.

Consumers can adjust settings, monitor inventory, and even receive alerts when the door is left open, enhancing the overall user experience. Such features not only provide convenience but also contribute to energy savings, as users can monitor and manage usage more efficiently.

The integration of smart technology opens additional pathways for personalization and user engagement, as beverage coolers become part of larger connected home systems. Consumers who prioritize convenience and tech-enabled functionality are likely to invest in smart beverage coolers, driving demand in this market.

Moreover, with the rise in urbanization and high disposable incomes, especially in emerging economies, the market for connected appliances is expected to grow substantially. The smart beverage cooler segment is well-positioned to capitalize on this trend, providing an opportunity for manufacturers to enhance their offerings with IoT features that cater to a tech-savvy consumer base, thereby expanding the market further.

Trends

Increasing Popularity of Energy-Efficient and Eco-Friendly Models

A growing trend in the beverage coolers market is the increasing demand for energy-efficient and eco-friendly models. As consumers become more environmentally conscious, they are actively seeking products that minimize energy consumption and reduce environmental impact.

Manufacturers are responding by designing coolers with energy-saving features and using sustainable materials and refrigerants that have a lower carbon footprint.

Modern coolers incorporate advanced insulation and energy-efficient compressors, reducing the amount of electricity needed to maintain cooling. This shift toward sustainability is especially pronounced in regions with stringent environmental regulations and high consumer awareness.

Eco-friendly beverage coolers are gaining popularity not only among environmentally conscious consumers but also within commercial settings that prioritize sustainability. Hotels, restaurants, and retailers are adopting energy-efficient models to reduce their operational costs and align with corporate social responsibility goals.

The trend towards eco-friendly appliances is expected to continue as both consumers and businesses seek solutions that combine functionality with sustainability. This focus on energy efficiency and environmental responsibility has become a defining trend in the market, offering both manufacturers and consumers the opportunity to contribute to a greener future while meeting market demand for high-quality cooling appliances.

Regional Analysis

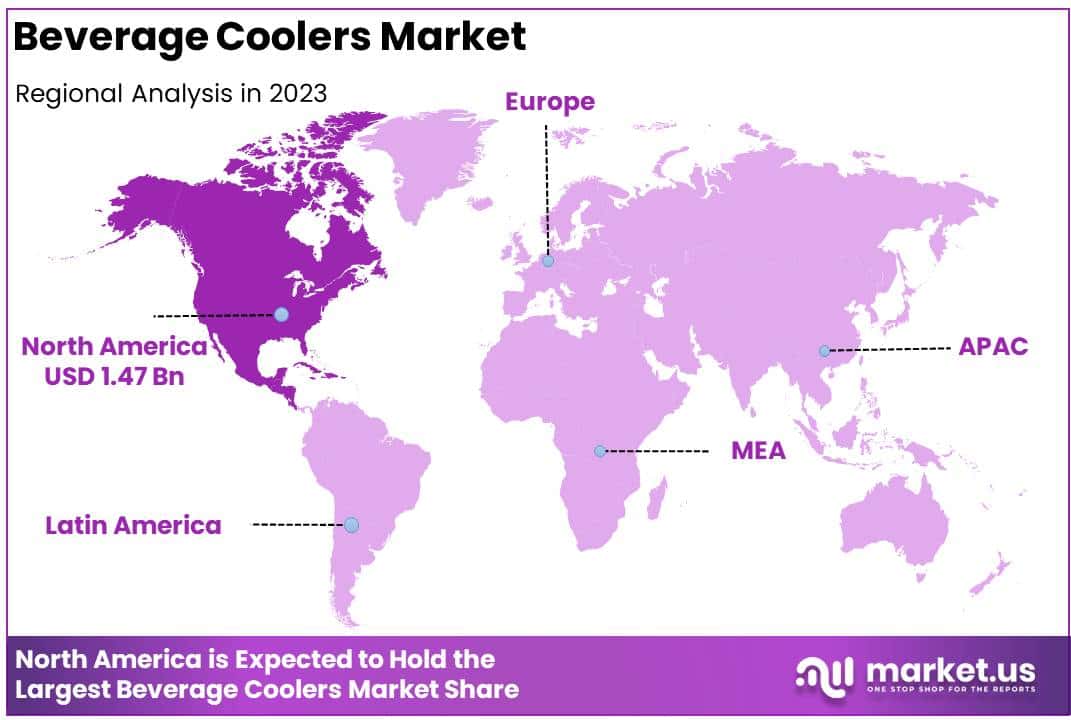

North America Leads the Beverage Coolers Market with Largest Market Share of 32%

In 2023, North America emerged as the lead region in the global beverage coolers market, holding a substantial market share of 32% equivalent to a market value of USD 1.47 billion.

This dominance is driven by increasing consumer preferences for convenient beverage storage solutions, particularly in the United States and Canada, where there is a high demand for premium coolers in residential and commercial settings.

