Global Antibody Drug Conjugates Market By Product Type (Kadcyla, Enhertu, Adcetris, Padcev, Trodelvy, Polivy, and Others), By Technology (Type (Non-cleavable Linker, Linkerless, and Cleavable Linker), Linker Technology Type (VC, VA, Sulfo-SPDB, Hydrazone, and Others), Payload Technology (MMAF, MMAE, DM4, Camptothecin, and Others)), By Application (Blood Cancer (Multiple Myeloma, Lymphoma, and Leukemia), Breast Cancer, Urothelial Cancer & Bladder Cancer, and Others), By Target (HER2, CD30, CD22, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 102579

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

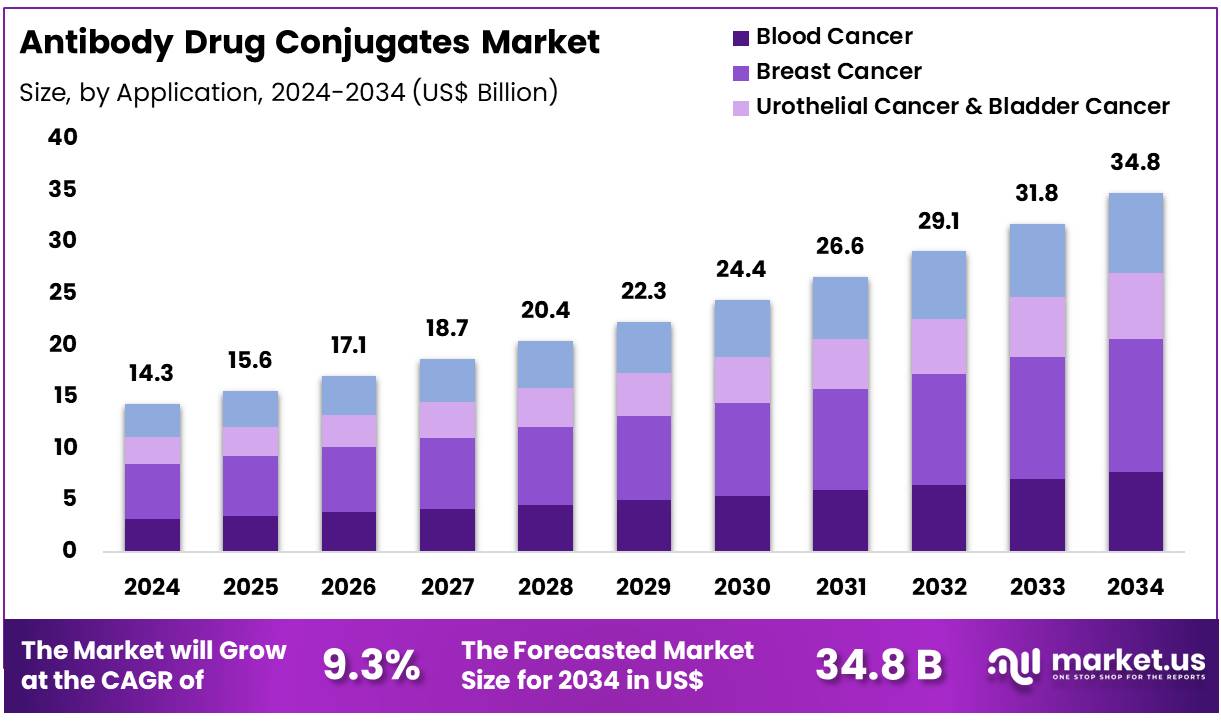

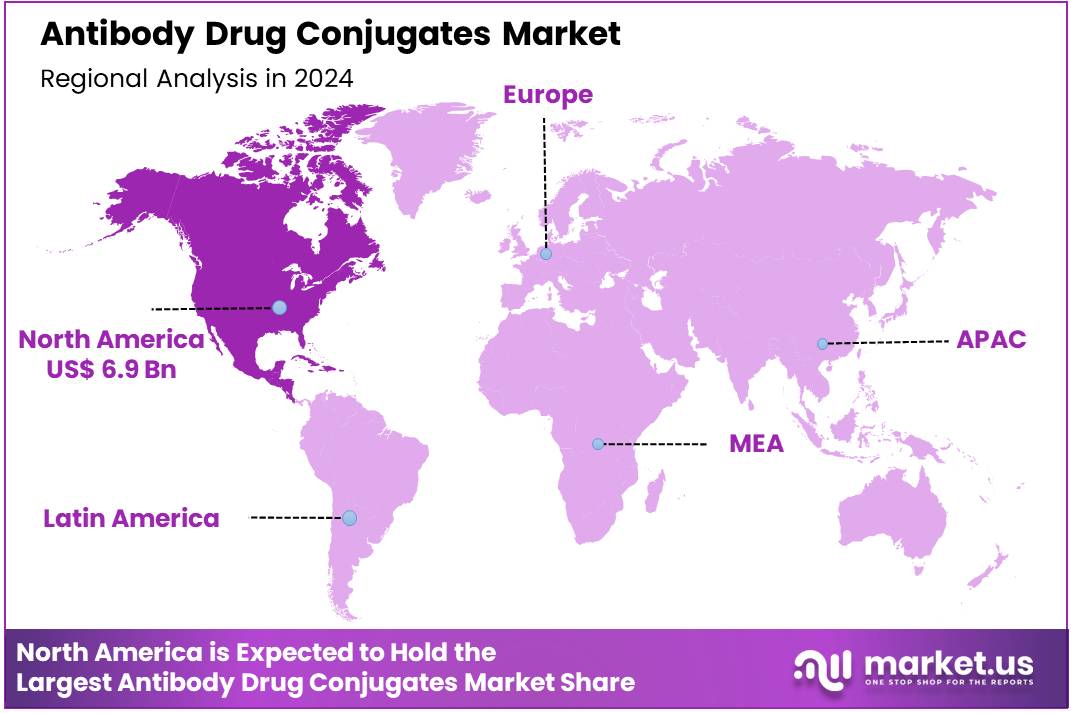

Global Antibody Drug Conjugates Market size is expected to be worth around US$ 34.8 Billion by 2034 from US$ 14.3 Billion in 2024, growing at a CAGR of 9.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.4% share with a revenue of US$ 6.9 Billion.

The growing incidence of cancer worldwide is a primary driver of the antibody-drug conjugates (ADCs) market. ADCs are highly targeted biopharmaceuticals that combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs, enabling precise delivery of therapeutic payloads directly to cancer cells.

According to the World Health Organization (WHO), cancer cases are projected to rise by approximately 70% over the next two decades, from 18.1 million new cases in 2020 to around 30 million by 2040. This increasing global cancer burden is creating an urgent need for more effective and less toxic treatments, positioning ADCs as a cornerstone of modern oncology.

