Global Antiseptic & Disinfectants Market By Type (Phenols & Derivatives, Quaternary Ammonium compounds, Alcohol & Aldehydes, Biguanides & amides, iodine compounds, Others), By Product (Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants), By Sales (B2B, FMCG), By End-User (Hospital, Clinics, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117409

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

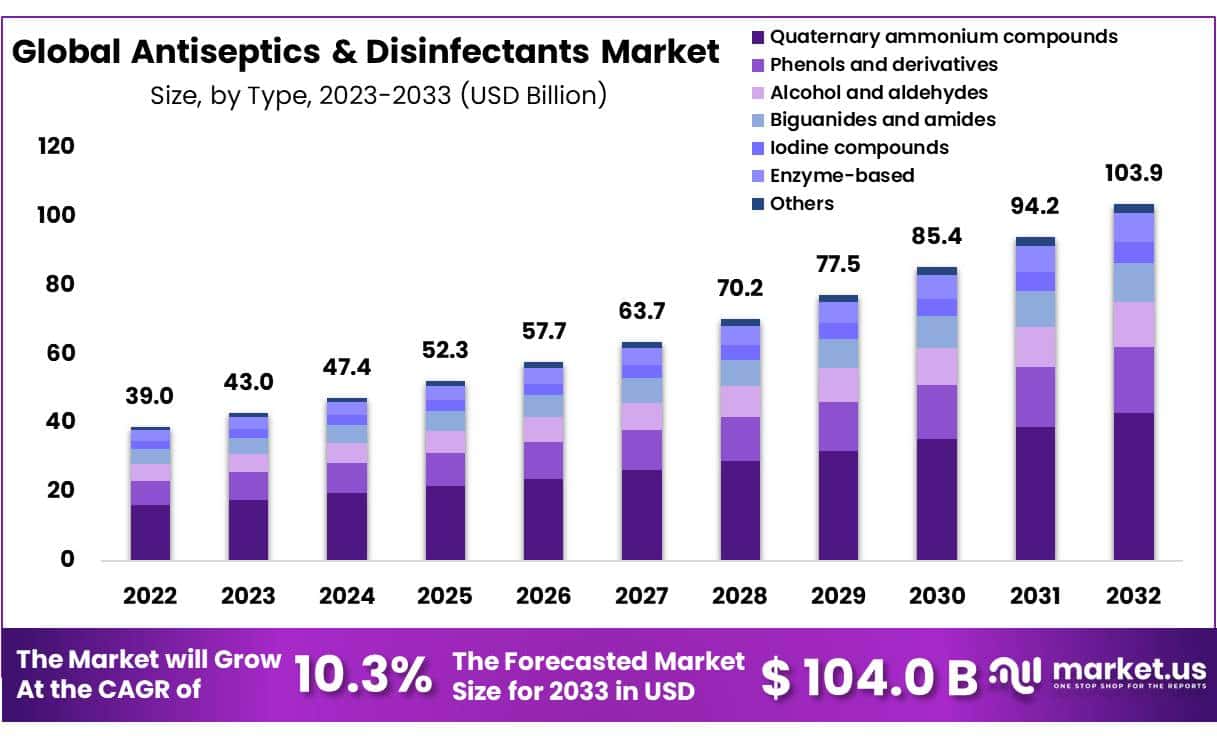

Global Antiseptic And Disinfectants Market size is expected to be worth around USD 104.0 Billion by 2033 from USD 39.0 Billion in 2023, growing at a CAGR of 10.3% during the forecast period from 2024 to 2033.

The agents utilized to combat microorganisms such as bacteria, viruses and fungi, albeit with distincions in their application and efficacy are popularly identified as antiseptics and disinfectants. The major difference between antiseptics and disinfectants comprise of the area of use.

Antiseptics are majorly utilized on living tissues like skin or mucous membranes with the aim to stave off infections or sepsis in wounds, cuts, or during surgical procedures. Some of the widely used antiseptics include hydrogen peroxide, iodine based solutions and alcohol.

In contrast, disinfectants are employed on non-living surfaces and objects to eradicate microorganisms and limit their propagation. Disinfectants are widely used in hospitals, households and laboratories for sanitizing the surfaces and medical equipment. Common disinfectants employed in day to day activities include chlorine compunds, quaternary ammonium compounds and phenolic compounds.

The global antiseptics and disinfectants market is majorly driven by rising incidences of hospital acquired infections, growing elderly population, pervasiveness of chronic illnesses and rising cases of surgical procedures aross the globe.

