Architectural Services Market Report By Service Type (Architectural Advisory Services, Construction And Project Management Services, Engineering Services, Interior Design Services, Urban Planning Services, Counseling Services, Others), By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 13650

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

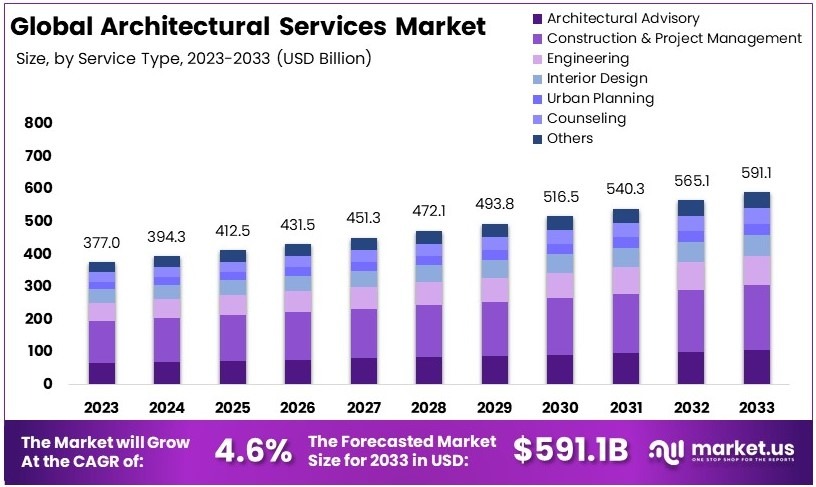

The Global Architectural Services Market size is expected to be worth around USD 591.1 Billion by 2033, from USD 377.0 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033.

Architectural services encompass the planning, designing, and overseeing of building projects. Architects collaborate with clients to create functional and aesthetically pleasing structures. These services include site analysis, conceptual design, detailed drawings, project management, and ensuring compliance with building codes and regulations.

The Architectural Services Market refers to the industry involved in providing architectural design and related services for various construction projects. This market includes firms and professionals that offer expertise in residential, commercial, industrial, and public infrastructure development. It is driven by factors such as urbanization, economic growth, and technological advancements.

Significant investments are required to meet growing infrastructure needs, with the Asian Development Bank estimating that USD 1.7 trillion annually is needed in Asia through 2030. Simultaneously, the European Union’s initiative to renovate 35 million buildings by 2030 underscores the expanding opportunities for architectural services in enhancing energy efficiency and supporting green job creation.

The global infrastructure market, set to grow from USD 4 trillion in 2020 to over USD 9 trillion by 2025, illustrates the vast potential for growth within the architectural services sector. This expansion is fueled by the need to accommodate increasing urban populations, projected to rise from 55% in 2018 to 68% by 2050.

The shift towards sustainable construction materials and building practices is gaining momentum, as evidenced by over 100,000 projects participating in the LEED certification program. This trend is strongly supported by government regulations and investments, aiming to reduce carbon footprints and promote environmental sustainability in building projects.

Key Takeaways

- Architectural Services Market was valued at USD 377.0 billion in 2023 and is expected to reach USD 591.1 billion by 2033, with a CAGR of 4.6%.

- In 2023, Construction and Project Management Services dominate the service type segment with 33.6%, highlighting their essential role in managing complex building projects efficiently.