Strategic collaborations and rising investments are shaping key market trends. Pharmaceutical companies are increasingly entering multi-billion-dollar partnerships and acquisitions to access innovative ADC platforms and pipelines. For instance, in October 2023, BioNTech secured global development and commercialization rights for a HER3-targeting ADC through a licensing agreement with MediLink Therapeutics.

The deal included an upfront payment of US$ 70 million and milestone-based payments totaling up to US$ 1 billion. Such agreements highlight the growing strategic focus on ADCs in cancer therapy, accelerating the development of novel candidates and expanding their application across both solid and hematological tumors.

Innovation in ADC design and efforts to overcome drug resistance are creating significant market opportunities. Next-generation ADCs are being developed with enhanced linker stability, novel cytotoxic payloads, and improved site-specific conjugation, aiming to reduce off-target toxicity and increase therapeutic efficacy.

The National Cancer Institute (NCI), part of the National Institutes of Health (NIH), continues to fund research in advanced drug delivery systems and targeted therapies, supporting the development of these complex molecules. This combination of private investment, public funding, and technological advancements ensures that the ADC market remains dynamic and poised for sustained growth.

Key Takeaways

- In 2024, the market for antibody drug conjugates generated a revenue of US$ 14.3 Billion, with a CAGR of 9.3%, and is expected to reach US$ 34.8 Billion by the year 2034.

- The product type segment is divided into kadcyla, enhertu, adcetris, padcev, trodelvy, polivy, and others, with kadcyla taking the lead in 2023 with a market share of 27.4%.

- Considering technology, the market is divided into type, linker technology type, and payload technology. Among these, linker technology type held a significant share of 42.8%.