- According to World health Organization, hundreds of millions of people every year are affected by healthcare-associated cited infections, many of which are avoidable. 48.7% of sepsis with organ dysfunction treated in adult ICUs are hospital acquired.

- According to World Health organization, the proportion of world’s population over 60 years will nearly double from 12% to 22% and by 2020, the number of people aged 60 years and older will outnumber children younger than 5 years.

Key Takeaways

- Based on type, quaternary ammonium compound segment dominates the global antiseptic and disinfectant market in 2023.

- Based on product, a hefty market share of 56.4% is withheld by medical device disinfectants segment.

- Based on sales channel, B2B segment captured an impressive market portion of 65.7% in recent years.

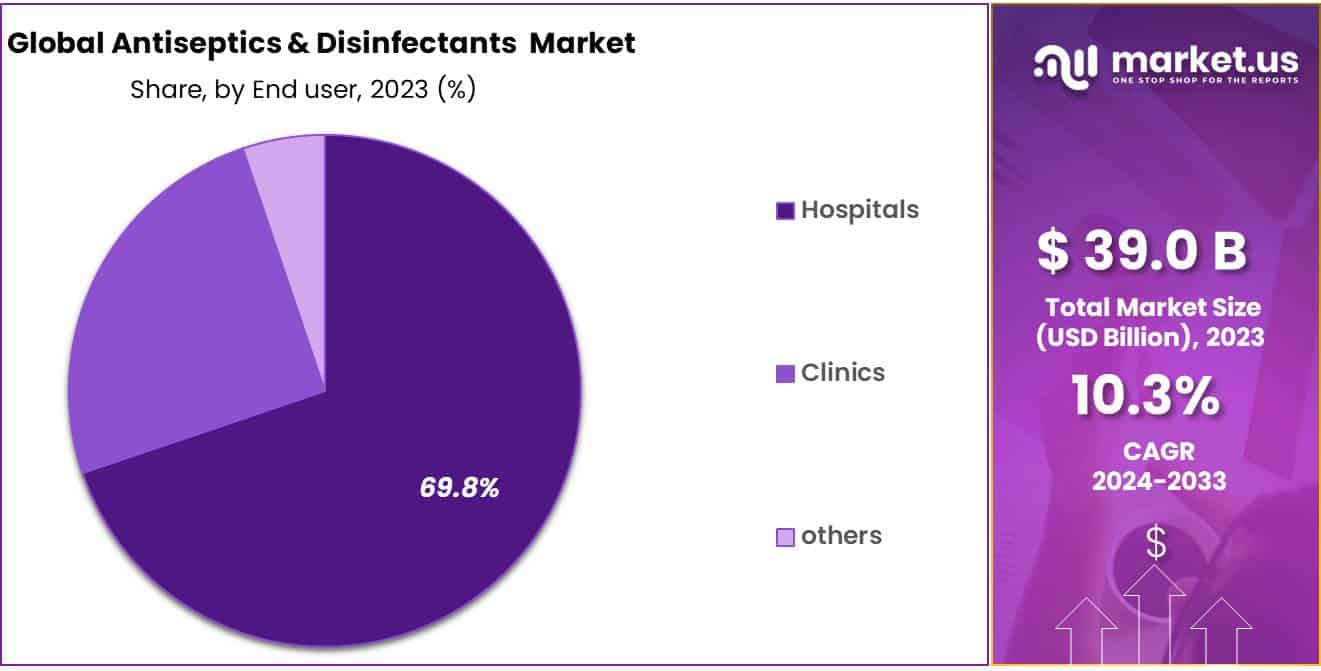

- Based on end use, hospital segment overshadows the global antispetics and disinfectants market capturing a valuable market share of 69.8%.

