Global Automotive Predictive Maintenance Market By Component (Solutions and Services), By Technology (IoT, Big Data & Data Analytics, Business Intelligence (BI), Cloud Computing and 5G), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches), By Application (Oil Change, Transmission Checkup, Belt Change, Brake and Tire Inspection, Coolant Replacement, Engine Air Filter, Cabin Filter, Others Application), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 99476

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

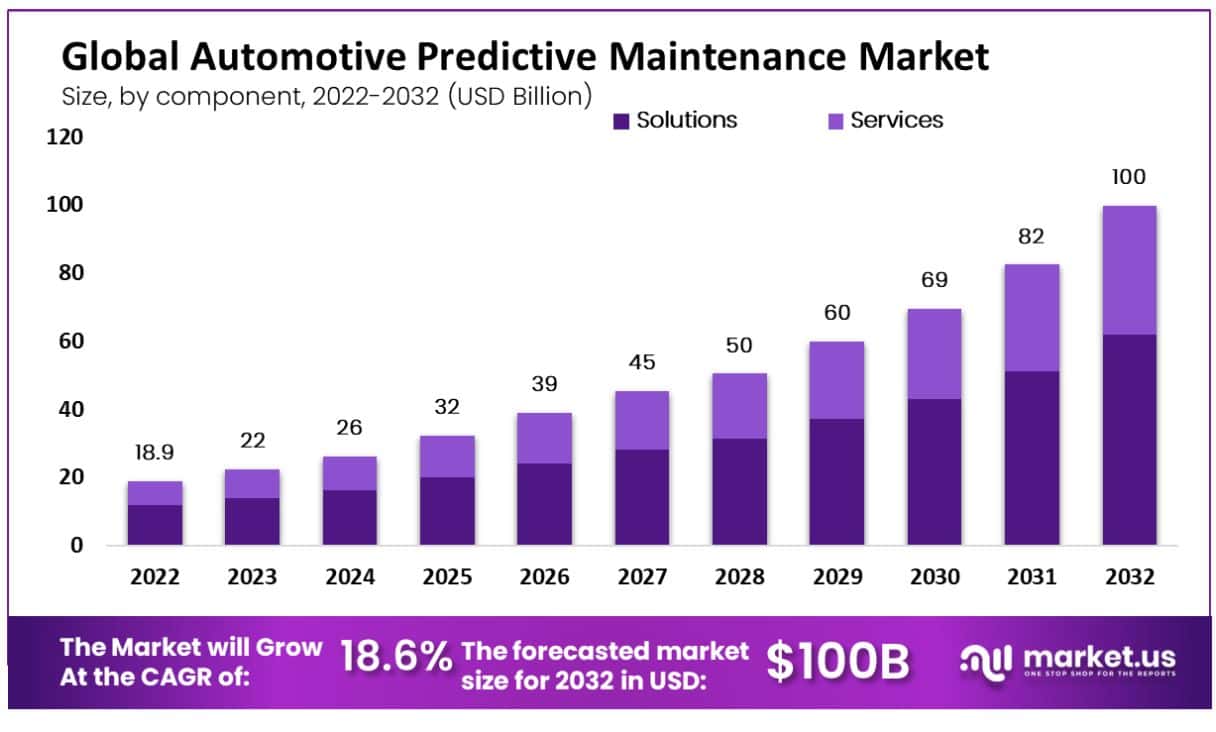

The global automotive predictive maintenance market size is expected to be worth around USD 100 Billion by 2032 from USD 22 billion in 2023, growing at a CAGR of 18.6% during the forecast period 2023 to 2032.

Automotive predictive maintenance is a cutting-edge approach that utilizes data analytics, machine learning, and AI to predict when a vehicle is likely to require maintenance. By analyzing various parameters such as engine performance, component wear and tear, driving patterns, and environmental conditions, predictive maintenance systems can forecast potential issues before they occur. This proactive strategy helps prevent unexpected breakdowns, reduces downtime, and ultimately saves costs for vehicle owners and fleet managers.

The automotive predictive maintenance market represents a critical segment within the automotive industry, aimed at preempting vehicle malfunctions and failures before they occur. This technology leverages data analytics and machine learning algorithms to analyze data from various sensors embedded in vehicles, predicting potential issues based on patterns and anomalies detected over time. The objective is to enhance vehicle reliability, reduce downtime, and lower maintenance costs, thereby increasing customer satisfaction and loyalty.

