Global Artificial Lift Systems Market By Type (Rod Lift, Electrical Submersible Pump, Progressive Cavity Pump, Gas Lift, Hydraulic Pumps, Others), By Mechanism (Pump-Assisted, Gas-Assisted), By Application (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 13686

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

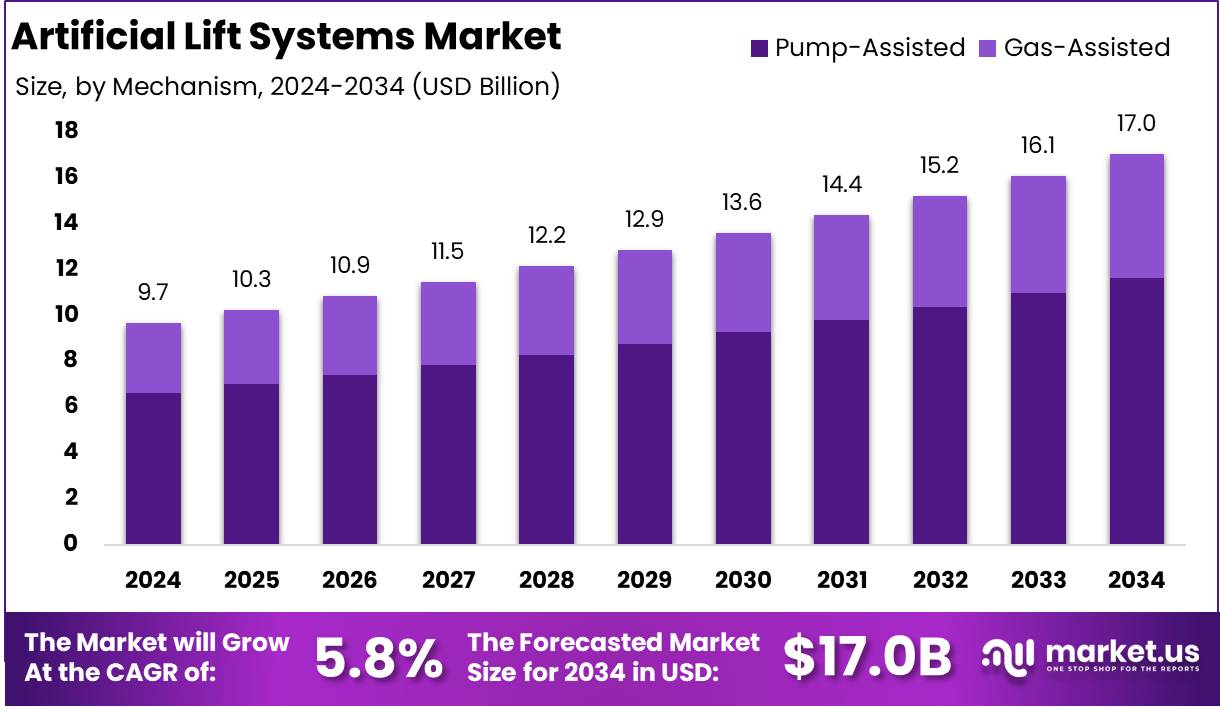

The Global Artificial Lift Systems Market size is expected to be worth around USD 17.0 Billion by 2034 from USD 9.7 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Artificial lift systems refer to mechanical devices or techniques used in the oil and gas industry to increase the flow of crude oil or natural gas from a production well when natural reservoir pressure is insufficient. These systems are crucial for enhancing recovery rates from mature or low-pressure reservoirs.

Common types include electrical submersible pumps (ESP), gas lift systems, sucker rod pumps, and progressive cavity pumps, among others. The selection of an appropriate artificial lift method is influenced by factors such as reservoir characteristics, well depth, fluid composition, and production goals. These technologies are instrumental in sustaining production levels and optimizing asset performance in both onshore and offshore operations.

The artificial lift systems market encompasses the global industry engaged in the design, manufacturing, deployment, and servicing of artificial lift technologies used in hydrocarbon extraction. This market is composed of equipment suppliers, technology providers, oilfield service companies, and end-use operators.

The growth of the artificial lift systems market can be attributed to the rising number of mature oil fields and the need to maintain production rates amid declining reservoir pressures. Additionally, the increasing reliance on unconventional resources, such as shale oil and tight gas, has necessitated the deployment of artificial lift technologies to facilitate economically viable extraction.

Further momentum is being provided by technological innovations in lift systems that enable real-time performance monitoring, lower operational costs, and improve system longevity. Supportive energy policies and strategic upstream investments in high-potential regions are also playing a pivotal role in market expansion.

Demand for artificial lift systems is being steadily driven by global energy consumption trends and the imperative to enhance hydrocarbon recovery from complex and depleting fields. As conventional reservoirs continue to decline, operators are increasingly turning to enhanced oil recovery (EOR) methods, with artificial lift systems forming a central component.

Significant opportunities exist within the artificial lift systems market through integration of digitalization, automation, and AI-based optimization solutions. As oil and gas companies seek to reduce lifting costs and extend the life of their assets, there is growing interest in intelligent lift systems capable of remote diagnostics, real-time adjustments, and predictive analytics. Emerging markets in Latin America, Africa, and Southeast Asia present untapped potential, where increased drilling activity and underdeveloped fields could drive considerable demand.

According to Pipingandinterface, the Artificial Lift Systems Market is witnessing robust demand as over 2 million oil wells operate globally, with more than 50% relying on artificial lift technologies. Notably, 50% of oil wells worldwide and an estimated 96% of wells in the United States require artificial lift systems. Among these, sucker rod pumps dominate the market, accounting for over 75% of installed lifts.

In the U.S. alone, around 350,000 oil wells currently utilize sucker rod pumps. This widespread dependence on artificial lift solutions underscores their critical role in sustaining global oil production and highlights significant growth opportunities for manufacturers and service providers in this market.

According to Frost & Sullivan, the Artificial Lift Systems market is set to expand, supported by a 1.2% annual rise in oil demand reaching 105 million barrels/day by 2025. Over 90% of producing wells use artificial lifts, and 94% will require them during their lifecycle. Additionally, 90% of existing wells rely on these systems for water removal. With 70% of oil and gas output from mature fields and over 90% of demand driven by transportation, artificial lift adoption will continue rising globally.

Key Takeaways

- The global Artificial Lift Systems market is projected to reach USD 17.0 billion by 2034, growing from USD 9.7 billion in 2024, at a CAGR of 5.8% during the forecast period 2025–2034.

- Electrical Submersible Pumps (ESP) dominated the market by type in 2024, accounting for over 45.4% of the global market share.

- Pump-Assisted systems led the market in 2024, capturing a dominant share of 68.2%.

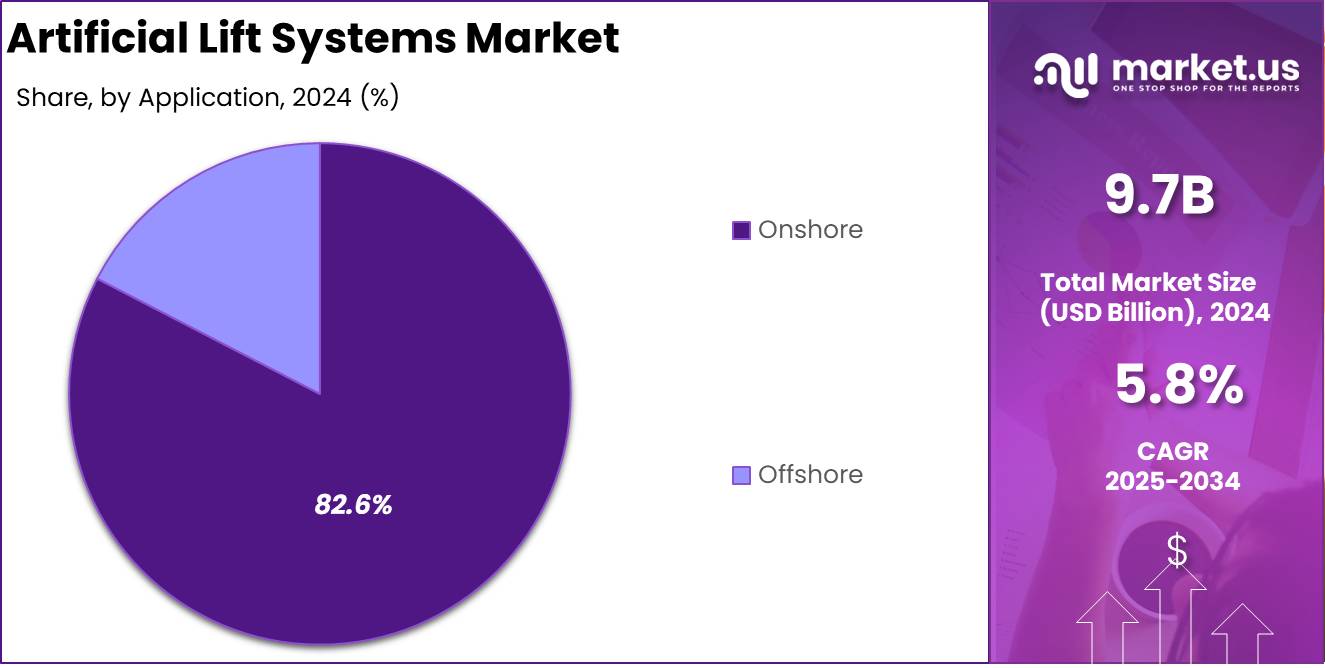

- Onshore applications were the primary deployment area in 2024, comprising more than 82.6% of the total market.

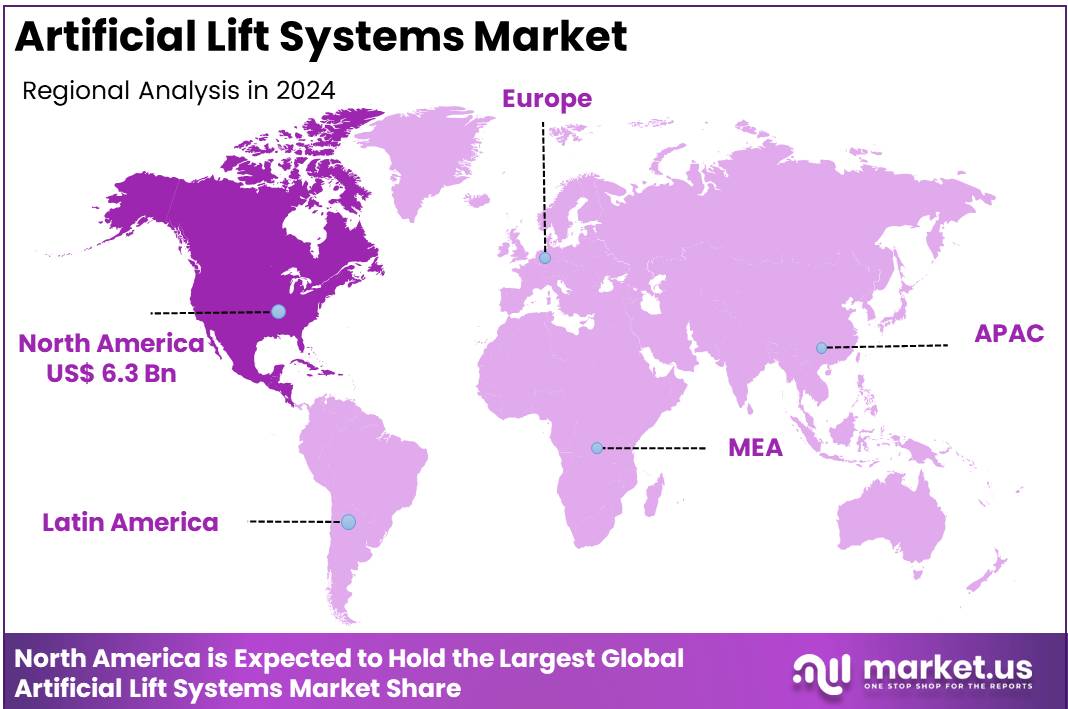

- North America held the largest regional share in 2024, contributing 37.6% of the global market, with a valuation of approximately USD 6.3 billion.

By Type Analysis

Electrical Submersible Pump (ESP) Dominated the Global Artificial Lift Systems Market with Over 45.4% Share in 2024

In 2024, Electrical Submersible Pump (ESP) held a dominant market position in the global Artificial Lift Systems market, capturing more than 45.4% of the market share. This strong position can be attributed to its high efficiency in lifting large volumes of fluid from deep wells, particularly in offshore and mature oilfields.

ESP systems are favored for their reliability, low maintenance, and ability to handle harsh operational environments, including high-temperature and high-pressure wells. Their widespread adoption across oil-rich regions such as the Middle East, North America, and parts of Asia-Pacific has reinforced their market leadership.

Rod lift systems are recognized for their cost-effectiveness and operational simplicity, making them particularly suitable for low-to-medium flow rate oil wells. These systems are widely implemented in onshore fields, especially across regions such as North America and Latin America, where a large number of mature wells exist.

The ease of maintenance and extended operational lifespan have contributed to the consistent demand for rod lift systems, reinforcing their role as a widely accepted artificial lift solution in conventional oil production environments.

Recent advancements in digital technologies have further revitalized interest in rod lift systems. The integration of real-time monitoring and predictive maintenance tools has enhanced operational efficiency by minimizing unplanned downtime and optimizing production rates. Despite the presence of alternative artificial lift methods, rod lift continues to maintain a strong position due to its energy efficiency, mechanical reliability, and economic suitability for low-cost operations.

Progressive cavity pumps have become increasingly favored for their ability to efficiently handle viscous fluids and solids-laden outputs. These systems have demonstrated particular value in the extraction of heavy oil and other unconventional resources. Their design simplicity, coupled with relatively low operational costs, makes them a preferred choice for marginal and low-yield fields, supporting their deployment in a variety of oil-producing regions.

The application of progressive cavity pumps has also expanded to include offshore and remote locations, where traditional lift methods face practical limitations. Their capability to adapt to varying flow rates and minimize environmental impact has supported ongoing market penetration. This segment continues to benefit from global investments in enhanced oil recovery technologies and increased exploration of challenging oil reserves.

Gas lift systems are widely utilized in wells that experience fluctuating production levels, including those located in offshore environments and horizontal formations. These systems are valued for their long operational life and minimal mechanical complexity, as they do not require moving parts downhole. This characteristic significantly reduces maintenance requirements and enhances reliability in remote or technically demanding applications.

The adoption of gas lift technology is closely linked to the growth of offshore oil and gas development, particularly in regions such as the Gulf of Mexico, Brazil, and West Africa. Its compatibility with existing field infrastructure has enabled operators to efficiently optimize production in mature wells. With ongoing advancements in automation and digital control systems, gas lift remains a versatile and evolving component of artificial lift strategies.

Hydraulic pump systems are employed primarily in high-pressure and deep well environments where high lifting capacity is required. These systems are well-suited for complex well geometries, such as deviated or horizontal wells, and offer the advantage of dynamic adaptability to changing production conditions. Their robust performance and ability to operate in extreme downhole environments support their selection in technically challenging projects.

Although hydraulic pumps entail higher upfront and operational costs, their dependability and production efficiency make them viable in specific applications, particularly in unconventional fields. Continuous technological innovation focused on enhancing energy efficiency and reducing maintenance complexity is expected to increase the feasibility of hydraulic pump systems in both onshore and offshore operations.

The remaining segment comprises specialized artificial lift technologies, including plunger lift and jet pump systems, which are deployed in select well conditions where mainstream solutions may not perform effectively. These technologies are often utilized in wells with unique production characteristics, such as low-pressure or intermittent flow conditions, where flexibility and adaptability are essential.

While this segment currently represents a smaller portion of the overall market, its development is being driven by improvements in customization, automation, and remote monitoring capabilities. As operators seek out more tailored solutions to improve cost control and operational efficiency in difficult field conditions, niche artificial lift technologies are expected to gain incremental market presence.

By Mechanism Analysis

Pump-Assisted Mechanisms Dominated the Global Artificial Lift Systems Market with Over 68.2% Share in 2024

In 2024, Pump-Assisted mechanisms held a dominant market position in the Artificial Lift Systems Market, capturing more than a 68.2% share. These systems include rod lifts, electrical submersible pumps (ESP), progressive cavity pumps (PCP), and hydraulic pumps all of which rely on mechanical pumping to lift fluids to the surface. The widespread adoption of pump-assisted systems can be attributed to their operational reliability, adaptability across various well conditions, and ability to deliver high production rates in both conventional and unconventional oilfields.

The segment’s dominance is further supported by its effectiveness in mature fields with declining reservoir pressure, where mechanical assistance becomes essential. Technological advancements such as real-time monitoring, automation, and predictive maintenance have improved operational efficiency and reduced downtime, further enhancing the appeal of pump-assisted mechanisms. With continued global investment in production optimization and artificial lift infrastructure, this segment is expected to retain its leading position in the coming years.

Gas-assisted mechanisms form a vital segment of the global Artificial Lift Systems Market. This category primarily comprises gas lift systems, which operate by injecting compressed gas into the wellbore to decrease fluid density and enable the upward movement of oil. These systems are especially advantageous in offshore oilfields and horizontal wells, where conventional mechanical lift technologies may encounter limitations due to well depth, structural complexity, or restricted operational space.

The enduring preference for gas-assisted systems can be attributed to their operational flexibility, absence of moving parts in the downhole environment, and extended service life. Their deployment is particularly strong in offshore drilling projects in key oil-producing regions.

By Application Analysis

Onshore Dominated the Global Artificial Lift Systems Market with Over 82.6% Share in 2024

In 2024, Onshore applications held a dominant position in the Artificial Lift Systems Market, capturing more than an 82.6% share. This strong market presence can be attributed to the widespread use of artificial lift systems across mature onshore oilfields, particularly in North America, the Middle East, and Latin America.

Onshore wells, often characterized by declining reservoir pressure and reduced natural flow, increasingly depend on mechanical and gas-assisted lift technologies to maintain production efficiency and extend field life.

The high volume of onshore wells globally, combined with lower installation and operational complexities compared to offshore environments, continues to support the segment’s leading position. Additionally, the availability of well servicing infrastructure and easier access to resources enable faster deployment and maintenance of artificial lift systems. With rising emphasis on optimizing production from aging assets and the adoption of automation in field operations, the onshore segment is expected to sustain its prominence in the global market.

The Offshore segment accounted for a smaller yet strategically significant share of the global Artificial Lift Systems Market in 2024. Offshore wells often present complex challenges such as deeper reservoirs, high-pressure environments, and constrained space for equipment deployment.

Despite these hurdles, artificial lift systems are increasingly being employed in offshore fields to enhance oil recovery and improve production performance, especially in deepwater and ultra-deepwater projects.

The rising number of offshore exploration and production activities, particularly in regions such as West Africa, the Gulf of Mexico, and Southeast Asia, is driving demand for advanced lift technologies suited to harsh marine environments.

The development of compact, automated, and high-efficiency artificial lift systems has made their use more feasible offshore. Moreover, the integration of remote monitoring and control capabilities is enabling safer and more cost-effective operations, contributing to gradual growth in this segment.

Key Market Segments

By Type

- Rod Lift

- Electrical Submersible Pump

- Progressive Cavity Pump

- Gas Lift

- Hydraulic Pumps

- Others

By Mechanism

- Pump-Assisted

- Gas-Assisted

By Application

- Onshore

- Offshore

Driver

Rising Demand for Enhanced Oil Recovery (EOR) from Mature Oil Fields

The growth of the global Artificial Lift Systems market in 2024 is significantly driven by the increasing need to enhance oil recovery from mature and declining oil fields. As a substantial portion of global oil production originates from aging reservoirs, the natural reservoir pressure in these fields often becomes insufficient to maintain optimal production levels.

Artificial lift systems, particularly rod lift, electric submersible pumps (ESPs), and progressive cavity pumps (PCPs), are being increasingly deployed to counter this challenge by providing mechanical lift to bring hydrocarbons to the surface efficiently. The adoption of such technologies is expected to rise, especially in regions with high concentrations of mature fields, including North America and parts of the Middle East, which continue to seek economically viable methods to extend the life of their assets.

Furthermore, as global energy demand remains robust, oil producers are under pressure to maintain or increase output levels without relying heavily on new discoveries, which are both time-consuming and capital-intensive. Artificial lift solutions offer a cost-effective and technically feasible method to extract remaining reserves from depleting wells.

According to industry, nearly 90% of the oil wells globally require artificial lift at some stage in their production lifecycle, underscoring the critical role of these systems. In 2024, the market is witnessing an increased focus on deploying tailored lift solutions based on reservoir characteristics and fluid properties, optimizing production efficiency and lowering operational costs.

This ongoing trend is further complemented by digital monitoring and automation technologies, which enhance lift performance and reliability. Consequently, the necessity of maintaining production in mature fields is directly fostering the expansion of the artificial lift systems market by compelling operators to invest in reliable, adaptable, and performance-optimized lifting technologies.

Restraint

High Operational and Maintenance Costs of Artificial Lift Systems

One of the primary restraints affecting the growth of the global Artificial Lift Systems market in 2024 is the high operational and maintenance costs associated with these systems. Artificial lift technologies, particularly those such as gas lift systems and electric submersible pumps, require substantial capital investment for installation, followed by continuous expenses for maintenance and servicing.

These systems are often deployed in challenging environments such as offshore platforms, deep wells, and high-temperature or corrosive conditions where component wear and tear occur more frequently. The cost burden intensifies when dealing with remote or complex wells, where system failure can lead to prolonged downtimes and significant revenue losses for operators.

Moreover, frequent interventions, such as workovers and pump replacements, add to the total cost of ownership, making it a critical concern, especially for small- and medium-sized exploration and production companies. In a volatile oil price environment, such companies are often more sensitive to cost escalations, which may delay or deter investment in artificial lift technologies.

Additionally, inconsistent performance of artificial lift systems due to improper selection, sizing errors, or fluctuating production rates further contributes to inefficiencies and increased maintenance requirements. These factors collectively reduce the cost-effectiveness of artificial lift deployment and present challenges for widespread adoption, particularly in price-sensitive markets.

While technological advancements are being made to improve durability and reduce servicing intervals, the high life cycle costs of artificial lift systems continue to act as a deterrent, thereby restraining market growth in 2024, especially in regions where profit margins are already compressed.

Opportunity

Integration of Digital Oilfield Technologies with Artificial Lift Systems

The integration of digital oilfield technologies into artificial lift operations presents a significant growth opportunity for the global Artificial Lift Systems market in 2024. With the increasing adoption of Industrial Internet of Things (IIoT), advanced analytics, and real-time monitoring, operators can now gain deeper insights into the performance of artificial lift equipment, allowing for predictive maintenance, optimized production, and reduced downtime.

These technologies enable continuous surveillance of parameters such as pressure, flow rate, vibration, and temperature, which are critical for the effective functioning of lift systems. By leveraging digital solutions, operators can remotely adjust lift parameters, detect failures early, and deploy data-driven strategies to extend the lifespan of equipment and reduce operational disruptions.

This digitization trend aligns with the industry’s broader push toward automation and intelligent oilfield management, aimed at enhancing overall asset efficiency and reducing human intervention. In 2024, the deployment of smart lift systems integrated with artificial intelligence and machine learning algorithms is gaining traction, particularly in regions with technologically mature upstream sectors.

These systems can adapt to dynamic well conditions in real time, thereby improving recovery rates and energy efficiency. Additionally, cloud-based platforms are enabling multi-site visibility, fostering centralized control, and facilitating better collaboration across teams. The ability to streamline operations, enhance safety, and minimize manual oversight makes digital integration a compelling value proposition.

As upstream companies continue to modernize their operations, the fusion of artificial lift systems with digital infrastructure represents a transformative opportunity to drive long-term cost savings, improve reliability, and unlock additional production from both new and mature assets.

Trends

Shift Toward Environmentally Sustainable and Energy-Efficient Lift Solutions

A notable trend shaping the Artificial Lift Systems market in 2024 is the shift toward environmentally sustainable and energy-efficient lift solutions. In response to rising environmental regulations and corporate sustainability goals, oil and gas operators are increasingly emphasizing the need for energy-optimized lifting technologies that minimize emissions and reduce the carbon footprint of upstream operations.

Traditional lift systems, especially gas lift and ESPs, often consume high amounts of energy or rely on auxiliary fossil fuel-powered equipment, thereby contributing to greenhouse gas emissions. As a result, the industry is moving toward advanced lift systems that offer better energy utilization and reduced environmental impact.

For instance, the adoption of variable speed drives (VSDs) in electric submersible pumps enables dynamic energy control, reducing unnecessary power consumption and enhancing operational efficiency. Similarly, rod lift systems are being integrated with smart controllers that optimize strokes per minute based on real-time well conditions, leading to lower energy usage.

Furthermore, the exploration of alternative energy sources, such as solar-powered lift systems for remote onshore fields, is gaining momentum. In 2024, this trend is further reinforced by stricter ESG (Environmental, Social, and Governance) frameworks and investor expectations, which are influencing capital allocation toward cleaner and more efficient technologies.

Consequently, the market is experiencing innovation in material selection, system design, and automation, all aimed at enhancing energy efficiency and sustainability. This trend not only supports environmental compliance but also reduces operational costs, positioning energy-efficient artificial lift systems as a strategic priority for forward-looking oil producers in the current and future landscape.

Regional Analysis

North America Leads Artificial Lift Systems Market with Largest Market Share of 37.6% in 2024

In 2024, North America emerged as the leading region in the global artificial lift systems market, commanding the largest market share of 37.6%. The regional market reached a valuation of USD 6.3 billion, reflecting its dominant position driven by extensive oil and gas production activities across the United States and Canada. The adoption of artificial lift technologies in this region is significantly influenced by the presence of mature oil fields and the increasing need to enhance production efficiency in shale reservoirs.

Horizontal drilling and hydraulic fracturing techniques have further boosted the demand for artificial lift systems to maintain optimal production rates in unconventional reserves. The region’s emphasis on optimizing hydrocarbon recovery rates and the presence of large-scale upstream infrastructure contribute notably to market growth.

Europe represents a developed and steadily expanding market for artificial lift systems, underpinned by technological advancements in offshore oil exploration, particularly in the North Sea region. Countries such as the United Kingdom and Norway continue to invest in subsea production systems, where artificial lift solutions are critical for extending the life of aging wells.

The region is also focusing on increasing operational efficiency and reducing environmental impacts, thereby stimulating the deployment of modern artificial lift technologies. Although Europe’s market share remains moderate compared to North America, the strategic investment in offshore assets is expected to sustain its demand in the long term.

Asia Pacific is witnessing a gradual rise in the adoption of artificial lift systems, primarily driven by increasing energy demands, aging onshore fields, and the expansion of exploration and production activities in countries such as China, India, and Indonesia.

The region’s diverse hydrocarbon landscape necessitates the use of artificial lift technologies to optimize production from both shallow and deeper wells. As regional governments prioritize energy security and domestic production, the artificial lift systems market is anticipated to experience further expansion across Asia Pacific.

The Middle East & Africa region continues to show significant potential, supported by vast reserves of conventional oil fields across countries such as Saudi Arabia, the UAE, and Nigeria. Despite relying largely on natural pressure in several fields, the gradual maturity of reservoirs is expected to lead to increased adoption of artificial lift systems to maintain production levels.

Latin America also presents a promising market, with countries such as Brazil and Argentina investing in artificial lift solutions to enhance recovery from both offshore and onshore assets. Collectively, while these regions contribute to global market growth, North America distinctly leads the market with the highest share and valuation in 2024.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Artificial Lift Systems Market in 2024 is characterized by a competitive landscape dominated by both established multinational corporations and specialized service providers. Leading entities such as Schlumberger Limited, Halliburton Company, and Weatherford International plc continue to leverage their extensive service portfolios and global operational presence to maintain a significant market share.