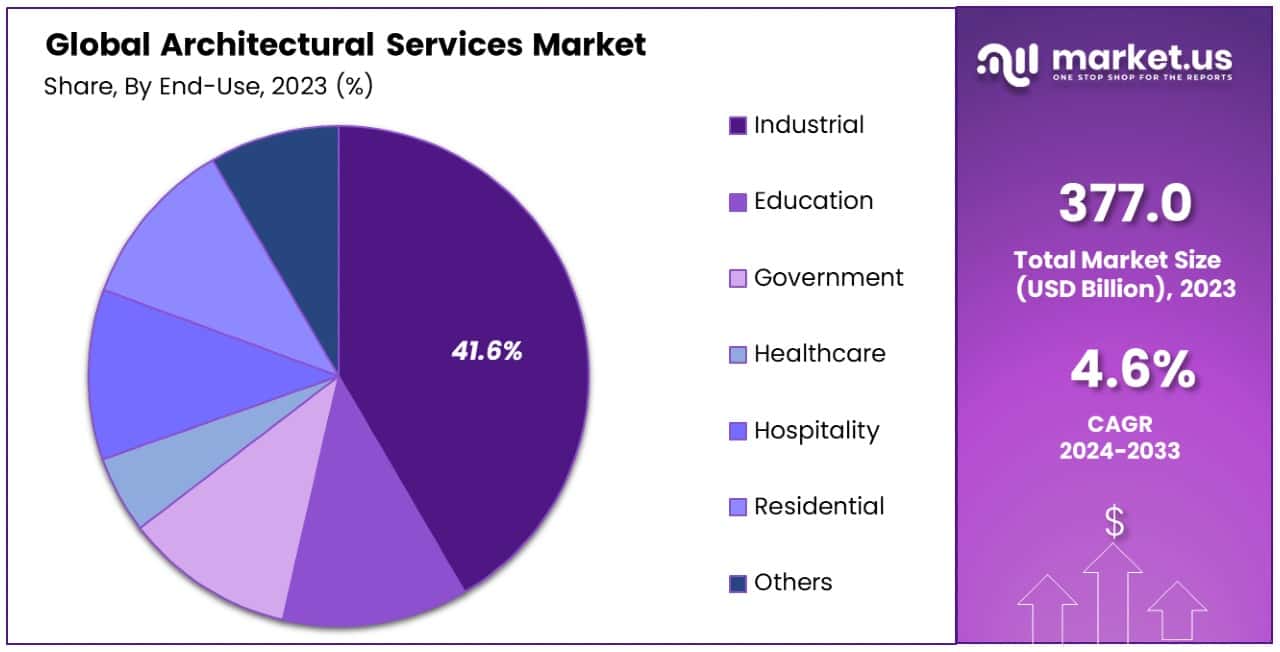

- In 2023, the Industrial Sector leads the end-use segment with 41.6%, underscoring its significant demand for specialized architectural services.

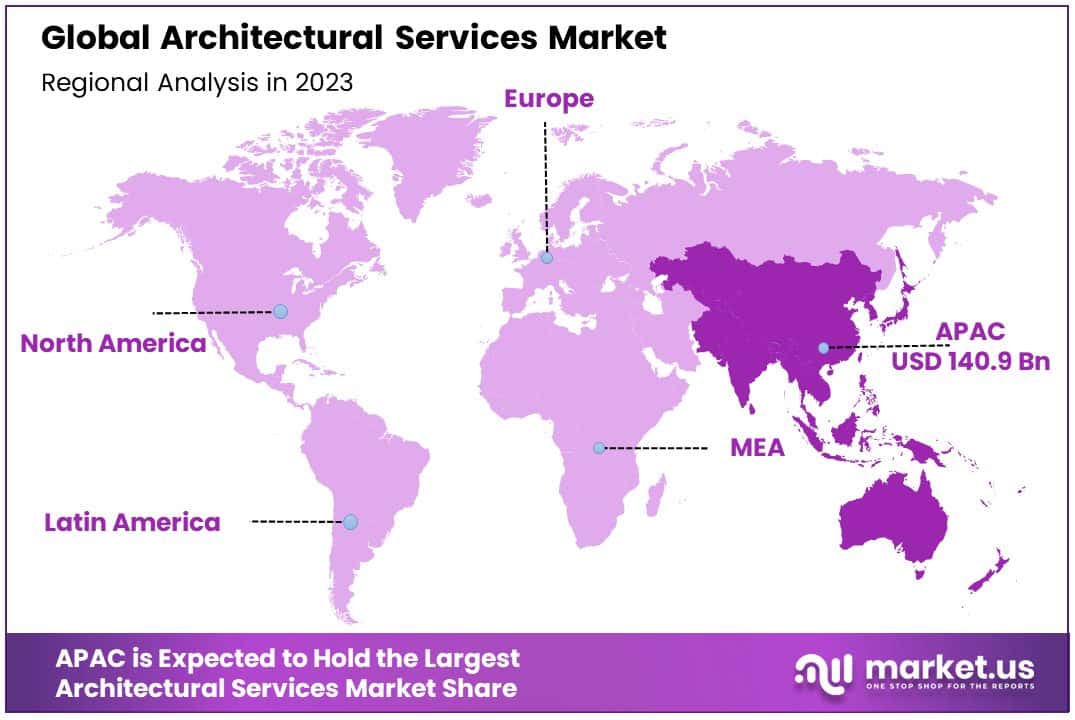

- In 2023, Asia Pacific is the dominant region with 37.4% market share, valued at USD 140.9 billion, reflecting its rapid urbanization and infrastructure expansion.

