Global Nasal Antiseptics Market By Type of Antiseptic (Iodine-based Nasal Antiseptics, Chlorhexidine-based Nasal Antiseptics, Alcohol-based Nasal Antiseptics, Others (Silver-based, etc.)) By Formulation (Sprays, Swabs, Ointments, Wipes) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 77558

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

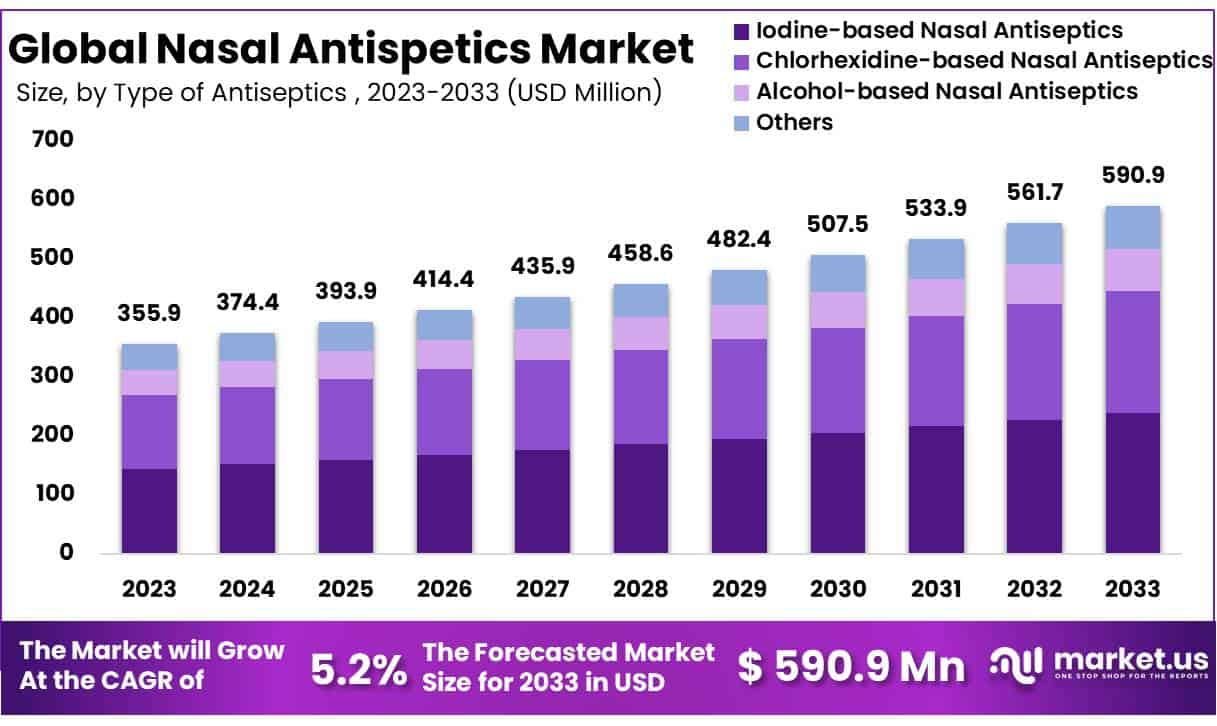

The Global Nasal Antiseptics Market size is expected to be worth around USD 590.9 Million by 2033 from USD 355.9 Million in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

An antiseptic is a liquid solution that kills germs. Nasal antiseptics are usually administered through the nasal cavity before surgery to help prevent infection. Nasal antiseptics are helpful for drug delivery and for treating nasal allergies. Allergies such as hay fever are common condition that causes symptoms such as sneezing, runny and stuffy nose, watery eyes, as well as the itching of the nose, eyes, or the roof of the mouth. According to data published in 2018 by the Asthma and Allergy Foundation of America (AAFA), allergic rhinitis affects 5.2 million children and 19.2 million adults.

The Nasal Antiseptics Market is anticipated to experience significant growth, with revenues expanding and a substantial CAGR forecasted for the period of 2023 to 2033. This market growth is primarily driven by increasing demands for nasal antiseptics across various applications, including hospital pharmacies, retail pharmacies, and online pharmacies, on a global scale. The analysis provides insights into potential opportunities within the Nasal Antiseptics Market at the national level, highlighting the importance of strategic geographical areas. Additionally, the report offers detailed information on costs, market segments, trends, and the regional presence, alongside developmental strategies of leading global players for the forecast period.