- Furthermore, concerning the application segment, the market is segregated into blood cancer, breast cancer, urothelial cancer & bladder cancer, and others. The breast cancer sector stands out as the dominant player, holding the largest revenue share of 36.9% in the antibody drug conjugates market.

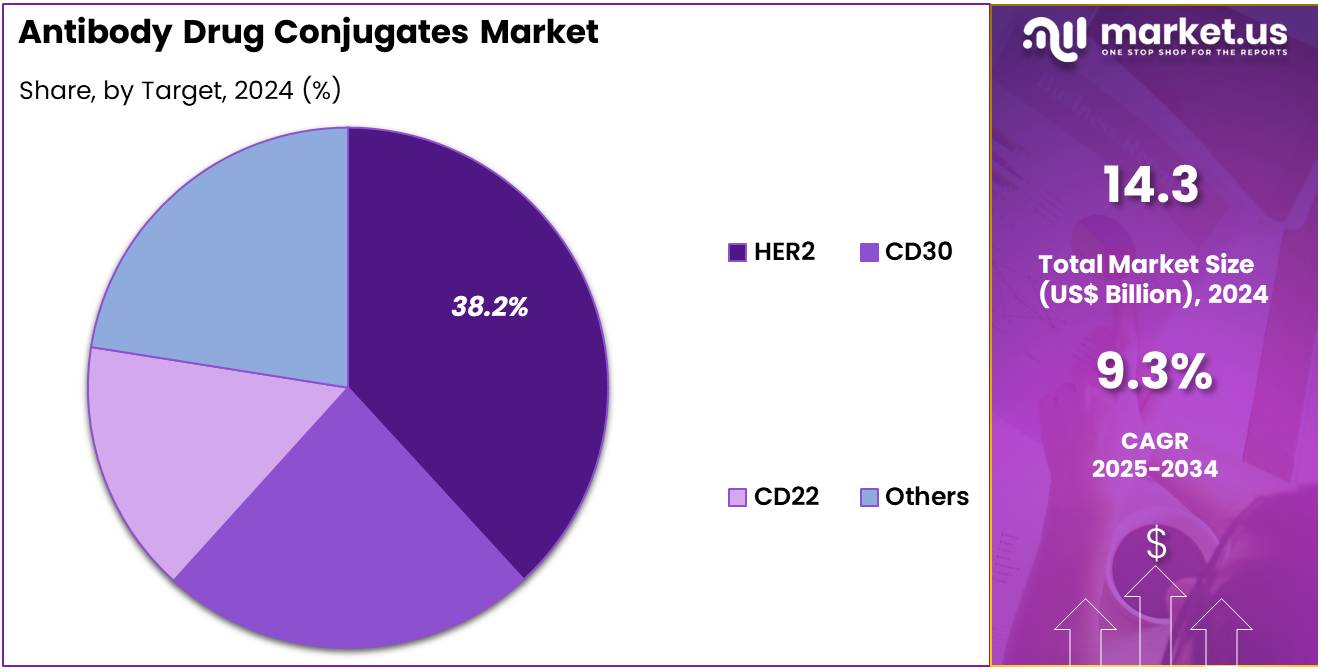

- The target segment is segregated into HER2, CD30, CD22, and others , with the HER2 segment leading the market, holding a revenue share of 38.2%.

- North America led the market by securing a market share of 48.4% in 2023.

Product Type Analysis

Increasing adoption of Kadcyla in the oncology sector drives the product’s market growth. Kadcyla is projected to benefit from its targeted mechanism, combining monoclonal antibodies with cytotoxic agents to selectively destroy cancer cells. The therapy is anticipated to expand its reach in breast cancer, particularly in HER2-positive patients, where traditional therapies show limited efficacy. Hospitals and oncology clinics are expected to increasingly prefer Kadcyla due to its clinical benefits and proven safety profile.

Ongoing clinical trials are likely to support extended indications, enhancing the product’s market penetration. The strategic collaborations of companies to improve distribution networks are projected to strengthen Kadcyla’s market share. Awareness campaigns among oncologists and patient advocacy groups are expected to further drive adoption. Manufacturing scale-ups are likely to reduce unit costs, increasing accessibility in high-demand regions.

Regulatory approvals for additional indications are anticipated to add growth momentum. Kadcyla is estimated to attract significant interest due to personalized medicine trends in oncology. Demand from emerging markets is projected to rise as diagnostic capabilities improve. Continuous investment in research and development is likely to introduce enhanced formulations. Kadcyla’s efficacy in combination therapy settings is expected to reinforce clinical preference.

