Global Automotive Fuel Tank Market Size, Share, Growth Analysis By Capacity (45-70L, Below 45L, Above 70L), By Material (Plastic, Aluminium, Steel), By Vehicle Type (Passenger Cars, Two-wheelers, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)), By Sales Channel (OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152355

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

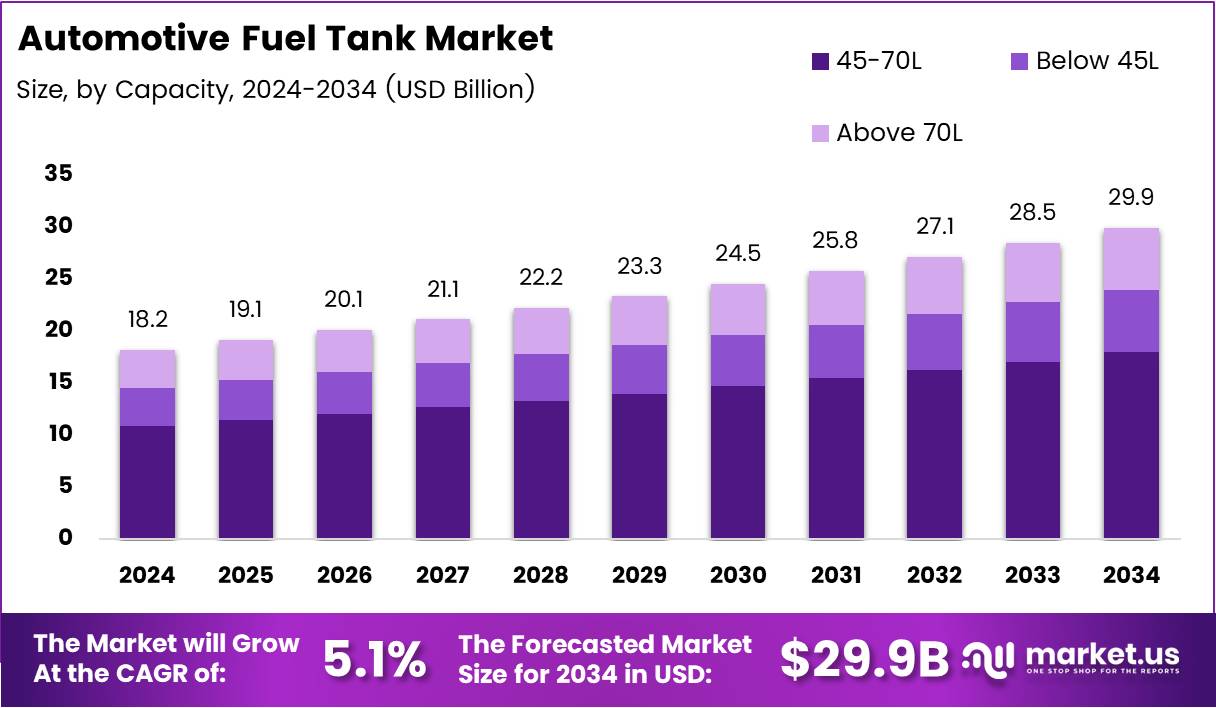

The Global Automotive Fuel Tank Market size is expected to be worth around USD 29.9 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The automotive fuel tank market plays a critical role in the automotive industry, offering essential components that store fuel for internal combustion engines in vehicles. As the demand for efficient fuel storage systems increases globally, manufacturers continue to focus on improving tank design, safety features, and capacity. This market encompasses a wide range of fuel tank types, including plastic, metal, and composite tanks, each offering unique benefits in terms of durability and performance.

The average fuel tank capacity in vehicles typically ranges between 10.5 and 18.5 gallons, according to Smith Chevrolet Turlock. This range depends on the type of vehicle and its design specifications. Smaller passenger cars generally have tanks on the lower end of the spectrum, while trucks and larger vehicles typically feature higher capacities. This variation allows the market to cater to diverse vehicle types, from compact sedans to heavy-duty commercial vehicles.

