Global Cell And Gene Therapy Manufacturing Market By Therapy Type (Cell therapy, Gene therapy) By Mode (In-house Manufacturing, Contract Manufacturing (CDMOs & CMOs)) By Scale (Preclinical and Clinical-Scale, Commercial-Scale) By Application (Oncology (Cancer Treatment), Neurological Disorders, Cardiovascular Diseases, Rare & Genetic Disorders, Infectious Diseases, Musculoskeletal Disorders, Autoimmune Diseases, Other Applications) By End-user (Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs/CMOs), Research Institutes & Academic Organizations, Hospitals & Clinics) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146488

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

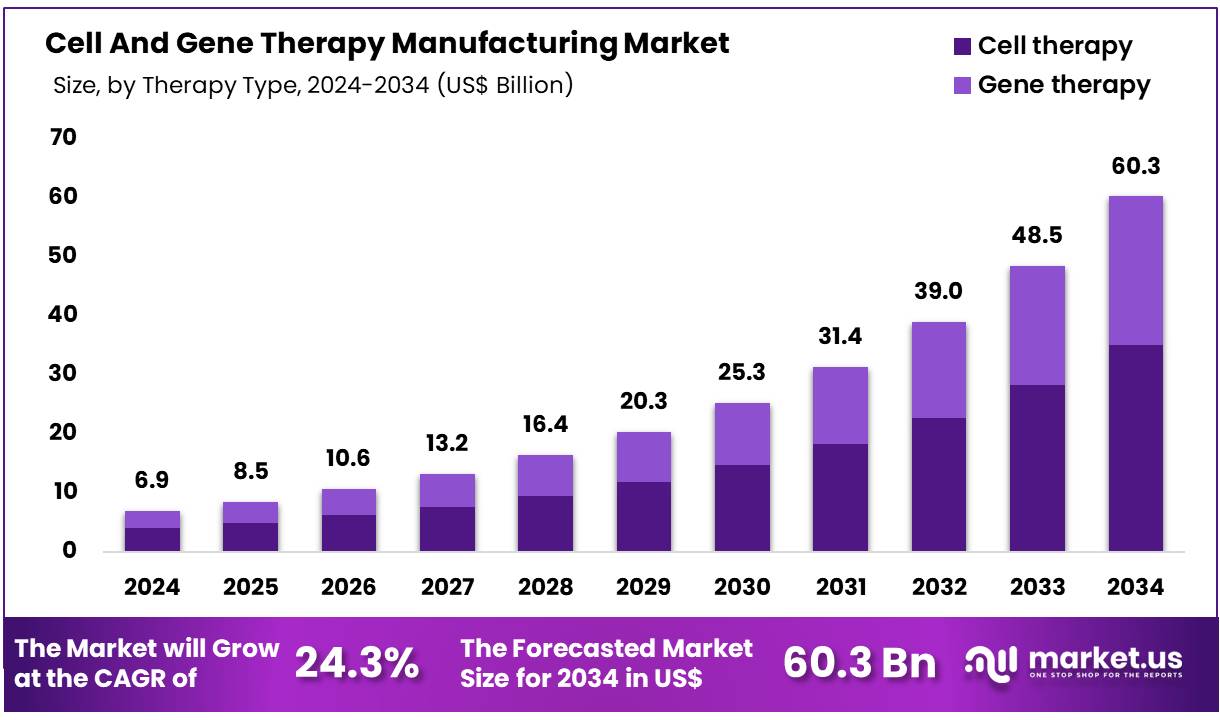

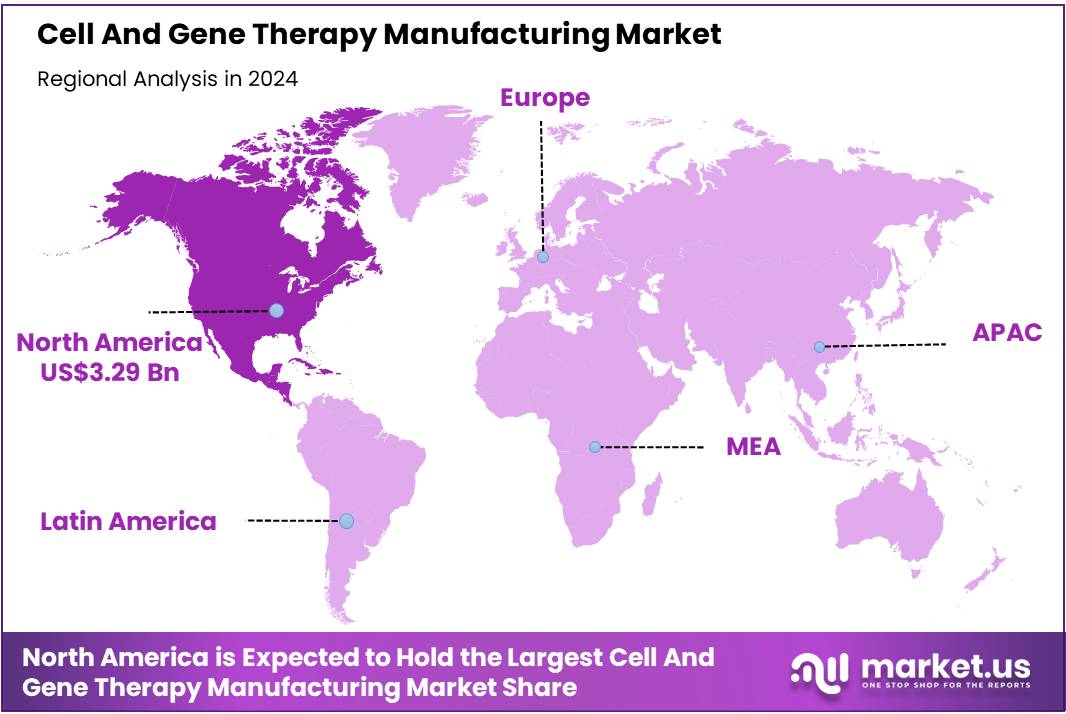

Global Cell And Gene Therapy Manufacturing Market size is expected to be worth around US$ 60.3 Billion by 2034 from US$ 6.9 Billion in 2024, growing at a CAGR of 24.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 48.1% share with a revenue of US$ 3.29 Billion.

Cell and gene therapies represent two cutting-edge approaches to treating various diseases, offering significant breakthroughs in modern medicine. Cell therapy involves modifying or enhancing cells outside the patient’s body before reintroducing them to function as living medication.

Gene therapy, on the other hand, focuses on altering genetic material either within or outside the patient’s cells—to deactivate, replace, or add genes that help correct underlying conditions. These innovative treatments aim to halt disease progression and even reverse the growth of chronic illnesses, including certain cancers and rare genetic disorders.

Recent years have witnessed a surge in investments from government bodies, pharmaceutical companies, and biotechnology firms to advance cell and gene therapy manufacturing. Over the past decade, approximately USD 2.3 billion has been directed toward gene therapy research and development.