The demand for automotive predictive maintenance is primarily driven by the rise in connected vehicles equipped with sensors and telematics. These vehicles generate vast amounts of data, which, when analyzed, can predict failures before they happen. Additionally, the push towards automation and the adoption of electric vehicles (EVs) contribute to the growth as these vehicles require precise maintenance to operate efficiently. Another significant driver is the increasing focus on safety and stringent regulations requiring regular vehicle maintenance to ensure road safety and reduce emissions.

Despite its potential, the market faces several challenges. The high cost of implementing predictive maintenance systems can be a barrier for small and medium-sized enterprises (SMEs). There is also the complexity of integrating these systems with existing automotive architectures. Furthermore, the accuracy of predictive analysis heavily depends on the quality and quantity of data collected, which can vary significantly across vehicles.

Opportunities in the automotive predictive maintenance market are large. As technology advances, the cost of sensors and IoT devices is decreasing, making predictive maintenance more accessible to a broader range of automotive players. There’s also a growing trend towards mobility-as-a-service (MaaS), which relies on vehicle uptime, thus highlighting the importance of predictive maintenance. Additionally, there is an opportunity to expand these services in emerging markets, where the automotive industry is rapidly growing and modernizing.

According to Market.us analysis, The Global Predictive Maintenance Market is poised for significant expansion, projected to reach approximately USD 107.3 Billion by 2033, up from USD 8.7 Billion in 2023. This impressive growth, characterized by a Compound Annual Growth Rate (CAGR) of 28.5% during the forecast period from 2024 to 2033, underscores the increasing adoption and technological advancements in this field.

Research from Infraspeak indicates that predictive maintenance offers substantial cost savings, reducing maintenance expenses by 30-40% compared to reactive maintenance strategies, and 8-12% when compared to preventive maintenance approaches. These savings highlight the efficiency and economic benefits of predictive maintenance systems.

Currently, 47% of global manufacturers have implemented predictive maintenance technologies to curtail operational costs. This trend suggests a significant market opportunity as the remaining 53% of manufacturers have yet to adopt these advanced maintenance strategies. The shift towards predictive maintenance is not just a technological upgrade but a strategic investment that manufacturers are increasingly recognizing as essential for enhancing operational efficiency and reducing downtime.

Key Takeaways

- The global automotive predictive maintenance market is projected to experience significant growth, with an anticipated valuation of approximately USD 100 Billion by 2032, up from USD 22 billion in 2023. This represents a robust compound annual growth rate (CAGR) of 18.6% during the forecast period from 2023 to 2032.

- In the segmentation by solutions, the Solutions segment demonstrated a leading position within the automotive predictive maintenance market in 2022, commanding a majority with more than 62% share. This segment underscores the increasing adoption of comprehensive maintenance solutions that enhance vehicle reliability and reduce downtime.