Pricing strategies aimed at reimbursement support are anticipated to maintain competitive positioning. Real-world evidence demonstrating survival benefits is projected to boost physician confidence. Hospital procurement programs are likely to integrate Kadcyla into standard protocols. Targeted marketing toward oncologists is expected to expand its adoption. The growing number of HER2-positive cancer diagnoses is anticipated to elevate demand. Kadcyla’s robust patent portfolio is projected to sustain market exclusivity. Overall, Kadcyla is expected to remain a leading ADC therapy segment due to clinical, strategic, and market-driven factors.

Technology Analysis

Rising importance of linker technology in antibody drug conjugates underpins its dominant market share. Linkers ensure targeted delivery of cytotoxic payloads to cancer cells, minimizing off-target effects and improving therapeutic index. Innovations in cleavable and non-cleavable linkers are projected to drive adoption across multiple ADC platforms. Pharmaceutical companies are expected to prioritize advanced linker development to differentiate ADC products. Research on stable and tumor-specific linkers is likely to expand clinical applications in breast and blood cancers.

The focus on enhancing linker stability is anticipated to reduce side effects, increasing physician confidence. Demand for optimized linker technology is projected to increase as ADC pipelines grow. Strategic collaborations between biotech firms and research institutes are expected to accelerate innovation. Patent-protected linkers are likely to attract investment and strengthen competitive advantage. Linker technology is anticipated to play a crucial role in combination therapies. Regulatory approvals emphasizing linker safety are projected to encourage adoption. The rise in precision medicine initiatives is expected to reinforce the value of sophisticated linkers.

Market growth is projected due to increasing ADC trials incorporating novel linker chemistries. Biopharmaceutical companies are anticipated to integrate linker optimization early in development. Manufacturing advancements in linker attachment methods are likely to improve scalability. Academic research highlighting linker efficacy is expected to support clinical adoption. Global expansion of oncology centers is projected to raise demand for ADCs with advanced linkers. Continuous innovation in cleavable linkers is anticipated to enhance payload delivery efficiency. Linker technology is expected to remain a primary growth driver in ADC market dynamics.

Application Analysis

Growing incidence of breast cancer worldwide supports its leading application segment in ADCs. Breast cancer treatment increasingly emphasizes targeted therapy, where ADCs provide clinical advantages in HER2-positive cases. Rising awareness and screening programs are anticipated to boost early diagnosis, enabling broader use of ADCs. Hospitals and oncology centers are expected to integrate ADCs into standard treatment protocols. The approval of multiple ADCs for breast cancer is projected to expand market uptake. Clinical studies demonstrating improved progression-free survival are likely to influence prescribing patterns. Demand for ADCs in neoadjuvant and adjuvant settings is expected to increase.

Pharmaceutical companies are projected to invest in breast cancer-specific ADC research. Expansion of patient assistance programs is anticipated to improve accessibility. Combination therapies incorporating ADCs are expected to enhance treatment outcomes. Increased insurance coverage for targeted therapies is likely to support adoption. Technological advancements in biomarker testing are projected to facilitate precise patient selection. Strategic collaborations between ADC developers and oncology hospitals are anticipated to strengthen market presence.

Development of next-generation ADCs for resistant breast cancer is expected to create growth opportunities. Data from real-world settings are projected to validate clinical trial results. Enhanced manufacturing capabilities are anticipated to meet rising demand. Advocacy campaigns are likely to inform patients about treatment options. The trend toward personalized oncology therapy is expected to reinforce ADC use. Breast cancer segment growth is projected to remain robust due to clinical efficacy and rising patient awareness.

Target Analysis

Increasing focus on HER2 as a therapeutic target drives substantial market growth in ADCs. HER2-positive cancers respond favorably to targeted ADC therapy, offering improved outcomes over conventional chemotherapy. Clinical research is anticipated to identify new HER2-expressing tumors suitable for ADC treatment. Oncology centers are expected to adopt HER2-targeting ADCs widely due to their specificity and safety profile. Strategic partnerships between biotech firms and academic institutions are projected to expand HER2-focused ADC pipelines.