This substantial funding underscores the strong commitment by global pharmaceutical players and contract development and manufacturing organizations (CDMOs/CMOs) to these transformative therapies. In addition to the financial investments, advancements in production technologies and regulatory processes have accelerated the development and commercialization of these therapies.

CAR-T cell therapy exemplifies the groundbreaking potential of this field. By engineering a patient’s own immune cells to target and eliminate cancer cells, CAR-T treatments have achieved unprecedented remission rates for certain types of blood cancers. These outcomes mark a significant departure from conventional therapies, offering patients long-lasting improvements and renewed hope.

Similarly, gene therapies targeting conditions such as spinal muscular atrophy (SMA) and Duchenne muscular dystrophy (DMD) have demonstrated the ability to correct genetic mutations and provide tangible clinical benefits. The success of these therapies underscores the growing capabilities of cell and gene therapy manufacturing to deliver life-changing treatments for patients with debilitating conditions.

The industry’s momentum is further reflected in the increasing number of clinical trials and regulatory approvals. By May 2022, 329 cell and gene therapy candidates were undergoing clinical trials, a figure that is projected to grow rapidly in the coming years. As of 2023, six CAR-T therapies have received FDA approval, and new gene therapies targeting rare diseases and bladder cancer were approved in 2022. This includes first-time approvals for certain regions and new indications, signaling a strong upward trajectory for the sector.

Key Takeaways

- Market Size: Global Cell And Gene Therapy Manufacturing Market size is expected to be worth around US$ 60.3 Billion by 2034 from US$ 6.9 Billion in 2024.

- Market Growth: The Market growing at a CAGR of 24.3% during the forecast period from 2025 to 2034.

