Global Co-living Market Size, Share, Growth Analysis By Room Type (Single Occupancy, Double Occupancy, Triple Occupancy, Studio Apartments), By End User (Students, Working Professionals, Digital Nomads, Senior Citizens), By Duration of Stay (Short-term (Less than 6 Months), Medium-term (6–12 Months), Long-term (More than 12 Months)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144845

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

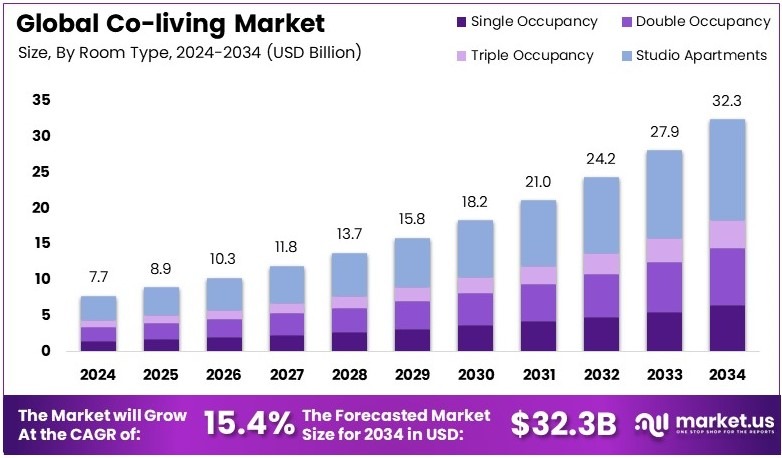

The Global Co-living Market size is expected to be worth around USD 32.3 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034.

Co-living is a modern housing concept where individuals share living spaces while having private rooms. It fosters community living among like-minded people. Co-living spaces often include shared kitchens, lounges, and work areas. It appeals to young professionals, digital nomads, and students. The concept promotes affordability and social interaction.

The co-living market includes companies offering shared housing solutions. It targets urban residents seeking flexible living arrangements. The market is growing due to rising rental costs and the desire for community living. Companies manage co-living spaces, offering amenities like Wi-Fi and housekeeping. Demand is strong in major cities and student hubs.

Co-living is gaining popularity as an affordable urban housing solution. Young professionals and students favor it for flexibility and community living. Rising urban populations and high housing costs drive demand. Additionally, changing lifestyles boost interest in shared living spaces.

The co-living market is dynamic and competitive. Major players include Habyt and Common, which merged in January 2023. This merger created a global entity managing over 30,000 units in 40 cities across 14 countries. In Europe, NREP, in partnership with Artisa Group, plans to develop 5,000 units in Germany by 2050. Similarly, Cohabs is expanding to 11 cities by 2026. As a result, established brands are consolidating to strengthen their presence.

Urban growth is a major factor. Currently, over 4.4 billion people live in cities. By 2050, this number could double, with nearly 70% of the global population being urban dwellers. This trend creates a huge demand for affordable and flexible housing. Therefore, co-living meets the needs of urban professionals who prioritize community and cost-efficiency. Moreover, it attracts investors seeking long-term returns in the residential sector.

On the other hand, market saturation remains low, especially outside major cities. Established operators focus on expanding to new locations. For instance, Cohabs is tapping into smaller cities to reach diverse demographics. Moreover, local regulations and zoning laws influence expansion strategies. In contrast, larger cities already host multiple co-living projects, increasing competition.

In local contexts, co-living helps address housing shortages. For example, in cities like Berlin and Essen, developers are actively building new units. Furthermore, these spaces support social interaction among young professionals. On a broader scale, co-living promotes urban density, reducing the need for sprawling housing developments. As such, it aligns with sustainable urban planning initiatives.

Key Takeaways

- The Co-living Market was valued at USD 7.7 billion in 2024 and is expected to reach USD 32.3 billion by 2034, with a CAGR of 15.4%.

- In 2024, Studio Apartments dominate the room type segment with 43.7%, appealing to solo tenants seeking privacy.