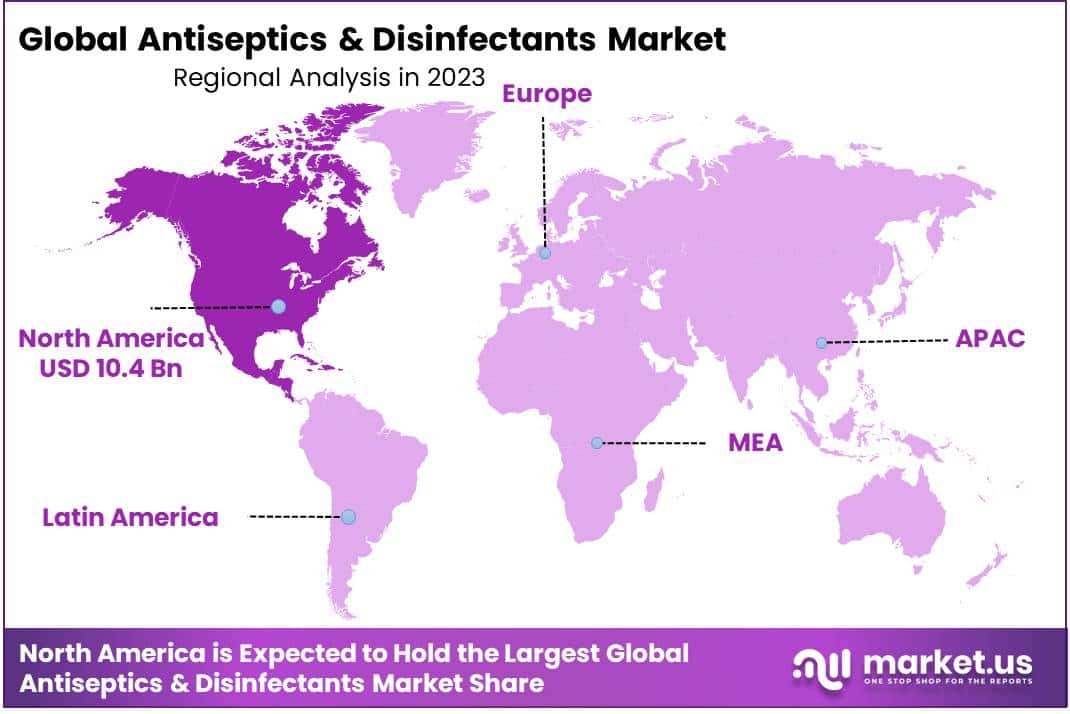

- North America leads the global antiseptics and disinfectants market in recent years.

By Type Analysis

Based on type, the anesthetic and disinfectants market is majorly classified into Phenols & Derivatives, Quaternary Ammonium compounds, Alcohol & Aldehydes, Biguanides & amides, iodine compounds, enzyme-based, and other segments. Amongst these segments, quaternary ammonium compounds dominates the market capturing a hefty revenue share of 41.3% in the year 2023. The dominance is by virtue of its wide usage as surface disinfectants in hospitals and laboratories, where it controls the spread of healthcare associated infections in hospitals and clinics.

Furthermore, quaternary ammonium compounds are also employed to disinfect medical equipment that come in direct contact with skin. In addition this, the segmental growth is robustly flourishing due to rising incidences of hospital acquired infections across the globe.

- According to World Health Organization, 7 out of every 100 hospitalized patients in industrialized nations and 10 out of every 100 hospitalized patients in underdeveloped countries acquire at least one hospital acquired infection every year.

On the other hand, fastest growth is anticipated by enzyme based antispetics and disinfectants segment. This type is employed to control odor created by chemical processes. Enzymes based antiseptics and disinfectants are majorly utilized in research facilities for cleaning enzyme based or catalyst based products. With the rising number of research facilities, the segmental demand is expected to skyrocket.

- According to Congressional Research Service, total global R&D spending has more than tripled in current dollars since 2000, rising from $677 billion to $2.2 trillion in 2019.

By Product Analysis

Based on product, the market bifurcates into Enzymatic Cleaners, Medical Device Disinfectants and Surface Disinfectants. The largest revenue share was held by the medical device disinfectants segment at 56.4% in 2023. The majority of medical device disinfectants can be used for the reprocessing of surgical units and endoscopes.

Phenol/phenate, hydrogen peroxide, Glutaraldehyde, and peracetic acid are some of the disinfectants used for the disinfection of medical devices. It is important to properly clean medical devices and endoscopes. They can transmit infection by direct contact with the skin. This segment may be driven by the growing number of surgeries performed worldwide.

- According to National Institute of Health, a staggering 310 million major surgeries are performed each year, with around 40 to 50 million performed in USA and 20 million in Europe.

The fastest expected growth rate in the segment of enzymatic cleaning products is predicted to occur over the forecast period. Enzymatic cleaners are better at removing bacteria from surfaces. They are also used to prevent odor. It is used to disinfect equipment and test kits in hospitals and clinics. These two factors are important in determining the growth of the industry.

