Global At Home Heart Health Testing Market By Product Type (Blood Pressure Monitors, Pulse Oximeters, Blood Glucose Devices, and Cholesterol Testing Kits), By Material (Blood, Saliva, and Urine), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, E-commerce, and Hypermarkets/Supermarkets), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168527

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

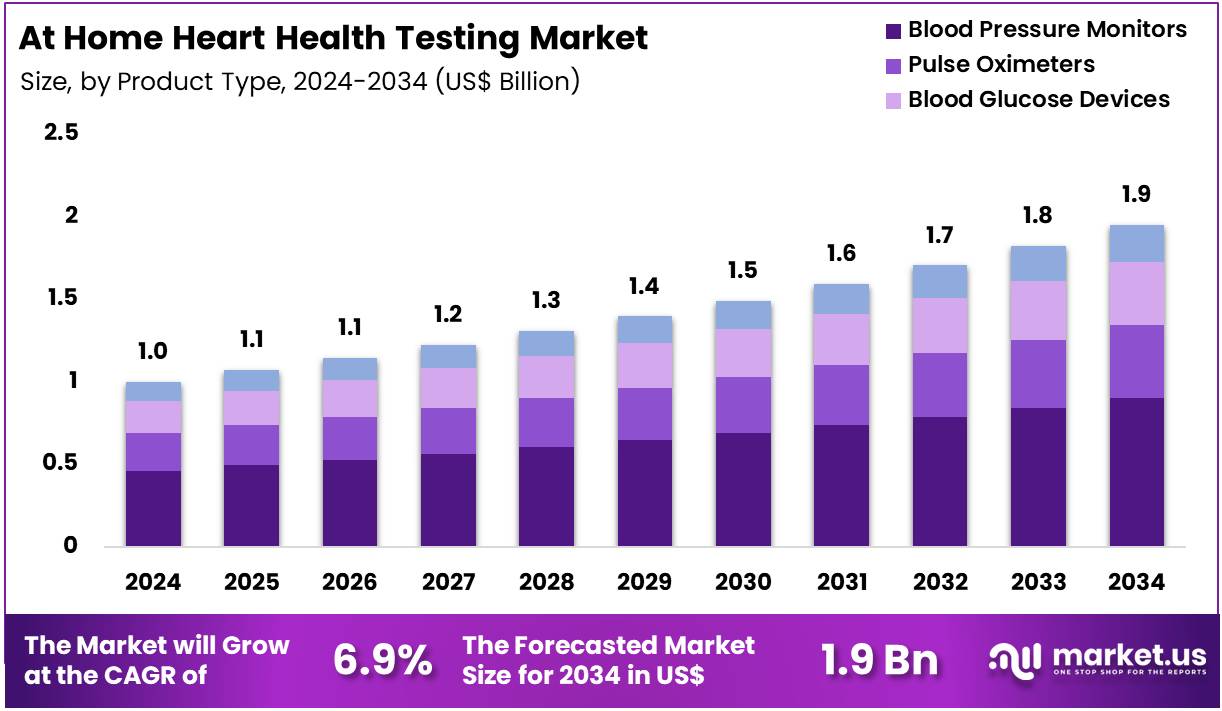

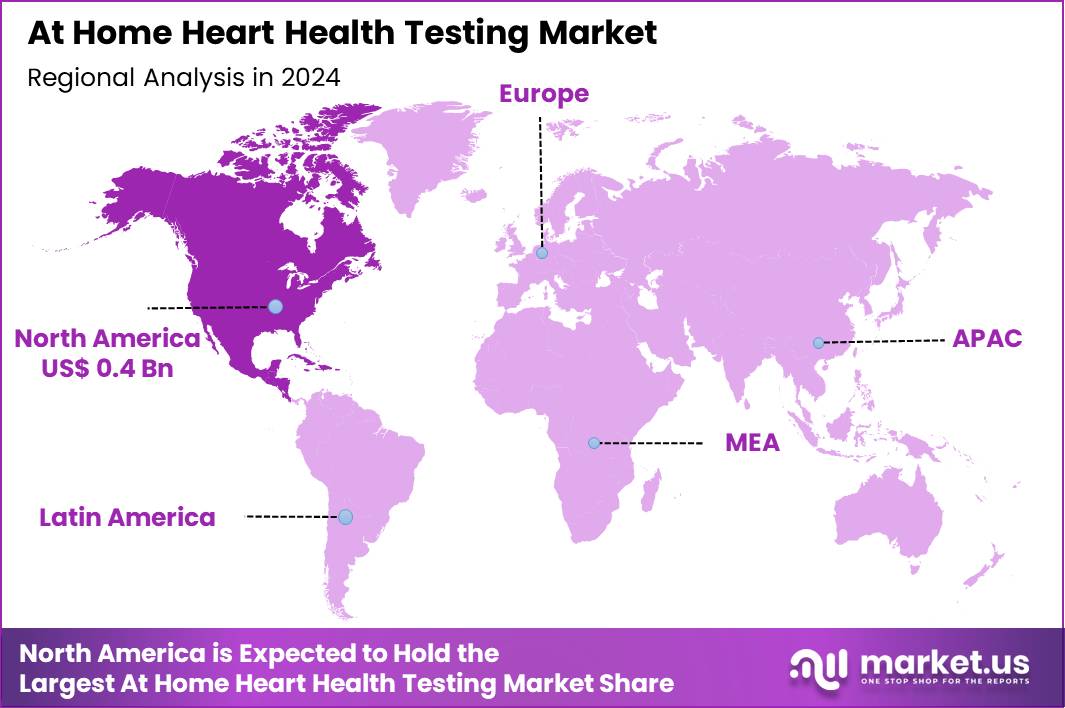

Global At Home Heart Health Testing Market size is expected to be worth around US$ 1.9 Billion by 2034 from US$ 1.0 Billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 0.4 Billion.

Increasing consumer awareness of cardiovascular risks propels the At-Home Heart Health Testing market, as individuals proactively monitor vital signs to prevent emergencies and optimize lifestyle interventions. Device manufacturers innovate with user-friendly kits that integrate smartphone connectivity for seamless data logging and trend analysis.

These tools enable daily blood pressure tracking for hypertension management, ECG recordings to detect atrial fibrillation episodes, cholesterol level assessments via fingerstick samples, and heart rate variability measurements during stress or exercise sessions. Digital integration creates opportunities for personalized coaching apps that interpret results and suggest dietary adjustments.

Omron Healthcare solidified its leadership in this space in April 2024 by broadening its portfolio of non-surgical, consumer-oriented wellness technologies, which enhances self-monitoring accessibility for cardiac risk control. This expansion directly fosters affordable, operable solutions that empower users to manage hypertension independently.