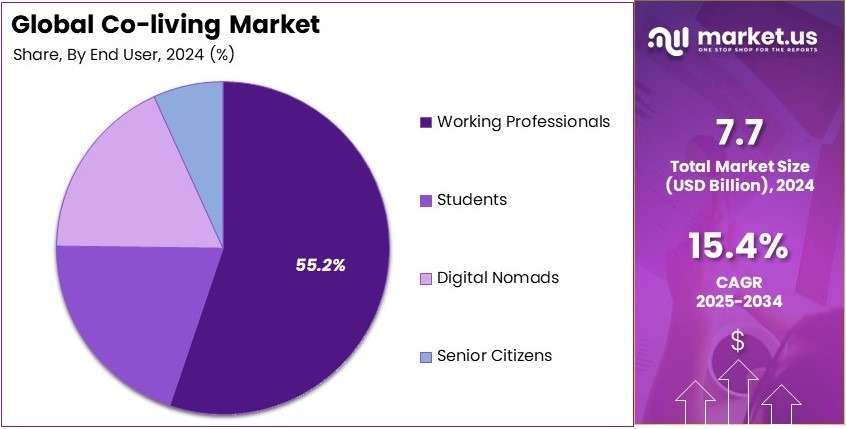

- In 2024, Working Professionals hold the highest end-user share at 55.2%, driven by affordability and networking opportunities.

- In 2024, Long-term (More than 12 Months) leads with 49.6%, as tenants prefer stability in housing.

- In 2024, Offline Retail dominates with 67.4%, benefiting from direct interactions and property visits.

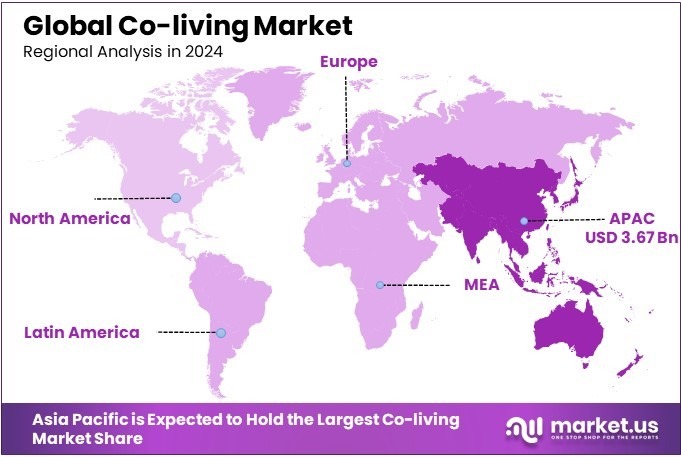

- In 2024, Asia Pacific leads with 47.6% and is valued at USD 3.67 billion, fueled by rapid urbanization and shared housing demand.

Business Environment Analysis

The Co-living Market is experiencing significant growth, driven by urbanization and the increasing popularity of shared living arrangements among millennials and young professionals. Consequently, this market segment caters to those seeking affordable, flexible housing solutions in major cities where rent and living costs can be prohibitively high.

Furthermore, the target demographic primarily includes young adults and remote workers who value community and connectivity over traditional housing. This shift has prompted co-living spaces to focus on creating environments that promote social interaction and professional networking, integrating communal areas and shared amenities like kitchens, lounges, and co-working spaces.

Moreover, differentiation in the co-living market is often achieved through unique offerings such as themed residences or properties that focus on sustainability and wellness. For example, some co-living spaces offer yoga studios, organic food options, and eco-friendly living conditions, which appeal to environmentally conscious consumers.

Additionally, there are substantial investment opportunities within this sector, especially in developing smart co-living spaces that leverage technology for security, energy management, and seamless resident services. These advancements can significantly enhance the appeal and functionality of co-living arrangements.

However, the regulatory landscape for co-living is complex and varies by region, affecting everything from zoning laws to tenant rights. Operators must navigate these regulations carefully to avoid legal challenges and ensure smooth operations.

Lastly, adjacent markets, such as short-term rental and boutique hostels, also impact the co-living space. These alternatives often cater to the same demographic but offer different levels of commitment and privacy. By understanding these dynamics, co-living operators can position their offerings to maximize appeal and capture a broader market share.

Room Type Analysis

Studio Apartments dominate with 43.7% due to their privacy and self-contained facilities.

