Global Artificial Disc Replacement Market Analysis By Type (Metal, Metal and Plastic), By Indication (Cervical Disc Replacement, Lumbar Disc Replacement), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 48639

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

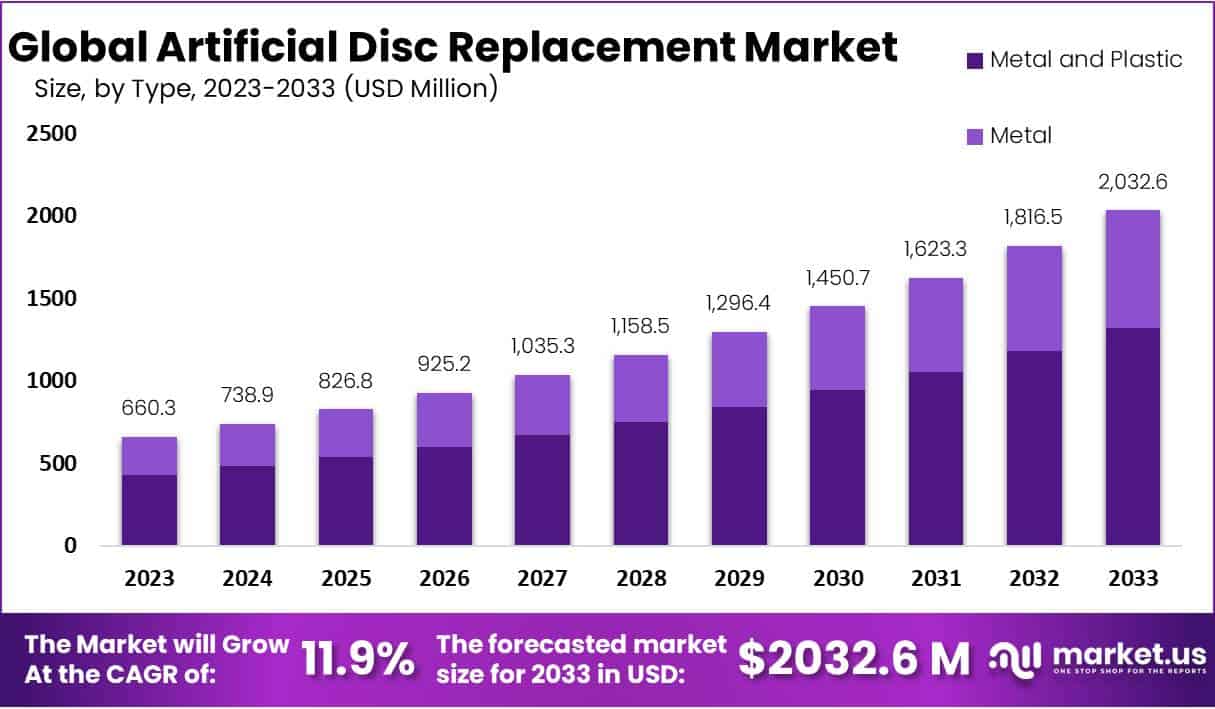

The Artificial Disc Replacement Market Size is anticipated to reach a value of approximately USD 2,032.6 million by the year 2033, showing significant growth compared to its USD 660.3 million valuation in 2023. This growth is projected to occur at a Compound Annual Growth Rate (CAGR) of 11.9% from 2024 to 2033.

Artificial Disc Replacement (ADR), or Total Disc Replacement (TDR), is a surgical intervention addressing spinal issues by replacing damaged intervertebral discs with artificial counterparts. During this procedure, surgeons remove the compromised disc, inserting an artificial one designed to mimic the spine’s natural movement. The primary objective is to alleviate pain, enhance mobility, and sustain spinal function. ADR, an alternative to traditional spinal fusion, preserves range of motion, potentially reducing risks like adjacent segment degeneration.