By Sales Channel Analysis

Based on sales channel, the market is fragmented into B2B and FMCG segments. B2B dominated the antiseptics and disinfectants market and had the highest revenue share, at 65.7%, in 2023. B2B sales channels allow companies to sell their products directly to businesses, and not to consumers. B2B sales channels typically have longer sales cycles, higher-order values, and more complex sales processes. B2B channel sales will experience a lower growth rate in the forecast period due to entry barriers.

These include a lack of investment in technologically advanced products and difficulties in coordinating with other vendors. The B2B channel is a major sales channel for disinfectants and antiseptics. The B2B channel is used by major end-users such as hospitals, clinics, healthcare providers, suppliers, and others.

The FMCG distribution channel consists of three main entities: agents and facilitators. Merchants are the third. Agents generate sales by promoting the products of the company. Agents can either be part of the company or independent individuals. Facilitators generally assist in the movement of manufactured goods between one place and another. The merchant’s category generally includes wholesalers and retailers.

FMCG products are usually purchased by consumers directly from wholesalers or retailers. Hand Sanitizers, Antiseptic Topical Creams, Antiseptic Washes, and Antiseptic Wipes are all included in the FMCG product category.

By End User Analysis

Based on end use, the market bifurcates into hospitals, clinics and other segments. Hospital segment acquired a huge market revenue share of 69.8% in the year 2023 owing to the rising incidence of hospital acquired infections.

The usage of approapriate antiseptics and disinfectants is crucial to reduce the spread of illnesses. The demand for disinfectants and antiseptics up scale with the increasing number of hospitals, which is in turn due to rising healthcare expenditure in developed and developing economies.

- As per Centre for Disease Control, nearly 1 out of every 31 hospital patient contracts a hospital-acquired infection.

- As per Eurostat, Germany, and France, had the highest healthcare spending (around 11.8%) in GDP in 2019.

Key Market Segments

By Type

- Phenols & Derivatives

- Quaternary Ammonium compounds

- Alcohol & Aldehydes

- Biguanides & amides

- Iodine compounds

- Enzyme-based

- Other

By Product

- Enzymatic Cleaners

- Medical Device Disinfectants

- Surface Disinfectants

By Sales Channel

- B2B

- FMCG

By End User

- Hospital

- Clinics

- Others

Drivers

The rising ultimatum for hand sanitizer production

The market for antiseptics and disinfectants is flourishing with the rising demand for production of hand sanitizers. For instance, during pandemic, there boosted a demand for hand sanitizer across the globe, particularly the demand for hydrogen peroxide and halogenated phenol infused hand sanitizers and disinfectants.

- As per Canadian Consumer Specialty Products Association, in 2020, the production capacity of hand sanitizers in the region stands at 3,000,000 bottles of water per day.

- As per Consumer News and Bussiness Channel, in Italy the demand for hand sanitizers scaled by 1, 870%, spiked by 1,400% in the United States and raised by 255% in UK during 2020.

Rising Demand for Medical Devices

There are some of the medical devices which are reused by other patients and therefore these medical devices has be to properly disinfected through appropriate antiseptics and disinfectants such as benzylkonium chloride, hydrogen peroxide and halogenated phenol.

- According to WHO, around 2 billion people will require atleast one assistive product, with elderly people requiring more than 2 by 2030. In recent year 1 in 10 people have access to assistive products. Approximately 76 million people require wheelchairs across the globe.

Restraints

Risk of toxic substances present in antiseptics and disinfectants

Various risk factors are associated with antiseptics and disinfectants, that are involved in causing hazardous side effects to human health. To exemplify, the overexposure to hydrogen peroxide can cause skin irritation and rashes. Ethylene oxide which is notable present in antispetics is highly inflammable, toxic, mutagenic and carcinogenic and has to be handled with utmost care.

The another toxic compound present in antispetics and disinfectants includes halogenated phenols which is known to be a protoplasmic poison that penetrates through the cellular membranes and deposit unwanted proteins on the way. Thus, these crucial factors causing harm to human health can cause hindrance in market growth during the forecast period.

Opportunities

Rising geriatric population

The growing geriatric population being more prone to infectious diseases demands for antiseptics and disinfectants to prevent the spread of infectious diseases. Thus, high quality of antiseptics and disinfectants becomes necessary to stop the spread of diseases and other ill effects of harmful chemicals, emerging as a significant opportunity for the market players.