- Therapy Type Analysis: Cell therapies hold a dominant position, accounting for 58.2% of the total market share.

- Mode Analysis: Contract manufacturing currently holds the largest share, capturing 67.5% of the market.

- Scale Analysis: Preclinical and clinical-scale manufacturing currently dominates, capturing 74.1% of the market share.

- Application Analysis: oncology applications hold the largest market share, dominating at 48.9%.

- End-Use Analysis: pharmaceutical and biotechnology companies hold the dominant share at 69.2%.

- Regional Analysis: In 2024, North America is projected to dominate the Cell and Gene Therapy Manufacturing Market, accounting for 48.1% of the global market share.

Therapy Type Analysis

The Cell and Gene Therapy Manufacturing Market can be segmented by therapy type into cell therapies and gene therapies. Among these, cell therapies hold a dominant position, accounting for 58.2% of the total market share. This strong presence is driven by the increasing adoption of advanced cell-based treatments for cancer, autoimmune diseases, and regenerative medicine. The robust pipeline of cell therapy products, along with expanding manufacturing capacities, has further contributed to their leading share in the market.

Gene therapies, while smaller in overall share, are rapidly gaining traction due to advancements in gene-editing technologies and a growing number of clinical approvals. The gene therapy segment focuses on treating genetic disorders, rare diseases, and certain cancers by introducing or modifying genetic material to restore or enhance cellular function. With ongoing research and the development of more efficient viral and non-viral vectors, the gene therapy segment is expected to witness accelerated growth, gradually narrowing the gap with the dominant cell therapy segment.

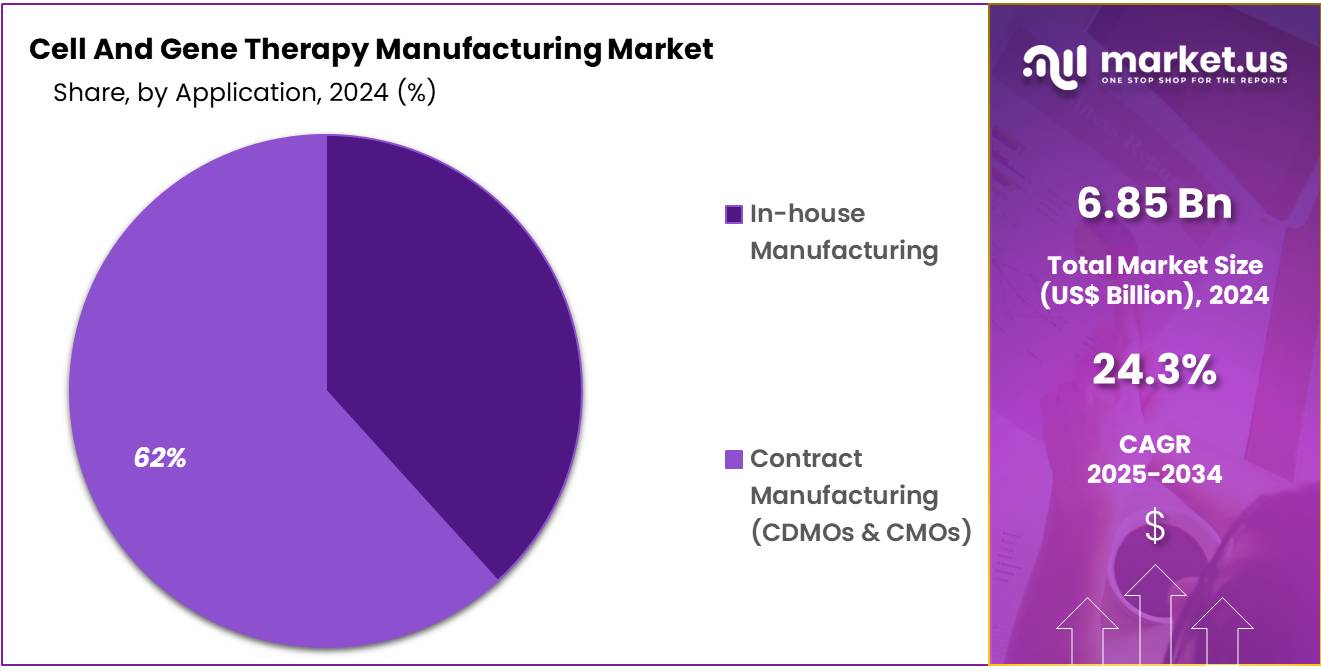

Mode Analysis

The Cell and Gene Therapy Manufacturing Market is divided by production mode into contract manufacturing and in-house manufacturing. Contract manufacturing currently holds the largest share, capturing 67.5% of the market.

