Global Athleisure Market By Product (Yoga Apparel(Tops, Pants, Shorts, Unitards, Capris, Others), Shirts & T-Shirts, Leggings, Shorts, Others), By Category (Mass, Premium), By End-user (Men, Women, Children), By Distribution Channel (Hypermarkets & Supermarkets, Sporting Goods Retailers, Online, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 104933

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

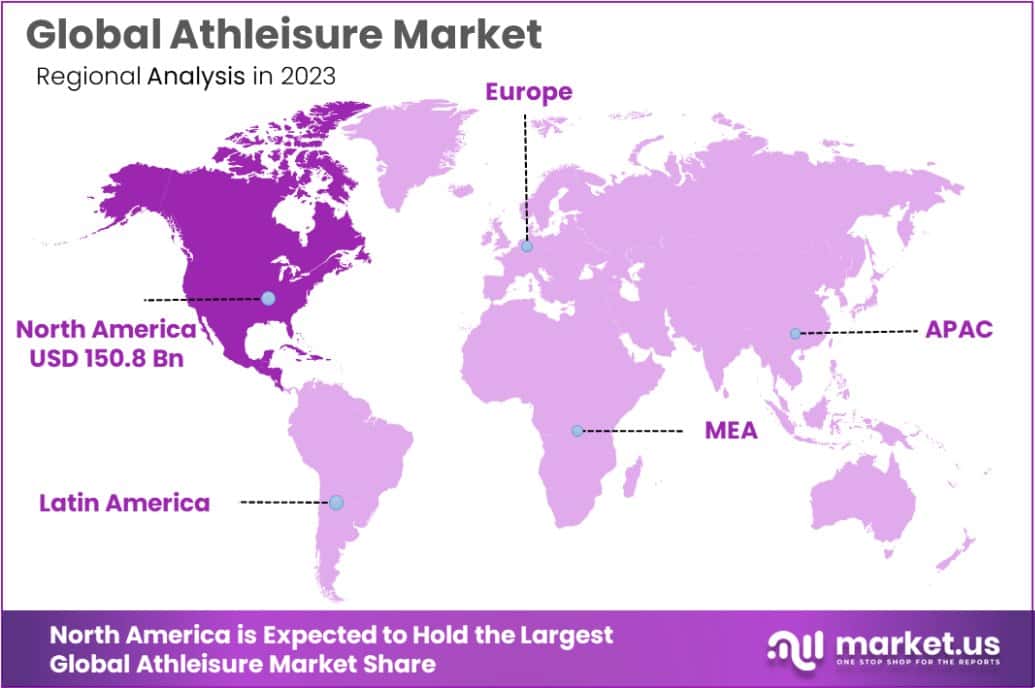

The Global Athleisure Market size is expected to be worth around USD 832.8 Billion by 2033, from USD 358.3 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033. North America dominated a 42.1% market share in 2023 and held USD 150.8 Billion in revenue from the Athleisure Market.

Athleisure refers to a fashion trend characterized by clothing designed for workouts and other athletic activities that are also worn in other settings, such as at the workplace, at school, or at other casual or social occasions. The term blends “athletic” and “leisure” and represents apparel that combines style, comfort, and function.

The Athleisure market comprises the sales of clothing and footwear that are stylish yet comfortable enough to be suitable for both exercise and everyday wear. This market has grown substantially, driven by evolving lifestyle trends and consumer demands for versatile, durable, and functional apparel.

The growth of the athleisure market can be attributed to increasing health consciousness, a surge in fitness enthusiasts, and the integration of fitness into everyday lifestyles. The fashion industry’s pivot towards more casual, comfortable, and versatile clothing has also accelerated market expansion.

Demand for athleisure is fueled by its widespread acceptance across various demographic segments. Enhanced by celebrity endorsements and influencer marketing, athleisure is perceived not only as practical but also as fashionable, impacting consumer preferences across global markets.

The athleisure market presents significant opportunities for expansion into new geographic regions and demographic segments. Innovations in fabric technology and eco-friendly manufacturing processes also offer growth prospects, catering to the rising consumer demand for sustainability in the fashion industry.

The athleisure market has demonstrated robust growth, propelled by evolving lifestyle trends and increasing health consciousness among consumers. As lifestyles continue to incorporate more elements of health and fitness, the demand for athleisure wear has surged, supported by its versatility and fashion-forward appeal.

This sector’s appeal to investors is highlighted by significant funding activities. For example, Agilitas Sports has successfully raised over $60 million through various funding rounds with prominent venture capitalists like Convergent Finance and Nexus Venture Partners, underscoring strong market confidence.

