Global Application Development Software Market By Type (Low-code Development Platforms, No-Code Development Platforms), By Deployment Mode (On-Premise, Cloud), By Organization Size (Small & Medium Enterprise, Large Enterprise), By End-Use Industry (IT & Telecommunications, BFSI, Travel & Tourism, Healthcare, Media & Entertainment, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 49711

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

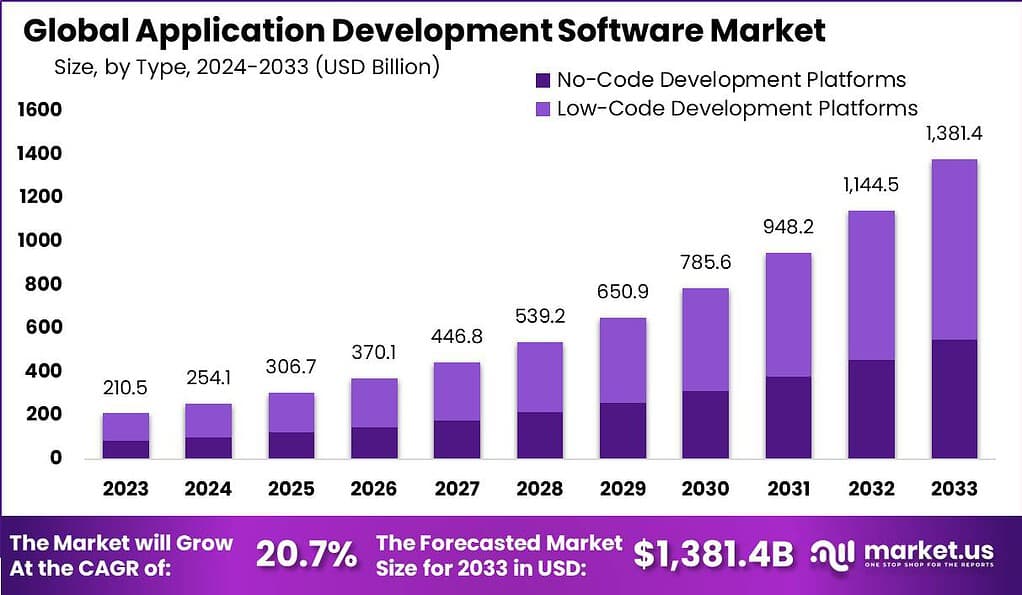

The Global Application Development Software Market size is expected to be worth around USD 1,381.4 Billion By 2033, from USD 210.5 Billion in 2023, growing at a CAGR of 20.7% during the forecast period from 2024 to 2033.

The application development software market has witnessed significant growth in recent years, driven by various factors. This market refers to the software tools and platforms used by developers to create applications for various operating systems and devices. The increasing demand for mobile and web applications, coupled with the rapid advancements in technology, has fueled the growth of this market.

One of the key growth factors for the application development software market is the rising adoption of smartphones and mobile applications. With the widespread availability of affordable smartphones and the increasing penetration of internet connectivity, the demand for mobile applications has soared. This has created a lucrative opportunity for application developers, leading to a higher demand for development software.

Furthermore, the growing emphasis on digital transformation across industries has also contributed to the market’s expansion. Organizations are realizing the importance of having their own mobile and web applications to enhance customer engagement, streamline operations, and stay competitive. As a result, there is a growing need for efficient application development software that enables businesses to create customized applications tailored to their specific requirements.

Despite the promising growth, the market faces several challenges. One major challenge is the high cost of advanced development tools and the need for skilled developers, which can be a barrier for small and medium-sized enterprises. Additionally, the fast-paced technological advancements require continuous learning and adaptation, which can be daunting for development teams. Furthermore, ensuring application security and compliance with regulations adds another layer of complexity to the development process.

However, these challenges also present opportunities. The increasing complexity of applications creates a demand for more innovative and user-friendly development tools, opening the door for new entrants with unique solutions. Additionally, the trend towards low-code and no-code platforms enables non-technical users to participate in application development, broadening the market’s potential user base.

The growing focus on digital transformation across industries further fuels the demand for application development software, providing significant growth opportunities for market players. According to research conducted by Radixweb, the global population of software developers is projected to reach approximately 28.7 million by the end of 2024, indicating a significant increase of around 3.2 million developers within a span of four years. In the United States alone, there are currently around 4.3 million software developers, highlighting the country’s substantial presence in the industry.