A nasal antiseptic is available in many different forms, such as a liquid, spray, ointment, cream, swab, aerosol powder, and even soap. Many antiseptics are allotted for a particular infection such as SARS-COV2 virus, and COVID-19, which are inactivated with the help of PVP-I nasal antiseptic, and according to ongoing research & development activities, other antiseptics are also available in this market for the treatment of COVID-19. For instance, a study published by the journal Infectious Diseases and Therapy says the use of a Povidone-Iodine (PVP-I) nasal antiseptic solution to fight SARS-CoV-2, the virus that causes COVID-19.2.

Key Takeaways

- Market Size: Nasal Antiseptics Market size is expected to be worth around USD 590.9 Million by 2033 from USD 355.9 Million in 2023.

- Market Growth: The market growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- Type of Antiseptic Analysis: Iodine-based solutions dominate the Nasal Antiseptics Market with a dominating 40% market share.

- Formulation Analysis: Formulation Analysis reports that sprays comprised a significant share in the global nasal antiseptics market at 42.1% in 2023.

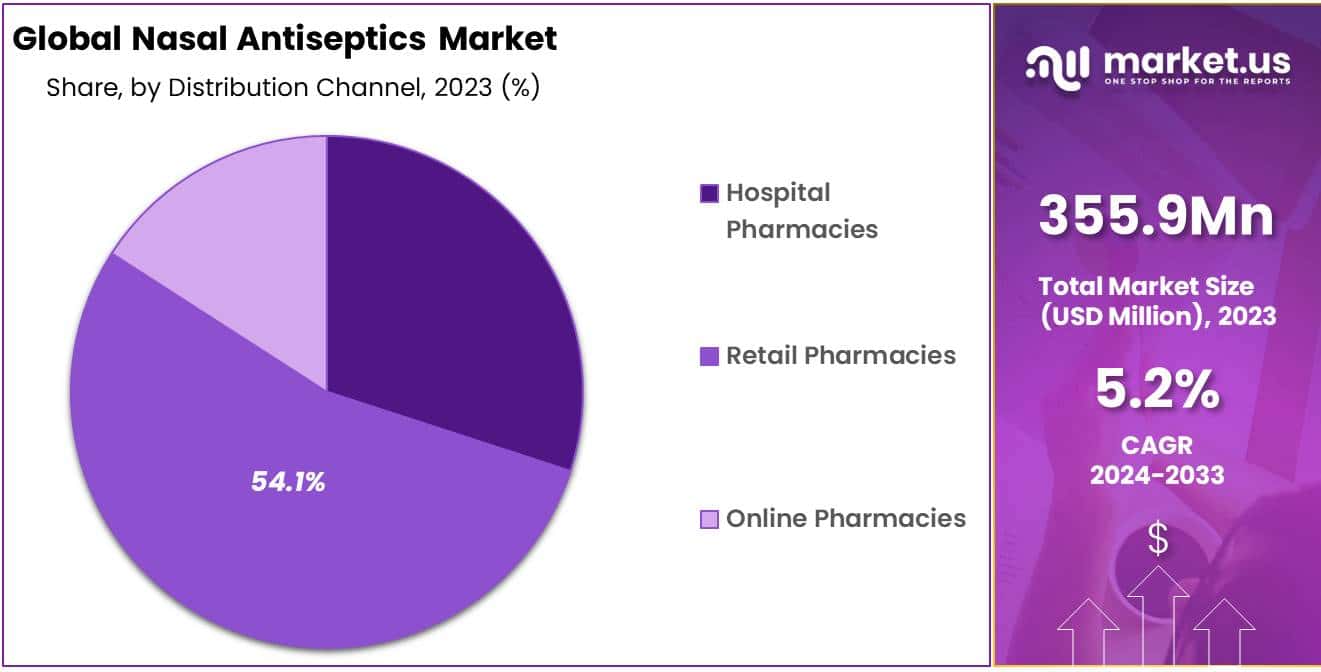

- Distribution Channel Analysis: Retail Pharmacies dominate the Nasal Antiseptics Market, commanding 54.1% market shar