The Artificial Disc Replacement Market encompasses the industry revolving around artificial disc development, manufacturing, and distribution. This market burgeons with an aging population, a surge in degenerative disc diseases, and advancements in implant technologies. Key players like Medtronic, Zimmer Biomet and other key industres contribute to the market’s growth, driven by innovative designs and materials. Challenges include regulatory complexities and the ongoing need for extensive clinical data to validate the long-term efficacy of artificial discs, despite their competitive edge against traditional spinal fusion procedures.

Key Takeaways

- Market Growth: The Artificial Disc Replacement Market is set to reach USD 2,032.6 million by 2033, displaying a robust 11.9% CAGR from 2024 to 2033.

- By Type Dominance: In 2023, Metal and Plastic held over 65% market share, valued at USD 660.3 million, due to its durability and adaptability.

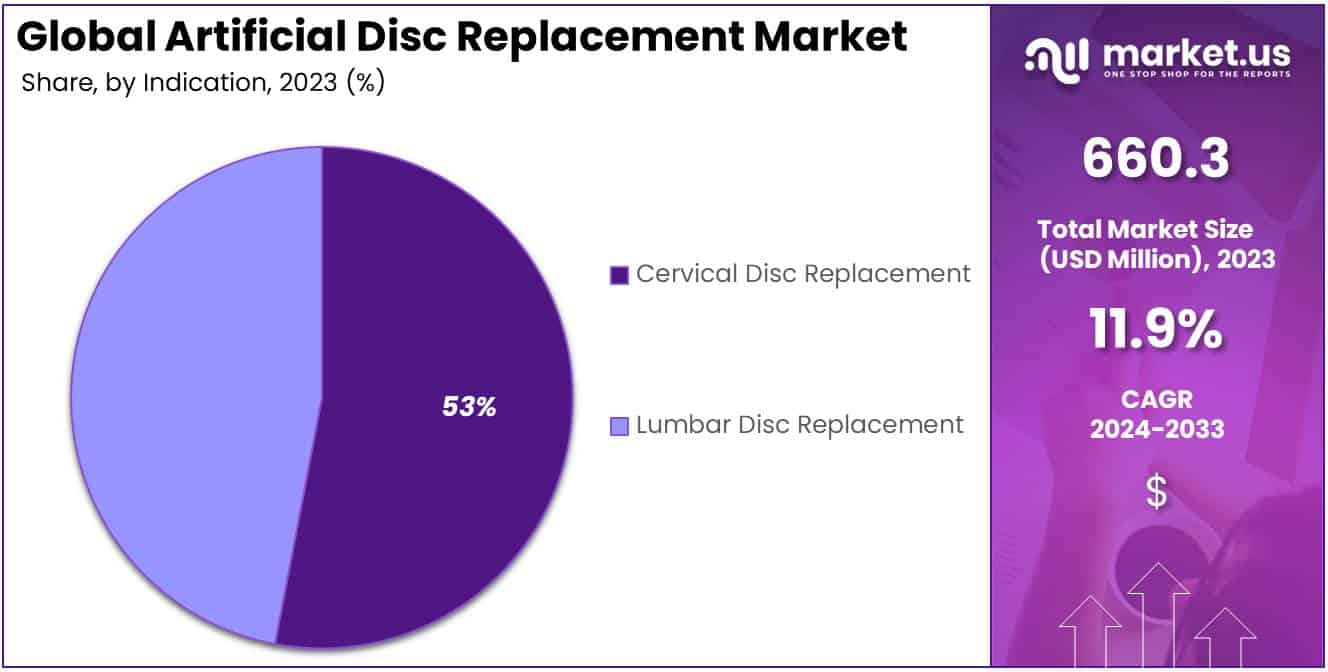

- By Indication: Cervical Disc Replacement led with 53% market share in 2023, addressing specific neck region issues.

- Driver of Growth: Continuous technological advancements drive the thriving ADR market, enhancing efficiency and reducing complications.

- Aging Population Impact: The rising global aging population significantly contributes to the ADR market growth, addressing increased degenerative disc disease cases.

- Cost Constraint: High procedure costs act as a significant restraint, limiting ADR access, especially in regions with financial barriers.

- Reimbursement Challenges: Limited reimbursement policies hinder market expansion, dissuading patients and healthcare providers in certain regions.

