Global Automotive Control Cable Market Size, Share, Growth Analysis By Material (Steel, PVC (Polyvinyl Chloride), Nylon, Rubber coated, Others), By Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles), By Application (Braking System, Engine Control, HVAC System, Transmission Control, Others), By Product Type (Brake Cable, Hood Cable, Door Cable, Trunk Cable, Fuel Cap Cable, Clutch Cable, Throttle Cable, Transmission Cable, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154922

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

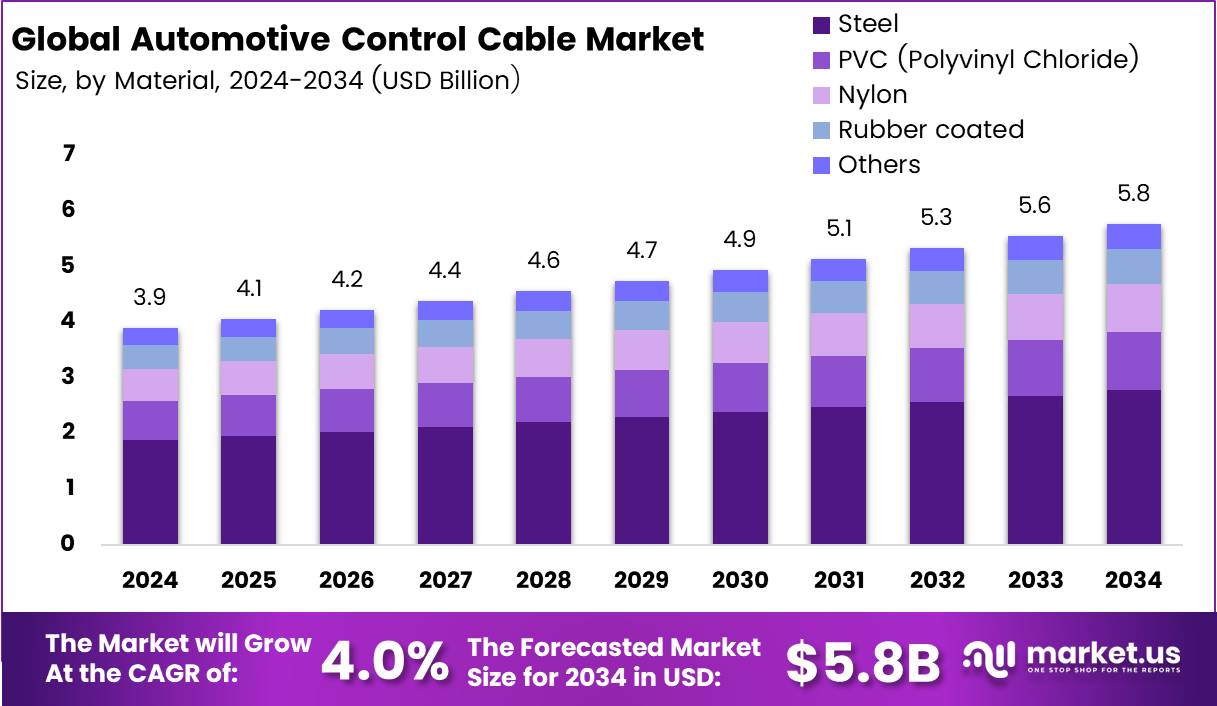

The Global Automotive Control Cable Market size is expected to be worth around USD 5.8 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The Automotive Control Cable Market forms a key segment within the broader automotive components industry. These cables enable essential vehicle functions, including gear shifting, braking, and throttle control. As vehicle design grows more complex, automakers increasingly depend on efficient and lightweight control cable systems to ensure performance, durability, and compliance with safety standards.

Rising global demand for fuel-efficient and lightweight vehicles directly influences the adoption of automotive control cables. With automakers shifting focus toward electric and hybrid vehicles, manufacturers are redesigning cable assemblies to fit evolving requirements. Moreover, the growing use of advanced driving systems increases the integration of mechanical and electronic control elements.

