Global Battery Energy Storage Systems Market By Battery Type (Lithium-ion, Lead-acid, Nickel based, Flow Batteries, Others), By Capacity (Below 100 MWh, 100 to 500 MWh, Above 500 MWh), By Connection Type (On-grid, Off-grid), By Ownership (Third-party-owned, Customer-owned, Utility-owned), By Application (Utility, Commercial And Industrial, Transportation, Critical Infrastructure, Infrastructure and Commercial Buildings, Others, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2025-2034

- Published date: Jan 2025

- Report ID: 36952

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

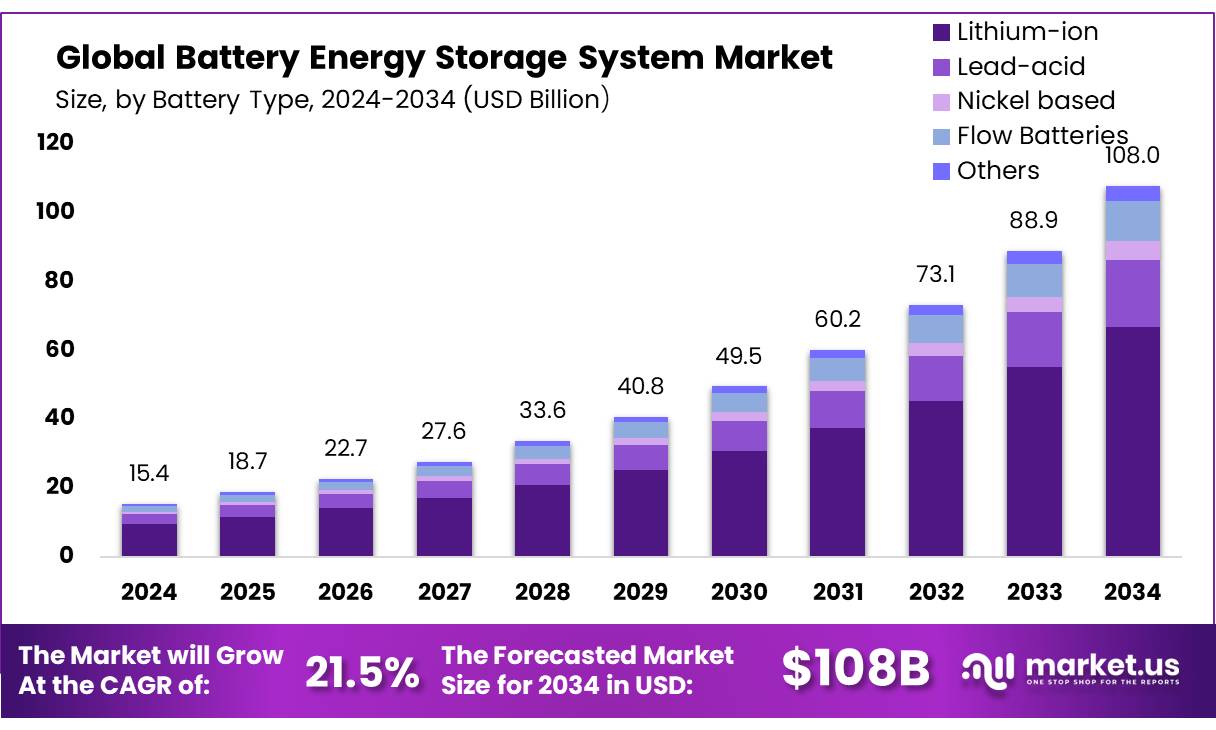

The global Battery Energy Storage Systems market size is expected to be worth around USD 108.0 billion by 2034, from USD 15.4 billion in 2024, growing at a CAGR of 21.5% during the forecast period from 2025 to 2034.

The global battery energy storage systems (BESS) market is witnessing significant expansion, driven by the rising demand for renewable energy integration, grid modernization, and energy security. As the world transitions towards cleaner energy solutions, battery storage has become a crucial component for stabilizing power supply, optimizing grid performance, and reducing reliance on fossil fuels.