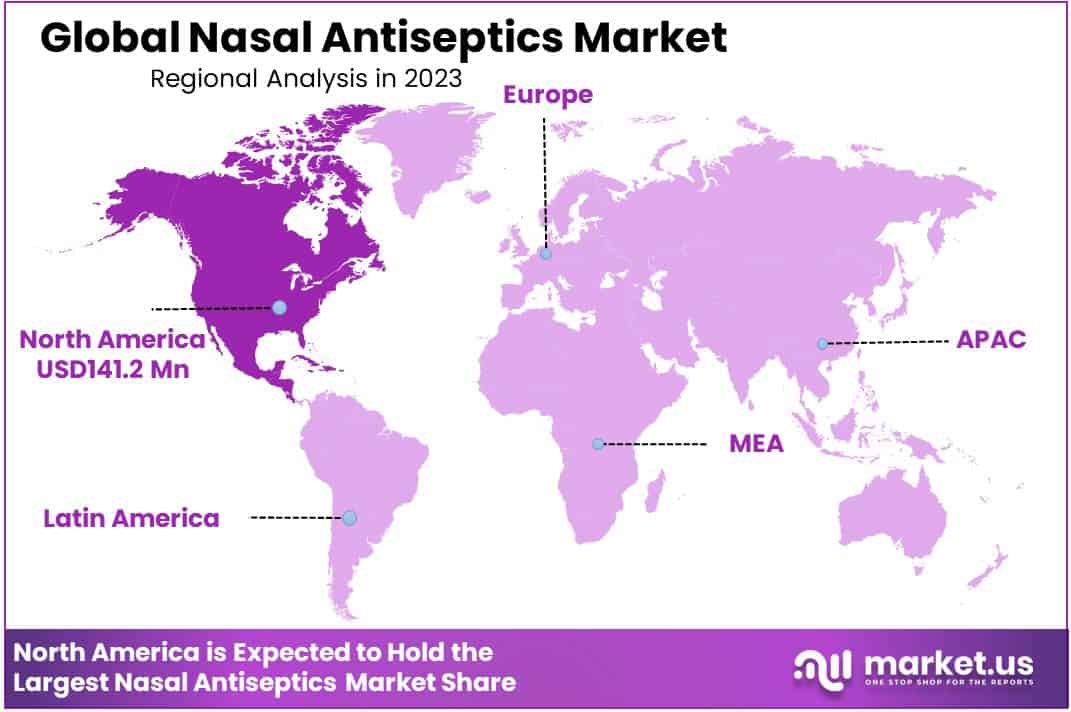

- Regional Analysis: North American nasal antiseptics market is expected to see significant growth, accounting for 39.7% market share by 2024.

Type of Antiseptic Analysis

Iodine-based solutions dominate the Nasal Antiseptics Market with a dominating 40% market share, reflecting their effectiveness and widespread acceptance. Iodine antiseptics play an integral role in combatting nasal infections and maintaining respiratory health; their success can be attributed to their potent antimicrobial properties capable of neutralizing an array of pathogens.

Iodine-based nasal antiseptics serve as a first-line defense against infectious agents like bacteria and viruses, helping reduce respiratory illnesses while improving overall health outcomes. Their versatility extends from preoperative nasal decolonization practices to everyday hygiene practices.

As awareness regarding nasal hygiene grows, driven by increasing concerns over contagious diseases and airborne pathogens, demand for effective antiseptic solutions should increase rapidly. This provides an exciting opportunity for market expansion and innovation within this space – Iodine-based formulations may continue to reign supreme as consumers and healthcare professionals choose them over competing options.

Formulation Analysis

Formulation Analysis reports that sprays comprised a significant share in the global nasal antiseptics market at 42.1% in 2023. Their popularity lies in their convenience and ability to deliver precise doses of antiseptic agents directly into nasal passages, according to Formulation Analysis. These nasal antiseptic sprays offer an easy and effective solution for maintaining nasal hygiene and warding off respiratory infections; their ease of use, portability and precision delivery make them popular products among users.

Spray formulations typically contain antimicrobial agents like iodine, chlorhexidine or silver compounds which exhibit powerful germicidal activity against various pathogens and pathogenic organisms. They are frequently used for both daily nasal hygiene routines as well as preoperative nasal decolonization in healthcare environments.

Nasal antiseptic sprays reflect an increasing emphasis on preventive healthcare and an awareness of their importance in lowering respiratory infection risk. With cutting-edge formulation technology constantly developing and new innovations emerging to serve consumers and healthcare professionals alike. Their continued popularity will only cement this stronghold further.

Distribution Channel Analysis

Retail Pharmacies dominate the Nasal Antiseptics Market, commanding 54.1% market share. Their prominence can be attributed to their ease of accessibility and convenience for consumers looking for nasal antiseptic products; retail pharmacies serve as key touchpoints where individuals can easily access an assortment of antiseptic solutions that can protect their nasal health.

Retail pharmacies, coupled with consumers’ trust of pharmacists as healthcare advisors, make them a key distribution channel for nasal antiseptics. Furthermore, over-the-counter products available at these establishments allow consumers to manage their nasal hygiene more proactively without needing a valid prescription.

