Global Augmented Reality Windshield Market Size, Share, Growth Analysis By Position Type (Front, Rear), By Vehicle Type (Passenger Car (PC), Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 99477

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

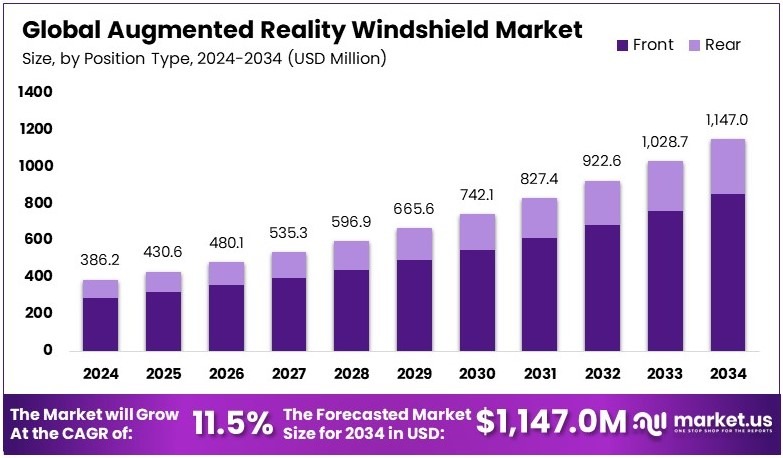

The Global Augmented Reality Windshield Market size is expected to be worth around USD 1,147.0 Million by 2034, from USD 386.2 Million in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034.

An Augmented Reality Windshield is a smart car display that shows digital information on the windshield. It helps drivers by projecting navigation, warnings, and speed data directly in their line of sight. This improves safety, reduces distraction, and creates a more advanced driving experience.

The Augmented Reality Windshield Market includes all technologies, systems, and companies involved in AR windshield development and sales. It covers display components, software, and vehicle integration. Growth is driven by demand for connected cars, driver safety tools, and premium in-vehicle technology experiences.

Augmented Reality (AR) windshields are changing the driving experience. These displays project real-time information like speed, directions, and warnings directly onto the glass. Drivers can stay focused on the road while receiving important updates. As more cars adopt smart systems, the use of AR windshields continues to increase worldwide.

The Augmented Reality Windshield market is growing due to rising interest in connected cars and safer driving tools. At CES 2025, BMW revealed its Panoramic Vision, a full-windshield Augmented Reality display. It projects data across the entire windshield, from pillar to pillar. This new tech reduces distractions and boosts driver awareness.

Demand is rising as automakers invest in digital dashboards. In March 2025, Israeli startup REE Automotive announced a deal that could bring in $770 million by 2030. The company will license its AR and autonomous driving tech. This reflects growing interest in combining AR with self-driving vehicle platforms.

Governments are also pushing for better road safety. AR windshields support this by improving driver response times and reducing manual distractions. As AR systems become smarter, they help drivers in cities, highways, and poor weather. This boosts safety at both local and global levels.

Despite strong growth, market saturation is still low. Most models with AR windshields are high-end. However, as production costs drop, more brands will adopt this feature in mid-range cars. The opportunity for expansion is wide, especially in Asia and North America.

Competition is moderate, with a few leading players. Companies are focusing on lightweight displays, energy savings, and smart visual layouts. Partnerships between auto and tech firms are growing. These joint efforts speed up innovation and help bring AR to more vehicles faster.

Key Takeaways

- The Augmented Reality Windshield Market was valued at USD 386.2 million in 2024 and is expected to reach USD 1,147.0 million by 2034, with a CAGR of 11.5%.

- In 2024, Front position type dominated with 74%, driven by demand for enhanced driver assistance.