- Opportunity in Emerging Markets: Emerging economies offer substantial growth opportunities as healthcare infrastructure improves, unlocking new markets.

- Personalized Solutions Trend: Customizing ADR solutions to individual patient needs presents growth potential, attracting those seeking optimized treatments.

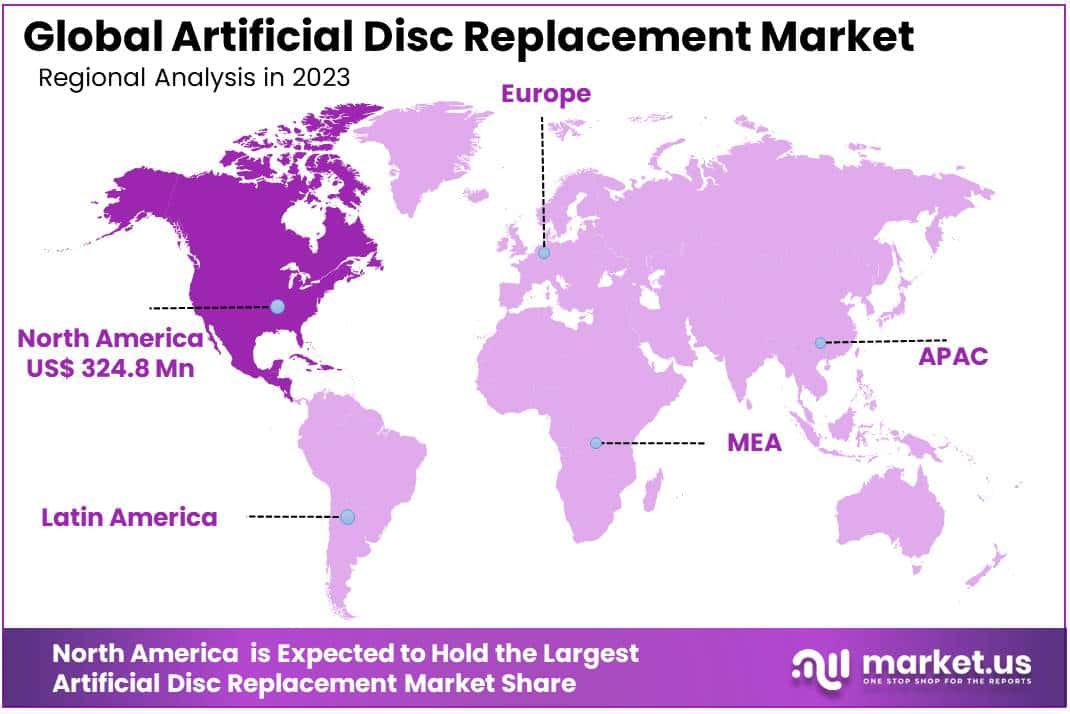

- Regional Leadership: North America leads with over 49.2% market share in 2023, driven by a well-established healthcare infrastructure and technological adoption.

Type Analysis

In 2023, the Metal and Plastic segment emerged as a frontrunner in the Artificial Disc Replacement market, securing a commanding position with a substantial market share of over 65%. This segment’s robust performance can be attributed to its unique combination of materials, blending the strength of metal with the flexibility of plastic. Healthcare professionals and patients alike have shown a strong preference for this innovative solution, appreciating its durability and adaptability.

Metal and Plastic artificial discs have become a cornerstone in disc replacement procedures, offering a harmonious balance of structural integrity and flexibility. This winning combination not only enhances the longevity of the artificial disc but also addresses the dynamic movement requirements of the spine. As a result, patients experience improved mobility and reduced discomfort, driving the widespread adoption of this segment.

The Metal and Plastic segment’s ascendancy in the market is further fueled by advancements in materials science and engineering, leading to the development of highly sophisticated and biocompatible artificial discs. These discs not only mimic the natural biomechanics of the spine but also boast enhanced wear resistance, ensuring sustained performance over the long term.

Furthermore, the Metal and Plastic segment has witnessed a surge in research and development activities, aimed at refining design features and optimizing the overall performance of artificial discs. This commitment to continuous improvement has garnered trust among healthcare professionals, contributing significantly to the segment’s dominant market share.