Additionally, early-stage investments are evident, as seen with Aastey, which secured ₹10 crore in seed funding from CXXO, a platform dedicated to empowering women founders. These investments reflect a bullish outlook on the sector’s growth and its potential to innovate and expand.

Key Takeaways

- The Global Athleisure Market size is expected to be worth around USD 832.8 Billion by 2033, from USD 358.3 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

- In 2023, Shirts & T-Shirts held a dominant market position in the By Product segment of the Athleisure Market, with a 39.3% share.

- In 2023, Mass held a dominant market position in the By Category segment of the Athleisure Market, with a 67.1% share.

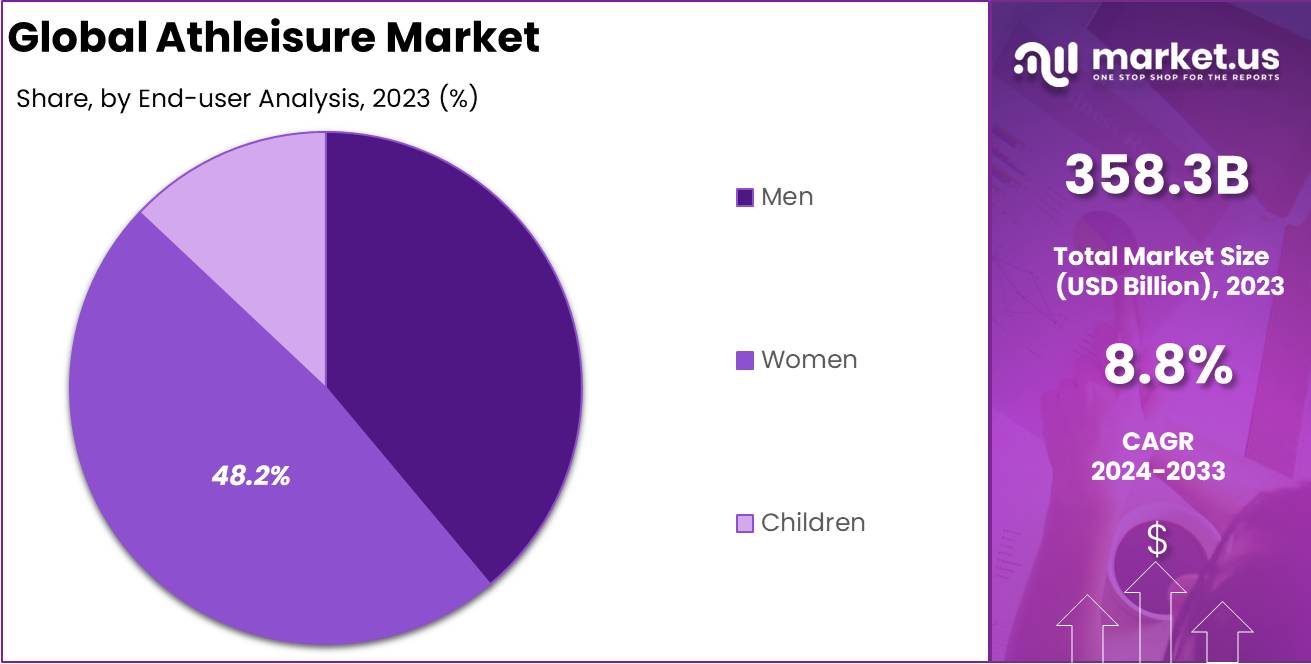

- In 2023, Women held a dominant market position in the end-user segment of the Athleisure Market, with a 48.2% share.

- In 2023, Sporting Goods Retailers held a dominant market position in the By Distribution Channel segment of the Athleisure Market, with a 34.5% share.

- North America dominated a 42.1% market share in 2023 and held USD 150.8 Billion in revenue from the Athleisure Market.

By Product Analysis

In 2023, Shirts & T-Shirts held a dominant market position in the “By Product” segment of the Athleisure Market, capturing a 39.3% share. This category outperformed other apparel types such as Leggings, which accounted for 25.4%, and Shorts, representing 12.1% of the market.

The popularity of Shirts & T-shirts can be attributed to their versatile use across various fitness activities and casual settings, appealing to a broad consumer base seeking comfort and style in their athletic and leisure pursuits.