Growing integration with telemedicine platforms accelerates the At-Home Heart Health Testing market, as virtual consultations demand reliable patient-generated data for remote triage and follow-up care. Technology providers develop Bluetooth-enabled monitors that transmit real-time readings to electronic health records for clinician review.

Applications encompass lipid profile self-testing for statin therapy adherence, pulse oximetry for sleep apnea screening, troponin indicator kits for early myocardial infarction alerts, and wearable patches for continuous arrhythmia surveillance in post-discharge patients. Telehealth compatibility opens avenues for subscription-based monitoring services and insurance-reimbursed home diagnostics. Pharmaceutical firms increasingly bundle these devices with medication adherence programs to improve chronic disease outcomes.

Rising advancements in biomarker detection invigorates the At-Home Heart Health Testing market, as biotechnology companies miniaturize lab-grade assays into compact, mail-back formats for comprehensive risk profiling. Innovators engineer biosensors that quantify C-reactive protein for inflammation evaluation and NT-proBNP for heart failure prediction from capillary blood.

These solutions support familial hypercholesterolemia screening through genetic marker tests, endothelial function assessments via nitric oxide proxies, oxidative stress panels for antioxidant therapy guidance, and vascular age estimation based on arterial stiffness metrics. Point-of-care validation creates opportunities for over-the-counter multi-panel kits that complement annual physician visits. Research institutions actively collaborate with device makers to refine accuracy thresholds and accelerate regulatory pathways for broader clinical endorsement.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.0 Billion, with a CAGR of 6.9%, and is expected to reach US$ 1.9 Billion by the year 2034.