Indication Analysis

In 2023, the Cervical Disc Replacement segment emerged as the frontrunner in the Artificial Disc Replacement market, securing a leading market position with an impressive share of over 53%. This indicates a robust demand for cervical disc replacement solutions among consumers and healthcare providers.

The significant dominance of the Cervical Disc Replacement segment can be attributed to its efficacy in addressing specific spinal issues in the neck region. Patients and healthcare professionals alike are increasingly recognizing the benefits of cervical disc replacement procedures, fostering a favorable market environment.

Lumbar Disc Replacement, while holding a substantial market share, trails slightly behind the cervical counterpart, capturing a noteworthy share of the market. The lumbar segment’s position underscores the ongoing demand for solutions targeting lower back concerns, highlighting the prevalence of spinal issues in this region.

Factors such as technological advancements, improved surgical techniques, and a growing awareness of the advantages associated with disc replacement procedures contribute to the steady growth of both the Cervical and Lumbar Disc Replacement segments. As these segments continue to evolve, they are expected to play pivotal roles in shaping the landscape of the Artificial Disc Replacement market in the foreseeable future.

Key Market Segments

Type

- Metal

- Metal and Plastic

Indication

- Cervical Disc Replacement

- Lumbar Disc Replacement

Drivers

Advancements in Technology

The Artificial Disc Replacement (ADR) market is thriving due to continuous technological advancements. Innovations in materials and design have led to the development of more efficient and durable artificial discs, improving patient outcomes and reducing complications. These technological breakthroughs attract both healthcare professionals and patients seeking state-of-the-art solutions for spinal disorders.

Increasing Aging Population

The rising global aging population contributes significantly to the growth of the ADR market. As individuals age, the incidence of degenerative disc diseases increases, creating a substantial demand for artificial disc replacement procedures. This demographic shift underscores the market’s expansion potential as healthcare providers address the specific needs of older patients seeking effective and long-lasting solutions.

Minimally Invasive Procedures

The increasing preference for minimally invasive surgical techniques propels the ADR market forward. Patients are increasingly opting for procedures with shorter recovery times, reduced pain, and lower post-operative complications. Artificial disc replacement offers a less invasive alternative to traditional spinal surgeries, driving patient interest and surgeon adoption, thereby fostering market growth.

Rising Awareness and Education

Growing awareness among patients and healthcare professionals about the benefits of artificial disc replacement is a key driving factor. Educational initiatives, coupled with the dissemination of success stories and positive outcomes, contribute to changing perceptions and increasing acceptance of ADR as a viable treatment option for degenerative spinal conditions. This enhanced awareness fosters market growth by expanding the pool of potential candidates for artificial disc replacement procedures.

Restraints

High Procedure Costs

One significant constraint on the Artificial Disc Replacement market is the high cost associated with the procedure. The expenses related to surgery, implants, and post-operative care can be substantial, limiting access for some patients and creating a financial barrier. This cost factor hampers market growth, especially in regions with limited healthcare resources and where insurance coverage for these procedures may be insufficient.

Limited Reimbursement Policies

The lack of comprehensive reimbursement policies for artificial disc replacement procedures poses a challenge to market expansion. In some regions, insurance coverage may be inadequate or absent, dissuading both patients and healthcare providers from pursuing ADR as a preferred treatment option. Addressing these reimbursement gaps is crucial to overcoming this restraining factor and fostering broader market adoption.

Long Regulatory Approval Processes

The stringent regulatory approval processes for artificial disc replacement devices contribute to slower market growth. The extensive testing and evaluation required before introducing new products to the market create delays in product availability. Accelerating regulatory approvals and streamlining these processes would facilitate quicker access to innovative ADR solutions, enhancing market dynamics and meeting patient needs more efficiently.

Perceived Surgical Risks

The perception of surgical risks associated with artificial disc replacement acts as a restraining factor. Some patients and healthcare professionals may express concerns about potential complications, despite advancements in technology and surgical techniques. Overcoming these perceptions requires targeted education and communication strategies to accurately convey the safety profile and benefits of ADR, ultimately mitigating concerns and encouraging wider adoption.

