Global Automotive Lubricants Market Size, Share, Growth Analysis By Oil Type (Conventional, Synthetic, Semi-synthetic), By Product Type (Engine Oil, Gear Oil, Coolant, Transmission Fluids, Brake Fluid & Greases), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141615

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

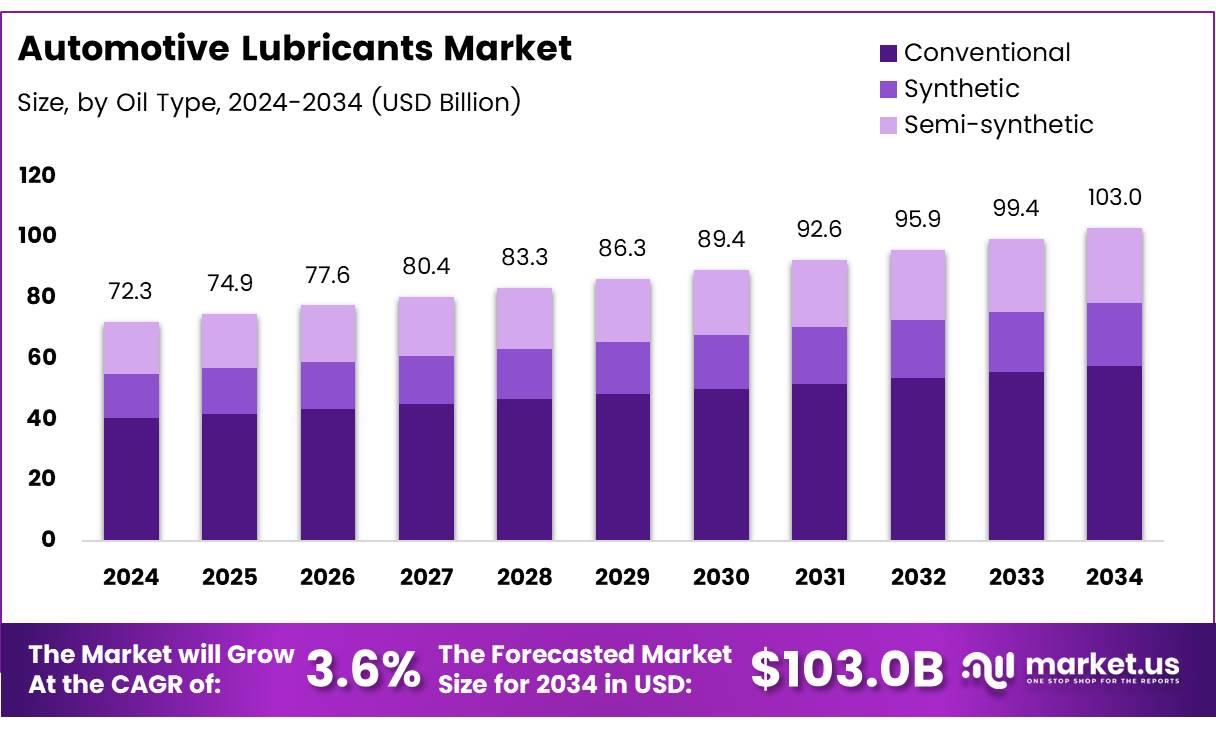

The Global Automotive Lubricants Market size is expected to be worth around USD 103.0 Billion by 2034, from USD 72.3 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

The Automotive Lubricants Market encompasses a range of products essential for the maintenance and performance of vehicles. These lubricants reduce wear and tear on moving parts, minimize friction, and dissipate heat, thus enhancing the longevity and efficiency of automotive engines and components. The scope of this market includes engine oils, transmission fluids, brake fluids, and coolants, each tailored to meet specific operational standards and vehicle requirements.

Automotive lubricants play a pivotal role in the automotive industry. As vehicles evolve with more stringent performance specifications, the demand for high-quality, durable, and efficient lubricants surges. Manufacturers are continuously innovating formulations to not only prolong engine life but also to comply with international environmental standards, which dictate lower emissions and biodegradability.

Moreover, the advent of synthetic lubricants has provided superior performance characteristics compared to traditional mineral-based oils, including improved viscosity stability, better thermal resistance, and longer service life.

The Automotive Lubricants Market is witnessing substantial growth, driven by increasing vehicle production and the rising adoption of high-performance lubricants. According to the Energy Information Administration (EIA), global liquid fuels consumption is expected to increase by 1.4 million barrels per day by 2025, indicating a robust demand trajectory for automotive lubricants.