According to Hedges & Company (2023), there are approximately 1.47 billion passenger cars in operation globally. This number grows even further when light commercial vehicles are included, pushing the total to 1.5 billion vehicles. This growing number of vehicles directly correlates with a higher demand for automotive fuel tanks, creating ample opportunities for growth in the market. As more vehicles hit the roads, the need for replacement fuel tanks and new manufacturing for the latest models intensifies.

The market is expected to grow due to several factors, including increased vehicle production, stringent safety regulations, and the growing focus on reducing carbon emissions. Technological advancements are also a significant driving force, as manufacturers are investing in lighter and more durable materials for fuel tanks, aiming to improve fuel efficiency and reduce the environmental impact of vehicles. Moreover, fuel tank manufacturers are aligning with regulations that require safer designs to minimize the risk of fuel leaks and explosions in the event of a crash.

As global fuel consumption patterns evolve, particularly with shifts toward electric and hybrid vehicles, the automotive fuel tank market faces a dynamic shift. However, internal combustion engines are projected to remain dominant for the foreseeable future, driving continued demand for fuel tanks.

In response, manufacturers are expected to adapt their product offerings to support both traditional combustion engine vehicles and the emerging alternative fuel vehicle market, ensuring they stay competitive as the automotive landscape evolves.

Key Takeaways

- The Global Automotive Fuel Tank Market is expected to reach USD 29.9 Billion by 2034, growing at a CAGR of 5.1% from 2025 to 2034.

- The 45-70L capacity segment leads the market with a share of 55.7% in 2024, driven by demand for mid-sized vehicles.

- Plastic fuel tanks dominate the market due to their lightweight, corrosion-resistant properties, and cost-effectiveness.

- Passenger cars continue to hold the largest share of the market, reflecting increasing consumer demand for personal transportation.

- OEMs account for the largest portion of the market share in the sales channel segment, primarily due to direct supply during vehicle assembly.