In the Co-living Market, Studio Apartments emerge as the dominant sub-segment, holding a 43.7% market share. This preference stems from the desire for privacy and the convenience of having self-contained facilities, which are particularly appealing to individuals seeking a blend of community living and personal space. Studio apartments in co-living setups often come equipped with a kitchenette, private bathroom, and sometimes a small living area, offering a complete living solution that attracts long-term residents.

Single Occupancy rooms, while offering privacy, typically do not provide the same level of self-sufficiency as studio apartments but are crucial for individuals who prefer living alone without the need for extensive personal facilities.

Double Occupancy rooms are essential for cost-sharing without compromising too much on personal space. They cater to pairs, whether friends or couples, who are looking to economize while maintaining a degree of privacy.

Triple Occupancy rooms contribute to the market by offering the most economical option for residents willing to share space with others. These are often preferred by students and young professionals looking to minimize living expenses.

End User Analysis

Working Professionals dominate with 55.2% due to their steady income and preference for hassle-free living arrangements.

Working Professionals constitute the largest end-user segment in the Co-living Market, with a significant 55.2% share. This group’s dominance is driven by their steady income and the growing preference among this demographic for hassle-free living arrangements that co-living spaces provide.

These environments offer flexible, community-oriented living solutions that align with the dynamic lifestyles of working professionals, including amenities like Wi-Fi, cleaning services, and often utilities, which are included in the rent.

Students, though not the dominant segment, are a critical target audience as they seek affordable housing options close to universities and colleges. Co-living spaces cater to their needs by providing flexible lease terms and a community of peers which helps in their academic and social pursuits.

Digital Nomads value co-living for the flexibility and networking opportunities it provides. This segment thrives in environments where they can connect with like-minded individuals while also having the freedom to move as their work dictates.

Senior Citizens are increasingly becoming part of the co-living community, attracted by the aspect of community and shared activities that enhance their social lives and provide a sense of belonging.

Duration of Stay Analysis

Long-term (More than 12 Months) dominates with 49.6% due to the stability and community engagement it offers.

The Long-term stay option leads the Duration of Stay segment in the Co-living Market, accounting for 49.6% of this category. This dominance is attributed to the stability and extended community engagement that long-term stays offer, which are highly valued by residents who wish to settle into a stable living environment without the hassle of frequent moves. Long-term residents tend to form deeper connections within the community, contributing to a vibrant communal life that enhances the co-living experience.

Short-term stays (Less than 6 Months) provide flexibility for those who are in transitional phases of their lives, such as relocating for temporary work assignments or exploring a new city.

Medium-term stays (6–12 Months) bridge the gap between short and long-term needs, offering a balance of stability and flexibility that appeals to residents not ready to commit to a full year while still desiring a semi-permanent base.

Key Market Segments

By Room Type

- Single Occupancy

- Double Occupancy

- Triple Occupancy

- Studio Apartments

By End User

- Students

- Working Professionals

- Digital Nomads

- Senior Citizens

By Duration of Stay

- Short-term (Less than 6 Months)

- Medium-term (6–12 Months)

- Long-term (More than 12 Months)

Driving Factors

Urban Housing Challenges and Lifestyle Shifts Drive Market Growth

The co-living market is experiencing robust growth, primarily driven by increasing housing affordability challenges in major urban centers. As rent prices continue to surge in cities, more people are opting for shared living spaces to reduce expenses. Co-living offers an economical solution by splitting rent and utilities among residents, making it an attractive option for young professionals and students.

Additionally, the growing popularity of remote work and the digital nomad lifestyle has fueled demand for flexible housing solutions. As more people work remotely, they seek living arrangements that offer convenience and community without long-term commitments. Co-living spaces cater to this lifestyle by providing furnished, managed accommodations with communal areas for socializing and networking.

Moreover, the expansion of co-living spaces offering fully furnished and community-centric environments is drawing attention. These spaces come with amenities like gyms, lounges, and coworking areas, creating a holistic living experience. This appeal to social connectivity attracts those seeking a sense of belonging in urban environments.