In recent years, automakers and Tier 1 suppliers have increased R&D investments to develop smarter, corrosion-resistant control cables. Simultaneously, the push toward vehicle electrification has created the need for heat-resistant, high-voltage-compatible cable systems. As EV production surges, these cables are becoming more complex and safety-critical across drivetrain and chassis functions.

Meanwhile, government initiatives across regions such as Europe, China, and North America are actively promoting vehicle electrification and emission reduction. These regulations require lightweight and efficient cable systems to help OEMs meet strict emission and fuel economy norms. In turn, this is opening avenues for suppliers of high-performance automotive control cables.

At the same time, favorable policies in emerging markets are encouraging new vehicle manufacturing hubs. Countries like India and Vietnam are seeing increased government spending on EV production infrastructure. This trend expands opportunities for local control cable manufacturers to cater to both domestic demand and global supply chains.

Additionally, OEMs are working closely with suppliers to reduce cable weight and optimize vehicle architecture. This aligns with the growing preference for modular platforms and shared components across multiple vehicle models. As a result, control cable vendors offering custom and modular solutions are witnessing strong demand and long-term contracts.

According to Wiring Harness News, a typical internal combustion engine (ICE) vehicle contains about 3.8 km of wiring weighing around 55 kg. In comparison, an electric vehicle (EV) includes about 4.2 km of wiring with a total weight of 68 kg, of which 13 kg is dedicated to high-voltage systems. This illustrates the rising complexity and strategic role of wiring and control cables in future vehicles.

The Automotive Control Cable Market is positioned for sustainable growth, driven by EV adoption, regulatory shifts, and light weighting trends. With evolving product needs, manufacturers focusing on customization, durability, and high-voltage readiness will gain a competitive edge in this expanding segment.

Key Takeaways

- The Global Automotive Control Cable Market is projected to reach USD 5.8 Billion by 2034, up from USD 3.9 Billion in 2024, growing at a CAGR of 4.0% from 2025 to 2034.

- In 2024, Steel dominated the Material segment with a 48.2% share due to its superior strength and corrosion resistance.