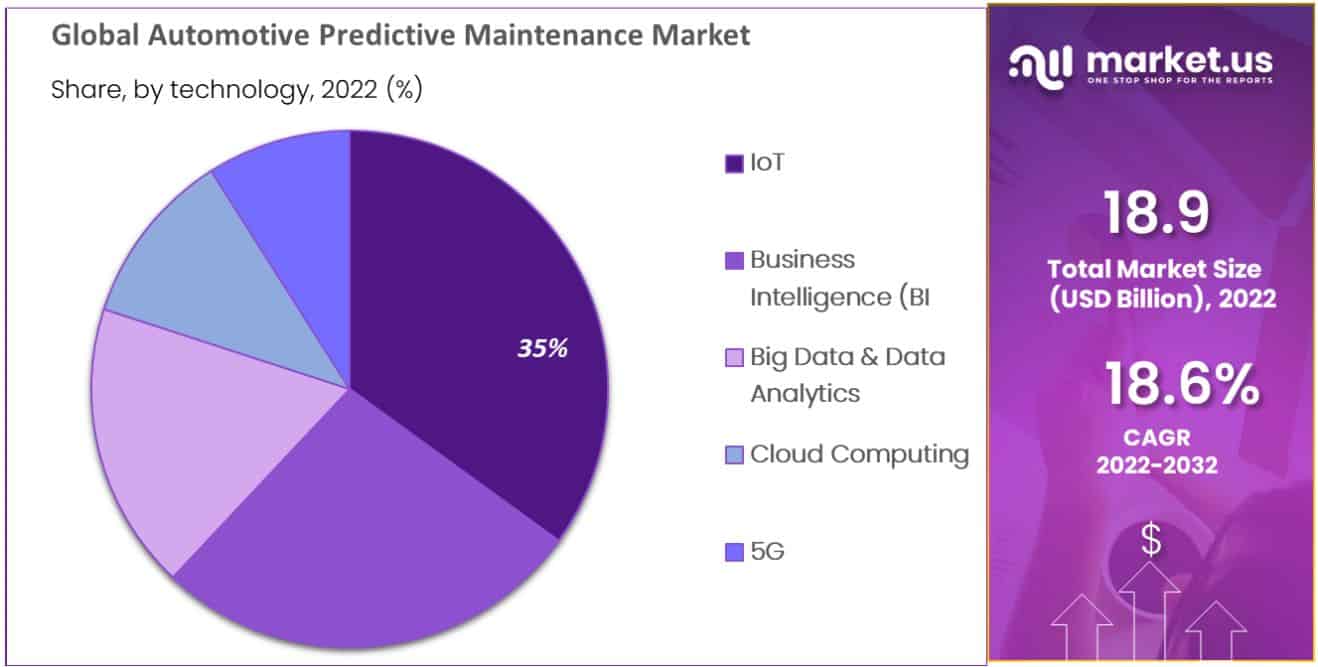

- Regarding technology integration, the Internet of Things (IoT) segment also emerged prominently in 2022, holding a significant share of over 35%. The integration of IoT technologies is pivotal in enabling real-time monitoring and predictive analysis in vehicle maintenance systems.

- From the perspective of vehicle types, the Passenger Cars segment dominated the market in 2022, accounting for more than 61% of the market share. This dominance is indicative of the increasing reliance on predictive maintenance solutions to improve safety and efficiency in personal vehicles.

- Focusing on maintenance services, the Oil Change segment secured a substantial market position by capturing more than 22% share in 2022. This reflects the critical importance of regular oil changes in vehicle maintenance, enhanced through predictive scheduling and diagnostics.

