Global Automotive Suspension System Market By System (Passive System, Active System, Semi-active System), By Component (Shock Absorbers, Struts, Control Arm, Ball Joint, Air Compressors, Others), By Suspension Type (Hydraulic Suspension, Air Suspension, Leaf Spring), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Off-Road Vehicles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141238

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

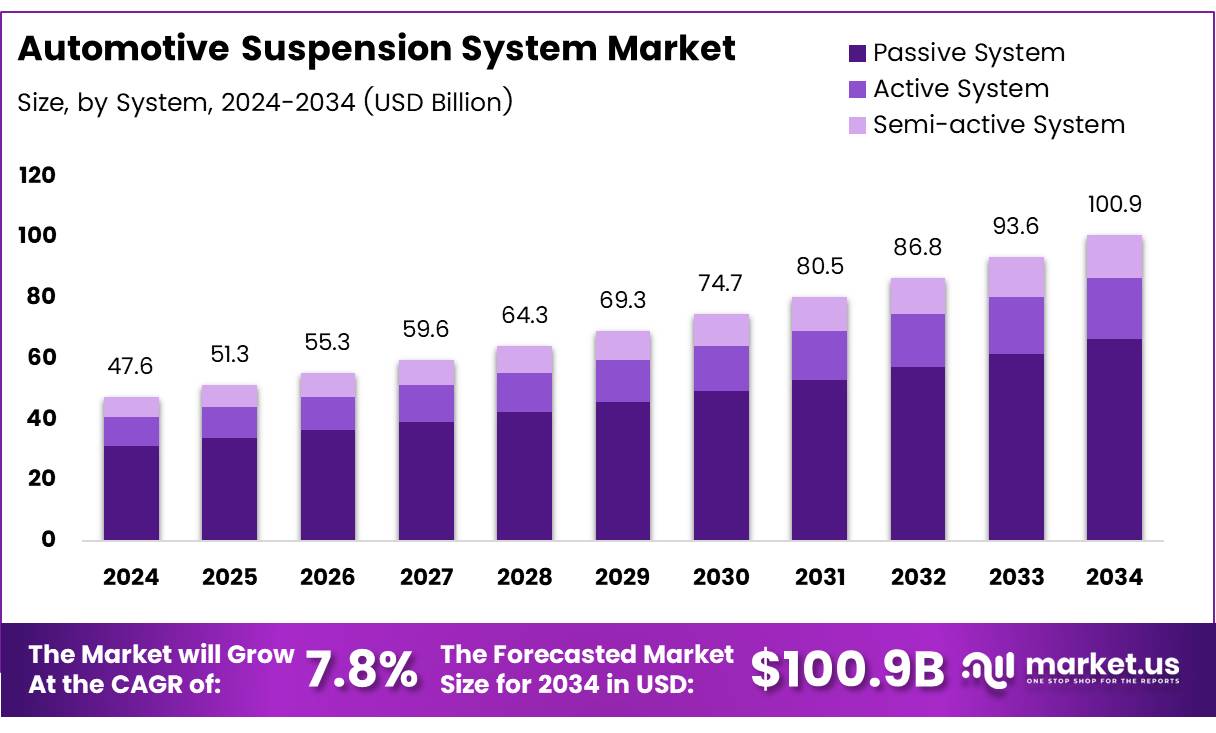

The Global Automotive Suspension System Market size is expected to be worth around USD 100.9 Billion by 2034, from USD 47.6 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The Automotive Suspension System plays a critical role in maintaining vehicle stability, safety, and overall driving comfort. By absorbing shocks from the road, suspension systems ensure a smooth ride while improving handling, reducing wear on the vehicle’s frame and components, and enhancing tire lifespan.

Modern suspension systems have evolved to include various types, such as independent suspension, air suspension, and electronic control systems, all designed to provide optimized performance. As the automotive industry leans toward innovation in terms of safety and performance, suspension systems have become integral to vehicle designs, further underscoring their importance in the current automotive landscape.

The Automotive Suspension System Market has witnessed significant growth due to rising demand for enhanced vehicle performance, comfort, and safety. As vehicles become more technologically advanced, the need for robust suspension systems has increased across various vehicle types, from passenger cars to commercial vehicles.