- The product type segment is divided into blood pressure monitors, pulse oximeters, blood glucose devices, and cholesterol testing kits, with blood pressure monitors taking the lead in 2024 with a market share of 46.2%.

- Considering material, the market is divided into blood, saliva, and urine. Among these, blood held a significant share of 58.3%.

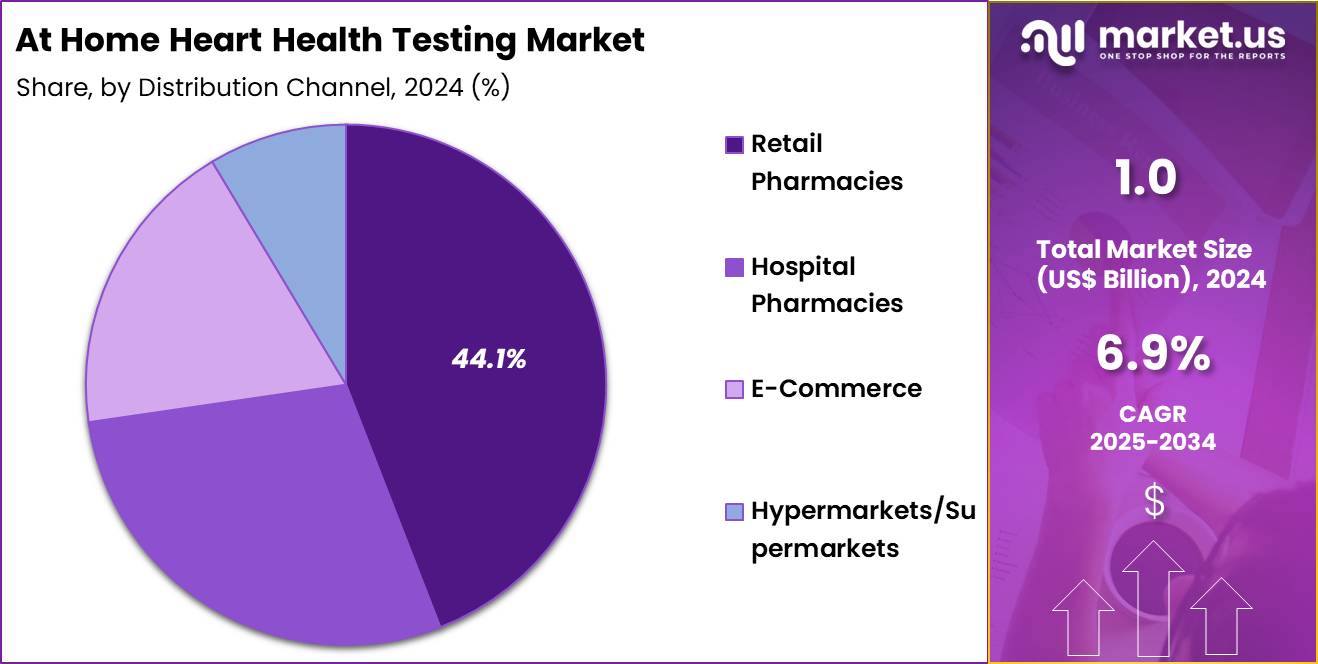

- Furthermore, concerning the distribution channel segment, the market is segregated into retail pharmacies, hospital pharmacies, e-commerce, and hypermarkets/supermarkets. The retail pharmacies sector stands out as the dominant player, holding the largest revenue share of 44. 1% in the market.

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

Blood pressure monitors, holding 46.2%, are expected to dominate due to rising global hypertension prevalence and growing preference for continuous home-based monitoring. Consumers adopt digital BP monitors as they support early detection of cardiovascular risks. Manufacturers introduce compact, app-connected devices that improve accuracy and tracking, strengthening adoption. Healthcare providers encourage at-home BP monitoring to enhance long-term disease management.

Awareness programs highlight the importance of daily blood-pressure tracking, increasing usage among middle-aged and elderly populations. Retailers expand availability of clinically validated BP monitors, boosting accessibility. Advancements in cuff design and measurement algorithms improve user comfort and reliability. Insurance programs in several countries promote at-home monitoring to reduce hospital visits. Increased focus on preventive cardiology further expands demand. These factors keep blood pressure monitors anticipated to remain the leading product type.

