Global Automatic and Smart Pet Feeder Market By Pet Type (Dog, Cat, Others), By Product (Wi-Fi Enabled Feeders, Portion Control Feeders, Camera-equipped Feeders, Voice-Activated Feeders, Interactive Feeders, Gravity Feeders, Timed Release Feeders), By Application (Pet Rehabilitation Center, Home Use, Pet Care Facilities, Veterinary Clinics, Pet Boarding Facilities, Pet Grooming Salons), By Distribution (Online Retailers, Pet Specialty Stores, Veterinary Clinics, Specialty Pet Boutiques), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130770

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

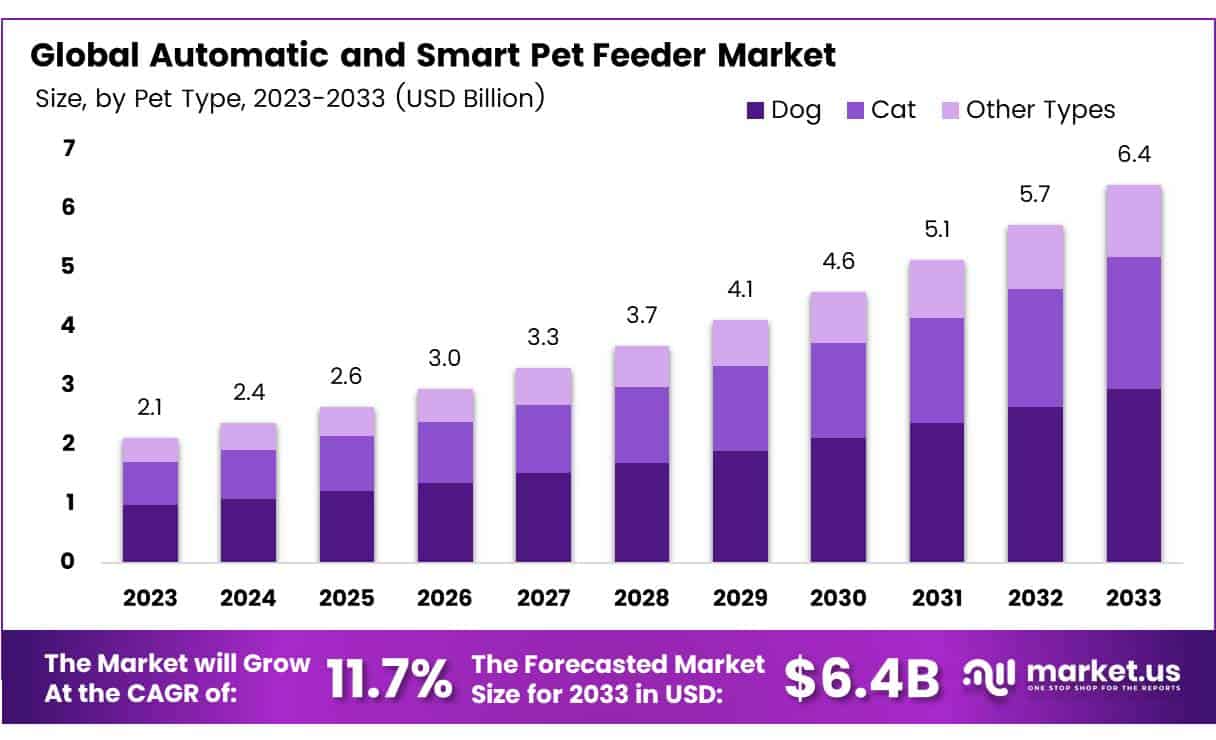

The Global Automatic and Smart Pet Feeder Market size is expected to be worth around USD 6.4 Bn by 2033, from USD 2.12 Bn in 2023, growing at a CAGR of 11.7% during the forecast period from 2024 to 2033.

Automatic and smart pet feeders represent a significant advancement in the pet care industry, blending convenience with technology to meet modern pet owners’ needs. These devices automate the feeding process through programmable settings, often integrated with mobile apps for remote management.

Advanced models incorporate features like portion control, voice interaction, and real-time video feeds, enabling pet owners to ensure their pets’ well-being even when they are not physically present.

