Global Antibody Fragments Market By Specificity (Monoclonal Antibodies and Polyclonal Antibodies), By Application (Immunodeficiency, Cancer and Others), By Type (FAB, sdAb, scFv and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175181

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

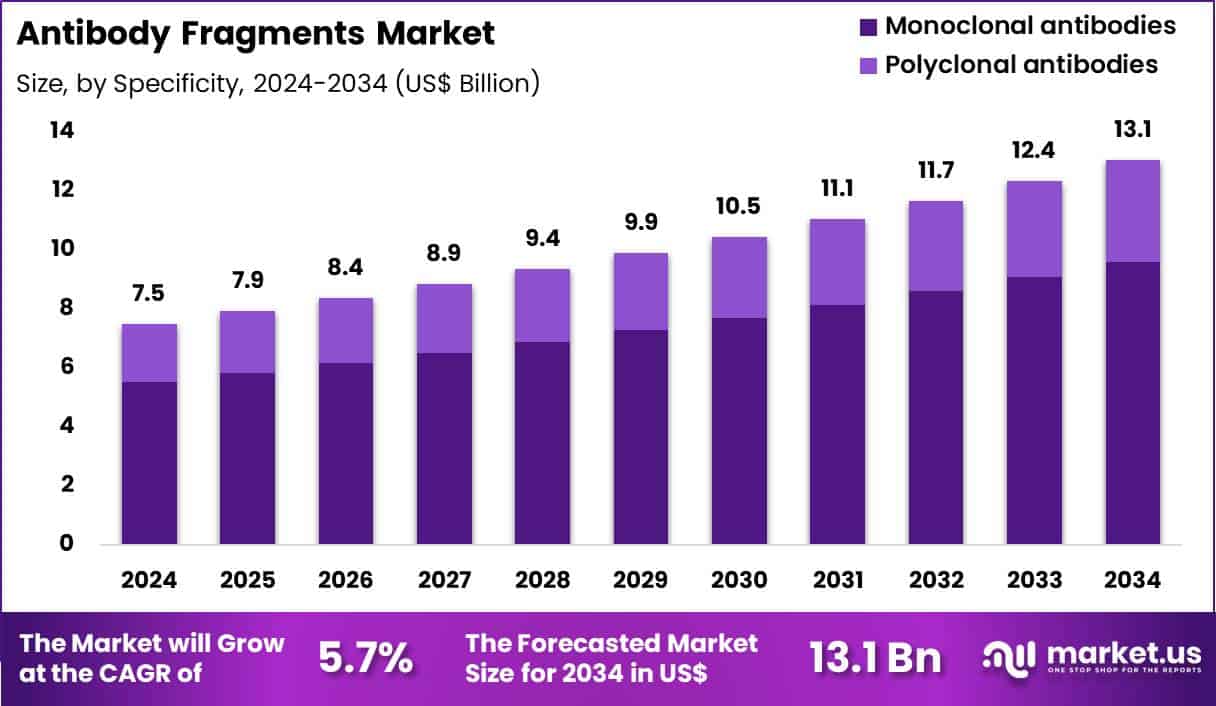

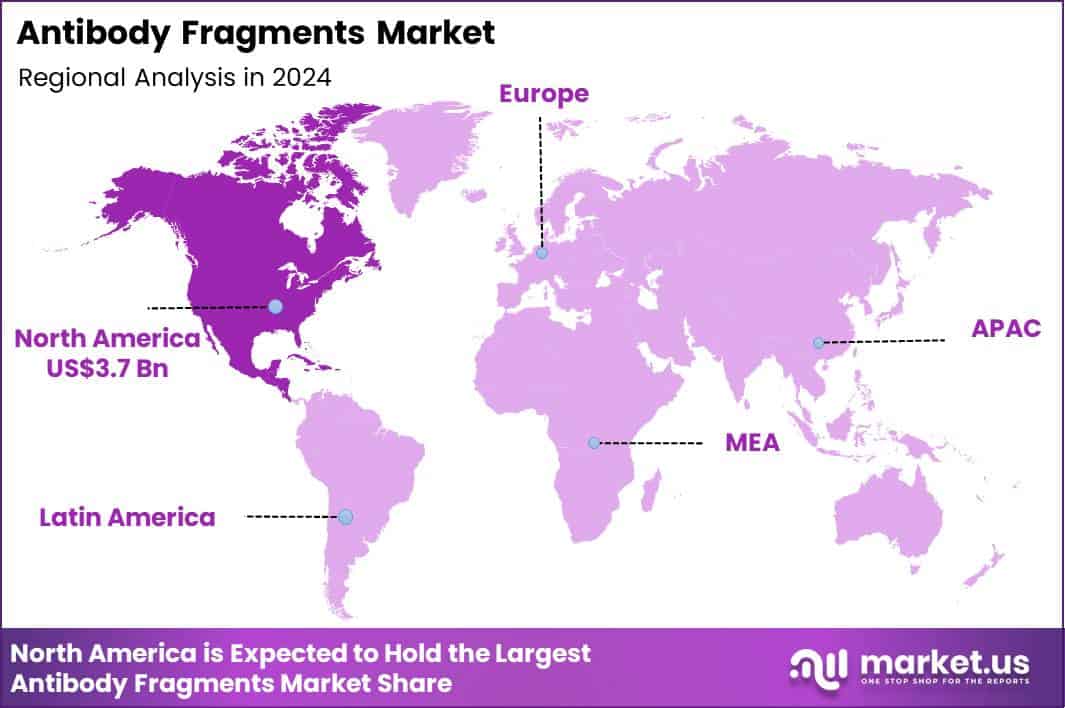

Global Antibody Fragments Market size is expected to be worth around US$ 13.1 billion by 2034 from US$ 7.5 billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 49.8% share with a revenue of US$ 3.7 Billion.

Increasing demand for precision therapeutics accelerates the antibody fragments market as biopharmaceutical companies prioritize smaller, engineered molecules that offer superior tissue penetration and reduced immunogenicity compared to full monoclonal antibodies. Researchers extensively apply single-chain variable fragments in cancer immunotherapy, where these entities bind tumor antigens to recruit immune cells for targeted cell lysis in solid malignancies.

These fragments support diagnostic imaging by conjugating to radionuclides or fluorophores, enabling precise visualization of metastatic lesions in oncology scans. Clinicians utilize Fab fragments in autoimmune disease management, neutralizing cytokines to alleviate inflammation in rheumatoid arthritis and inflammatory bowel disease without triggering unwanted immune responses.