Regulatory approvals emphasizing HER2 indications are likely to encourage physician adoption. Investment in companion diagnostics is anticipated to enhance patient selection for HER2 therapies. HER2-targeted ADCs are expected to play a crucial role in combination regimens with immunotherapy and hormonal therapy. Expansion of clinical trials exploring novel HER2 linkers and payloads is projected to support innovation. Healthcare providers are likely to implement treatment guidelines favoring HER2-specific ADCs.

Manufacturing improvements are anticipated to increase production efficiency and supply. Real-world evidence demonstrating survival benefits is expected to reinforce clinical trust. Market penetration in emerging economies is projected to rise as diagnostic capabilities improve. HER2 biomarker testing adoption is anticipated to accelerate, supporting precision therapy. Physician education initiatives are likely to expand HER2-targeted treatment uptake.

Portfolio diversification by pharmaceutical companies is projected to enhance market competitiveness. Patent-protected HER2 ADCs are expected to maintain exclusivity and drive revenue. Integration of HER2-targeted ADCs into early-line therapy is likely to broaden use. Research into overcoming resistance mechanisms is projected to sustain growth. Overall, HER2-targeting ADCs are expected to dominate the market due to therapeutic relevance and clinical performance.

Key Market Segments

By Product Type

- Kadcyla

- Enhertu

- Adcetris

- Padcev

- Trodelvy

- Polivy

- Others

By Technology

- Type

- Non-cleavable Linker

- Linkerless

- Cleavable Linker

- Linker Technology Type

- VC

- VA

- Sulfo-SPDB

- Hydrazone

- Others

- Payload Technology

- MMAF

- MMAE

- DM4

- Camptothecin

- Others

By Application

- Blood Cancer

- Multiple Myeloma

- Lymphoma

- Leukemia

- Breast Cancer

- Urothelial Cancer & Bladder Cancer

- Others

By Target

- HER2

- CD30

- CD22

- Others

Drivers

The rising global incidence of cancer is driving the market.

The market for antibody drug conjugates (ADCs) is experiencing significant growth, primarily driven by the escalating global burden of cancer. ADCs represent a novel class of targeted therapies that combine the specificity of an antibody to target cancer cells with the cytotoxic power of a chemotherapy drug. This targeted delivery mechanism minimizes damage to healthy cells, thereby reducing the severe side effects often associated with traditional chemotherapy.

According to the World Health Organization (WHO), cancer is a leading cause of death worldwide, with an estimated 10 million deaths in 2020. This alarming and growing statistic underscores the urgent need for more effective and less toxic treatment options. In 2023, the US alone saw nearly 103,000 new cancer cases potentially linked to radiation from medical imaging, as estimated by researchers in a study. This massive patient population, coupled with the proven efficacy of ADCs in specific cancer types, provides a powerful and sustained impetus for the continued development and commercialization of these innovative therapies.

Restraints

The high cost of research and development is restraining the market.

A significant restraint on the market is the substantial financial investment required for the research, development, and clinical trials of these complex biopharmaceuticals. The process of developing an ADC is a lengthy and expensive endeavor, involving the intricate synthesis of three distinct components: the antibody, the cytotoxic payload, and the linker. Each component must be optimized for safety and efficacy, and the final conjugate must undergo rigorous testing to ensure stability and targeted delivery.

According to a 2024 analysis, the average cost of a Phase III clinical trial for an oncology drug can exceed US$100 million. This high cost of entry limits the number of companies that can participate in the market and can slow the pace of innovation. Additionally, the manufacturing process for ADCs is highly complex and requires specialized facilities, adding to the overall cost of bringing a product to market. This financial burden can be a significant barrier to the widespread availability and affordability of these life-saving drugs.

Opportunities

The expansion into new indications beyond oncology is creating growth opportunities.

The market is presented with significant opportunities from the accelerating research into using ADCs for indications beyond cancer. While ADCs have demonstrated remarkable success in oncology, their targeted mechanism of action is equally relevant for a range of other diseases, particularly those involving a specific, overexpressed cell type.

Researchers are now actively exploring the use of these molecules for the treatment of autoimmune disorders, infectious diseases, and even cardiovascular conditions. This diversification opens up vast, untapped patient populations and new revenue streams. For instance, a search of the US National Library of Medicine’s clinical trials database in 2024 revealed that a number of clinical trials were investigating ADCs for conditions like rheumatoid arthritis and systemic lupus erythematosus. This expansion into new therapeutic areas represents a paradigm shift for the technology and is poised to be a major driver of future growth by addressing the unmet medical needs in a wide array of disease states.