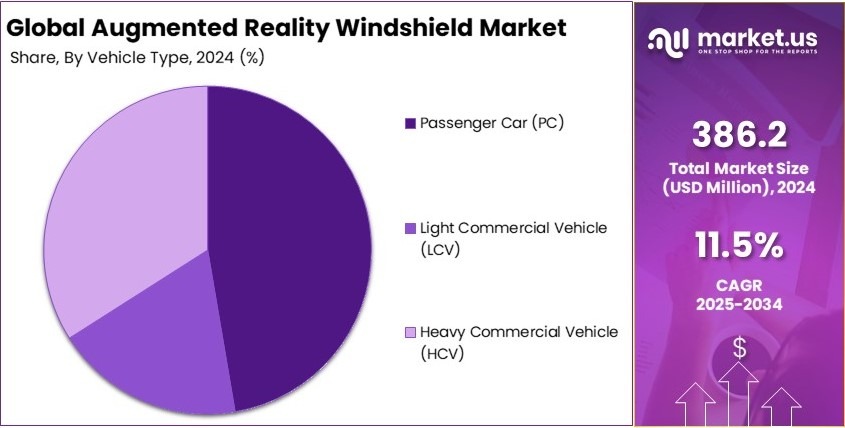

- In 2024, Passenger Cars led the vehicle type segment due to rising adoption of AR technology.

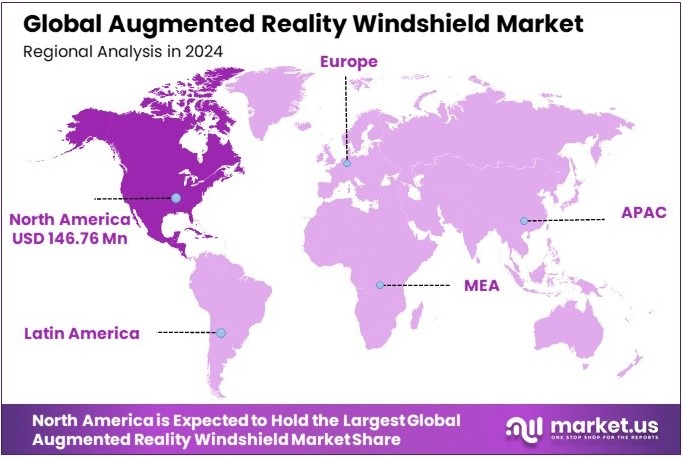

- In 2024, North America held 38% market share, valued at USD 146.76 million, supported by early tech adoption.

Position Type Analysis

Front dominates with 74% due to its integral role in driver information and safety enhancement.

The Front position type leads the Augmented Reality Windshield Market, capturing a substantial 74% of the market. This dominance is primarily because the front windshield is crucial for displaying vital navigational and vehicle performance data directly within the driver’s line of sight.

Augmented Reality (AR) technology on front windshields enhances driver awareness and safety by overlaying important information, such as speed limits and navigation arrows, onto the real-world view, minimizing the need for drivers to divert their attention from the road.

The Rear position type, though less common, serves an important role by providing critical information on rear-view displays that assist with parking and monitoring blind spots. This technology is gradually being adopted as it contributes to vehicle safety and convenience, particularly in dense urban environments.

Vehicle Type Analysis

Passenger Cars lead the market due to the increasing demand for advanced technology in personal vehicles.

In the Vehicle Type segment, Passenger Cars are the dominant category, reflecting the growing consumer expectation for advanced technological features in personal transportation. This demand drives manufacturers to incorporate AR windshields, which offer enhanced safety and a futuristic driving experience, into more models. This trend is bolstered by the rise in consumer spending on high-tech vehicle upgrades, making AR features a standard expectation in new passenger vehicles.

Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) also integrate AR windshield technology, primarily to improve navigation and driver safety. LCVs benefit from AR features that help manage urban deliveries more efficiently, while HCVs use these systems to enhance long-haul travel safety. Both segments acknowledge the role of AR in reducing the risk of accidents and improving overall fleet efficiency.

Key Market Segments

By Position Type

- Front

- Rear

By Vehicle Type

- Passenger Car (PC)

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

Driving Factors

AR Innovations and Smart Displays Drive Market Growth

The Augmented Reality (AR) Windshield market is gaining traction due to major advancements in AR and heads-up display (HUD) technologies. These systems project key driving data directly onto the windshield, improving visibility and helping drivers keep their eyes on the road. As a result, they offer enhanced safety and convenience.