As lifestyles become busier and more urbanized, these feeders offer a solution that addresses the growing need for efficiency in pet care management. This aligns with the broader trend of integrating smart home technologies into everyday routines, making automatic feeders a valuable asset for tech-savvy pet owners.

The Automatic and Smart Pet Feeder Market is poised for sustained growth, driven by the confluence of increasing pet adoption rates and the rising trend of pet humanization. Pet owners are more inclined toward premium, health-focused products that offer convenience and precision, aligning with the capabilities of smart feeding solutions. Key growth drivers include higher disposable incomes, urbanization, and the expanding role of pets as family members.

Opportunities lie in leveraging IoT and AI to create feeders with adaptive feeding algorithms, allowing personalized nutrition plans. Additionally, the shift towards e-commerce and online retail provides manufacturers with broader market access, accelerating product reach and customer acquisition. As consumer expectations evolve, companies that prioritize innovation in functionality and user experience are likely to capture significant market share.

Automatic and smart pet feeders offer a solution to the challenges faced by modern pet owners, particularly those managing busy schedules. These devices automate pet feeding by controlling meal times and portions through programmable settings, often managed via smartphone apps. This allows pet owners to ensure their pets are fed consistently, even when their schedules are unpredictable.

For example, the RobotChow solution aims to address the needs of pet breeders in Brazil, where over 74.3 million dogs and cats are present, by offering precise feeding schedules to match the needs of pets. As such, these feeders are increasingly valuable to busy urban households, providing peace of mind to pet owners who often face last-minute schedule changes.

In regions like Asia Pacific, where there are approximately 300 million pet dogs and cats, companies like Xiaomi are leveraging this market by integrating smart technology into their product line, ensuring efficient and timely feeding of pets through their digital solutions.

The Automatic and Smart Pet Feeder Market is experiencing robust growth, fueled by shifting consumer demographics and increased pet ownership. Generational changes play a significant role, with Morgan Stanley noting that 34% of respondents aged 18 to 34 intend to get a pet, up from 28% in 2022. This demographic shift, coupled with the trend of pet humanization, has increased the demand for premium and tech-enabled pet care solutions.

Additionally, the evolving shopping behaviors of pet owners present a substantial market opportunity. While 80% still prefer in-store purchases, nearly 70% have bought pet food and supplies online in the past six months, showing a significant rise in e-commerce engagement. This shift toward online shopping offers companies an expanded reach, driving the adoption of smart feeders available through digital channels.

In emerging markets like Brazil, where the cost of raising pets is heavily influenced by the expense of feeding, smart feeders provide a cost-effective and convenient solution. As a result, market players that combine technological innovation with user-friendly features are well-positioned to capture market share in this dynamic landscape.

Key Takeaways

- The Global Automatic and Smart Pet Feeder Market size is expected to grow from USD 2.12 billion in 2023 to USD XX billion by 2033, expanding at a CAGR of 11.7% from 2024 to 2033.

- In 2023, the Dog segment dominates with a significant market share due to the Automatic and Smart Pet Feeder Market’s focus on pet-specific feeding needs.

- In 2023, Wi-Fi Enabled Feeders dominate with a leading position in the Automatic and Smart Pet Feeder Market, reflecting consumer demand for connected and easy-to-control feeding solutions.

- In 2023, Pet Rehabilitation Centers dominate with notable growth due to the rising demand for specialized feeding solutions in the Automatic and Smart Pet Feeder Market, catering to pets recovering from injuries or surgeries.