Additionally, the market value of lubricants in the United States reached nearly $20 billion in 2021, as per Study, marking a significant increase over the past seven years. This growth is supported by sustained investments in automotive technologies and a rebound in industrial activities post-pandemic.

The sector’s growth is further catalyzed by governmental investments and regulations aimed at reducing environmental impact. Regulations mandating the use of eco-friendly lubricants are reshaping market dynamics, prompting companies to develop products that align with these new norms.

However, the production of lubricants in the United States has seen a slight decline, with net production at 149,000 barrels per day in 2023, down from the previous year, as reported by Study. This dip highlights the challenges and adjustments the industry faces in balancing production efficiency with regulatory compliance. Nonetheless, the overarching trend remains positive, with ample opportunities for market players to innovate and expand their presence in both developed and emerging markets.

Key Takeaways

- Global Automotive Lubricants Market projected to decrease from USD 103.0 Billion in 2024 to USD 72.3 Billion by 2034, at a CAGR of 3.6%.

- Conventional oil dominates the oil type segment with a 55.4% share in 2024, favored for its cost-effectiveness and reliability.

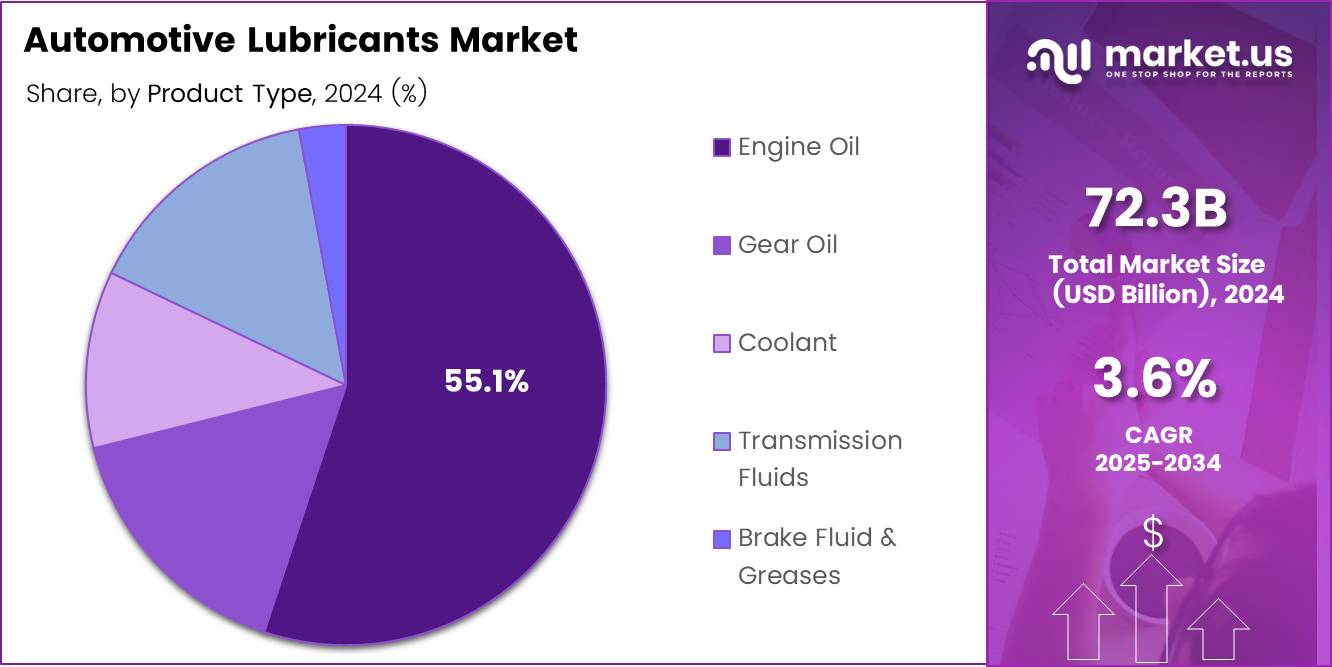

- Engine Oil leads the product type segment, holding a 55.1% share in 2024, essential for reducing vehicle wear and enhancing performance.