As consumer awareness regarding nasal hygiene grows, retail pharmacies are poised to maintain their dominant market position. Their convenient locations combined with experienced pharmacists providing personalized healthcare recommendations make them key players in meeting consumers’ evolving needs for nasal antiseptics.

Market Segments

Type of Antiseptic

- Iodine-based Nasal Antiseptics

- Chlorhexidine-based Nasal Antiseptics

- Alcohol-based Nasal Antiseptics

- Others (Silver-based, etc.)

Formulation

- Sprays

- Swabs

- Ointments

- Wipes

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Driver

Growing Awareness Regarding Infection Prevention

A report by the World Health Organization (WHO) highlighted that hand and nasal hygiene plays a critical role in preventing the transmission of infectious diseases, including respiratory viruses such as COVID-19. The report emphasizes that interventions aimed at improving hygiene can reduce the incidence of respiratory infections by up to 21%.

Rise in Surgical Procedures

According to the American College of Surgeons, over 50 million surgical procedures are performed in the United States annually. The Centers for Disease Control and Prevention (CDC) estimates that surgical site infections (SSIs) account for about 22% of all healthcare-associated infections (HAIs), underscoring the significance of preventive measures like nasal antiseptics in surgical settings.

Trend

Preference for Natural and Safe Ingredients

A survey conducted by the National Center for Complementary and Integrative Health (NCCIH) reveals that approximately 33% of adults prefer healthcare products made from natural ingredients, indicating a significant consumer shift towards products perceived as safer and more environmentally friendly.

Technological Advancements in Product Delivery Systems

Technological advancements in product delivery systems, such as nasal sprays and nasal irrigators, are revolutionizing the landscape of nasal antiseptics. Innovations in device design, material science, and manufacturing processes are enhancing the efficiency, convenience, and patient compliance of nasal antiseptic applications. For instance, the development of nasal sprays with precise droplet size distribution and controlled release mechanisms ensures optimal coverage and retention of antiseptic agents within the nasal cavity, maximizing therapeutic efficacy. Such advancements are anticipated to stimulate market growth and foster adoption among healthcare professionals and consumers alike.

Restraint

Limited Regulatory Framework

The variability in regulatory standards can be exemplified by the differences in approval processes and safety requirements between the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). This disparity complicates global market strategies for nasal antiseptic products, reflecting the need for harmonized international standards.

Opportunity

Expanding Application Scope Beyond Healthcare Settings

An emerging opportunity within the nasal antiseptics market lies in expanding the application scope beyond traditional healthcare settings to encompass diverse end-user segments, including residential, commercial, and institutional sectors. With the growing emphasis on hygiene and infection control in public spaces, there is a burgeoning demand for nasal antiseptics in settings such as schools, offices, transportation hubs, and recreational facilities. By targeting these non-healthcare environments and promoting the adoption of nasal antiseptic protocols as part of routine hygiene practices, manufacturers can capitalize on untapped market potential and diversify their revenue streams.

Rising Investments in Research and Development

Investment in medical and health research and development in the United States alone totaled approximately USD 194 billion in 2018, as reported by Research!America. A portion of this investment is directed towards developing more effective antiseptic formulations and delivery systems, highlighting the ongoing efforts to advance nasal antiseptic solutions.

Regional Analysis

North American nasal antiseptics market is expected to see significant growth, accounting for 39.7% market share by 2024. This growth can be attributed to an increasing prevalence of sinus infections and awareness campaigns as well as rising healthcare expenditures. 31 million Americans suffer from sinusitis each year, spending billions of dollars each year on over-the-counter remedies to alleviate their symptoms.

Key industry players’ research and development initiatives geared at producing effective yet cost-effective nasal antiseptics is helping drive market expansion across the United States. Urbanization, increased travel and dense living conditions all play a role in spreading infections, making nasal antiseptics increasingly popular as preventive measures against infectious diseases.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The market report features a detailed examination of the principal entities in the Nasal Antiseptics Market within its competitive landscape and company profiles sections. It assesses the major market participants by analyzing their product or service offerings, financial performance, notable activities, strategic market positioning, market penetration across different regions, and other pivotal attributes. Additionally, for the leading three to five companies, it provides an in-depth SWOT analysis, highlighting their strengths, weaknesses, opportunities, and threats, alongside their winning strategies, current focus, strategies for market engagement, and potential competitive threats.