Business Environment Analysis

The architectural services market is moderately saturated with strong competition. According to UNCTAD, global services exports reached $7.1 trillion in 2022. Consequently, firms must strategically position themselves to differentiate and thrive in this crowded landscape.

Furthermore, innovation and technology integration define the market characteristics. For example, Huawei’s “City Intelligent Twins Architecture” utilizes AI and IoT to enhance urban management. Such advancements not only drive efficiency but also support the digital transformation of cities worldwide.

Target demographics primarily include urban developers and government bodies. Notably, over 200 cities in 40 countries have adopted intelligent systems. This focus on large-scale infrastructure projects highlights the growing demand for sustainable and technologically advanced architectural solutions.

Additionally, product differentiation is achieved through specialized services and cutting-edge technology. Accenture’s acquisition of BOSLAN and AUAR’s £2.6 million investment illustrate the trend towards integrating management services and construction technology, thereby offering unique value to clients.

Investment opportunities are abundant in digital transformation and sustainable architecture. For instance, the US maintains a trade surplus exceeding $1 billion in architectural services exports. Therefore, investing in innovative technologies can effectively tap into the growing global demand.

Export activities remain robust, with the US sustaining a trade surplus of $100 to $200 million annually in architectural services. Additionally, initiatives like Huawei’s international projects rise global exports. Meanwhile, import dynamics are shaped by the necessity for advanced materials and technologies, ensuring that firms remain competitive on a global scale.

Service Type Analysis

Construction and Project Management Services dominate with 33.6% due to their crucial role in overseeing projects from inception to completion.

The architectural services market is segmented by various service types, among which Construction and Project Management Services have emerged as the dominant sub-segment. Holding a significant market share of 33.6%, this segment’s dominance can be attributed to the increasing complexity of construction projects which require professional management to ensure timely and budget-compliant delivery.

These services are integral to coordinating between various stakeholders, managing resources, and adhering to regulatory requirements, which are critical factors in large-scale developments.

Architectural Advisory Services, although not the dominant sub-segment, play a pivotal role in the early stages of project development. These services provide clients with essential advice on the feasibility, sustainability, and potential impact of proposed construction projects, thereby shaping the initial scope and vision of the development.

Engineering Services are crucial for ensuring the structural integrity and operational efficiency of projects. These services encompass a broad range of engineering expertise including mechanical, electrical, and civil engineering. They are vital for the technical design and implementation of architectural projects along with engineering services outsourcing.

The ‘Others’ category encompasses miscellaneous services that do not fall strictly into the main categories but support the architecture industry, such as landscape architecture and heritage conservation, which cater to niche market needs.

End-Use Analysis

The Industrial Sector leads with 41.6% due to the increasing industrialization and need for specialized facilities.

Within the architectural services market, segmented by end-use, the Industrial sector emerges as the dominant area with a 41.6% share. This preeminence is driven by global trends in industrialization, the rise in manufacturing sectors, and the need for highly specialized facilities. Architectural services in this sector are tailored to meet the rigorous demands of industrial operations, focusing on maximizing space, enhancing efficiency, and integrating technology.

The Education sector, though not the largest, requires architectural services for the design and renovation of educational facilities. These services are crucial in creating environments that are conducive to learning and development, with considerations for safety, accessibility, and technological integration.

In the Government sector, architectural services are employed to develop and maintain public infrastructures such as municipal buildings, courts, and administrative spaces that meet high standards of security and functionality.

Other end-uses include segments not specifically listed but integral to niche markets such as recreational facilities and cultural institutions, which require unique architectural solutions tailored to their specific activities and visitor experiences.

Key Market Segments

By Service Type

- Architectural Advisory Services

- Construction And Project Management Services

- Engineering Services

- Interior Design Services

- Urban Planning Services

- Counseling Services

- Others

By End-Use

- Industrial

- Education

- Government

- Healthcare

- Hospitality

- Residential

- Others

Drivers

Urbanization and Technological Advancements Drive Market Growth

Urbanization and technological advancements are key drivers fueling the growth of the Architectural Services Market. The rapid urbanization across emerging economies leads to increased demand for residential, commercial, and infrastructure projects, creating a steady need for architectural expertise.