The study reveals that a substantial portion of software development projects, approximately 84.7%, are centered around enterprise applications. These projects aim to address the needs of businesses by providing software solutions that enhance their internal processes and operations. Furthermore, around 53.6% of software development projects are focused on business automation, while 38.5% are dedicated to the development of eCommerce applications.

In terms of the overall IT sector, it is anticipated to surpass its pre-pandemic position by 2024, exhibiting an estimated Compound Annual Growth Rate (CAGR) of 5%. This growth is indicative of the sector’s resilience and potential for expansion despite the challenges posed by the global pandemic. Considering the employment prospects, the United States is expected to witness a 22% increase in the employment of software developers by 2029. This signifies a promising opportunity for software developers in the country, particularly in the early stages of 2024.

Key Takeaways

- The Global Application Development Software Market is projected to reach approximately USD 1,381.4 Billion by 2033, growing from USD 210.5 Billion in 2023. This indicates a robust CAGR of 20.7% during the forecast period from 2024 to 2033.

- In 2023, the Low-Code Development Platforms segment demonstrated significant dominance within the Application Development Software market, securing over 60.1% share.

- Similarly, the On-Premise Platforms segment also held a leading position, accounting for more than 53.4% share of the market in 2023.

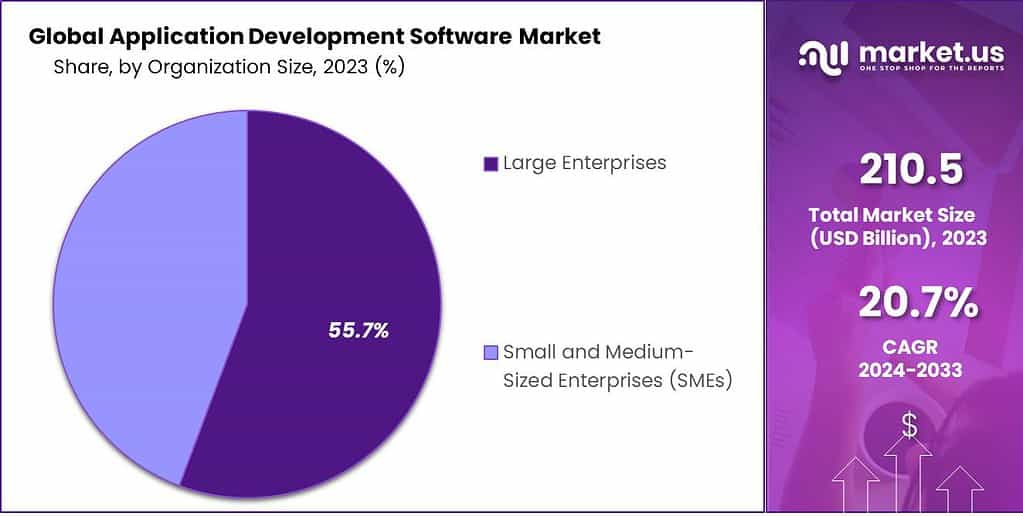

- The Large Enterprises segment showcased its prominence by capturing over 55.7% share in the Application Development Software market in 2023.

- The Media & Entertainment segment stood out by acquiring a notable 28.9% share of the market in 2023.