The trend toward home entertainment and increased beverage consumption contributes to North America’s strong position, supported by a rising inclination towards smart, energy-efficient appliances.

Europe closely follows North America in market size, underpinned by demand across countries such as Germany, the UK, and France. The region sees a rising interest in eco-friendly and energy-efficient cooling solutions, aligning with stringent EU regulations aimed at reducing energy consumption and environmental impact.

Meanwhile, Asia Pacific exhibits strong growth potential, driven by rapid urbanization, increasing disposable incomes, and expanding retail and hospitality sectors in countries like China, Japan, and India. As the adoption of premium beverage coolers grows, Asia Pacific is anticipated to register robust growth in the coming years.

The Middle East & Africa and Latin America, while smaller in market share, are steadily expanding due to a rise in the hospitality sector and growing consumer interest in luxury and premium products.

In Latin America, countries like Brazil and Mexico show increased adoption of cooling solutions, especially in metropolitan areas. The Middle East & Africa, benefiting from tourism and hospitality growth, continues to present opportunities for beverage cooler manufacturers as premium and smart cooler solutions gain traction in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global beverage coolers market in 2024 is driven by a diverse set of key players, each leveraging unique strengths to address evolving consumer demands, particularly in energy efficiency, digital integration, and innovative design. Siemens AG, a global leader in technology, brings advanced cooling solutions that emphasize energy efficiency and smart technology integration, positioning itself well in high-demand regions where sustainability is paramount.

LG Electronics Inc. continues to dominate with consumer-focused innovations in its product lines, offering IoT-enabled beverage coolers with custom temperature control and enhanced usability, appealing to a tech-savvy audience.

Haier Group Corporation and Whirlpool are leveraging their vast distribution networks and manufacturing expertise, allowing them to offer high-quality, competitively priced models across multiple markets, particularly in emerging economies.

Electrolux AB, known for premium appliances, targets niche segments in the beverage cooler market by focusing on high-end designs that cater to affluent consumers and luxury hospitality clients.

Meanwhile, Frigoglass and Perlick Corporation focus heavily on the commercial sector, providing durable, efficient solutions tailored to restaurants, bars, and retail establishments, where reliability and volume are critical factors.

Danby Appliances Co. and NewAir are appealing to the cost-conscious consumer by offering compact and budget-friendly options that cater to small-scale users, like individual households and small offices.

Viking Range Corporation and MVP Appliances target luxury and professional-grade segments, with models that meet the demands of high-end home and commercial kitchens.

Together, these players shape a competitive landscape that is increasingly focused on sustainability, technological advancement, and varied product offerings to meet a wide array of customer needs.

Top Key Players in the Market

- Siemens AG

- LG Electronics Inc.

- Haier Group Corporation

- Whirlpool

- Electrolux AB

- Frigoglass

- Danby Appliances Co.

- Perlick Corporation

- NewAir

- Viking Range Corporation

- MVP Appliances

- Other Key Players

Recent Developments

- In 2024, Keurig Dr Pepper (KDP) reached an agreement to acquire Ghost Lifestyle LLC and Ghost Beverages LLC, makers of the Ghost sports nutrition brand known for its ready-to-drink energy products. KDP will initially acquire a 60% stake in Ghost for $990 million, with plans to acquire the remaining share by 2028. The acquisition, expected to close by late 2024 or early 2025, places Ghost within KDP’s U.S. Refreshment Beverages segment. Ghost’s co-founders, Dan Lourenco and Ryan Hughes, will continue to lead the brand.

- In 2023, Quench, a leading North American provider of filtered water, ice, and coffee solutions, announced its acquisition of Neighbors Coffee. This South Florida-based coffee supplier has been serving offices for over 35 years, enhancing Quench’s offerings in the region.

- In 2024, Tilray Brands, Inc., a global lifestyle and consumer goods company, completed its acquisition of several craft breweries from Molson Coors Beverage Company. This acquisition includes Hop Valley Brewing Company, Terrapin Beer Co., and Revolver Brewing, further expanding Tilray’s presence in the craft beer market.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 7.9 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Freestanding Beverage Coolers, Built-in Beverage Coolers, Countertop Beverage Coolers, Outdoor Beverage Coolers), By Capacity (Less than 100 cans and bottles. 100 to 200 cans and bottles, 200 to 300 cans and bottles, Above 300 cans and bottles), By End-User (Households, Supermarkets and Hypermarkets, HoReCa, Convenience Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, LG Electronics Inc., Haier Group Corporation, Whirlpool, Electrolux AB, Frigoglass, Danby Appliances Co., Perlick Corporation, NewAir, Viking Range Corporation, MVP Appliances, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- LG Electronics Inc.

- Haier Group Corporation

- Whirlpool

- Electrolux AB

- Frigoglass SAIC

- Danby Appliances Co.

- Perlick Corporation

- NewAir

- Viking Range LLC

- MVP Appliances

- others.