Opportunities

Emerging Economies and Untapped Markets

The Artificial Disc Replacement market holds immense growth potential in emerging economies and untapped markets. As healthcare infrastructure improves and awareness increases, these regions present opportunities for market players to expand their reach and cater to a growing population seeking advanced spinal solutions. Strategic market entry and collaboration with local healthcare stakeholders can unlock substantial growth in these untapped markets.

Customization and Personalized Solutions

The trend towards personalized medicine offers a significant growth opportunity in the ADR market. Tailoring artificial disc replacement solutions to individual patient needs and characteristics can enhance treatment outcomes. Market players focusing on research and development to create customizable implants and surgical approaches stand to capture a competitive advantage, attracting both patients and healthcare providers seeking optimized and patient-specific solutions.

Collaboration with Research Institutions

Collaborating with research institutions and academic centers presents a growth avenue for the ADR market. Partnerships with these entities facilitate continuous innovation, research, and development of cutting-edge technologies. Market players engaging in collaborative ventures can access valuable resources, expertise, and funding, driving the development of advanced artificial disc replacement solutions and maintaining a competitive edge in the market.

Expanding Indications for ADR

The expansion of indications for artificial disc replacement beyond traditional degenerative disc diseases creates new growth opportunities. Research and clinical studies exploring the efficacy of ADR in addressing a broader range of spinal conditions, such as deformities and trauma, open avenues for market expansion. Market players investing in research to establish the safety and effectiveness of ADR in diverse indications position themselves at the forefront of this evolving landscape.

Trends

Focus on Outpatient Procedures

A notable market trend is the increasing focus on outpatient artificial disc replacement procedures. Advances in surgical techniques and anesthesia allow for shorter recovery times, making outpatient settings more viable. This trend aligns with patient preferences for quicker rehabilitation and reduced hospital stays, influencing healthcare providers to shift towards outpatient ADR procedures, thereby shaping the market landscape.

Technological Integration with Robotics

The integration of robotics in artificial disc replacement surgeries is a prominent market trend. Robotic-assisted procedures offer precision, accuracy, and enhanced surgical outcomes. Market players incorporating robotics into their ADR solutions gain a competitive advantage by providing surgeons with advanced tools for precise implant placement, contributing to improved patient experiences and clinical outcomes.

Growing Adoption of 3D Printing

The growing adoption of 3D printing technology in manufacturing artificial disc replacements is a significant market trend. This technology allows for the customization of implants based on patient anatomy, promoting better fit and functionality. Market players leveraging 3D printing in their product offerings showcase a commitment to innovation and patient-centric approaches, positioning themselves as leaders in the evolving landscape of artificial disc replacement.

Patient-Centric Approaches in Product Design

Market trends reflect a shift towards patient-centric approaches in the design of artificial disc replacement products. The emphasis on patient experience, reduced invasiveness, and faster recovery times drives innovation in product design. Companies focusing on developing patient-friendly solutions, such as less traumatic implantation techniques and improved post-operative comfort, are poised to meet the evolving preferences of both patients and healthcare providers in the ADR market.

Regional Analysis

In 2023, North America asserted its dominant position in the Artificial Disc Replacement (ADR) Market, capturing a significant market share of more than 49.2%. The region’s robust performance is underscored by a market value of USD 324.8 million for the year, reflecting a substantial economic contribution to the global ADR market.

Key factors contributing to North America’s market leadership include a well-established healthcare infrastructure, increasing prevalence of degenerative disc diseases, and a high adoption rate of advanced medical technologies. The region’s commitment to technological innovation, coupled with a favorable reimbursement scenario, has further propelled the adoption of artificial disc replacement procedures.

The United States, as a major contributor to North America’s dominance, has witnessed a surge in demand for ADR procedures owing to the rising aging population and an escalating incidence of chronic back pain. The proactive approach of healthcare providers in adopting advanced surgical interventions has significantly driven market growth.