Rising investments in co-living startups and real estate tech further bolster the market. Innovations like smart housing solutions enhance the appeal, as tenants enjoy modern living with features like automated lighting and app-based management. These factors collectively make co-living a promising alternative to traditional housing, blending affordability with community engagement.

Restraining Factors

Competition and Regulatory Challenges Restraints Market Growth

The co-living market faces several challenges that restrain its growth. One major issue is the high competition from traditional rental markets and other shared housing options. While co-living offers unique advantages, some potential residents still prefer conventional apartments or shared houses that offer more privacy. This competitive landscape makes it essential for co-living operators to offer distinct benefits to stand out.

Moreover, regulatory and zoning challenges can significantly limit the development of co-living spaces in certain cities. Urban planning policies often favor traditional housing models, making it difficult to obtain permits for co-living projects. This restriction limits the expansion of co-living communities, especially in densely populated areas.

Privacy concerns also pose a challenge. Sharing living spaces with strangers can lead to social compatibility issues, which may deter some individuals from choosing co-living arrangements. Addressing these concerns requires thoughtful design and community management strategies to foster positive interactions.

Economic uncertainty further impacts the co-living sector. Fluctuations in the job market and economic downturns can lead to decreased occupancy rates and lower rental yields. Operators must adapt to these economic shifts by offering flexible contracts or diversified services to maintain stability. These factors present hurdles that co-living providers must navigate to ensure sustainable growth.

Growth Opportunities

Smart and Themed Co-Living Spaces Provide Opportunities

Innovations in smart living and themed communities present substantial opportunities for the co-living market. The development of smart and AI-enabled co-living spaces allows for enhanced energy efficiency and personalized experiences. Automated climate control, lighting adjustments, and voice-activated systems appeal to tech-savvy tenants who value convenience.

Moreover, there is a growing demand for senior and retiree-focused co-living communities. These spaces not only offer affordable living but also provide healthcare support and social activities tailored to older residents. As the aging population increases, co-living concepts that blend care and community are becoming more relevant.

Themed co-living spaces focused on wellness, entrepreneurship, or the arts are also emerging as niche markets. For instance, wellness-themed spaces may include yoga studios and meditation rooms, attracting health-conscious individuals. Similarly, entrepreneurship-focused co-living can offer coworking areas and networking events, appealing to freelancers and startup founders.

Another promising opportunity lies in subscription-based co-living memberships. These programs allow residents to access multiple co-living locations worldwide, appealing to digital nomads and business travelers. By offering flexibility and global mobility, these memberships cater to modern, transient lifestyles, making co-living more adaptable to contemporary needs.

Emerging Trends

Sustainable and Hybrid Living Models Are Latest Trending Factor

Sustainability is becoming a key trend in the co-living market. Many residents now prefer eco-friendly and green co-living spaces that feature energy-efficient designs and sustainable building materials. From solar panels to water-saving fixtures, these spaces attract environmentally conscious individuals who value reducing their carbon footprint. This trend reflects a broader shift towards sustainable urban living.

Another notable trend is the rise of luxury and boutique co-living spaces. These upscale options offer high-end amenities like private gyms, rooftop lounges, and gourmet kitchens. Targeting professionals and affluent individuals, luxury co-living provides a blend of community engagement and premium living standards. This segment of the market caters to those willing to pay more for comfort and exclusivity.

Blockchain and smart contracts are also gaining traction in managing rental agreements and payments. By using blockchain technology, co-living operators can simplify lease processes and ensure transparency. This integration of digital contracts reduces administrative overhead and builds trust among tenants.

Lastly, hybrid co-living and co-working spaces are increasingly popular among freelancers and entrepreneurs. Combining residential and professional spaces, these environments support work-life integration. Tenants can work from shared office areas while enjoying communal living. This model suits those who value both productivity and social interaction, reflecting modern urban living preferences.

Regional Analysis

Asia Pacific Dominates with 47.6% Market Share in the Co-living Market

Asia Pacific leads the Co-living Market with a substantial 47.6% market share and valuation of USD 3.67 Bn. This significant dominance is fueled by the region’s rapid urbanization, the cultural acceptance of shared living, and the increasing mobility of young professionals.