Impact of Macroeconomic / Geopolitical Factors

The advanced cancer therapy sector is operating within a challenging macroeconomic and geopolitical environment, which directly influences research budgets and supply chain stability. Rising global inflation has increased the costs of key raw materials, specialized reagents, and the skilled workforce essential for biopharmaceutical production. Data from the US Centers for Medicare & Medicaid Services (CMS) indicate that national healthcare spending grew by 8.2% in 2024, reflecting higher costs for medical products and biopharmaceuticals.

Geopolitical tensions have added further uncertainty, as trade disruptions and export controls have created volatility in the supply of critical components such as monoclonal antibodies. A 2024 industry report noted that regional conflicts and trade disputes caused notable shipping delays and cost surges for vital inputs. Despite these challenges, biopharmaceutical companies are adapting by diversifying suppliers and investing in local manufacturing capabilities, strengthening supply chain resilience and ensuring consistent availability of therapies.

Current US tariff policies are fundamentally reshaping the strategic landscape for companies operating in the biopharmaceutical sector, compelling a re-evaluation of global supply chain networks. The imposition of duties on imported bioprocessing equipment and raw materials, such as specialized resins or single-use systems, introduces a significant and direct cost for manufacturers. A US Customs and Border Protection report for Fiscal Year 2023 highlighted that the agency collected more than US$38 billion in Section 301 duties on goods from certain regions, a cost that influences the entire production chain for complex therapies like ADCs.

This financial pressure is prompting a proactive search for alternative sourcing strategies and is forcing companies to reconsider their long-term reliance on global suppliers. While this creates a direct negative financial impact, it is also catalyzing a powerful strategic shift toward establishing more robust, domestically-focused supply chains. The need to mitigate tariff-related risks is accelerating investment in US-based biomanufacturing capabilities.

A 2024 report from a government-sponsored initiative noted a significant increase in capital expenditure for the localization of critical biopharmaceutical manufacturing. This strategic push is ultimately strengthening the nation’s healthcare supply chain, reducing its vulnerability to future geopolitical shocks and ensuring a more reliable supply of essential medicines.

Latest Trends

The development of next-generation linker and payload technologies is a recent trend.

A significant trend in 2024 is the intense focus on developing next-generation linker and payload technologies to improve the therapeutic window and reduce the off-target toxicity of ADCs. Early generations of ADCs sometimes faced challenges with linker stability, leading to premature release of the cytotoxic payload and resulting in systemic side effects. Recent R&D efforts have concentrated on creating more stable linkers that only release the drug once they have reached the target cell, thereby enhancing the safety profile of the therapy.

Additionally, scientists are developing more potent payloads to improve efficacy. This trend is evident in the increasing number of clinical trials for ADCs that utilize these advanced technologies. According to a 2023 report on ADC development, a number of these novel approaches were being explored to address limitations of earlier-generation therapies. This continuous innovation in the core components of these drugs is critical for their long-term success and is a key factor in improving patient outcomes.

Regional Analysis

North America is leading the Antibody Drug Conjugates Market

The North American market for antibody drug conjugates (ADCs) held a substantial 48.4% share of the global market in 2024. This leadership is directly attributable to a highly developed healthcare infrastructure, significant investment in oncology research, and a high prevalence of cancer. According to the American Cancer Society, an estimated 1.9 million new cancer cases were diagnosed in the US in 2022.

This substantial and growing patient population drives a continuous demand for innovative and targeted cancer therapies. Furthermore, significant funding from government bodies supports the research and development pipeline for ADCs. The National Cancer Institute (NCI), for instance, has a large budget for cancer research, with a total budget of US$7.22 billion in 2023.

This funding accelerates the discovery and clinical translation of new therapies. The US Food and Drug Administration (FDA) has also played a crucial role by providing fast-track and breakthrough therapy designations, which have accelerated the approval of new ADCs, making them available to patients more quickly than ever before.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for antibody drug conjugates is anticipated to experience robust growth during the forecast period. This is largely a result of a significant and rising cancer burden, increasing healthcare expenditure, and a growing focus on precision medicine. The World Health Organization (WHO) has noted a significant increase in cancer cases across the region.