In 2023, global grid-scale battery storage capacity reached approximately 50 GW, with projections suggesting it will exceed 250 GW by 2030. Energy storage is also gaining traction in commercial and industrial sectors to reduce energy costs and enhance power reliability. Additionally, the proliferation of electric vehicles (EVs) has spurred demand for second-life battery applications, fostering a circular economy in battery storage.

Key driving factors fueling market growth include declining battery costs, advancements in energy storage technologies, and increasing adoption of renewables. The cost of lithium-ion batteries has dropped by nearly 90% since 2010, reaching around $137/kWh in 2023, and is expected to decline further, making energy storage more economically viable.

Governments worldwide are implementing favorable policies, such as tax incentives and subsidies, to accelerate battery storage deployment. The U.S. Inflation Reduction Act (IRA) and the European Union’s Green Deal Industrial Plan have allocated substantial funds to boost energy storage infrastructure. Additionally, the need for grid stability in regions prone to blackouts and extreme weather events has further propelled the market.

Future growth opportunities in the BESS market are abundant, particularly in the expansion of decentralized energy systems, virtual power plants (VPPs), and hybrid energy storage solutions. The integration of artificial intelligence (AI) and machine learning in energy management systems is enhancing battery efficiency and lifespan, creating new avenues for market players.

Key Takeaways

- Battery Energy Storage Systems market size is expected to be worth around USD 108.0 billion by 2034, from USD 15.4 billion in 2024, growing at a CAGR of 21.5%.

- Lithium-ion held a dominant market position, capturing more than a 62.10% share.

- Above 500 MWh held a dominant market position, capturing more than a 37.20% share.

- On-grid systems held a dominant market position, capturing more than a 74.20% share.

- Third-party-owned systems held a dominant market position, capturing more than a 43.20% share.