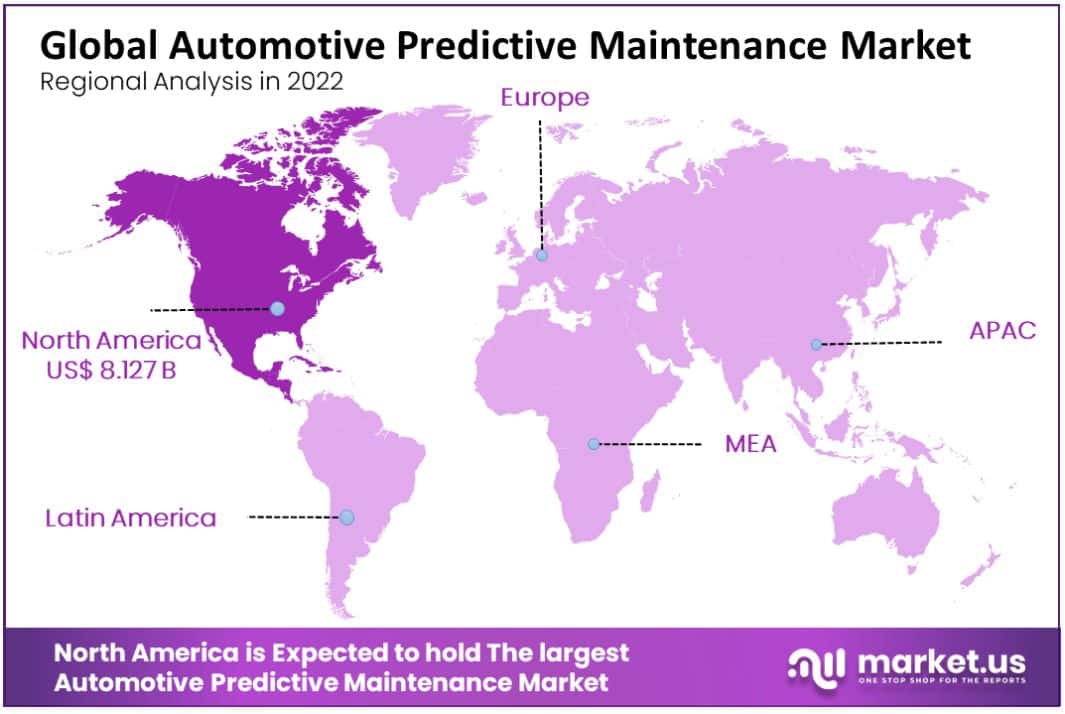

- Geographically, North America led the automotive predictive maintenance market in 2022, with a dominant share of over 43% and generating revenues amounting to USD 8.1 billion. This regional dominance can be attributed to the advanced adoption of technology and stringent regulations regarding vehicle maintenance and safety in the region.

By Component Analysis

In 2022, the Solutions segment held a dominant market position within the automotive predictive maintenance market, capturing more than a 62% share. This significant market share is primarily due to the increasing demand for integrated diagnostic systems in vehicles that can predict maintenance needs accurately and efficiently.

Automotive manufacturers and fleet operators are heavily investing in predictive solutions that utilize advanced analytics and machine learning algorithms to monitor vehicle health in real time. These solutions are designed to detect potential issues before they lead to costly repairs or downtime, thereby saving money and improving vehicle longevity.

The leadership of the Solutions segment can also be attributed to the rising adoption of connected vehicles equipped with IoT technologies, which are essential for the implementation of predictive maintenance. As vehicles become smarter and more connected, the amount of data generated increases, providing more opportunities for predictive maintenance solutions to analyze and utilize this data effectively. These solutions not only help in reducing operational costs but also enhance safety by preventing failures that could lead to accidents.

Furthermore, the push towards electric vehicles (EVs) and autonomous driving technologies is expanding the scope for advanced predictive maintenance solutions. These vehicles require precise monitoring due to their complex electronic systems and software, making predictive solutions indispensable. The ability of these solutions to provide actionable insights and proactive maintenance recommendations continues to drive their adoption, reinforcing their leading position in the market.

By Technology Analysis

In 2022, the IoT segment held a dominant market position in the automotive predictive maintenance market, capturing more than a 35% share. This leadership is largely driven by the crucial role of IoT in enabling continuous real-time monitoring and data collection from vehicles.

IoT devices are integral to the automotive industry, facilitating the transmission of vital information about vehicle performance and health to predictive maintenance systems. This constant flow of data allows for the early detection of potential issues, preventing breakdowns and extending vehicle lifespan.

The prominence of the IoT segment is further bolstered by the increasing integration of connected devices in vehicles, which are becoming standard features in new models. These devices gather extensive data on vehicle operations, which, when analyzed through sophisticated algorithms, can predict failures with high accuracy. The predictive insights provided by IoT technologies help reduce maintenance costs and downtime, offering substantial value to vehicle manufacturers and owners alike.

Additionally, the expansion of IoT in automotive predictive maintenance is supported by advancements in wireless technology and the growing infrastructure of connected services. As networks become more robust and widespread, the effectiveness and reliability of IoT solutions in predictive maintenance continue to improve. This ensures that the IoT segment not only leads but also continues to expand its influence in the predictive maintenance market, driven by technological innovations and the increasing demand for smarter, safer vehicles.

By Vehicle Type Analysis

In 2022, the Passenger Cars segment held a dominant market position in the automotive predictive maintenance market, capturing more than a 61% share. This substantial market share is primarily attributed to the increasing penetration of advanced diagnostic and monitoring technologies in passenger vehicles.

As the number of connected passenger cars continues to rise, so does the integration of predictive maintenance systems designed to enhance vehicle safety, performance, and longevity. These systems leverage data analytics and IoT technologies to provide real-time insights into vehicle health, predicting potential issues before they escalate into costly repairs.

The leadership of the Passenger Cars segment is further reinforced by consumer demand for higher reliability and lower ownership costs. Modern consumers are more informed and prefer vehicles that offer not only comfort and performance but also cost-effective maintenance solutions.

Predictive maintenance services in passenger cars help meet these demands by ensuring that vehicles operate at optimal conditions, reducing the frequency and severity of maintenance interventions. This proactive approach to maintenance is becoming a key selling point for automakers looking to attract and retain customers.