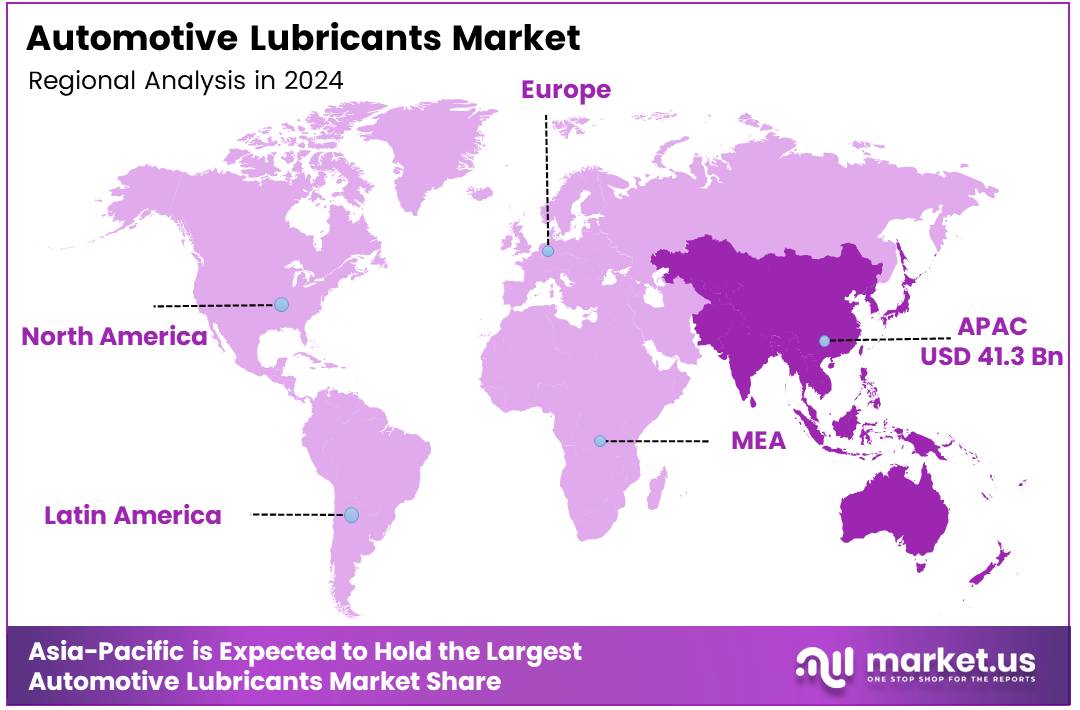

- Asia Pacific is the leading region in the market, holding a 57.6% share valued at USD 41.3 billion, driven by industrial growth and rising automotive production.

Oil Type Analysis

Conventional Oils Maintain Market Supremacy with 55.4% Share Amid Diverse Preferences

In 2024, Conventional oil continued to hold a dominant position in the By Oil Type Analysis segment of the Automotive Lubricants Market, capturing a significant 55.4% share. This prominence can be attributed to its longstanding reliability and cost-effectiveness, which appeal to a broad base of consumers, particularly in emerging markets and among owners of older vehicle models who prioritize affordability over advanced specifications.

Synthetic oils, known for their superior performance and longer service intervals, are gaining traction but still remain a premium choice. They are particularly preferred in high-performance and luxury vehicles due to their enhanced viscosity, thermal stability, and better overall protection against wear and tear, especially under extreme conditions.

Semi-synthetic oils serve as a middle ground between conventional and synthetic oils, offering a balance of improved performance at a more accessible price point compared to full synthetics.

This category is increasingly popular among consumers who seek to upgrade from conventional oil without fully committing to the cost of synthetic oils, providing an effective compromise that supports moderate driving conditions and engine requirements. Each type of oil caters to distinct consumer needs, reflecting diverse priorities and budget considerations within the automotive lubricants market.

Product Type Analysis

Engine Oil Continues to Lead with a 55.1% Share Owing to Robust Demand in Automotive Sectors

In 2024, Engine Oil maintained a commanding presence in the By Product Type Analysis segment of the Automotive Lubricants Market, capturing a 55.1% share. This substantial market share underscores the critical role of engine oil in vehicle maintenance and performance enhancement across various automotive sectors.

Engine oils are essential for reducing wear and tear on moving parts, preventing corrosion, and ensuring efficient operation under extreme conditions, which significantly contributes to their dominant market position.

Other product segments such as Gear Oil, Coolant, Transmission Fluids, and Brake Fluid & Greases also hold significant positions but trail behind the predominance of Engine Oil. Gear Oil, crucial for protecting vehicle transmissions under high pressure and temperature, follows as a vital segment. Meanwhile, Coolants play an indispensable role in heat regulation within engine systems, essential for maintaining an optimal operating temperature and preventing overheating.

Transmission Fluids and Brake Fluid & Greases contribute to the safety and functionality of vehicles, focusing on smooth transmission operations and reliable braking systems, respectively. Each segment reflects specialized applications and ongoing advancements in automotive lubricant formulations, addressing diverse operational demands within the automotive industry.