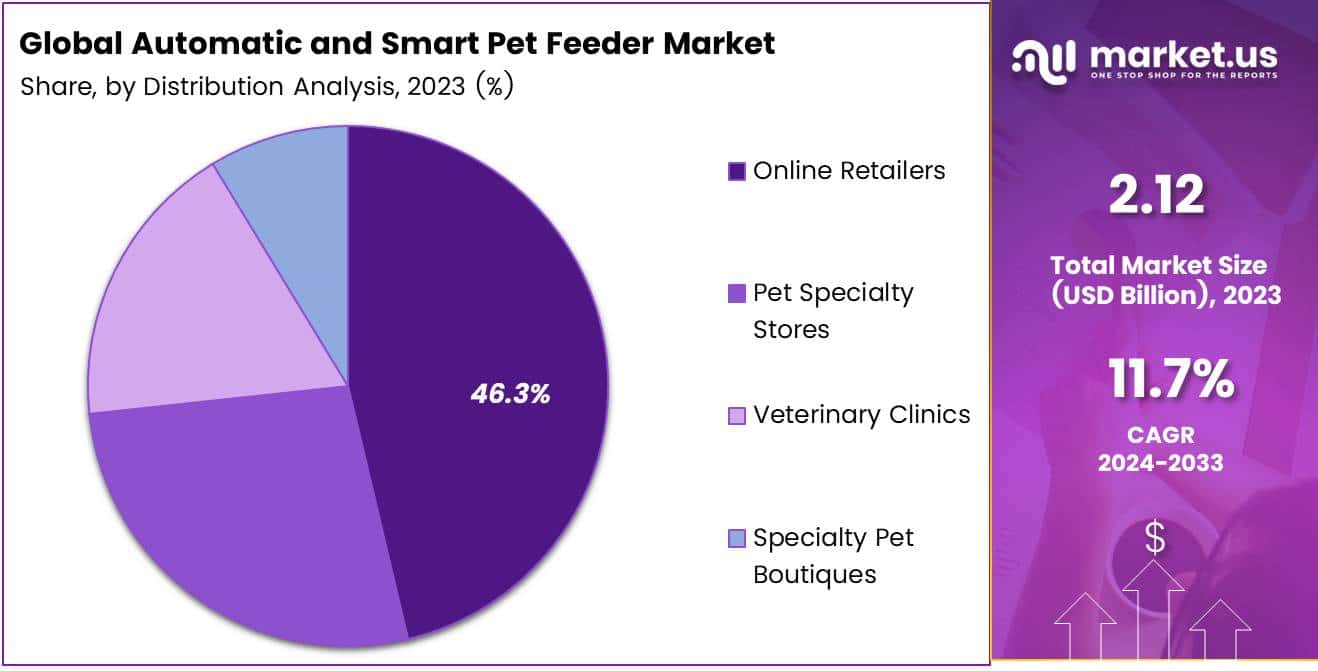

- In 2023, Online Retailers dominate with a substantial market share in the Automatic and Smart Pet Feeder Market, driven by the convenience and variety of products available on digital platforms.

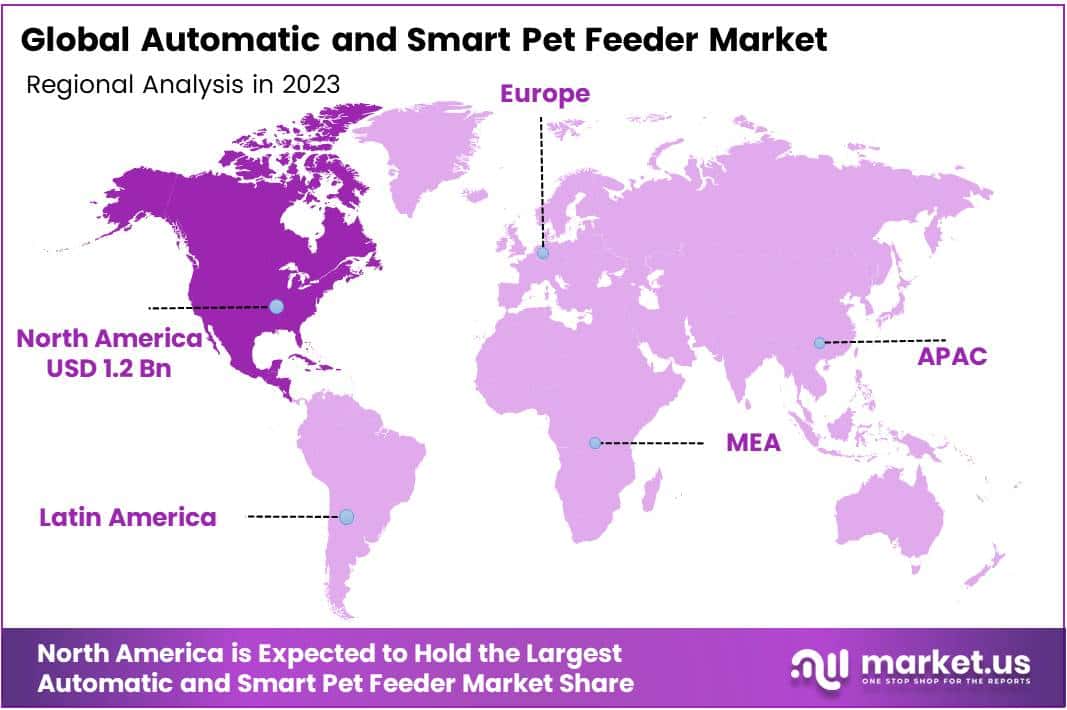

- In 2023, North America dominates with 59% of the global market share in the Automatic and Smart Pet Feeder Market, reaching a market value of USD 1.25 billion.

