Global Artificial Tendons and Ligaments Market By Application (Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries and Others) By End-use (Hospitals & Clinics and Ambulatory Surgery Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 65628

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

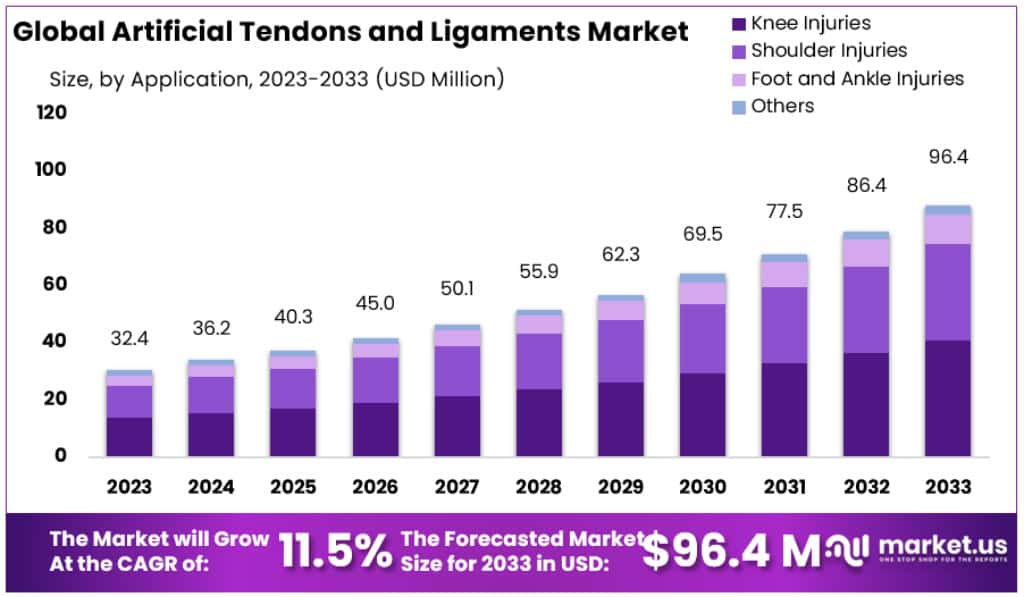

The Global Artificial Tendons and Ligaments Market size is expected to be worth around USD 96.4 Million by 2033, from USD 32.4 Million in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

Artificial tendons and ligaments are devices used to replace damaged or missing tendons and ligaments, respectively. They are made from synthetic materials and have been developed to mimic the structure, strength, and durability of natural tendons and ligaments.

The increasing prevalence of injuries in sports drives this market. Sports injuries are often caused by improper equipment, bad training, improper practice, inadequate warm-up, stretching, or the absence of conditioning. Sports injuries commonly seen in athletes include groin pulls, hamstring strains, ACL tears, tennis elbow, and hamstring strains.

Key Takeaways

- Market Size: The Artificial Tendons and Ligaments Market is expected to be worth USD 96.4 million by 2033, a significant increase from USD 32.4 million in 2023.

- Market Growth: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% from 2024 to 2033.

- Application Analysis: Knee Injuries held the largest market share in 2023, accounting for over 42.5% of the market.

- End-use Analysis: Hospitals & Clinics dominated the market in 2023, with a share of more than 64%.

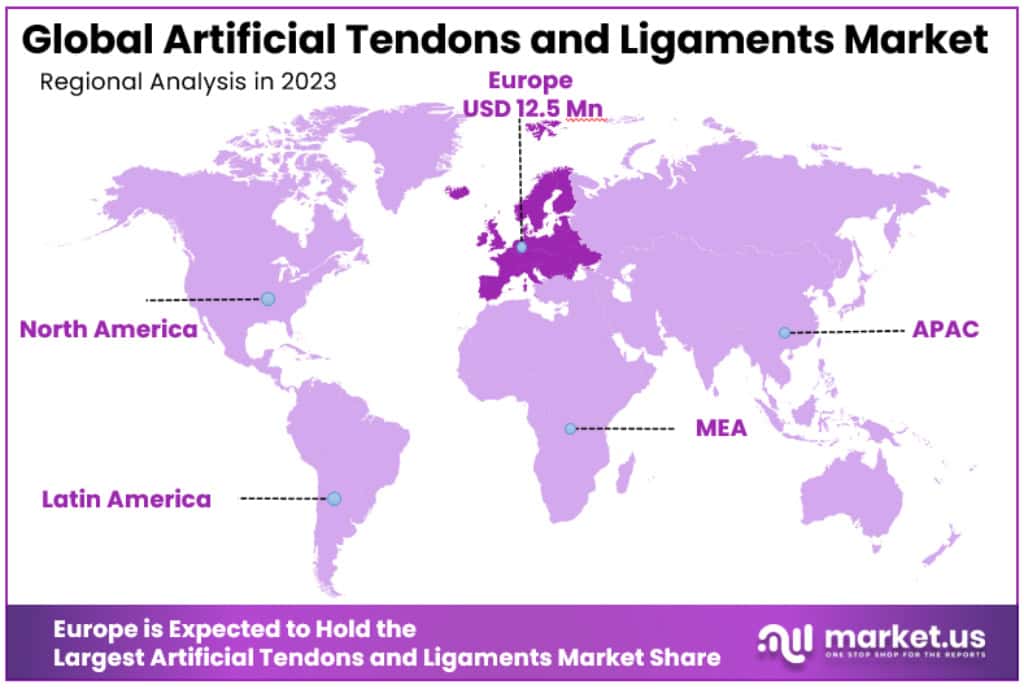

- Regional Analysis: Europe dominated the market in 2023, with a value of USD 12.5 million.