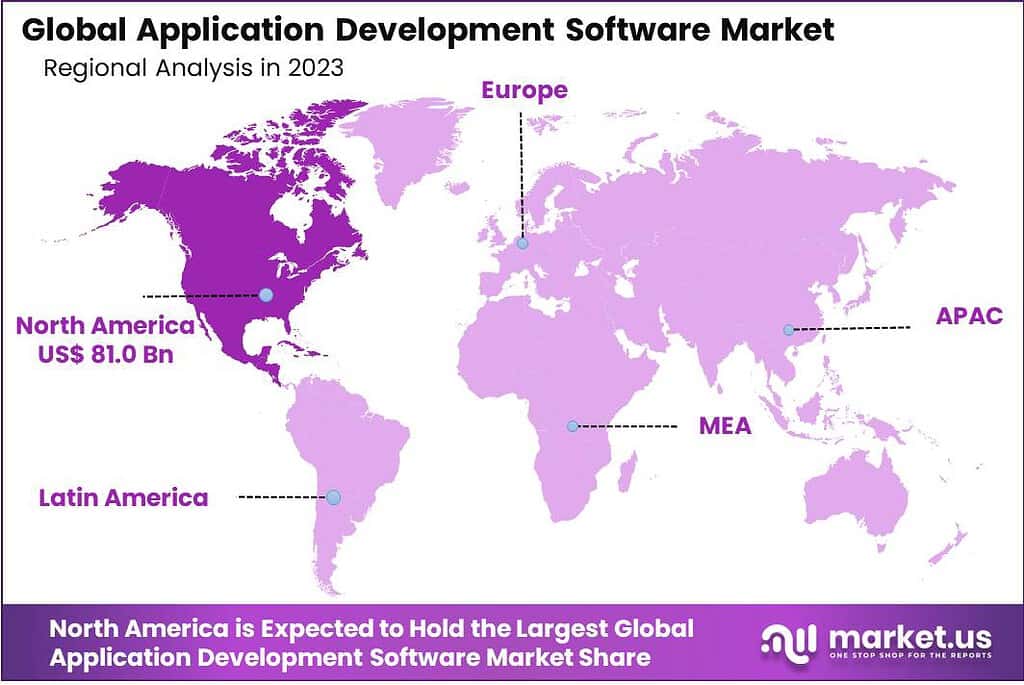

- Geographically, North America maintained its leadership in the Application Development Software market, holding more than a 38.5% share in 2023.

Type Analysis

In 2023, the Low-Code Development Platforms segment held a dominant market position in the Application Development Software market, capturing more than a 60.1% share. This significant stake is primarily due to the platforms’ ability to enable rapid application development with minimal coding, making it accessible to a broader range of users, including those with limited technical expertise.

Businesses are increasingly adopting low-code platforms to accelerate digital transformation, streamline workflow, and quickly respond to market changes. These platforms also reduce the burden on IT departments and lower development costs, making them a preferred choice for many organizations. Low-code development platforms are particularly popular among enterprises seeking agility and speed, as they allow for the quick creation and deployment of apps that can easily evolve with changing business needs.

The rise in demand for custom applications to improve customer experiences and operational efficiency further propels the growth of this segment. Moreover, as remote work and digital collaboration continue to rise, low-code platforms provide an effective way for teams to build and modify applications in a distributed environment.

On the other hand, No-Code Development Platforms are also gaining traction, especially among small and medium-sized businesses and non-technical users. These platforms allow users to build applications through graphical user interfaces and configuration instead of traditional programming. While they hold a smaller market share compared to low-code platforms, the ease of use, affordability, and the ability to empower non-technical staff to create their own solutions drive their growth.

No-code platforms are particularly appealing to businesses looking to democratize application development and foster innovation across all levels of the organization. They enable rapid prototyping and testing, allowing companies to experiment with new ideas and solutions without significant investment or risk. As technology continues to advance and businesses seek more customizable and flexible solutions, the no-code segment is expected to grow, offering new opportunities for users and vendors in the application development market.

Both low-code and no-code development platforms are revolutionizing the way applications are built and deployed, each catering to different needs and skill levels. As businesses continue to prioritize digital transformation, these platforms are set to play a crucial role in enabling faster, more efficient, and more inclusive application development.

Deployment Mode

In 2023, the On-Premise Platforms segment held a dominant market position in the Application Development Software market, capturing more than a 53.4% share. This predominance is largely due to the high level of control, security, and customization that on-premise solutions offer to organizations. Many businesses, particularly those in sectors with stringent data protection regulations like finance and healthcare, prefer on-premise platforms to keep sensitive data within their own infrastructure. Additionally, companies with significant investments in existing IT infrastructure find on-premise solutions more compatible with their legacy systems.

On-premise platforms provide organizations with a stable and predictable environment for developing and deploying applications. They allow businesses to maintain physical control over their development tools and data, which is a critical factor for many companies concerned with data security and governance. However, this segment faces challenges such as higher upfront costs, the need for ongoing maintenance, and the requirement for in-house expertise to manage and operate the infrastructure.

Conversely, the Cloud-based Platforms segment is rapidly growing, driven by the flexibility, scalability, and cost-efficiency it offers. Businesses, especially small to medium-sized enterprises (SMEs), are increasingly adopting cloud solutions to avoid the substantial initial investment and ongoing maintenance costs associated with on-premise solutions. Cloud platforms allow organizations to access a wide range of development tools and services on demand, pay as they go, and scale resources up or down as needed. This flexibility makes it easier for businesses to adapt to changing market demands and accelerate the development and deployment of applications.