Key factors contributing to this high market share include high population density in urban areas, rising property prices which make co-living a more affordable option, and a young demographic that values community and shared experiences. The region’s tech-savvy population also appreciates the digital conveniences offered by modern co-living spaces, such as app-based services for room booking and community engagement.

The future of the Co-living Market in Asia Pacific looks promising. As urbanization continues and young professionals seek flexible and community-centric living arrangements, the demand for co-living spaces is expected to grow. Innovations in service and facility offerings tailored to local preferences will likely enhance the appeal of co-living, potentially increasing the region’s market share further.

Regional Mentions:

- North America: North America is experiencing steady growth in the Co-living Market, driven by urban millennials and tech workers seeking community living environments. The trend is particularly strong in tech hubs like San Francisco and New York, where high housing costs push young professionals towards alternative living arrangements.

- Europe: Europe’s Co-living Market is expanding, influenced by increasing mobility among young professionals and students. Major cities like Berlin and London are seeing a rise in co-living spaces, which are becoming popular due to their flexibility and emphasis on community.

- Middle East & Africa: The Middle East and Africa are slowly embracing the co-living trend, with developments primarily in major business hubs like Dubai. The region’s market growth is driven by the expatriate community and young professionals looking for networking and communal living opportunities.

- Latin America: Latin America shows potential in the Co-living Market as urban populations grow and cultural shifts occur. Young professionals in cities like São Paulo and Mexico City are gradually adopting co-living, drawn by affordability and the opportunity to live in supportive community settings.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The co-living market is driven by companies that focus on flexible living solutions, community engagement, and modern amenities. The top four companies in this market are WeLive (WeWork), The Collective, Common Living, Inc., and Quarters Co-living. These key players dominate through innovative housing concepts and customer-centric services.

The Collective focuses on creating vibrant, community-oriented spaces. Its co-living properties feature shared lounges, rooftop gardens, and social events. The brand targets millennials and young urban dwellers seeking affordable housing with a community vibe. The Collective’s large-scale projects cater to long-term stays, making them unique in the co-living sector.

Common Living, Inc. is known for offering cost-effective co-living spaces with a focus on community and convenience. Its properties are designed to reduce the hassles of urban living, providing cleaning services, utilities, and Wi-Fi included in one monthly fee. The company’s strategic locations in major cities attract young professionals looking for practical yet social housing.

Quarters Co-living emphasizes flexibility and modern living. Its apartments come fully furnished with shared spaces designed for social interaction. Quarters also offers a digital app for managing bookings and community events, making the experience tech-friendly. The brand’s focus on community integration attracts residents who value networking and socializing.

These companies lead the co-living market by blending convenience, affordability, and community. Their ability to offer flexible leases and modern amenities appeals to urban professionals and digital nomads. Their focus on community living and shared experiences keeps them at the forefront of the co-living industry.

Major Companies in the Market

- The Collective

- Common Living, Inc.

- Quarters Co-living

- Ollie

- Zolo Stays

- Hmlet

- Cohabs

- CasaOne

- Habyt

Recent Developments

- Safestay PLC: On January 2025, Safestay PLC, a London-based hostel operator, plans to expand its European portfolio from 20 to over 50 hostels within the next three years. The company reported record revenues in 2024, with a 2.2% increase to £23 million.

- Habyt and Common: On January 2023, co-living companies Habyt and Common merged to create a significant global presence in the co-living sector. Both companies experienced three-fold growth in 2022 and projected to double their businesses in 2023.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Billion Forecast Revenue (2034) USD 32.3 Billion CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Room Type (Single Occupancy, Double Occupancy, Triple Occupancy, Studio Apartments), By End User (Students, Working Professionals, Digital Nomads, Senior Citizens), By Duration of Stay (Short-term (Less than 6 Months), Medium-term (6–12 Months), Long-term (More than 12 Months)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Collective, Common Living, Inc., Quarters Co-living, Ollie, Zolo Stays, Hmlet, Cohabs, CasaOne, Habyt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- WeLive (WeWork)

- The Collective

- Common Living, Inc.

- Quarters Co-living

- Ollie

- Zolo Stays

- Hmlet

- Cohabs

- CasaOne

- Habyt