- Technological Advancements: Innovations in biomaterials and tissue engineering are enhancing product durability and biocompatibility.

- Challenges and Opportunities: High costs and post-surgical complications are challenges; opportunities lie in cost-effective solutions and emerging markets.

- Aging Population Impact: Increasing global aging population drives demand due to higher susceptibility to musculoskeletal disorders and injuries.

Application Analysis

Knee Injuries

In 2023, Knee Injuries held a dominant market position, capturing more than a 42.5% share. This significant portion is due to the high incidence of sports-related knee injuries and the aging population experiencing knee degeneration. Innovative artificial tendons and ligaments, offering better outcomes and quicker recovery, are driving this segment’s growth.

Shoulder Injuries

Shoulder injuries form another vital segment in the market. Although smaller than knee injuries, this segment benefits from increased awareness and improved surgical techniques. Athletes, particularly in sports involving overhead activities, frequently sustain shoulder injuries, boosting demand for advanced artificial solutions.

Foot and Ankle Injuries

The market for artificial tendons and ligaments for foot and ankle injuries is growing steadily. Factors such as lifestyle-related sports activities and accidents contribute to this trend. The foot and ankle segment, though not as large as knee injuries, is gaining traction due to improved success rates in surgeries and prosthetics.

Other Injuries

This segment includes injuries related to the hip, spine, and elbows, among others. While it holds a smaller share compared to knee and shoulder injuries, it shows potential for growth. Innovations in artificial tendons and ligaments, catering to a wider range of injuries, are expected to propel this segment in the coming years.

End-use Analysis

Hospitals & Clinics

In 2023, Hospitals & Clinics held a dominant market position, capturing more than a 64% share. This dominance is largely due to their comprehensive facilities and the trust patients place in them for complex procedures. Hospitals and clinics, equipped with advanced technologies and specialized staff, are the primary choice for tendon and ligament surgeries, driving their high market share.

Ambulatory Surgery CentersAmbulatory Surgery Centers (ASCs) are rapidly growing in this market. They are favored for their cost-effectiveness and convenience, especially for less complicated procedures. In 2023, ASCs have seen an increase in patient preference due to their efficiency, shorter waiting times, and the trend towards outpatient surgical procedures.

Кеу Маrkеt Ѕеgmеntѕ

By Application

- Knee Injuries

- Shoulder Injuries

- Foot and Ankle Injuries

- Others

By End-Use

- Hospitals & Clinics

- Ambulatory Surgery Centers

Driver

Lifting and carrying heavy objects, strenuous exercises, accidents, and other illnesses are the key growth factors for the artificial tendons and ligaments market. When people around the world are active through the engagement of sports and other related physical activities they end up injuring themselves through situations like ligament tears and tendon ruptures. This trend is more inevitable especially in the case of the young people who are involved in some of these highly intense activities.

In addition, the growing number of geriatrics also leads to the vulnerability of musculoskeletal disorders and thus the use of artificial tendons and ligaments. From the American Academy of Orthopaedic Surgeons, more than 4. 5 million knee surgeries alone are conducted annually in the U. S. This is something that will expectantly open a great market to the creation of robotic surgeries especially for this knee operations.

Trend

As for the emerging trends in market development, significant changes cover the usage of sophisticated biomaterials and tissue engineering in the manufacture of artificial tendons and ligaments. Advancements in these fields are paving way for product design that are more rugged and that are functional in the human body hence improving the efficiency of surgeries.

For example, implants that dissolve in the body and are replaced by the tissues are increasingly being used. This trend does not only enhance the quality of a patient’s life, but it also minimizes the chances of getting long-term adverse effects of having synthetic implants. One more noticeable trend is the application of 3D printing, which allows for better adaptation of the implants the patient’s anatomy.

Restraint

This factor is a major limitation since the artificial tendons and ligaments are very expensive in the global market. The growth and manufacture of these high-end technologies entail heavy capital investments meaning high costs for the consumers on the other end. Also, the expenses of surgery and post-surgery treatment may be unbearable to many patients especially in the developing nations where health care costs are usually high.

These are major financial barriers that limit the use of such products. In order to overcome this challenge companies are working or identifying cost efficient strategies to reduce cost of these treatments and to look or ways to secure reimbursement for these treatments.