The report also offers customization options for the list of companies included in the study based on client specifications. In the competitive overview, it details the ranking of the top five companies, key developments including recent partnerships, mergers, acquisitions, and product launches, the geographical and industry footprint of each company, and their positioning in the market according to the Ace matrix.

Market Key Players

- GlaxoSmithKline plc

- Novartis AG

- Johnson & Johnson

- 3M Company

- Cipla Limited

- Becton, Dickinson and Company (BD)

- Merck & Co., Inc.

- Procter & Gamble Co. (P&G)

- Reckitt Benckiser Group plc

- Eli Lilly and Company

- Church & Dwight Co., Inc.

- Pfizer Inc.

- AstraZeneca plc

Recent Developments

- GlaxoSmithKline plc – GlaxoSmithKline plc (GSK) delivered an impressive performance and growth outlook in 2023 with sales reaching £ 30.3 billion, an increase of 5% year over year, and upgraded its growth outlooks accordingly. GSK achieved significant vaccine sales increases of 25% year on year while specialized medicines sales growth of 15% (excluding COVID sales growth ).

- Novartis AG – Novartis AG Strategic Focus and Organizational Structure: Novartis has set its sights on becoming one of the top five players in the US by 2027, while also unveiling a new organizational structure designed to increase productivity, streamline its pharmaceutical business, and achieve a compound annual compound sales growth target of 4% (CAGR 2020-2026).

Report Scope

Report Features Description Market Value (2023) USD 355.9 Million Forecast Revenue (2033) USD 590.9 Million CAGR (2024-2033) 5.2 Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Antiseptic (Iodine-based Nasal Antiseptics, Chlorhexidine-based Nasal Antiseptics, Alcohol-based Nasal Antiseptics, Others (Silver-based, etc.)) By Formulation (Sprays, Swabs, Ointments, Wipes) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape GlaxoSmithKline plc, Novartis AG, Johnson & Johnson, 3M Company, Cipla Limited, Becton, Dickinson and Company (BD), Merck & Co., Inc., Procter & Gamble Co. (P&G), Reckitt Benckiser Group plc, Eli Lilly and Company, Church & Dwight Co., Inc., Pfizer Inc., AstraZeneca plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Nasal Antiseptics?Nasal antiseptics are solutions or sprays designed to disinfect the nasal passages, helping to reduce the risk of respiratory infections by eliminating pathogens such as bacteria and viruses.

How do Nasal Antiseptics work?Nasal antiseptics typically contain antimicrobial agents like iodine, chlorhexidine, or silver compounds. These agents target and neutralize harmful microorganisms present in the nasal passages, thereby promoting nasal hygiene and reducing the risk of infections.

How big is the Nasal Antiseptics Market?The global Nasal Antiseptics Market size was estimated at USD 355.9 Million in 2023 and is expected to reach USD 590.9 Million in 2033.

What is the Nasal Antiseptics Market growth?The global Nasal Antiseptics Market is expected to grow at a compound annual growth rate of 5.2%. From 2024 To 2033

Who are the key companies/players in the Nasal Antiseptics Market?Some of the key players in the Nasal Antiseptics Markets are GlaxoSmithKline plc, Novartis AG, Johnson & Johnson, 3M Company, Cipla Limited, Becton, Dickinson and Company (BD), Merck & Co., Inc., Procter & Gamble Co. (P&G), Reckitt Benckiser Group plc, Eli Lilly and Company, Church & Dwight Co., Inc., Pfizer Inc., AstraZeneca plc.

What are the benefits of using Nasal Antiseptics?Using nasal antiseptics can help individuals maintain respiratory health by reducing the presence of pathogens in the nasal passages. They are particularly beneficial in preventing the spread of contagious diseases and mitigating the risk of upper respiratory tract infections.

Where can I find Nasal Antiseptics?Nasal antiseptics are commonly available in retail pharmacies, online stores, and healthcare facilities. They may be sold over-the-counter or prescribed by healthcare professionals, depending on the formulation and intended use.

Are Nasal Antiseptics safe for daily use?When used as directed, nasal antiseptics are generally safe for daily use. However, it's essential to follow the instructions provided by the manufacturer or healthcare provider to minimize the risk of adverse effects and ensure optimal efficacy.

-

-

- GlaxoSmithKline plc

- Novartis AG

- Johnson & Johnson

- 3M Company

- Cipla Limited

- Becton, Dickinson and Company (BD)

- Merck & Co., Inc.

- Procter & Gamble Co. (P&G)

- Reckitt Benckiser Group plc

- Eli Lilly and Company

- Church & Dwight Co., Inc.

- Pfizer Inc.

- AstraZeneca plc