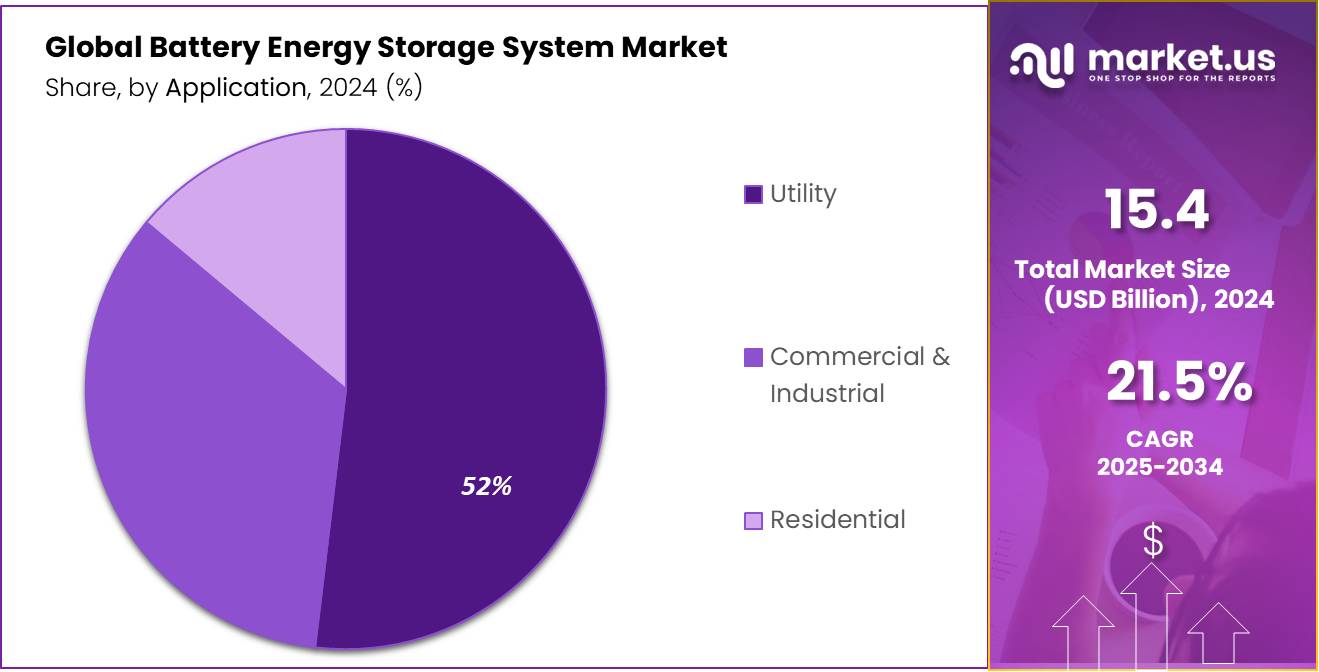

- Utility segment held a dominant market position, capturing more than a 52.10% share.

By Battery Type

In 2024, Lithium-ion held a dominant market position, capturing more than a 62.10% share of the global battery energy storage system (BESS) market. The growth of this segment is driven by its high energy density, longer lifespan, and rapid charge-discharge capabilities, making it the preferred choice for grid-scale and commercial energy storage applications.

Lead-acid batteries retained a declining market share in 2024, mainly due to their lower efficiency, shorter lifespan, and heavier weight compared to lithium alternatives. However, their affordability and recyclability have kept them relevant in off-grid applications.

Nickel-based batteries, including Nickel-Cadmium (NiCd) and Nickel-Metal Hydride (NiMH), held a limited presence in the BESS market in 2024. These batteries are mainly used in industrial applications where rugged performance is required, particularly in extreme temperature environments.

Flow batteries, particularly Vanadium Redox Flow Batteries (VRFB), gained traction in 2024, with increased adoption in long-duration energy storage projects. Their ability to provide stable power output for extended periods without degradation has positioned them as an attractive solution for utility-scale energy storage.

By Capacity

In 2024, Above 500 MWh held a dominant market position, capturing more than a 37.20% share of the global battery energy storage system (BESS) market. The rising demand for large-scale energy storage solutions in utility and grid applications has been the primary driver of this segment’s growth. Governments and private enterprises are heavily investing in high-capacity battery storage systems to enhance grid stability and manage the growing integration of renewable energy sources such as wind and solar.

The 100 to 500 MWh segment followed closely, accounting for a significant share of the market in 2024. This capacity range is widely adopted in commercial and industrial applications, as well as medium-scale grid stabilization projects. Many energy developers and utility providers prefer this segment for its balance between storage capacity and investment cost, making it an ideal choice for regional grid management and microgrid solutions.

The Below 100 MWh segment held a notable share in 2024, primarily driven by demand from commercial buildings, small industrial units, and community energy storage projects. This capacity range is widely used in applications such as backup power, demand charge management, and residential microgrids. The growing adoption of electric vehicle charging infrastructure and decentralized renewable energy solutions has also contributed to the expansion of this segment.

By Connection Type

In 2024, On-grid systems held a dominant market position, capturing more than a 74.20% share of the global battery energy storage system (BESS) market. This segment’s significant growth is primarily attributed to the increasing integration of BESS with the public electricity grid to manage peak load times, enhance grid stability, and store excess power generated by renewable energy sources.

Off-grid battery systems, while smaller in market share, play a vital role in providing energy solutions in remote and rural areas where grid connectivity is either unreliable or non-existent. In 2024, off-grid systems were essential for powering standalone systems, including residential homes, remote industrial operations, and emergency power systems in critical infrastructure.

By Ownership

In 2024, Third-party-owned systems held a dominant market position, capturing more than a 43.20% share of the global battery energy storage system (BESS) market. This growth is primarily driven by the increasing number of energy service companies (ESCOs) that offer battery storage as a service without upfront costs to the customer. This model is particularly appealing to commercial and industrial clients who seek to reduce their energy costs and enhance reliability without the financial burden of owning and maintaining the systems.