Nanobody fragments find applications in infectious disease treatments, rapidly crossing blood-brain barriers to inhibit viral entry in central nervous system infections. Developers harness diabody constructs for bispecific targeting, simultaneously engaging tumor cells and T-cells to enhance antitumor efficacy in hematologic cancers.

Manufacturers seize opportunities to engineer multi-valent fragments that combine diagnostic and therapeutic functions, expanding applications in theranostics for personalized cancer care. Developers advance camelid-derived nanobodies for rapid production via microbial systems, broadening utility in point-of-care diagnostics for pathogen detection.

These innovations facilitate hybrid fragments with extended half-lives through PEGylation, optimizing dosing regimens in chronic inflammatory conditions. Opportunities emerge in fragment-based vaccines that elicit focused immune responses against conserved epitopes in viral and bacterial pathogens.

Companies invest in high-throughput screening platforms to identify affinity-matured fragments, accelerating discovery for rare disease interventions. Recent trends emphasize AI-driven design of bispecific and trispecific fragments, enhancing versatility across oncology, neurology, and infectious disease therapies while minimizing off-target effects.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.5 Billion, with a CAGR of 5.7%, and is expected to reach US$ 13.1 Billion by the year 2034.

- The specificity segment is divided into monoclonal antibodies and polyclonal antibodies, with monoclonal antibodies taking the lead with a market share of 73.6%.