By Pet Type Analysis

In 2023, the Dog segment held a dominant market position in the “By Pet Type Analysis” segment of the Automatic and Smart Pet Feeder Market. This leadership is attributed to the high adoption rates of dogs as pets globally, particularly in North America and Europe.

The segment’s growth is further driven by the increasing trend of pet humanization, where pet owners seek convenient feeding solutions that ensure timely and accurate portions for their dogs. The rising awareness of pet health and wellness also supports the demand for smart feeding devices, allowing users to control and monitor feeding times remotely.

The Cat segment follows closely, reflecting the growing number of cat owners, especially in urban areas where cats are favored for their lower maintenance needs. Smart pet feeders for cats are increasingly in demand due to their ability to manage portion sizes and accommodate various feeding schedules.

The “Others” segment, encompassing animals such as rabbits and birds, remains niche but shows potential for growth as the trend toward automated pet care devices expands. This segment appeals to specific pet owners looking for tailored feeding solutions for their unique needs. The overall market growth across all segments highlights the increasing consumer inclination towards technologically advanced pet care products.

By Product Analysis

In 2023, Wi-Fi Enabled Feeders held a dominant market position in the “By Product Analysis” segment of the Automatic and Smart Pet Feeder Market. This segment’s leading status is primarily due to its advanced features, such as remote feeding control, real-time notifications, and monitoring capabilities through smartphone applications. These functionalities resonate well with pet owners seeking convenience and flexibility in managing their pets’ feeding schedules, particularly in North America and Europe, where the adoption of smart home devices is high.

Portion Control Feeders closely follow, as they cater to the increasing awareness of pet health and weight management among owners. The ability to dispense precise portions ensures balanced nutrition, making these feeders particularly popular among health-conscious consumers.

Camera-equipped Feeders and Voice-Activated Feeders have also gained traction due to their interactive capabilities, allowing owners to monitor and communicate with their pets remotely. Interactive Feeders, on the other hand, are favored for engaging pets, providing mental stimulation alongside feeding.

Gravity Feeders and Timed Release Feeders serve as more basic solutions, appealing to pet owners seeking cost-effective options for regular feeding schedules. Despite their simpler technology, they maintain a steady presence in the market, especially among budget-conscious consumers. The varied product offerings underscore the market’s appeal to a diverse range of customer preferences.

By Application Analysis

In 2023, Pet Rehabilitation Centers held a dominant market position in the “By Application Analysis” segment of the Automatic and Smart Pet Feeder Market. This segment’s growth can be attributed to the rising demand for specialized feeding solutions that cater to pets recovering from injuries or surgeries.

Automatic feeders equipped with features like portion control and timed release ensure precise feeding schedules, which are crucial for rehabilitation. Pet Care Facilities emerged as the second-largest segment, driven by an increasing preference for automated feeding solutions to manage multiple pets efficiently.

Veterinary Clinics also represented a significant share, leveraging smart feeders to streamline feeding routines during medical treatments. These feeders facilitate better monitoring of food intake, which is critical for diagnosing health conditions.

Pet Boarding Facilities have shown steady growth, with demand driven by pet owners’ emphasis on maintaining feeding schedules during boarding periods. Lastly, Pet Grooming Salons adopted these feeders to provide convenience for pets during long grooming sessions, although their market share remained smaller compared to other segments.

By Distribution Analysis

In 2023, Online Retailers held a dominant market position in the “By Distribution Analysis” segment of the Automatic and Smart Pet Feeder Market, accounting for a significant share of the market.

The convenience of online shopping, coupled with the availability of a wide range of products, has driven consumer preference towards online platforms. The increasing penetration of e-commerce and the rising use of smartphones have further bolstered the segment’s growth, allowing consumers easy access to various automatic and smart pet feeders.