Material Analysis

Blood-based testing, holding 58.3%, is anticipated to dominate due to its high diagnostic accuracy for lipid profiles, glucose levels, inflammatory markers, and other cardiovascular indicators. Consumers rely on blood-based kits for early detection of high cholesterol, triglycerides, and cardiac risk biomarkers. At-home lancet devices and simplified collection cards increase user comfort and boost adoption.

Clinical studies support the reliability of finger-prick samples for cardiovascular assessment, strengthening trust. Digital testing platforms integrate blood results into mobile dashboards for trend monitoring. Home-based screening programs encourage routine heart-health monitoring, raising blood-test demand.

Manufacturers develop multi-marker blood panels that provide broader risk insights. Preventive-health campaigns emphasize blood biomarkers for early risk stratification. Growth in lifestyle diseases increases consumer need for regular blood assessment. These drivers keep blood positioned as the most influential sample material.

Distribution Channel Analysis

Retail pharmacies, holding 44.1%, are expected to dominate distribution due to their accessibility, trusted service environment, and growing role in preventive health. Consumers prefer retail pharmacies for at-home heart-testing products due to immediate availability and professional guidance. Pharmacies partner with diagnostic brands to stock validated devices and test kits, expanding choices.

Awareness campaigns run by pharmacists increase adoption of at-home BP, cholesterol, and glucose tests. Retail chains expand shelf space for digital monitoring devices as demand rises. Pharmacies operate loyalty programs that encourage regular purchases of home-testing supplies. Urban and semi-urban areas experience increasing pharmacy density, improving access to consumers.

Pharmacists recommend at-home testing to support medication adjustments and risk assessments. Retail pharmacies also act as key pick-up points for subscription-based test kits. These factors keep retail pharmacies anticipated to remain the primary distribution channel in the at-home heart health testing market.

Key Market Segments

By Product Type

- Blood Pressure Monitors

- Pulse Oximeters

- Blood Glucose Devices

- Cholesterol Testing Kits

By Material

- Blood

- Saliva

- Urine

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- E-commerce

- Hypermarkets/Supermarkets

Drivers

Rising Prevalence of Cardiovascular Diseases is Driving the Market

The increasing prevalence of cardiovascular diseases worldwide serves as a fundamental driver for the at-home heart health testing market, as consumers seek convenient tools for early detection and monitoring. This trend is fueled by aging populations and lifestyle factors contributing to hypertension and arrhythmias, prompting demand for accessible devices like home ECG monitors. Healthcare providers encourage self-testing to alleviate clinic burdens, integrating results into virtual consultations for proactive management.

Manufacturers are responding with user-friendly kits that measure blood pressure and cholesterol without professional oversight. Regulatory endorsements validate these products for consumer use, ensuring safety in non-clinical environments. Public awareness campaigns highlight the benefits of routine home checks in preventing heart events. Economic pressures from rising healthcare costs motivate individuals to adopt affordable testing options.

Collaborative initiatives between medical societies and tech firms accelerate innovation in accurate, app-connected devices. This driver sustains growth through recurring consumable sales, such as test strips and sensors. Educational resources empower users to interpret results correctly, fostering long-term adherence. The Centers for Disease Control and Prevention reported that coronary heart disease caused 371,506 deaths in the United States in 2022.

Restraints

Accuracy and Reliability Concerns are Restraining the Market

Concerns over the accuracy and reliability of at-home heart health tests represent a primary restraint, as inconsistent results can lead to misdiagnosis or delayed medical intervention. Many devices struggle with user error in application, such as improper electrode placement on ECG monitors, compromising data validity. This issue erodes consumer confidence, limiting widespread adoption despite marketing claims of precision.

Regulatory scrutiny intensifies, with agencies requiring rigorous clinical validations that slow product launches. Manufacturers face challenges in standardizing performance across diverse user demographics, including varying skin tones and body types. The restraint exacerbates health disparities, as vulnerable populations may distrust self-testing outputs.