Additionally, advancements in design and construction technologies, such as Building Information Modeling (BIM) and 3D printing, enhance the efficiency and precision of architectural services, allowing firms to deliver complex projects more effectively. The growth in the real estate sector further amplifies this demand, as new developments require innovative architectural solutions.

Moreover, the rising emphasis on sustainable and green building practices compels architects to integrate eco-friendly designs, which not only meet regulatory standards but also cater to environmentally conscious clients. These combined factors create a robust environment for the Architectural Services Market, driving continuous expansion and evolution within the industry.

Restraints

Economic Barriers and Skilled Labor Shortages Restrain Market Growth

Economic barriers and skilled labor shortages are significant restraints impacting the Architectural Services Market. High costs associated with architectural services can deter potential clients, especially in price-sensitive regions, limiting market penetration and growth opportunities.

Additionally, the industry faces a shortage of skilled professionals, which hampers the ability to meet the increasing demand for architectural projects. This shortage is exacerbated by the specialized knowledge required for modern architectural practices, including sustainable design and advanced construction technologies.

Furthermore, stringent regulatory and compliance standards impose additional challenges, as firms must navigate complex legal requirements and obtain necessary approvals, delaying project timelines and increasing costs. Economic uncertainty and fluctuations also play a role, as volatile markets can lead to reduced investment in new projects and a cautious approach from clients.

Opportunity

Expansion into Emerging Markets Provides Opportunities

Expansion into emerging markets provides substantial opportunities for the Architectural Services Market. As developing regions experience economic growth and urbanization, there is a rising demand for new infrastructure, residential, and commercial projects that require professional architectural services.

Building Information Modeling (BIM) integration offers firms the chance to enhance their service offerings and improve project efficiency, making them more competitive in these markets. Additionally, the increasing demand for renovation and retrofitting services presents opportunities for firms to diversify their portfolios and cater to the needs of aging infrastructures seeking modernization.

The adoption of smart building technologies further opens avenues for innovation, allowing architects to design buildings that incorporate advanced automation, energy management, and connectivity features.

Challenges

Intense Competition and Rapid Technological Changes Challenge Market Growth

Intense competition and rapid technological changes present significant challenges to the Architectural Services Market. The market is highly competitive, with numerous firms vying for projects, which can lead to price wars and reduced profit margins. This competition forces firms to continuously innovate and differentiate their services to maintain a competitive edge.

Additionally, the rapid pace of technological advancements requires architectural firms to invest in new tools and training, which can be costly and time-consuming. Keeping up with the latest technologies, such as virtual reality (VR), augmented reality (AR), and modular construction techniques, is essential for firms to meet client expectations and deliver high-quality projects.

Managing project timelines and budgets becomes increasingly complex as projects become more sophisticated and technologically driven. Furthermore, navigating complex client requirements, which often include sustainability goals, aesthetic preferences, and functional demands, adds another layer of difficulty.

Emerging Trends

Sustainability and Smart Technologies Are Latest Trending Factors

Sustainability and smart technologies are the latest trending factors driving the Architectural Services Market. There is a growing emphasis on sustainable design, as clients and governments prioritize eco-friendly buildings that reduce environmental impact and promote energy efficiency. This trend pushes architects to incorporate green materials, renewable energy sources, and innovative waste management solutions into their designs.

Additionally, the integration of smart technologies, such as automation systems, IoT devices, and advanced energy management systems, is becoming increasingly popular. These technologies enhance the functionality and efficiency of buildings, providing users with greater control and improving overall building performance.

Furthermore, the rise of modular and prefabricated construction methods is changing the way buildings are designed and assembled, offering faster construction times and reduced costs.

Regional Analysis

Asia Pacific Dominates with 37.4% Market Share

Asia Pacific leads the Architectural Services Market with a 37.4% share, amounting to USD 140.9 billion. This significant market presence is driven by rapid urbanization, extensive infrastructure projects, and economic growth across the region. The demand for architectural services is further boosted by the increasing focus on sustainable and green building practices.

The region’s diverse economic landscapes and fast-paced development provide a dynamic environment for the architectural services industry. Rapid urbanization in countries like China and India, combined with government investments in public infrastructure, housing, and commercial spaces, shapes the market dynamics.

The influence of Asia Pacific in the global Architectural Services Market is expected to grow, driven by continuous urban development and the increasing sophistication of architectural requirements. The region’s commitment to innovative and sustainable architecture is likely to further enhance its market share.