Key Market Segments

By Oil Type

- Conventional

- Synthetic

- Semi-synthetic

By Product Type

- Engine Oil

- Gear Oil

- Coolant

- Transmission Fluids

- Brake Fluid & Greases

Drivers

Rising Vehicle Production Spurs Growth in the Automotive Lubricants Market

The automotive lubricants market is witnessing robust growth, primarily driven by an upsurge in global vehicle production. As more vehicles roll off the production lines, the demand for high-quality lubricants escalates, necessary for ensuring the smooth operation and longevity of engine components.

Additionally, stringent environmental regulations are pushing manufacturers to develop lubricants that contribute to lower emissions and enhanced fuel efficiency. These regulations are not just shaping production standards but also fostering innovations in lubricant technology, leading to advanced formulations that offer better performance and longer service intervals.

Furthermore, there is a noticeable rise in consumer awareness regarding the critical role of premium lubricants in vehicle maintenance, which is steering customers towards more reliable and efficient products. Together, these drivers are sculpting the trajectory of the automotive lubricants market, steering it towards sustained growth and technological evolution.

Restraints

Electric Vehicles Diminish Demand for Traditional Automotive Lubricants

As an analyst observing the automotive lubricants market, it’s important to highlight several key restraints impacting its growth. Primarily, the surge in electric vehicle (EV) adoption is notably reducing the demand for traditional automotive lubricants.

Electric vehicles require significantly fewer lubricants compared to internal combustion engine vehicles, which traditionally drive lubricant sales. This shift is reshaping market dynamics and could potentially decrease long-term demand in this sector. Additionally, the market faces challenges from fluctuations in raw material prices.

The volatility of crude oil prices, a principal component of many lubricants, affects not only pricing but also the availability of these essential products. This volatility can lead to unpredictable costs for lubricant manufacturers, impacting their ability to plan and budget effectively.

Together, these factors pose significant restraints on the growth of the automotive lubricants market, urging companies to innovate and adapt to a rapidly changing automotive landscape.

Growth Factors

Growing Demand for Bio-based Lubricants Fuels Market Expansion

The automotive lubricants market is witnessing significant growth driven by several emerging opportunities. A notable trend is the increasing demand for bio-based lubricants, which are gaining traction due to the rising emphasis on environmental sustainability.

As consumers and regulatory bodies demand more eco-friendly solutions, manufacturers are investing in developing lubricants derived from renewable resources, offering both performance benefits and reduced environmental impact.

In addition to sustainability, high-performance lubricants are gaining popularity for their ability to provide superior protection, enhance engine efficiency, and extend oil life. This has created opportunities for manufacturers to innovate and produce lubricants that cater to the growing need for longevity and reliability in modern automotive engines.

Furthermore, expanding automotive markets in developing countries are presenting new avenues for growth, as the demand for vehicles and associated products like lubricants increases.

As automotive sales surge in these regions, there is a strong opportunity to capture market share. Additionally, strategic partnerships with Original Equipment Manufacturers (OEMs) are becoming increasingly vital.

By collaborating with OEMs, lubricant producers can develop tailored products designed for specific vehicles or engines, thus strengthening their market position and addressing the unique needs of various automotive segments.

Collectively, these factors highlight a promising outlook for the automotive lubricants market, with ample opportunities for innovation, market penetration, and sustainable development.

Emerging Trends

Synthetic Lubricants Gain Popularity in the Automotive Industry

In the automotive lubricants market, a significant trend is the shift towards synthetic lubricants, as they are increasingly favored over traditional mineral oil-based products. This preference is driven by synthetic lubricants’ superior performance attributes, including enhanced engine protection, longer oil life, and better fuel efficiency.

Additionally, the market is witnessing a rise in Lubrication as a Service (LaaS), where companies offer comprehensive lubrication management and monitoring solutions, aimed at reducing operational costs and improving machinery lifespan. Manufacturers are also focusing on customized lubricant solutions, designed to meet the specific needs of different market segments or customer requirements.

Furthermore, advancements in additive technology are pivotal, as they significantly enhance the performance of lubricants by improving their viscosity, reducing wear, and increasing thermal stability. These factors collectively propel the automotive lubricants market forward, catering to the evolving demands of modern automotive engines and industrial applications.