Customer-owned battery systems accounted for a significant portion of the market in 2024. Homeowners, businesses, and some industrial users increasingly prefer to own their energy storage systems to maximize control over their energy use and improve energy independence. This segment benefits from various governmental incentives, including tax credits and rebates, which reduce the overall cost burden on the consumer.

Utility-owned battery systems also played a crucial role in the energy storage market in 2024. Utilities invest in these systems to manage load, integrate renewable energy sources efficiently, and stabilize the grid. This segment is essential for large-scale energy storage applications that support the entire grid rather than individual users.

By Application

In 2024, the Utility segment held a dominant market position, capturing more than a 52.10% share of the global battery energy storage system (BESS) market. This segment’s significant market share is primarily due to the increasing adoption of large-scale energy storage systems by utilities to manage peak loads, enhance grid stability, and integrate renewable energy sources effectively.

The Commercial & Industrial segment also saw substantial growth in 2024, driven by businesses looking to reduce energy costs, improve energy reliability, and achieve sustainability goals. Energy storage systems in these sectors are used for demand charge management, backup power, and participation in demand response programs. Transportation sector, BESS plays a critical role in electric vehicle charging infrastructure, providing grid services such as load balancing and storing excess renewable energy during off-peak times for vehicle charging. The growing electrification of transport, including buses, fleets, and personal vehicles.

Critical Infrastructure facilities, including hospitals, military bases, and data centers, increasingly rely on battery storage systems to ensure uninterrupted power supply and enhance energy security. The adoption of BESS in these applications saw notable growth in 2024, with critical infrastructure operators valuing the reliability and immediate response capabilities of modern BESS. Infrastructure & Commercial Buildings includes the use of BESS in managing energy costs and improving energy efficiency within public and commercial buildings. In 2024, this application area was marked by a steady adoption rate, especially in regions with high electricity prices and strong incentives for energy efficiency.

Key Market Segments

By Battery Type

- Lithium-ion

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Titanate Oxide (LTO)

- Lead-acid

- Nickel based

- Flow Batteries

- Others

By Capacity

- Below 100 MWh

- 100 to 500 MWh

- Above 500 MWh

By Connection Type

- On-grid

- Off-grid

By Ownership

- Third-party-owned

- Customer-owned

- Utility-owned

By Application

- Utility

- Commercial & Industrial

- Transportation

- Critical Infrastructure

- Infrastructure & Commercial Buildings

- Others

- Residential

Drivers

Accelerated deployment of grid energy storage systems in ongoing grid modernization on projects

Grid modernization efforts focus on integrating renewable energy like solar and wind power into the grid. However, these sources are unreliable, leading to power fluctuations. Battery energy storage systems tackle this by storing extra energy when there’s a surplus and releasing it when needed or when renewables aren’t active.

This stabilizes the grid and guarantees a steady power supply. They help grid operators save excess electricity and boost reliability and flexibility in generating, transmitting, and distributing power.

During transmission, these systems handle various tasks like deferring asset use, regulating frequency, suppressing harmonic effects, supporting voltage, and maintaining power quality. They also aid in shifting energy timing, leveling power usage, and managing peak loads, enhancing the reliability of renewable energy and overall grid performance.

Restraints

High initial investment costs of installing battery energy storage systems

Battery energy storage technologies, like lithium-ion, flow, and lead-acid batteries, need significant upfront investment due to their high energy capacity and better performance. Lithium-ion batteries are expensive but offer high energy density, low self-discharge rates, and need minimal maintenance.

However, their costs are expected to decrease in the future. They’re commonly used in electric vehicles due to their lightweight nature, compact size, and large capacity. On the other hand, flow batteries require substantial initial investment for manufacturing, posing a challenge to market growth.

Moreover, supporting infrastructure like power conversion systems, control systems, and safety measures add to the overall system costs. For flow batteries, the expenses cover capital, components, materials, installation, and upkeep, posing a significant investment challenge for smaller enterprises.

Opportunity

Reduction in prices of lithium-ion batteries

The cost of lithium-ion batteries has significantly dropped due to tech advancements, larger-scale production, and better manufacturing efficiency. This decline has made battery energy storage systems (BESS) more budget-friendly and accessible for various uses.