Moreover, regulatory pressures for safer and more environmentally friendly vehicles compel manufacturers to adopt predictive maintenance technologies that can monitor and ensure compliance with emissions and safety standards. This regulatory landscape, coupled with advancements in vehicle technology, continues to drive the adoption of predictive maintenance in the passenger cars segment, ensuring its dominant position in the market.

By Application Analysis

In 2022, the Oil Change segment held a dominant market position in the automotive predictive maintenance market, capturing more than a 22% share. This leadership is primarily due to the critical role oil changes play in vehicle maintenance, ensuring engine efficiency and longevity.

Predictive maintenance technologies have significantly enhanced the process of scheduling oil changes by accurately predicting the optimal timing based on real-time engine data and operating conditions rather than relying on standardized service intervals. This tailored approach helps prevent engine wear and tear, optimizing the vehicle’s performance and fuel efficiency.

The prominence of the Oil Change segment is also supported by the widespread recognition of its importance among vehicle owners and operators. Regular oil changes are a well-understood necessity, and the ability of predictive maintenance systems to forecast the precise need for an oil change resonates well with consumers seeking to maximize their vehicle’s lifespan and operational efficiency.

These systems use algorithms to analyze data such as mileage, engine temperature, and historical performance to provide timely alerts, thus preventing the engine damage that can result from depleted oil. Moreover, the adoption of predictive maintenance for oil changes is being driven by advancements in oil quality sensors and diagnostic technologies, which provide more detailed and accurate assessments of oil condition.

This allows for more precise maintenance scheduling, reducing unnecessary service visits and associated costs. As automotive technology continues to evolve, the Oil Change segment is expected to maintain its lead by offering significant cost savings and convenience, further encouraging the adoption of predictive maintenance practices in this application.

Key Market Segments

Based on Component

- Solutions

- Integrated

- Standalone

- Services

- Managed Services

- Professional Service

Based on By Technology

- IoT

- Big Data & Data Analytics

- Business Intelligence (BI)

- Cloud Computing

- 5G

Based on Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses and Coaches

Based on Application

- Oil Change

- Transmission Checkup

- Belt Change

- Brake and Tire Inspection

- Coolant Replacement

- Engine Air Filter

- Cabin Filter

- Others Application

Driver

Increasing Demand for Vehicle Efficiency and Safety

The automotive predictive maintenance market is significantly driven by the increasing emphasis on vehicle efficiency and safety. Technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) are crucial in predicting vehicle maintenance needs, thereby minimizing downtime and extending vehicle lifespan. This proactive approach not only enhances safety by preventing potential failures but also optimizes maintenance schedules, making it a pivotal strategy in modern automotive operations.

Restraint

High Costs of Implementation

A major restraint facing the automotive predictive maintenance market is the high cost associated with implementing predictive maintenance systems. These systems often require sophisticated sensors, advanced data analytics platforms, and substantial initial investment in integration and training. For many small and medium-sized enterprises, these costs can be prohibitive, limiting the widespread adoption of predictive maintenance technologies.

Opportunity

Expansion into Electric Vehicles (EVs)

The automotive predictive maintenance market has a significant opportunity in the expansion into the electric vehicles (EVs) sector. As EVs continue to gain market share, their complex electronic systems require more sophisticated maintenance techniques to ensure operational efficiency and safety. Predictive maintenance can play a crucial role in monitoring the health of EV components, such as batteries and electric motors, thus fostering greater reliability and consumer trust in this growing segment.

Challenge

Data Management and Integration

One of the primary challenges in the automotive predictive maintenance market is the management and integration of large volumes of data. Effective predictive maintenance requires the collection, processing, and analysis of massive datasets from various sensors and systems within the vehicle. Integrating this data into a cohesive system that can accurately predict maintenance needs without overwhelming existing IT infrastructure remains a complex challenge for many automotive companies.

Growth Factors

The automotive predictive maintenance market is experiencing substantial growth, primarily driven by the increasing adoption of advanced technologies such as IoT, big data analytics, and AI. These technologies enhance the effectiveness of predictive maintenance systems by enabling real-time monitoring and data analysis, which help in predicting vehicle maintenance needs accurately before failures occur.

This proactive approach is particularly beneficial in reducing downtime and maintenance costs while improving vehicle safety and longevity. The rising demand for connected vehicles and the growing emphasis on vehicle efficiency and emissions standards are further propelling market growth. This trend is supported by stringent government regulations that require regular vehicle maintenance to ensure safety and reduce environmental impact.