This dominance is primarily due to the growing reliance on contract development and manufacturing organizations (CDMOs) that offer specialized expertise, state-of-the-art facilities, and scalable production capacity. Small and mid-sized biopharmaceutical companies, in particular, benefit from outsourcing as it reduces infrastructure costs and expedites time-to-market.

In-house manufacturing, while representing a smaller portion of the market, is critical for organizations requiring tight control over production processes, proprietary technologies, or intellectual property. Larger pharmaceutical companies and established biotech firms often maintain in-house capabilities to ensure quality consistency and streamline their supply chains.

Although in-house manufacturing has seen growth, the complexity and cost of establishing advanced facilities have allowed contract manufacturing to maintain a dominant position in the current market landscape.

Scale Analysis

The Cell and Gene Therapy Manufacturing Market is segmented by production scale into preclinical and clinical-scale manufacturing and commercial-scale manufacturing. Preclinical and clinical-scale manufacturing currently dominates, capturing 74.1% of the market share.

This is largely driven by the high number of early-stage research programs and clinical trials in the field, where small to medium production volumes are sufficient. The demand for flexible, modular production facilities capable of adapting to various therapies and patient populations has further reinforced this segment’s leading position.

Commercial-scale manufacturing, although still in the minority, is steadily increasing as more cell and gene therapies receive regulatory approval and enter widespread use. Large-scale production facilities are gradually being established to meet the growing demand for these advanced treatments.

While commercial-scale operations are expected to expand in the coming years, the preclinical and clinical-scale segment remains dominant due to the continued growth of clinical pipelines and the exploratory nature of many therapeutic candidates.

Application Analysis

The Cell and Gene Therapy Manufacturing Market can be segmented by application into various therapeutic areas, including oncology, neurological disorders, cardiovascular diseases, rare and genetic disorders, infectious diseases, musculoskeletal disorders, autoimmune diseases, and other applications. Among these, oncology applications hold the largest market share, dominating at 48.9%.

The prevalence of cancer worldwide and the rise of CAR-T cell therapies have been significant drivers, as these therapies have demonstrated strong efficacy in treating certain hematological malignancies. The continual development of new cancer immunotherapies and personalized medicine approaches also supports this segment’s leading position.

Applications for neurological disorders and rare and genetic disorders are also gaining traction, propelled by advances in gene-editing technologies and a growing understanding of the underlying genetic causes of these conditions. While oncology remains dominant, the diversification of cell and gene therapy approaches to treat a broad spectrum of diseases signals ongoing market expansion. This trend reflects the evolving potential of these therapies across multiple therapeutic areas.

End-user Analysis

The Cell and Gene Therapy Manufacturing Market can be segmented by end-user into pharmaceutical and biotechnology companies, contract development and manufacturing organizations (CDMOs/CMOs), research institutes and academic organizations, and hospitals and clinics. Among these, pharmaceutical and biotechnology companies hold the dominant share at 69.2%.

This is primarily due to their significant investments in cell and gene therapy development, well-established infrastructure, and expertise in navigating regulatory pathways. These companies often leverage their own in-house capabilities or strategically partner with CDMOs to bring therapies to market efficiently.

CDMOs and CMOs represent another critical segment, offering specialized manufacturing services that help smaller firms and emerging biotechs overcome production challenges. Research institutes and academic organizations play a key role in the discovery and early-stage development of cell and gene therapies.

While hospitals and clinics contribute to manufacturing through initiatives aimed at personalized therapies and localized production. While pharmaceutical and biotechnology companies maintain the largest share, collaboration among all end-users continues to drive market growth and innovation.

Key Market Segments

Therapy Type

- Cell therapy

- Gene therapy

Mode

- In-house Manufacturing

- Contract Manufacturing (CDMOs & CMOs)

Scale

- Preclinical and Clinical-Scale

- Commercial-Scale

Application

- Oncology (Cancer Treatment)

- Neurological Disorders

- Cardiovascular Diseases

- Rare & Genetic Disorders

- Infectious Diseases

- Musculoskeletal Disorders

- Autoimmune Diseases

- Other Applications

By End-user

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs/CMOs)

- Research Institutes & Academic Organizations

- Hospitals & Clinics

Regional Analysis

In 2024, North America is projected to dominate the Cell and Gene Therapy Manufacturing Market, accounting for 48.1% of the global market share. This leadership is attributed to the region’s advanced healthcare infrastructure, substantial investments in biotechnology, and a robust pipeline of cell and gene therapy candidates.