Further down the list, Yoga Apparel and Tops collectively secured 8.7% of the market, reflecting a targeted but significant demand within niche wellness and fitness communities. Pants and Capris followed, with market shares of 6.2% and 3.5% respectively, indicating a steady preference for traditional and functional athleisure pieces. Unitards and other specialized items grouped under “Others,” including niche products like unitards, collectively accounted for the remaining 4.8% of the market.

The data underscores the continued expansion of the athleisure industry, driven by consumer preferences for multifunctional apparel that accommodates both athletic performance and everyday casual wear, signaling robust growth prospects for Shirts & T-shirts within this burgeoning sector.

By Category Analysis

In 2023, Mass held a dominant market position in the “By Category” segment of the Athleisure Market, with a commanding 67.1% share. This category significantly outpaced the Premium segment, which captured a 32.9% share. The substantial lead of the Mass category can be attributed to its accessibility and wide appeal among a diverse consumer base.

Affordable pricing strategies and extensive distribution channels, including online retail and large-scale chain stores, have played pivotal roles in making mass-market athleisure products readily available to a broader audience.

The Premium segment, while smaller in market share, caters to a niche demographic that values premium materials, exclusive designs, and brand prestige. This segment benefits from consumers’ increasing willingness to invest in higher-quality items that promise enhanced performance and longevity, trends that align with growing health consciousness, and a cultural shift towards sustainable fashion choices.

Overall, the distribution of market shares between Mass and Premium segments illustrates a clear preference for cost-effectiveness coupled with quality, indicating that while consumers are drawn to affordability, there is a significant portion of the market that is willing to pay a premium for added value in their athleisure wear.

By End-user Analysis

In 2023, Women held a dominant market position in the “By End-user” segment of the Athleisure Market, with a 48.2% share. This segment’s strong performance is indicative of the increasing demand for women-specific athleisure wear, reflecting broader social trends towards health, wellness, and casual comfort in women’s daily apparel.

The Men’s segment followed closely, accounting for 39.6% of the market, driven by a growing acceptance of athleisure as everyday and functional wear among male consumers.

Children’s athleisure accounted for the remaining 12.2% of the market. Although smaller in comparison, this segment is gaining traction as parents increasingly opt for comfortable, durable, and versatile clothing options that accommodate the active lifestyles of children. The growth in this segment is further fueled by the rising popularity of sports and outdoor activities among younger demographics.

The overall market dynamics reveal that while women continue to be the primary drivers of the athleisure trend, there is substantial and growing market penetration among men and children. This diversification in the end-user base underscores the universal appeal of athleisure wear and its potential for sustained growth across all demographic segments.

By Distribution Channel Analysis

In 2023, Sporting Goods Retailers held a dominant market position in the “By Distribution Channel” segment of the Athleisure Market, securing a 34.5% share. This channel outperformed other distribution methods, notably Hypermarkets & Supermarkets and Online platforms, which captured 27.8% and 25.2% of the market, respectively.

The prominence of Sporting Goods Retailers can be attributed to their targeted product assortments, expert staff, and the ability to offer consumers a tactile shopping experience where they can assess product quality and fit directly.

Online distribution, while slightly trailing, has shown robust growth, driven by the convenience of home shopping and the broadening reach of e-commerce platforms. This growth is supported by the increasing comfort of consumers with online purchases, bolstered by improved return policies and enhanced digital engagement strategies.

The segment labeled “Others,” which includes specialty stores and department stores, accounted for the remaining 12.5% of the market. These outlets still play a crucial role by catering to niche markets and providing specialized products not widely available in larger chains.

The diverse performance across these distribution channels highlights the shifting patterns of consumer behavior in the athleisure market and points to the potential for further growth and competition, particularly online.

Key Market Segments

By Product

- Yoga Apparel

- Tops

- Pants

- Shorts

- Unitards

- Capris

- Others

- Shirts & T-Shirts

- Leggings

- Shorts

- Others

By Category

- Mass

- Premium

By End-user

- Men

- Women

- Children

By Distribution Channel

- Hypermarkets & Supermarkets

- Sporting Goods Retailers

- Online

- Others

Drivers

Athleisure Market Growth Factors

The Athleisure market is experiencing robust growth, driven primarily by increasing health awareness and a cultural shift towards more casual, comfortable clothing. Consumers are increasingly adopting lifestyles that emphasize fitness and wellness, which has propelled the demand for athleisure apparel that is versatile enough for both exercise and everyday wear.

The rise of remote work and more flexible dress codes has further boosted the popularity of athleisure, as people seek a blend of functionality and style in their attire. Additionally, advancements in fabric technology have improved the comfort, durability, and aesthetic appeal of athleisure wear, making it an attractive choice for a broad demographic.