Regional Mentions:

- North America: North America maintains a robust architectural services market, supported by a mature real estate sector and high standards for building codes and sustainability. The region’s focus on revitalizing aging infrastructure and increasing investment in residential projects contribute to its market stability.

- Europe: Europe’s architectural services market is propelled by historical preservation projects and stringent environmental regulations. The region’s commitment to energy-efficient and green building designs continues to drive demand for innovative architectural solutions.

- Middle East & Africa: The Middle East and Africa are witnessing significant growth in architectural services, spurred by massive investments in tourism, luxury real estate, and infrastructure projects. The focus on iconic constructions and smart cities in the Gulf countries notably pushes the regional market.

- Latin America: Latin America’s architectural services market is growing, fueled by urban renewal projects and infrastructure development. The region’s efforts toward modernizing its urban landscapes and improving housing quality play a crucial role in this growth trajectory.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global architectural services market, a few key players demonstrate significant influence and leadership. AECOM, Gensler, HOK, and Foster + Partners are particularly notable for their expansive portfolios and strategic market positions.

AECOM stands out with its vast global presence and a broad spectrum of services that extend beyond traditional architectural design to include engineering and construction management. This diversity allows AECOM to engage in large-scale projects worldwide, capitalizing on urbanization trends, particularly in emerging markets.

Gensler is renowned for its design excellence and innovation. As the world’s largest architecture firm by revenue, Gensler influences significant commercial, retail, and mixed-use projects globally. The firm’s focus on sustainable and user-centric designs significantly shapes contemporary architectural standards.

HOK is another global leader known for integrating architecture, engineering, and planning services. The firm’s expertise in environmental sustainability and its investment in research and development position it uniquely to cater to the increasing demand for green and smart buildings.

Foster + Partners, a UK-based firm, is distinguished by its modernist approach to architecture and its commitment to the engineering craft. Known for iconic projects like Apple’s headquarters and London’s Gherkin, the firm significantly impacts architectural aesthetics and urban landscapes, pushing the envelope in architectural innovation and sustainable design.

These companies not only lead in revenue but also set trends in the architectural world, influencing building practices and the future development of cities. Their commitment to innovation, sustainability, and the effective integration of technology in design processes places them at the forefront of the industry, driving growth and setting benchmarks in architectural excellence.

Top Key Players in the Market

- AECOM

- AEDAS

- DP Architects Pte Ltd.

- PCL Constructors Inc.

- HKS Inc.

- HOK

- Foster + Partners, Perkins Eastman

- HDR

- Gensler

- IBI Group

- Nikken Sekkei Ltd.

- Jacobs Engineering Group

- Perkins

- Will

- Stantec

Recent Developments

- On February 2024, the Little Rock Municipal Airport Commission approved the extension of two architectural services contracts, paving the way for continued development and enhancement of facilities at Bill and Hillary Clinton National Airport/Adams Field.

- On October 2023, the Architecture Billings Index (ABI) reported a decline in business conditions for architecture firms, with a score of 44.8 in September. This marks the second consecutive month of decline, following a brief stabilization period over the summer.

- On January 2024, the City of Champaign initiated a search for a firm to provide professional architectural services to support facility projects. This invitation calls for interested companies to submit a letter of interest, with the city employing a qualification-based selection process for the procurement.

Report Scope

Report Features Description Market Value (2023) USD 377 Billion Forecast Revenue (2033) USD 591.1 Billion CAGR (2024-2033) 4.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Architectural Advisory Services, Construction And Project Management Services, Engineering Services, Interior Design Services, Urban Planning Services, Counseling Services, Others), By End-Use (Industrial, Education, Government, Healthcare, Hospitality, Residential, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AECOM, AEDAS, DP Architects Pte Ltd., PCL Constructors Inc., HKS Inc., HOK, Foster + Partners, Perkins Eastman, HDR, Gensler, IBI Group, Nikken Sekkei Ltd., Jacobs Engineering Group, Perkins, Will, Stantec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Architectural Services MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Architectural Services MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AECOM

- Gensler

- Foster + Partners

- Jacobs Engineering Group

- IBI Group

- Perkins Eastman

- HDR

- Stantec inc.

- IBI Group inc.

- HKS inc

- Nikken Sekkei Ltd.

- Perkins and Will

- Other Key Players