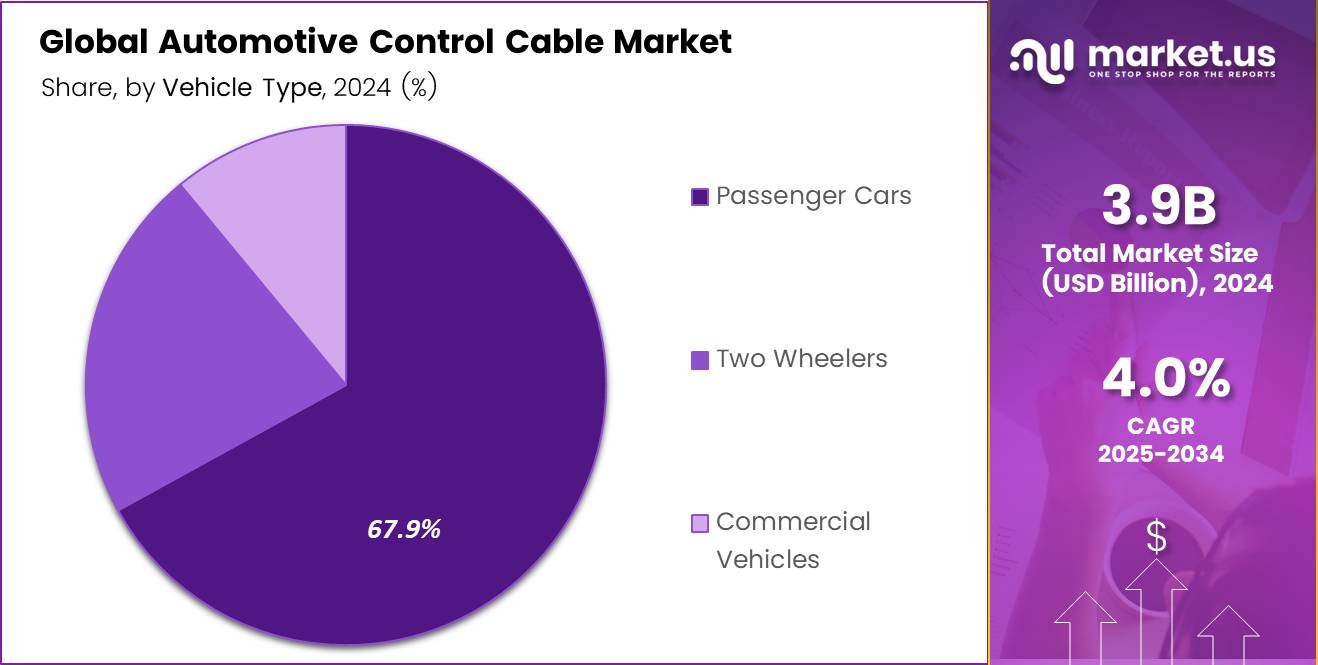

- Passenger Cars led the Vehicle Type segment in 2024 with a 67.9% market share, driven by rising ownership and demand for safer vehicles.

- The Braking System application held the top spot in 2024 with a 35.8% share, reflecting the essential safety role of brake cables.

- In the Product Type segment, Brake Cable led with a 27.3% share in 2024, underscoring its importance in both modern and traditional braking systems.

- OEM sales channels dominated in 2024 with a 62.4% share, due to manufacturer preference for assured compatibility and logistics efficiency.

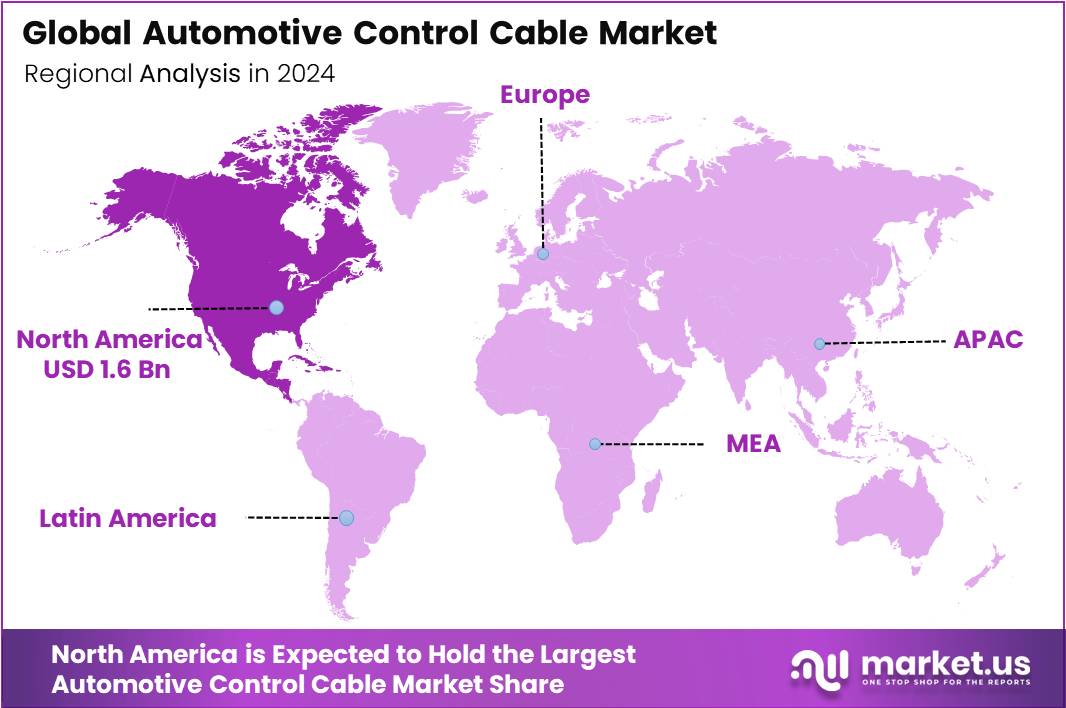

- North America led regionally with a 41.6% market share, valued at USD 1.6 Billion, supported by strong manufacturing and demand for advanced vehicle components.