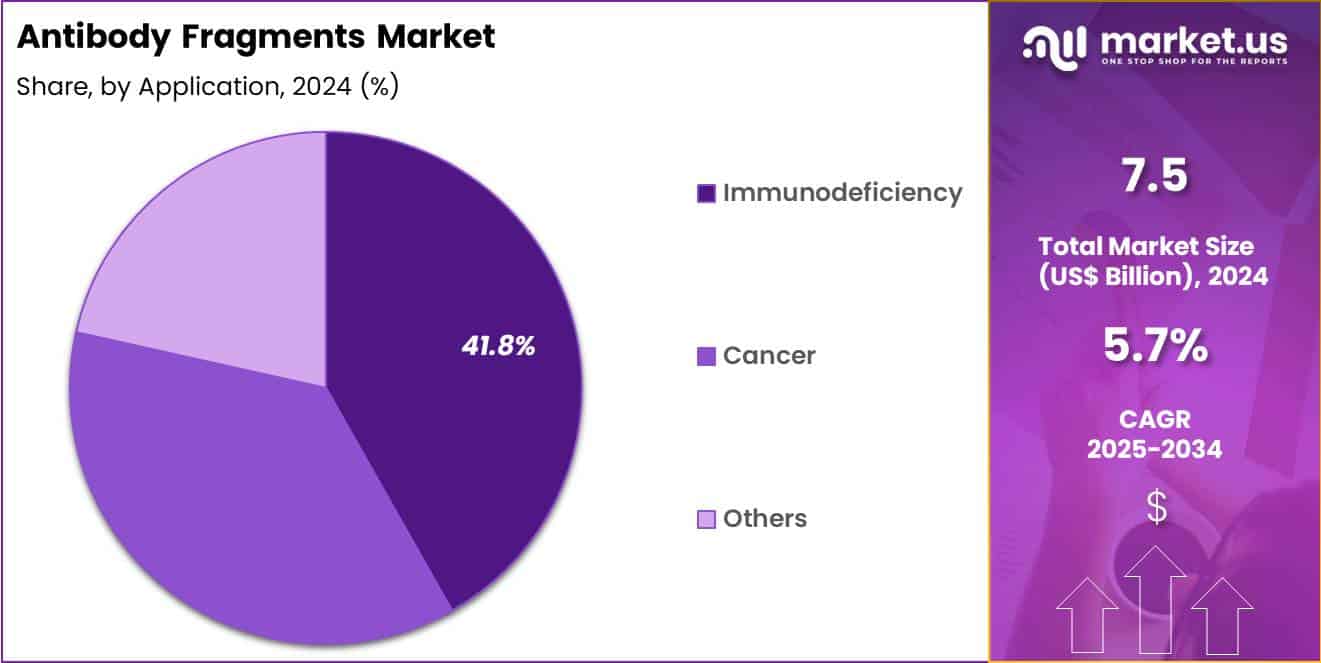

- Considering application, the market is divided into immunodeficiency, cancer and others. Among these, immunodeficiency held a significant share of 41.8%.

- Furthermore, concerning the type segment, the market is segregated into FAB, sdAb, scFv and others. The FAB sector stands out as the dominant player, holding the largest revenue share of 39.4% in the market.

- North America led the market by securing a market share of 49.8%.

Specificity Analysis

Monoclonal antibodies contributed 73.6% of growth within specificity and shape the antibody fragments market through higher consistency, stronger targeting precision, and scalable production economics. Developers prefer monoclonal-derived fragments because they bind a single epitope, which improves reproducibility across batches and clinical programs.

Standardized manufacturing workflows also support tighter quality control, an important factor for therapeutic and diagnostic fragment development. Fragment engineering pipelines frequently start from well-characterized monoclonal backbones, which shortens discovery timelines and reduces screening complexity. Industry demand rises as companies expand bispecific formats and targeted delivery strategies that rely on predictable binding behavior.