There is also growing demand for smart navigation and real-time driver information systems. Drivers want more than just maps—they want alerts about traffic, hazards, and turns without looking away from the road. This has led to strong interest in AR windshields, especially in high-tech vehicle models.

Moreover, automakers are partnering with AR tech companies to speed up innovation. These collaborations blend automotive design with cutting-edge software, enabling more accurate and dynamic displays. At the same time, consumers are increasingly attracted to futuristic in-car experiences. They see AR windshields as the next step in digital driving, combining function and style.

As an example, companies like BMW and Hyundai have already introduced AR elements in select models. This trend shows how AR is becoming a central part of next-gen driving systems.

Restraining Factors

Cost, Tech Gaps, and Regulations Restraint Market Growth

Despite its potential, the AR windshield market faces several barriers. A major concern is the high cost of AR technology. These systems require advanced optics, sensors, and processors, which raise vehicle prices. This makes them less appealing to average buyers and limits adoption mostly to luxury segments.

Another issue is safety. Regulators worry that too much visual information may distract drivers. As a result, strict rules are being considered or already implemented in some regions, delaying broader rollouts. These regulatory concerns create uncertainty for manufacturers.

Technological limitations also affect the market. Current display technologies still struggle with brightness, clarity, and integration under changing light or weather conditions. This makes it hard to ensure consistent performance, especially in real-world driving scenarios.

Furthermore, slow consumer adoption is a challenge. Many drivers are unaware of AR windshield benefits or do not see it as essential. Combined with high pricing, this limits demand in mainstream markets. These factors, taken together, are slowing down mass adoption and pushing the market to rely heavily on innovation and high-end buyers for now.

Growth Opportunities

Fleet Expansion and Smart Features Provide Opportunities

The AR windshield market is positioned to benefit from emerging growth avenues. One such area is commercial and fleet vehicles. Businesses are exploring AR to improve logistics, navigation, and safety for drivers. Real-time route guidance and hazard alerts can help reduce accidents and increase efficiency, especially in delivery or transport services.

Another opportunity lies in the development of customizable AR content. Interactive features, such as driver-specific displays and gesture-based controls, are being tested to enhance user experience. These options can turn the windshield into a personalized control center, appealing to tech-savvy drivers.

Moreover, combining AR with AI and machine learning is opening new doors. These technologies can analyze traffic patterns and update displays in real time, making driving smarter and safer. As these systems learn driver behavior, they can provide tailored guidance and timely alerts.

Luxury and high-tech vehicle segments are also expanding globally. Buyers in these markets are more likely to invest in advanced technologies. Automakers can leverage this demand to test and improve AR solutions. Together, these opportunities pave the way for more practical and scalable AR windshield applications.

Emerging Trends

Interactive Displays and Smart Design Are Latest Trending Factor

Several trends are shaping the future of the AR windshield market. One of the most promising is the rise of mixed reality in vehicles. This approach blends real-world visuals with digital overlays, offering a more immersive driving experience. For example, drivers can see virtual lane guides or points of interest as they move through a city.

Another trend is the rising demand for personalized user interfaces. Modern drivers want control over what is displayed and how. As a result, systems are being designed with customizable dashboards that adapt to user preferences. This adds both convenience and a sense of ownership.

Partnerships are also forming to create lightweight, energy-efficient AR displays. Reducing system weight and power usage helps manufacturers meet fuel efficiency and sustainability goals. These innovations are important for making AR systems more viable across a wider range of vehicles.

Finally, supportive legislation is encouraging the use of safety-enhancing technologies. In regions where advanced driver assistance features are promoted, AR windshields are gaining acceptance. These trends point to a future where smart, interactive displays become a common part of everyday driving.

Regional Analysis

North America Dominates with 38% Market Share

North America leads the Augmented Reality Windshield Market with a 38% share, amounting to USD 146.76 million. This significant market presence is driven by advanced automotive technology integration, high consumer acceptance of augmented reality features, and substantial investments in autonomous vehicles.

The region benefits from the presence of major automotive and technology companies that are pioneers in AR applications. This ecosystem fosters innovation and rapid adoption of AR windshields, which are increasingly seen as a value-added feature in premium vehicles. The ongoing push towards autonomous driving technologies also enhances the need for AR windshields to provide real-time information and enhance driver safety.