Cloud deployment also facilitates collaboration and remote working, as team members can access the development environment from anywhere at any time. This has become particularly relevant as more businesses adopt remote and hybrid work models. Moreover, as cloud providers continually enhance their security measures and compliance certifications, the perceived security gap between cloud and on-premise solutions is narrowing, making cloud platforms an increasingly viable option for a broader range of businesses.

Organization Size

In 2023, the Large Enterprises segment held a dominant market position in the Application Development Software market, capturing more than a 55.7% share. This significant portion is primarily attributed to the extensive resources and capital that large organizations can allocate toward advanced application development platforms and tools.

These enterprises often deal with complex, large-scale operations and require robust, comprehensive software solutions that can integrate seamlessly with their existing systems and manage substantial workloads. Large enterprises also tend to prioritize security and compliance, driving them towards premium solutions that offer advanced features and support.

Additionally, large enterprises are typically at the forefront of innovation, seeking to leverage new technologies to maintain a competitive edge. This drive leads to a higher adoption rate of cutting-edge application development software that can support complex, bespoke applications, and facilitate digital transformation initiatives. However, the segment also faces challenges, including managing the complexity of integrating new software into legacy systems and the need for ongoing training and support for their sizable workforce.

On the other hand, the Small & Medium Enterprise (SME) segment is rapidly growing and presents a substantial opportunity in the application development software market. SMEs are increasingly recognizing the importance of digitalization and are seeking affordable, flexible, and user-friendly platforms that can help them develop applications quickly and efficiently. This demand has led to a rise in the adoption of no-code and low-code development platforms, which allow businesses with limited technical expertise to build and deploy applications tailored to their specific needs.

SMEs benefit from the scalability and cost-effectiveness of these platforms, as they can start with smaller investments and scale up as their business grows. Cloud-based solutions are particularly attractive to SMEs, as they typically require less upfront investment and can be accessed from anywhere, providing flexibility and mobility. However, SMEs often face challenges such as limited IT resources, budget constraints, and the need for solutions that can deliver quick returns on investment.

End-Use Industry

In 2023, the Media & Entertainment segment held a dominant market position in the Application Development Software market, capturing more than a 28.9% share. This significant share is driven by the industry’s constant need for innovative and engaging digital content, platforms, and user experiences.

Media & Entertainment companies are leveraging application development software to create immersive and interactive experiences for their audiences, from streaming services to gaming and virtual reality. The demand for personalized content and multi-platform accessibility has further amplified the need for robust, versatile development tools in this sector.

The IT & Telecommunications industry is also a major player, utilizing application development software to build and maintain the vast array of services and infrastructure required to support global communication and data services. As this sector continues to expand and evolve with new technologies like 5G and the Internet of Things (IoT), the need for efficient, scalable, and secure application development solutions becomes increasingly critical.

In the Banking, Financial Services, and Insurance (BFSI) sector, there’s a growing emphasis on digital transformation to enhance customer service, operational efficiency, and compliance management. Application development software in BFSI is crucial for creating secure, reliable, and user-friendly digital platforms for online banking, trading, insurance services, and more. The demand in this sector is driven by the need for high-security standards and regulatory compliance, as well as the competitive pressure to provide innovative financial products and services.

The Travel & Tourism industry relies on application development software to create seamless, user-friendly booking systems, customer service platforms, and interactive mobile apps to enhance the travel experience. With the increasing trend of personalized travel and the need for real-time information and booking capabilities, this sector’s demand for advanced development platforms is growing rapidly.

Healthcare is another critical segment, where application development software is used to create solutions for patient care management, telemedicine, health records management, and more. The emphasis on improving patient outcomes and operational efficiency in healthcare, along with the growing trend of digital health solutions, drives the demand for secure, compliant, and user-friendly applications.

Other End-Use Industries, including education, retail, and manufacturing, are also increasingly adopting application development software to digitalize operations, improve customer engagement, and innovate products and services. These industries seek platforms that can help them quickly adapt to market changes, streamline operations, and provide enhanced user experiences.