The International Agency for Research on Cancer (IARC) reported that in 2022, there were an estimated 9.8 million new cancer cases in Asia, representing a substantial patient pool for these advanced therapeutics. This high disease prevalence fuels the need for innovative and effective treatment options.

The market is also supported by more streamlined regulatory processes in key countries. For instance, in 2023, China’s National Medical Products Administration (NMPA) approved a record 104 new drugs, with oncology drugs being the top therapeutic area. This regulatory efficiency is likely to attract more global pharmaceutical companies, which are actively seeking to bring their ADCs to the large and rapidly growing markets in Asia.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A primary strategy for key players in the antibody drug conjugate market is an aggressive mergers and acquisitions and partnership strategy. Companies frequently pursue licensing agreements and acquisitions of smaller biotech firms to gain access to novel technologies, proprietary platforms, and promising drug candidates. This approach allows them to quickly expand their pipelines and leverage external expertise without the time and cost of internal development.

Furthermore, companies are heavily investing in research and development, with a focus on improving linker technology and payload potency to enhance efficacy and reduce off-target toxicity. They also pursue indications expansion for existing approved therapies, effectively increasing the addressable patient population.

Daiichi Sankyo, a global pharmaceutical company headquartered in Japan, has firmly established itself as a leading innovator in this sector. The company utilizes its proprietary DXd platform to develop a range of highly effective and potent drug conjugates. Their most prominent product is Enhertu (trastuzumab deruxtecan), a co-developed drug with AstraZeneca that has gained multiple approvals for treating various HER2-positive cancers. Daiichi Sankyo’s business model leverages strategic collaborations to accelerate the development and commercialization of its oncology portfolio. This strategy has resulted in a robust pipeline and positions the company as a key player in the global oncology market.

Top Key Players

- Takeda Pharmaceutical Company Ltd

- Seagen, Inc

- Pfizer, Inc

- GlaxoSmithKline Plc

- Gilead Sciences, Inc

- Hoffmann-La Roche Ltd

- Daiichi Sankyo Company Ltd

- AstraZeneca

- Astellas Pharma, Inc

- ADC Therapeutics SA

Recent Developments

- In January 2024, Celltrion, Inc. partnered with WuXi XDC under a Memorandum of Understanding to offer end-to-end services for antibody-drug conjugates (ADCs), covering both research and manufacturing processes.

- In January 2024, Johnson & Johnson Services, Inc. acquired Ambrx Biopharma, Inc., gaining access to its proprietary ADC platform. The acquisition is aimed at advancing innovative treatments for prostate cancer using next-generation ADC technologies.

- In January 2024, MediLink Therapeutics entered into a collaboration and licensing deal with F. Hoffmann-La Roche Ltd. to jointly develop YL211, a cutting-edge ADC designed to enhance therapeutic outcomes in oncology.

Report Scope

Report Features Description Market Value (2024) US$ 14.3 Billion Forecast Revenue (2034) US$ 34.8 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kadcyla, Enhertu, Adcetris, Padcev, Trodelvy, Polivy, and Others), By Technology (Type (Non-cleavable Linker, Linkerless, and Cleavable Linker), Linker Technology Type (VC, VA, Sulfo-SPDB, Hydrazone, and Others), Payload Technology (MMAF, MMAE, DM4, Camptothecin, and Others)), By Application (Blood Cancer (Multiple Myeloma, Lymphoma, and Leukemia), Breast Cancer, Urothelial Cancer & Bladder Cancer, and Others), By Target (HER2, CD30, CD22, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takeda Pharmaceutical Company Ltd, Seagen, Inc, Pfizer, Inc, GlaxoSmithKline Plc, Gilead Sciences, Inc, F. Hoffmann-La Roche Ltd, Daiichi Sankyo Company Ltd, AstraZeneca, Astellas Pharma, Inc, ADC Therapeutics SA. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antibody Drug Conjugates MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Antibody Drug Conjugates MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Takeda Pharmaceutical Company Ltd

- Seagen, Inc

- Pfizer, Inc

- GlaxoSmithKline Plc

- Gilead Sciences, Inc

- Hoffmann-La Roche Ltd

- Daiichi Sankyo Company Ltd

- AstraZeneca

- Astellas Pharma, Inc

- ADC Therapeutics SA