Monoclonal fragments also support better safety profiling because development teams can track on-target and off-target interactions with clearer specificity. Pharmaceutical partners increasingly invest in fragment libraries derived from monoclonals to accelerate next-generation biologics. Higher affinity maturation success rates strengthen program efficiency across immunology and oncology pipelines.

Researchers also adopt monoclonal fragments for assays and imaging due to uniform performance across experiments. The segment is projected to stay dominant because clinical translation demands consistent targeting and scalable production, and monoclonal-derived fragments fit both requirements.

Application Analysis

Immunodeficiency accounted for 41.8% of growth within application and leads the antibody fragments market due to sustained demand for targeted immune support and diagnostic precision. Primary immunodeficiency and secondary immune suppression cases require consistent monitoring and specialized biologic interventions, which strengthens adoption of fragment-based tools.

Clinicians and laboratories increasingly use fragments in immunoassays because smaller binding units improve specificity and reduce background signal. Fragment-based formats also support rapid development of diagnostic reagents for immune profiling and pathogen-related immune complications.

Demand increases further as healthcare systems expand screening and management of immune-compromised populations, including patients receiving immunosuppressive therapies. Antibody fragments support faster tissue penetration and flexible design, which improves their utility across immunodeficiency testing workflows.

Research groups also use fragments to map immune pathways and receptor interactions that guide therapeutic development. Rising investment in immune disorder research strengthens industry use of fragment platforms. The segment is anticipated to remain strong because immunodeficiency management depends on accurate targeting, repeat testing, and specialized biologic development pipelines.

Type Analysis

Fab represented 39.4% of growth within type and remain a preferred antibody fragment format due to a balance of specificity, stability, and established development familiarity. Fab fragments retain antigen-binding capability while reducing the size compared with full antibodies, which improves tissue diffusion and enables faster functional interaction.

Developers often select Fab formats for diagnostics, imaging, and therapeutic prototypes because manufacturing and characterization protocols remain well standardized. Many labs also prefer Fab fragments because they reduce Fc-driven effects, which helps when teams need pure binding without immune effector activity.

Fab fragments also integrate well into conjugation workflows for targeted delivery and labeling, supporting broad research and clinical use. Pharmaceutical pipelines use Fab-based constructs as building blocks for more advanced biologics, including engineered multispecific formats. Strong historical usage improves regulatory and quality confidence, which supports adoption across clinical development programs.

Improved expression platforms and purification kits increase accessibility for smaller research teams. The segment is projected to remain dominant because Fab offers a practical middle ground between full antibodies and newer ultra-small formats, supporting wide adoption across immunology-focused applications.

Key Market Segments

By Specificity

- Monoclonal Antibodies

- Polyclonal Antibodies

By Application

- Immunodeficiency

- Cancer

- Others

By Type

- FAB

- sdAb

- scFv

- Others

Drivers

Increasing prevalence of cancer is driving the market.

The escalating global burden of cancer has significantly boosted the demand for innovative therapeutics, including antibody fragments, which offer targeted treatment options with reduced side effects. Enhanced diagnostic capabilities and population aging contribute to higher detection rates, expanding the application of antibody fragments in oncology.

According to the World Health Organization, in 2022, there were an estimated 20 million new cancer cases worldwide. This surge necessitates advanced biologics capable of precise tumor targeting and improved tissue penetration. Antibody fragments, such as nanobodies and Fab segments, are increasingly utilized in combination therapies for various malignancies.

Healthcare systems are prioritizing research into these molecules to address unmet needs in cancer management. Key pharmaceutical companies are allocating resources to develop fragment-based drugs to capitalize on this growing patient base. Government-funded initiatives in cancer research further accelerate the integration of these therapeutics.

The correlation between rising cancer rates and the need for efficacious, less immunogenic treatments underscores market expansion. This driver continues to fuel collaborations between academia and industry for novel antibody fragment innovations.

Restraints

High development costs are restraining the market.

The substantial financial investment required for research, clinical trials, and manufacturing of antibody fragments limits accessibility and slows market progression. Complex production processes involving recombinant technologies contribute to elevated expenses passed on to end-users. Smaller biotechnology firms often struggle with funding constraints, hindering innovation in this sector.