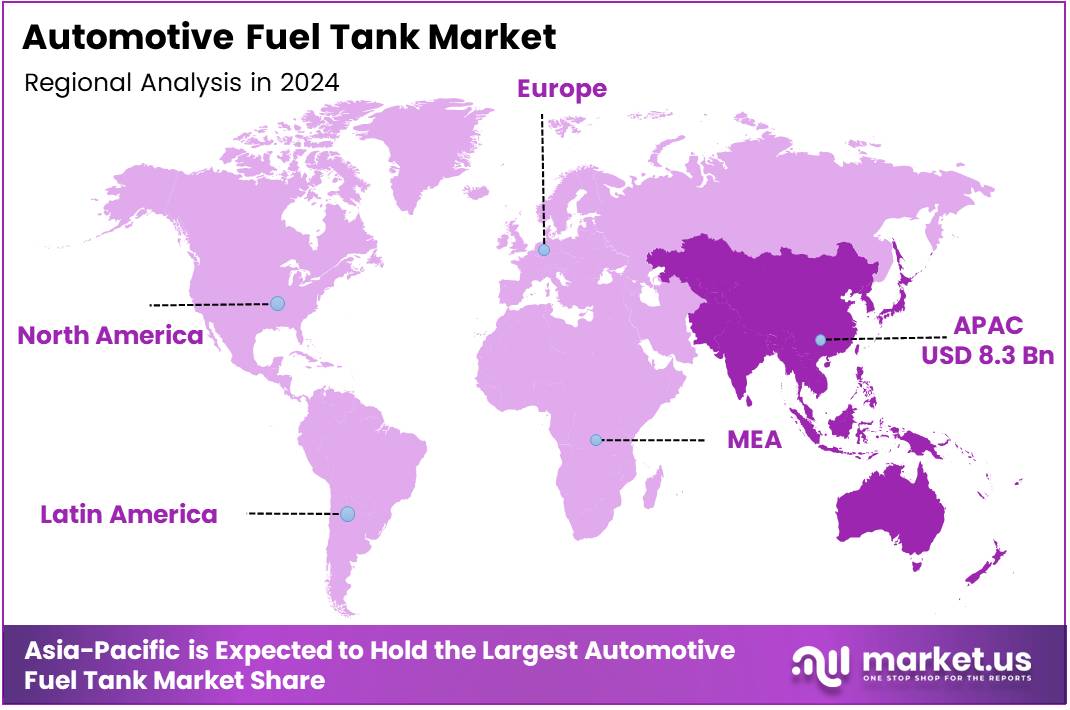

- The Asia Pacific region dominates the market with a share of 45.8%, valued at USD 8.3 Billion, driven by high production rates in China, Japan, and India.

Capacity Analysis

45-70L Range Fuel Tanks Lead with a 55.7% Share in 2024

The 45-70L capacity segment continues to lead in 2024, holding a significant share of 55.7% in the automotive fuel tank market. This dominance can be attributed to the growing demand for mid-sized vehicles, where fuel tank capacities of this range are optimal for consumer needs. Mid-range tanks balance fuel efficiency with range, catering to a wide array of passenger cars, especially in regions with moderate distances between refueling stations.

The Below 45L segment follows, often found in smaller, more compact vehicles designed for urban commuting. These smaller tanks are ideal for fuel-efficient vehicles, but the overall market share is lower compared to the 45-70L segment.

The Above 70L segment, while important, holds a comparatively smaller share due to the focus on larger vehicles like trucks and SUVs. These large-capacity fuel tanks are typically used in heavy-duty and commercial vehicles, where extended driving ranges are required.