- According to the Worlds’ Aging Population, in 2022, there were 771 million people aged 65+ years across the globe, which evaluates 10% of the world’s population.

Increasing number of hospitals

Globally, the number of hospitals is surging with time, which is resulting in fostering the economy for antiseptics and disinfectants. Antiseptics and disinfectants proves to be an effective method for maintaining hygiene in hospital environments. Nowadays, hospital sectors are more into the use of these solution in comparison with its domestic use.

- According to Hospital Statistics and Facts, In 2021, there are approximately 6,090 hopsitals in United States and approximately 165,000 in the world.

Latest Trends

Several advancements are scaled in the area of Antiseptic and disinfectants resulting into market expansion. Some of these advances include:

Hydrogen peroxide gas plasma: It is a new sterilization technology based on plasma. The mechanism of action of the device includes the production of free radicals within a plasma field that are capable of interacting with essential cell components (eg., Enzymes, nucleic acids) and thereby disrupt the metabolism of microorgnisms.

Peracetic acid immersion: The concentrated peracetic acid is diluted to 0.2% with filtered water at a temperature of around 50o celcius. The diluted peracetic acid is circulated within the chamber of machine and pumped through the channels of the endoscope for 12 minutes, decontaminating exterior surfaces, lumens and accessories.

Impact of Macroeconomic factors

Pandemic or disease outbreaks can impact the market for antiseptic and disinfectants, as more children and adults are affected with infectious diseases so more is the demand for related disinfectants. However, the changes in currency exchange rates can have a vital effect on cost import and export of antiseptics and disinfectants, impacting the pricing and availability of these in diverse market areas.

Regional Analysis

North America proves to be highly advanced region in Anesthesia Drugs market

A significant market share of 26.9% is withheld by North America, dominating the global antiseptic and disinfectants market in the year 2023. The prominence owes to the rising number of surgeries being carried out in North America coupled with rising number of workers in healthcare sector. The rise in surgical procedures escalates the demand for antiseptics and disinfectants.

The incorporation of antiseptics and disinfectants reduces the risk of contamination and transmission of infections from one patient to another. In addition to the aforementioned benefactors, the region also comprise increasing cases of hospital acquired infections fostering an ultimatum for such solutions.

- According to Health Information & Management System Society, 1 out of 25 patients in United States is affected with hospital acquired infection every day.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major companies are focusing on growth strategies such as product developments, new product approvals, and mergers & acquisitions to enhance their share of the worldwide Antiseptic and Disinfectants market. Approvals by regulatory authorities play a pivotal role in extending the use of these solutions in research institutes, hospitals and in households to minimize the risk of contamination caused due to diverse microorganisms.

Market Key Players

- Procter & Gamble Co.

- Ecolab, Inc.

- The Clorox Company

- Unilever Plc

- GOJO Industries, Inc.

- Stepan Company

- Steris Plc.

- The Dow Chemical Company

- Virox Technologies Inc.

- Johnson & Johnson

- 3M Company

Recent Developments

- In June 2023: A manufacturer of ultrasound and accessories, Parker Laboratories Inc., received US Food and Drug Administration approval for a unique disinfectant foam, called TrIstel ULT, as a high level disinfectant for ultrasound probe used within body cavities and for skin surface transducers.

- In April 2023: 3M SoluPrep S Sterile Antiseptic Solution chlorhexidine gluconate (2%w/v) and isopropyl alcohol (70%v/v) was launched by 3M Health Care.

Report Scope

Report Features Description Market Value (2023) USD 39.0 Billion Forecast Revenue (2033) USD 104.0 Billion CAGR (2024-2033) 10.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Phenols & Derivatives, Quaternary Ammonium compounds, Alcohol & Aldehydes, Biguanides & amides, iodine compounds, Others), By Product (Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants), By Sales (B2B, FMCG), By End-User (Hospital, Clinics, Other) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Procter & Gamble Co., Ecolab, Inc., The Clorox Company, Unilever Plc, GOJO Industries, Inc., Stepan Company, Steris Plc., The Dow Chemical Company, Virox Technologies Inc., Johnson & Johnson, 3M Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antiseptic & Disinfectants MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Antiseptic & Disinfectants MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Procter & Gamble Co.

- Ecolab, Inc.

- The Clorox Company

- Unilever Plc

- GOJO Industries, Inc.

- Stepan Company

- Steris Plc.

- The Dow Chemical Company

- Virox Technologies Inc.

- Johnson & Johnson

- 3M Company