Material Analysis

Steel leads with a commanding 48.2% share, driven by strength and durability in automotive applications.

In 2024, Steel held a dominant market position in the By Material Analysis segment of the Automotive Control Cable Market, with a 48.2% share. This leadership can be attributed to its superior tensile strength, high corrosion resistance when treated, and its ability to maintain structural integrity under stress—making it ideal for critical automotive applications.

PVC (Polyvinyl Chloride) followed as a popular choice due to its lightweight, flexibility, and insulation properties. It remains widely used in mid-range automotive segments for covering and protecting inner cable mechanisms. Nylon also accounted for a considerable share, owing to its abrasion resistance and thermal stability, which support long-term use in engine control systems.

Rubber-coated cables are gaining attention for their added protection in extreme weather conditions, especially in regions with variable climates. They provide a layer of insulation that prevents wear and tear from friction and vibration.

The Others category includes newer composites and hybrid materials aiming to strike a balance between cost and performance. However, these alternatives have yet to achieve widespread adoption compared to steel, which continues to dominate due to its established supply chains and proven performance history.

Vehicle Type Analysis

Passenger Cars dominate with 67.9% share, reflecting robust demand and rising consumer preference for safety and control.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Control Cable Market, with a 67.9% share. This segment’s growth is primarily driven by the global surge in vehicle ownership, growing middle-class populations, and an increasing emphasis on vehicle safety and performance.

Passenger cars, being the most widely owned and manufactured type of vehicle worldwide, consistently require control cables for various functionalities such as braking, engine operation, and HVAC control. Manufacturers are also enhancing cable technology to improve efficiency, safety, and durability in compact and luxury passenger vehicles.

Two Wheelers represent a smaller but stable portion of the market. Their demand is particularly high in developing nations where motorcycles are a primary mode of transportation. These vehicles typically utilize control cables for throttle, clutch, and brake operations.

Commercial Vehicles, including light and heavy trucks, rely heavily on robust cable systems, especially in logistics and transportation. Although the share is smaller than passenger cars, commercial vehicles contribute steadily due to the replacement cycle of control cables and increased fleet operations globally.

Application Analysis

Braking System takes the lead with a 35.8% share, highlighting its critical role in safety and performance.

In 2024, Braking System held a dominant market position in the By Application Analysis segment of the Automotive Control Cable Market, with a 35.8% share. This dominance reflects the critical safety function of braking systems and the need for highly durable and responsive control cables in this application.

Automotive manufacturers prioritize control cables in braking systems due to regulatory mandates and rising consumer demand for enhanced safety. Cable systems must offer high responsiveness and minimal wear to meet stringent safety standards, which drives innovation and demand in this segment.

Engine Control follows closely, serving essential functions in throttle control and powertrain operations. With the rise of more advanced and electronically assisted engine systems, the demand for reliable control cables in this area is increasing steadily.

HVAC Systems in vehicles use control cables to regulate airflow and temperature. While not as critical as braking or engine control, comfort-based applications like HVAC contribute consistently to market demand.

Transmission Control cables support gear shifting operations and are particularly vital in manual transmission vehicles. The Others category includes emerging and less common applications but remains relatively small in share compared to established systems like braking and engine control.

Product Type Analysis

Brake Cable leads with 27.3% share, driven by its central role in vehicle safety systems.

In 2024, Brake Cable held a dominant market position in the By Product Type Analysis segment of the Automotive Control Cable Market, with a 27.3% share. Brake cables are essential for both traditional and modern braking systems, which makes them a high-volume product in global automotive manufacturing and aftermarket sectors.