According to Study, suspension and braking components accounted for 15% of the domestic OEM auto components market in the financial year 2024. With a market size of 5.16 trillion Indian rupees, this sector has experienced steady growth and continues to contribute significantly to the overall automotive industry. Additionally, the growing trend towards electric and hybrid vehicles has spurred innovations in suspension technology, particularly in terms of energy-efficient designs and adaptive systems.

The automotive suspension system market is poised for substantial growth, driven by multiple factors, including technological advancements, increasing consumer demand for vehicle safety, and improved driving experiences.

In particular, the expansion of electric vehicles (EVs) and autonomous driving technologies is creating opportunities for new suspension system designs that support these innovations. Furthermore, regulatory measures aimed at improving vehicle safety standards and reducing emissions are pushing manufacturers to adopt state-of-the-art suspension technologies.

Government investments in infrastructure and automotive research are also playing a pivotal role. For example, in China, Recent Study reports that around 2.8 million passenger cars and 364,000 commercial vehicles were sold in December 2023, showing positive growth in vehicle sales that may correlate with higher demand for suspension system upgrades and replacements.

The regulatory framework, especially in emerging markets, is also becoming stricter, with a stronger emphasis on vehicle safety and fuel efficiency, further driving the need for advanced suspension technologies.

Notably, the cost of repairing a suspension system is considerable, with Synchrony estimating the average cost of suspension repairs ranging from $1,000 to $5,000, depending on the extent of damage. This provides a clear indication of the high value placed on suspension components in vehicle maintenance and aftermarket services.

As demand for suspension system upgrades continues to rise, it presents lucrative opportunities for manufacturers and suppliers, particularly in the aftermarket segment, where repairs and replacements are essential to vehicle maintenance.

Key Takeaways

- The global automotive suspension system market is projected to reach USD 100.9 billion by 2034, growing at a CAGR of 7.8% from 2025 to 2034.

- Passive systems dominate the market, holding 65.1% of the market share in 2024 due to their reliability, cost-effectiveness, and simple design.

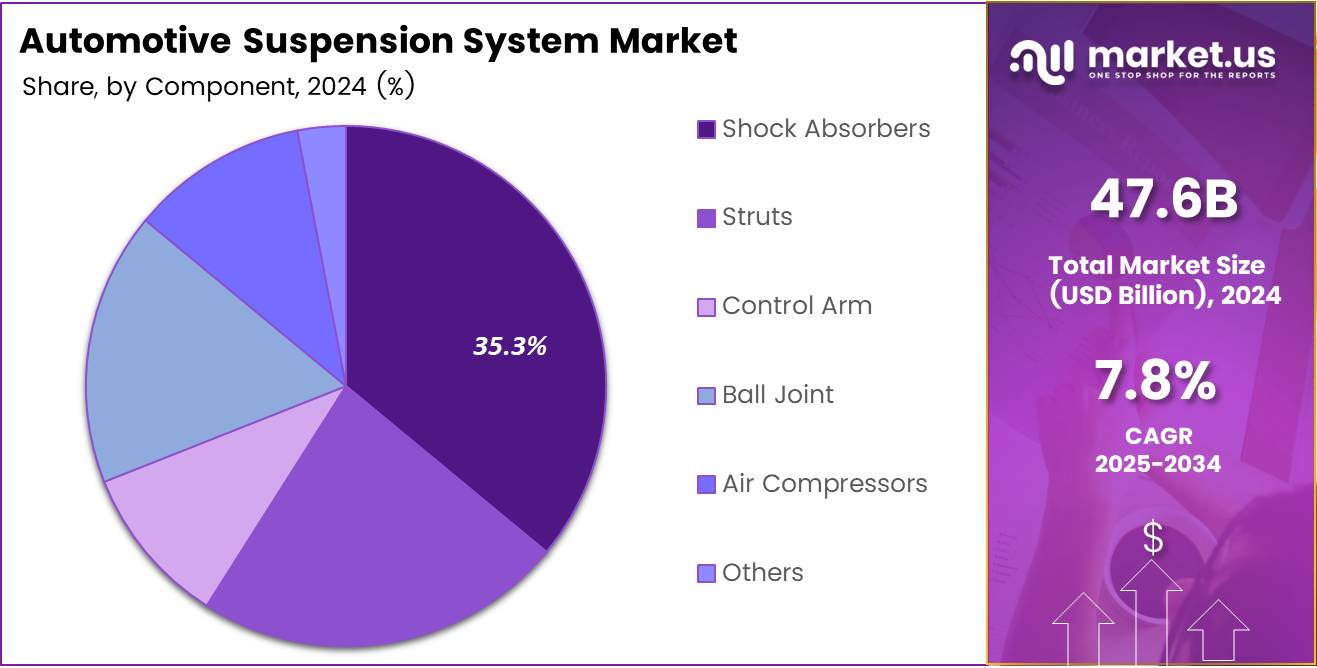

- Shock absorbers lead the component segment with a 35.3% market share, enhancing vehicle comfort and stability.