Regional Analysis

Asia Pacific Dominates the Automotive Lubricants Market with a 57.6% Share Worth USD 41.3 Billion

The Asia Pacific region stands as the dominating sector in the automotive lubricants market, commanding a 57.6% share with a valuation of approximately USD 41.3 billion. This preeminence is driven by robust industrial growth, increasing automotive production, and significant investments in automotive technologies in key countries such as China, India, and Japan. Rising disposable incomes and heightened consumer awareness about vehicle maintenance further fuel demand in this region.

Regional Mentions:

In North America, the market is propelled by stringent environmental regulations that mandate the use of advanced lubricant technologies. The region is increasingly turning towards bio-based and synthetic lubricants to improve engine efficiency and reduce environmental impact. Similarly, Europe’s market prioritizes sustainability, with a growing emphasis on lubricants that support the functionality of electric vehicles and modern engine designs to align with stringent emissions norms.

The Middle East & Africa region, although growing at a slower pace, is witnessing an expansion in the automotive sector influenced by urbanization and economic diversification efforts. These changes are gradually increasing the demand for automotive lubricants tailored to the region’s unique requirements.

Latin America, meanwhile, experiences growth driven by the recovery of the automotive manufacturing sector and an increase in commercial vehicle usage, spurred by economic recovery post-pandemic. Although smaller in market share compared to other regions, Latin America shows potential for significant market penetration and development in the coming years.

Overall, while the Asia Pacific leads the market significantly, each region presents unique opportunities and challenges that stakeholders must navigate to optimize their market strategies and capitalize on emerging trends in the automotive lubricants industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global automotive lubricants market is poised to witness significant growth in 2024, driven by advancements in automotive technologies and increasing emphasis on sustainability. Among the key players, Exxon Mobil, Shell, and Castrol are projected to maintain their leadership through strategic expansions and innovations.

Exxon Mobil continues to dominate, leveraging its extensive R&D capabilities to develop high-performance lubricants that enhance engine efficiency and reduce emissions. The company’s commitment to environmental sustainability is evident in its shift towards synthetic lubricants, which offer longer life cycles and reduced environmental impact.

Shell, with its robust global distribution network, is well-positioned to capitalize on emerging markets. The introduction of Shell’s advanced synthetic products tailored for electric vehicles (EVs) positions it as a forward-thinking leader adapting to the shift in automotive technologies.

Castrol, known for its strong brand reputation and technological leadership, is focusing on partnerships with automotive manufacturers to co-develop specialized lubricants. This strategy not only enhances Castrol’s product offerings but also strengthens its market presence by aligning with the industry’s move towards more efficient and environmentally friendly vehicles.

Furthermore, players like LUKOIL and Fuchs are expected to expand their market share by emphasizing innovations in biodegradable and low-viscosity lubricants, catering to the growing demand for sustainable automotive solutions.

Top Key Players in the Market

- Exxon Mobil

- LUKOIL

- Sasol

- Indian Oil Corporation Ltd

- Castrol

- HP Lubricants

- Fuchs

- Shell

- Repsol

- Cepsa

Recent Developments

- In May 2024, Klüber Lubrication announced an investment of Rs 142 crore in India, aiming to fuel growth and expand its market presence in the region. This strategic move is expected to enhance their manufacturing capabilities and improve supply chain efficiency.

- In July 2024, AMSOIL INC. acquired Aerospace Lubricants, aligning with its strategic goals for expansion into new markets and sectors. This acquisition is poised to strengthen AMSOIL’s product offerings in the aerospace industry and drive growth.

- In February 2024, Saneg declared the acquisition of the oil and lubricants producer, CGC Lubricants Italy. This acquisition is part of Saneg’s strategy to diversify its product portfolio and enhance its operational footprint in the European market.

- In June 2024, TotalEnergies announced its acquisition of Tecoil, a strategic move to bolster its lubricants division and expand its market share. This acquisition supports TotalEnergies’ growth strategy and enhances its competitive edge in the global lubricants market.

Report Scope

Report Features Description Market Value (2024) USD 72.3 Billion Forecast Revenue (2034) USD 103.0 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Oil Type (Conventional, Synthetic, Semi-synthetic), By Product Type (Engine Oil, Gear Oil, Coolant, Transmission Fluids, Brake Fluid & Greases) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Exxon Mobil, LUKOIL, Sasol, Indian Oil Corporation Ltd, Castrol, HP Lubricants, Philipps 66, Fuchs, Shell, Repsol, Cepsa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Lubricants MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Lubricants MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Exxon Mobil

- LUKOIL

- Sasol

- Indian Oil Corporation Ltd

- Castrol

- HP Lubricants

- Philipps 66

- Fuchs

- Shell

- Repsol

- Cepsa