Professional guidelines caution against sole reliance on home results, redirecting users to confirmatory clinical exams. Supply of validated devices remains limited, inflating costs for reliable options. These factors collectively hinder market maturation, favoring traditional in-office diagnostics. Addressing this demands enhanced instructional designs and AI-assisted error correction.

Opportunities

Expansion of Telehealth Integration is Creating Growth Opportunities

The growing integration of at-home heart health testing with telehealth platforms is generating significant growth opportunities, enabling seamless data sharing between users and remote clinicians. This synergy allows real-time review of home-captured metrics, facilitating personalized advice without physical visits. Opportunities arise in developing hybrid apps that aggregate test data with wearable inputs for comprehensive profiles.

Regulatory frameworks support this by reimbursing telehealth-linked testing, incentivizing provider adoption. Partnerships between device makers and digital health services expand reach to underserved rural areas. The model reduces emergency admissions by enabling early flagging of abnormalities. Economic analyses project savings from averted hospitalizations, appealing to payers and insurers.

Global scalability emerges as telehealth infrastructure matures in emerging markets. These developments diversify revenue through subscription-based monitoring ecosystems. Sustained clinical trials will validate efficacy, solidifying market positioning. In 2023, 17% of healthcare visits in the United States were conducted remotely.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends strongly favor the At Home Heart Health Testing market as consumers and insurers embrace convenient, self-monitoring solutions amid rising cardiovascular risks and an aging global population. Companies actively expand their portfolios with user-friendly kits for cholesterol, blood pressure, and ECG tracking to meet this surging demand and enhance preventive care access.

Inflationary strains and economic uncertainties, however, challenge affordability for budget-conscious households and prompt retailers to limit shelf space for premium home devices in volatile markets. Geopolitical discord, particularly US-China frictions, undermines supply chains for electronic sensors and biochemical strips, requiring manufacturers to absorb delays and reroute shipments through riskier paths. These tensions further escalate raw material volatility and hinder international R&D partnerships vital for next-gen accuracy improvements.

Current US tariffs, including a 10% baseline on most imports since April 2025, sharply elevate component costs for diagnostic kits, which providers relay to end-users and briefly dampen adoption rates in price-sensitive segments. Enterprises counter effectively by accelerating US reshoring efforts, tapping federal incentives for domestic assembly, and forging alliances with tariff-exempt suppliers in Canada and Europe. Ultimately, the market fortifies its foundation through these resilient moves, empowering at-home heart health testing as a cornerstone of accessible, proactive wellness strategies.

Latest Trends

FDA Clearance for HeartBeam At-Home ECG System is a Recent Trend

The U.S. Food and Drug Administration’s clearance of advanced at-home ECG systems has emerged as a prominent trend in 2024, emphasizing high-fidelity arrhythmia detection without clinical supervision. This innovation allows users to generate 12-lead equivalents from smartphone attachments, transforming personal devices into diagnostic tools. The trend prioritizes AI algorithms to filter noise and flag irregularities, enhancing usability for non-experts.

Developers are incorporating cloud uploads for physician review, aligning with virtual care models. Regulatory focus on validation data accelerates similar clearances, fostering competitive advancements. Adoption in consumer wellness apps integrates ECG with lifestyle tracking for holistic insights. This shift reduces barriers to frequent monitoring, particularly for high-risk individuals.

Broader implications include applications in post-discharge follow-up, minimizing readmissions. The trend intersects with wearable ecosystems, previewing seamless data fusion. Ethical considerations address privacy in transmitted cardiac profiles. On December 16, 2024, the U.S. Food and Drug Administration granted 510(k) clearance to the HeartBeam system for comprehensive arrhythmia assessment.

Regional Analysis

North America is leading the At Home Heart Health Testing Market

North America accounted for 41.3% of the overall market in 2024, and the region saw strong expansion as consumers increasingly adopted home-based cardiac-risk monitoring supported by digital health ecosystems. Higher awareness of early detection encouraged adults to regularly track cholesterol, hs-CRP, and other cardiac biomarkers without visiting clinics. Insurers expanded reimbursement for remote cardiac monitoring, which strengthened adoption across older adults and high-risk groups.