- Hydraulic suspension systems are the most adopted suspension type, offering superior ride comfort and handling.

- Passenger cars dominate the vehicle type segment, driven by the growing consumer preference for these vehicles.

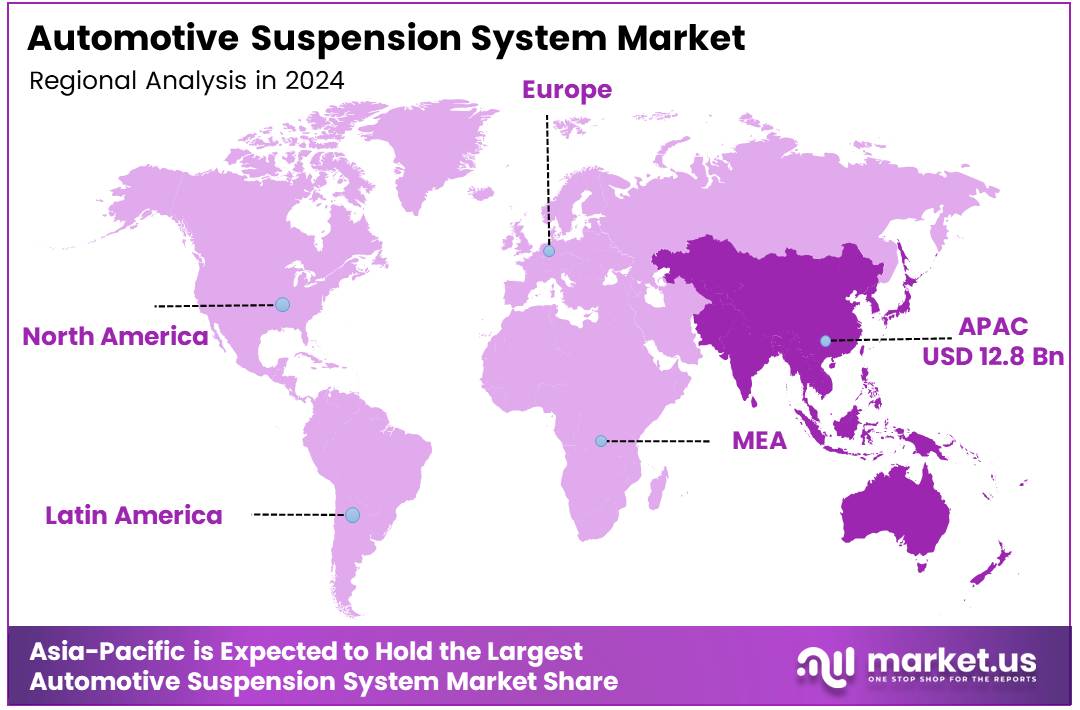

- Asia-Pacific is the largest regional market, accounting for 27.2% of the global market share, valued at approximately USD 12.8 billion.

System Analysis

Passive Systems Lead Automotive Suspension Market with 65.1% Share in 2024

In 2024, Passive Systems held a dominant market position in the By System Analysis segment of the Automotive Suspension System Market, accounting for 65.1% of the total market share.

The growth of passive systems can be attributed to their reliability, cost-effectiveness, and simplicity in design, making them the preferred choice for a wide range of vehicle types. These systems, which include shock absorbers and coil springs, offer a stable and consistent driving experience without the need for complex electronic components.

Active Systems, while growing in adoption, represented a smaller portion of the market due to the higher cost and advanced technology required. These systems, which adjust to road conditions in real-time, are often found in premium vehicles seeking superior performance. Active suspension systems accounted for a notable but smaller share of the market, driven by increasing consumer demand for high-end features and improved ride quality.

Semi-active Systems, a hybrid of passive and active systems, experienced moderate growth. These systems provide adjustable dampers that can adapt to changing road conditions, offering a balance between cost and performance. However, their market share remained lower than that of passive systems, reflecting the ongoing preference for simpler, more cost-efficient solutions in the automotive sector.