Furthermore, strategic collaborations between healthcare institutions, research organizations, and industry players have facilitated the development of cutting-edge ADR technologies, augmenting the overall market landscape. North America’s strong regulatory framework and adherence to quality standards have instilled confidence among consumers, fostering the acceptance of artificial disc replacement as a viable treatment option.

While North America continues to lead the ADR market, Europe closely follows with a notable market share. The European market, characterized by a sophisticated healthcare system and increasing awareness about minimally invasive surgical options, has demonstrated significant growth in ADR adoption. Countries such as Germany, the United Kingdom, and France have emerged as key contributors to the regional market expansion.

Asia-Pacific, with its rapidly growing healthcare infrastructure and a burgeoning aging population, is poised to be a lucrative market for artificial disc replacement. The region’s increasing healthcare expenditure, coupled with rising awareness regarding advanced treatment modalities, is anticipated to drive substantial market growth in the coming years.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic arena of Artificial Disc Replacement (ADR), influential contributors include key players such as Medtronic, a frontrunner capitalizing on its vast experience and technological innovation. Orthofix Medical Inc. plays a pivotal role, bringing specialized expertise in medical devices to the ADR market, reflecting a commitment to advancing orthopedic solutions.

Globus Medical, known for its dynamic spine technology, significantly impacts the ADR landscape with a focus on cutting-edge solutions and patient-centric approaches. Aesculap Inc., renowned for precision in surgical instruments, shapes the market with high-quality products and a dedication to meeting evolving surgical and patient needs.

In parallel, alongside these industry giants, other key players contribute diversely but cohesively to the ADR market’s growth. The collaborative landscape emphasizes constant advancements, research, and user-friendly solutions, propelling the industry forward. The competitive spirit among these companies fuels innovation, ensuring the ADR market remains on a trajectory of sustained growth and positive transformation.

Market Key Players

- Medtronic

- Orthofix Medical Inc.

- Globus Medical

- Aesculap Inc.

- NuVasive Inc.

- AxioMed LLC

- Zimmer Biomet

- SpineArt SA

- Synergy Spine Solutions Inc.

- Centinel Spine

Recent Developments

- In October 2023, medical device leader Globus Medical acquired Alphatec Holdings for $1.4 billion, enhancing its spine portfolio and reach in minimally invasive spine surgery. Alphatec’s expertise in artificial disc replacement, especially in anterior lumbar interbody fusion (ALIF) systems, complements Globus’ strengths. This move is expected to benefit both companies by leveraging each other’s technology and distribution channels.

- In September 2023, KineMed introduced an AI-powered lumbar disc replacement system, enhancing precision through real-time data analysis during surgery. This innovation signifies a leap towards intelligent and personalized spine surgery, potentially improving patient recovery.

- In August 2023, Spineology received FDA approval for its Mobi-C cervical disc replacement system, a less invasive alternative for degenerative disc disease. With a mobile core mimicking natural spine movement, the system aims for improved patient outcomes, marking a significant advancement in cervical disc treatment.

- In July 2023, Saw industry giants Medtronic and Zimmer Biomet joining forces to develop the next generation of artificial disc technology. This strategic partnership aims to expedite innovation in materials, designs, and surgical techniques, promising advanced disc replacement solutions. The collaboration holds potential for significant impacts on the artificial disc replacement market, offering improved options for patients with spinal disc degeneration.

Report Scope

Report Features Description Market Value (2023) USD 660.3 Mn Forecast Revenue (2033) USD 2032.6 Mn CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Metal, Metal and Plastic), By Indication (Cervical Disc Replacement, Lumbar Disc Replacement) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Orthofix Medical Inc., Globus Medical, Aesculap Inc., NuVasive Inc., AxioMed LLC, Zimmer Biomet, SpineArt SA, Synergy Spine Solutions Inc., Centinel Spine Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Disc Replacement MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Artificial Disc Replacement MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Orthofix Medical Inc.

- Globus Medical

- Aesculap Inc.

- NuVasive Inc.

- AxioMed LLC

- Zimmer Biomet

- SpineArt SA

- Synergy Spine Solutions Inc.

- Centinel Spine