Regulatory demands for extensive safety and efficacy data further inflate development budgets. In competitive landscapes, high costs deter entry for new players, consolidating market share among established entities. Novartis expects to decrease annual R&D expense by $1.1 billion by 2027 compared to 2024, highlighting the current burden of these investments.

Providers may shift focus to more cost-effective alternatives, impacting adoption rates. This restraint affects scalability in resource-limited settings, particularly for rare disease applications. Industry strategies to optimize processes aim to alleviate these pressures over time. Consequently, addressing cost efficiencies remains critical for broader market penetration.

Opportunities

Expansion into Asian markets is creating growth opportunities.

The rapid advancement of biotechnology infrastructure in Asia presents avenues for antibody fragment commercialization and localized production. Increasing investments in healthcare by regional governments support the uptake of advanced biologics for chronic conditions. Rising awareness of precision medicine among clinicians enhances demand for targeted therapies like antibody fragments.

Partnerships with local firms facilitate regulatory navigation and distribution networks in diverse economies. The expanding middle class improves affordability for innovative treatments in urban centers. GenScript reported that Chinese biotech contributed to 44% of global TCE deals in 2024, indicating robust regional activity in antibody-related transactions.

Educational efforts for healthcare professionals promote standardized use of these molecules. This opportunity enables global players to diversify revenue streams beyond mature markets. Strategic manufacturing setups reduce import dependencies and logistics challenges. Overall, Asian expansion aligns with efforts to meet escalating therapeutic needs in high-population areas.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions infuse capital into biopharmaceutical innovations, accelerating the antibody fragments market as research institutions ramp up development of targeted therapies for oncology and autoimmune diseases in high-growth regions. Executives capitalize on robust venture funding environments, which expands clinical trials and commercialization efforts amid favorable monetary policies.

Regrettably, surging worldwide inflation compounds expenses for cell culture media and purification tools, prompting developers to reassess investment priorities in volatile fiscal climates. Geopolitical instabilities in key biotech corridors fracture partnerships for fragment engineering, obliging international collaborators to endure regulatory hurdles and knowledge-sharing delays.

Visionaries adapt by channeling resources into collaborative hubs in geopolitically neutral areas, which refines project timelines and unlocks synergistic gains. Current US tariffs, imposing a 100% duty on imported branded biologics including patented antibody fragments from major exporters effective October 2025, heighten financial strains for firms reliant on overseas production.

Native biotech leaders respond by escalating U.S.-centric facilities, which generates specialized roles and fortifies intellectual property protections domestically. Groundbreaking evolutions in bispecific fragment designs invariably bolster the industry’s endurance, heralding amplified therapeutic versatility and profitable horizons for global healthcare advancements.

Latest Trends

Rise in bispecific antibody approvals is a recent trend in the market.

In 2024, the authorization of novel bispecific antibodies reflects a shift toward multifunctional therapeutics in the antibody fragments domain. These molecules, often incorporating fragment architectures, enable simultaneous targeting of multiple antigens for enhanced efficacy. Clinical advancements focus on oncology applications, where bispecifics improve immune cell engagement with tumors.

The U.S. Food and Drug Administration approved zanidatamab in 2024 as a bispecific antibody for HER2-positive biliary tract cancer. This trend emphasizes reduced immunogenicity and better pharmacokinetics compared to traditional formats. Industry investments in engineering platforms accelerate the development of next-generation bispecific fragments.

Regulatory pathways have adapted to expedite reviews for these complex biologics. Collaborations between companies enhance expertise in fragment assembly and optimization. The focus addresses resistance mechanisms in standard treatments, broadening clinical utility. These developments position bispecific antibodies as pivotal in evolving therapeutic landscapes for 2025.