Component Analysis

Shock Absorbers dominate with a 35.3% share in the Automotive Suspension System Market due to their critical role in ride comfort and vehicle stability.

In 2024, Shock Absorbers held a dominant position within the By Component Analysis segment of the Automotive Suspension System Market, commanding a 35.3% market share. The growth of shock absorbers can be attributed to their essential function in absorbing and dissipating energy from road irregularities, significantly enhancing vehicle comfort and stability. The widespread adoption of these components in both passenger vehicles and commercial fleets has fueled their market prominence.

Struts followed closely, contributing a notable share due to their integrated design, which combines the functionality of a shock absorber and a spring. This design flexibility has made struts an integral component in modern suspension systems, particularly in front suspension designs.

Control Arms and Ball Joints also maintain significant shares, owing to their role in connecting key suspension components and ensuring proper wheel alignment. Air Compressors, although smaller in comparison, are increasingly incorporated in advanced suspension systems, particularly in vehicles with air suspension, providing enhanced ride quality.

Other components, such as bushings and links, represent a smaller, though vital, portion of the market. These elements support the overall structure and performance of the suspension system.

Suspension Type Analysis

Hydraulic Suspension Leads the Market in 2024 by Suspension Type

In 2024, hydraulic suspension systems held a dominant position in the By Suspension Type Analysis segment of the global automotive suspension system market. The widespread adoption of hydraulic suspension can be attributed to its ability to offer superior ride comfort and enhanced vehicle handling, which are essential for both passenger vehicles and commercial transport.

Hydraulic systems are known for their efficiency in absorbing road irregularities, providing a smoother driving experience, which is highly sought after in luxury cars and performance vehicles.

While air suspension systems continue to hold a significant share, offering benefits such as ride height adjustment and load adaptability, hydraulic systems have outpaced air suspensions in terms of overall market preference, particularly for their reliability and cost-effectiveness in varied driving conditions.

Leaf spring suspensions, though still used in certain vehicle types, are gradually being replaced by more advanced systems due to limitations in performance and comfort. As a result, hydraulic suspension continues to lead in market share, solidifying its place as the preferred choice for enhanced driving experiences.

Vehicle Type Analysis

Passenger Cars Lead the Automotive Suspension System Market with a Dominant Share in 2024

In 2024, Passenger Cars held a dominant position in the By Vehicle Type segment of the Automotive Suspension System Market. This segment benefited from the growing consumer preference for passenger vehicles, which continue to be the primary driver of automotive market growth.

The increasing demand for comfort, safety, and advanced features in personal vehicles has led to significant investments in suspension technology. Passenger cars, particularly in regions with high purchasing power, remain the largest consumer of advanced suspension systems, leveraging innovations such as air suspension and electronically controlled shock absorbers.

Other segments, including Commercial Vehicles, Two-Wheelers, Off-Road Vehicles, and Others, contribute to the overall market, but with comparatively lower shares. While these vehicle types also require specialized suspension systems, their market impact remains secondary to that of passenger cars, which consistently lead in terms of both demand and technological adoption.

Key Market Segments

By System

- Passive System

- Active System

- Semi-active System

By Component

- Shock Absorbers

- Struts

- Control Arm

- Ball Joint

- Air Compressors

- Others

By Suspension Type

- Hydraulic Suspension

- Air Suspension

- Leaf Spring

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Off-Road Vehicles

- Others

Drivers

Rising Consumer Demand for Vehicle Comfort Drives Growth in Automotive Suspension Systems

The growing consumer preference for enhanced vehicle comfort is a key factor driving the demand for advanced suspension systems. Consumers increasingly seek smoother and more comfortable driving experiences, which is prompting automakers to integrate sophisticated suspension technologies. This trend is particularly noticeable with air suspension and adaptive systems, which are designed to provide superior ride quality by adjusting to road conditions and driving dynamics.

In addition to comfort, advancements in suspension technology such as active and semi-active systems are improving vehicle performance, attracting consumers who prioritize both comfort and handling. As the automotive industry continues to grow, particularly in emerging markets where vehicle production and sales are on the rise, the need for modern suspension systems becomes more critical.

The growing adoption of luxury vehicles, which often feature high-performance suspension systems, further drives the demand for these advanced technologies. Overall, the market is benefiting from consumer expectations for improved ride quality, which is directly influencing the evolution of suspension systems in the automotive sector.