The demand for brake cables is sustained by increasing vehicle safety regulations and regular replacement cycles. As vehicles age or encounter rugged terrain, brake cables tend to wear out, prompting consistent aftermarket demand.

Hood Cables and Door Cables are also key contributors, supporting the opening and securing of vehicle compartments. Though smaller in volume, they are necessary components for vehicle functionality and contribute to overall convenience and safety.

Trunk Cables and Fuel Cap Cables serve similar purposes in enabling access and locking mechanisms for external components. Meanwhile, Clutch and Throttle Cables are critical in manual transmission vehicles, especially in regions where such vehicles remain prevalent.

Transmission Cables are used for gear shifting, especially in commercial vehicles and older passenger cars. The Others category includes specialized or emerging cable types used in electric vehicles or luxury cars, which are yet to gain a significant foothold in the broader market.

Sales Channel Analysis

OEM held a dominant 62.4% share in 2024, showcasing strong manufacturer reliance.

In 2024, OEM held a dominant market position in By Sales Channel Analysis segment of Automotive Control Cable Market, with a 62.4% share. This dominance reflects the preference of automotive manufacturers to source control cables directly from OEM suppliers, ensuring compatibility, warranty assurance, and streamlined logistics.

OEMs continue to benefit from long-standing supply chain agreements, trusted quality standards, and integration with vehicle production lines. Their consistent demand supports large-scale production, giving them both cost advantage and influence over design specifications. Additionally, the growing demand for advanced driver assistance systems (ADAS) and electrification trends strengthens the OEM’s position as they supply cables tailored for evolving vehicle technologies.

Conversely, the aftermarket segment also plays a vital role, although it remains secondary to OEM. Customers in the aftermarket tend to seek more cost-effective or replacement solutions post-warranty. However, they may face variability in quality and compatibility. Despite its limitations, the aftermarket continues to support aging vehicle fleets and regions where OEM parts are less accessible.

Together, these channels serve complementary functions, but the clear preference of major automotive manufacturers for OEM-sourced control cables underlines the strategic advantage and trust placed in this channel.

Key Market Segments

By Material

- Steel

- PVC (Polyvinyl Chloride)

- Nylon

- Rubber coated

- Others

By Vehicle Type

- Passenger Cars

- Two Wheelers

- Commercial Vehicles

By Application

- Braking System

- Engine Control

- HVAC System

- Transmission Control

- Others

By Product Type

- Brake Cable

- Hood Cable

- Door Cable

- Trunk Cable

- Fuel Cap Cable

- Clutch Cable

- Throttle Cable

- Transmission Cable

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Integration of Electronic Control Systems with Mechanical Linkages Drives Market Growth

The integration of electronic control systems with traditional mechanical linkages is playing a major role in driving the automotive control cable market. This fusion allows for more accurate and responsive vehicle operations, especially in throttle, gear shift, and brake applications. Automakers are increasingly relying on hybrid solutions that combine electronic sensors with mechanical components to improve reliability and reduce driver fatigue.

The rapid expansion of automotive production in emerging economies such as India, Brazil, and Southeast Asia is significantly contributing to market growth. As more vehicles are manufactured to meet rising local demand, the need for control cables in mass production continues to rise. These regions also serve as manufacturing hubs, further increasing the demand for cost-effective and durable control cables.

Lightweight and high-performance materials are also gaining attention in the industry. Automakers are focused on reducing vehicle weight to improve fuel efficiency and lower emissions. This creates a strong demand for advanced cable materials that are both strong and light, such as fiber-reinforced polymers and composite metals.

Additionally, the rising use of two-wheelers in developing countries is fueling the need for control cables. Scooters and motorcycles rely heavily on mechanical control systems for throttle and brake operations. With increased urbanization and affordability, the two-wheeler segment is expanding fast, boosting demand for control cables.

Restraints

High Maintenance and Replacement Costs of Control Cables Restrain Market Expansion

One of the biggest restraints in the automotive control cable market is the high cost associated with maintenance and replacement. Over time, control cables can wear out, leading to performance issues or failures. Regular servicing and part replacements become necessary, which increases ownership costs for vehicle users and discourages frequent replacements.