Regional Analysis

North America is leading the Antibody Fragments Market

North America possesses a 49.8% share of the global antibody fragments market, reflecting strong momentum in 2024 driven by accelerated clinical translation of fragment-based biologics in precision oncology and chronic inflammatory conditions. Innovations in camelid-derived VHH domains and humanized scFv constructs have yielded superior tissue penetration and reduced immunogenicity compared to conventional monoclonal antibodies.

Major biotechnology firms in the region have expanded proprietary phage-display libraries to generate high-affinity candidates against previously intractable targets. Concentrated research hubs facilitate rapid prototyping through integrated structural biology and protein engineering workflows. Streamlined regulatory interactions with health authorities have expedited advancement of fragment therapeutics into late-stage trials.

Growing emphasis on combination regimens has heightened demand for modular fragments amenable to bispecific and CAR-T formats. Strategic alliances between established players and emerging entities have optimized production scalability under stringent quality controls. In 2023, the National Cancer Institute committed approximately $28 million to antibody fragment-related immunotherapy projects through targeted R01 and U01 mechanisms.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Companies and research organizations intensify efforts to advance fragment-derived biologics across the Asia Pacific region during the forecast period, responding to expanding patient populations and strategic national priorities. China leads through large-scale state-supported programs that fund high-throughput screening and engineering of domain antibodies for prevalent diseases.

India strengthens capabilities by establishing specialized facilities dedicated to recombinant fragment expression and purification. Japan contributes sophisticated analytical platforms that enhance binding kinetics and stability assessments.

Pharmaceutical developers incorporate these entities into pipelines targeting autoimmune disorders and solid tumors. Collaborative ventures with overseas partners accelerate technology adoption while building local expertise. Regulatory bodies streamline review processes for innovative biologics to encourage domestic origination. In 2024, Japan’s Agency for Medical Research and Development allocated ¥15.2 billion toward advanced therapy projects encompassing antibody engineering initiatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Antibody Fragments market drive growth by developing smaller, high-affinity biologics that deliver better tissue penetration and faster clearance, supporting oncology and immunology programs with differentiated performance. Companies expand pipelines through platform technologies for Fab, scFv, and single-domain constructs, enabling rapid candidate generation and scalable manufacturing.

Commercial strategies emphasize partnerships and licensing with large biopharma firms to accelerate clinical development and widen indication coverage. Innovation priorities include bispecific formats, conjugation-ready designs, and half-life extension approaches that improve durability while preserving targeting precision.

Market expansion targets regions investing in advanced biologics and specialty care infrastructure that supports high-value therapeutics. Roche operates as a leading participant with deep biologics expertise, global clinical development capabilities, and a strong oncology-focused innovation engine that supports broad adoption of fragment-based therapies.

Top Key Players

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- Bristol Myers Squibb

- F. Hoffmann La Roche Ltd

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

Recent Developments

- In March 2025, Johnson and Johnson shared 84 week findings for nipocalimab in generalized myasthenia gravis, showing that patients were able to reduce corticosteroid use by 45%. This update strengthens confidence in targeted immunotherapy approaches that can lower long term steroid dependence, supporting broader adoption of advanced biologics designed to improve disease control while reducing steroid related side effects and overall treatment burden.

- In January 2025, Novartis completed a USD 3 billion deal with Dren Bio to access its anti myeloid bispecific platform as part of a strategy to strengthen solid tumor development programs. The agreement reflects rising demand for next generation immune oncology mechanisms and reinforces investment momentum in bispecific antibody platforms, which are increasingly viewed as a high value pathway for improving tumor targeting and expanding treatment options in hard to treat cancers.

Report Scope

Report Features Description Market Value (2024) US$ 7.5 Billion Forecast Revenue (2034) US$ 13.1 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Specificity (Monoclonal Antibodies and Polyclonal Antibodies), By Application (Immunodeficiency, Cancer and Others), By Type (FAB, sdAb, scFv and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AbbVie Inc., Amgen Inc., AstraZeneca, Bristol Myers Squibb, F. Hoffmann La Roche Ltd, Johnson & Johnson, Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- Bristol Myers Squibb

- F. Hoffmann La Roche Ltd

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi