Global Commercial Scrubbers and Sweepers Market Size, Share, Growth Analysis By Type (Walk-behind, Ride-on, Robotic), By Product Type (Scrubbers, Sweepers, Other Product Types), By Power Source (Electricity, Batteries), By End-User (Contract Cleaning, Manufacturing, Transportation & Travel, Healthcare, Education, Government, Chemical & Pharmaceutical, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 106047

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

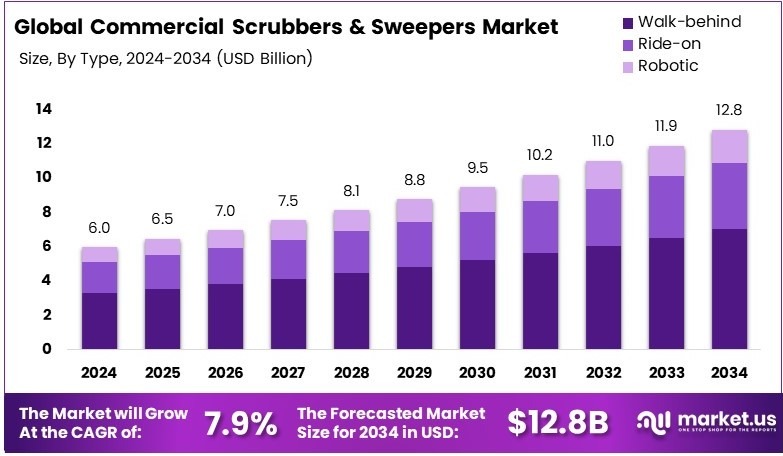

The Global Commercial Scrubbers and Sweepers Market size is expected to be worth around USD 12.8 Billion by 2034, from USD 6.0 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Commercial scrubbers and sweepers are machines used to clean large floor areas in places like malls, airports, and factories. Scrubbers wash and dry surfaces, while sweepers remove dust and debris. They help save time, reduce labor, and maintain cleanliness in commercial, industrial, and public environments.

The commercial scrubbers and sweepers market includes the manufacturing, sales, and service of floor cleaning machines. It serves industries such as retail, healthcare, hospitality, and logistics. Market growth is driven by rising cleanliness standards, automation, and urban infrastructure development. Both manual and robotic models are part of this market.

Commercial scrubbers and sweepers are essential tools for keeping large indoor and outdoor spaces clean. These machines reduce dust, germs, and slip hazards. Their use is growing as hygiene becomes a bigger concern. In places like malls, airports, and warehouses, they help meet rising cleanliness and safety standards.

The commercial scrubbers and sweepers market is expanding steadily. Demand is driven by more infrastructure and stricter safety rules. For instance, Hudson Yards in New York introduced a 1 million square foot mall with over 100 shops, requiring frequent large-scale cleaning. This highlights how new developments fuel equipment demand.

According to the U.S. Department of Labor, over 890,000 workplace injuries occurred in 2023. This number shows the urgent need for safer and cleaner workspaces. As a result, companies are investing more in machines that maintain clean surfaces to reduce accident risks and ensure staff well-being.

On a broader scale, the International Labour Organization reported that almost 3 million workers die each year from work-related causes. This marks a 5% rise since 2015. In this context, demand for automated cleaning systems is expected to rise, especially in high-traffic and high-risk industrial settings.

Meanwhile, new investments in infrastructure further support market growth. According to Global Infrastructure Outlook, around $94 trillion is needed by 2040 to meet global demand. In just the first half of 2024, over $40 billion was raised in infrastructure funds. These projects often require professional-grade cleaning equipment.

However, market saturation varies by region. North America and Europe already have many suppliers, making competition high. On the flip side, Asia-Pacific markets are still growing. Cities expanding their commercial real estate need more cleaning systems, creating room for new players to enter.

Key Takeaways

- The Commercial Scrubbers and Sweepers Market was valued at USD 6.0 billion in 2024 and is expected to reach USD 12.8 billion by 2034, with a CAGR of 7.9%. Increased demand for automated cleaning solutions drives market expansion.

- In 2024, Walk-Behind scrubbers dominated with 55%, due to their cost-effectiveness and suitability for small to mid-sized spaces.

- In 2024, Scrubbers led with 57%, as they provide deeper cleaning and are widely used in commercial and industrial applications.

- In 2024, Battery-Powered models were the dominant segment, offering enhanced mobility and reduced operational costs compared to corded alternatives.

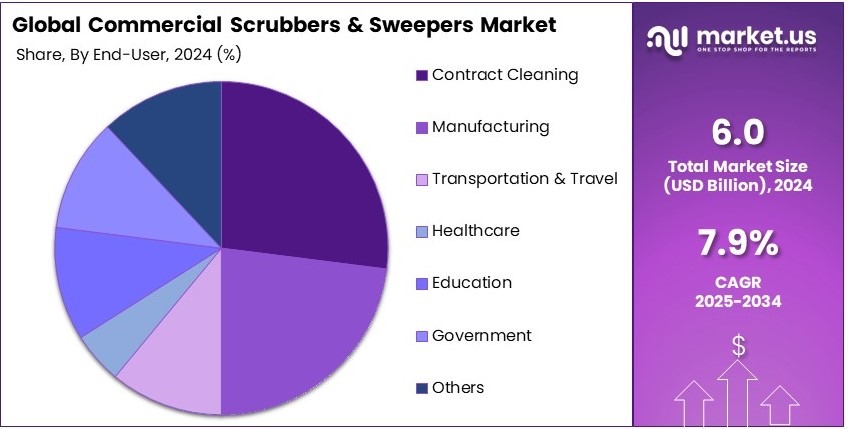

- In 2024, Contract Cleaning was the dominant end-user segment, driven by rising outsourcing of cleaning services in commercial spaces.

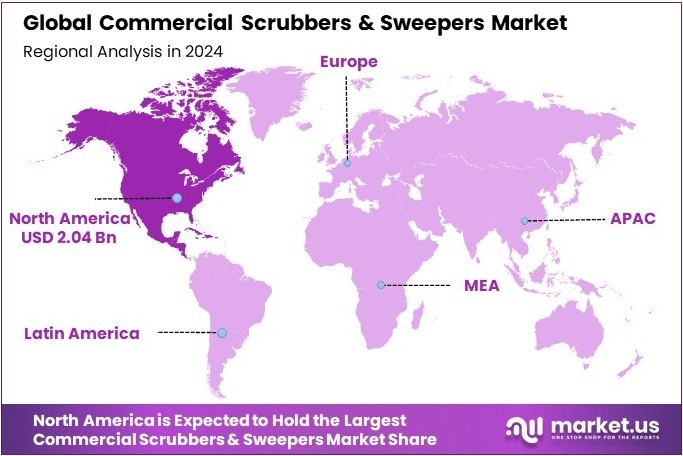

- In 2024, North America led with 34% with valuation of USD 2.04 billion, supported by stringent hygiene regulations and high adoption of advanced cleaning equipment.

Type Analysis

Walk-behind dominates with 55% due to its affordability and versatility.

In the commercial scrubbers and sweepers market, the Walk-behind segment is the most prominent, holding a 55% share. This dominance is largely due to the affordability and versatility of walk-behind models, which are ideal for small to medium-sized areas such as retail spaces and schools. These machines are user-friendly, making them accessible for a wide range of operators.

The Ride-on scrubbers and sweepers are preferred in larger commercial spaces like shopping centers and airports due to their efficiency over large areas. They reduce cleaning time significantly compared to walk-behind models.

Robotic cleaning equipment like scrubbers and sweepers represent the cutting-edge of this market, offering automation that can increase productivity and consistency in cleaning operations. They are gaining traction in environments that benefit from minimal human intervention, such as during off-hours in public spaces.

Product Type Analysis

Scrubbers dominate with 57% due to their effectiveness in maintaining hygiene.

Scrubbers lead the product type segment with a 57% market share. Their effectiveness in deep cleaning and maintaining hygiene in environments like hospitals and food processing plants drives their dominance. Scrubbers are capable of handling various cleaning fluids to tackle different types of dirt and stains, making them indispensable in strict hygiene compliance settings.

Sweepers are essential for quickly clearing debris and dust from surfaces. They are commonly used in both indoor and outdoor settings, such as streets and manufacturing facilities, where quick cleanup is necessary.

Other Product Types include specialized equipment for particular environments, such as hazardous material handlers or those designed for rugged outdoor use. These niche products are vital for specific industrial applications where standard scrubbers and sweepers are not sufficient.

Power Source Analysis

Battery-powered dominates due to its convenience and eco-friendliness.

Battery-powered devices lead the power source segment in the commercial scrubbers and sweepers market. Their dominance is underpinned by the convenience of cordless operation and the growing preference for eco-friendly solutions within facility management. Batteries eliminate the hazards of cords and allow machines to be used in a wider range of environments without concerns about power access.

Electricity-powered scrubbers and sweepers are typically tethered to power outlets, which can be a limitation in larger or more obstructed spaces. However, they remain popular in settings where power supply is consistent and usage is heavy, as they can run longer without needing recharges.

End-User Analysis

Contract Cleaning dominates due to the outsourcing trend in facility management.

Contract Cleaning services, which often manage cleaning for multiple client facilities, heavily rely on commercial scrubbers and sweepers. This segment’s dominance is driven by the trend towards outsourcing cleaning services, which allows businesses to focus on their core operations while ensuring that their environments are meticulously maintained.

Manufacturing facilities use these machines to maintain clean floors, which is crucial for safety and efficiency. The presence of debris can pose risks to both employees and machinery, making effective and regular cleaning a priority.

Transportation & Travel sectors, including airports and train stations, need quick and effective cleaning solutions to handle the high traffic of people, making robust scrubbers and sweepers essential for maintaining standards.

Healthcare, Education, and Government facilities prioritize hygiene and cleanliness, driving the demand for high-performance cleaning machines that can deliver consistent results, especially in high-traffic areas.

Key Market Segments

By Type

- Walk-behind

- Ride-on

- Robotic

By Product Type

- Scrubbers

- Sweepers

- Other Product Types

By Power Source

- Electricity

- Batteries

By End-User

- Contract Cleaning

- Manufacturing

- Transportation & Travel

- Healthcare

- Education

- Government

- Chemical &am; Pharmaceutical

- Other End-Users

Driving Factors

Urban Growth and Hygiene Standards Drives Market Demand

The commercial scrubbers and sweepers market is seeing consistent growth due to rising demand for workplace hygiene and urban cleanliness. One of the strongest drivers is the increasing enforcement of hygiene and safety regulations in industrial and commercial settings. Governments and agencies now require facilities to maintain cleaner, safer environments, especially in post-pandemic conditions. This has led to higher adoption of mechanized cleaning solutions.

The growing use of automated cleaning equipment in industrial facilities further supports market expansion. Large factories, warehouses, and distribution centers prefer automated scrubbers and sweepers to improve productivity and reduce labor dependency. This trend is accelerating in logistics hubs and manufacturing clusters.

Urban infrastructure growth and smart city initiatives are also fueling the need for efficient cleaning technologies. Modern urban spaces, including airports, transit stations, and public venues, rely on mechanical cleaning equipment to ensure fast, large-area cleaning with minimal disruption.

Additionally, the expansion of commercial real estate—such as shopping malls, office complexes, and mixed-use developments—creates new demand for daily, high-efficiency cleaning. These spaces require machines that are not only fast but also safe for use in public areas.

Restraining Factors

Cost and Operational Issues Restraints Market Penetration

Despite rising demand, the commercial scrubbers and sweepers market faces several barriers that limit faster adoption. One significant challenge is the high initial investment required to purchase automated cleaning machines. Many of these machines involve advanced features, battery systems, and control interfaces, which make them costly for small businesses or public institutions.

Operational costs are another concern. Regular maintenance, replacement parts, and energy consumption can increase long-term ownership expenses. This makes it difficult for cost-sensitive users to justify switching from manual cleaning methods.

Limited awareness and market penetration in small and medium enterprises (SMEs) also restrict growth. Many SME owners are unfamiliar with the cost benefits of mechanized cleaning over time or view it as unnecessary for smaller facilities. Education and demonstration efforts are still needed in this segment.

Downtime and maintenance issues, especially in heavy-duty or multi-shift applications, further impact market confidence. Industrial users often hesitate to adopt machines that may require frequent servicing or cause workflow disruptions. In addition, fluctuating prices of raw materials like steel and plastic directly affect manufacturing costs. These issues create pricing pressure for suppliers and manufacturers, limiting competitive pricing strategies.

Growth Opportunities

Smart Technology and Sector-specific Needs Provides Opportunities

The commercial scrubbers and sweepers market is rich with new opportunities, especially as technology and customer needs evolve. One major area is the integration of IoT-enabled monitoring systems. These allow real-time tracking of machine usage, battery levels, and maintenance needs. For fleet managers in large facilities, IoT connectivity helps improve scheduling and reduce downtime.

Another promising opportunity is the development of compact and multi-surface cleaning machines. These are especially valuable for facilities with limited storage or diverse flooring types, such as supermarkets, schools, and hospitals. Compact designs increase flexibility without compromising cleaning performance.

A demand surge in specific sectors—such as hospitality, healthcare, and public transportation—is also creating new growth potential. Hotels, hospitals, and airports require regular, efficient cleaning to meet hygiene standards and maintain a pleasant environment. These sectors are actively investing in newer, quieter, and more efficient equipment.

Moreover, expanding into emerging markets brings untapped potential. As industrialization and urbanization grow in countries like Vietnam, Kenya, and the Philippines, the need for organized cleaning solutions rises. Companies entering these markets with affordable and rugged products can gain early advantage.

Emerging Trends

Sustainable Tech and Automation Are Latest Trending Factor

Several forward-looking trends are currently shaping the commercial scrubbers and sweepers market. One significant development is the adoption of lithium-ion battery technology. These batteries offer longer runtimes, shorter charging times, and reduced maintenance compared to traditional lead-acid models. This allows for continuous cleaning operations, especially in larger commercial environments.

Another strong trend is the rising preference for eco-friendly and water-efficient machines. With growing environmental awareness, customers are seeking equipment that minimizes water usage and reduces chemical dependency. This not only lowers operating costs but also aligns with corporate sustainability goals.

Automation is also transforming the market. Robotic and autonomous sweepers are gaining traction in large facilities such as airports, malls, and factories. These machines can operate with minimal supervision, reduce labor costs, and ensure consistent cleaning quality.

Noise reduction and ergonomic design improvements are also trending. Manufacturers are introducing quieter machines and user-friendly controls to reduce operator fatigue and make the equipment suitable for use in noise-sensitive environments like schools and hospitals. These trends reflect a market shift toward intelligent, sustainable, and worker-friendly equipment. As customer expectations evolve, manufacturers are innovating to meet demand for smarter and greener cleaning solutions.

Regional Analysis

North America Dominates with 34% Market Share

North America leads the Commercial Scrubbers and Sweepers Market with a 34% share, totaling USD 2.04 billion. This market strength is fueled by a high demand for cleanliness and hygiene in commercial spaces, coupled with technological advancements in cleaning equipment.

The region’s commitment to maintaining high health standards in public and private facilities drives the widespread adoption of advanced scrubbers and sweepers. Furthermore, the presence of established manufacturers and a strong distribution network enhances the market’s robustness.

The future influence of North America in the global Commercial Scrubbers and Sweepers Market is expected to remain strong. Increasing awareness about the importance of hygiene, coupled with innovation in eco-friendly cleaning technologies, is likely to drive further growth in this market segment.

Regional Mentions:

- Europe: Europe holds a significant share of 29.8% in the market, valued at USD 1.79 billion. The region’s strict regulations on cleanliness and an increasing trend towards sustainability in cleaning practices are key contributors to its market position.

- Asia Pacific: Asia Pacific has a market share of 25.6%, with a value of USD 1.54 billion. Rapid urbanization and growth in commercial sectors such as retail and hospitality drive the demand for cleaning equipment in this region.

- Middle East & Africa: Middle East & Africa, with a 6.3% share valued at USD 0.38 billion, is seeing growth due to expanding urban centers and the development of commercial infrastructure demanding higher cleanliness standards.

- Latin America: Holding a 4.3% market share at USD 0.26 billion, Latin America is gradually adopting more advanced cleaning solutions to improve hygiene standards in its expanding urban and commercial landscapes.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Commercial Scrubbers and Sweepers Market is dominated by Nilfisk, Tennant, Kärcher, and Hako Group. These top four players have built a strong global presence through innovation, product quality, and diverse product portfolios.

These companies offer a wide range of floor cleaning machines suitable for industrial, commercial, and municipal use. Their products include ride-on and walk-behind scrubbers and sweepers, designed for high performance, safety, and energy efficiency.

A major factor behind their leadership is continuous product innovation. For example, Tennant and Kärcher have launched battery-powered and autonomous cleaning machines. Nilfisk and Hako focus on compact, eco-friendly designs and smart technologies that reduce water and detergent use.

The growing demand for automated and sustainable cleaning solutions drives these firms to invest in R&D. They are developing machines with IoT integration, remote monitoring, and data analytics to meet modern cleaning needs.

Their strong distribution networks, service support, and after-sales solutions enhance customer loyalty. These companies also benefit from serving a wide customer base, including airports, hospitals, malls, warehouses, and municipalities.

With rising hygiene standards in commercial spaces, the demand for advanced cleaning machines is expected to grow. The top four players are well-positioned to lead the market with new technology, customer-focused designs, and strong global operations.

Major Companies in the Market

- Nilfisk

- Tennant

- Kärcher

- Hako Group

- Factory Cat

- Power-Flite

- Numatic

- Amano

- TASKI

- Bucher Industries

- IPC

- Cleanfix

- Other Key Players

Recent Developments

- Nilfisk Reports €994 Million Revenue in 2023: Nilfisk, a global provider of professional cleaning equipment, reported a 3.5% year-over-year revenue increase in 2023, reaching €994 million. Growth was driven by strong demand in industrial and commercial sectors, particularly in Europe and North America.

- Tennant Company Acquires Gaomei Cleaning Equipment: On August 2023, Tennant Company completed the acquisition of Gaomei Cleaning Equipment, a China-based manufacturer of commercial cleaning solutions. The acquisition strengthens Tennant’s presence in the Asia-Pacific region and expands its product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Billion Forecast Revenue (2034) USD 12.8 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Walk-behind, Ride-on, Robotic), By Product Type (Scrubbers, Sweepers, Other Product Types), By Power Source (Electricity, Batteries), By End-User (Contract Cleaning, Manufacturing, Transportation & Travel, Healthcare, Education, Government, Chemical & Pharmaceutical, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nilfisk, Tennant, Kärcher, Hako Group, Factory Cat, Power-Flite, Numatic, Amano, TASKI, Bucher Industries, IPC, Cleanfix, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Scrubbers and Sweepers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Scrubbers and Sweepers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nilfisk

- Tennant

- Kärcher

- Hako Group

- Factory Cat

- Power-Flite

- Numatic

- Amano

- TASKI

- Bucher Industries

- IPC

- Cleanfix

- Other Key Players