Pet Specialty Stores also contributed substantially to the market, leveraging their expertise in pet care products to attract consumers seeking professional advice and personalized shopping experiences. These stores often provide a hands-on demonstration of feeder products, which can appeal to customers who prefer in-store purchases.

Veterinary Clinics represent a niche but growing segment, driven by the recommendation of smart feeding solutions for pets with specific dietary needs. This segment benefits from the credibility and trust that veterinarians hold with pet owners.

Lastly, Specialty Pet Boutiques serve a luxury-focused consumer base, offering high-end, customized pet feeding solutions. Although this segment accounts for a smaller market share, it caters to discerning pet owners looking for exclusive and premium products.

Key Market Segments

By Pet Type

- Dog

- Cat

- Others

By Product

- Wi-Fi Enabled Feeders

- Portion Control Feeders

- Camera-equipped Feeders

- Voice-Activated Feeders

- Interactive Feeders

- Gravity Feeders

- Timed Release Feeders

By Application

- Pet Rehabilitation Center

- Home Use

- Pet Care Facilities

- Veterinary Clinics

- Pet Boarding Facilities

- Pet Grooming Salons

By Distribution

- Online Retailers

- Pet Specialty Stores

- Veterinary Clinics

- Specialty Pet Boutiques

Drivers

Drivers of Automatic Pet Feeder Demand

The Automatic and Smart Pet Feeder Market is experiencing growth driven by several key factors. Increasing pet ownership rates globally have fueled the demand for convenient feeding solutions, making automated feeders a popular choice among pet owners. As more people adopt pets, the need for time-saving and reliable feeding options has surged.

Additionally, there is growing awareness of pet health among consumers. Many pet owners are becoming more mindful of maintaining consistent feeding schedules and controlling portion sizes, which automated feeders can easily manage. This focus on pet well-being further drives the market’s expansion.

Rising disposable incomes also play a significant role. With a higher capacity for spending, consumers are more inclined to invest in premium pet care products, including technologically advanced feeders that offer features like remote control, portion management, and real-time monitoring.

These feeders not only enhance convenience but also cater to the desire for better pet care solutions. As a result, the combination of increasing pet ownership, awareness of pet health, and rising income levels is propelling the growth of the Automatic and Smart Pet Feeder Market.

Restraints

High Costs and Limited Awareness

The Automatic and Smart Pet Feeder Market faces significant challenges, primarily due to high initial costs and limited awareness in developing regions. The premium pricing of smart feeders, especially those equipped with advanced features like Wi-Fi connectivity, cameras, and voice activation, can be a barrier for price-sensitive consumers. This cost factor makes it difficult for middle-income households to justify the expense, particularly when more affordable traditional feeding options exist.

Moreover, the adoption of these smart devices remains slow in emerging markets, where awareness about such innovative pet care solutions is relatively low. Many pet owners in these regions remain unaware of the potential benefits, such as remote feeding and portion control, that these devices offer.

As a result, companies targeting these markets face challenges in driving product adoption and must invest heavily in educational marketing and awareness campaigns. This need for additional market education further increases the overall marketing costs, impacting profit margins. Together, these factors constrain the potential market growth, limiting the reach of automatic and smart pet feeders to more developed markets where consumers are both aware and willing to pay for these premium solutions.

Opportunity

Opportunities in Automatic Pet Feeder Market

The Automatic and Smart Pet Feeder Market holds significant opportunities, driven by technological advancements and evolving consumer preferences. The development of energy-efficient models offers a crucial growth avenue as more eco-conscious pet owners seek products that align with sustainability goals. Devices that minimize power consumption can differentiate brands in a competitive market.

Additionally, the integration of feeders with mobile apps creates an opportunity to attract tech-savvy consumers, offering real-time updates, remote control, and customization options for pet feeding. These features enhance convenience and appeal to pet owners who prioritize a seamless experience. Moreover, partnerships with veterinary services present another promising opportunity.