With a lower cost per kilowatt-hour (kWh) of energy storage, businesses can invest in larger and more powerful systems, ensuring they can handle power needs during outages or high-demand periods. This cost reduction in lithium-ion batteries is a major driver for the BESS market growth.

Cheaper batteries make BESS a more viable, competitive, and appealing solution for ensuring a reliable and uninterrupted power supply.

Challenges

Difficulties pertaining to the installation of battery energy storage systems in remote and isolated locations

Setting up battery energy storage systems in remote areas poses challenges due to limited or unreliable grid power. Establishing a dependable power source for installation and maintenance might require alternative options like solar panels.

Maintaining these systems in remote areas can be tough due to limited local service providers and spare parts access. Additionally, harsh environmental conditions like extreme temperatures, high humidity, or corrosive atmospheres in these isolated locations can affect system performance and lifespan, demanding extra protection and durability measures.

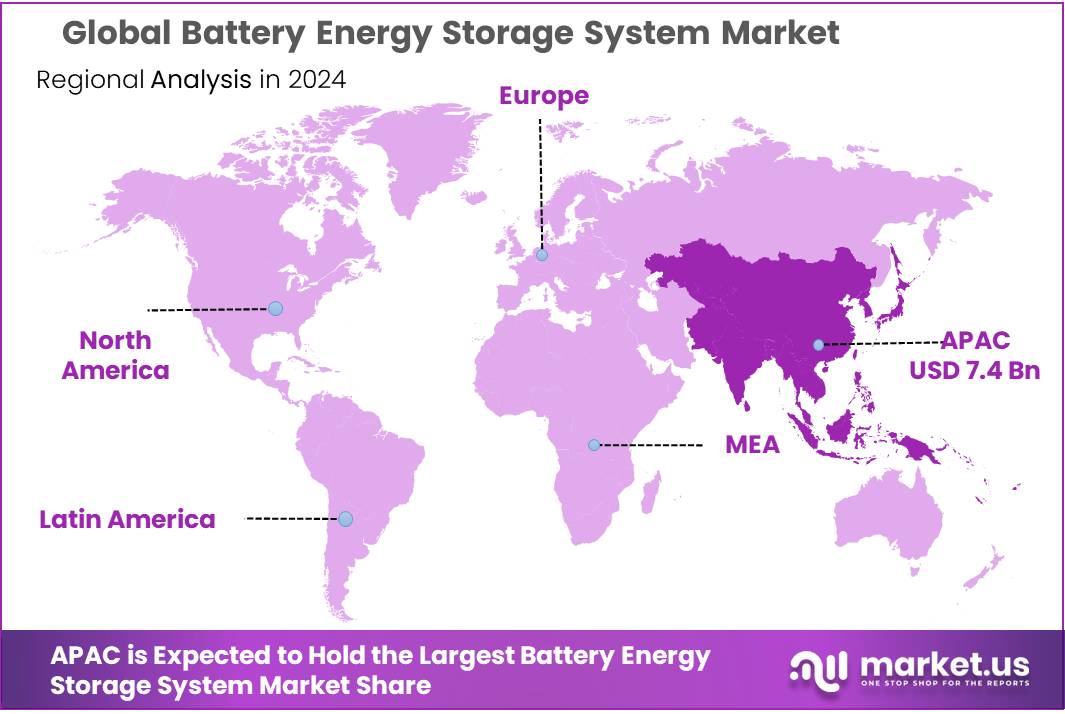

Regional Analysis

The Asia-Pacific (APAC) region dominates the global Battery Energy Storage Systems (BESS) market, accounting for 48.30% of the market share, valued at approximately USD 7.4 billion. The region’s growth is driven by rapid industrialization, expanding renewable energy deployment, and government initiatives supporting energy storage solutions. China, Japan, South Korea, and India are key contributors, with China leading due to its strong battery manufacturing ecosystem and large-scale renewable energy projects. Japan and South Korea also play a crucial role, investing heavily in lithium-ion battery technology and smart grid integration.