This convergence of lifestyle changes and technological advancements is significantly shaping the market dynamics, ensuring sustained growth in the athleisure sector.

Restraint

Challenges Limiting Athleisure Market Growth

Despite its strong growth, the Athleisure market faces significant challenges, primarily due to market saturation. As more brands and manufacturers enter this lucrative sector, the market has become overcrowded, making it harder for companies to stand out and maintain profitability.

This saturation often leads to intense price competition, which can erode profit margins and lead to a race to the bottom, where quality may be compromised for cost-cutting. Moreover, fluctuations in the prices of raw materials such as synthetic fibers, which are crucial for making athleisure wear, also pose a risk to maintaining consistent production costs and product pricing.

These factors combine to restrain the market’s potential, limiting growth opportunities for new and existing players in the athleisure apparel industry.

Opportunities

Expanding Opportunities in the Athleisure Market

The athleisure market offers promising opportunities, particularly through expanding into emerging markets and innovating product designs. As athleisure fashion continues to gain traction globally, new markets in developing regions present untapped growth potential.

These regions are witnessing increased urbanization and rising disposable incomes, making them ripe for introducing athleisure as a lifestyle trend. Furthermore, continuous innovation in athleisure products, such as integrating smart technology for enhanced functionality or using sustainable materials to appeal to environmentally conscious consumers, can provide a competitive edge.

These strategic moves can not only attract a broader consumer base but also cater to the growing demand for apparel that supports a versatile, health-conscious lifestyle while being mindful of environmental impacts. This dual focus on geographical and product expansion represents significant opportunities for growth in the athleisure market.

Challenges

Key Challenges in the Athleisure Market

The athleisure market faces several challenges that could impede its growth. A major hurdle is the intense competition among established brands and new entrants, making it difficult to capture and retain customer attention. This competitive pressure often leads to a decrease in prices and profit margins as companies strive to offer cost-effective options to attract consumers.

Additionally, changing fashion trends pose a constant challenge, as athleisure must continuously evolve to stay relevant and appealing to fashion-conscious consumers. There is also the challenge of maintaining a balance between style, comfort, and functionality, which is essential to meet the high expectations of athleisure consumers.

Furthermore, the increasing scrutiny of the environmental and ethical aspects of production in the fashion industry pressures companies to adopt sustainable practices, adding to operational complexities and costs. These challenges require strategic planning and innovation to navigate successfully.

Growth Factors

Driving Forces Behind Athleisure Expansion

The growth of the athleisure market is propelled by several key factors. Firstly, there’s a rising trend of health and wellness fitness consciousness among consumers worldwide, which increases the demand for clothing that is both functional for workouts and stylish for everyday wear.

Additionally, the shift in work environments, with more people working from home, has heightened the demand for comfortable, yet presentable clothing, which athleisure provides. Technological advancements in textile production have also enabled the creation of innovative fabrics that enhance the comfort and functionality of athleisure wear, making it more appealing to consumers.

Moreover, the influence of social media and celebrity endorsements has significantly boosted the visibility and desirability of athleisure apparel. These factors collectively contribute to the sustained growth and popularity of the athleisure market.

Emerging Trends

Emerging Trends Shaping the Athleisure Market

Several emerging trends are significantly shaping the athleisure market, driving its growth and evolution. A notable trend is the incorporation of sustainable practices in the production of athleisure wear, as consumers increasingly prefer eco-friendly products. This shift is leading brands to use organic or recycled materials, appealing to environmentally conscious buyers.

Another trend is the blending of fashion with functionality, where athleisure items are not only designed for athletic activities but are also stylish enough for social settings. Additionally, the integration of technology in athleisure, such as moisture-wicking fabrics and temperature control, enhances the appeal of these garments.

The rise of influencer marketing and social media promotions also continues to play a crucial role in popularizing athleisure wear among diverse demographics. These trends are poised to keep the athleisure market dynamic and growing.

Regional Analysis

The Athleisure market exhibits diverse characteristics across global regions, with North America leading with a dominant 42.1% market share, valued at USD 150.8 billion. This region benefits from a well-established wellness culture and high consumer spending power, which fuel demand for premium athleisure products.

Europe follows, characterized by a strong preference for sustainable and ethically produced athleisure wear, reflecting the region’s heightened environmental awareness.

In Asia Pacific, the market is rapidly expanding due to increasing urbanization and a growing middle class, with countries like China and India emerging as significant contributors to regional growth. This region is expected to exhibit the highest growth rate in the coming years due to its large population base and increasing health consciousness among consumers.