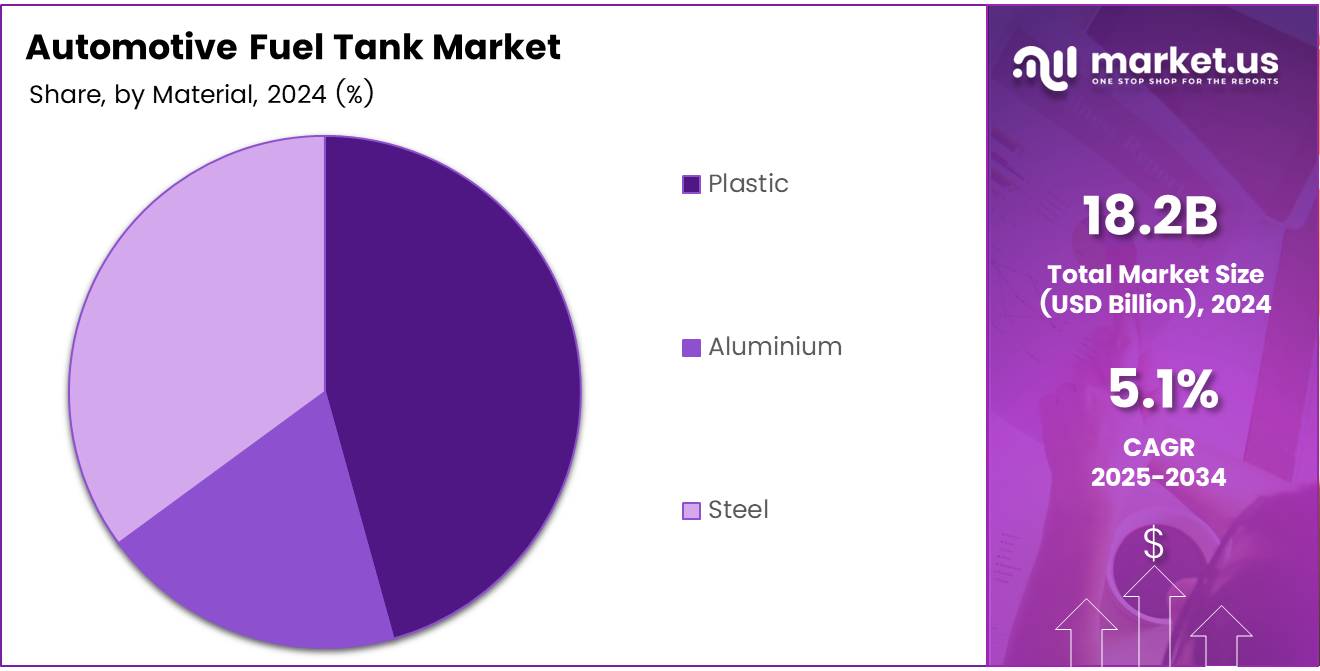

Material Analysis

Plastic Dominates Fuel Tank Materials with Unmatched Popularity in 2024

Plastic fuel tanks continue to dominate in 2024, capturing a large portion of the market share due to their lightweight, corrosion-resistant properties and cost-effectiveness. Plastic is widely used in the automotive industry for fuel tanks, offering advantages in terms of production scalability and design flexibility.

The Aluminium segment follows, offering increased strength and resistance to impact. However, aluminium tanks are typically more expensive to produce, leading to a smaller share in comparison to plastic.

The Steel segment, while durable, is less popular due to its susceptibility to corrosion and heavier weight. Steel tanks are commonly found in older vehicle models or in specific commercial applications, but plastic continues to dominate the overall material landscape in the automotive fuel tank market.

Vehicle Type Analysis

Passenger Cars Remain the Largest Contributor in the Fuel Tank Market in 2024

Passenger cars remain the leading vehicle type in the automotive fuel tank market, holding a substantial market share. The large demand for passenger vehicles, driven by increasing consumer mobility and personal transportation needs, continues to drive the market for fuel tanks of various capacities and materials.

The Two-wheelers segment holds a smaller portion of the market, as motorcycles and scooters typically have smaller fuel tanks. However, this segment is growing, particularly in regions where two-wheelers are a primary mode of transport.

The Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) segments, while crucial for business and logistics, have a more specialized demand for fuel tanks with higher capacities. These segments are important but contribute less to the overall market compared to passenger cars.

Sales Channel Analysis

OEMs Maintain Stronghold in Fuel Tank Sales Channels in 2024

OEMs (Original Equipment Manufacturers) continue to dominate the sales channel segment, accounting for a significant portion of the market share. This dominance is largely driven by the direct supply of fuel tanks to automobile manufacturers for integration during vehicle assembly. OEMs are the primary source for new vehicles, contributing heavily to the demand for automotive fuel tanks.

The Aftermarket segment, while important for replacement and customization, holds a smaller share compared to OEMs. This segment sees demand for fuel tanks driven by vehicle maintenance, repairs, and upgrades, but it does not match the volume of new vehicle production from OEMs.

Key Market Segments

By Capacity

- 45-70L

- Below 45L

- Above 70L

By Material

- Plastic

- Aluminium

- Steel

By Vehicle Type

- Passenger Cars

- Two-wheelers

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Sales Channel

- OEMs

- Aftermarket

Drivers

Increasing Demand for Fuel-Efficient Vehicles Drives Market Growth

The automotive fuel tank market is experiencing growth due to the rising demand for fuel-efficient vehicles. Consumers and manufacturers are increasingly focused on reducing fuel consumption to lower operating costs and reduce environmental impact. With more emphasis on fuel efficiency, automakers are developing advanced vehicles that require improved fuel tank designs to optimize fuel storage and distribution.

Stringent government regulations on emissions are also a significant driver in this market. Governments worldwide are implementing stricter rules to control air pollution and reduce carbon emissions. These regulations push automakers to adopt advanced technologies in their fuel tanks to meet environmental standards and reduce the carbon footprint of their vehicles.

Additionally, advancements in fuel tank materials and manufacturing processes are driving the market. Lighter and stronger materials are being used to create fuel tanks that are both durable and efficient. These innovations enhance vehicle performance while maintaining safety and durability.