Opportunity

There are new opportunities in the manufacture and application of artificial tendons and ligaments, especially in the Asia-Pacific and Latin American markets. These areas are experiencing a sharp rise in healthcare costs and developments of health facilities. Thirdly, increased knowledge and understanding of the availability of improved treatment interventions by patients and physicians has fueled the need for unique orthopedic solutions.

Such opportunities should not be ignored by companies aiming to increase their presence in these regions, collaborate with local healthcare providers, and enter strategic partnerships. Moreover, a rise in interest in medical tourism in countries such as India and Thailand also presents other opportunities for the development of market participants.

Regional Analysis

Europe is dominating Artificial Tendons and Ligaments Market Market with USD 12.5 million value in 2023. This was due to increasing consumer acceptance and better knowledge about artificial grafts for various sports injuries. The presence of major regional players will also stimulate market growth.

France, Germany, and the United Kingdom are Europe’s largest markets. They accounted for more than 59% of all income in 2018. Because more people participate in sports in Europe, this has resulted in increased Anterior Cruciate Ligament (ACL) ruptures.

According to a 2017 Health Economics Review paper, Germany treats approximately 30,000 ACL ruptures annually. As per a 2017 Health Economics Review paper, the hospital costs in Germany are US$129.61 million.

APAC is expected to experience significant market expansion over this forecast period. This industry is driven by significant investments in R&D by international market leaders and growing public awareness concerning artificial tendons, ligaments, and ACL surgeries. China and India are expected to expand at a rapid pace, however, Australia & Japan have established markets in this area. Orthopedic surgery involving the knee, ankle, and shoulder often uses autologous, allogenic ligaments. Despite the fact that LARS artificial ligament is widely used in Canada & other European countries, the U.S. FDA is yet to approve the same.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Corin Group, Xiros Ltd. (Neoligament), and Mathys AG Bettlach are three of the most notable industry players. To boost their respective market position, these businesses are now concentrating on growing their circulation networks, R&D facilities, and given geographic reach. They participate in conferences to display their goods and expand their clientele. Orthomed S.A.S., Arthrex Inc., Olympus, Cousin Biotech, FX Solutions, and Stryker Corporation are other key players in this market.

Маrkеt Кеу Рlауеrѕ

- Corin Group

- Xiros Ltd. (Neoligament)

- Mathys AG Bettlach

- Orthomed S.A.S.

- Arthrex Inc.

- Olympus

- Cousin Biotech

- Artelon

- Corin Groups

- F H Orthopedics

- fx solutions

- Mathys AG

- FX Solutions

- Integra Lifesciences Corporation

- Stryker Corporation

- Other Key Players

Recent Developments

- Corin Group (March 2024): Corin Group acquired Precision Orthopedics Ltd., enhancing its portfolio with advanced orthopedic solutions. This acquisition aims to integrate innovative tendon and ligament repair technologies, strengthening Corin Group’s market position in the artificial tendons and ligaments segment.

- Xiros Ltd.(April 2024): Xiros Ltd. introduced the Neoligament Plus, an advanced artificial ligament designed for superior durability and biocompatibility. This new product leverages the latest biomaterials to offer enhanced performance and quicker recovery times for patients undergoing ligament reconstruction surgeries.

- Arthrex Inc.(May 2024): Arthrex Inc. launched the BioLigament System, an advanced artificial ligament solution incorporating bioresorbable materials. This product aims to improve patient outcomes by providing a more natural integration with the body’s tissues, reducing long-term complications.

- Olympus (June 2024): Olympus merged with Meditech Solutions, aiming to enhance its orthopedic division with advanced tendon and ligament repair technologies. This merger is set to strengthen Olympus’s market position and expand its product offerings in the artificial tendons and ligaments sector.

- Cousin Biotech (March 2024): Cousin Biotech introduced the FlexiTendon, a new artificial tendon designed for high flexibility and strength. This product is targeted at patients requiring robust tendon repair solutions, offering improved functionality and faster recovery times.

Report Scope

Report Features Description Market Value (2023) USD 32.4 Million Forecast Revenue (2033) USD 96.4 Million CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries and Others) By End-use (Hospitals & Clinics and Ambulatory Surgery Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Corin Group, Xiros Ltd. (Neoligament), Mathys AG Bettlach, Orthomed S.A.S., Arthrex Inc, Olympus, Cousin Biotech, Artelon, Corin Groups, F H Orthopedics, fx solutions, Mathys AG, FX Solutions, Integra Lifesciences Corporationm, Stryker Corporation and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Tendons and Ligaments MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Artificial Tendons and Ligaments MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Corin Group

- Xiros Ltd. (Neoligament)

- Mathys AG Bettlach

- Orthomed S.A.S.

- Arthrex Inc.

- Olympus

- Cousin Biotech

- Artelon

- Corin Groups

- F H Orthopedics

- fx solutions

- Mathys AG

- FX Solutions

- Integra Lifesciences Corporation

- Stryker Corporation

- Other Key Players