The presence of major pharmaceutical and biotechnology companies, coupled with supportive regulatory frameworks, has facilitated rapid advancements in manufacturing capabilities. Additionally, the increasing prevalence of chronic and genetic diseases has heightened the demand for innovative therapies, further propelling market growth.

Collaborations between academic institutions and industry players have also played a pivotal role in fostering research and development activities. With ongoing technological advancements and a strong focus on personalized medicine, North America is expected to maintain its leading position in the cell and gene therapy manufacturing sector.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cell and Gene Therapy Manufacturing Market features a diverse range of participants who play critical roles in its development and expansion. These include contract development and manufacturing organizations, specialized biotech firms, and integrated pharmaceutical companies. Each contributes unique strengths to the market. Some focus on providing end-to-end production solutions, while others excel in particular areas such as viral vector manufacturing, cell culture process optimization, or quality assurance.

These players often invest heavily in advanced technologies, including automation and gene-editing platforms, to enhance production efficiency and scale. Many collaborate with academic institutions and research organizations, driving innovation and accelerating the transition from clinical trials to commercial manufacturing.

In addition, their commitment to regulatory compliance and adoption of emerging bioprocessing strategies helps address the industry’s challenges, such as cost control and supply chain complexities. Altogether, their combined efforts ensure a robust and competitive market, paving the way for future therapeutic breakthroughs.

Market Key Players

- Lonza

- Bluebird Bio Inc.

- Catalent Inc.

- F. Hoffmann-La Roche Ltd.

- Samsung Biologics

- Boehringer Ingelheim

- Cellular Therapeutics

- Hitachi Chemical Co., Ltd.

- Bluebird Bio Inc.

- Takara Bio Inc.

- Miltenyi Biotec

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Merck KGaA

- Others

Recent Developments

- Lonza (October 2024): Acquired Genentech’s Vacaville facility for $1.2 billion in October 2024, adding major biologics manufacturing capacity and supporting commercial production.

- Bluebird Bio (February 2025): Acquired by Carlyle and SK Capital in February 2025 to fund gene therapy commercialization, including Lyfgenia for sickle cell disease.

- Catalent (December 2024): Novo Holdings bought Catalent in December 2024 for $16.5 billion, bolstering its CDMO capabilities and expanding cell and gene therapy services.

- Roche (November 2024): Acquired Poseida Therapeutics in November 2024 for up to $1.5 billion, advancing off-the-shelf cell therapies and strengthening oncology and immunology pipelines.

Report Scope

Report Features Description Market Value (2024) US$ 6.9 Billion Forecast Revenue (2034) US$ 60.3 Billion CAGR (2025-2034) 24.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Cell therapy, Gene therapy) By Mode (In-house Manufacturing, Contract Manufacturing (CDMOs & CMOs)) By Scale (Preclinical and Clinical-Scale, Commercial-Scale) By Application (Oncology (Cancer Treatment), Neurological Disorders, Cardiovascular Diseases, Rare & Genetic Disorders, Infectious Diseases, Musculoskeletal Disorders, Autoimmune Diseases, Other Applications) By End-user (Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs/CMOs), Research Institutes & Academic Organizations, Hospitals & Clinics) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Lonza, Bluebird Bio Inc., Catalent Inc., F. Hoffmann-La Roche Ltd., Samsung Biologics, Boehringer Ingelheim, Cellular Therapeutics, Hitachi Chemical Co., Ltd., Bluebird Bio Inc., Takara Bio Inc., Miltenyi Biotec, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd, Novartis AG, Merck KGaA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell And Gene Therapy Manufacturing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Cell And Gene Therapy Manufacturing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lonza

- Bluebird Bio Inc.

- Catalent Inc.

- F. Hoffmann-La Roche Ltd.

- Samsung Biologics

- Boehringer Ingelheim

- Cellular Therapeutics

- Hitachi Chemical Co., Ltd.

- Bluebird Bio Inc.

- Takara Bio Inc.

- Miltenyi Biotec

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Merck KGaA

- Others