Lastly, the rise in the adoption of electric and hybrid vehicles is contributing to the market’s growth. As electric and hybrid vehicles become more common, there is an increasing need for specialized fuel tanks for these vehicles, including those that accommodate alternative fuels like hydrogen.

Restraints

High Production Costs and Volatility in Fuel Prices Restrain Market Growth

One of the key restraints in the automotive fuel tank market is the high production cost associated with advanced materials used for fuel tanks. Materials such as carbon fiber and lightweight composites can be expensive to produce, which increases the overall cost of the fuel tank. This makes it more challenging for manufacturers to keep the final product affordable for consumers.

Another restraint is the volatility in crude oil prices, which directly impacts fuel consumption. Fluctuating fuel prices make it difficult for consumers and manufacturers to predict long-term fuel costs, influencing buying behavior and demand for fuel-efficient vehicles. When fuel prices are low, there may be less urgency to develop more fuel-efficient vehicles, which could slow down the demand for advanced fuel tank technologies.

Growth Factors

Emerging Opportunities in the Automotive Fuel Tank Market

The automotive fuel tank market has significant growth opportunities. One key opportunity is the expansion of electric vehicle (EV) charging infrastructure. As the EV market grows, the need for improved fuel storage systems for alternative energy sources increases. This drives innovation in fuel tanks that can support electric, hybrid, and even hydrogen-powered vehicles.

Another opportunity lies in the development of lightweight and durable composite materials. These materials provide strength and efficiency, reducing the overall weight of vehicles while improving fuel efficiency. Innovations in fuel storage systems for hydrogen-powered vehicles also present growth potential as hydrogen becomes a viable alternative fuel source for the automotive industry.

The rise of emerging markets, particularly in developing countries, is another growth opportunity. Increased vehicle ownership in these regions, driven by a growing middle class, leads to higher demand for fuel-efficient vehicles and, consequently, the need for advanced fuel tank solutions.

Emerging Trends

Trends Shaping the Automotive Fuel Tank Market

Several trends are shaping the automotive fuel tank market. One major trend is the focus on sustainable fuel tank designs. Manufacturers are exploring eco-friendly materials and designs that reduce the environmental impact of fuel tanks. This includes using recyclable materials and optimizing tank structures for better energy efficiency.

Integration of advanced safety features into fuel tanks is also a growing trend. With increasing safety regulations and consumer demand for secure vehicles, automakers are incorporating innovative safety measures, such as reinforced structures and enhanced leak prevention systems, into fuel tank designs.

Another trend is the development of connected vehicle technologies. Fuel tanks are being integrated with IoT systems that allow for real-time monitoring of fuel levels, leak detection, and fuel usage analytics. This helps improve vehicle performance and user convenience.

Regional Analysis

Asia Pacific Dominates the Automotive Fuel Tank Market with a Market Share of 45.8%, Valued at USD 8.3 Billion

The Asia Pacific region holds the largest share in the automotive fuel tank market, accounting for 45.8%, valued at USD 8.3 Billion. This dominance is largely driven by the high production rates of automotive vehicles in countries such as China, Japan, and India. The increasing demand for fuel-efficient and eco-friendly vehicles in this region continues to contribute to the market’s growth, alongside significant automotive industry advancements.

North America Automotive Fuel Tank Market Trends

North America holds a substantial portion of the automotive fuel tank market, supported by the robust automotive industry in the U.S. The region has seen growth in vehicle production, particularly in electric vehicles (EVs) and fuel-efficient models, which directly influences fuel tank requirements. With advancements in fuel tank technology, including the move toward lighter materials, the demand is expected to rise further in this region.

Europe Automotive Fuel Tank Market Outlook

Europe represents a key market for automotive fuel tanks, with a strong emphasis on sustainability and environmental regulations. The region’s automotive sector is focusing on reducing carbon emissions, which is pushing for the adoption of lightweight fuel tanks and alternative fuel solutions. The ongoing shift towards electric vehicles (EVs) is expected to impact the market, particularly in terms of material requirements and design innovations.