Key Market Segments

Type

- No-Code Development Platforms

- Low-Code Development Platforms

Deployment Mode

- Cloud-Based

- On-Premise

Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Travel & Tourism

- Healthcare

- Media & Entertainment

- Other End-Use Industries

Drivers

- Increasing demand for various application software among industries: Industries are continually seeking ways to innovate, streamline operations, and enhance customer experiences. This drives a robust demand for application development software across sectors, as these tools enable businesses to create and deploy applications that meet their specific needs, from customer service to internal process management.

- Rising automation across industries: As industries look to increase efficiency and reduce costs, automation becomes a key objective. Application development software is critical in this regard, as it helps create the applications that control and manage automated processes, further driving the need for these tools.

- Robust demand for customized and scalable software: Businesses today require software solutions that not only fit their current needs but can also scale and evolve as they grow. Application development software allows for the creation of tailored solutions that can adapt to changing business requirements, making it an attractive choice for organizations of all sizes.

- Growing adoption of smartphones, computers, and laptops: The widespread use of smartphones and computers has led to increased demand for applications across these devices. This, in turn, boosts the market for development software that can create apps for various platforms and devices, catering to a mobile-first consumer base.

Restraints

- High cost of these software: While application development software offers many benefits, the high cost associated with some advanced and enterprise-level platforms can be a significant barrier, especially for small and medium-sized enterprises with limited budgets.

- Growth in data and privacy concerns: As the use of application development software expands, so does the amount of data these applications handle. This raises concerns about data security and privacy, particularly in industries dealing with sensitive information, potentially restraining market growth as businesses become more cautious.

- Integration with Existing Systems: Challenges in integrating new applications with existing legacy systems can hinder the adoption of new development software.

- Resource Intensive: Developing applications, particularly sophisticated ones, can be resource-intensive in terms of time, money, and human capital, which can be a constraint for many businesses.

- Evolving Technology Landscape: The fast pace of technological change can render applications obsolete quickly, deterring businesses from investing heavily in development.

Opportunities

- Increasing trend of cloud-based applications: The shift towards cloud computing opens significant opportunities for application development platforms. Cloud-based solutions offer the advantages of scalability, flexibility, and accessibility, making it easier for businesses to develop and manage applications without the need for extensive infrastructure.

- Rapid adoption in aerospace and defense industries: These industries are increasingly adopting advanced technologies, including application development software, to create sophisticated and secure applications for various purposes, from operations management to simulation and training. This adoption represents a growing market opportunity.

- Rising digitalization: The overarching trend of digitalization across all sectors is perhaps the most significant market opportunity. As businesses continue to move their operations, customer interactions, and services online, the need for custom applications will continue to grow, driving demand for development software.

Challenges

- Security Concerns: With increasing cyber threats, ensuring the security of applications developed is becoming more challenging and critical.

- Keeping Up with Rapidly Changing Consumer Expectations: Users’ expectations for functionality, design, and performance are continually evolving, posing a challenge for developers to keep applications up-to-date and relevant.

- Talent Gap: There is a growing talent gap in the market, with a shortage of skilled developers proficient in the latest development technologies and methodologies.

- Scalability Issues: Ensuring applications can scale effectively to handle growth in users and data is a persistent challenge, particularly for growing businesses.

Key Market Trends

- Shift Towards Cloud-Based Development Environments: Cloud platforms are becoming the preferred environment for application development, offering scalability, collaboration, and reduced infrastructure costs.

- Rise of Analytic Applications: There’s an increasing trend of incorporating analytics into applications to provide insights and drive decision-making.

- Focus on User Experience (UX) Design: Emphasis on UX design in application development is growing, as businesses recognize the importance of user satisfaction and engagement.

- Adoption of Agile and DevOps Practices: More companies are adopting Agile and DevOps methodologies for faster and more efficient application development and deployment.

Regional Analysis

In 2023, North America held a dominant market position in the Application Development Software market, capturing more than a 38.5% share. This substantial market share is largely driven by the presence of a robust technological infrastructure, a highly competitive business environment, and a strong focus on innovation and digital transformation.

The region, particularly the United States, is home to many leading application development software companies and startups, continuously pushing the boundaries of software capabilities. Additionally, the widespread adoption of advanced technologies such as cloud computing, AI, and IoT in various industries further fuels the demand for sophisticated application development tools and platforms in North America.