Emerging Trends

Emerging trends in the automotive predictive maintenance market include the integration of machine learning algorithms and the increased use of digital twins that enhance predictive capabilities. These technologies allow for more precise anomaly detection and the estimation of the remaining useful life (RUL) of vehicle components, leading to more effective maintenance strategies. There is also a notable shift towards cloud-based solutions, which offer scalability and ease of integration with existing automotive systems.

Additionally, the deployment of 5G technology is expected to revolutionize this market by enabling faster data transmission and improved connectivity, thereby facilitating more efficient real-time data processing and responsiveness in predictive maintenance systems. These advancements are making predictive maintenance solutions more accessible and effective, driving their adoption across the automotive industry.

Regional Analysis

In 2022, North America held a dominant market position in the automotive predictive maintenance market, capturing more than a 43% share with revenues amounting to USD 8.1 billion. This leading stance can be attributed to several key factors, including the high adoption rate of advanced automotive technologies and a strong presence of major automotive and technology firms.

The region’s robust automotive infrastructure supports the integration of IoT, big data analytics, and cloud computing into vehicles, facilitating the growth of predictive maintenance solutions. The leadership of North America in this market is further reinforced by stringent regulatory standards regarding vehicle emissions and safety, which drive the demand for predictive maintenance to ensure compliance and operational efficiency.

The U.S., in particular, has seen significant investments in connected vehicle technologies and telematics, which are critical components in the implementation of predictive maintenance systems. These technologies enable real-time monitoring and analysis of vehicle data, which is pivotal in predicting maintenance needs accurately and promptly.

Additionally, the cultural emphasis on vehicle maintenance and high consumer awareness regarding the benefits of predictive maintenance contribute to the market’s growth in North America. Vehicle owners in the region are keen on adopting new technologies that enhance vehicle lifespan and reduce long-term ownership costs, making predictive maintenance an attractive solution.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The automotive predictive maintenance market is shaped significantly by contributions from leading players like IBM, SAP, and SAS Institute Inc., each actively pushing the boundaries through strategic initiatives such as acquisitions, new product launches, and mergers.

IBM has been instrumental in expanding its predictive maintenance capabilities through acquisitions and innovation in AI and cloud computing. For instance, IBM’s acquisition of Red Hat has enabled more robust cloud-based analytics solutions, enhancing its ability to offer predictive maintenance insights across various industries, including automotive.

SAP continues to innovate in this sector with new product launches that integrate predictive maintenance with Internet of Things (IoT) solutions. SAP’s Intelligent Asset Management suite, for example, optimizes the performance of assets and reduces operational risks by predicting maintenance needs and scheduling timely interventions.

SAS Institute Inc. focuses on enhancing its analytics platforms that support predictive maintenance. Their recent upgrades to the SAS Viya platform demonstrate a strong commitment to providing advanced analytics that enable predictive maintenance. This platform uses AI and machine learning to process and analyze large volumes of data from vehicle sensors to predict potential failures before they occur.

Top Key Players in the Market

- IBM

- SAP

- SAS Institute Inc.

- Software AG

- TIBCO Software Inc

- Hewlett Packard Enterprise Development LP

- Altair Engineering Inc.

- Splunk Inc

- Oracle

- Amazon Web Services, Inc

- General Electric

- Schneider Electric

- Hitachi, Ltd.

- PTC

- RapidMiner Inc

- Operational Excellence (OPEX) Group Ltd

- Dingo

- CHIRON Swiss SA

Recent Developments

- Launch of Predictive Maintenance Service: In January 2024, AWS launched a new predictive maintenance service tailored for the automotive sector. This service uses machine learning models to analyze vehicle sensor data and predict potential failures, thereby enhancing maintenance scheduling and reducing unexpected breakdowns.

- Partnership with Dingo: In March 2024, SAP announced a partnership with Dingo to integrate Dingo’s predictive maintenance solutions with SAP’s asset management software. This collaboration aims to provide automotive manufacturers with advanced predictive analytics tools to improve maintenance planning and reduce downtime.

- Acquisition of Apptio Inc.: In June 2023, IBM acquired Apptio Inc. for $4.6 billion. This acquisition aims to enhance IBM’s IT automation capabilities, providing integrated financial and operational insights that can optimize technology spend across hybrid and multi-cloud environments, which includes predictive maintenance for automotive applications.