Restraints

High Manufacturing Costs Limit Market Expansion of Automotive Suspension Systems

The automotive suspension system market faces significant challenges due to the high manufacturing costs associated with advanced suspension technologies. Systems such as air suspension, magnetic ride control, and active suspensions involve intricate engineering, high-quality materials, and sophisticated components, all of which contribute to elevated production costs.

These systems, while offering superior performance, often lead to increased vehicle prices, making them less accessible to the average consumer and limiting their widespread adoption. Additionally, automakers may face difficulties in passing on these higher costs to consumers without negatively impacting vehicle sales, especially in highly competitive segments.

Furthermore, the complexity involved in manufacturing such systems requires specialized equipment and expertise, which can be costly to maintain. This results in a restraint on the overall growth of the market, as both manufacturers and consumers weigh the trade-offs between performance enhancements and affordability. As a result, manufacturers must carefully balance innovation with cost efficiency to achieve a competitive edge in the market while maintaining profitability.

Growth Factors

Development of Air Suspension Systems Drives Market Growth

The automotive suspension system market is poised for significant growth, driven by several key factors. One of the most notable opportunities lies in the increasing demand for air suspension systems. These systems offer enhanced comfort, which is highly valued in both passenger vehicles and commercial fleets. Air suspension allows for a smoother ride by adjusting the suspension’s height, adapting to road conditions and vehicle load, and improving overall stability.

Furthermore, the shift towards electric vehicles (EVs) provides a unique opportunity to design lightweight, energy-efficient suspension systems that meet the specific needs of EVs, particularly in enhancing driving range and performance.

In addition, the growing automotive production and sales in emerging economies, such as India, Brazil, and China, offer vast potential for modern suspension systems. As automotive markets in these regions expand, the adoption of advanced suspension technologies is expected to rise.

Additionally, the integration of smart suspension systems, which utilize sensors and real-time data analytics, is gaining traction with the increasing trend of connected and autonomous vehicles.

These systems can dynamically adjust to changing road conditions and improve overall vehicle performance, positioning themselves as a key development in the market. Thus, the automotive suspension system market is expected to experience substantial growth, driven by technological advancements, regional expansions, and evolving consumer preferences.

Emerging Trends

Adaptation of Suspension Systems for Electric and Hybrid Vehicles

The automotive suspension system market is being increasingly shaped by the rising demand for electric and hybrid vehicles, where the focus is shifting towards designing systems that enhance energy efficiency and reduce weight while ensuring maximum comfort. This shift aligns with the broader industry trend of improving fuel efficiency and vehicle performance.

Moreover, as electric vehicles (EVs) often feature heavier battery packs, there is a growing need for specialized suspension designs that can accommodate these additional weights without compromising on ride quality.

Alongside this, advancements in vibration and noise reduction technologies are driving innovations aimed at providing consumers with quieter, smoother rides, meeting the growing demand for a comfortable driving experience.

This trend is further supported by the integration of tire pressure monitoring systems (TPMS) into suspension designs, enhancing vehicle stability and safety by providing real-time monitoring of tire pressure and potential issues.

On the other hand, the development of off-road and heavy-duty suspension systems is gaining traction, as manufacturers continue to innovate to support the needs of off-road vehicles and commercial trucks, which require robust systems capable of handling rugged terrains and heavy payloads.

Regional Analysis

Asia-Pacific Leads the Automotive Suspension System Market with 27.2% Share and USD 12.8 Billion

The automotive suspension system market is geographically diverse, with significant contributions from regions such as Asia-Pacific, North America, Europe, Middle East & Africa (MEA), and Latin America. Among these, Asia-Pacific is the dominant region, accounting for 27.2% of the global market share, valued at approximately USD 12.8 billion.

This region’s dominance can be attributed to the robust automotive manufacturing sector in countries like China, India, and Japan. The region also benefits from the growing demand for passenger vehicles, especially in emerging economies, alongside the increasing production of electric vehicles (EVs) and the shift toward advanced suspension technologies.

Regional Mentions:

North America holds a significant market share due to the presence of major automotive manufacturers in the United States and Canada. The region is particularly driven by innovations in suspension technologies, such as air suspensions and adaptive systems, which cater to both passenger and commercial vehicle markets. The U.S. remains the largest contributor in this region, with an increasing focus on vehicle comfort and safety. However, North America’s growth rate is slightly subdued compared to Asia-Pacific, given the region’s mature automotive market.