By collaborating with veterinarians, companies can develop feeders with tailored feeding plans that meet specific dietary needs, adding a layer of professional expertise and trust. This approach can cater to pets with special dietary requirements, thereby expanding the market reach. Together, these opportunities—energy-efficient designs, mobile integration, and veterinary partnerships can drive the growth of this market, meeting the evolving needs of modern pet owners while offering added value

Challenges

Challenges Facing Smart Pet Feeder Market

The automatic and smart pet feeder market is facing significant challenges, primarily due to intense competition and rapid technological changes. The market has become crowded with numerous brands offering similar products, making it increasingly difficult for companies to differentiate themselves. This intense competition drives the need for unique features, competitive pricing, and strong brand loyalty, which can be costly and difficult to achieve.

Moreover, the rapid pace of technological innovation further complicates the market. Consumers are demanding more advanced features such as camera integration, voice control, and app connectivity, pushing manufacturers to continually upgrade their products. Keeping up with these advancements requires substantial investment in research and development, which may not be feasible for smaller players in the industry.

As a result, maintaining a balance between staying current with technological trends and offering competitively priced products is a considerable challenge. Companies that fail to innovate or adapt quickly risk losing their market share to those who offer more advanced and appealing solutions. Thus, competition and technology evolution stand as key hurdles for the automatic and smart pet feeder market.

Growth Factors

Smart Pet Feeder Market Growth Drivers

The Automatic and Smart Pet Feeder Market is experiencing growth due to several key factors. Firstly, the shift toward smart home integration has fueled demand for advanced pet care solutions. As more households adopt home automation systems, the need for smart feeders that can be seamlessly integrated into these networks has increased.

Secondly, advancements in AI-based pet behavior analysis are boosting the market’s appeal. These devices can monitor pets’ eating habits and adjust feeding schedules accordingly, enhancing convenience for pet owners. Finally, a rising interest in pet insurance and overall pet health awareness has led to greater demand for products that support well-being, such as automatic feeders.

As pet owners prioritize the health of their pets, they are more likely to invest in technology that ensures regular feeding and monitoring, contributing to market growth. These combined factors are driving the adoption of smart pet feeders as consumers seek convenience and better care for their pets through innovative solutions.

Emerging Trends

Key Trends in Smart Pet Feeders

The Automatic and Smart Pet Feeder Market is witnessing several key trends driving growth and demand. Integration of voice control features, such as compatibility with Alexa or Google Assistant, has become a significant trend, allowing pet owners to manage feeding schedules with voice commands. Eco-friendly materials are also gaining traction, with a growing preference for biodegradable or recyclable components in feeders, reflecting increased consumer concern for environmental sustainability.

Another emerging trend is the inclusion of automated water dispensers, enabling dual functionality with both food and water dispensing capabilities, which appeals to convenience-focused consumers. Real-time video monitoring is also becoming highly desirable, as camera-equipped feeders allow pet owners to monitor their pets remotely, offering peace of mind when away from home.

These trends underscore a broader shift toward convenience, smart home integration, and eco-consciousness in the pet care industry. Together, they reflect a market that is evolving to meet the needs of modern pet owners who prioritize seamless technology and sustainability in their purchasing decisions. As these trends continue to shape product offerings, the market is expected to see sustained growth and innovation.

Regional Analysis

The Automatic and Smart Pet Feeder Market is witnessing substantial growth across various regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America emerges as the dominant market, accounting for approximately 59% of the global share and reaching a market value of USD 1.25 billion.

This significant share can be attributed to high pet ownership rates, increased spending on pet care, and the adoption of smart home technologies. The United States, in particular, is a key driver within this region due to the widespread use of advanced pet care devices and the preference for automated solutions that ensure regular feeding schedules.

Regional Mentions:

Europe holds a notable share of the market, supported by rising disposable incomes and a growing awareness of pet health and wellness. The increasing number of working professionals seeking convenient pet care solutions contributes to the demand for automatic feeders. Countries such as Germany, the United Kingdom, and France are leading markets within the region due to the trend toward premium pet products.

The Asia Pacific region is expected to experience rapid growth over the forecast period, driven by urbanization, increasing pet adoption rates, and rising awareness regarding pet nutrition. China and Japan are key markets in this region, with a growing middle-class population willing to invest in smart pet care devices. The market’s expansion is further supported by the emergence of e-commerce platforms, making these products more accessible.