Latin America Automotive Fuel Tank Market Dynamics

The automotive fuel tank market in Latin America is expanding, driven by steady growth in vehicle production and consumption. Countries like Brazil and Mexico are seeing increased vehicle demand, both from domestic production and imports. The market is also witnessing technological innovations in fuel tank systems as automakers aim to meet evolving consumer expectations for efficiency and eco-friendliness.

Middle East and Africa Automotive Fuel Tank Market Insights

In the Middle East and Africa, the automotive fuel tank market is primarily influenced by the growing automotive industry and infrastructural developments. The region is seeing an increase in vehicle ownership, and with it, the demand for fuel-efficient tanks. Additionally, with the rising awareness of environmental concerns, there is a gradual shift toward adopting more sustainable automotive fuel technologies in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Fuel Tank Company Insights

The global Automotive Fuel Tank market in 2024 is dominated by several key players, each contributing to the market’s growth with their innovative solutions and strategic moves.

Kautex continues to lead with its advanced fuel tank technologies, focusing on lightweight materials and sustainable production processes. Their expertise in plastic fuel tanks and environmental considerations positions them as a major player in the market.

OPmobility SE is rapidly gaining traction due to its cutting-edge designs in fuel tank systems, with a strong emphasis on improving fuel efficiency and reducing environmental impact. Their solutions cater to both traditional and electric vehicle markets, making them a versatile contender.

Yapp.ing has been instrumental in the development of new fuel tank designs that improve safety and durability. By incorporating advanced composite materials, Yapp.ing is not only enhancing the structural integrity of fuel tanks but also contributing to reducing vehicle weight.

SRD HOLDINGS Ltd. offers highly durable fuel tank systems, with a particular focus on the automotive industry’s growing demands for fuel efficiency and emission reduction. Their strategic partnerships with major OEMs have solidified their position in the competitive automotive fuel tank sector.

These companies, along with others in the market, are poised to shape the future of the global Automotive Fuel Tank market through continuous innovation and focus on sustainability.

Top Key Players in the Market

- Kautex

- OPmobility SE

- yapp.ing

- SRD HOLDINGS Ltd.

- TI Fluid Systems plc

- Magna International Inc.

- Fuel Total Systems

- ContiTech Deutschland GmbH

- SMA Serbatoi S.p.A.

- Motherson Yachiyo Automotive Systems Co., Ltd.

Recent Developments

- In Jun 2024, VOC Automotive secured INR 1.5 crore in funding from Corporate Warranty India to revolutionize the two-wheeler service industry in India, enhancing service offerings and expanding operations.

- In Mar 2024, EV motor and controller startup Attron Automotive raised Rs 4.75 crore in seed funding, which will be utilized to strengthen its electric vehicle technologies and grow its market presence.

- In Mar 2024, Attron Automotive secured Rs 4.75 crore in seed funding led by Venture Catalysts and Anicut Capital, aiming to accelerate the development of its innovative EV motor and controller solutions.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Billion Forecast Revenue (2034) USD 29.9 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (45-70L, Below 45L, Above 70L), By Material (Plastic, Aluminium, Steel), By Vehicle Type (Passenger Cars, Two-wheelers, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)), By Sales Channel (OEMs, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kautex, OPmobility SE, yapp.ing, SRD HOLDINGS Ltd., TI Fluid Systems plc, Magna International Inc., Fuel Total Systems, ContiTech Deutschland GmbH, SMA Serbatoi S.p.A., Motherson Yachiyo Automotive Systems Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Fuel Tank MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Fuel Tank MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kautex

- OPmobility SE

- yapp.ing

- SRD HOLDINGS Ltd.

- TI Fluid Systems plc

- Magna International Inc.

- Fuel Total Systems

- ContiTech Deutschland GmbH

- SMA Serbatoi S.p.A.

- Motherson Yachiyo Automotive Systems Co., Ltd.