These companies are actively investing in automation technologies and integrated artificial lift solutions to enhance oil recovery rates and optimize production in mature fields. Dover Corporation, National Oilwell Varco, Inc., and General Electric Company are further contributing to technological advancements by focusing on artificial intelligence (AI)-driven diagnostics and equipment efficiency.

In addition, emerging and mid-sized firms like Levare Energy Services, JJ Tech Holdings, Inc., and ELKAM ArtEfficial Lift are carving out niches by offering customized and region-specific solutions, particularly in unconventional oilfields. Companies such as Novomet Group, Rimera Group, and Canadian Advanced ESP Inc. are enhancing their competitive edge through innovative electric submersible pump (ESP) systems.

Furthermore, Occidental Petroleum Corporation and Aker Solutions ASA are integrating artificial lift technologies within broader upstream strategies, enabling greater field optimization. Regional players like Alkhorayef Petroleum Company, PetroLift Systems, Inc., and BCP Group are strengthening market penetration in the Middle East and Latin America through strategic partnerships and field-proven technologies. Collectively, these players are shaping a dynamic and technologically evolving artificial lift ecosystem.

Top Key Players in the Market

- Schlumberger Limited

- Dover Corporation

- Halliburton Company

- Weatherford International plc

- Levare Energy Services

- General Electric Company

- National Oilwell Varco, Inc.

- JJ Tech Holdings, Inc.

- Aker Solutions ASA

- Novomet Group

- BCP Group

- Occidental Petroleum Corporation

- Canadian Advanced ESP Inc.

- Alkhorayef Petroleum Company

- ELKAM ArtEfficial Lift

- PetroLift Systems, Inc.

- Rimera Group

Recent Developments

- In 2024, ChampionX Corporation completed the acquisition of Artificial Lift Performance Limited (ALP), a company from Scotland known for its software that helps boost oil and gas production. This move adds advanced analytics to ChampionX’s services, supporting better performance and longer equipment life in oil fields.

- In 2024, SLB launched two new artificial lift systems—Reda Agile and Reda PowerEdge. These systems are designed to be compact, energy-efficient, and easier to install. Both are digitally connected, allowing real-time monitoring, improved performance, and lower emissions during oil production.

- In 2024, Silverwell Energy Inc. secured a key project offshore Nigeria, expanding the use of its DIAL gas lift optimization system into Africa. This system helps increase well value significantly, and the success of this project is likely to encourage more use across West Africa.

- In 2023, AIQ and Halliburton partnered with ADNOC to launch RoboWell, an AI-driven autonomous well control system in Abu Dhabi. This technology supports smarter decision-making and improves safety by automating well operations in one of the region’s key oil fields.

Report Scope

Report Features Description Market Value (2024) USD 9.7 Billion Forecast Revenue (2034) USD 17.0 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rod Lift, Electrical Submersible Pump, Progressive Cavity Pump, Gas Lift, Hydraulic Pumps, Others), By Mechanism (Pump-Assisted, Gas-Assisted), By Application (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schlumberger Limited, Dover Corporation, Halliburton Company, Weatherford International plc, Levare Energy Services, General Electric Company, National Oilwell Varco, Inc., JJ Tech Holdings, Inc., Aker Solutions ASA, Novomet Group, BCP Group, Occidental Petroleum Corporation, Canadian Advanced ESP Inc., Alkhorayef Petroleum Company, ELKAM ArtEfficial Lift, PetroLift Systems, Inc., Rimera Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Lift Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Artificial Lift Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger Limited

- Dover Corporation

- Halliburton Company

- Weatherford International plc

- Levare Energy Services

- General Electric Company

- National Oilwell Varco, Inc.

- JJ Tech Holdings, Inc.

- Aker Solutions ASA

- Novomet Group

- BCP Group

- Occidental Petroleum Corporation

- Canadian Advanced ESP Inc.

- Alkhorayef Petroleum Company

- ELKAM ArtEfficial Lift

- PetroLift Systems, Inc.

- Rimera Group