Technology companies introduced app-linked self-testing kits that enabled continuous data sharing with cardiologists. The CDC reported 699,659 heart-disease deaths in the United States in 2022 (CDC – National Center for Health Statistics, Heart Disease Facts), and this high burden prompted wider uptake of preventive home diagnostics. Pharmacies expanded online kit distribution, while telehealth platforms improved virtual cardiac-care access. These factors collectively accelerated regional market growth through 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record steady growth during the forecast period as consumers prioritize preventive cardiology and shift toward convenient diagnostic options. Urban populations increasingly seek rapid self-screening tools to monitor lipid levels and blood-pressure-related risks. Governments strengthen national cardiovascular-disease control programs, which encourages greater adoption of digital testing solutions.

Hospitals integrate remote monitoring into chronic-care pathways, pushing more patients to adopt home-based testing. Rising smartphone penetration improves engagement with app-connected biomarker kits. The Japan Ministry of Health, Labour and Welfare reported 208,378 heart-disease deaths in 2022 (MHLW Vital Statistics Japan 2022), and this rising disease load fuels demand for early detection tools.

Diagnostic companies expand distribution channels across Japan, South Korea, and Southeast Asia. These developments position the region for sustained long-term expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Market participants pursue strategic growth by developing integrated devices that combine ECG, blood-pressure monitoring and cholesterol analytics to offer broader cardiovascular insights in the home. They expand through digital health partnerships that enable mobile apps, cloud connectivity and tele-consultation services, thereby creating sticky ecosystems around cardiovascular wellness.

They scale globally by entering emerging health-conscious markets, tailoring local regulatory-compliant versions of monitoring kits and deploying direct-to-consumer online channels. They reinforce brand trust via clinical-validation studies, health-care professional endorsements and certification adherence to attract consumers who prioritise accuracy and reliability.

They adopt subscription or service-based models that bundle hardware, software analytics and periodic diagnostics to increase recurring revenue and customer retention. Abbott Laboratories provides a strong example: the company operates across diagnostics, nutrition and medical-devices segments, serves over 160 countries, and leverages its diagnostic division to support at-home cardiovascular monitoring solutions.

Top Key Players

- Siemens Healthineers

- Roche Diagnostics

- QuidelOrtho Corporation

- Omron Healthcare

- LetsGetChecked

- Everlywell

- Cue Health

- BioTelemetry

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

Recent Developments

- In April 2024, Abbott Laboratories increased its investment in research and development to advance next-generation therapeutic devices. While focused on improving outcomes in men’s health, these investments also strengthen Abbott’s broader diagnostics ecosystem. As Abbott expands its capabilities in sensor technology, digital monitoring, and patient-centric device design, it indirectly supports the adoption of home-based heart health tests. The company’s emphasis on more intuitive, patient-friendly devices helps normalize remote monitoring and encourages consumers to use at-home cardiovascular screening tools for ongoing wellness tracking.

- In September 2023, Philips Healthcare advanced its portfolio of non-invasive and minimally invasive devices designed for comfortable user experiences. This focus on ease-of-use and non-clinical treatment settings accelerates consumer trust in health technologies that can be used outside the hospital. As Philips continues building expertise in remote diagnostics and connected care systems, these innovations enhance the infrastructure needed for at-home heart health testing. The company’s design philosophy supports a market shift toward devices that deliver reliable cardiovascular insights without requiring in-person clinical visits.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 Billion Forecast Revenue (2034) US$ 1.9 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Blood Pressure Monitors, Pulse Oximeters, Blood Glucose Devices, and Cholesterol Testing Kits), By Material (Blood, Saliva, and Urine), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, E-commerce, and Hypermarkets/Supermarkets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Roche Diagnostics, QuidelOrtho Corporation, Omron Healthcare, LetsGetChecked, Everlywell, Cue Health, BioTelemetry, Becton, Dickinson and Company (BD), Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  At Home Heart Health Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

At Home Heart Health Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Roche Diagnostics

- QuidelOrtho Corporation

- Omron Healthcare

- LetsGetChecked

- Everlywell

- Cue Health

- BioTelemetry

- Becton, Dickinson and Company (BD)

- Abbott Laboratories