Another challenge is the growing shift toward drive-by-wire technologies. These systems use electronic controls instead of mechanical linkages, reducing the need for traditional control cables. As drive-by-wire becomes more common in new vehicle models, it could reduce the long-term demand for mechanical cable systems.

The market also faces quality concerns, especially with low-cost aftermarket products. Many consumers opt for cheaper cables for repairs or replacements, but these often lack durability and safety. This affects consumer trust and could result in costly failures or accidents, impacting overall market reputation.

Lastly, cable manufacturers are under pressure to meet strict regulatory standards. From emissions to safety and materials compliance, regulations differ across regions and require constant updates. This increases production complexity and cost, especially for global players trying to meet multiple regional requirements.

Growth Factors

Development of Custom and Specialty Control Cables for EVs Unlocks New Opportunities

The growing electric vehicle (EV) segment presents exciting opportunities for the automotive control cable market. EVs require specialized cables that are lightweight, heat-resistant, and highly efficient. Manufacturers are now developing custom solutions tailored to EV applications, opening new revenue streams and markets.

Off-road and recreational vehicles are gaining popularity across various regions, especially in North America and Europe. These vehicles often operate in tough conditions and require durable, high-performance control cables. The rising demand for such vehicles is creating growth potential for companies that offer rugged and reliable cable products.

Technological progress in cable coatings and insulation is another opportunity area. Better coatings improve cable life by protecting against moisture, heat, and abrasion. These innovations can help reduce maintenance costs and improve vehicle safety, making advanced cables more attractive to OEMs and consumers.

Collaborations between control cable manufacturers and original equipment manufacturers (OEMs) are also becoming a key growth strategy. These partnerships enable early involvement in vehicle design, allowing for customized cable solutions that enhance vehicle performance. Strategic alliances like these strengthen market position and drive innovation.

Emerging Trends

Increasing Use of Composite Materials in Cable Manufacturing Influences Market Trends

One of the major trends in the automotive control cable market is the use of composite materials in manufacturing. These materials offer better strength, flexibility, and corrosion resistance compared to traditional metals. As a result, cables made from composites are becoming popular for their longer lifespan and reduced weight.

Automation is transforming how control cables are produced. With automated assembly lines and robotic handling, manufacturers can improve quality control and reduce production time. This shift not only increases efficiency but also lowers manufacturing costs in the long run.

Another rising trend is the integration of smart technology into control cables. Cables with sensors that monitor real-time performance, such as tension or wear, are being explored. These smart cables can send alerts for preventive maintenance, improving vehicle safety and reducing unexpected failures.

Lastly, retrofitting is gaining momentum, especially in vintage or classic vehicles. Car enthusiasts and restoration professionals are upgrading old control cables to modern versions to improve reliability. This niche but growing trend adds an aftermarket revenue channel for cable manufacturers focused on heritage vehicles.

Regional Analysis

North America Dominates the Automotive Control Cable Market with a Market Share of 41.6%, Valued at USD 1.6 Billion

North America holds the leading position in the automotive control cable market, accounting for 41.6% of the global share, valued at USD 1.6 billion. The region benefits from a robust automotive manufacturing base, high vehicle ownership rates, and increasing demand for advanced vehicle components. Innovations in vehicle safety and efficiency continue to drive the adoption of high-performance control cables across the U.S. and Canada.

Europe Automotive Control Cable Market Trends

Europe follows as a significant contributor to the market, driven by strong automotive engineering capabilities and the presence of premium vehicle manufacturers. The region’s stringent regulations on vehicle safety and emissions also push demand for quality control cable systems. Increased adoption of electric vehicles in countries like Germany and France is further augmenting market growth.