In Europe, the automotive suspension system market is supported by stringent government regulations regarding vehicle safety and emissions. European countries such as Germany, France, and the UK are key players, with advancements in suspension technologies aimed at improving fuel efficiency and vehicle handling. The growth of electric and hybrid vehicles is also contributing to market expansion, with a shift towards lightweight suspension systems.

The Middle East & Africa region is experiencing moderate growth, driven by increasing automotive production in countries like South Africa and the UAE. However, the market is primarily supported by imports and regional trade agreements, limiting its overall share.

Latin America shows slow but steady growth in the automotive suspension system market, primarily led by Brazil and Mexico, which are witnessing increased automotive manufacturing activities. Despite this, the region holds a smaller portion of the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global automotive suspension system market is characterized by a competitive landscape where key players are consistently focusing on technological advancements and strategic partnerships to expand their market share. As of 2024, the market remains highly fragmented, with several leading companies shaping the dynamics.

Continental AG and Thyssenkrupp AG are at the forefront, leveraging their robust R&D capabilities and global manufacturing footprint to maintain leadership. Continental AG, known for its high-performance systems, has increasingly incorporated electric vehicle (EV) solutions, capitalizing on the growth of the EV segment. Similarly, Thyssenkrupp’s continuous investment in innovative suspension technologies, including air and active suspension systems, positions it as a key innovator in this space.

Schaeffler AG and KYB Corporation are also notable players. Schaeffler has expanded its portfolio with advanced suspension components for electric and hybrid vehicles, capitalizing on the trend toward lightweight and energy-efficient solutions. KYB Corporation, a prominent supplier in Asia, is enhancing its offerings in both traditional and adaptive suspension systems, catering to both OEMs and aftermarket demand.

Mando Corporation and FOX Factory, Inc. are gaining traction in the premium and performance vehicle segments. Mando’s strength lies in its integration of smart suspension systems, while FOX Factory is focusing on high-performance shock absorbers, particularly in off-road and motorsport applications.

With increasing demand for advanced suspension systems, driven by electrification and autonomous driving technologies, players like ZF TR, Hendrickson USA, and Tenneco Inc. are positioning themselves as key contributors to the market’s evolution. These companies are expected to continue expanding their portfolios through strategic acquisitions and alliances, ensuring sustained growth in an increasingly dynamic market.

Top Key Players in the Market

- Continental AG

- Thyssenkrupp AG

- NHK Spring

- Schaeffler AG

- FOX Factory, Inc.

- Gabriel India Limited

- KYB Corporation

- Mando Corporation

- Hendrickson USA, LLC

- Sogefi SpA

- Tenneco Inc.

- WABCO

- ZF TR

- Benteler

Recent Developments

- In January 2025, Gabriel India expanded its suspension product portfolio through the acquisition of Marelli Motherson, a move aimed at strengthening its position in the automotive components market by integrating advanced suspension technologies.

- In October 2024, Brembo, a global leader in braking systems, acquired Öhlins, a premium suspension technology manufacturer, to diversify its product offerings and enhance its presence in the high-performance automotive segment.

- In November 2024, MidOcean Partners acquired Arnott Industries, a key player in the automotive aftermarket suspension products sector, signaling an increased focus on expanding its footprint in the replacement and aftermarket suspension solutions market.

Report Scope

Report Features Description Market Value (2024) USD 47.6 Billion Forecast Revenue (2034) USD 100.9 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System (Passive System, Active System, Semi-active System), By Component (Shock Absorbers, Struts, Control Arm, Ball Joint, Air Compressors, Others), By Suspension Type (Hydraulic Suspension, Air Suspension, Leaf Spring), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Off-Road Vehicles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Continental AG, Thyssenkrupp AG, NHK Spring, Schaeffler AG, FOX Factory, Inc., Gabriel India Limited, KYB Corporation, Mando Corporation, Hendrickson USA, LLC, Sogefi SpA, Tenneco Inc., WABCO, ZF TR, Benteler Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Suspension System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Suspension System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental AG

- Thyssenkrupp AG

- NHK Spring

- Schaeffler AG

- FOX Factory, Inc.

- Gabriel India Limited

- KYB Corporation

- Mando Corporation

- Hendrickson USA, LLC

- Sogefi SpA

- Tenneco Inc.

- WABCO

- ZF TR

- Benteler