Europe follows closely as a significant market, characterized by its stringent data protection regulations, which influence the development and adoption of software applications, particularly those handling sensitive information. Countries like Germany, the UK, and France are leading in adopting new technologies and digital practices, driving the demand for application development software that can deliver secure, reliable, and compliant solutions.

The Asia-Pacific (APAC) region is experiencing rapid growth in the application development software market, thanks to its fast-paced digitalization, increasing technological adoption, and growing startup ecosystem. Countries like China, Japan, India, and South Korea are heavily investing in IT infrastructure and digital initiatives, making APAC a hotbed for innovation and development in application software. The region’s expanding SME sector and increasing mobile and internet penetration are also significant drivers for the market.

Latin America is emerging as a promising market, with countries like Brazil and Mexico leading the way in digital transformation efforts. The region is witnessing an increasing number of businesses adopting digital tools and platforms to improve their operations and reach customers more effectively. However, challenges such as political instability and economic fluctuations can impact the growth and adoption rates of application development software.

The Middle East and Africa (MEA) region, though smaller in comparison, is showing signs of accelerated growth in the application development software market. With initiatives to diversify economies and develop smart cities, particularly in the Gulf Cooperation Council (GCC) countries, there’s a growing emphasis on leveraging technology to drive innovation and economic development. Africa, with its vast potential and ongoing digitalization efforts, presents numerous opportunities for the adoption and implementation of application development tools.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Application Development Software Market is highly competitive and features several key players that offer a diverse range of software tools, platforms, and services. These companies are at the forefront of driving innovation, providing robust development solutions, and catering to the evolving needs of developers and organizations. The market players focus on undertaking various strategic initiatives, new product launches, joint ventures, contracts and agreements, and partnerships to enhance their position in the market.

Top Key Рlауеrѕ

- Microsoft Corporation

- Google LLC

- SAP SE

- Oracle Corporation

- IBM Corporation

- HCL Technologies Limited

- Zoho Corporation

- Atlassian Corporation

- Wipro Ltd.

- Joget

- GitLab Inc.

- Alice

- Other Key Players

Recent Developments

- In April 2023, Fujitsu unveiled the Fujitsu AI Platform, named Fujitsu Kozuchi, providing robust solutions and global access to a diverse range of powerful artificial intelligence (AI) and machine learning (ML) technologies specifically designed for commercial users.

- In March 2023, Fujitsu initiated a collaborative venture with Osaka University, jointly pioneering a quantum computing architecture known for its superior computational prowess and the ability to rectify quantum errors.

Report Scope

Report Features Description Market Value (2023) USD 210.5 Bn Forecast Revenue (2033) USD 1,381.4 Bn CAGR (2023-2032) 20.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Low-code Development Platforms, No-Code Development Platforms), By Deployment Mode (On-Premise, Cloud), By Organization Size (Small & Medium Enterprise, Large Enterprise), By End-Use Industry (IT & Telecommunications, BFSI, Travel & Tourism, Healthcare, Media & Entertainment, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft Corporation, Google LLC, SAP SE, Oracle Corporation, IBM Corporation, HCL Technologies Limited, Zoho Corporation, Atlassian Corporation, Wipro Ltd., Joget, GitLab Inc., Alice, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What does the Application Development Software Market encompass?The market covers a broad spectrum of software tools, platforms, and services dedicated to supporting application development across various industries.

How big is the application software development market?The Global Application Development Software Market is estimated to be worth USD 210.5 billion in 2023 and projected to be valued at USD 1,381.4 billion in 2033. Between 2024 and 2033, the market is expected to register a growth rate of 20.7%.

What is the application software industry?The application software industry refers to the sector that develops and provides software applications for various purposes, including business, entertainment, productivity, and more. It plays a crucial role in meeting the software needs of end-users and businesses.

What are the driving factors behind the growth of this market?The market's growth is primarily fueled by the increasing demand for software applications to meet evolving business needs, digital transformation initiatives, and the proliferation of mobile and web-based applications.

What industries benefit from the Application Development Software Market?Virtually all industries can benefit, as the market's offerings cater to diverse domains and sectors.

Application Development Software MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Application Development Software MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Google LLC

- SAP SE

- Oracle Corporation

- IBM Corporation

- HCL Technologies Limited

- Zoho Corporation

- Atlassian Corporation

- Wipro Ltd.

- Joget

- GitLab Inc.

- Alice

- Other Key Players