The influence of North America in the global Augmented Reality Windshield Market is expected to expand as the demand for smarter and safer vehicles continues to grow. The integration of AR windshields in mainstream vehicles, coupled with advancements in AR technology, will likely boost the market further.

Regional Mentions:

- Europe: Europe holds a significant share in the Augmented Reality Windshield Market, driven by stringent safety regulations and a high rate of technology adoption. The region’s focus on automotive innovation and the presence of leading luxury car manufacturers promote the integration of advanced driving assistance features.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Augmented Reality Windshield Market, fueled by increasing vehicle production and technological advancements. Countries like Japan and South Korea are at the forefront, integrating AR features to enhance connectivity and driver information systems.

- Middle East & Africa: The Middle East and Africa are slowly embracing the Augmented Reality Windshield Market, with luxury vehicle sales and technological investments driving adoption. The market is set to grow as regional consumers show increasing interest in high-tech automotive features.

- Latin America: Latin America’s Augmented Reality Windshield Market is in its nascent stages but shows potential for growth through increasing awareness and gradual adoption of advanced vehicle technologies, especially in premium automotive segments.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Augmented Reality Windshield Market is powered by innovation in automotive safety and driver assistance technologies. The top four companies—AGC Inc, Compagnie de Saint-Gobain, Magna International, and Xinyi Glass Holdings Limited—lead the market through advanced product development and strategic OEM partnerships.

These players specialize in automotive glass manufacturing and have invested in integrating augmented reality (AR) features such as navigation, hazard alerts, and speed display into windshields. Their goal is to make driving safer and more interactive by displaying real-time data directly in the driver’s line of sight.

Key players benefit from close collaboration with global car manufacturers, allowing early integration of AR windshields into luxury and next-generation vehicles. Their production capabilities and advanced research centers help bring new prototypes to market quickly. As vehicles become smarter and more autonomous, demand for AR technology in windshields continues to grow.

Another advantage is their global presence, especially in high-growth regions like Asia Pacific and North America, where demand for premium vehicles and in-car technology is increasing. These companies are also responding to the push for vehicle safety and driver convenience, which positions them well for future expansion.

Major Companies in the Market

- AGC Inc

- Compagnie de Saint-Gobain

- Magna International

- Xinyi Glass Holdings Limited

- Fuyao Glass Industry Group Co Ltd

- Shenzhen Benson Automobile Glass Co Ltd

- Dura Automotive Systems Inc

- Niantic

- Scanta

- Other Key Players

Recent Developments

- BMW’s Panoramic iDrive: On January 2025, BMW introduced its latest iDrive operating system at CES, featuring a 3D heads-up display (HUD) that extends across the entire windshield. This system integrates augmented reality to project essential driving information, navigation guidance, and driver assistance features directly onto the windshield, eliminating traditional dashboard gauges. The technology is set to debut in BMW’s upcoming all-electric Neue Klasse platform, with the first vehicle expected to launch in late 2025.

- WayRay’s Investment Led by Porsche: In September 2024, Swiss technology company WayRay secured an $80 million funding round led by Porsche, with participation from Hyundai Motor Group and other investors. The investment aims to accelerate the development of WayRay’s holographic AR display technology for automotive applications, including augmented reality windshields.

Report Scope

Report Features Description Market Value (2024) USD 386.2 Million Forecast Revenue (2034) USD 1,147.0 Million CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Position Type (Front, Rear), By Vehicle Type (Passenger Car (PC), Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGC Inc, Compagnie de Saint-Gobain, Magna International, Xinyi Glass Holdings Limited, Fuyao Glass Industry Group Co Ltd, Shenzhen Benson Automobile Glass Co Ltd, Dura Automotive Systems Inc, Niantic, Scanta, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Augmented Reality Windshield MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Augmented Reality Windshield MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Inc

- Compagnie de Saint-Gobain

- Magna International

- Xinyi Glass Holdings Limited

- Fuyao Glass Industry Group Co Ltd

- Shenzhen Benson Automobile Glass Co Ltd

- Dura Automotive Systems Inc

- Niantic

- Scanta

- Other Key Players