North America follows as a significant market, driven by increasing adoption of renewable energy sources, grid modernization efforts, and supportive government policies. The U.S. and Canada lead the region, with the U.S. seeing substantial growth in utility-scale battery storage deployments. The U.S. Department of Energy (DOE) has set ambitious targets for energy storage adoption.

Europe is witnessing steady growth due to stringent carbon reduction goals and the expansion of energy storage capacities. Countries such as Germany, the U.K., and France are at the forefront, supported by EU policies like the Green Deal, which aims for climate neutrality by 2050. Germany’s energy storage market alone is expected to exceed USD 5 billion by 2030.

The Middle East & Africa (MEA) and Latin America are emerging markets, focusing on integrating renewable energy with storage solutions. Countries like Saudi Arabia, the UAE, Brazil, and Chile are investing in large-scale solar-plus-storage projects to enhance grid stability and support energy diversification.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape

The global battery energy storage systems market is highly competitive, with several key players driving innovation and expansion. BYD Co. Ltd., General Electric, Panasonic Corporation, LG Energy Solution Ltd., and Tesla Inc. are among the leading companies shaping the industry. These players are heavily investing in lithium-ion battery technology, solid-state advancements, and energy management systems to enhance storage capacity, efficiency, and sustainability. Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd., AEG, and Varta AG also hold significant market shares, leveraging their expertise in battery manufacturing and renewable energy integration.

Delta Electronics, Inc., Hitachi Energy Ltd., Honeywell International Inc., Siemens AG, Toshiba Corporation, and Mitsubishi Heavy Industries, Ltd. are expanding their energy storage solutions through strategic partnerships and infrastructure development. These firms are actively involved in grid-scale storage projects, virtual power plants (VPPs), and hybrid storage systems to address the growing demand for reliable and sustainable energy storage.

Market Key Players

- BYD Co. Ltd.

- General Electric

- Panasonic Corporation

- LG Energy Solution Ltd

- Tesla Inc

- Contemporary Amperex Technology Co., Limited.

- Samsung SDI Co., Ltd.

- AEG

- Varta AG

- Delta Electronics, Inc.

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Siemens AG

- Toshiba Corporation

- Mitsubishi Heavy Industries, Ltd.

- Other Key Players

Recent Development

In December 2023, BYD had established 15 major production bases across more than 10 cities in China, underscoring its rapid expansion.

In 2024, GE’s energy storage division contributed to the global investment in battery storage and power grids, which surpassed $450 billion.

Report Scope

Report Features Description Market Value (2024) USD 15.4 Billion Forecast Revenue (2034) USD 108.0 Billion CAGR (2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-ion (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO)), Lead-acid, Nickel based, Flow Batteries, Others), By Capacity (Below 100 MWh, 100 to 500 MWh, Above 500 MWh), By Connection Type (On-grid, Off-grid), By Ownership (Third-party-owned, Customer-owned, Utility-owned), By Application (Utility, Commercial And Industrial, Transportation, Critical Infrastructure, Infrastructure and Commercial Buildings, Others, Residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BYD Co. Ltd., General Electric, Panasonic Corporation, LG Energy Solution Ltd , Tesla Inc, Contemporary Amperex Technology Co., Limited. , Samsung SDI Co., Ltd., AEG , Varta AG, Delta Electronics, Inc., Hitachi Energy Ltd., Honeywell International Inc., Siemens AG, Toshiba Corporation , Mitsubishi Heavy Industries, Ltd., Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Battery Energy Storage Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Battery Energy Storage Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Co. Ltd.

- General Electric

- Panasonic Corporation

- LG Energy Solution Ltd

- Tesla Inc

- Contemporary Amperex Technology Co., Limited.

- Samsung SDI Co., Ltd.

- AEG

- Varta AG

- Delta Electronics, Inc.

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Siemens AG

- Toshiba Corporation

- Mitsubishi Heavy Industries, Ltd.

- Other Key Players