Asia Pacific Automotive Control Cable Market Trends

Asia Pacific is witnessing rapid expansion in the automotive control cable market, supported by high vehicle production in countries such as China, India, and Japan. A rising middle-class population and growing demand for both passenger and commercial vehicles play a crucial role. Moreover, the push for automotive electrification and industrialization in emerging economies is expected to propel market demand.

Middle East and Africa Automotive Control Cable Market Trends

The Middle East and Africa region show steady growth, backed by infrastructural development and a growing automotive aftermarket. While the market is still developing compared to other regions, increasing investments in transportation and logistics are creating new opportunities for automotive control cable manufacturers.

Latin America Automotive Control Cable Market Trends

Latin America is gradually advancing in the automotive control cable market, driven by economic recovery and industrial growth in countries such as Brazil and Mexico. Government initiatives to strengthen the automotive sector and increased vehicle exports are fostering regional market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Control Cable Company Insights

In 2024, the global Automotive Control Cable Market is witnessing notable developments driven by innovation, OEM collaboration, and a push toward lightweight and efficient vehicle components.

Cablecraft Motion Controls continues to maintain a strong foothold by leveraging its deep expertise in motion control solutions. The company’s ability to offer highly customizable and precise cable assemblies has helped it cater to both traditional and electric vehicle (EV) markets.

HI-LEX Corporation remains a dominant global player due to its extensive production capabilities and long-standing partnerships with major automakers. Their focus on quality and innovation in mechanical control cables supports their strong market presence across Asia, North America, and Europe.

Grand Rapids Controls LLC has been recognized for its engineering-driven approach and strong capabilities in providing complex cable assemblies. The company benefits from its focus on ergonomic designs and integration of advanced materials to meet evolving OEM specifications.

Sila Group is strengthening its role in the European market by emphasizing sustainability and technological innovation. Their involvement in electric and hybrid vehicle projects is positioning them as a forward-looking supplier aligned with global automotive trends.

These companies, among others, are contributing to a competitive and rapidly evolving automotive control cable landscape, marked by growing EV penetration, demand for lightweight solutions, and regulatory pressure for performance and reliability enhancements.

Top Key Players in the Market

- Cablecraft Motion Controls

- HI-LEX Corporation

- Grand Rapids Controls LLC

- Sila Group

- Parker Hannifin Corporation

- Venhill Engineering Ltd.

- Dorman Products Inc.

- Aptiv

- DURA Automotive Systems

- Furukawa Electric

- Kongsberg Automotive

- Lear

- TE Connectivity

Recent Developments

- In May 2023, Amo Special Cables Limited announced the successful acquisition of the High Performance Cable factory from Leviton Manufacturing UK Limited. This move enhances their manufacturing capabilities and strengthens their global cable production footprint.

- In Jun 2025, ASK Automotive’s Board approved a joint venture with T.D. Holding GMBH (TDH) focused on sunroof control cables and helix cables for passenger vehicles. ASK Automotive will hold a 49% stake in the JV with a planned investment of ₹2.45 crore, aiming to expand its product portfolio in the automotive segment.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, PVC (Polyvinyl Chloride), Nylon, Rubber coated, Others), By Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles), By Application (Braking System, Engine Control, HVAC System, Transmission Control, Others), By Product Type (Brake Cable, Hood Cable, Door Cable, Trunk Cable, Fuel Cap Cable, Clutch Cable, Throttle Cable, Transmission Cable, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cablecraft Motion Controls, HI-LEX Corporation, Grand Rapids Controls LLC, Sila Group, Parker Hannifin Corporation, Venhill Engineering Ltd., Dorman Products Inc., Aptiv, DURA Automotive Systems, Furukawa Electric, Kongsberg Automotive, Lear, TE Connectivity Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Control Cable MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Control Cable MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cablecraft Motion Controls

- HI-LEX Corporation

- Grand Rapids Controls LLC

- Sila Group

- Parker Hannifin Corporation

- Venhill Engineering Ltd.

- Dorman Products Inc.

- Aptiv

- DURA Automotive Systems

- Furukawa Electric

- Kongsberg Automotive

- Lear

- TE Connectivity