The Middle East & Africa, though smaller in comparison, is seeing an uptick in demand influenced by increasing disposable incomes and a young population. Latin America is also showing promising growth, driven by an active lifestyle trend and the rising popularity of sports and fitness among its population. These regional dynamics underscore the global appeal and expansive growth potential of the athleisure market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, key players such as Nike Inc., Adidas AG, and Under Armour Inc. continue to significantly shape the global Athleisure Market, each leveraging distinct strategies and innovations to capture and expand their market share.

Nike Inc. remains a powerhouse, driven by its strong brand equity and extensive global distribution network. Nike has capitalized on digital engagement and direct-to-consumer sales channels, which have become increasingly important in a market where consumers demand convenience and personalized experiences.

Their commitment to innovation is evident in their product lines featuring sustainable materials and advanced fabric technologies, aligning with the growing consumer preference for eco-friendly products.

Adidas AG has also made substantial gains, focusing heavily on sustainability and inclusivity. Adidas has set industry standards with initiatives like using recycled plastics in their manufacturing processes.

Their marketing strategies, which effectively blend cultural resonance with technological advancements in their products, have helped them maintain a strong position in diverse global markets. Adidas’s collaborations with celebrities and designers continue to keep the brand in the public eye and appeal to a broad consumer base.

Under Armour Inc., while smaller than Nike and Adidas, has carved out a niche by focusing on performance-enhancing athleisure wear. Their emphasis on professional and amateur athlete endorsements and their investments in performance technology have helped distinguish their offerings in a crowded market.

Under Armour’s strategic expansions into emerging markets and enhancements in supply chain efficiencies are key components of its strategy to compete with larger brands.

Together, these companies not only lead but also define the trends within the Athleisure Market through their competitive strategies, innovation, and adept navigation of consumer and technological trends. Their actions set the pace for market dynamics and will likely influence the sector’s trajectory well beyond 2023.

Top Key Players in the Market

- Nike Inc.

- Adidas AG

- Under Armour Inc.

- Lululemon Athletica Inc.

- PUMA SE

- Gap Inc.

- ASICS Corporation

- Hennes & Mauritz AB

- New Balance Athletics Inc.

- Eileen Fisher

- Wear Pact, LLC

- Ajio Company

- COLUMBIA SPORTSWEAR COMPANY

- PVH Corp.

- Esprit Retail B.V. &

- Kalaari Capital

- Patagonia, Inc.

- Lululemon Athletic

- Hanesbrands Inc.

- Other Key Players

Recent Developments

- In August 2023, Gap Inc. acquired a smaller activewear brand, aiming to expand its athleisure offerings and reach a younger demographic.

- In June 2023, PUMA launched a new eco-friendly athleisure line, utilizing 75% recycled materials, targeting environmentally conscious consumers.

- In May 2023, ASICS introduced a cutting-edge shoe technology that increases athletic performance, enhancing their competitive edge in the athleisure market.

Report Scope

Report Features Description Market Value (2023) USD 358.3 Billion Forecast Revenue (2033) USD 832.8 Billion CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Yoga Apparel(Tops, Pants, Shorts, Unitards, Capris, Others), Shirts & T-Shirts, Leggings, Shorts, Others), By Category(Mass, Premium), By End-user(Men, Women, Children), By Distribution Channel(Hypermarkets & Supermarkets, Sporting Goods Retailers, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nike Inc., Adidas AG, Under Armour Inc., Lululemon Athletica Inc., PUMA SE, Gap Inc., ASICS Corporation, Hennes & Mauritz AB, New Balance Athletics Inc., Eileen Fisher, Wear Pact, LLC, Ajio Company, COLUMBIA SPORTSWEAR COMPANY, PVH Corp., Esprit Retail B.V. &, Kalaari Capital, Patagonia, Inc., Lululemon Athletic, Hanesbrands Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nike Inc.

- Adidas AG

- Under Armour Inc.

- Lululemon Athletica Inc.

- PUMA SE

- Gap Inc.

- ASICS Corporation

- Hennes & Mauritz AB

- New Balance Athletics Inc.

- Eileen Fisher

- Wear Pact, LLC

- Ajio Company

- COLUMBIA SPORTSWEAR COMPANY

- PVH Corp.

- Esprit Retail B.V. &

- Kalaari Capital

- Patagonia, Inc.

- Lululemon Athletic

- Hanesbrands Inc.

- Other Key Players