The Middle East & Africa and Latin America markets, while smaller in comparison, are witnessing steady growth due to the rising trend of pet humanization and increased awareness of automated feeding solutions. Brazil and South Africa are key contributors in their respective regions, showing a growing interest in smart pet care solutions as disposable incomes rise.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Mars Incorporated is a dominant force in the market, leveraging its extensive experience in the pet care industry and strong brand presence. As a leader in pet nutrition and wellness, Mars has expanded its product offerings to include advanced feeding solutions, emphasizing convenience and health for pets. This strategic positioning has allowed Mars to cater to the growing demand for automated feeding systems, especially in regions like North America and Europe.

Garmin International, Inc. is known for its expertise in GPS technology, which has been adapted into innovative pet care products, including smart feeders. Garmin’s integration of precise tracking capabilities into pet feeding devices offers a unique value proposition, attracting tech-savvy consumers who prioritize connectivity and monitoring.

This approach has positioned Garmin as a preferred choice for pet owners seeking smart solutions that integrate seamlessly with their connected lifestyles, contributing to its growing market share in North America and Europe.

Motorola Solutions, Inc. (Binatone Global) has made substantial inroads into the market by focusing on Wi-Fi-enabled feeders and interactive devices. Its emphasis on user-friendly designs and affordability has made its products appealing to a broad consumer base.

Additionally, Motorola’s global distribution network and strong brand recognition have enabled it to capture significant market share, particularly in emerging markets such as Asia Pacific. Its innovative approach to combining communication technologies with smart pet care has strengthened its competitive edge in the market.

Top Key Players in the Market

- Actijoy Solution

- Halo Collar

- IceRobotics, Ltd

- Link My Pet

- Loc8tor Ltd.

- CleverPet, Inc

- Dogtra Co.

- Mars Incorporated

- Motorola Solutions, Inc. (Binatone Global)

- Nedap N.V.

- Pawbo, Inc. (Acer Inc.)

- Felcana

- FitBark Inc

- Garmin International, Inc.

Recent Developments

- In 2023, Nestlé Purina PetCare initiated plans to construct a new manufacturing facility in Clermont County, Ohio, as part of its ongoing expansion efforts in the pet food sector. This new facility, designed to produce wet pet food, is strategically located near the company’s existing $500 million plant in Ohio.

- PetDine expanded its operational capacity by acquiring a second facility in Windsor, Colorado, in 2023. The new facility, valued at $11.7 million, provides an additional 50,000 square feet of pre- and post-production space.

- Blue Buffalo, a key player in the pet food market, embarked on a significant expansion of its Richmond, Indiana-based facility in 2023. On March 23, the company broke ground on a $200 million project to add 169,000 square feet of processing and warehouse space to the existing plant.

- Musti Group strengthened its market presence by increasing its ownership in the Premium Pet Food Suomi Oy factory from 49.2% to 100%. The facility, based in Lieto, Finland, benefits from its strategic location near raw material suppliers, enabling access to high-quality ingredients sourced from local producers.

Report Scope

Report Features Description Market Value (2023) USD 2.12 Bn Forecast Revenue (2033) USD 6.4 Bn CAGR (2024-2033) 11.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Type(Dog, Cat, Others), By Product(Wi-Fi Enabled Feeders, Portion Control Feeders, Camera-equipped Feeders, Voice-Activated Feeders, Interactive Feeders, Gravity Feeders, Timed Release Feeders), By Application(Pet Rehabilitation Center, Home Use, Pet Care Facilities, Veterinary Clinics, Pet Boarding Facilities, Pet Grooming Salons), By Distribution(Online Retailers, Pet Specialty Stores, Veterinary Clinics, Specialty Pet Boutiques) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Actijoy Solution, Halo Collar, IceRobotics, Ltd, Link My Pet, Loc8tor Ltd., CleverPet, Inc, Dogtra Co., Mars Incorporated, Motorola Solutions, Inc. (Binatone Global), Nedap N.V., Pawbo, Inc. (Acer Inc.), Felcana, FitBark Inc, Garmin International, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic and Smart Pet Feeder MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Automatic and Smart Pet Feeder MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Actijoy Solution

- Halo Collar

- IceRobotics, Ltd

- Link My Pet

- Loc8tor Ltd.

- CleverPet, Inc

- Dogtra Co.

- Mars Incorporated

- Motorola Solutions, Inc. (Binatone Global)

- Nedap N.V.

- Pawbo, Inc. (Acer Inc.)

- Felcana

- FitBark Inc

- Garmin International, Inc.