- Acquisition of StepZen Inc.: In February 2023, IBM acquired StepZen Inc., a company specializing in GraphQL servers, to enhance their capabilities in data and API management, potentially benefiting predictive maintenance solutions with more efficient data integration.

- Expansion of AI Capabilities: In May 2023, Google expanded its AI capabilities for predictive maintenance by integrating advanced machine learning algorithms into its cloud platform. This update allows automotive companies to leverage real-time data analytics for better maintenance planning and operational efficiency.

- Launch of New Predictive Analytics Tool: In September 2023, GE introduced a new predictive analytics tool for the automotive industry. This tool uses AI and IoT technologies to monitor vehicle conditions continuously and predict maintenance needs, helping to prevent costly failures and improve vehicle reliability.

Report Scope

Report Features Description Market Value (2023) USD 22 Bn Forecast Revenue (2032) USD 100 Bn CAGR (2023-2032) 18.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions and Services), By Technology (IoT, Big Data & Data Analytics, Business Intelligence (BI), Cloud Computing and 5G), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches), By Application (Oil Change, Transmission Checkup, Belt Change, Brake and Tire Inspection, Coolant Replacement, Engine Air Filter, Cabin Filter, Others Application) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, SAP, SAS Institute Inc., Software AG, TIBCO Software Inc, Hewlett Packard Enterprise Development LP, Altair Engineering Inc., Splunk Inc, Oracle, Google, Amazon Web Services, Inc, General Electric, Schneider Electric, Hitachi Ltd., PTC, RapidMiner Inc, Operational Excellence (OPEX) Group Ltd, Dingo, CHIRON Swiss SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is automotive predictive maintenance?Automotive predictive maintenance uses data analytics, machine learning, and AI technologies to predict and prevent vehicle failures before they occur. It involves monitoring the condition of various vehicle components and systems to provide maintenance recommendations.

How big is automotive predictive maintenance market?The global automotive predictive maintenance market size is expected to be worth around USD 100 Billion by 2032 from USD 22 billion in 2023, growing at a CAGR of 18.6% during the forecast period 2023 to 2032.

What are the key factors driving the growth of the Automotive Predictive Maintenance Market?Key factors include advancements in IoT and connected vehicle technologies, the increasing adoption of data analytics and AI, the growing demand for reducing vehicle downtime and maintenance costs, rising consumer expectations for enhanced vehicle reliability, and regulatory requirements for vehicle safety.

What are the current trends and advancements in the Automotive Predictive Maintenance Market?Current trends include the integration of machine learning algorithms for predictive analytics, the use of telematics and vehicle health monitoring systems, the adoption of cloud-based platforms for data storage and analysis, advancements in sensor technologies for real-time monitoring, and the growing use of digital twins for vehicle diagnostics.

What are the major challenges and opportunities in the Automotive Predictive Maintenance Market?Major challenges include data privacy and security concerns, the high cost of implementation, the complexity of integrating predictive maintenance systems with existing vehicle technologies, and the need for standardization. Opportunities lie in reducing vehicle breakdowns, extending the lifespan of vehicle components, providing personalized maintenance services, and leveraging data for new business models.

Who are the leading players in the Automotive Predictive Maintenance Market?Leading players include IBM, SAP, SAS Institute Inc., Software AG, TIBCO Software Inc, Hewlett Packard Enterprise Development LP, Altair Engineering Inc., Splunk Inc, Oracle, Google, Amazon Web Services, Inc, General Electric, Schneider Electric, Hitachi Ltd., PTC, RapidMiner Inc, Operational Excellence (OPEX) Group Ltd, Dingo, CHIRON Swiss SA. These companies are key innovators in providing predictive maintenance solutions and technologies for the automotive industry.

Automotive Predictive Maintenance MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Predictive Maintenance MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- SAP

- SAS Institute Inc.

- Software AG

- TIBCO Software Inc

- Hewlett Packard Enterprise Development LP

- Altair Engineering Inc.

- Splunk Inc

- Oracle

- Amazon Web Services, Inc

- General Electric

- Schneider Electric

- Hitachi, Ltd.

- PTC

- RapidMiner Inc

- Operational Excellence (OPEX) Group Ltd

- Dingo

- CHIRON Swiss SA